Starting from nine application categories, discuss the future of encrypted native consumer products

Compilation of the original text: Paimon

Compilation of the original text: Paimon

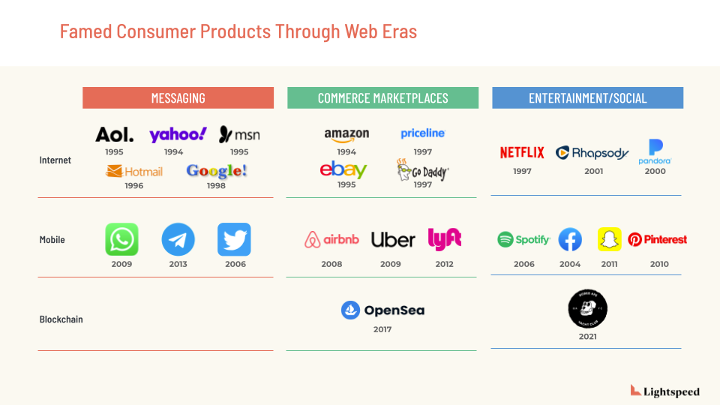

Every major technological change eventually spawns a wave of new consumer technology companies. The Internet brought media applications like AOL and Yahoo, online marketplaces like Amazon and eBay, and entertainment sites like Netflix and Pandora. The shift of the Internet's focus to the mobile terminal has led to the rise of companies such as Twitter, Uber, Facebook and Snap.

We are at the moment of the third major structural shift, and the cornerstone of all applications and services is gradually turning to the blockchain (Web3). The potential of blockchain is enormous, as it solves many of the issues surrounding identity, transparency, and trust that currently plague the internet.

why?

why?

One reason for this is that it is too early for the magic that blockchain holds to appeal to a large number of "mainstream" folks. In the crypto world, users are mostly attracted by reward incentives and ownership. Most successful consumer products tap into a wide range of core drivers of human behavior—the need for being and meaning, expressing and creating, connecting and influencing, owning and belonging, safety and security, influencing and engaging, stimulation and dopamine, achievement and construction. need.

This is why it is so difficult to create unique consumer products - creators have only a few seconds to grab the user's attention, and after they do, they have to face an even harder problem, which is Drive product reuse and ongoing user engagement.

Building a lasting cryptocurrency brand that meets these needs of users presents both a challenge and an opportunity. Encryption-native companies need to take the acceptance of ordinary consumers for decentralization as one of the metrics, and find an optimal balance between "experience" and "decentralization". Some companies are still using some consumer product building principles (bring trust, safety, seamless experience, surprise and delight for users) - they are excellent in community building and bring a strong sense of belonging to users.

There are plenty of potential stocks vying for these opportunities. Cryptocurrency-native products have already shined in 9 fields, including digital wallets and NFT markets, and will become mainstream in several emerging fields in the future (future articles will select some of these fields for more detailed discussion).

We are in a “correction period” for cryptocurrencies, and the crises created during the correction will create new opportunities for new categories of consumption. It is conceivable that after a year, the following categories will change course.

Here are a few areas where we are likely to see crypto-native consumer giants emerge, broadly in categories ranging from mature to young.

#1 Commerce / NFT Marketplace

Whether you are video, art, games, music, there are NFTs (non-fungible tokens) derived from each field, and each NFT also has a market. NFT marketplaces are the town squares, business centers of cryptocurrencies, and their success stems from their perception of popular elements.

Before NFTs can become a trusted mass-market product, they need to overcome mass-market distrust of cryptocurrencies and improve the buying experience.

A potential opportunity for designers to build a platform with world-class trust, safety and security and open up a broader market for NFT benefits. Utility NFTs can appeal to the mass market — and we’re likely to see more embedded and platform commerce opportunities on the sidelines as well.

Although OpenSea has always been dominant in this field, it has recently been overtaken by Magic Eden in terms of users and numbers. Other well-known companies currently working on this include LooksRare, Hawku, Fractal, Zora, and Autograph.

#2 CeFi / DeFi, and the development prospects of wallets

Just look at the sky-high net worth of Coinbase, Blockchain.com, Uniswap, Metamask, and Zerion, Zapper, and you have to admit that consumer fintech products are arguably one of the biggest successes to date. In centralized and decentralized finance, wallets are undoubtedly the biggest winners.

Wallets are to cryptocurrencies what email is to Web1.0. The wallet has become an authentication method that connects people who log in to a single node in series, and groundworks the original encrypted world. But they haven't reached the heights of mass consumer-grade products.

