Hutt Capital: Overview of Blockchain VC Landscape in 2022

Original Author: Hutt Capital

Original compilation: Gary Ma Wu said blockchain

introduce

introduce

Hutt Capital is pleased to publish our fourth annual review of the blockchain venture capital landscape. It's been a particularly busy year for the blockchain venture capital scene. In the spirit of transparency in the industry, we are pleased to share the aggregated data openly.

Focusing solely on blockchain VC funds, this report seeks to understand where institutional LPs can invest, which aligns with our vision at Hutt capital, the fund platform for the leading independent blockchain VC funds.

Summarize

Summarize

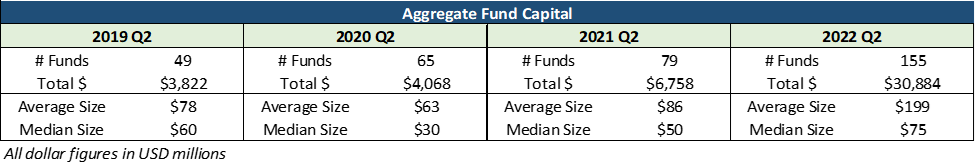

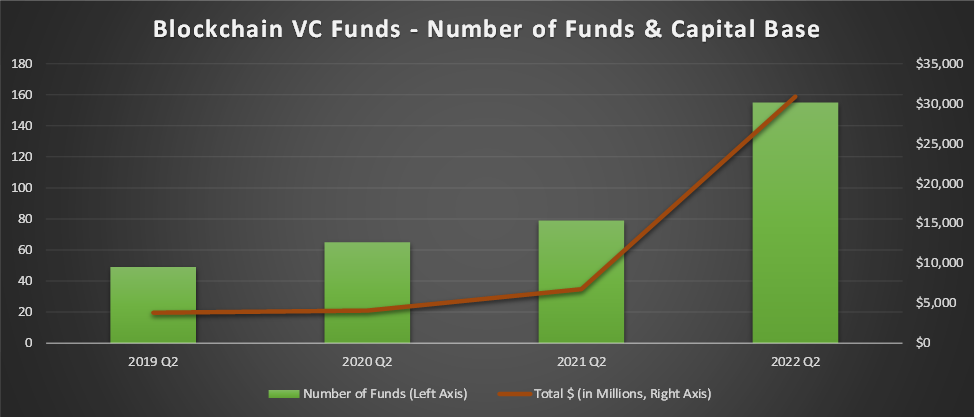

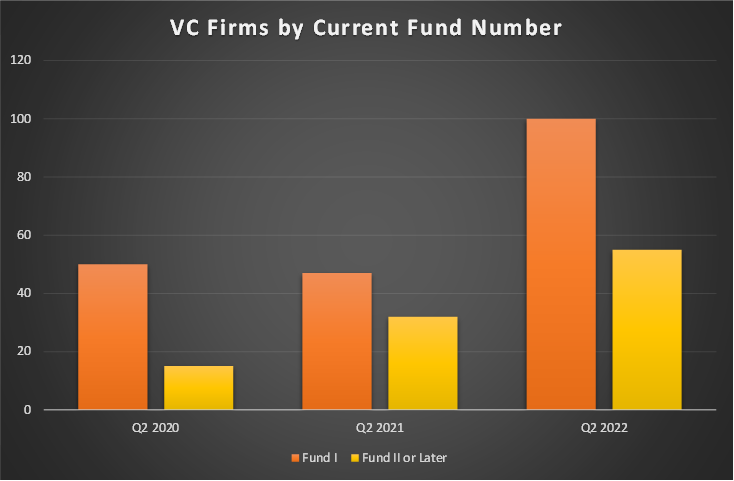

This year is a record year for the establishment of blockchain VC funds, with a net increase of 76 blockchain VC funds in the past 12 months. The number of venture funds we track now stands at 155, up from 79 a year ago and a 96% increase year-over-year.

