Looking back on 2018: Through the cycle? those who left and those who remained

Original Author: Hippy

Original source: Foresight Research

Editor's recommendation:

Disclaimer: The content of this article is only for information display and sharing, and does not promote or endorse any operation and investment behavior. This article does not provide any investment advice.

Disclaimer: The content of this article is only for information display and sharing, and does not promote or endorse any operation and investment behavior. This article does not provide any investment advice.

"I don't understand the bull market, but I understand the bear market too much"

0. write in front

Recently, many old friends talked to me about "Dream Back to 2018", and many old leeks began to write "Guide to Surviving the Bear Market". More new friends who entered the bull market in this round are eager to know what will happen to the market. Seeing the eager eyes of these new friends reminded me of myself in 2018 listening to the bragging of the old leek, full of confidence in the future market, but I didn't know that what was waiting for me was a long bear that lasted for 3 years.

mdnice editor

1. Market overview - the era of mixed fish and dragons and strange powers

mdnice editor

Public Chain/Protocol

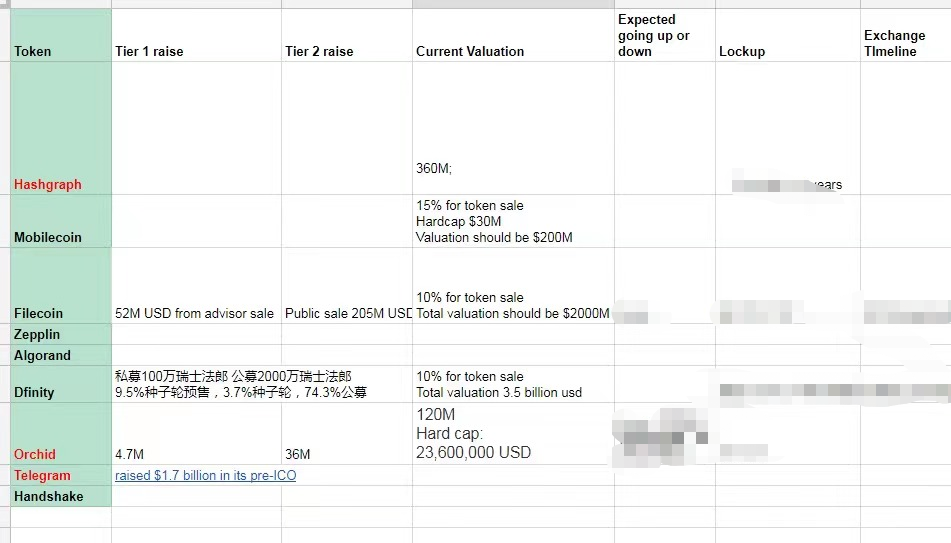

image description

Overview of the public chain in the first half of 2018

In such a market environment, investors in the primary market basically open their mouths to the consensus standard, and shut their mouths to TPS. Today, we will study how to solve the asynchronous problem with a directed acyclic graph, and tomorrow we will think about how Byzantine generals can achieve peer-to-peer communication. However, most of the public chains are in the early development stage, and there are very few projects launched on the main network. The first-level investment can only start from the angel stage, but no one knows whether it will be implemented. Such a market environment has spawned a large number of pseudo-technical projects. A white paper and a few consultant platforms can start financing. Project due diligence can only look at technical solutions, but there is no data or developed products to verify. Everyone is looking for the next-generation public chain other than BTC and ETH. Someone told me it was called EOS in 2018.

(Foresight Ventures is still optimistic about the cosmos ecosystem and various new public chains)

image description

Overview of agreements in the first half of 2018

mdnice editor

chain change

mdnice editor

transaction mining

death spiral

death spiral

mdnice editor

STOs, EOS/Tron dApps, and others

During the two months of sideways trading in the market, the primary market also tried to do some small work: the first is compliance-oriented ST (Security Token) and STO (Security Token Offering), which are simply a form of asset tokenization . The process from Asset backed security to Asset backed token. Owning assets or cash flow as a value support, but it is essentially another form of ICO that is closer to regulation. In view of the downturn in the market at that time, the demand for issuance in the primary market had begun to shrink, so the concept of STO did not become a reality in the end.

