Panoramic analysis of the status quo of the encryption ecosystem: which tracks and projects will be the first to break the deadlock?

Original author:tolks

Compilation of the original text: The Way of DeFi

Original author:

Compilation of the original text: The Way of DeFi

Disclaimer: The following is not financial advice and the author owns some of the tokens mentioned in the article. This post provides an overview of much of the cryptocurrency ecosystem, particularly the protocols and developments in the field that the author considers to be the most interesting.

For those who want to quickly understand the article, here are the main points of the article:

1. Introducing the current state of the cryptocurrency ecosystem

2. What developers are doing - growth in developer size, their importance and incentives

3. Seeding – Outlines the good, desirable parts of venture capital

4. What we learned - an overview of the various areas, as well as lead projects

Scaling (L1/L2), NFTs, scaling infrastructure, token incentives, GameFi, interoperability and bridges

5. what happens next

Discuss developments I'm excited to see and how the industries covered will combine and leverage each other to drive the next cycle

My outlook on the current market and my thoughts on the next few months of the year

The Current State of the Cryptocurrency Ecosystem

Veterans in the currency circle should know that the price fluctuations of cryptocurrencies will be cyclical. Often the cryptocurrency market will undergo a substantial correction after a surge, and enter a chilling deep bear phase before the start of the next major cycle. The price of Bitcoin reached a historical high on November 8 last year, when the currency price was 68,000 US dollars, and the price of Ethereum also reached a historical high of 4,800 US dollars on the same day. It is down 60% from its highs and many altcoins are down more than 80%.

Developers are doing real things

Developers are the most important players in the cryptocurrency ecosystem. Their growth is related to the creation, maintenance and updates of innovative protocols. It is they who drive the growth flywheel forward. In a surprising development over the past six-plus months, FAANG developers have ventured into the cryptocurrency ecosystem. While the pace of developer migration may have slowed as prices have fallen, the trend is clear and it solidifies the direction the entire space is headed.

Unfortunately, developers are getting less heat from market participants when token prices drop, but cryptocurrencies offer them an opportunity that the FAANGs and Big Tech cannot: global, 24/7 crypto The currency "battlefield", and the ability to empower users, coupled with the explosion of new protocols or prototypes finding product-market fit, will continue to attract and seduce the world's most motivated and curious developers.

The developers of Web3 follow the open source spirit of the early web, and they have the ability to create economic value and impact of incredible scale in the code they write. We’ve seen numerous protocols (good and bad) launched over the years get drowned in hundreds of millions to billions of dollars in funding, and this presents a unique incentive for developers of future protocols. The ability of one person or a small group of people to have a huge impact on the future of global capital markets and the coordination of humanity in an emerging asset class is the most powerful incentive that exists in the Internet age.

