A detailed analysis of Solana's liquidity staking ecosystem, who will be the winner?

Original source: members.delphidigital.io

Original Compilation: Old Yuppie

Original Compilation: Old Yuppie

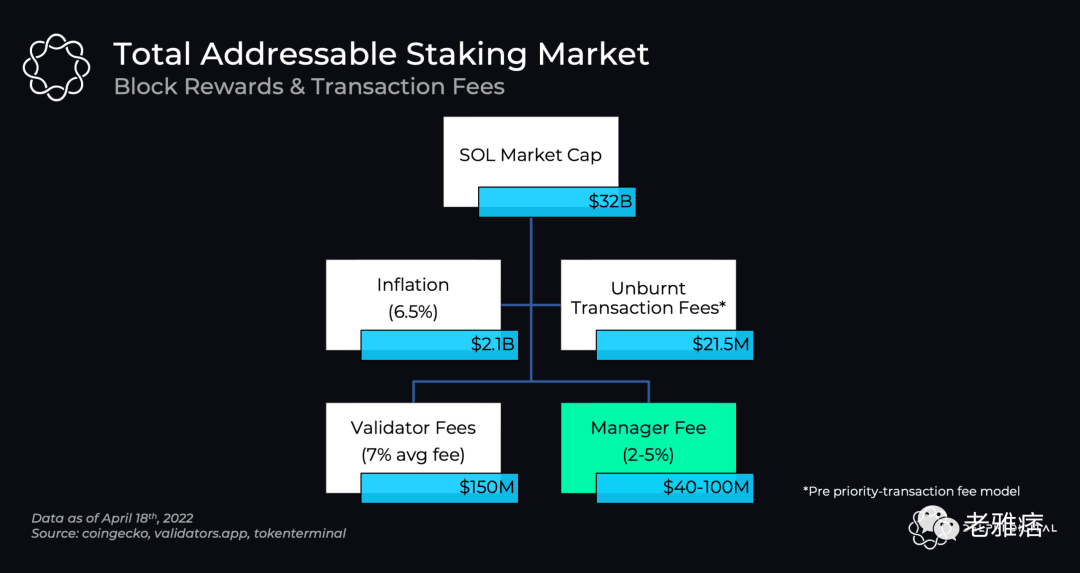

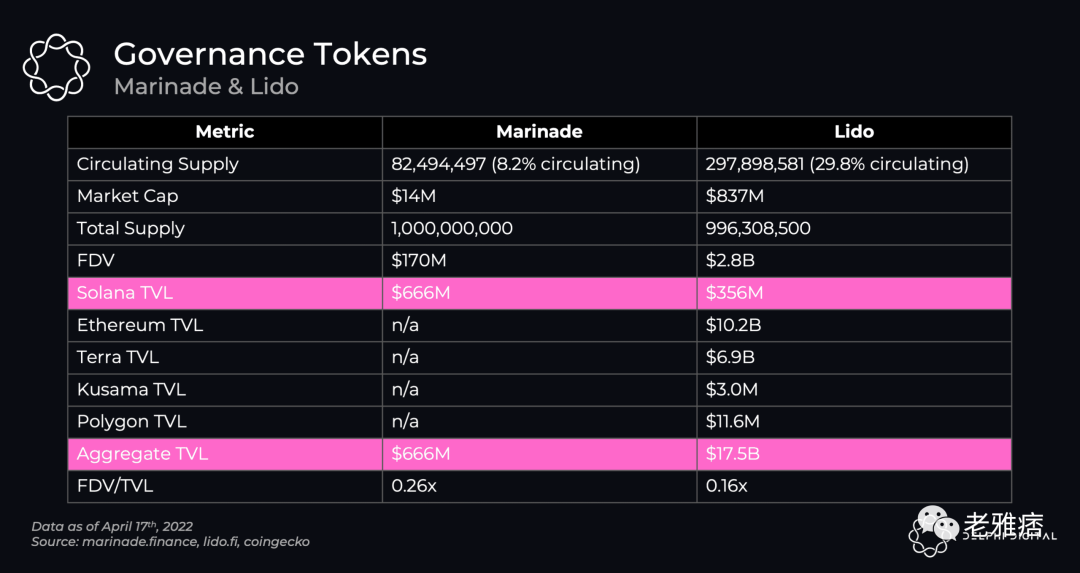

Staking Solana generates approximately $2.1 billion in annual returns. Currently, liquid staking protocols account for only 3% of that, which means it clearly has growth opportunities. For context, Lido alone accounts for 28% of total ETH2.0 staking.

