Interpretation of Avalanche: From EVM-compatible L1 to "Subnet Pioneer"

1 Introduction

1 Introduction

With its unique subnetwork design, Avalanche offers an interesting value proposition to the market: it can be seen as either an EVM-compatible L1, or a heterogeneous network interoperability platform (similar to L0), and L2 can also be built On top of the Avalanche infrastructure. Since its inception in 2020, Avalanche has grown into a vibrant ecosystem with more than 500 Dapps currently in the ecosystem, with a total locked-up volume of more than $5 billion.

2022 will be a year full of changes for Avalanche. As subnets gain more attention, Avalanche's identity will gradually evolve from another "Ethereum killer" to a "subnet pioneer".

"Subnet will be the next growth engine in the crypto space...In the past five years, smart contracts have laid the foundation for amazing innovation in the blockchain space, and nothing can continue this momentum like Subnet."

—Emin Gun Sirer, Founder and CEO, Ava Labs

This article will conduct an in-depth analysis of Avalanche's technical architecture, application scenarios, competition landscape, and ecosystem to help you better understand the Avalanche subnet.

2. Avalanche overview

Avalanche is an open-source platform developed by Ava Labs that provides developers and enterprises with an interoperable, highly scalable ecosystem for creating custom subnet-based blockchains. With the novel Avalanche consensus, this Avalanche can achieve 4500 TPS and near-instant finality.

image description

(Ava Lab founding team; source: Ava.Network)

2.1 The scaling problem of Ethereum

To understand the architecture of Avalanche, we should first understand the scaling issues of Ethereum.

Blockchain is like a city, imagine you live in a city with limited space. As more and more people move in, cities get crowded and house prices go up. The same thing happens on the blockchain, but at this time people are no longer competing for living space but Block sapce, and the aborigines on the chain are no longer people but transactions.

Based on this, Avalanche proposes two expansion ideas:

Vertical expansion: Avalanche Consensus. Avalanche consensus can scale network performance up to 4500 TPS without compromising decentralization and security. Making Avalanche one of the fastest and most secure blockchains in the crypto world.

Horizontal expansion: Avalanche Subnet. Avalanche should not be considered as a single blockchain, but as a collection of multiple subnetworks. Developers can launch their own subnets in a few hours, and the Avalanche subnet solution provides blockchain with unlimited scalability possibilities.

2.2 Vertical Expansion: Avalanche Consensus

2.2.1 Avalanche Consensus

Next, let us use a simple metaphor to illustrate the operation mechanism of Avalanche consensus.

Imagine that you are in a stadium with thousands of people, and the audience needs to reach a consensus on the task of "which team to support". Since the stadium is large and crowded, and wanting to know what the majority prefers, you decide to:

Ask 5 random people nearby for their preferences.

If >= 3 people voted for the blue team, then you will increase your confidence in the blue team, and vice versa.

You run this sampling process repeatedly to increase your confidence.

Simultaneously, everyone in the stadium repeats the small sampling to determine the final answer to the matter.

Each time a random sample is taken, the number of people who find the correct answer will increase, and eventually everyone will reach a consensus, just like a snowball is rolling down a hill and eventually leads to an avalanche.

Avalanche Consensus is a new leaderless BFT protocol built with metastability achieved by repeated subsampling among nodes and transitive voting in a DAG. In order to reach a consensus, the verification node only needs to spot-check some nodes, instead of communicating with all nodes to complete the consensus. As a result, it can achieve finality with lightning speed and high accuracy, while each node has a say in the voting process, because the validator nodes will randomly select the sampling nodes.

"The parameters in the Avalanche consensus are flexible and adjustable. We can make the probability of wrong conclusions close to infinitely small,< .0000000001% 。」

—Connor Daly, founder of Pangolin

In addition to high performance, Avalanche also has the following two characteristics:

decentralized. The number of verification nodes can theoretically be infinite, and the increase in the number of nodes will not affect the efficiency of information transmission, because the amount of information that each node needs to transmit can always remain constant when consensus is reached;

Lightweight and easy to deploy. Anyone with common hardware can join the mainnet by staking 2000 AVAX to become a validator.

2.3 Horizontal expansion: Avalanche subnet

2.3.1 Avalanche architecture

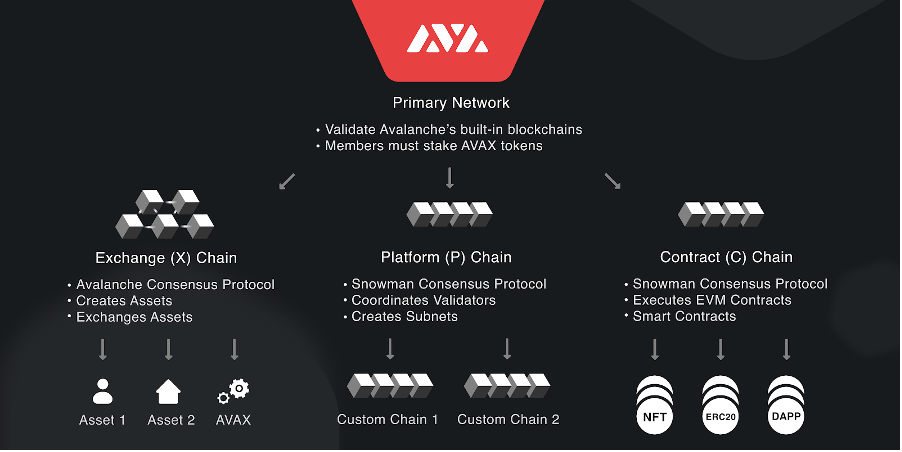

Avalanche has 3 built-in blockchains: X-Chain, P-Chain, C-Chain.