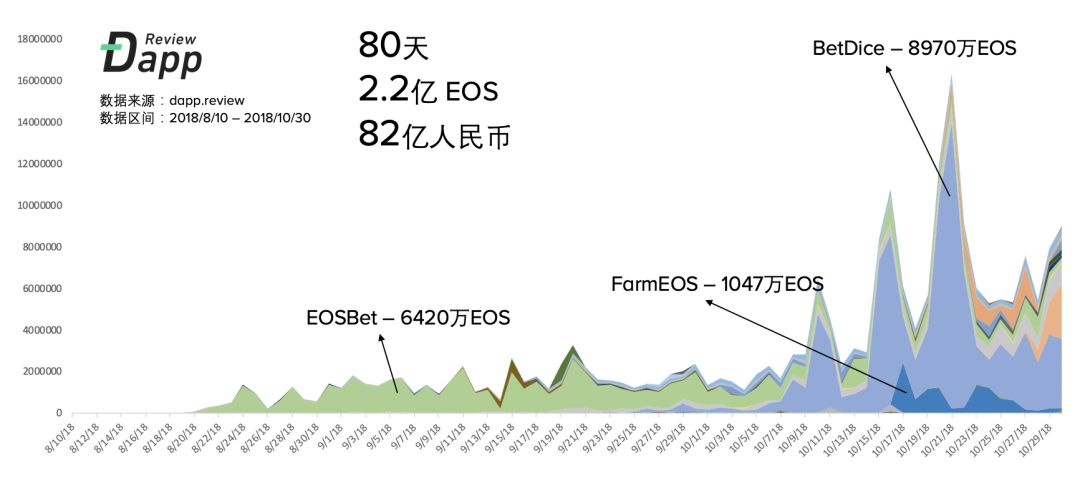

The second is the outbreak of EOS dApp, a large number of games and gambling projects appear on the EOS chain. The EOS dAPP represented by BetDice generated RMB 8.2 billion turnover in two months and attracted hundreds of thousands of users. Decentralized exchanges, wallets, mining robots and other related services built on EOS have developed rapidly, and their popularity has even led to the explosion of EOS RAM. For the first time, the situation where the entire public chain ecology is brought to life by the application side. However, the projects on EOS are mainly based on the attribute of spinach. The transaction volume of spinach dApp accounts for 90% of the total transaction volume, and the life cycle of its users is basically kept within one month. Crashes quickly. Later, Tron also copied the EOS model, trying to continue the glory of EOS, but its user data and activity also fell off a cliff within a few weeks.

mdnice editor

exchange

exchange

image description

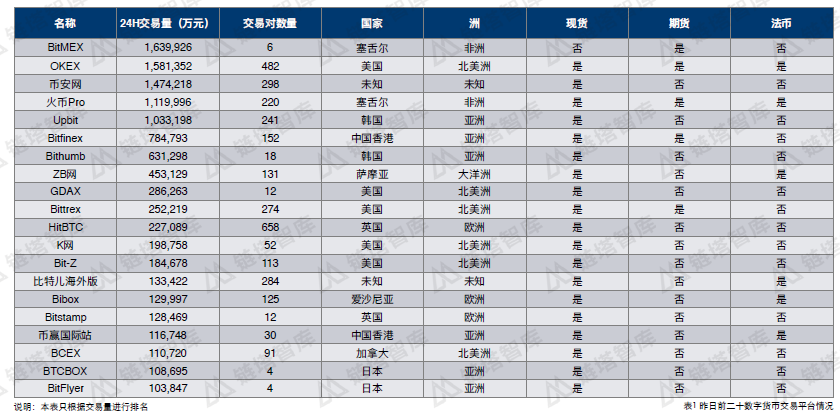

April 2018 Exchange Trading Ranking

The picture above shows the trading volume ranking of exchanges in April 2018. It can be seen that BitMEX, which focuses on contract trading, occupies the top spot, followed by the three major domestic exchanges and overseas regional exchanges. BitMEX and OKEX were the places where the contract trading function was launched earlier, and they were also the choices of most people for contract trading at that time. In the second half of 2018, most exchanges began to develop contract trading business. Huobi opened the contract trading zone Huobi DM at the end of 2018, and Binance started the USDT perpetual contract business after acquiring JEX in September 2019. In terms of the spot market, Binance pioneered the Launchpad concept in the first half of 2019, and then major exchanges began to launch their own IEO imitations, resulting in a wave of IEO market independent of the broader market.

