Zonff Partners Research: 4-word long essay captures the value of the ZK Rollup era

Original source: Zonff Partners

Original source: Zonff Partners

Guide:Article directory

Article directory

1. Why pay attention to Zero-Knowledge (ZK) Rollup?

Comparison of Optimistic and ZK schemes

text

text

text

Pain Points of ZK Rollup

text

text

text

Towards Community Issues

first level title

Why focus on Zero-Knowledge (ZK) Rollup?

Zero-Knowledge (Zero-Knowledge) cryptography has been called one of the most underestimated technologies of our generation. Unlike the overwhelming news coverage of topics such as artificial intelligence and big data, there is almost no media attention to zero-knowledge technology. Still, the technology is a great breakthrough that brings valuable privacy guarantees to an era of big data where personal information has nowhere to hide.

Zero-knowledge cryptography is a broad topic, but in this article we only focus on one area most relevant to blockchains: zero-knowledge proofs. A zero-knowledge proof is a non-interactive, zero-knowledge argument of knowledge that assumes two parties: a prover and a verifier. The prover wishes to prove to the verifier that they know some information, but not reveal what it is. At the same time, the verifier will look at the proof and accept or reject it.

These schemes have three properties:

Completeness: Any valid result can prove that a given program

Robustness: no dishonest actor can create valid proofs

Zero-knowledge: the verifier knows nothing about the input to the proof, only the result

This ability to prove a statement without revealing its truth is a powerful primitive in the blockchain realm, which is publicly visible on all datachains. Whether for individuals, businesses or governments, this technology can solve many real-world pain points, such as protecting user data, designing sensitive systems or contracts, proving the fairness of the distribution of public goods and achieving more efficient economic government agencies .

In the field of blockchain, in addition to being applied to privacy protection, the most eye-catching application is ZK Rollup, the expansion scheme of Ethereum. At present, Ethereum is embracing a rollup-centric expansion solution, which reflects the optimal trade-off in decentralization, security and scalability. Essentially, Ethereum upgrades will make the network more scalable, sustainable and secure.

The expansion scheme of Ethereum is divided into on-chain expansion and off-chain expansion.

On-chain extension technologyIt is an upgrade to the blockchain base layer to improve scalability. Ethereum's long-term on-chain scaling solution is called sharding, which actually divides the base layer into 64 chains, with the beacon chain ensuring shared security.

Off-chain scaling refers to scaling solutions that use an external execution layer instead of the base layer. These Layer 2s or "L2s" are auxiliary layers that sit on top of the base layer and provide more transactional capabilities to the entire blockchain.

The L2s solution embraced by Ethereum is Rollup, which can bring the following features:

Through Rollup, Ethereum can increase from about 25 TPS to 3,000 TPS without sacrificing security;

With Rollup, users' funds cannot be stolen or censored (as is the case on some sidechains);

Users can always access the data on L1, and no one can prevent users' funds from exiting Rollup safely at any time;

There are two (main) types of Rollups in current solutions:

secondary title

Comparison of Optimistic and ZK schemes

Optimistic Rollup is a more mature solution than ZKRU. Products from Optimstic and Arbiturm are currently available to Ethereum developers. However, due to the use of a fraud proof mechanism, its withdrawal time and security are currently questionable, and its cost optimization is also slightly inferior to that of ZK. The weaknesses of ZK Rollup are basically technical issues. With a large number of excellent developers investing in related research, most people, including Vitalik, agree that ZK Rollup will be a better expansion solution in the future.