X-chain is responsible for the creation, management and transaction chain of digital assets. It is based on the "DAG" model, which is another unique form of consensus model.

C-chain is dedicated to smart contracts. It is a copy of the EVM that supports the development of dApps based on the Avalanche protocol.

P-chain is responsible for coordinating validators and creating Subnet and staking mechanisms.

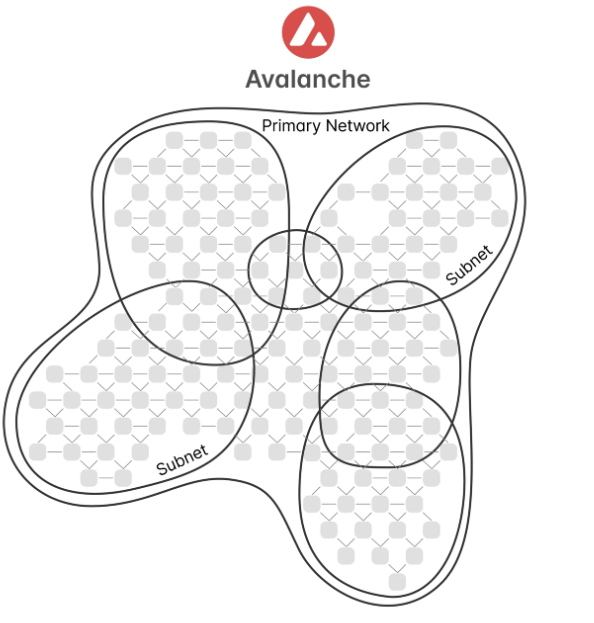

A subnet is a group of validators that agree on the state of the network. The subnet can be thought of as the bottom layer of the stack. Each blockchain needs to have a subnet responsible for verifying transactions, and a subnet can verify multiple blockchains.

The main network is a special subnet: X-Chain, P-Chain, and C-Chain all belong to the main network. Members of all custom subnets must also pledge at least 2,000 AVAX to join the mainnet and jointly verify transactions on the mainnet.

2.3.2 Why is the subnet (Subnet) important?

In theory, Avalanche allows the creation of unlimited Subnets, which is the secret to its network expansion. Each Subnet can be private (permissioned), or public (permissionless). For cross-chain interoperability, blockchains that use the same subnet (i.e. have the same set of validators) will be compatible by default. There are four main advantages to running a custom blockchain with Avalanche Subnet:

1. Cost control

Deploying applications on subnets means you can customize your own gas tokens and customize the transaction fee structure - tokens can be distributed to validators, burned directly, or as airdrops, etc.

2. User experience

Developing a subnet means you don't need to share the blockchain network with other applications, eliminating the risk of applications becoming too expensive due to network congestion, ensuring a smooth and affordable user experience for developers and users .

3. Customization

Different blockchains, decentralized applications may require validator nodes to have certain properties. For example, Gamefi should require high RAM and CPU capabilities, and Subnet developers can set the hardware threshold for verification nodes to ensure that Dapps will not suffer from poor performance due to slow node speeds.

4. Compliance

The subnet can also set some compliance requirements for the verification nodes to promote the adoption of blockchain technology by mainstream institutions. Some examples of compliance requirements include:

