One-week financing express | 55 projects have been invested; the total disclosed financing is about 1.27 billion US dollars (5.16-5.22)

According to Odaily's incomplete statistics, a total of 55 blockchain financing incidents at home and abroad were announced during the week from May 16 to May 22, a certain increase from the previous week; the total disclosed financing was about 1.27 billion U.S. dollars. There is a certain rise.

The following are the specific financing events (Note: 1. Sorting according to the announced amount; 2. Excluding fundraising and mergers and acquisitions; 3. * is a "traditional" company whose business involves blockchain):

The following are the specific financing events (Note: 1. Sorting according to the announced amount; 2. Excluding fundraising and mergers and acquisitions; 3. * is a "traditional" company whose business involves blockchain):

Encryption startup KaJ Labs completes $400 million in financing led by GEM Digital

Encryption startup KaJ Labs completed $400 million in financing through the LITHO token sale, marking the second largest seed round in the world so far in 2022. Global Emerging Markets (GEM) Digital led the investment, and Four Digital participated in the investment. It is reported that GEM Digital is an alternative investment group with assets under management of US$5 billion, headquartered in the Bahamas.

Lithosphere, a blockchain platform under KaJ Labs, uses embedded deep neural networks to make smart contracts smart, and supports cross-chain network operations. This interoperability enables multiple value transfer methods under a single management structure, thereby Eliminates many of the problems inherent in existing blockchain networks. (PRNewswire)

Southeast Asian digital payment company Xendit has announced the completion of a US$300 million Series D round of financing, co-led by Coatue and Insight Partners, with participation from investment institutions and investors including Accel, Tiger Global, Kleiner Perkins, EV Growth, Amasia, Intudo, and Goat Capital. Part of the funds will be used to expand into new markets such as Thailand, Malaysia and Vietnam. Prior to this round of financing, Xendit had completed its Series C round of financing led by Tiger Global Management in September 2021.

It is reported that Xendit was established in 2016 and currently has more than 3,000 customers. Its annualized transactions tripled from last year, from 65 million to 200 million. The total value of deals also jumped from $6.5 billion to $15 billion. Its clients include Traveloka, Transferwise and Grab. (Forbes)

Voyager Digital Raises $60M in Private Placement Led by Alameda Research

Encrypted asset brokerage Voyager Digital raised $60 million through a private placement, led by Alameda Research, with participation from Galaxy Digital, Blockdaemon, and Digital Currency Group (DCG).

Voyager Digital said that when the offering is complete, the company will have more than $225 million in liquidity, including about $175 million in cash and another $50 million in cryptocurrencies. In addition, as of March 31, 2022, Voyager Digital's revenue in the first quarter was US$102.7 million, a year-on-year increase of 70%. (Yahoo Finance)

Chain game company N3twork Studios completes $46 million financing, led by Griffin Gaming Partners

N3twork Studios, a blockchain game start-up company, announced the completion of a US$46 million Series A round of financing, led by Griffin Gaming Partners, with participation from Kleiner Perkins, Galaxy Interactive, KIP, and Floodgate.

It is reported that the financing funds will be used to develop the team's two current blockchain games, of which Legendary: Heroes Unchained will be launched later this year. (Businesswire)

Certora Completes $36M Series B Funding Led by Jump Crypto

Certora, an Israeli company that provides security analysis tools for blockchain smart contracts, completed a $36 million Series B round of financing led by Jump Crypto, Tiger Global, Galaxy Digital, Electric Capital, ACapital, Framework Ventures, Coinfund, Lemniscap, Coinbase, VMware, etc. Participate in voting. (The Block)

According to official news, the private computing network Oasis announced that it has received additional investment of US$35 million from investment institutions such as Newman Capital and Seven X Ventures, bringing the total amount of ecosystem development funds to US$235 million.

