How does Terra founder Do Kwon respond to UST unanchoring concerns?

This article comes from the WeChat public account Laoyapi (id: laoyapi).

This article comes from the WeChat public account Laoyapi (id: laoyapi).

While a 1% depreciation is not uncommon for stablecoins during a market downturn, in the case of UST it has been over 16 hours.

Terra's native token, LUNA, has plunged about 10% since yesterday, to $65.80, amid concerns that Terra's stablecoin UST, which is largely backed by LUNA, may lose its peg.

Stablecoins are cryptocurrencies pegged 1:1 to fiat currencies such as the U.S. dollar. Depegging refers to stablecoins trading above $1, or more commonly below $1.

UST fell as low as $0.985 on Saturday and is now trading at $0.99. While it is not uncommon for stablecoins to lose 1% of their value from $1 during times of market stress, parity tends to recover fairly quickly. As far as UST is concerned, it has exceeded 16 hours.

Some commentators say this highlights the UST as a liability for the broader cryptocurrency market, as the Luna Foundation Guard, a group that supports the UST, has $3.5 billion in bitcoin ready to sell as a last resort if it needs to defend the stability of the UST sex. LFG's reserves are BTC (93%), LUNA (3.5%), and AVAX (3.5%).

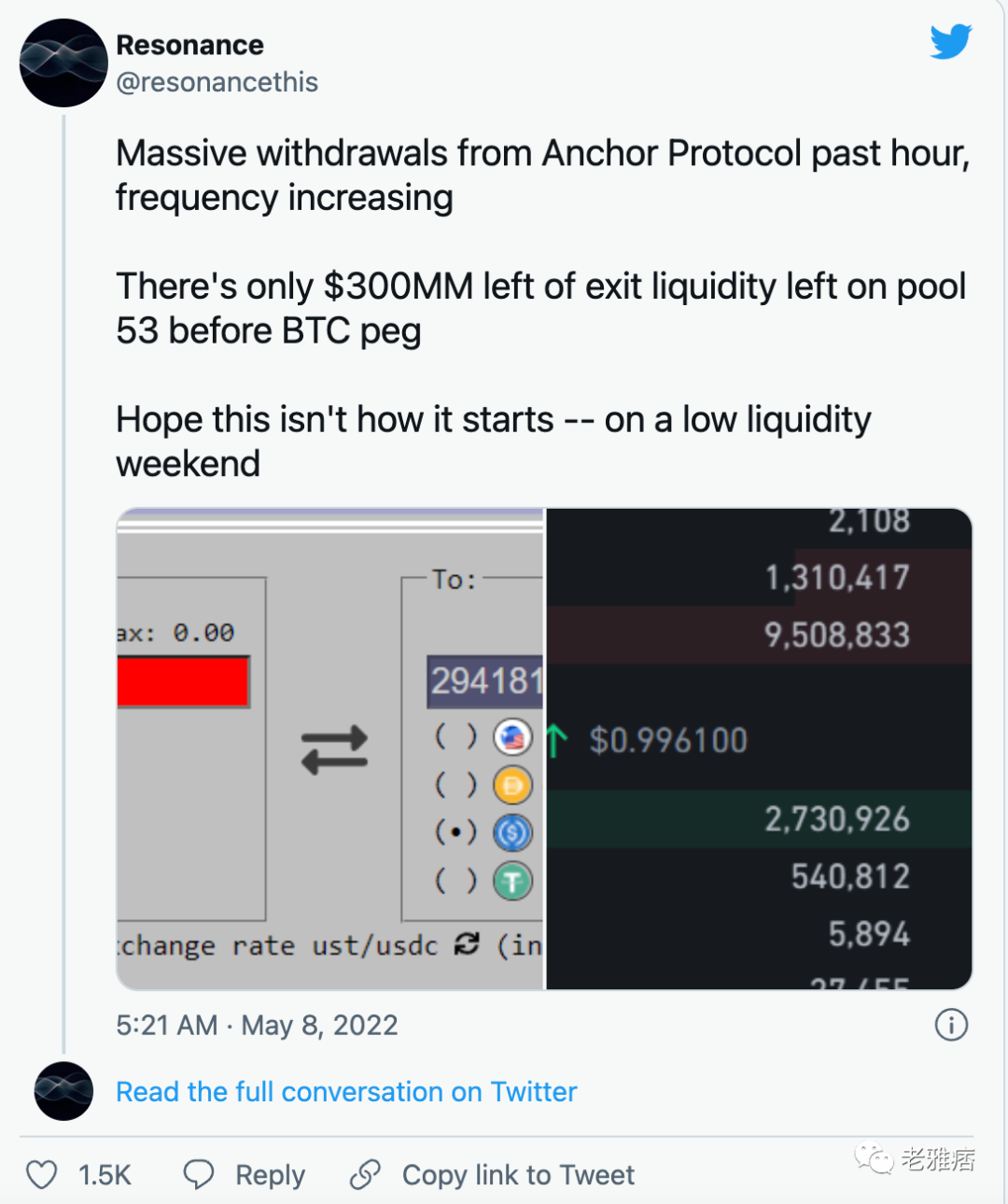

In the past few days, Terra's Anchor Protocol has seen a large number of withdrawals, UST's deposits are currently earning investors an 18.8% annual interest rate, and the pressure on UST has begun to increase. While it's unclear what caused these withdrawals, it could be a bearish turn in the broader market."In what appears to be a domino effect, at the time of writing, the UST liquidity pool on Curve is showing ~67% imbalance (typically with a 50% split). Curve, the primary protocol for stablecoin liquidity on Ethereum, is admired for its deep liquidity, often allowing traders to"Slippage

, or the price difference before and after the transaction to exchange stablecoins such as UST and USDC. Since Curve is at the heart of DeFi, any sign of something out of whack in its pool would cause panic."Tyler Reynolds, a Web3 investor who closely follows stablecoins, told Decrypt that concerns about Curve’s UST imbalance are"。

"exaggerated"But it's kind of like a vending machine. He said:

It's hard to overthrow, but once it's in motion, no one can stop it."Curve researcher (alias nagaking) told decrypt that, in his view,"Such an imbalance is not actually a cause for concern.". He explained that the bonding curve of the Curve fund pool is designed like this:"