Validators must be located in specific countries

Validators must pass KYC/AML checks

Validators must hold certain licenses

3. Subnet application scenarios

3.1 GameFi use cases

a. DeFi Kingdom:DFK Chain

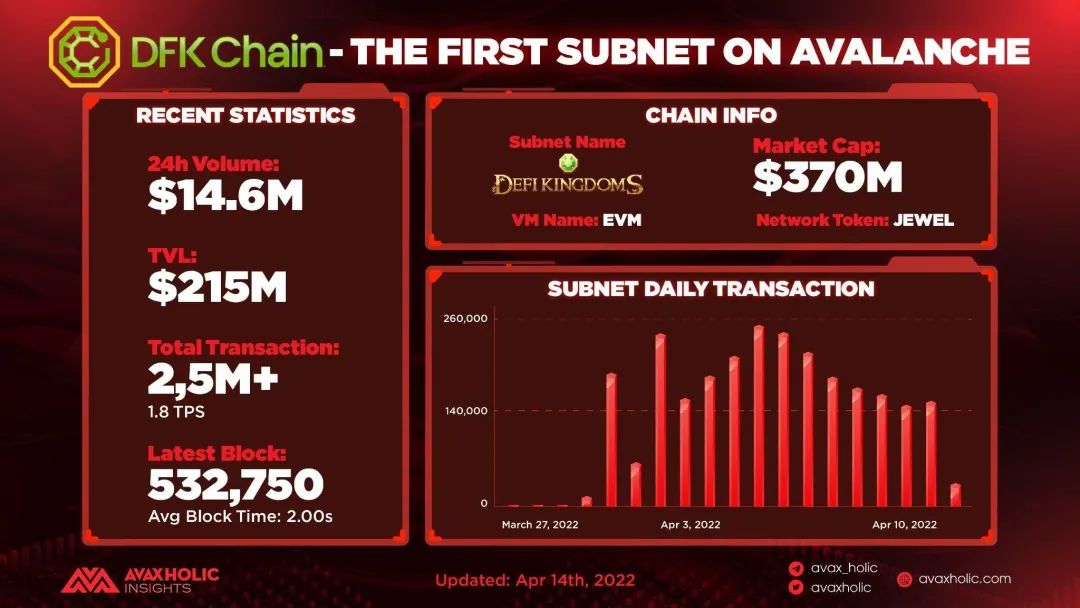

image description

(DFK Chain Statistics; Source: @AVAXholic)

Data performance:As of April 14, the total transaction volume of DFK chain reached 2.5 million US dollars, and the TVL was 215 million US dollars. Since the launch date, Avalanche’s overall daily transaction volume has increased by nearly 30%, active users have increased by 10%, and the overall network performance has been quite stable.

Interoperability:DFK Subnet applies a custom EVM, which combines the Directed Acyclic Graph (DAG) model in the EVM, allowing the blockchain to expand efficiently at a lower cost.

Interoperability:Because Avalanche has not yet announced a native interoperability method between subnets, asset transfers between the AVAX mainnet and the DFK chain are currently handled by the third-party bridge Synapse.

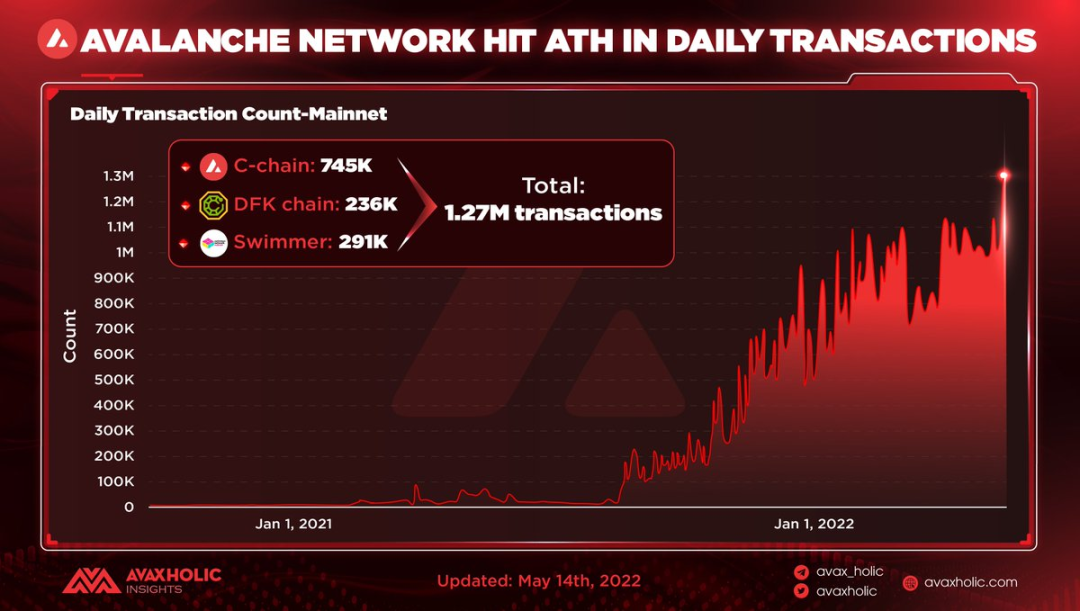

b. Crabada:Swimmer Network

Crabada, an Axie-like Play-to-earn game in the Avalanche ecosystem, is a very popular game that previously accounted for 15% - 40% of the total transaction fees of the Avalanche C-chain.

On May 14th, Crabada announced the community's long-awaited Subnet - Swimmer Network. After the launch of the Swimmer Network, the transaction fees of the Avalanche C chain have been significantly reduced. This subnet will also help the Crabada community perform breeding and mining tasks more efficiently, allowing players to obtain lower transaction fees and excellent user experience.

Crabada's native inflation token $TUS, similar to Axi's SLP, may bring more value to the community in the future. Crabada is looking at the possibility of bringing smaller games, such as Snake City, into the subnet. If more and more games use $TUS to play in their marketplace, there will be added value in the token and the network itself.

3.2 Subnet with native KYC function

Avalanche has also recently launched a subnet with native KYC (Know Your Customer) functionality. This kind of feature is called precomplie, an optional feature option that developers can decide whether to turn on when creating their evm-subnet.

This special precompilation allows subnetwork developers to control who can submit transactions to the subnetwork. By default, transactions from unknown addresses are blocked and only whitelisted addresses are allowed. Certain admins can update the whitelist after genesis.

This is the first step in building a KYC / private subnet. After setting up the KYC provider as an allow list admin, they can let verified people into the subnet.

This feature also has great potential in social-gated communities such as FWB. A subnet creator can treat his subnet as a privately writable, publicly readable database. Some data can be widely distributed in well-known formats by a small group of users using public metrics and integrations.

