The Ultimate Bear Market Guide for Junior, Advanced Crypto Players

This article comes from BanklessThis article comes from

, the original author: frogmonkee, compiled by Odaily translator Katie Koo.

In a bear market, market conditions are depressed. It is easy to lose faith, be driven by fear, and only invest for the short term. These impulsive decisions will cost you. Therefore, we must first determine what the goal is, what investment principles to follow, and what the portfolio management strategy is.

This article will provide beginner, intermediate and advanced crypto traders with strategic advice to put you in the best position for the next bull market.

First, are we in a bear market?

Let's align the basic definitions first. According to Investopedia:

“A bear market is when a market experiences a prolonged period of price declines. It typically describes a decline in security prices of 20% or more from recent highs due to widespread investor pessimism and negativity.”

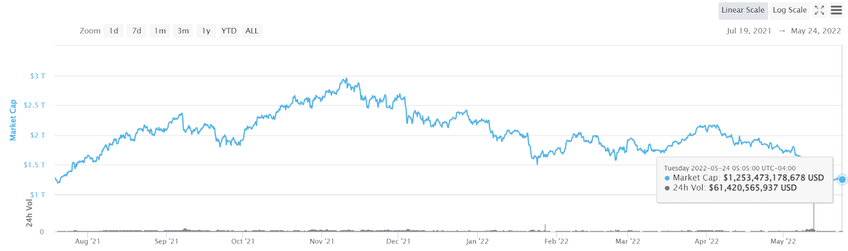

The market capitalization of cryptocurrencies peaked in early November last year at just under $3 trillion, according to CMC data. At press time, cryptocurrencies are worth around $1.25 trillion.

As I've been betting wildly on cryptocurrencies, I've noticed a marked drop in enthusiasm. Fewer people are following new NFT projects or venturing into small-cap tokens, and more people are moving their assets into ETH, BTC or stablecoins.

secondary title

The Three Guiding Principles of a Bear Market

Bear markets are opportunities. Nobody wants a bear market, but if you handle it right, you can benefit. Smart investors can steadily accumulate assets in a bear market and earn huge returns in the next bull market.survive. This is your goal. In a bull market, your goal is to accumulate wealth and make a profit. In a bear market, your goal is to survive the next bull market while losing as little of your equity as possible.

Keep it simple, keep learning. In the ecstasy of a bull market, it's easy to look like financial geniuses. In a bear market, your strategy will be stress tested. So, keep it simple, and trust your strategy for the long term.

secondary title

Assess your risk profile

Before we discuss any strategies, I want to talk about portfolios. A venture portfolio is a tool investors use to determine whether an investment fits their risk appetite. Here are some representative examples:

Under aggressive risk appetite:

Mainly small-cap tokens, some BTC and ETH, excluding stablecoins;

Willingness to use unaudited protocols;

Invest in dozens of different projects;

Moderate risk appetite:

Mainly BTC and ETH, as well as some stable coins and small market value tokens;

To stake in a higher-yielding pool, you must first understand the protocol;

Use a small portion of your portfolio to keep up with projects;

Under conservative risk appetite:

All in BTC, ETH and stablecoins;

Pledge the stable currency in the composite market and earn a low single-digit rate of return;

Hold no more than 5-10% of your net worth in cryptocurrencies.

Remember, in a bear market, our goal is to get our portfolio into the next bull market intact.

secondary title

Bear Market Survival Strategies

Junior Crypto Players - DCA (Dollar Cost Averaging) and Hold.

Target population:

Experience a bear market for the first time;

New to investing and financial markets;

Have a full-time job that has nothing to do with crypto.

The premise of a beginner's strategy is simple: choose a portfolio of low-risk assets, invest your budgeted amount regularly, and forget about other unrealistic thoughts until the market heats up.

This strategy has two steps:

Determine what assets you want to own;

Transfer dollar cost averaging into these assets and hold.

asset allocation

The first step in this strategy is to determine which assets you want to own. These assets will be a staple of your portfolio until the market starts to heat up.