Previously, with the support of AME Cloud Ventures, FBG, Pantera Capital, Dragonfly Capital, Binance Labs and other ecological partners, Oasis established an ecosystem development fund of US$200 million, aiming to support the Oasis ecological DeFi, data DAO, NFT, metaverse Project development in other fields to promote Oasis ecological prosperity. After receiving an additional investment of US$35 million, the Oasis Ecosystem Development Fund has become one of the largest and most powerful ecological funds in the industry.

Coins.ph, an encrypted wallet service provider, announced the completion of a US$30 million Series C financing, led by CRibbit Capital and participated by several undisclosed strategic investors. (Youker)

DeFi protocol iZUMi Finance raised $30 million, with participation from Ivy Venture, Cobo, etc.

iZUMi Finance, the multi-chain DeFi protocol, announced the completion of US$30 million in financing, including from institutional investors such as Ivy Venture, Cobo, and Mirana, of which more than US$10 million came from the convertible bond financing (Bond Vouchers) in cooperation with Solv Protocol.

At the same time, iZUMi also announced the launch of iZiSwap, an innovative DEX on the BNB Chain. This DEX pioneered a new type of discrete liquidity DL-AMM protocol, which has the characteristics of capital efficiency thousands of times higher than the traditional constant product AMM. Investors provide better depth and provide more returns for LPs. Currently, iZiSwap has a TVL of 13 million US dollars and a 24-hour trading volume of more than 1 million US dollars. (CoinDesk)

Metatheory, a Web3 interactive media company, completed a $24 million Series A round of financing led by a16z, with Pantera Capital, FTX Ventures, Breyer Capital, Merit Circle, Recharge Theme Ventures, Dragonfly Capital Partners, Daedalus, Sfermion, and Global Coin Research participating.

According to reports, Metatheory was founded by Twitch co-founder Kevin Lin to build Web3 games and virtual worlds, focusing on building franchises with strong IP beyond the game itself. (Business Wire)

Streami, the South Korean encryption exchange Gopax operator, completed a 30 billion won (about 23.68 million U.S. dollar) round of financing at a valuation of 370 billion won (about 292 million U.S. dollars). ZVC, a venture capital subsidiary of Z Holdings, a joint venture between Softbank and LINE, , KB Investment, Grayscale parent company DCG, Strong Ventures, etc. participated in the investment. It is reported that DCG became the second largest shareholder of Gopax in May last year. (South Korean economy)

Fanhouse, a fan monetization platform, recently announced that it has completed a US$20 million Series A round of financing, led by a16z.

Rosie Nguyen, co-founder of Fanhouse, said that the total income of creators on the Fanhouse platform is close to 10 million US dollars. Top creators on the platform include the band group The Chainsmokers (also the platform’s Pre-seed investor), chess KOL Andrea Botez, and actor Yoshi Sudarso, among others.

(Techcrunch)

News Decentralized Global Geek Organization and Web3 Open Source Developer Incentive Platform DoraHacks Completed $20 Million B1 Round Financing, FTX Ventures and Liberty City Ventures Jointly Lead the Investment, Circle Ventures, Gemini Frontier Fund, Sky9 Capital, Crypto.com Capital, Amber Group and others participated in the investment.

After this round of financing, the total financing scale of Dora’s ecological core infrastructure (including DoraHacks and Dora Factory, but excluding decentralized governance organizations such as Dora Grant DAO and Dora Infinite Fund) exceeded US$50 million. (CoinDesk)

Animoca Brands’ blockchain game Phantom Galaxies raises $19.3 million

Animoca Brands and its subsidiary Blowfish Studios announced that its AAA-level mech fighting chain game Phantom Galaxies completed a $19.3 million planet NFT private placement financing, and sold a total of 7,734 planet (Planet) and asteroid (Asteroid) NFT.

Strategic backers include Sequoia China, Liberty City Ventures, GameFi Ventures, Everest Ventures Group, Terrace Tower Group, MDDN.co, C Ventures, SMO Capital, Polygon Ventures, Dapper Labs, NFT Live + Cagyjan, Kingsway, 3Commas Capital, Double Peak, Mind Fund, Defi Cap, Avocado DAO, YGG and YGG SEA, etc.