3.3 Enterprise Use Cases - Beyond GameFi, Beyond Web 3.0

One of Ava Labs' goals is to apply innovations in the web3 space to traditional web2 companies. By merging these two worlds, Ava Labs thinks it can make everyday transactions cheaper and easier for people.

"Cooperating with Master Card gives us the opportunity to bring the benefits of blockchain to ordinary consumers" - John Wu, President of Ava Labs Some companies are currently building on the Avalanche platform, such as the partnership between Avalanche and Deloitte. The network function is still being deployed.

3.4 Other Potential Subnet Use Cases

In industries that need to divide and sell assets, such as the real estate industry, in such scenarios, the verification node needs to store the asset's file records outside the chain. (Possible Dapp with Avalanche subnet solution: Retok Finance)

For very high-performance applications, subnets may require high-performance validator nodes with large amounts of RAM or CPU power for applications requiring 10,000+ TPS.

Similar to private subnetworks of enterprise blockchains, such as JP Morgan's Quorum, R3's Corda, and Hyperledger, the contents of their blockchains are only visible to certain participants.

Other public chains can transfer their state to avalanche and use its consensus mechanism for faster performance, finality and higher security. Therefore, blockchains such as BCH and Ethereum Classic can have subnets and use their own tokens to implement POS pledges.

4. Analysis of Competitive Landscape

4.1 Comparison with L1s: Cosmos, BNB, Avalanche

In fact, the competition for subnet expansion solutions between L1 has become fierce:

BSC announced the launch of the BSC Application Sidechain (BAS) testnet on March 29

Avalanche launched its first Subnet — DFK Chain on April 1st and Swimmer Network on May 14th

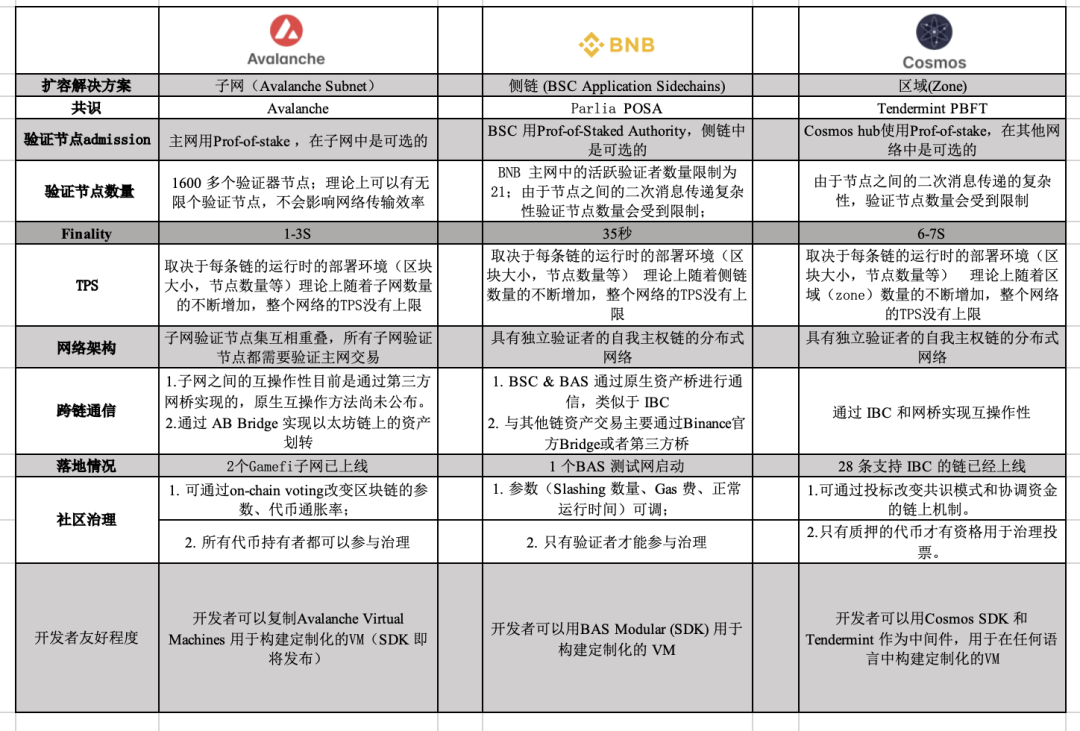

image description

(Comparative analysis of Avalanche and BSC, Cosmos; reference: Comparison of heterogeneous blockchain networks.)

As shown in the figure, each of the three scale-out networks described above has its own design choices and trade-offs:

Network Operational Cost vs. Security vs. Scalability

First of all, classic consensus protocols (for example, PBFT, Tendermint/Cosmos) often require all nodes to vote, and the communication cost usually increases quadratically (for example, 10 nodes need to transmit 1010=100 messages, 1,000 nodes need to transmit 10001000 =1,000,000 messages]). For faster performance and lower messaging costs, blockchains typically limit the number of validators, sacrificing decentralization for high performance. For example, BSC has only 21 validators; Cosmos has 150+ validators.

Node requirements vs scalability

In order for the system to be as permisionless as possible, the hardware requirements to run the nodes should be relatively low. However, as node requirements decrease, so does the total computing power available to the network. Therefore some blockchains increase node requirements for higher performance. For Solana's validator nodes, hardware costs tend to run into the thousands of dollars, as validators need devices with 12 core CPUs, at least 128 GB of RAM, and lots of storage; BSC validator nodes also require at least 48 GB of RAM and 12 CPU cores.

