Start the death spiral or the end of the stress test? Can UST be saved?

Algorithmic stablecoin leader Terra USD (UST) is in catastrophic chaos.

According to data from Coingecko, with the overall decline in the cryptocurrency market in recent days, BTC once fell below the $30,000 mark, and UST’s departure from the anchor point ($1) is getting bigger and bigger. Dollar. At press time, UST has rebounded to around $0.9.

This is not only the most serious unanchor in the history of UST, but the chain reaction of its "collapse" and "multi-party rescue" to the market has also become a hot topic of discussion.

UST encounters selling pressure, breaks anchor warning

In order to clarify the whole incident, Odaily first briefly reviewed the operating principle and anchoring mechanism of UST.

UST is an algorithmic stablecoin that runs on the Terra public chain and whose price is anchored at $1.

In terms of execution, the system realizes the dynamic control of UST supply by burning the original assets LUNA and UST of the Terra chain: when the demand for UST increases and the currency price rises above $1, LUNA will be burned to mint new UST; Conversely, if the demand for UST decreases and falls below $1, UST will be burned to mint new LUNAs to restore the peg to the US dollar.

With the rapid development of LUNA ecology and the ecological empowerment of UST's own operating mechanism, UST's market value has soared from less than 3 billion US dollars to more than 18 billion US dollars in the past six months, and it has firmly secured its leading position in the track.(Supplementary reading "Messari Report: Terra will have the best ecological development in 2022, and UST will become the key to ecological expansion》)

At the same time, the Terra ecological development organization Luna Foundation Guard (LFG) further consolidated the stability of UST (and its high deposit APY) by increasing its holdings of BTC in large quantities. On May 5, LFG's Bitcoin holdings reached 80,394, making it the seventh largest whale address in Bitcoin.

But on May 7, a whale began selling UST worth US$285 million, causing the stablecoin to fall to US$0.98 at one point, and UST briefly stepped out of the usual US dollar exchange rate range. Meanwhile, LUNA also fell to a three-month low of $61.

Subsequently, on the evening of May 8, news of UST selling with a transaction amount of one million levels was frequently sent out on Twitter.

On the evening of May 9, UST continued to test downwards. The rising panic among LUNA and UST holders led to the withdrawal of a large amount of funds on Anchor (the UST interest-earning deposit service in the Terra ecosystem, whose APY was once stable at 20%), and the value of Anchor’s deposits was reduced by nearly 1/4 , about $3.5 billion in encrypted assets was withdrawn. This puts enormous pressure on UST to remain anchored.

In the early morning of May 10, due to the unanchor of UST, the ratio of UST/3CRV pool on the Curve platform has been seriously tilted, of which the ratio of UST/3CRV is 94.16%/5.84%.