Web3 infrastructure provider NodeReal completes $16 million Series A financing led by Sky9 Capital

Web3 one-stop infrastructure provider Nodereal completed a $16 million Series A financing led by Sky9 Capital. It is reported that NodeReal was established in 2021 and is headquartered in Singapore. It aims to empower developers, innovative Web3 applications and large Web2 applications to explore the blockchain with scalable solutions. (Digital Journal)

FreshCut, a short game video platform, has completed $15 million in financing, led by Galaxy Interactive, Animoca Brands, and Republic Crypto, with participation from Hashed, SkyVision Capital, Tamarack Global, C2X, Polygon, and Kevin Lin (co-founder of Twitch). Funding will be used for product development, onboarding creators, developing membership programs, and scaling. (The Block)

Web3 Infrastructure Startup Coinshift Completes $15M Funding Led by Tiger Global

Coinshift, a Web3 infrastructure start-up company, completed a US$15 million Series A financing led by Tiger Global, with participation from Sequoia Capital India, Alameda Ventures, Spartan Group, Ethereal Ventures, and Polygon Studios. Angel investors include Product Hunt and Weekend Fund founder Ryan Hoover, OpenSea VP of Operations Shiva Rajaraman, and FalconX founder Prabhakar Reddy. (The Block)

Chain game studio Azra Games completes USD 15 million seed round financing led by a16z

Chain game studio Azra Games announced the completion of a $15 million seed round of financing, led by a16z, with participation from NFX, Coinbase Ventures, Play Ventures, and Franklin Templeton. Funds raised will be used to launch its first combat RPG game, "Project Arcanas." (CoinDesk)

CyberConnect Completes $15M Series A Funding Led by Animoca Brands and Sky9 Capital

CyberConnect, a Web3 social graph protocol, completed a $15 million Series A round led by Animoca Brands and Sky9 Capital. CyberConnect plans to use the funds to continue building out the protocol, expanding the team and launching new Web 3 projects.

According to Wilson Wei, CEO of CyberConnect, 23 projects have integrated CyberConnect so far, and 12 more projects are in the process of integration. (CoinDesk)

Web3 Accelerator Seedclub Completes $15 Million Financing, Multicoin Capital and USV Participate

Web3 Accelerator Seedclub completed $15 million in financing, with participation from Multicoin Capital, Union Square Ventures, Placeholder Ventures, Blockchain Capital and 10 individual participants. This round of financing was completed in the form of 15 million USDC exchanged for 1 million CLUB Tokens (accounting for 10% of the total supply), and Seedclub was valued at approximately US$150 million.

According to official news, Web3 cross-chain wallet BitKeep completed a $15 million A round of financing at a valuation of $100 million, led by Dragonfly, KuCoin Ventures, Foresight Ventures, A&T Capital, SevenX, Matrixport, Bixin Capital, Danhua Capital, Peak Capital, YM Capital and others participated in the investment.

Web3 media company Tally Labs completes $12 million financing, led by a16z Crypto

News Web3 media company Tally Labs completed a $12 million seed round of financing, led by a16z Crypto, with participation from Sterling VC, Dapper Ventures, Roham Gharegozlou (Dapper Ventures CEO), Odell Beckham Jr, and Allyson Felix. (Cointelegraph)

Gusto Collective, an immersive experience technology service provider headquartered in Hong Kong, China, announced the completion of a US$10 million Seed Plus (seed +) round of financing, led by Animoca Brands and Gaw Capital, and participated by Black Pine, YCI Limited, and ClearVue Partners. After the completion of this round of financing, the company has received a total of US$23 million in external funding since its launch in 2020. Gusto Collective, led by CEO Aaron Lau, is a BrandTech holding company. The company aims to drive brand value and growth through immersive customer experiences operating in the AR, Metaverse and NFT space. (PR Newswire)

Web3 Music Startup Medallion Completes $9 Million Seed Round Led by The Chernin Group