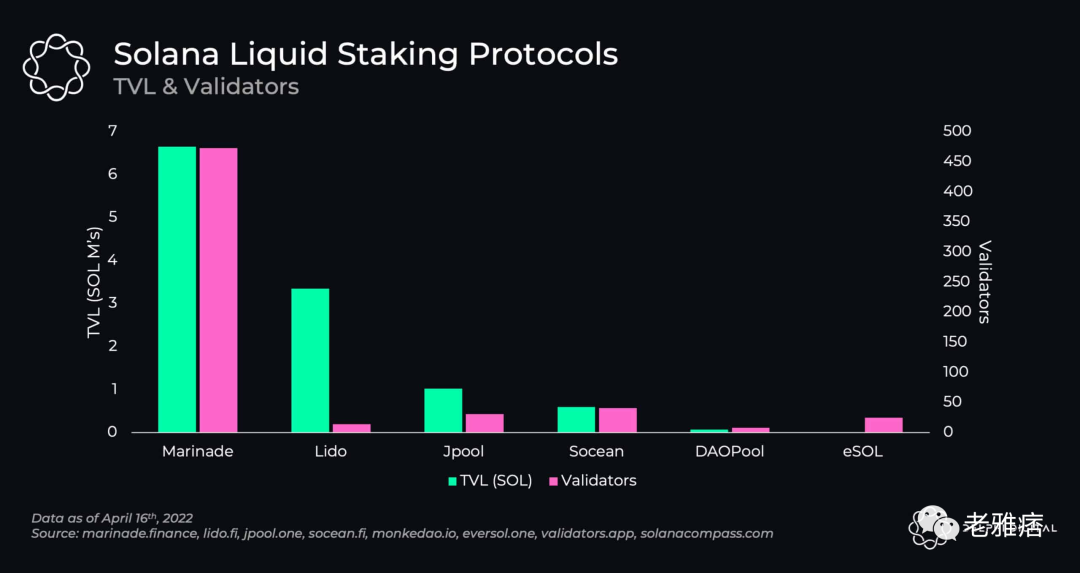

Marinade has a market share of 57%, Lido 29%, and the rest combined 14%.

All liquidity staking protocols have different strategies, with Marinade focusing on decentralization, Lido focusing on market-leading validators and multi-chain, JPool has the highest APY, Socean owns the protocol’s liquidity and Socean Streams, DAOPool has the new Ecosystem validators, while eSOL aims to fund ecosystem projects.

The Marinade was everywhere, with the Lido a close second and the Socean in third. Lido is the first protocol for cross-chain (Terra Anchor protocol) integration.

Power laws have us expecting some long-term winners.

Staking is one of the largest and fastest-growing industries in the cryptocurrency space, but most staking solutions today have one glaring problem: they weren't built for DeFi.