Advantages of Avalanche

Avalanche provides a solution to the above two dilemmas:

Regarding the dilemma of decentralization, the number of verification nodes in Avalanche can theoretically be infinite, because the amount of information transmitted each time a consensus is reached in the Avalanche consensus remains constant, so no matter how many participants in the verification network there will be no Affects the speed at which consensus is reached.

In terms of node requirements, the Avalanche verification node only needs moderate hardware requirements (2 cores, 4 GB memory), and can guarantee a high performance of 4500 TPS under normal hardware conditions.

In addition to the above two advantages, Avalanche also has the following advantages:

Great compatibility. Avalanche supports EVM, AVM, and WASM, and subnet developers can port most existing codebases to new projects without much effort. Subnet can also build its own VM using the Avalanche virtual machine. Although developers can create new VMs, they may still choose to create subnets instead of doing a separate L1, because Avalanche can help solve the most difficult aspects of launching a new blockchain: consensus engine, security and network effects, Provide a similar "package check-in agreement".

Avalanche Subnet is currently the only subnet that implements landing applications. Other public chains such as BSC and Polygon have also launched side chain solutions, but Avalanche is the only one that has been implemented and tested in practice, and other networks are still in the testing stage.

Overlap architecture of subnet validators. Currently, most L1s such as Avalanche, Solana, and Cosmos attract validators by offering staking rewards. The question is, after 50 years, the staking reward will gradually decrease, how can we ensure that there are still people willing to maintain the chain? One possible answer is to use network transaction fees to incentivize validators. For Avalanche, its unique design means that the main network will be maintained by subnet validators for a long time --- because validators of any subnet must join the main network. This unique architecture also gives Avalanche greater design space and interoperability potential in the future, which is not available in other L1 networks.

Deflationary monetary models. Avalanche has many favorable factors such as Avalanche Multiverse, Avalanche Rush incentive plan, Blizzard Ecological Fund, Avalanhce subnet launch, etc. These factors will facilitate the mass adoption of the Avalanche network and create strong demand for AVAX. On the supply side, the launch of the Subnet will lock the liquidity of AVAX, and at the same time, the higher transaction volume on the chain will make more AVAX consumed as gas fees, further reducing the circulating supply.

future challenges

Of course, Avalanche also has its own shortcomings:

Avalanche's development tools are not as convenient as Cosmos (Cosmos SDKs) and BSC (Modular SDKs). Basically all web 3.0 public chain players are competing for the limited developer talent pool, and providing ready-made modules and SDKs will be an attractive value-add for developers.

A bridging method for native interoperability has not yet been published. In contrast, both Cosmos and BSC have their own common protocols for inter-chain communication. Although the bridging solutions on the market still have clear winners, cross-chain interoperability is still an important issue restricting the expansion and development of Avalanche Subnet.

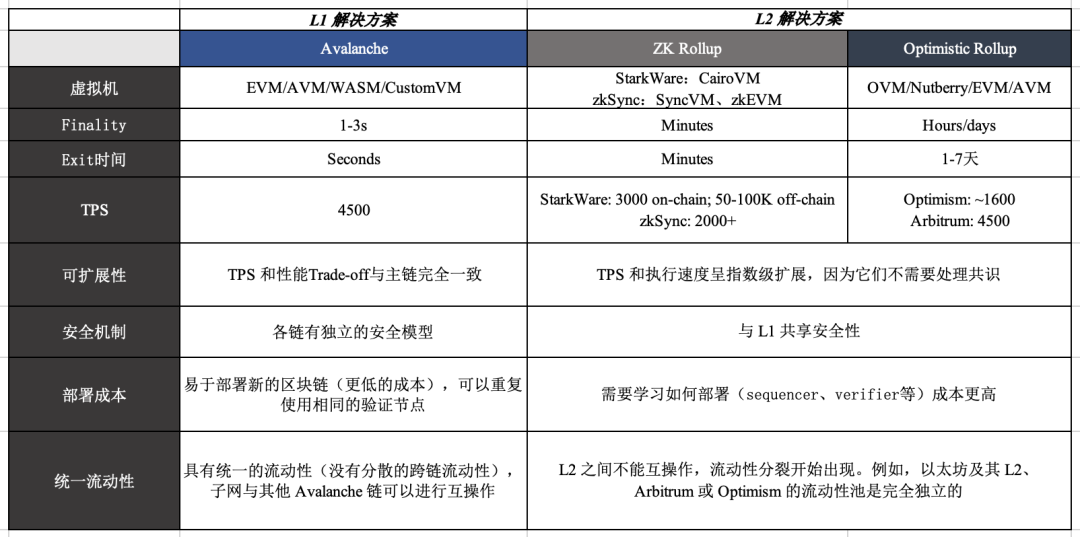

4.2 Comparison with L2 Rollups

image description

(Comparative analysis of Avalanche and L2, reference: Ava. Network, Arbitrum.Network; @StarkWareLtd|Twitter, @zkSync|Twitter)

The biggest difference between Avalanche subnet and L2 is the learning cost for developers.