Poor wallet usability and UX design - creating a wallet requires memorizing an absurdly long mnemonic and risking getting locked out to transfer funds (YouTube, good luck).

Even after completing the above steps, you have to pay a bunch of handling fees when you buy things. As such, the entire system is not quite ready for the mass market.

And the good news is that there is a huge market opportunity to improve this process. Big players like Blockchain, Metamask, WalletConnect, Phantom, and Rainbow are bound to take steps to respond aggressively, and wallets-as-a-service WAAS like Triangle and Slaz will also redefine the market.

#3 Games / Metaverse

Back in October 2021, someone realized that this metaspace was different. While the word "meta" may seem confusing, you can't deny that crypto metaverses like Sandbox and Decentraland, and the larger Web2 metaverse like Roblox, Minecraft, VRchat, RecRoom, etc., are the main social circles for players the resulting impact.

Young people are happy to spend time in open-world social games, which is why they have the highest growth rate.

Cryptocurrencies connect these platforms to real-world currencies for the first time, greatly increasing the potential and utility of games.

Due to the intrusion of "earn while playing" and other related problems in encrypted native universe games, the game experience is not good.

It will be interesting to see if Faraway, Star Atlas, Defi Kingdoms, Harvest and many other blockchain gaming startups can usher in a new era of cryptocurrency gaming.

#4 Digital IP/PFPs: The Disneyland of Cryptocurrencies

Perhaps the most visible success of crypto products so far has come from NFT profile pictures like AYC, Cryptopunks, World of Women, Azuki, and others. The first 3 NFT series alone will drive 40% of OpenSea's transaction volume in 2021. These projects create community and shared identities around art and will bring characters to life in the same way Disney and Pixar did.

Digital-first IP brands have a number of advantages over IP development in traditional media – with enhanced community engagement, they can quickly iterate and tokenize through social media, making it to the front of the story before the story begins.

In the case of Crypto Coven and Invisible Universe, compelling storylines are key to increasing engagement—in the age of Web3, projects are not just consumption-driven, but more like ongoing interactions among community participants. This is also the secret to making the story and characters more vivid.

The best digital IP companies are monetizing with sustainable portfolios, partnering with gaming and other recurring royalty pools, and not relying on one-off bespoke licensing deals. Companies to watch in this space include Recur, Yuga Labs (BAYC), Invisible Universe, and others.

#5 Creator / Entertainment Medium / Collectibles

Entertainment and sports have been the biggest bridges for cryptocurrencies into the mass market - Staples Center is now Crypto.com Arena; Generate income continuously. Articles on Creator Currency and Future Income appear in October 2021, a category that, while still in its infancy, highlights the impact of game-changing cryptocurrencies on creativity.

Creator currency turns a community of fans into a financial backstop, turning someone's personal brand into a form of currency.

Tokens, NFTs, and crypto assets work great for creators with volatile incomes — who need to constantly produce new content or increase their popularity to keep generating income. The creator's fan group owns the creator's unique works and converts their love for the works into financial support for the creator.

Creator tool companies provide creators with the means to publish articles and create music on the platform by connecting with cryptocurrency-native platforms such as Mirror and Mayk.

Sports have always been closely associated with collectibles, and entertainment collectibles companies look forward to further optimizing digital collections in a trusted, verifiable, and scalable manner in Web3 on top of existing Web2 behaviors

Players in this space include HumanIPO, Mad Realities, Dapper/NBA TopShot, Audius, Rally, Fan Controlled Football, Royal and Autograph.

#6 A collection of search/discovery and interest-driven DAOs

While Web1's biggest innovations addressed search and global information access, Web3 adds an identity layer. The added new dimension allows block search engines to easily obtain ownership records, bringing more new things to people. But so far, it's been hard for people who just hang out in Twitter Square to find interesting things in the crypto world like new collections of NFTs, DAOs, attractive people, etc.

The emergence and proliferation of DAO may be able to solve the previous dilemma. DAOs (Decentralized Autonomous Organizations) enable communities to form and act collectively around interests without the need for hierarchies or bureaucracies. And, because they rely on smart contracts (code), transparency and trustworthiness are greatly improved. DAO will be one of the dominant consumer applications for the following reasons.

DAOs can be created for almost any purpose -- from supporting Ukraine (UkraineDAO) to research around aging and longevity (VitaDAO), from social clubs (Friends With Benefits) to owning a sports league (Fan Controlled Football).

Whoever can aggregate all these DAOs and enable discovery across social groups can replace Facebook groups with an embedded financial system that rewards people for their contributions to each community.