Uniswap started with 500 lines of code and one developer @haydenzadams

Their cumulative trading volume hit over $100 billion yesterday

The leverage entrepreneurs can exert in the cryptocurrency space is self-evident

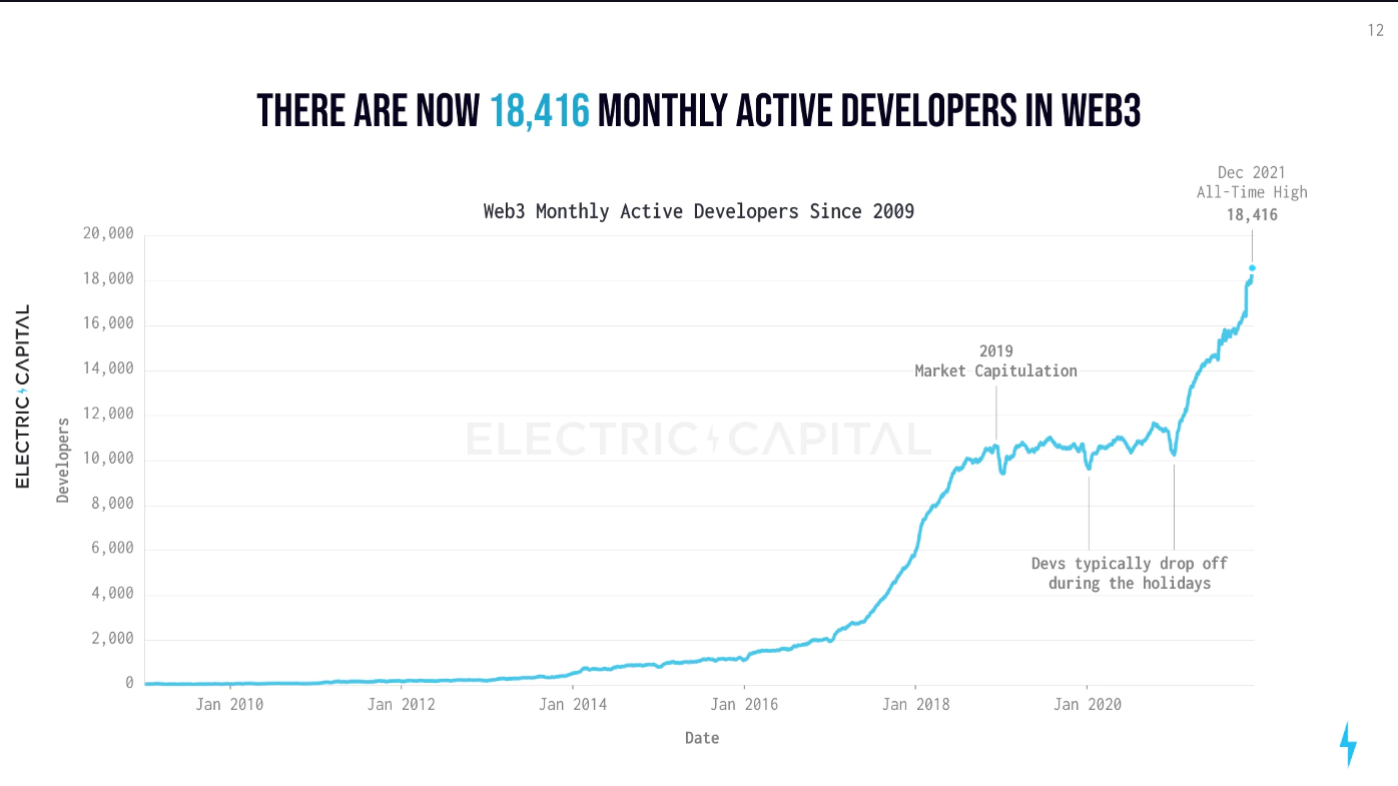

Further solidifying the above argument is the Web3 Developer Report from Electric Capital. They regularly publish the most comprehensive Web3 developer report in the industry, most recently in January of this year. A few key figures from their report are as follows:

There are currently more than 2,500 developers working on DeFi projects

image description

Web3 Developer Chart

image description

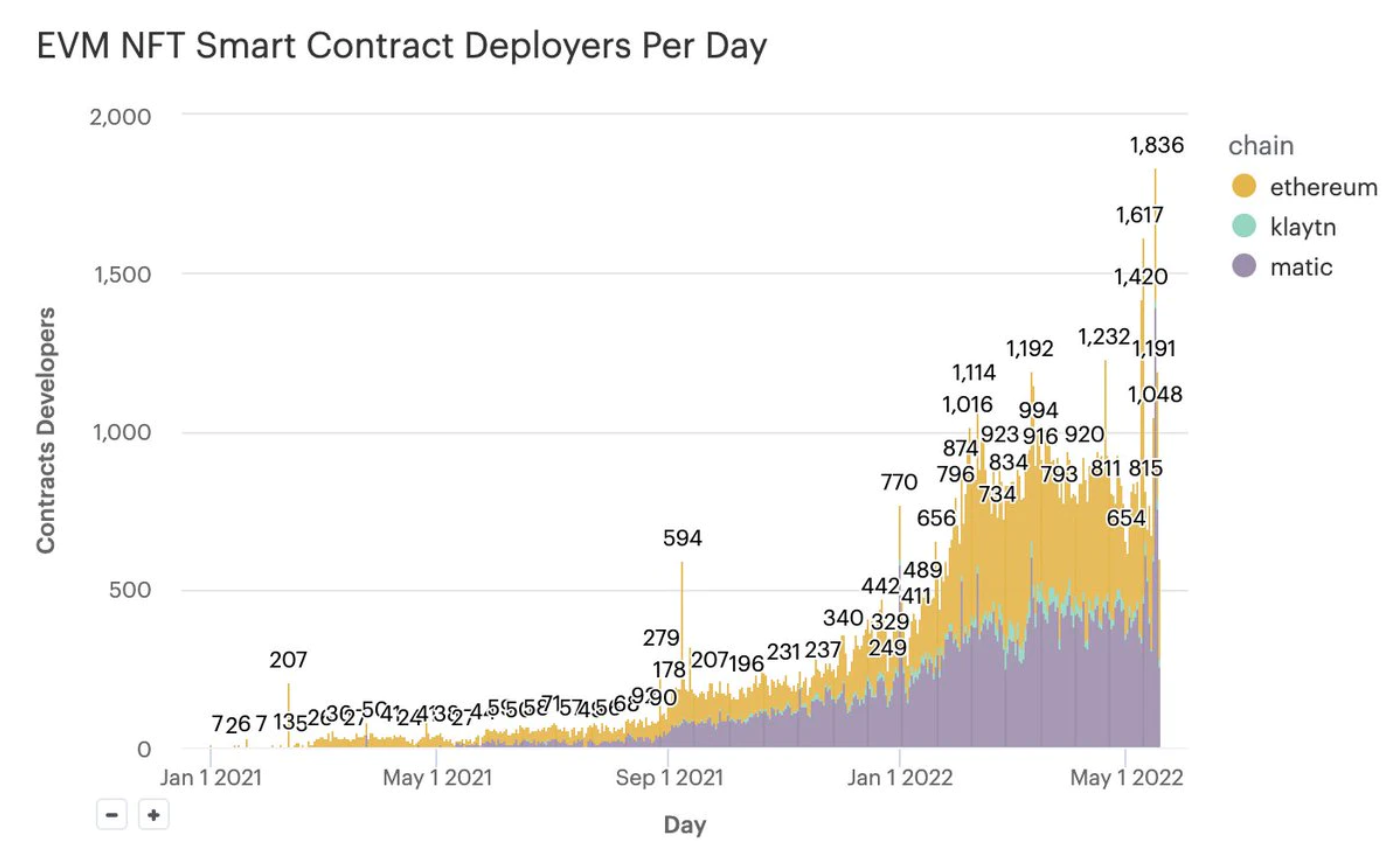

NFT contract deployment growth from Alex Atallah

Developers are the past, present, and future of the cryptocurrency ecosystem, and their growth, incentives to build, available support/funding, and curiosity about the space are at all-time highs.

The most important long-term fundamental indicator for crypto/Web3 is the quality of talent inflow.

Despite the troubling market declines, the influx of talent remains strong, and they seem to be accelerating, as many Web2 companies' stocks are down 50-80%.

This is the "Great Migration of 2022".

sow the seeds

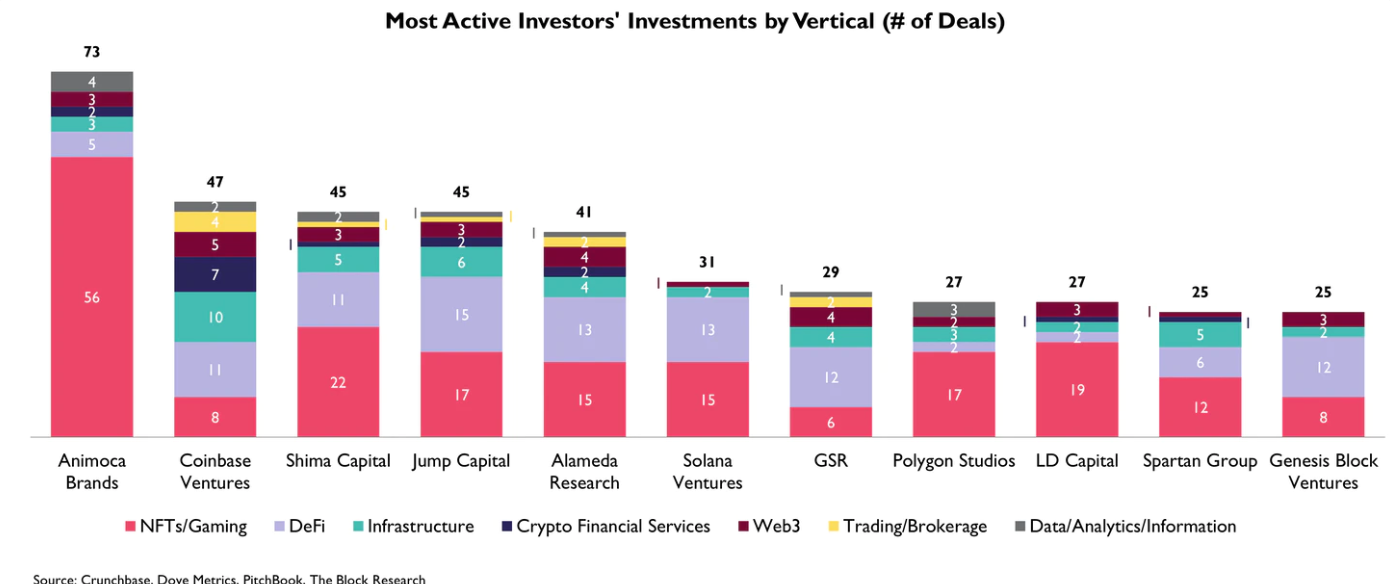

Developers and the protocols they build require significant capital, and there is currently ample capital waiting to enter the cryptocurrency ecosystem. The current cryptocurrency risk market is accelerating at a dizzying pace. Obviously, this metric has nothing to do with market conditions, but providing ecosystem-specific funding that attracts and empowers entrepreneurs and developers to come in and create the protocols of the future is a necessary evil.

Cryptocurrencies will always be an open, global, 24/7 marketplace that enables users to invest themselves and do their due diligence. The same is true, the protocols that enter the bull market seem to face unlimited funds, and many foundational pillars of the cryptocurrency ecosystem are now on the verge of running out of funds.

Ideally, the ICO era would teach investors the proper lesson that every innovative idea that enters the cryptocurrency ecosystem can leverage the wealth of public money.