Avalanche supports all virtual machines, including EVM, AVM, WASM, or custom virtual machines, so developers can port code from other chains effortlessly.

Optimistic Rollup is compatible with EVM because OVM can implement arbitrary smart contract logic.

Things are more complicated for ZK Rollup. Since EVM was not designed with ZK in mind, there is no direct solution for ZK's EVM compatibility. People have been trying to solve this problem for years. There are two main players in ZK Rollup: StarkWare and zkSync. StarkWare currently deploys CairoVM, which requires developers to write code in a new language (Cairo), and has introduced a translator (Warp) to help developers translate Solidity to Cairo. ZkSync has launched its 2.0 testnet, which deploys ZK Rollups-friendly zkEVM and is expected to be compatible with EVM. The performance and ease of use of zkSync 2.0 needs to be further tested.

Another advantage of Avalanche is ease of deployment. Developers can use Avalanche to create a chain in a few hours. There are currently 19 blockchains on the Avalanche mainnet and 300+ chains on the Fuji testnet. In contrast, ZK rollups have higher deployment costs. Because zero-knowledge cryptographic proofs require a lot of computing resources. Even with node service providers, developers need to learn new languages (or use transpilers) to build Dapps in ZK.

Compared with the Avalanche subnet, L2 does not sacrifice the security of the main chain, because it still relies on the main chain as a backup to verify transaction execution.

Avalanche does not have such a shared security model, but in many cases,Shared security is not a desirable feature.Intertwining your beliefs with other people's is not an advisable thing to do if you don't want to risk the chain stopping every day. L2 should not do this, nor should sidechains with independent finality.

Another key difference between Avalanche Subnet and EVM L2 is whether the liquidity is unified or decentralized.

L2s is no longer a complete chain but disperses the liquidity on the chain into multiple different systems. Users must now interact with each of these chains differently. In this case, certain combinations are not possible, for example dYdX cannot interact with flash loans elsewhere.

L2 not only breaks liquidity, but the protocol itself is different, you cannot automatically switch from one protocol to another.

In contrast, Avalanche Subnet has unified liquidity, funds will not stay in one Subnet and can interoperate between subnets, and each cross-chain transfer will use the C chain and burn AVAX, such as from Swimmer Net > DFK Net requires AVAX to transfer funds, which is also a healthy use case for the AVAX token model.

As the Avalanche Subnet grows, new validator economies will emerge.

In Avalanche, you can have a subnet with a small number of validators, or you can have a subnet with a large number of validators. As the Avalanche Subnet grows, a thriving validator economy will emerge, and people will start giving additional incentives to attract the diverse set of validators they need, so that more people will be willing to provide customized validator nodes Serve.

Subnet developers can decide for themselves which services they need to use. The requirements of each blockchain may be different. Some people need millions of verification nodes, and some may only need a few verification nodes to run a chain. These are all achievable in Avalanche.

5. Avalanche Ecosystem

What follows is a brief introduction to new projects in the Avalanche ecosystem.

5.1 Shrapnel

Shrapnel is the world's first blockchain-enabled modifiable AAA extraction-based first-person shooter developed by seasoned experts who have worked on the biggest games in the gaming industry - Halo, Call of Duty, Odaily Wars wait. Shrapnel also offers a robust set of creation tools that players can use to create custom maps and skins.

This FPS game is decidedAvalanche Subnet is scheduled to run, completely independent of the main chain.Subnet allows projects to define their own parameters and fee structure, providing Shrapnel with a high degree of customization and flexibility to capture diverse needs.There is also the possibility of allowing other game developers to build games on top of their Subnet - sort of for L1-as-a-Service.

5.2 Arrow Market

Arrow Markets is a decentralized options protocol built on top of Avalanche. Arrow's option creation and settlement mechanism is based on a two-pool structure. There are two pools: trading pool and market making pool. A dynamic hedging engine is embedded in the system to hedge the net increment of option contracts in the trading pool. Options are cash-settled in stablecoins.

Avalanche is the ideal base layer for Arrow due to its fast throughput, near-instant finality, near-zero transaction costs, and leading censorship resistance. A Subnet that meets the DeFi protocol can be created in the Avalanchez subnet to meet the needs of MEV resistance and speed, and the subnet can also be customized to allow institutional users to participate in the protocol in a regulatory manner.