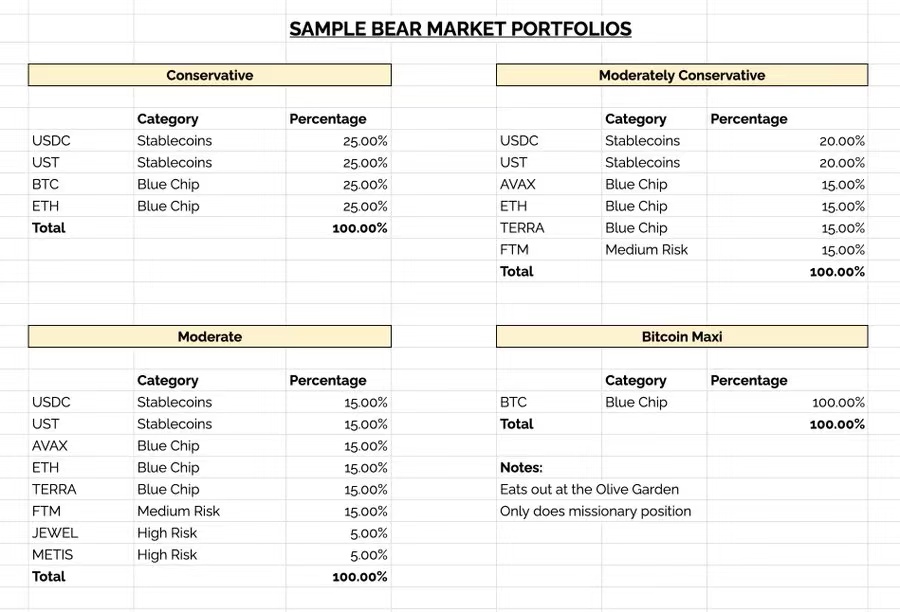

The figure below has some examples of asset allocations for different risk profiles (does not represent Bankless endorsement).

image description

(Odaily Note: This table is only an example of configuration methods under different risk preferences, made before the crash of Terra, non-standard selection reference)