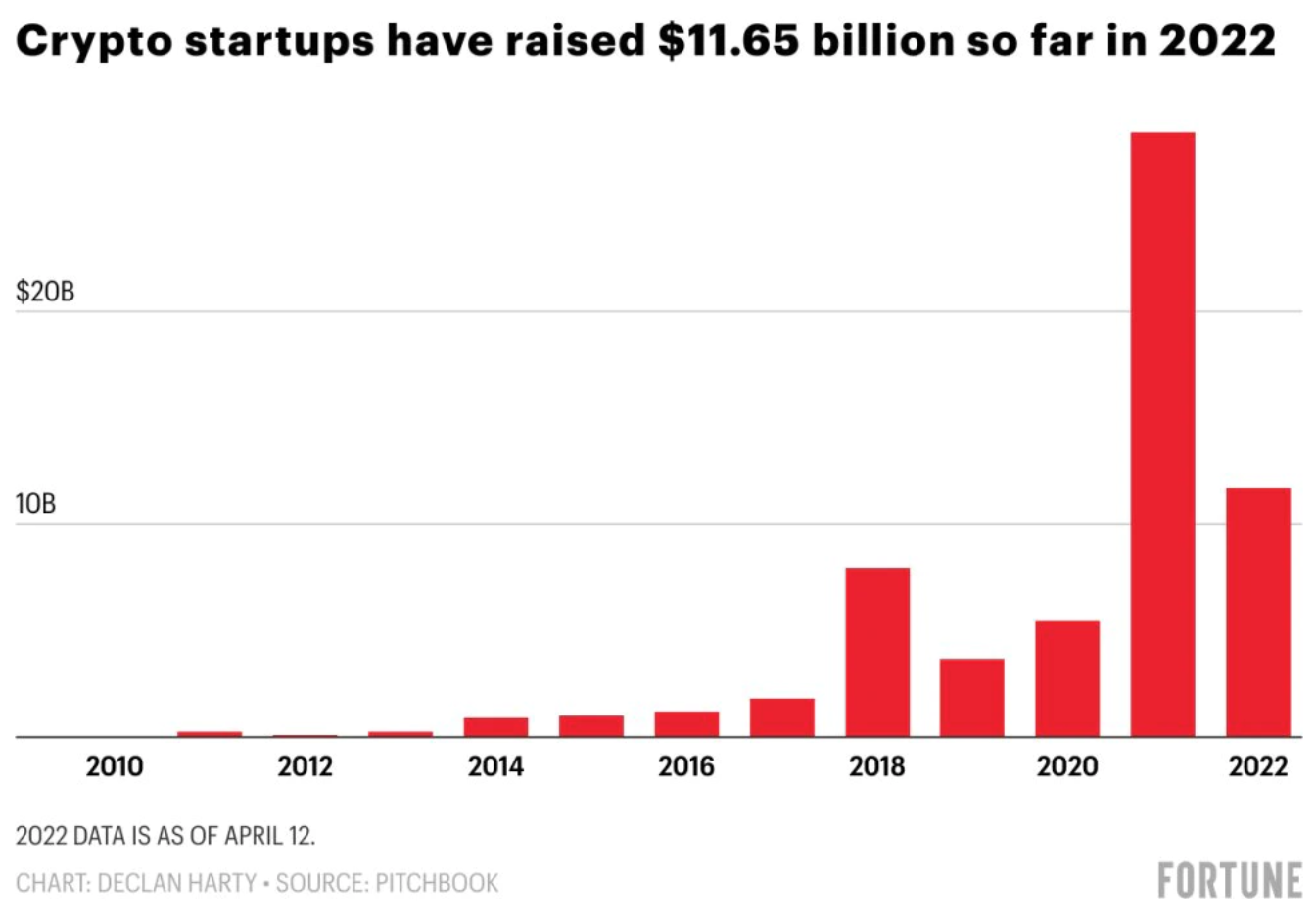

The Block's first-quarter venture funding

Plenty of PmF (product market fit models) and global demand are at the heart of the tech boom we've witnessed over the past decade or so, but the capacity, formation and mainstream acceptance of venture capital funding also played an integral role. The same dynamic is playing out in cryptocurrencies as capital continues to search for returns. Established venture capital giants, global market makers, banks, pension funds, endowments, traditional corporations, credit card institutions, established brands, public companies, athletes, etc. are all chasing returns, and over the past decade, funding/buying Cryptocurrencies offer the best risk-adjusted returns. Likewise, venture capital has some rent-collecting properties that are antithetical to the core values of cryptocurrencies, but the ability for future innovators to access capital pools on demand will be critical to the adoption we see in cryptocurrencies in the coming years.

image description

That figure was closer to $15 billion a month later

what did we gain

So, the crypto space has healthy, albeit frothy and semi-pumped funding, while developer interest, growth, and incentives are at all-time highs, but what has all this brought us? What did developers, entrepreneurs, and builders create together? Have we gained something?

So, the total market capitalization of cryptocurrencies just reached 50 million dollars today. But have we gained anything?

The total market capitalization of cryptocurrencies, after peaking at over $3 trillion, is now at $123 million, which is several times higher than the $500 billion when Vitalik tweeted the above. Let’s examine the core circuits that have been established in the cryptocurrency space and the leaders in them, and explore the protocols that prove the market capitalization of cryptocurrencies and will inevitably lead to their upward scaling.

Scaling - L1 and L2

There’s a reason L1 (mainnet) exchanges have been one of the most profitable of the entire cycle in recent times. As many Ethereum users and market participants are driven off by the high transaction fees in the bull market, smart contract platforms for some competing chains have been established and will continue to expand their ecosystems.