What can achieve this kind of aggregation may be DAO tool companies that already support the DAO network, such as CollabLand, Superdao, Syndicate, or analysis companies such as DeepDAO. DAO tools are interesting candidates because they already support the DAO network.

#7 Connection/encrypted native messaging

Every new technological change creates a new messaging giant. At Web1, it's email companies like AOL, Yahoo, Hotmail, and Gmail. In Web2, there has been an explosion of SMS, Whatsapp, and other mobile messaging companies. Why?

Information transfer is one of the highest types of social activity and a value called "connection" realized by the Internet.

For reasons such as wanting to buy similar assets or just wanting to meet people with the same interests, the function of sending messages to the wallet owner based on the assets in the wallet is absolutely impossible for people today.

Send a message directly to the wallet address and pay for the access right, so you don't have to worry about making a difference in the middleman and save the handling fee they charge.

Companies like XMTP, Dialect, Waku, Web3mq, and Satellite are developing the core infrastructure that will enable this, while companies like Blockscan, Metalink, and Mailchain are trying to enable on-chain messaging at the application layer.

#8 Real World Utility/Experience

The success of NFTs in the arts often comes with the question: “What can I use them for? What do they really do?” The answers to these questions are usually X to earn, NFT ticketing and experience, and task-based rewards Ways to combine cryptocurrency purchases with IRL events and real-world quests with cryptocurrency rewards. X to Earn started from play to earn, and then gradually derived: move to earn, learning to earn, sleep, eat, mediate, etc.

The problem with X to earn comes from the sustainability of the project itself. These projects are often filled with speculators looking for a quick return, so the tokens skyrocket and then lose value over time. Until this problem is solved, the measure of the utility of X-to-earn remains unknown.

NFT Ticketing + Experience will help drive utility by providing proof of access to special events, as well as exclusive loyalty programs. Some are one-time events, while others entitle users to ongoing rewards, perks, and social spaces.

If the ticketing+experience is "pay crypto to get value", then the other interesting part is "work to get crypto". These platforms and apps give consumers small tasks in exchange for cryptocurrency-based rewards (NFTs, stablecoins, the project’s native currency).

This potentially huge space has no shortage of contenders — notable ones include Axie Infinity, Stepn, Sweatcoin, and Layer3. There are also Percs, Afterparty, TokenProof, Mintgate, Rabbithole, Coordinape, Bitsports and other fresh blood constantly injected into it.

#9 Digital Identity Profile/Social Networking

The wallet address is also another medium for storing personal identity information and on-chain activities. But so far there is still no way to show all of a person's on-chain activity and treat it as an on-chain digital identity. There are a few startups working on this problem.

Proof of Attendance Protocol (POAP) allows users to generate NFT tokens that reveal records of attendance at conferences, concerts, or sporting events, and proof that you are a member of a DAO. Claiming these tokens will bring some barriers to use, but this may be a feature rather than a bug.

Entre, as LinkedIn in the blockchain field, is used to store professional files and relationship networks, while ENS (Ethereum Name Service) provides long and complex wallet addresses equivalent to an easy-to-remember domain name.

Other projects that can aggregate and share on-chain credentials include crypto-finance projects such as Lemon Cash or Webull, NFT market projects such as Socket, Magic Eden or Hawku, and social network projects such as Bitclout, Farcaster, Showtime.

Players in this space will need to strike a reasonable balance between sharing identities and maintaining privacy.

#10 Massive infrastructure building layers

But identity protocols, social graphs, wallet security, DAO tools, and more work is underway, and these on-chain infrastructure constructions are all serving the above projects.

an ever-evolving category

Clearly, crypto-native startups are still in the early stages of their development, so it’s too early to tell exactly where the next crypto explosion will come from.

Categories 6 to 9 above are still nascent categories of development, and they do have a lot of potential overlap - as NFTs are seen as an access tool for all, commerce/marketplaces and utilities may merge reward types, Creators and utilities are already integrated with exclusive fan experiences and other loyalty products; on-chain profiles become proof of real-world activity, leading to the eventual merger of digital identities and utilities; joining interest groups, entertainment, gaming and digital The merger of IP, the extension of cryptocurrency-native IP to the real world, will also bring about the merger of digital identity and discovery functions...

And about "Who is tomorrow's consumer?", "Who will lead cryptocurrency into the next bull market?", "Which product areas will be the first to grow rapidly?", "How can cryptocurrency elements enhance the consumer experience?", "Which The field is really surpassing Web2 and breaking new ground" and so on, the questions that people are quite concerned about have not been answered in the above overview.

Original link