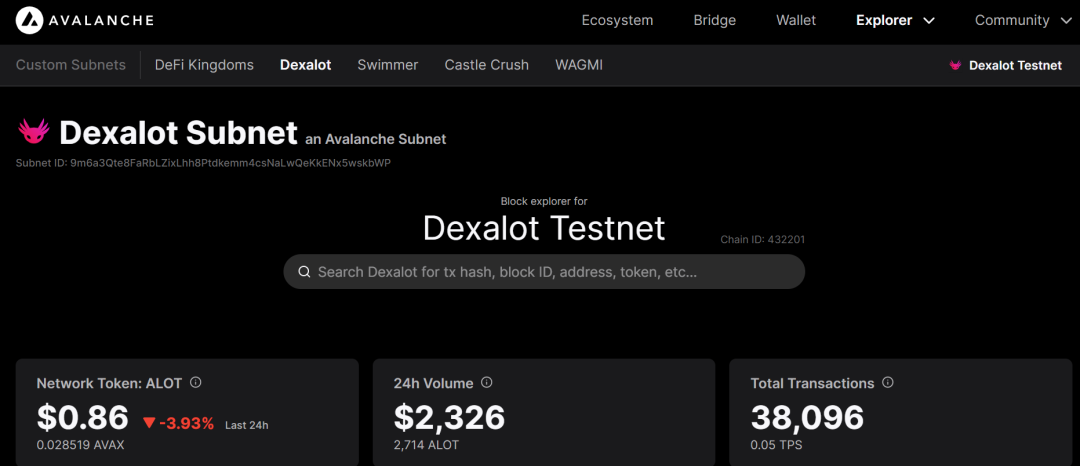

5.3 Dexalot

Dexalot wants to bring transparent, user-friendly and modern transactions to the Avalanche community. They hope to bring users an experience comparable to traditional centralized exchanges through decentralized applications on Avalanche.

Dexalot will be one of the first, if not the first DeFi project to build a subnet. The purpose of creating the subnet is to increase transaction speed by at least 10x and reduce transaction fees to negligible levels while improving user experience, community engagement, and capital efficiency.

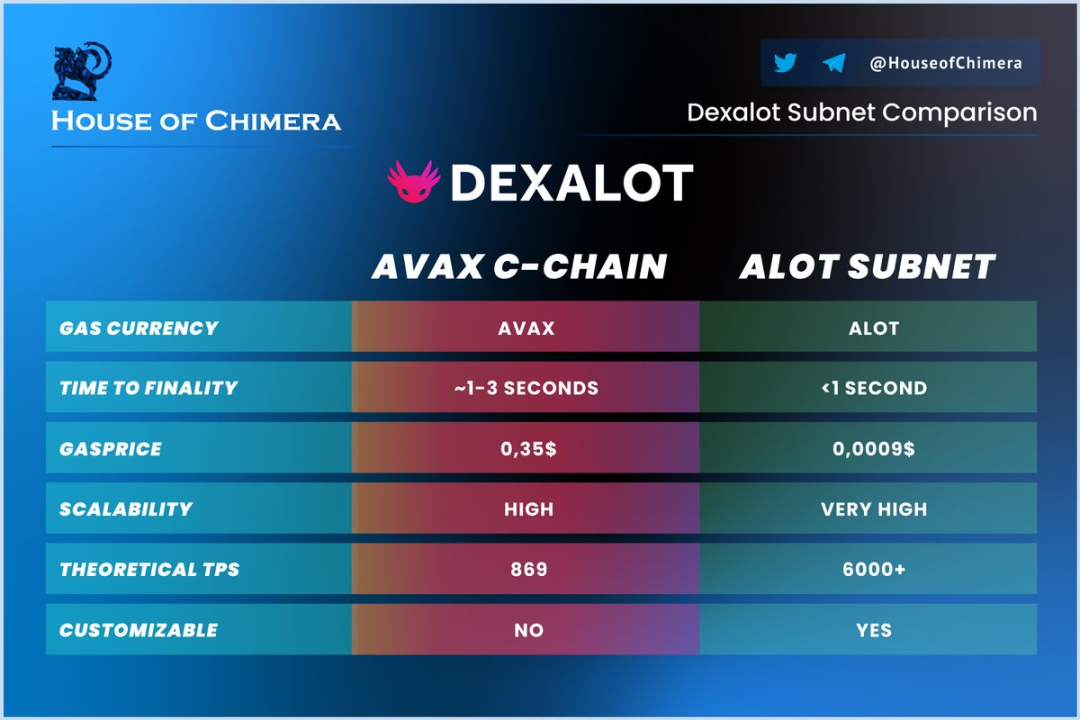

The House of Chimeria compared the Dexalot subnet with the current AVAX C-Chain Dexalot exchange as they envision it. These features below bode well for the community.