The field of blockchain VC is growing rapidly, but the amount of funds controlled by funds is growing even faster. These blockchain VC funds have $30.9 billion in invested capital in their liquid funds, up from just $6.8 billion a year ago, representing an annual growth rate of 357%. Venture capital is no longer the cottage industry it was in the past few years.

image description

Blockchain VC fund financing round

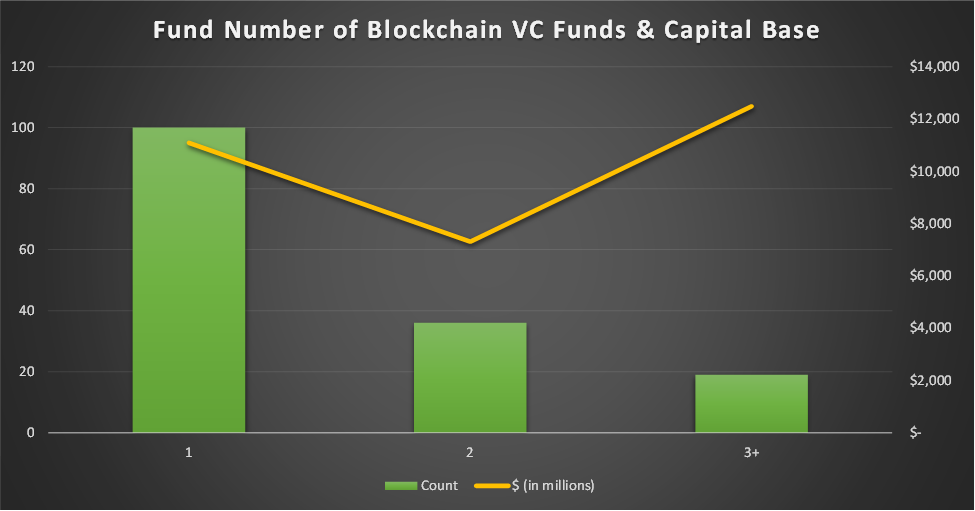

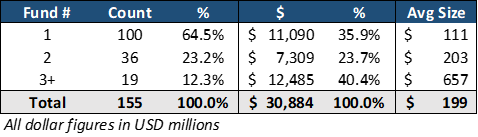

Of the 155 blockchain VC funds, 100 were first-time funding funds, 36 were second-round funds, and 19 were third- or higher-round funds.

More long-term funds have the most capital. Funds that raised more than three times accounted for 12% of the entire fund, but 40% of the capital. There are 19 funds that have raised more than three times, and their total capital exceeds 100 first-time financing funds.

That ratio would be skewed even further were it not for big first-time funds like Hivemind Capital Partners and Haun Ventures (both of which reportedly raised $1.5 billion).

The breakdown of these funds has not changed substantially over the past year, as each has seen strong growth. There are now 55 funds that have raised more than two rounds, up from 32 last year and just 15 two years ago.