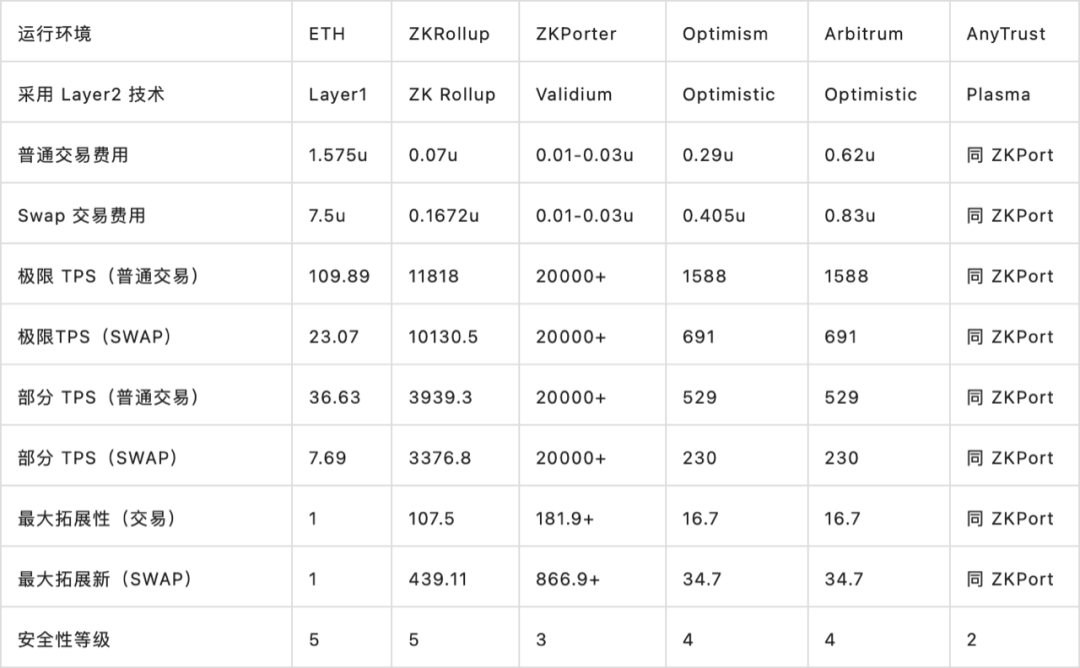

image description

image description

Source: Xiang|W3.Hitchhiker, the premise of the above calculation is that the current ETH price is 2500u, the block gas limit is 30000000, the gas fee is 30Gwei, and the average block time is 13 seconds. The limit TPS means that the corresponding operating environment occupies all Ethereum Block space (500,000 gas is spent on proof verification), ordinary TPS means that the corresponding operating environment occupies 1/3 of the block space of all Ethereum.

In terms of cost efficiency,The ZK scheme is more efficient than the OR scheme, with higher TPS and lower cost.

In terms of time cost, due to the fraud proof mechanism, withdrawals on Optimtisc Rollup require a submission period of 7-14 days for others to falsify potential malicious behavior. Although there are already liquidity pool mechanisms proposed by Optimstic Rollup solutions such as Boba Network to reduce the withdrawal period.

In terms of compatibility,Both Optimsitic and ZK are faced with the problem of compatibility and adaptation of complex EVM contract call operations, but Optimstic is easier to implement. OR solutions including Arbiturm and Optimsim all have EVM-compatible virtual machines, allowing them to handle Ethereum main All transactions that occur on the chain.

One of the main problems that restricts the development of ZK Rollup is the compatibility of Ethereum EVM.At the beginning of EVM design, developers had no idea that ZK technology would be used in the future. It is almost impossible for EVM operations to generate usable zero-knowledge proofs, thus giving rise to the demand for ZK-EVM. Many people thought that it would take at least a few years to realize ZKSync 2.0, but the ZKSync 2.0 public test network was officially launched at the end of February. This is also the first EVM-compatible ZK Rollup on the Ethereum test network. Perhaps the official large-scale implementation of ZK Rollup It's a little faster to use than we thought.

Why is EVM compatibility so difficult for ZK?

Most of the existing ZK Rollup solutions can only support simple payment and Swap scenarios. The reason is that, in addition to the normal execution of the bytecode of the smart contract, ZKEVM also needs to generate a Proof to indicate that the state has been updated correctly after the transaction is completed. Due to the design of the EVM and the algorithm principle of the ZK proof, the two are very compatible. difficulty.

In terms of security, the security of OR comes from economics. A reasonable incentive mechanism must be designed to drive a group of validators on the main chain to monitor submitters at any time and prepare to submit fraud proofs. Submitters also need to pass pledges, etc. The method ensures that the node will pay the corresponding price for doing evil. Zonff Partners

advantage

advantage

Contains less data in each transaction, increasing layer 2 throughput and scalability, greater scalability and lower transaction cost benefits compared to Optimistic Rollups;

No need for anyone to monitor ZKR;

No need for fraudulent dispute windows like in Optimistic Rollups, reducing withdrawal time from about 2 weeks to minutes;

shortcoming

shortcoming

The difficulty of computing zero-knowledge proofs will require data optimization for maximum throughput;

Initially building and integrating into the Ethereum network is more difficult than Optimistic rollups;