SOL - the highest throughput transaction chain (when fully operational) with innovative DeFi solutions, developed with the support of Serum, a CLOB center. In my opinion, SOL is the most likely winner of non-Ethereum smart contract platforms as it will continue to scale up runtime and throughput and implement a functional fee market. The upshot of this is that SOL will be the blockchain home to several large GameFi and DeFi projects over the next few years, while it continues to expand the nascent NFT ecosystem.

AVAX - AVAX has cemented its position as an inexpensive Ethereum Virtual Machine (EVM) compatible proving ground for DeFi, and through its subnetwork architecture, a place where future application-specific DeFi and gaming protocols can be built (see JEWEL Crystalvale subnet ). While AVAX's long-term sustainability relative to Layer 2 networks (L2) remains somewhat questionable, the project's short-to-medium-term traction and growth is solid, and it can thrive long-term.

ATOM - Cosmos and the IBC network have innovated through multiple cycles of cryptocurrency, but it has failed to gain mainstream hype and traction. JUNO and OSMO are good protocol developments, and Tendermint consensus supports more and more cryptocurrency protocols. The collapse of LUNA may also trigger the growth of the ATOM ecosystem, because ATOM is compatible with several previous LUNA protocols, which have begun to be ported to the ATOM chain. The ATOM-backed ecosystem over-collateralized stablecoin Inter Protocol was recently launched, which should be a positive development.

NEAR - NEAR is the public chain project that I am most interested in observing and experimenting in the next few months, because it has launched the USN stable currency and advertised the compatibility of the Aurora Ethereum Virtual Machine for easy connection. The Aurora-based Bastion Protocol, which describes itself as an "algorithmic DeFi protocol," put $410 million in Bastion's initial lockup, making it NEAR's largest growth accelerator. NEAR is also partnering with Infura for a smoother developer experience and scalable platform, while development of its NFT ecosystem and Nightshade sharding is also underway.

DOT - Polkadot has long been admired by venture capital firms and institutional investors, but these have not yet translated into actual impact. Still, the DOT ecosystem still has the strongest number of developers, and it recently announced a Statemint upgrade that supports parachain messaging and NFTs.

Other notable public chain projects: Secret (programmable privacy), Espresso Systems (zero-knowledge proof base layer and CAPE protocol), Celestial (modular consensus and application layer).

Layer 2 (L2) scaling solutions remain paramount to onboarding hundreds of millions to billions of future users into the cryptocurrency ecosystem. Optimistic and ZK (zero-knowledge) Rollups are still the main players here, with Optimistic's Rollups having real-time, applicable deployment benefits in the short term, and ZKR being the long-term sweet spot. ZKR is advancing rapidly and is ready for the second half of this year. If you want to learn more about the various ZKRs, please read my previous article on the zero-knowledge proof ecosystem.

Optimism - announced the OP token, is growing and currently has $492 million in total lockup

Arbitrum - As the race to incentivize users is underway, Arbitrum will soon follow in Optimism's footsteps by issuing tokens; it is currently the leader of the second layer network with $2.65 billion in total locked

StarkWare - Creator of Starknet and StarkEx. StarkWare secured $100 million in new funding on May 25 and announced StarkNet-enabled StarkGate Alpha on May 9, bringing its valuation to $8 billion

zkSync - Released zkSync 2.0 and EVM-compatible ZKR, currently in testnet phase

Polygon - Announces the addition of Nightfall zk L2 to its suite of scaling solutions

Aztec - Aztec Connect Confirmed to Live on Ethereum Mainnet June 6th

NFT

IMX - current leader in ZKR adoption with a focus on NFTs and gaming, also announces partnership with StarkWare for cross-Rollup NFT liquidity

While everyone is aware of the PFP NFT craze, we are still in the earliest stages of exploring how NFTs will have a huge impact. Behind the myths of wealth creation, people seem to have forgotten a very important fact: the simple and comprehensive revolution brought about by NFT as a verifiable digital packaging of any unique asset. The programmability of the technology and the royalties they can charge creators is a functional advance.

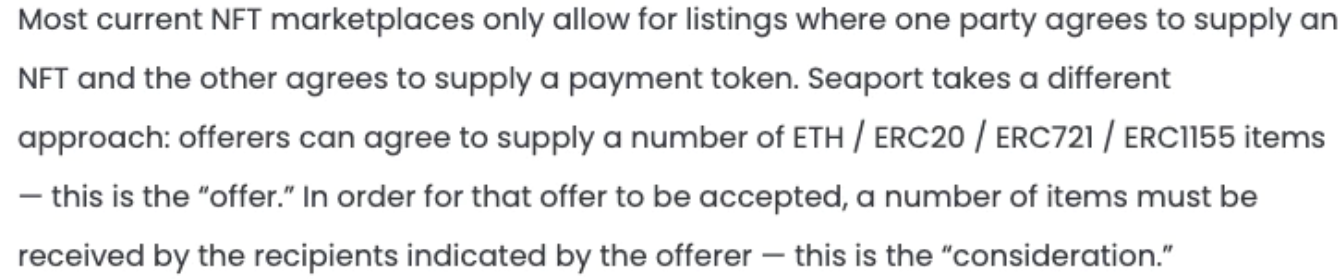

There are currently two traditional asset verticals starting to have an impact on NFTs; liquidity and financialization. The improvement of NFT liquidity is accomplished through two main concepts. The first is to expand potential market participants by fragmenting NFTs (fragmentation protocols); the second is to expand potential buyers by increasing the available sales methods. SudoSwap, NFTX, and Seaport announced by OpenSea are the leading candidates in this category. Seaport is a completely different marketplace than OpenSea, allowing buyers and sellers to offer or accept combinations of various tokens.