dollar cost averaging

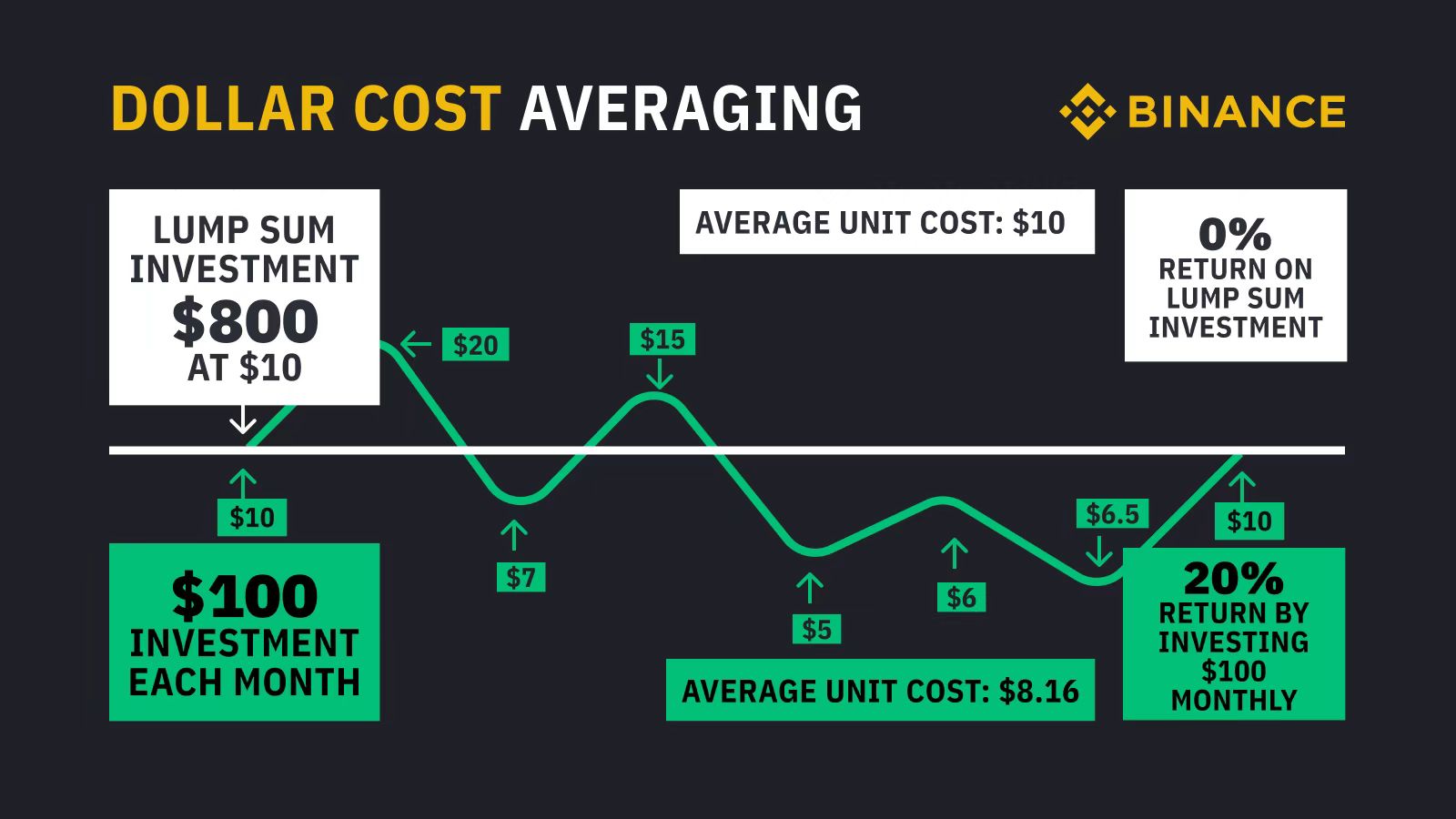

Once you've decided on your portfolio allocation, the next step is to budget how much you want to invest in these assets on a regular basis. This strategy is one of the most basic investing strategies and is known as Dollar Cost Averaging (DCA).

The beauty of DCA is that it removes the cognitive burden of market timing. The premise is simple: buy at the same time each period (say once a month). Ignore the price, just buy it.

Just prepare and forget they're there, come back and check your portfolio during the next bull market, and reap the rewards of your steadily accumulating blue-chip capital assets.

Intermediate Crypto Players - Investing in Index and Sector Rotation

Target population:

Tried a variety of DeFi protocols;

slightly risky;

Time to follow the market.

The intention behind this strategy is to spread out your holdings, thereby hedging market volatility and capitalizing on small bull market bubbles in bear markets.

diversification

Any sound investment advice starts with diversifying your portfolio risk and limiting your risk in any one asset class. The above asset allocation chart is an example of investment diversification, but we need to further strengthen investment diversification.