"They take some of the imbalance before the price shifts too far."From a [liquidity pool] perspective, the only real problem is when the pool never returns to close to a 50/50 balance, corresponding to a 1:1 price. So the imbalance itself is not a problem, but as the pool becomes more unbalanced and the price moves further away from 1:1, there will obviously be more concerns that the price/pool balance may not return to normal,

Nagaking tells decrypt.

While Curve’s capital pool was able to absorb this imbalance, investor panic yesterday led to a massive sell-off in UST, mostly to buy other stablecoins such as USDC.

In the biggest UST sell-off, Curve Whale Watching, a bot that monitors and feeds massive swaps, showed a trade of 85 million UST for 84.5 million USDC. The trader paid nearly $34,000 in fees to the liquidity pool."Reynolds told decrypt that there are also"People convert LUNA to UST and sell to USDC/USDT

second-hand reports.

Traders swapping LUNA for UST is the way UST maintains its stability. The system is designed so that 1 UST can be exchanged for 1 USD of LUNA at any time.

When UST fell below its $1 peg yesterday, arbitrageurs swooped in, trading LUNA for discounted UST, generating profits. This mechanism helps maintain UST’s peg to the U.S. dollar because every time a trader buys a UST and exchanges it for LUNA, the Terra protocol removes that UST from circulation. The pressure to buy UST helps maintain its peg.

But selling pressure on Terra means its price could drop to save the stablecoin on its native network, as seen on Saturday. In addition, traders take advantage of UST's stabilization mechanism by selling LUNA for UST, when they sell a large amount of UST for other stablecoins (such as USDC), it will break the peg, because this will bring unstable selling pressure to UST .

Since UST's peg needs to be defended by the sacrifice of LUNA, some traders are so bearish that they will bet millions of dollars on LUNA's price remaining low (defined as below $88) until March 2023.

"Those passionate about the terra ecosystem view the recent events that caused UST to drop and continue to hold at $0.99 as a conspiracy against UST."Today's attack on Terra-Luna-UST was deliberate. Caetano Manfrini, legal officer for Brazil’s cryptocurrency business alliance GEMMA Ecosystem, wrote on Twitter:"

One player massively dumped 285 million UST on Curve and Binance, followed by massive shorting on Luna and hundreds of posts on Twitter. Sheer deception. This project is bugging someone, we are on the right path!

"Meanwhile, Do Kwon, CEO and founder of Terraform Labs (the company behind Terra), played down the panic in the market."So, is this $UST depeg with us now?"Kwon tweeted Saturday, along with a cartoon of a psychiatrist bear.