Relatively speaking, the weaknesses of ZK Rollup are basically technical problems. With a large number of excellent developers investing in related research, I believe these problems will be resolvedfirst level title

secondary title

ZK Rollups main players comparison

There are two main players in the ZK Rollup technology space:zkSync and StarkWare

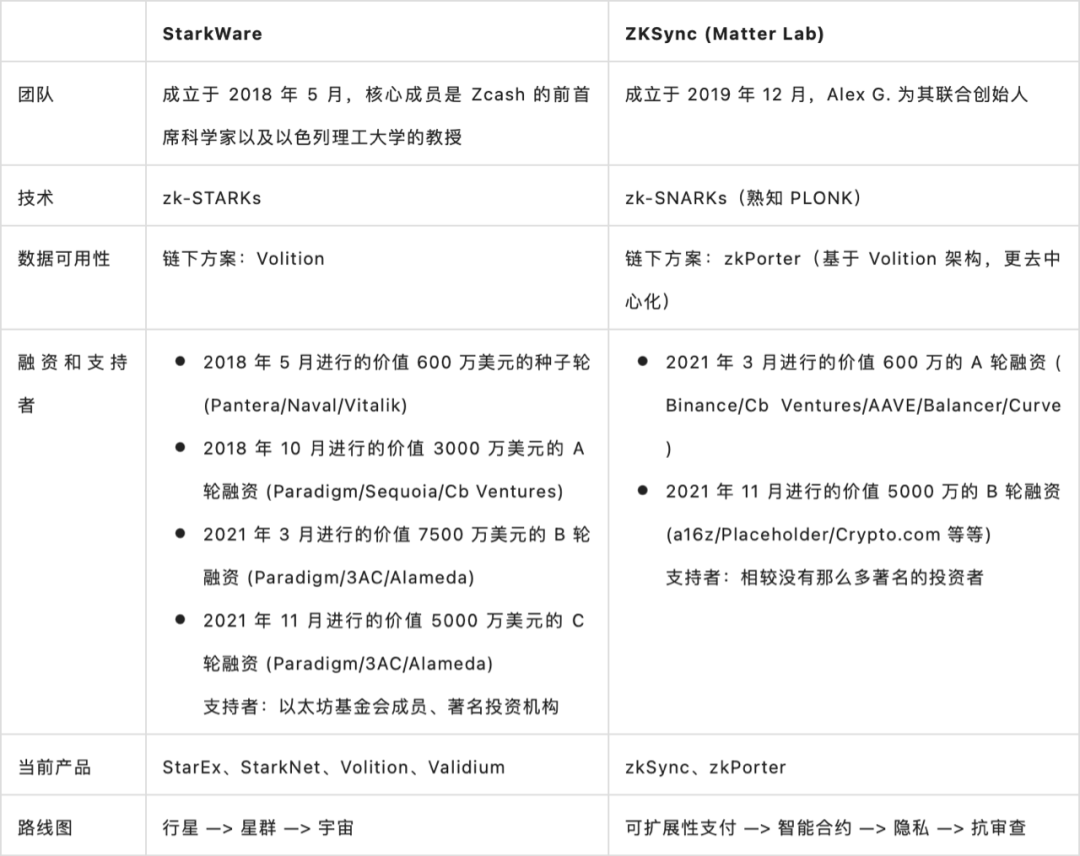

The table below visualizes some of the previous major differences between the two in terms of team, technology, data availability, funding and backers, as well as current products and roadmaps.

From the team point of view,StarkWare is more academic, the team is composed of world-class cryptographers and scientists who have pioneered and innovated in the zero-knowledge field for many years, published many academic papers, and are turning it into a real product StarkWare; the zkSync team was not able to find more information , but judging from its product release, it has the temperament of a cross-industry player and high efficiency.

Technically speaking,StarkWare is generally a better technology, and it provides blockchain finality, which means that its capital efficiency is optimal. In addition, the main advantages of STARK are:

Invented and built their own ZK-STARK system, while zkSync's technology stack was built by others (PLONK built by Aztec). This also means that StarkWare has a stronger grasp of technology and the ability to improve technology;

There are already several systems running in production using a Turing-complete programming language called Cairo, which is readily available. Matter Labs only has a simple payment system in production, and no Turing-complete language is available;

faster, more secure (in a cryptographic sense), transparent (no trusted setup required), and post-quantum secure, whereas the core technology used by Matter Labs (built by another team) is slower, requires a trusted setup, and can be broken by quantum computers;

In terms of data availability,StarkWare pioneered the Volition system to solve the DA problem. Volition allows end users to choose between a rollup scheme (on-chain data availability) and a validium scheme (off-chain data availability) for each transaction. zkSync uses the Volition-based zkPorter technology. The main difference is that in the Volition solution, users can choose a data storage method based on each transaction, while in the zkPorter solution, users can choose a transaction settlement method based on each account (zkPorter accounts can only DA way to generate transactions). In addition, zkPorter's off-chain DA system is more decentralized, because its DA is secured by the Guardian network (Guardian) incentivized by zkSync native tokens, rather than a centralized "DAC".