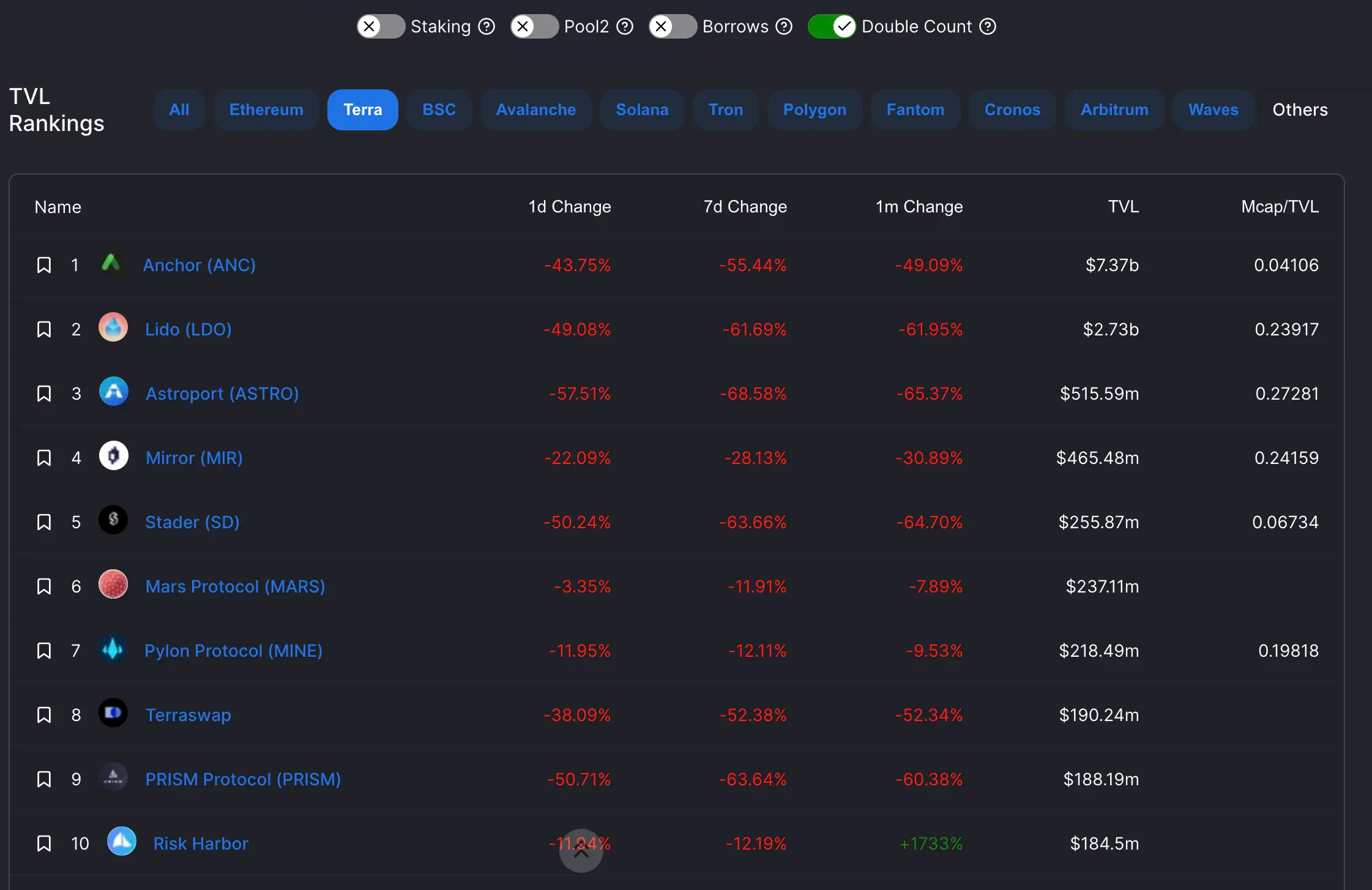

The de-anchoring of UST also triggered a huge ecological earthquake in LUNA. The price of LUNA has been cut in half and is now hovering around 32 USDT. According to DeFi Llama, LUNA TVL fell by 44.81%, and the top 10 protocols in its ecological TVL have all shrunk significantly.

Can the unanchored UST be recovered when the "guard plate" is in progress?

In order to prevent UST from falling into a death spiral, all parties started a joint rescue operation:

1. LFG's self-help

On May 9, LFG loaned $750 million worth of BTC to OTC trading firms to help protect the UST peg, and loaned another $750 million worth of UST to accumulate BTC when market conditions normalize.

Subsequently, LFG decided to deploy $1.5 billion in BTC/UST liquidity ($750 million for BTC and $750 million for UST) to ease market concerns surrounding UST. Its officials also declared that they would not liquidate their BTC positions.

In addition, LFG also supplemented UST reserves with 28,205 BTC.

Thanks to LFG's efforts, UST price found relief on May 9 and returned to around $0.99.

2. Under the multi-party "recharge", the panic did not spread

LFG's "self-help trilogy" only brought UST back to around $1 briefly, and then began to fall sharply. Faced with the current market situation, many companies and individuals are also taking action.

Larry Cermak, director of research at The Block, tweeted, “There are rumors that companies such as Jump and Alameda have provided another $2 billion to save UST and bring UST back to $1.” He said that the only way to save UST now is to completely ( or possibly very close to full) mortgage. Otherwise the UST will not be used again.

0xSifu, former CFO of Frog Nation, exchanged 2.8 million USDT for 3.88 million UST.

· Justin Sun bought more than 1 million UST and deployed a UST/USDD pool on Uniswap.

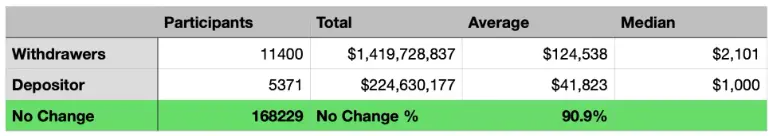

· According to Pedro Ojeda, in this unanchor incident, although a large amount of funds escaped from Anchor, 91% of users chose to ignore or lie flat. Among the deposits and withdrawals, 75% of the value came from more than 1 million 182 wallets in USD (about 1%). Therefore, mass panic did not spread and people still wanted to store UST in Anchor.

With the efforts of various parties, UST rebounded to 0.9 USDT at noon on May 10.

There are still different opinions in the market on whether UST will resume anchoring in the future:

Regarding the unanchor incident, many people on Twitter remained calm, thinking that when the Luna team finds an effective long-term solution, UST will regain everyone's trust.

“I still hope and think that the Luna team will be able to peg UST back to $1. The short-term solution is to back it with a centralized stablecoin like USDT. Wish them all the best.”

At the same time, it was also stated that everyone who sold UST at 60c and 70c was really just helping it re-peg by reducing the asset-liability mismatch.

The simplest thing is that people believe that the invisible giants behind UST, such as 3AC and Binance, will not easily cause UST to completely collapse. Many people joked about the example of USDT. Tether has also been criticized for the risk of thunderstorms all year round, but it has always been sitting on the throne of stablecoins under the bundled support of various symbiotic stakeholders.

Of course, there are also views that under the current situation of unstable bitcoin market and general panic in the market, UST will face challenges in the short-term recovery of anchoring. If UST breaks again, can LFG's limited bullets (bitcoin reserves) protect UST? If not, it will cause LFG to sell Bitcoin, and a large number of buyers will be liquidated in the market, and the market will further fall into panic and risk. Will those capitals continue to "generously donate" at that time?

As of press time, the price of UST was around $0.918, and LUNA also rebounded slightly, rebounding from the bottom of $23.5 to the highest of $37, temporarily reported at $31.65. Many investors have begun to enter the market to buy bottoms, and the panic has eased slightly.

Related Reading

Related Reading

Nearly 5 billion US dollars evaporated in 2 hours, while the Luna crash was in progress

From peak to collapse, UST's roller coaster ride

Related topics