image description

Excerpt from OpenSea's announcement about Seaport

Most current NFT marketplaces only allow one party to agree to offer NFTs and the other party to agree to offer payment tokens. Seaport takes a different approach: Bidders can agree to offer a certain amount of ETH/ERC20/ERC721/ERC1155 items - this is an "offer". In order for the bid to be accepted, the recipient designated by the bidder must receive a certain amount of the item—this is the "consideration."

SudoSwap is about to launch its novel AMM (Automated Market Maker) based NFT decentralized exchange. 0xmons, the developer of SudoSwap, describes the protocol as: “a capital-efficient, gas-optimized base layer protocol for NFT liquidity.” Seaport and Sudowap should improve NFT liquidity in the coming months/years, which is an exciting development.NFTX is the last notable protocol, which further improves the liquidity of NFT by establishing an NFT exchange liquidity pool. Users of the protocol have the ability to deposit their NFTs into pools that are exchanged for fungible tokens and create yield-generating opportunities while allowing anyone to buy tokens representing specific NFTs on an open decentralized exchange A fungible token for collectibles.The Financialization of Non-Fungible Tokens

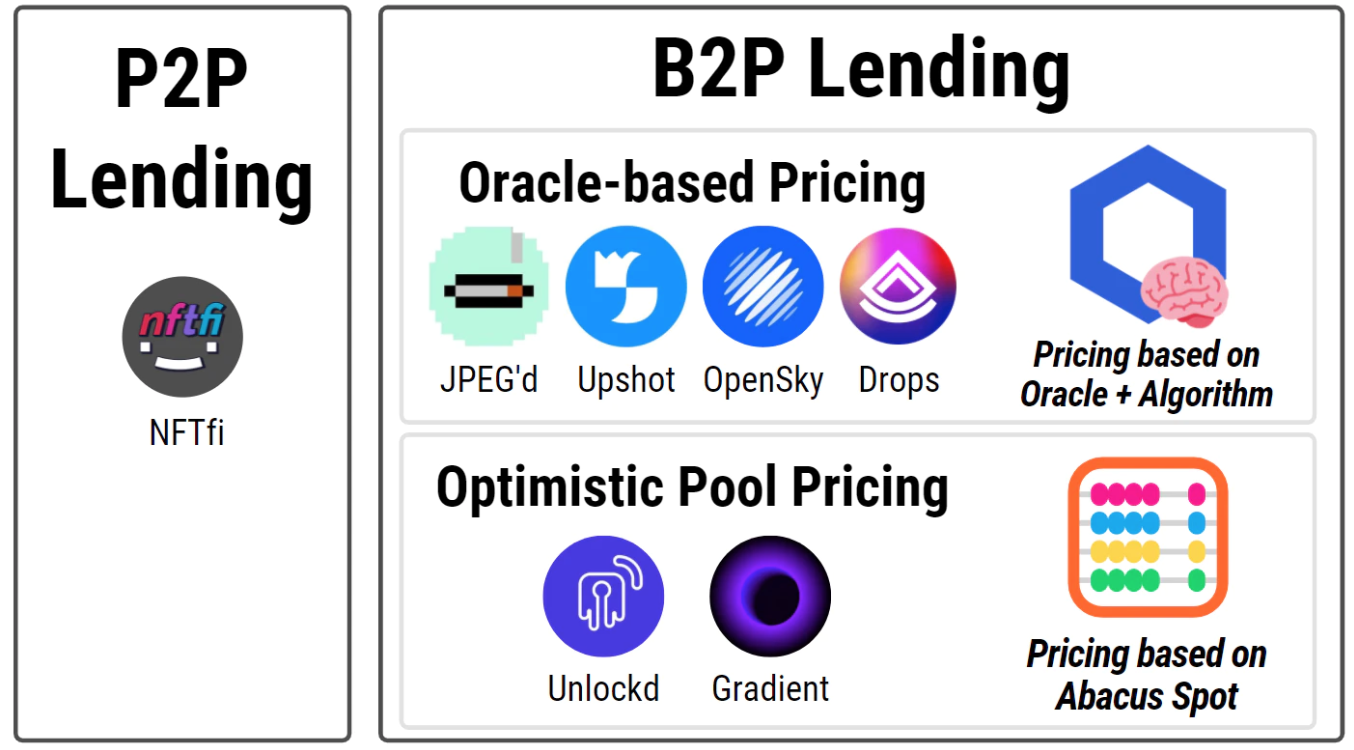

Two differentiated approaches are elegantly described and explored in: peer-to-peer lending and protocol lending.

image description

Image from 0xRusowsky's article

Ultimately, NFTs will become the most valuable asset class in the world as they continue to evolve to impact every industry. NFT will drastically change the fields of artwork, collectibles, social clubs, music, real estate, titles, user data, utility passes, intellectual property, and more, while NFT will further integrate into the gaming field.