In terms of financing and support,StarkWare is valued at $2 billion and is raising a Series D round at a $6 billion valuation. This is a world-class level of financing, with many prominent investors. Its supporters include some tycoons and members of the Ethereum Foundation, and Vitalik himself has reviewed most of the articles published by StarkWare. Compared with StarkWare, zkSync has relatively few famous investors and looks like a large Defi/CEX crypto home financing. Each of these projects is well-known, and together they can form a very good ecology. This is important though, the success of ZK Rollup will depend heavily on the onboarding of DeFi protocols and direct integration with CEXs.

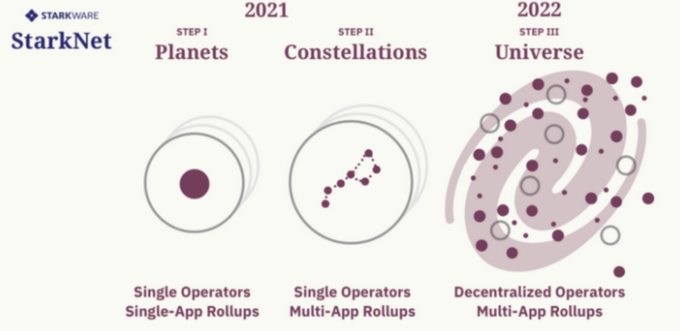

From the current product and roadmap,In June 2020, StarkWare first launched StarEx, which corresponds to the "Planets" phase of their roadmapimage description

Source: StarkWare

Source: StarkWare

On November 29, 2021, they released the Alpha version of StarkNet's main network, quickly developing towards the "Constellations" (Constellations) stage in the roadmap. StarkNet is the permissionless, multi-application general-purpose ZK Rollup we've been looking forward to. As of March 2022, the StarkNet test network Goerli has generated a total of 1.4 million transactions, and the main network has generated a total of 45,000 transactions. In terms of contract deployment, there are 26,000 contracts on the test network Goerli and 1,600 contracts on the main network.

In the preliminary stage StarkNet will be driven by a centralized prover, and applications will need to apply for a whitelist to be deployed sequentially, like Optimism. Their plan is to grow the ecosystem and gradually decentralize StarkNet to achieve the "Universe" phase of the roadmap.

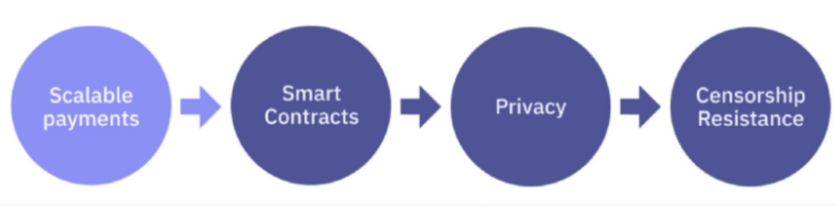

The roadmap of zkSync can be summarized as the following 4 steps.image description

image description

Source: Matter Lab

secondary title

Advantages of ZK Rollups

The ZK Rollup solution can bring some unique advantages, such as privacy protection, reserved scalability, and the realization of cross-chain applications.

Privacy is one of the advantages and characteristics of ZK Rollup

Permissionless blockchains can achieve computational integrity without trusting third parties, but they come at a price in terms of scalability and privacy. Beginning in the 1980s, theoretical work on proof systems such as zero-knowledge proofs, interactive proofs, and probabilistically checkable proofs has illuminated pathways to both problems and embodied them in practical applications;

Retaining scalability gives developers theoretically almost unlimited computing power

This makes it possible to transplant all the ecology on the Internet, such as fighting games, it was difficult to realize on Ethereum before, but ZK Rollup can change this. In addition, the super computing power coupled with the characteristics of the blockchain can also generate many new applications;

The other is cross-chain applications, one of the representatives of ZK Rollup, StarkNet has very diverse bridging functions

secondary title

Pain Points of ZK Rollup

Although ZK Rollup is a very good Ethereum expansion solution, its application is still accompanied by some risks, such as liquidity fragmentation, communication problems and technical barriers to reduce composability and centralization risks.