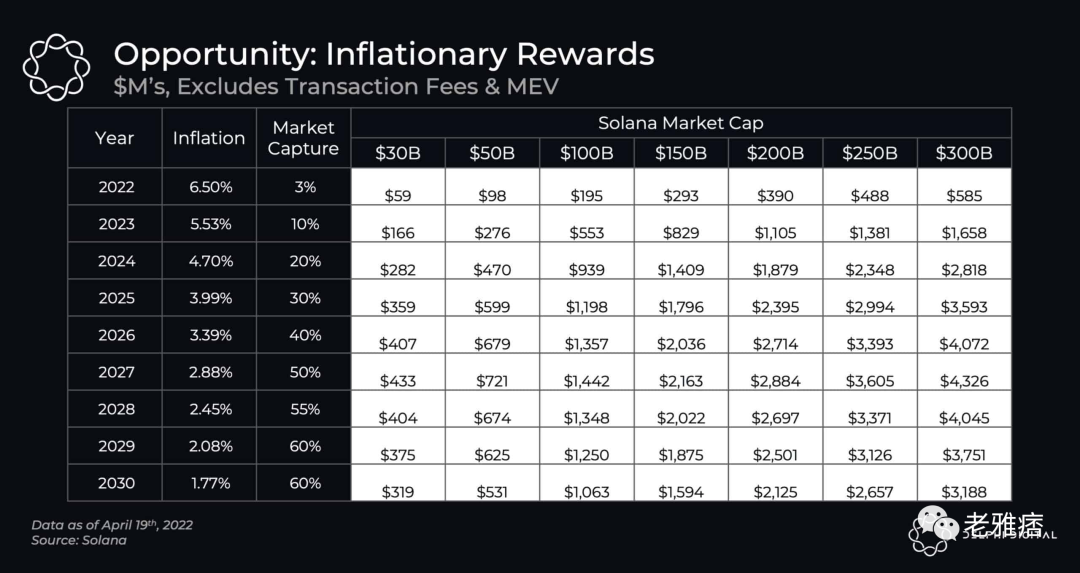

As a refresher, Proof-of-Stake blockchains like Solana achieve consensus through validators running hardware and locking up SOL collateral to secure the network. In return for securing the network, validators receive an inflationary reward of ~6.5% (started at 8% last year), which will decrease at an annualized rate of 15% until eventually reaching ~1.5%. Validators also earn transaction fees, which are currently low but could become very substantial as Solana continues to develop and a new prioritized fee model is implemented. At the core protocol level, users can stake themselves or delegate tokens to validators of their choice. While delegating SOL to validators allows users to avoid dilution due to inflation, it also has some disadvantages, namely:

SOL is locked and requires a 2-3 day cooldown period

Overhead for user research/selecting validators

Staked SOL cannot be used as collateral throughout DeFi

first level title

Solana's Liquidity Staking Ecosystem

Given Solana's focus on DeFi from the start, liquid collateralized tokens will naturally be a key area of development. So, what are Liquid Collateral Tokens? Simply put, they are derivative tokens of the native asset (SOL) that earn staking rewards but are not locked. This allows users to use their SOL in DeFi applications without forgoing the opportunity cost of staking rewards. In an ecosystem without liquid staking, one would have to earn a greater return on the native (non-staked) asset than from staking, which can be thought of as the blockchain’s native risk-free rate. For example, if a lending protocol offers a 4% SOL yield, it doesn’t make sense for someone to lend their SOL out compared to getting 6.5% through native staking.

In addition to the benefits for users, it also has benefits for the network itself. Firstly, liquid staking tokens will be delegated to numerous validators to diversify/decentralize network staking, and secondly, by opening up native tokens as collateral, it helps to grow and create activity in the ecosystem over time Over time, these activities will increase. On Ethereum, Lido dominates the liquidity staking landscape with >85% share. In the long term, we expect major liquidity collateral tokens to emerge, as they become more valuable the more liquid and used they are in the ecosystem. It's a reflexive flywheel effect that gets stronger the more the protocol is separated. However, competition for Solana is unclear, and as a new ecosystem, the status of the dominant liquidity staking platform has not yet been decided. As of April 16, the Solana liquidity staking landscape is as follows:

At first glance Marinade appears to have been disconnected from the ecosystem. This is partly true! Roughly twice the size of Lido, Marinade is by far the most decentralized with over 400 validators and has become a Solana DeFi workhorse since launching last summer. However...