Medallion, a Web3 music startup, completed a $9 million seed round led by The Chernin Group, Alive VC, Betaworks, Blue Mind Capital, Coil, Copper, Flamingo DAO, Infinite Capital, Noise DAO, POAP Ventures, Polygon Ventures, Shima Capital, Spacestation, Synergis Capital, The Chernin Group, Third Prime, and music industry investors Wave Financial, Another Planet Entertainment, Dan Berkowitz, iLLENIUM, Mick Management, Mike Shinoda, Red Light Ventures, Ryan McMahon, Ryan Rabin, Tycho and tvg hospital participated . The new financing will be used for early product development and to grow Medallion's engineering and product teams and recruit additional talent. (Digital Music News)

Encrypted donation platform QuestBook completes $8.3 million Series A financing, led by Lemniscap

Encrypted donation platform QuestBook completes $8.3 million Series A financing led by Lemniscap, Coinbase Ventures, Alameda Research, Dragonfly, Hashed, Polygon, Balaji Srinivasan, Raj Gokal (Solana), Arjun Sethi (Tribe Capital), Maneesh Sharma (GitHub), etc. Participate in voting. (Techcrunch)

Web3 game and e-sports platform Joystick completes $8 million in seed round financing

Joystick, a Web3 game and e-sports platform co-founded by TikTok celebrity Michael Le, announced the completion of a seed round of financing of US$8 million. The investor information has not yet been disclosed. The company is currently raising up to $110 million in Series A funding. (Venturebeat)

Parcl, a blockchain-based real estate platform based on Solana, announced the completion of strategic financing of US$7.5 million. Existing investors Archetype, Dragonfly Capital, Shima Capital, Solana Ventures, Not Boring Capital, FJ Labs and new investors Fifth Wall, JAWS (Barry Sternlicht family Office), IA Capital & Eberg Capital, Big Brain Holdings, and angel investor Santiago Santos participated. The new financing will be used to further expand the business, including key real estate, data and software partnerships, and more. (PR Newswire)

Saga, an agreement focused on providing blockchain space for game and entertainment developers, completed a $6.5 million seed round of financing at a valuation of $130 million. Maven 11, Longhash Ventures, Hypersphere, Figment, Polygon Studios, Samsung NEXT, Chorus One, GSR, C2X, CRIT Ventures, Akash Network, Unanimous Capital, Strangelove Ventures, Tess Ventures, Merit Circle, Hustle Fund, Polymer, Zaki Manian, Jae Kwon, Garrette Furo, Alex Shin, Nick Tomaino and other angel investors participated. (The Block)

Layer 2 cross-chain protocol Zecrey receives $6 million strategic investment from Binance Labs

According to an official announcement, Binance Labs announced a $6 million strategic investment in Zecrey, a Layer 2 cross-chain protocol. The funds will be used for Zecrey’s development team expansion, marketing and branding, and blockchain collaborations.

Zecrey is a Layer 2 privacy cross-chain protocol based on ZK Rollup, which can realize cross-chain aggregation and management of digital assets in different public chains (Ethereum, NEAR, Solana, BNB Chain, etc.).

Kiln, an enterprise-level staking platform, announced the completion of US$5 million in financing. Third Kind managing partner and Andreessen Horowitz (a16z) board partner Shana Fisher, SV Angel, Blue Yard, Alven, Kima Ventures and others participated in the investment.

Kiln will use the funds to bring in new talent, enhance its technology and build out its services, enabling fintech companies, crypto companies and financial institutions to offer their clients one-click staking of crypto assets, or stake their crypto assets directly on Kiln . Currently Kiln supports Ethereum, Solana, Tezos, NEAR, Terra and Cosmos staking, and plans to support more blockchains in the future. (Cryptoninjas)

News Web3 education community Encode Club completes $5 million in financing, led by Galaxy Digital and Lemniscap, Dragonfly Ventures, Folius Ventures, not3lau Capita, Ascensive Assets, Stefan George (co-founder of Gnosis), Anton Bukov (co-founder of 1inch), SolBigBrain Wait to vote.