Blockchain VC Fund Financing Scale

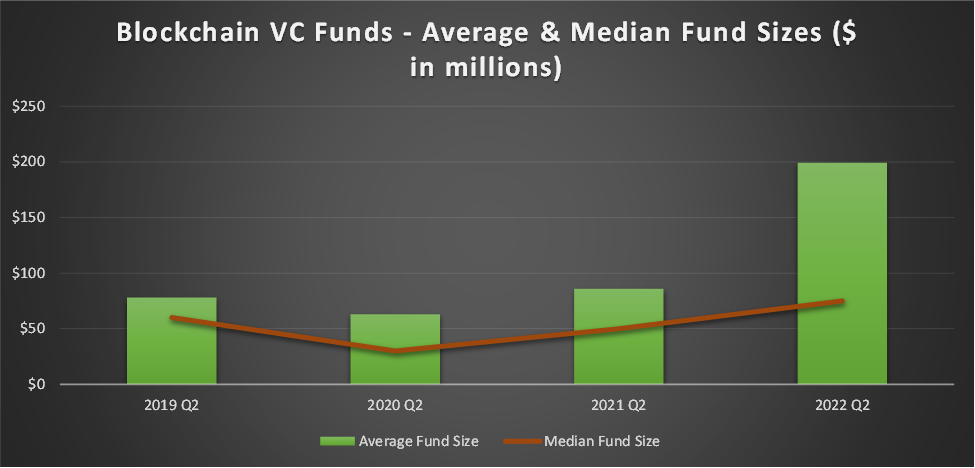

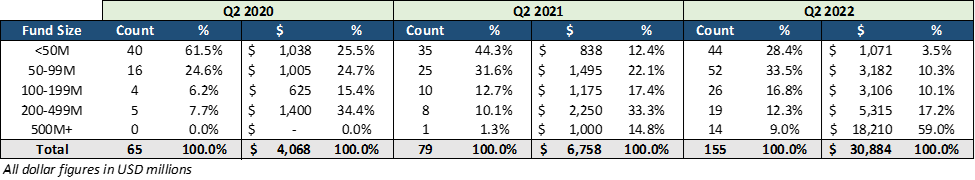

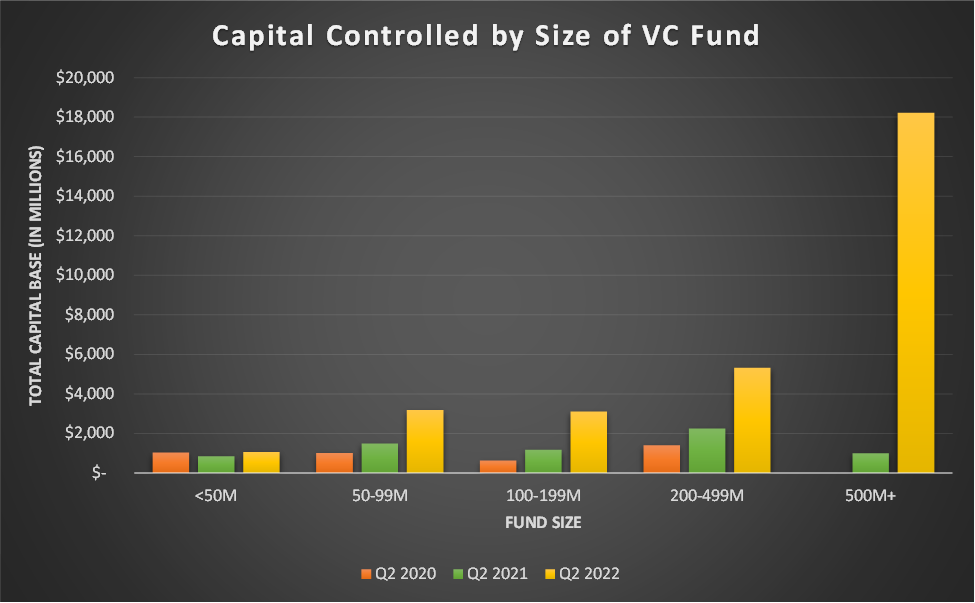

The size of blockchain VC funds has grown significantly in the past year, and the level of capital controlled by large funds is unprecedented.

$18.2 billion of capital, or 59 percent of the industry's capital base, is controlled by 14 funds of $500 million or more. A year ago, the funds themselves had nearly three times as much capital as the industry as a whole.

The industry is more polarized than ever. Thirty-three funds with an average size of $713 million control 76% of the capital. The remaining 122 funds control the remaining 24%, with an average fund size of $60 million.

Despite this divide between large and small funds, the 122 funds under $200 million still control 9% more capital than the entire fund industry did a year ago.

Except for funds under $50 million, all categories saw substantial growth compared to last year. Funds under $50 million have remained somewhat insulated as many of their peers have grown and entered the market. The 44 funds under $50 million managed $1.1 billion, a 28 percent increase from the 35 funds managing $838 million a year earlier.

As capital became easier to raise, we saw the emergence of opportunity funds and growth funds. These are growth-stage funds that complement existing early-stage platforms and are common in traditional VCs but are now entering the blockchain space.