Project side

Project side

image description

Top 10 Digital Asset Crowdfunding Projects by Funding Amount in 2017

Here we classify the project parties into projects that have raised funds and have issued coins, projects that have raised funds but have not issued coins, and projects that have not raised funds.

mdnice editor

corporate investor

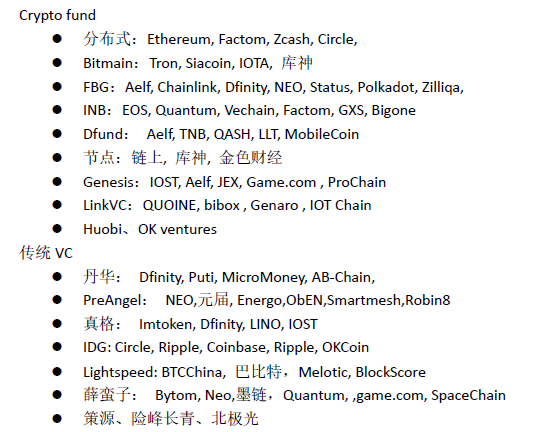

The primary market in 2017 was basically dominated by individual participants, and a large number of Token Funds and traditional VCs began to appear in early 2018. The quality of these institutions varies, some are professional investors from the traditional financial and Internet fields, and the other are early digital currency players and large investors with primitive accumulation. The figure below lists the well-known domestic investment institutions in the market at that time, as well as A16Z, Pantera, Hashed, Kenetic and so on overseas. If we compare it with the current list of investment institutions, we can find that most of the domestic institutions have withdrawn from the stage of history, and the reshuffle of primary market participants is also quite thorough.

image description

mdnice editor

Media, community and other service organizations

mdnice editor

3. Investment logic—transformation from bureau-making path to research path

I started to study in the digital currency market in early 2018. Before entering this industry, I was engaged in securities research. I believed in fundamental analysis and sneered at technical analysis. When I started to invest in the primary market, I started with the principle of the project, and examined the technical solution, consensus mechanism, token model, release rules and team quality of the project. Although I do not come from a technical background, I have read a lot of papers, white papers and technical articles. I have done in-depth study of commonly used solutions on the market, and I am full of longing for the blockchain world.

Later, when I really devoted myself to the market, I found that fundamental analysis is basically ineffective in an ineffective market. There is no data support, only concepts and theories, how to make investment judgments in this situation? I try to sort out the following logic from limited data and due diligence information:

• Technical solution: project progress, technical enthusiasm, and technical feasibility;

• Market popularity: number of media reports, roadshows, community data, search index;

• Economic model: token distribution scheme, token function, token unlocking situation, financing and valuation;

• Team situation: the background of the founding team, the background of the consultant team, the background of the investment team;

But in the actual operation of most investment funds, this set of investment systems is gradually transformed into two - tokens and teams. Investment has become extremely simple. There are only two points to consider when investing in a project: one is when the tokens will be listed, the proportion of the first release, and whether the unlocking time is reasonable; the other is who is the advisor, who will invest, and who will come to the platform. As a result, investment in the primary market has become a complete follow-up behavior. There is a list of institutional seats that everyone keeps in mind. Basically, if the top-ranked investment institutions invest, other institutions will inevitably follow suit. After the primary market shrank more and more, the above logic eventually degenerated into the logic of being the dealer. Incubation, management, and market value management have become the last resort to harvest the stock market.

mdnice editor

4. What do we get?

By sorting out the investment hotspots, market participants, and investment logic of the bear market, and comparing them with the current market conditions, we can actually easily draw the following conclusions:

1. Market volatility is huge, and investment targets and market participants have undergone a huge reshuffle.The Beta of the industry is very large, but how to keep the profits of Beta through the bear market is difficult, which requires strong investment ability and forward-looking judgment on market trends. More than 90% of incompetent people have been eliminated in the bear market, and more than 90% of unreliable projects have been abandoned by the market. The essence of this industry is what settles down after the big waves wash away the sand.

2. The market is getting better and more effective.With the recognition of digital currency and blockchain technology worldwide, a large number of professional investment institutions and capable industry builders have continuously entered the digital currency industry in the past few years. There are fewer and fewer fraudulent projects, more and more teams doing things, and great changes have taken place in the participants and fundamentals of the industry.

3. The market is rewarding long-termists and hard-builders.mdnice editor

5.

Finally, I will tell you a short story for everyone: On April 19, 2019, my colleagues and I had a meeting with a curly-haired kid on WeChat. He told me that they were going to be a contract exchange, and after listening to it, I felt that it was no different from the BitMEX model. So I asked him a few related questions encountered by BitMEX, and he didn't have a good answer. I went to their website and looked at the transaction data and saw that there were only a few transactions a day. In addition, the market conditions are very cold, and we no longer plan to invest more in the primary market, so we quickly passed the project. Later, I saw him again on the live broadcast of the hearing in the United States. On the name tag on his chest, there was a line of words "Mr Bankman-Fried".

Data Sources:

Data Sources:

Huobi Research Institute "Global Blockchain Industry Panorama and Trend Report (First Half of 2018)"

Chain Tower Think Tank "2018 Digital Currency Exchange Research Report"

DappReview "80 days, 8 billion, undercurrents under the cold winter - EOS DApp ecological explosion that you don't understand"