Funds from this round of financing will be used to further develop Encode’s Web3 training camps, hackathons and accelerator programs. (Decrypt)

UnicornDAO completes USD 4.5 million in financing, with participation from MoonPay and Yuga Labs

The NFT project UnicornDAO announced the completion of financing of US$4.5 million, with the participation of World of Women and Moonbirds NFT series, MoonPay, Polygon and Yuga Labs.

It is reported that the project is led by Nadya Tolokonnikova, a founding member of the Russian art group Pussy Riot, and aims to empower women and LGBTQ NFT creators. Funds from this round will be used to advance the work of the DAO, with initial investors receiving board seats. (CoinDesk)

Music NFT startup Serenade raises $4.2 million, "Wolverine" Hugh Jackman participates

Music NFT startup Serenade announced the completion of a new round of financing of 6 million Australian dollars (about 4.2 million U.S. dollars), with investors including executives from various companies in the music industry and Wolverine actor Hugh Jackman (Hugh Jackman).

Serenade stated that they plan to use the new financing for global expansion, including setting up an office in the United States and relaunching the Serenade 2.0 NFT marketplace. (Musically)

Evaluate.Market, an NFT portfolio management platform, announced the completion of a $4 million seed round investment led by Rho Capital’s Ignition Fund, Driveby Draft Kings, Castle Island Ventures, Arca, Notation Capital, Flamingo Capital Syndicate, Dapper Labs, Visary Capital, Niche Capital and Dan Nova and others participated in the vote. Additionally, Evaluate.Market announced that it will expand beyond Flow, adding over 800 Ethereum projects and thousands more to come. Evaluate.Market has also added real-time support for LooksRare, an NFT trading marketplace.

STEMuli, a Web3 education start-up company, announced the completion of a $3.25 million seed round of financing, with investors including Slauson & Co, Valor Ventures and Draper Associates, and WNBA star Renee Montgomery. STEMuli will use the new financing to expand into New York, California, Illinois, Georgia and Washington, DC.

According to reports, STEMuli has created a core classroom platform based on 3D games, which aims to connect companies with the K-12 workforce and strive to narrow the achievement and employment gaps of users. (Essence)

Security Token Group (STG), a venture capital studio focused on building financial infrastructure to support security tokens, confirmed the completion of US$3 million in Series A financing, led by Blue Bay Ventures and Blizzard Fund (Ava Labs / Avalanche's venture capital fund) , Exodus, etc. participated in the vote.

With the new financing, STG will seek to expand into other business verticals, including Security Token Advisors (STA) and Security Token Capital (STC). Meanwhile, Security Token Capital will prepare to launch tokenized investment products. (PR Newswire)

According to official news, NFT lending platform AFKDAO announced the completion of a $3 million private placement financing, with participating investors including AC Capital, YGG SEA, Hoo Labs, Avocado DAO, Yunko Association, Youbi Capital, GEMS, Sharding Capital, CryptoVN, Keys Labs, Blokpact, Koi Capital, IOBC, Play It Forward DAO, Lead Capital, SilverFox Foundation, Hot DAO, FishDAO, NFV, WAGMI33, and GMC Capital.

Pnkfrg, a studio that develops games based on the Bitcoin Lightning Network, has completed $3 million in financing, led by London Venture Partners (LVP) and Initial Capital, with participation from Stillmark, Velo Partners, and Fulgur Ventures. The financing will be used to develop casual games based on the Lightning Network. (Bitcoin Magazine)

UBet, a decentralized sports prediction market, completed a $2.7 million seed round of financing, led by Shima Capital, GSR, Republic Crypto, LD Capital, Old Fashioned Research, Decimus, and M6.