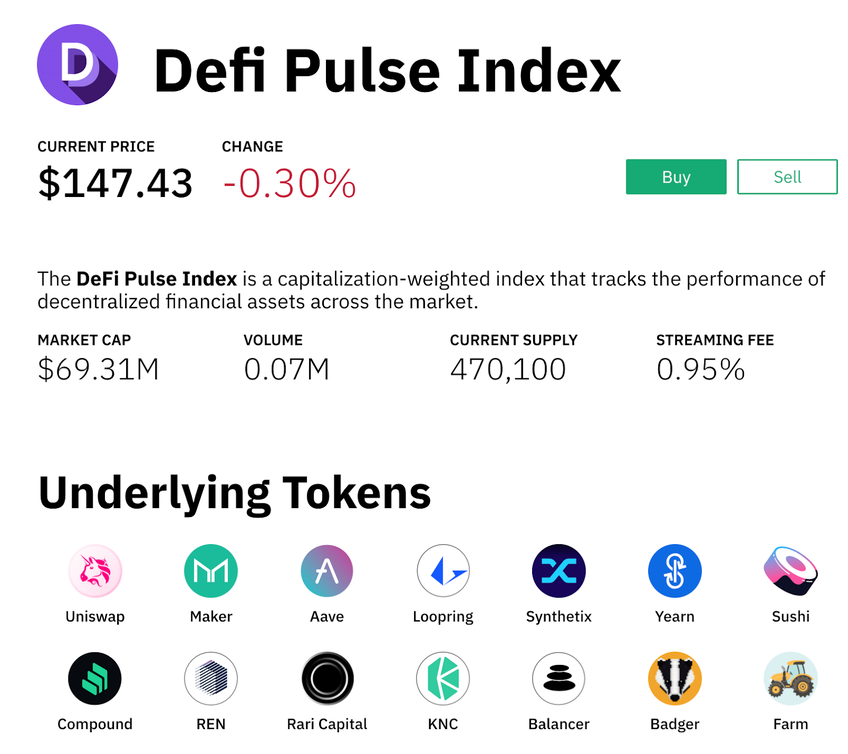

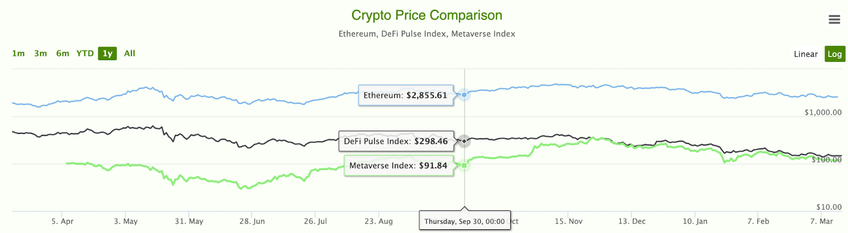

Diversification of a particular coin is one thing. What about the index? Indices are simply baskets of tokens, which means they represent a microcosm of diversification itself. For example, decentralized and autonomous asset manager Index Coop’s DPI token captures blue-chip DeFi tokens into a single basket token, spreading the risk and reward of a tested DeFi protocol across multiple tokens.

If you're thinking about diversifying your portfolio, look at indices, not individual coins. Index Coop has many different products, but that can be found in many other categories on the tokenset, and you can even create your own category.

Once you pick a category you like, you can do DCA (dollar cost averaging) on it.

Investment sector

Many indices are broken down into sectors, which represent a basket of tokens for a particular market:

DPI = blue chip DeFi token;

MVI = Metaverse Project;

DATA (data) = data economy.

In all types of markets, some sectors outperform others. For example, when comparing MVI, DPI, and ETH, we can see that ETH performs better in the long run. In other periods such as September to December, MVI leads ETH and DPI:

This is the first time the crypto industry has seen such a massive bear market. In 2018-2020, there is no DeFi or Metaverse to segment the market. Because of this, there is also no data showing which sectors will outperform the overall market average.A detailed intermediate strategy will accommodate how to invest in sector rotation, including which coins to consider within a sector, which indicators to follow, how to set stops and alerts. If you have time to watch the market,

Rotating in and out of stable sectors throughout a bear market is a good way to stay afloat, if not make a small profit.

Advanced Crypto Players - Defensive Options Trading

Target population:

Have a financial or self-study background;

Familiar with options;

Veteran player in the bear market.

I generally do not recommend actively trading in bear markets. Trying to profit in a bear market is riskier than in a bull market. Defensive trading is a set of market trading principles centered on limiting losses and volatility. Common strategies include diversification, sector rotation, DCA, and holding.

To use these strategies, you need to find an options exchange that supports the asset you want to short.

Opyn;

Dopex;

Ribbon Finance;

Hegic……

Some popular native DeFi options exchanges:

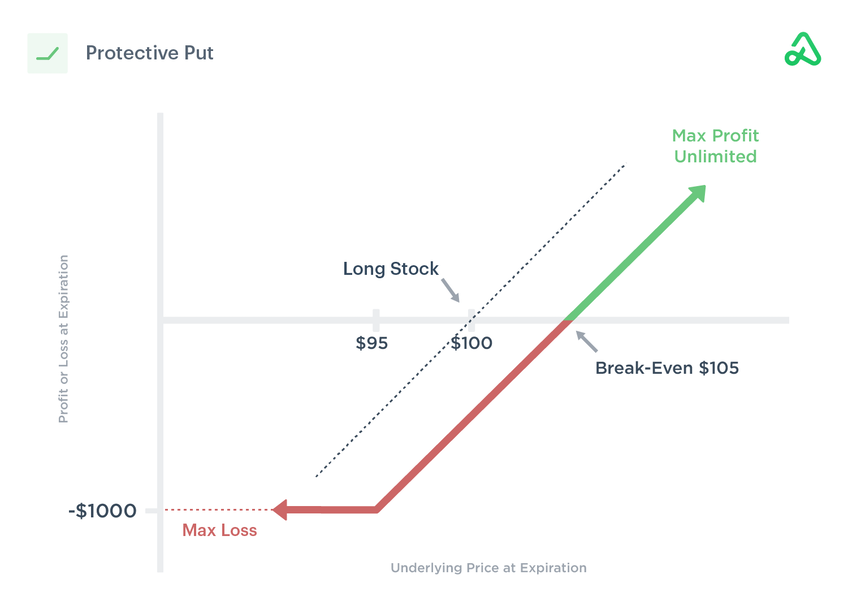

Pairing Put Options (Protective Put)

Buying paired puts is a hedging strategy that uses options to limit downside risk while going long on an asset.