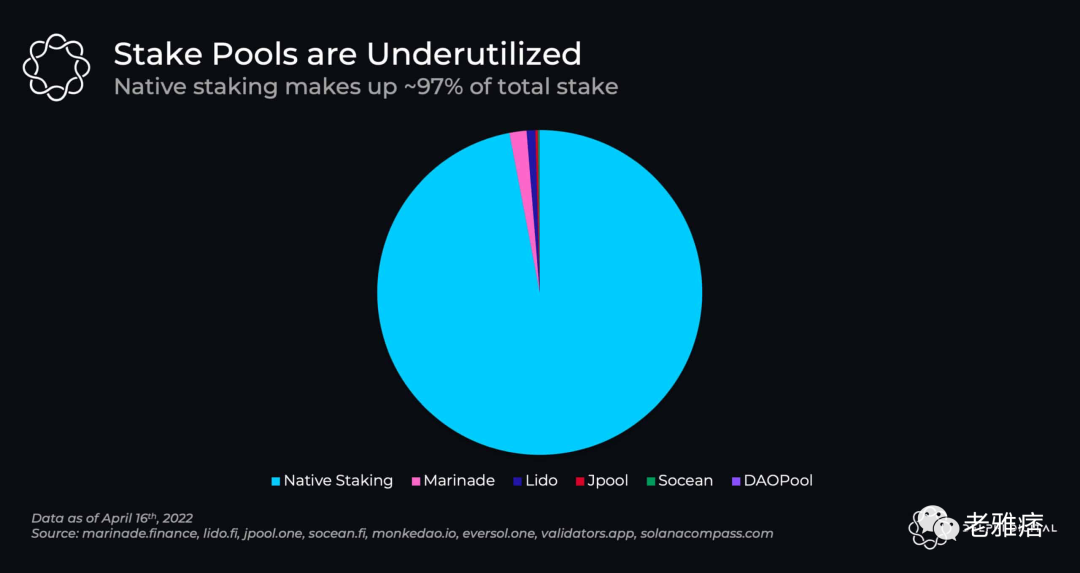

Stake pools make up a very small portion of Solana's total staking today. Despite the benefits that stake pools bring, they have yet to gain rapid adoption in Solana. For comparison, Lido’s $10 billion on ETH 2.0 already accounts for 3% of Ethereum’s total market cap and 28% of ETH 2.0’s total pledges. ETH 2.0 has ~32% liquid collateral, which is much higher than what we saw with Solana.

There are several reasons for this dynamic:

ETH 2.0 deposits open in late 2020, liquid collateral Solana launches in summer 2021

Staking on ETH 2.0 requires technical knowledge compared to authorizing Solana. If Ethereum users want to earn ETH 2.0 benefits, they need to run their own nodes or use a pool. On Solana, delegating to validators is a simple process. Ethereum does not have Delegated Proof of Staking, but you can think of stake pools as analogous to Delegated Staking.

ETH 2.0 staking is locked, Lido unlocks it

In addition to the above reasons, there are some reasons that are not specific to Solana.

Smart Contract Risk

potential tax liability

The first one is self-explanatory. Storing SOL into a smart contract increases the non-zero risk of smart contract bugs, which do not exist with native staking. In fact, we had a recent example of this where a mistake by Marinade in March resulted in the unstaking of almost all SOL entrusted to them. While no funds were at risk, a staking period totaling ~2.5K SOL rewards was missed. On the positive side, it highlighted the reliance on the now-deleted StakeView and the faulty emergency braking feature, but the incident still highlights how liquid staking adds risk that native staking does not.

first level title

Equity pool strategy

As mentioned above, one of the core benefits of liquidity staking is to diversify validator exposure. This is beneficial for users as they are not dependent on a single validator and risk funds being slashed due to malicious behavior (note: slashing is not yet implemented in Solana). When a user's stake is delegated to multiple validators, the risk of loss from slashing is minimized. From an ecosystem perspective, liquid staking helps to decentralize the network, as user deposits are automatically distributed across validators, which helps improve the Nakamoto coefficient. Each of Solana's liquid collateral tokens takes a different approach. Along with different staking strategies, they have different fee arrangements as described below.