It is reported that UBet is a point-to-point sports prediction market based on Polygon. Through its unique system and architecture, sports fans can use USDC to trade prediction products at market odds. (Globe News Wire)

Awkay Technologies, a chain game development company, announced the completion of US$2.5 million in financing, led by Vendetta Capital and Icetea Labs, Animoca Brands, Morningstar Ventures, Bridge Mutual, Momentum6, FomoCraft, GAINS Associates, Paribu Ventures, Cryowar, AU21, ZBS Capital, Good Games Labs , BreederDAO, PolkaCity, RBL Labs, Tuzanye Game Guild, AvStar Capital, Parachain Ventures and Tehmoonwalker participated in the investment. In addition, individual investors including Illuvium CEO Kieran and Cross The Ages CEO Sami Chlagou also participated in this round of financing. (Accesswire)

NFT trademark platform Haloo completes US$2.3 million in financing, led by The51 and others

Haloo (formerly Heirlume), an IP anti-infringement startup in the NFT market, completed a seed round of 2.9 million Canadian dollars (about 2.3 million U.S. dollars), co-led by The W Fund and The51, Prosus, Inovia Capital, Hashed VC, 2 Punks Capital, Frank and Oak co-founder Ethan Song and others participated in the investment.

So far, Haloo has raised a total of $4 million in financing, with early investors including MaRS IAF, Backbone Angels, Future Capital and Angels of Many.

As IP infringement has become a big problem in the Web3 field, Haloo tries to imitate the Web2 e-commerce market to solve the counterfeiting problem, and uses IP verification services to provide solutions. (Betakit)

BEAM+ LAB, an art and technology company focused on empowering cultural IP to enter the Web 3, announced the completion of a US$2.2 million seed round of financing, led by Edvance International (1410.HK) and Mei Ah Capital Holdings, with participation from Avalanche, SNZ Capital Amino Capital and M77 Ventures cast.

It is reported that BEAM+ LAB's main brand "CRYPTYQUES" will launch the first NFT of the Seven Emotions series - Desire in June.

Fintech startup Relai closes €2 million in funding

Swiss fintech startup Relai has raised €2 million (~$2.09 million) from more than 750 investors in its first bitcoin-focused funding round on Crowdcube. Founded in 2020, Relai's easy-to-use Bitcoin app now has more than 24,000 active users across Europe. The app allows novice investors to buy and sell Bitcoin in minutes without registration, verification or deposits. The crowdfunding will last until May 20, following a previous seed round of 1.2 million euros. (finextra)

Decentralized wireless network Hexagon Wireless completed a $2 million seed round of financing, with participation from Hypersphere Ventures, Mechanism Capital, Superfluid Group, Inc, etc.

According to reports, Hexagon Wireless is focused on developing a revolutionary new model for building and maintaining wireless networks, democratizing ownership and access to spectrum and Internet connections by allowing anyone to purchase and deploy hardware that creates wireless coverage. (Globe Newswire)

Decentralized network Wayru completes $1.96 million financing led by Borderless Capital

Decentralized Internet service provider Wayru completed a $1.96 million seed round, led by Borderless Capital. The financing funds will be used for the company's working capital needs and marketing costs for the next 12 months.

It is reported that Wayru intends to create a decentralized Internet service provider (ISP), platform users can use commercial WiFi equipment to set up nodes, and attract other users to connect to the node's network area, and ultimately provide low-cost WiFi alternatives for underserved areas . (Ledger Insights)

Pine Protocol, a license-free NFT encrypted lending agreement, announced the completion of a $1.5 million seed round of financing, led by Sino Global Capital, Amber Group, and Spartan Group, followed by Alameda Research, Shima Capital, Impossible Finance, and Gate Ventures. The new financing will be used to further develop the Pine platform and Pine protocol, and add multi-chain support such as Solana, BNB Chain, Avalanche, and Fantom.

It is understood that since the alpha version was launched in February and the product was officially launched at the end of April 2022, the Pine platform has facilitated more than $2 million in loans. NFT users can currently get crypto loans on 30 popular NFT collectibles, including BAYC (Bored Ape Yacht Club), Azuki, CloneX, Moonbirds, Doodles, and more.