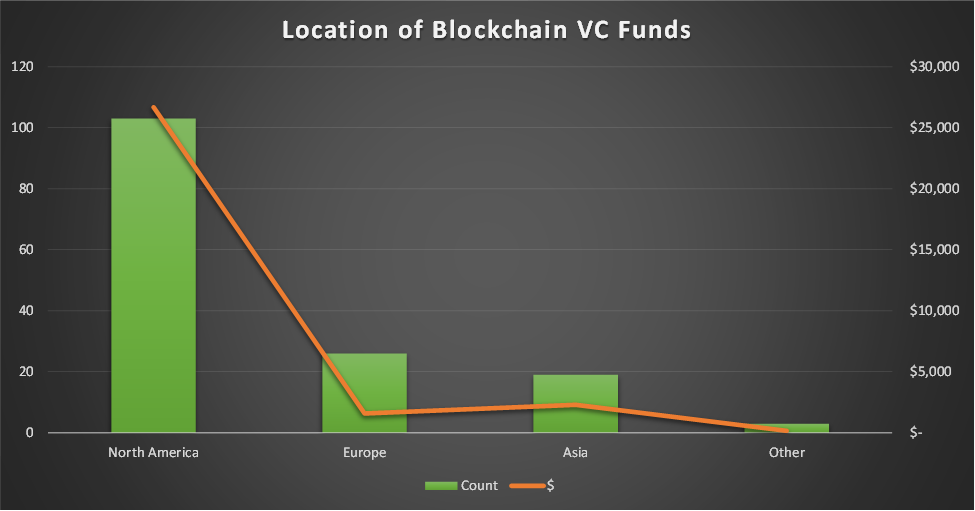

Geographic distribution of blockchain VC funds

North America remains the leading location for blockchain VC funds, with 68% of funds based in the region and representing 87% of the industry's capital base.

North America is also driving the mega-fund trend, with average fund sizes of $259 million, Europe at $61 million and Asia at $120 million. Of the 14 funds with more than $500 million, only one is based outside North America.

For blockchain VC companies, coordinate geography is not as important as traditional VC companies. Many of these funds have a global focus regardless of where they are located. Thus, while blockchain VC deal data is not included in this analysis, we expect that underlying blockchain VC deal data will be more globally distributed relative to the location of blockchain VC funds.

additional observation

The blockchain VC investment market has grown a lot in the past 12-18 months.

The emergence of mega funds/asset aggregators

Availability of capital drives more competition for deals among funds

High-quality blockchain venture capital funds are massively oversubscribed and hard to come by.

DAOs and guilds are taking market share from traditional VC funds

Increase in professional funds

secondary title

The emergence of mega funds/asset aggregators

There is enough demand to invest in blockchain VC funds that companies with ambitions to raise large sums of money can do so for the first time. As funds continue to grow in size, these players have moved upmarket and now need to write larger checks in large rounds to deploy their funds. This has resulted in more capital being deployed into growth stage companies and liquidity tokens, whether through outright purchases or through treasury deals.

The move to the upper end of the market has opened up a gap in the pre-seed and seed stages that is being filled by new and existing smaller funds that will support founders at an early stage. Many large funds (or their general partners) and industry strategies act as limited partners in new early-stage funds, creating a vetted deal flow for their own companies.

Availability of capital drives more competition for deals among funds

One effect of the 357% growth in the industry's capital base in one year is that competition for deals has become cutthroat. Before 2021, people with almost all funds can participate in financing with low valuations. This has changed. Funds are now competing fiercely based on reputation and value proposition (or, in some cases, willingness to pay top price). Valuations have also risen as a result.

From a LP perspective, it is critical to understand which companies have built differentiated brands and value propositions in order to sustainably repeat historical success. Each fund's track record looks good, but the environment that produced them was far less competitive than it is today.

High-quality blockchain VC funds are massively oversubscribed and hard to come by

LPs have more investment options than ever before when it comes to blockchain VC funds, but the demand for LPs to invest in blockchain VC funds is clearly growing faster than the capital base of these funds. Every fund was oversubscribed. LPs are fighting to get in because a lot of them are being turned down. Institutions are coming in with the ability to write big checks. The access game we saw in traditional VC has now entered the crypto space.

DAOs and guilds are taking market share from traditional VC funds

Venture DAOs and game guilds receive grants from venture funds at an early stage (mainly pre-sale seed stage and seed stage). High-quality venture capital DAOs are an attractive source of capital because founders have access to a diverse network of individual members who can bring a variety of expertise and relationships. We've seen this with Seed Club Ventures. Today, most VC DAOs are relatively small, so payouts are small in very early rounds, but we believe this source of funding will grow over time.

Game guilds provide blockchain game startups with a unique source of strategic capital, which is difficult for traditional venture capital to replicate. The number of game guilds continues to grow, and these groups continue to occupy a share of the early game market. Guilds themselves are often VC funds, and VC funds that aren't as deep into games may prefer to have indirect exposure to a set of games rather than picking winners in less familiar categories.

Increase in professional funds

In our view, specialization is increasing due to two main factors:

1 The industry today is too big and too broad to cover everything, and different categories require unique expertise and relationships, so funds must identify where they have a competitive advantage and strive to be the best in that area;

2 Specialization is a way for emerging funds to differentiate themselves and gain an advantage over incumbent players, especially in younger categories like DeFi, gaming, NFTs or DAOs, where we most often see specialized sub-sectors fund.

Web3 has become the trend for general-purpose VC funds, but specialized funds dominate

Original link