Faster settlement time, allowing users to easily trade assets

Lower transaction costs, even negligible, to improve financial inclusion

The subnet will use $ALOT as gas, adding utility to native tokens

6. AVAX Valuation Analysis

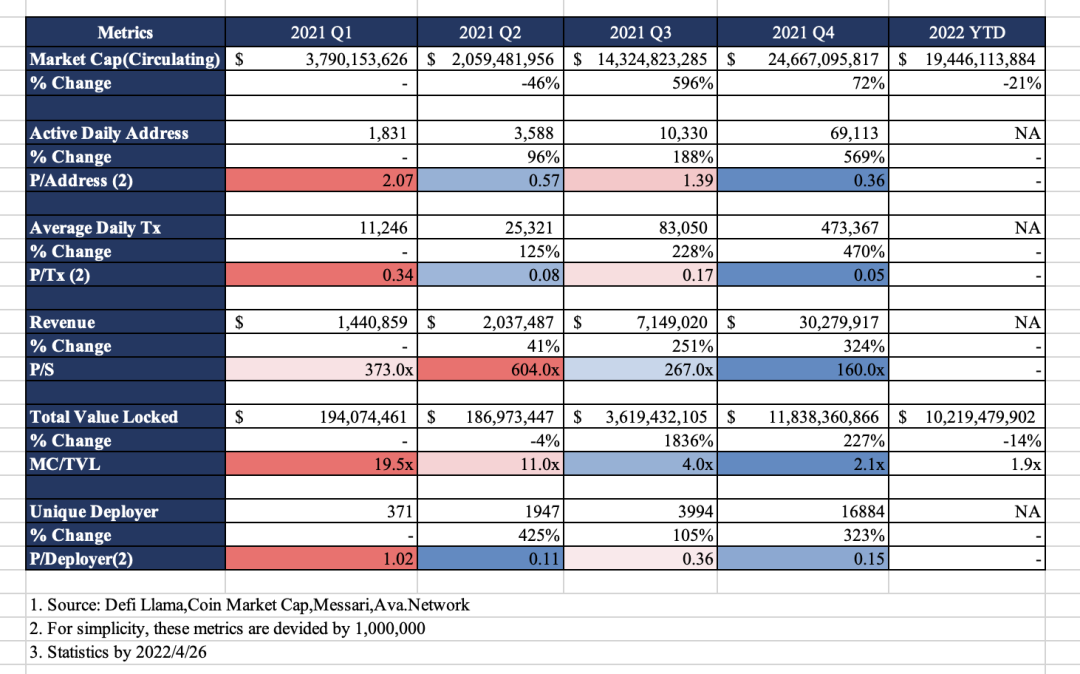

Going back to the metaphor at the beginning of the article, we think of blockchains as cities or countries. The core value of the blockchain network is the ecological innovation capability of the entire system. This capability is reflected in data indicators, which can be measured by the number of active addresses, daily transaction volume, developer ecology, and TVL.

According to the calculation in the figure above, indicators of different colors reflect different valuation multiples. Dark red indicates that people are more fomo and are willing to pay a higher premium per unit of value captured in the network, dark blue is the opposite, indicating low market sentiment and lower price per unit of value captured.

We can see that since the fourth quarter of 2021, valuation multiples have been relatively low. The primary reason for this phenomenon is that the recent market sentiment has continued to decline due to the Luna crash. Another reason is that Avalanche has experienced rapid growth in total transaction volume, number of users, TVL and revenue since 2021 Q3, so the valuation multiples of Q3 and Q4 will be more reasonable than Q1.

7. Conclusion

In general, we have full confidence in Avalanche in the upcoming expansion competition, because Avalanche is the best balance of scalability, deployment cost, and security among all current solutions, and has actually implemented EVM expansion solution. It has a novel Avalanche consensus, thoughtful technical architecture design, and an excellent leadership team.

refer to

refer to

1.Avalanche Architecture Avalanche Intro: https://www.avalabs.org/whitepapers

Avalanche Subnet: https://docs.AVAX.network/build/tutorials/platform/subnets/

AVAX Analyst call Q4 https://www.youtube.com/watch?v=CB98syIcGoM&t=981s

A Comparison of Heterogeneous Blockchain Networks https://medium.com/@arikan/a-comparison-of-heterogeneous-blockchain-networks-4bf7ff2fe279

Emin Gün Sirer: Problems with L2 Scaling Solutions and Avalanche Subnets Explained https://www.youtube.com/watch?v=g9IZEkwbglI&t=1087s

Comparison of the Transaction speed of swimmer network &$AVAX C-Chain https://twitter.com/inigozart/status/1500592248785977344?s=21&t=g6ZyBvXPptRwWpFl83VEjg

L1 Recovery, AVAX Activity, & Intro to Crypto Raiders https://members.delphidigital.io/reports/l1-recovery-AVAX-activity-intro-to-crypto-raiders

State of Avalanche Q1 2022 https://messari.io/article/state-of-avalanche-q1-2022

2.BAS Architecture Ankr doc for BAS: https://docs.ankr.com/bnb-application-sidechain/about-bas

Build your GameFi on BAS “Aries” Testnet https://medium.com/@NodeReal/build-your-GameFi-on-bas-aries-testnet-bf54dd99b959

3.Cosmos Architecture Cosmos Intro https://v1.cosmos.network/intro Cosmos shared security https://blog.cosmos.network/interchain-security-is-coming-to-the-cosmos-hub-f144c45fb035

Precedent research from Foresight Ventures https://mp.weixin.qq.com/s/IBmAUBcnAhHasOTrQMa4Vw

4.Rollups Rollup: scaling blockchain to one billion users https://dealroom.co/blog/rollup-rollup-scaling-blockchain-to-one-billion-users

Optimistic Rollups: the present and future of Ethereum scaling https://medium.com/offchainlabs/optimistic-rollups-the-present-and-future-of-ethereum-scaling-60fb9067ae87 ZK Rollups-Ethereum.org https://ethereum.org/en/developers/docs/scaling/zk-rollups/

5.On-chain Data Avascan: https://avascan.info/

Avalanche explorer: https://explorer.AVAX.network/

Avalanche Subnet: https://stats.AVAX.network/dashboard/subnet-chain-activity/

State of Avalanche Q1 2022: https://messari.io/article/state-of-avalanche-q1-2022

Picture referencehttps://www.cyberbit.com/blog/cybersecurity-training/red-team-training-blue-team-training-what-is-the-difference/https://medium.com/@vdtcaglayan/Avalanche-AVAX-token-satış-detayları-60a5cfc4659dhttps://www.youtube.com/watch?v=xQHgnSWizWEhttps://www.cloudrangecyber.com/red-teamblue-team-exercises