Token-Enabled Incentives

One of the most exciting verticals in cryptocurrency is incentivizing a user base of diverse global market participants to perform some real-world actions through unique cryptocurrency tokens. Empowering people to contribute and build networks by exchanging spare resources or time for tokens and ownership is very powerful.

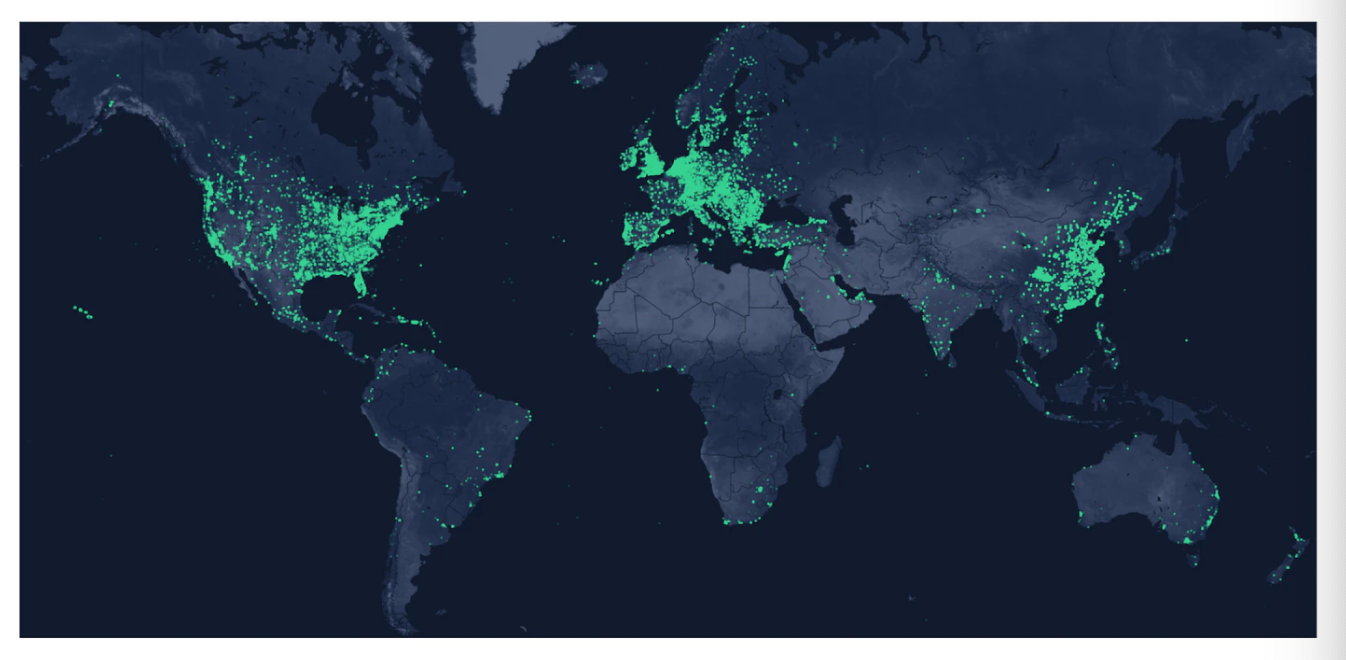

StepN (GMT), once the topic of crypto-twitter in media around the world, deploys a similar token-backed incentive structure. Although HNT and GMT serve completely different purposes, the similarities between the two are obvious. Multicoin calls this area "Proof of Work in Kind," and we'll continue to see these experiments reward real-world actions with tokens.

Protocols to watch: HNT, Pollen Mobile, Livepeer, Braintrust, Sweatcoin

GameFi

image description

Helium has 826,000 hotspots around the world and counting

While GameFi is more of a meme than an idea to actually gain and show sustainable market impact, the future in this space is bright. There has been a lot of writing and discussion around this industry and its potential future impact.

The eventual successful implementation of games combined with NFTs, DeFi, and the economies they will support will have a flywheel effect on the entire cryptocurrency ecosystem. Axie demonstrates the unparalleled growth these ecosystems can achieve in just a few weeks or months, while also ultimately demonstrating the results of poor token economics, sustainability, and incentive alignment. High-quality, engaging games take years to build, and attaching a sustainable economic model to the blockchain is very difficult.

Fortunately, there is currently an abundance of funding, developers, and gaming enthusiasts inspired and driven by the opportunity and total addressable market. We should start to see GameFi take shape by the end of the year led by two of the most exciting players in the space: Aurory on SOL and Illuvium on Ethereum (powered by IMX).