Manager Fee: Reward fee sent to DAO treasury or used for OPEX

Deposit Fee: Fee paid in full upon deposit

Withdrawal fee: the fee paid in full when withdrawing

picture

Marinade is the first liquid staking token launched by Solana. It has the largest pledged amount and more than 8 times the number of validators than the next one (Socean). Marinade follows the Solana Foundation's strategy of "dispersing equity in the long tail of high-performance, low-commission, decentralized validators". This results in Marinade not being entrusted to the largest validator, but to many small and medium validators, which directly improves the distribution of benefits in the ecosystem. In contrast, Lido delegates to mostly well-known large professional partners who are vetted through a rigorous application process, most of which overlap with their Ethereum partners. The largest validators on Solana include Everstake(1), Chorus One(2), Staking Facilities(4), Figment(10) and many more. Lido validates stake equally among all their validators (currently ~150k SOL each). Again, this is in contrast to Marinade, as they support small validators, use formulas for delegation, and vary stake based on different weights.

JPool is the fastest-growing alternative among the top two. It was released in late October and is the third-ranked equity pool in TVL, surpassing Socean, which was launched in September (however, Socean is more integrated in the ecosystem). JPool's approach is to delegate to the validator with the lowest fee/highest APY under certain conditions (must be outside the top 20, must have a website/logo, must be active for at least 10 epochs). This aggressive strategy allows JPool to have the highest APY of all equity pools. Although JPool has the highest rewards, they are not yet integrated into the ecosystem. Socean is the fourth largest equity pool and is regarded as the second tier together with JPool. Their strategy is similar to Marinade's in that they don't delegate to the minimum security group or minimum data center security group, but unlike Marinade's focus on maximizing decentralization, they select fewer validators with higher rewards/lower fees . They recently slashed deposit and withdrawal fees in an attempt to get more deposits. Low fees are a way for new protocols to try to gain market share, as it can be challenging to compete with more established, liquid protocols when starting from behind. This gives Marinade and Lido more pricing power in competition with other companies. Socean does attempt to differentiate fees through their Socean Streams product, which is discussed later in this report.