Web3 Platform Ecosapiens Completes $1.5 Million Financing Led by BoostVC

Ecosapiens, a Web3 and NFT platform, completed $1.5 million in financing, led by BoostVC, with participation from Slow Ventures, Menlo Ventures, CRV, Alumni Ventures Blockchain Fund, Climate Capital, Chaos Ventures, UpHonest Capital, Genius Fund under Ben Taft, and Ovo Fund. (Finsmes)

Algoracle, a decentralized oracle network, announced the completion of a $1.5 million seed round of financing led by Borderless Capital, with participation from the Algorand Foundation, Valhalla Capital, Big Brain Holdings, Xpand Capital, Parea Capital, OrcaDAO, GMI Capital, and EXA Finance. Funds raised will be used to help and accelerate the development and launch of Algorand's native decentralized oracle network. (Bitcoin.com)

Web3 game startup Voyage Finance completed a $1 million Pre-Seed round of financing, led by Delphi Ventures, Darryl Wang, head of BlockchainSpace, PathDAO, and DeFiance Capital, Gabby Dizon, co-founder of Yield Guild Games, and Sam Kazemian, founder of Frax Finance, etc. .

Voyage Finance mainly provides DeFi services for blockchain game guilds and gamers, and its first partner is the game Crabada on the Avalanche chain. (Tech in Asia)

SportZchain, a Web3 fan engagement platform focused on the Asian sports ecosystem, completed a $600,000 seed round of financing, co-led by SUNiCON Ventures and MAKS Group.

It is reported that the company has completed a pre-seed round of financing of US$400,000 in October 2021, and the total amount of financing so far is US$1 million. SportZchain aims to be a communication bridge between brands and fans. The platform can help officials make decisions to meet the needs of fans through fan polls and other means, and at the same time allow fans to earn benefits by holding the corresponding Fan Token. (Businessworld)

Encrypted Wallet Startup Bridgecard Completes $440,000 Financing, ABV Fund and Others Participate

Encrypted wallet startup Bridgecard announced the completion of a $440,000 Pre-Seed round of financing, with participating investors including ABV Fund, Ingressive Capital, Voltron Capital, Venture Platform, Velocity Digital, and Berrywood Capital.

It is reported that Bridgecard aims to combine users' bank cards, bank accounts and fintech wallets into one application, allowing users to perform online transactions, pay bills, and withdraw money from any linked accounts. (Benjamindada)