Interoperability and Bridges

In addition to the urgent need for more block space through competing chains and second-layer networks, another dominant narrative emerging this cycle is an interoperable, multi-chain future through secure bridges and asset transfers. Unfortunately, this claim has become the focus of mainstream discussion due to a series of hacks involving Wormhole, Axie’s Ronin sidechain, and to a lesser extent the Poly Network. With the continuous development of the ecosystem, some main chain and second-layer network services will become specialized, and people's demand for safe and decentralized bridges will further increase. Here are a few protocols worth highlighting that can compete with current market leaders STG and SYN:

LayerZero and STG - Built on the LayerZero network, STG aims to solve the "impossible triangle of bridges" problem through its innovative one-click on-chain native asset exchange. Layer Zero is a sophisticated messaging protocol that pioneered omnichain tokens and enabled NFTs, and several protocols are now being incorporated and built on top of that network.

SYN - Synapse is a favorite of crypto twitter (large positions), and its bridge protocol is currently the most used cross-chain liquidity network. Its latest innovation is xAssets, a project that converts native single-chain tokens into multi-chain assets. Synapse also recently announced that its cross-chain communication protocol will support NFTs.

Connext - Facilitates transfers between blockchains and rollups, allowing developers to build expressive cross-domain applications (called xApps). Connext also confirmed its upcoming $NEXT token and vision.

HOP - Originally launched as a USDC swap in July 2021, Hop has expanded to include swaps with ETH, DAI, USDT, and MATIC. Hop also recently confirmed and airdropped $HOP tokens and outlined its vision for the HOP DAO.

Wormhole, the bridge solution powered by Jump, now supports the Cosmos IBC network, also marking the 11th base layer chain it supports. Wormhole has approximately $670 million in total locked-up across different chains and utilizes token locking, wrapping and minting.

Other protocols to watch: REN, RUNE, Axelar, and Nomad.

Expand infrastructureOne of the positive developments of the crypto capital glut is that a significant portion of these investments are being deployed on the infrastructure track. Blockchain analytics and data analytics companies, non-custodial wallet providers, L2 scaling infrastructure, mining companies, service providers, staking solutions, fiat deposit and withdrawal providers, and the necessary infrastructure all got a lot of funding this year because The infrastructure layer supporting hundreds of millions of users has already taken shape.There are a lot of protocols to highlight in this space, but I recently read an excellent article by Zee Prime Capital

content, and strongly recommend that irons also read this article. Zee Prime has always had the best analysis of middleware and infrastructure stacks, and my thoughts are with them. Therefore, it is very stupid to want to imitate their research and depth on this issue, so please go to them for a detailed analysis of the current state of the infrastructure. For the lazy ones, I'll provide below the protocols that run within the infrastructure domains highlighted in their article:

what happens next

Protocols covered by Zee Prime: AR, POKT, Spheron Protocol, KYVE, Ceramic, Subsquid, SolanaFM, Glitter, Lit, Polywrap, Sepana, Kwil, and Guild.xyz

what happens next

The foundations of the cryptocurrency ecosystem are already broadly established, and the necessary infrastructure is advancing rapidly. These primitives and protocols are mature enough that they can leverage and integrate with each other to expand the demand for cryptocurrencies through more impactful applications, enhanced user experience, offering lower transaction fees, interoperable cross-chain experience , and enable people around the world to take ownership of what they deserve to better assemble and build in the future.

A couple of verticals that I'm watching closely are starting to grow:GameFi Economies Begin to Leverage and Incorporate Existing DeFi

Wallets expand their services - see article

Aiming Big: Wallets as Configuration Files

Expanding the use cases and liquidity of NFTs, and their downstream impact

Omnichain's protocol and NFTs offer leverage various chains to enable new use cases

Developments around rollup liquidity and Ethereum compatibility

ZK Rollups: their tokens and valuations, and dynamic control of market share

The SOL/ETH ratio and the capabilities of SOL, SOL continues to gain traction across the NFT ecosystem and create demand for DeFi tokens

NFT Market Metrics - Growth of LooksRare and Launch of SudoSwap

Continued growth and symbiosis of FXS, Curve, Convex and BTRFLY

Outlook for the second half of the year

My current view is that the market will experience a long period of pain before a sustained late-Q3/early-Q4 rally begins this year, which will accelerate in the first quarter. Many of the developing industries I outlined in the article will start to accelerate catalytically from the third quarter of this year, but there will be a very important event in this period, and that is whether Ethereum can be successfully merged.

Layer 2 network scaling solutions will continue to be advanced and deployed to mitigate transaction costs on ETH, they provide certain economic activity, and they will issue tokens to incentivize users (Optimism, Arbitrum, zkSync, StarkEx, and StarkNet).

NFTs expand their use cases and impact by increasing liquidity and enhancing financialization. The intersection of NFTs, games, and DeFi continues to accelerate and gradually take shape at the end of the third quarter with the developing meta-narrative (Gamefi provides a lot of demand), and there are several Gamefi ecosystems in this track that will be released in the fourth quarter or next year. And committed to long-term construction.

Layer Zero, Stargate, and Synapse provide developers with the ability to leverage cross-chain native assets and NFTs, and build protocols to leverage chain and application-specific benefits, all of which will begin to take shape in Q4.