first level title

Liquidity staking for DeFi

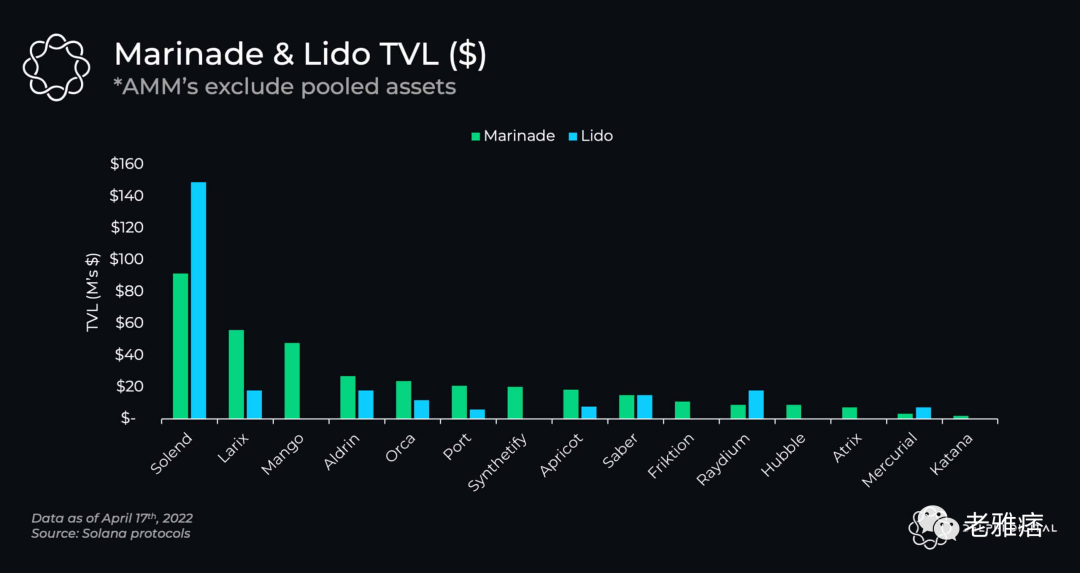

Aside from stake pool strategies and fees (arguably the most important), what matters most is how well the stake pool tokens are integrated in DeFi. Since stake pools are capital efficient derivatives of the underlying asset, if they just keep it in their wallet, they won't see much of a difference compared to self-delegation outside of diversification. Liquidity and composability are another major selling point to users, and liquidity begets more liquidity. As the first major liquid collateral token to launch (and native to Solana), mSOL (Marinade) has the most DeFi integrations in the ecosystem, being incorporated into every major lending and AMM platform, as well as options library, derivatives platform, and is the only token accepted as collateral for Mint USDH. Note that the chart above only includes materials and/or incentive pools for AMMs (Saber, Raydium, Orca, Atrix, Aldrin). Since they are permissionless, a pool can be created at any time. Protocols that use tokens as collateral (the primary use case for liquidity staking) have a more diligent onboarding process.

Lido is in a similar position to Marinade, although less integrated so far. It is expected that Lido’s stSOL will continue to be included at a similar rate to Marinade’s mSOL, as it has a strong name in the cryptocurrency space and has major Solana partners such as Alameda Research and Jump crypto as investors. One notable protocol that Lido needs to be aware of is Anchor, a protocol that lives on a different blockchain, Terra. Anchor has joined Lido for bLUNA and bETH, and stLUNA is used in the Terra ecosystem for protocols such as Astroport and Mars. Recently, it was proposed to add bSOL to Anchor, which would use Lido to connect SOL from Solana to Terra via the Portal/Wormhole bridge. Integrations such as these highlight that while Marinade may be the most liquid and the first to integrate on Solana, Lido's multi-chain strategy opens up many more possibilities due to its relationships with other chains.

By analyzing the top protocols, it is clear how much preference mSOL has in the Solana ecosystem, with Lido not far behind. Other protocols are not included in the above chart due to their size at this stage, though it is important to note that scnSOL (Socean) is third in terms of integration, with $12 million on Solend and $4 million on Orca. Liquidity pools are crucial when underwriting collateral, and this is one of the main reasons why mSOL and stSOL are accepted almost everywhere. mSOL has a few more integrations than stSOL, such as Mango, synthesis, and Hubble, but both are largely integrated into the main protocol, which is not the case for other protocols. Over time, if other stake pools continue to grow, they should be included more, but Marinade and Lido have a big head start. This advantage allows them to compound faster and become the collateral of choice for protocols, as their liquidity and large holder base make them considered less risky.

first level title

Valuations of Marinade and Lido

While TVL is an overused and often poor valuation metric in cryptocurrencies (for AMMs we don't want to know TVL, we want to know Volume/TVL, or even just Volume), it's liquid staking one of the most important indicators. The primary goal of the liquidity staking protocol is to grow TVL and take root across the ecosystem as quickly (and safely) as possible. The winner here will have a solid revenue stream to extract value from. As highlighted at the beginning of this report, currently Solana has approximately $2.1 billion in accessible fees, of which only $60 million (3%) is captured by liquid staking protocols.

first level title

final thoughts

The Liquidity Staking Protocol is an important part of the Proof-of-Stake network. Over time, we expect a winner-take-all outcome where a few protocols get all the liquidity. As these protocols become more integrated in the ecosystem and used as interwoven blocks, the liquidity complex of these protocols can have a significant flywheel effect. Once protocols start composing and building on top of each other, it becomes nearly impossible to undo this glue. These tokens have their own Lindy effect, and once a lead is established, it is very difficult to beat.

Marinad is the clear leader in the Solana ecosystem today, with Lido in second place, but this is still early days as only 3% of TAM is captured. Socean, JPool and more recently DAOPool and eSOL have all launched unique strategies that could allow them to gain market share over the next year, but it will be an uphill battle to catch up to the leads that Marinade and Lido have already established.