By buying a put option on the underlying asset you own, you are effectively buying an insurance policy that sets a price floor so that you cannot lose more money even if the price of the underlying asset continues to fall.

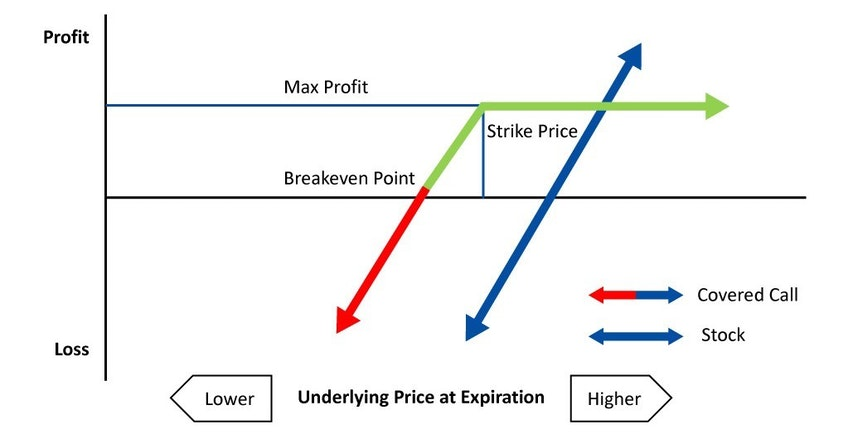

Covered call option (Covered Call)

A covered call is another options trading strategy that sacrifices potential upside to earn a current income stream.

A covered call requires you to hold the underlying asset and sell a call option to buy that asset at a fixed price. In a bear market, this works to your advantage because asset prices are likely to remain stable over the life of the option, allowing you to earn premium income by selling calls.

However, if the underlying asset appreciates beyond the strike price, your earning potential is limited.

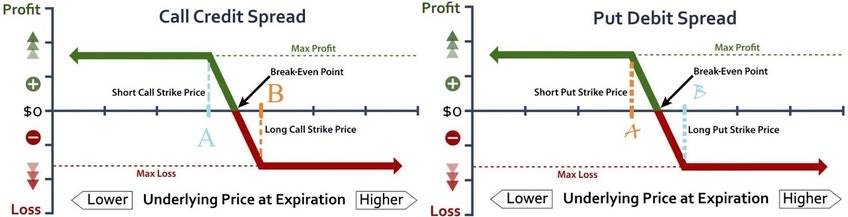

Bear spread option portfolio (Bear Spread)

There are two types of short spreads: put spreads and call spreads. Both strategies work in the same way: buy an option at the strike price and sell the same amount of options at the lower strike price. In doing so, these spreads create limited profit and limited loss trading strategies for moderately bearish investors.

secondary title

Lessons from the Bankless team

If this is your first bear market, here are some lessons from the Bankless team from 2018 to 2020:

Think long term. Don't stare at the market every day. Be mentally healthy, pick a strategy, follow it, and forget about numbers. It will pay off in the long run.

Remember your goals. survive. If you are experiencing FUD, remember that everyone feels FUD when they are bears. Put it aside, stay conservative and wait for the bull market.

Invest your time. Speculators and retail investors leave in a bear market, but builders stay. If you take the time to contribute to the project, you are sure to make meaningful connections and maybe even gain an edge before the next bull market. To learn and improve yourself.

Become a crypto user. Become a real crypto user. Those who traded on Uniswap, registered ENS names, and donated to Gitcoin all received handsome rewards from the airdrop. You get the best yield in the world and take ownership of key agreements. By becoming a cryptocurrency user, you are preparing for a future bull market.