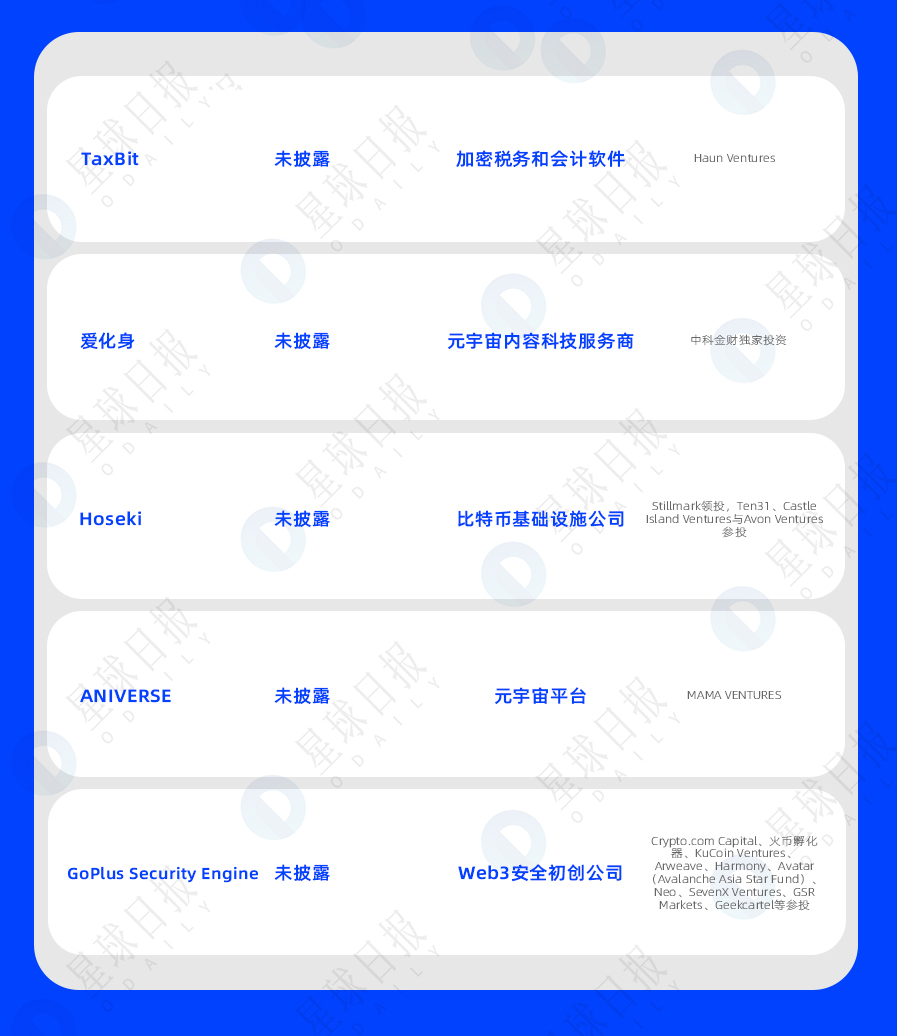

Encrypted Tax Software Company TaxBit Receives Strategic Investment from Haun Ventures

TaxBit, an encrypted tax and accounting software company, announced that it has received a strategic investment from Haun Ventures.

It is reported that the software provided by TaxBit makes it easier for users to report capital gains and losses on their crypto investments to the IRS. The company is also working with crypto businesses to make crypto tax reporting easier for its clients and providing data analytics to government agencies.

According to previous reports, in August 2021, TaxBit announced the completion of Series B financing of US$130 million, making its valuation exceed US$1.3 billion, making it a new crypto unicorn. This round of financing was led by IVP and Insight Partners, with participation from Tiger Global Management, Paradigm, and 9Yards. (Bloomberg)

Metaverse content technology service provider Avatar has recently completed tens of millions of angel round financing, with Zhongke Financial as the exclusive investment, and Yuze Capital as the company's long-term exclusive financial advisor.

This round of financing will be used for continuous incubation of tool systems, technology research and development, and production. After this round of financing, Avatar will continue to expand its technical product capabilities in the fields of virtual human brand marketing, virtual interactive live broadcast, and explore the application of AI technology in the field of virtual human and metaverse. (36 krypton)

Bitcoin Infrastructure Firm Hoseki Completes Seed Funding Round Led by Stillmark

Bitcoin infrastructure company Hoseki has completed a seed round of financing led by Stillmark, with participation from Ten31, Castle Island Ventures and Avon Ventures. The financing amount has not been disclosed. With the new financing, Hoseki intends to accelerate infrastructure-oriented technology and product development to meet the growing demand for verification services related to the Bitcoin ecosystem.

The company is understood to have identified 50 traditional lenders and mortgage brokers who will accept Hoseki's asset certification documents. Hoseki plans to launch a private alpha version of its product to test groups, and plans to launch a public beta version in the third quarter of 2022. (Bitcoin Magazine)

Metaverse platform ANIVERSE receives investment from MAMA VENTURES

ANIVERSE, an end-to-end Metaverse platform, announced that it has received investment from MAMA Ventures, an accelerated cryptocurrency venture capital institution. Through this cooperation, MAMA VENTURES will support ANIVERSE's ecological development, diversification of business structure, overseas expansion, etc. (Globe Newswire)

Web3 security startup GoPlus Security Engine announced the completion of multi-million dollar private placement financing, Crypto.com Capital, Huobi Incubator, KuCoin Ventures, Arweave, Harmony, Avatar (Avalanche Asia Star Fund), Neo, SevenX Ventures, GSR Markets, Geekcartel, etc. Participate in voting.

It is reported that Goplus Security aims to build a Web3 security infrastructure and provide security detection platform functions, including token risk detection, malicious address library, NFT risk detection, real-time risk warning and DApp contract security detection and other services. (Cryptoslate)