The problem of liquidity fragmentation has become increasingly prominent under the current multi-chain structure, and this is not a unique problem faced by ZK Rollup applications

Due to the existence of various technical solutions, there will be more rollup networks in the future, which will lead to more serious liquidity fragmentation. The good news is that there are many cross-chain communication technology solutions to solve this problem, such as StarGate launched by LayerZero in March 2022 (note that StarGate does not currently support ZK Rollup). On the premise of ensuring security, LayerZero is bringing us a "full-chain future", including state sharing, unified bridge liquidity, cross-chain lending, Swap, and multi-chain revenue aggregators;

The composability problem is mainly reflected in the interaction between the main chain dapp and the sub-chain dapp

Every new protocol built on Ethereum is like Lego bricks that other protocols can easily build on top of, which is one of the reasons why DeFi is growing rapidly. If the problems of communication and contract standards cannot be solved, the dapps on the sub-chain need to re-establish their own ecology, which causes a greater waste of resources. Not only between the sub-chain and the main chain, but also between the sub-chain and the sub-chain need to build a communication mechanism and corresponding contract standards;

The risk of centralization is mainly due to the fact that in the current various Rollup solutions

first level title

What does the future of scaling look like

In the expansion roadmap of Ethereum, it describes an expansion scenario in which Ethereum focuses on Optimistic Rollup in the short term, and "sharding + ZK Rollup" in the medium and long term.

On the whole, Rollup is undoubtedly the best choice for the expansion of Ethereum. Its biggest features are security and scalability. Although it takes time for technical research in terms of programmability, in the medium and long term, this is a very important task. The ideal expansion technology, the combination of Ethereum sharding and ZK Rollup, will break the so-called impossible triangle. At the same time, the introduction of zkEVM can take into account programmability and help developers move to the second layer more easily.

In the medium to long term, as ZK-SNARK technology improves, ZK rollups will win in all use cases. — Vitalik Buterin

secondary title

technical problem

The above has briefly explained the technical problems of ZK Rollup, and here are some supplementary details.

Regarding compatibility issues, the technical problem of ZK Rollup is that it is not friendly to developers, resulting in limited functions. Previously, it was difficult to build a general-purpose DApp mainly due to the following two reasons.

First, if you want to develop a DApp in ZK Rollup, you need to use a special language (namely R1CS) to write all your smart contract logic. Not only is the syntax of the required language complex, but doing so requires extremely strong zero-knowledge proof expertise;

Second, ZK Rollup does not support composability. This means that different ZK Rollup applications cannot interact with each other within Layer 2. This quality greatly undermines the composability of DeFi applications;

There are two ways to build a general-purpose DApp in ZK Rollup. One is to build a dedicated circuit "ASIC" for different DApps. This is the path adopted by the early ZK Rollup. It corresponds to the planetary stage of StarkWare, and applications cannot interact . The other is to build a common "EVM" circuit for smart contract execution, and StarkWare and zkSync are currently making great progress in solving this.

Judging from the current situation, the development of StarkWare is in the "Constellations" (Constellations) stage. In September 2021, StarkWare announced the launch of a permissionless, multi-application general-purpose ZK Rollup, and supports smart contracts through the Cairo language. The development of zkSync is also in the second stage. In February 2022, the zkSync 2.0 test network will be launched. Continuous testing will ensure LLVM/Solidity compatibility, fully compatible with EVM and ensure the composability of smart contracts.

Note that in terms of solutions, StarkWare and zkSync adopt two completely different technical solutions.

StarkWare adopted Cairo, a new Turing-complete programming language, and cooperated with OpenZeppelin to develop standardized contracts, just like they cooperated with Ethereum, which means that they adopt new contract standards to achieve composability. This is undoubtedly a bold decision, because it will greatly increase the cost of entry for developers. Currently, Nethermind's Warp team is helping developers convert ERC-20 contracts from EVM bytecodes to StarkNet contracts and deploy them on StarkNet. This work is progressing rapidly, and its next goal is to transfer arbitrary smart contracts from Yul to Cairo.

zkSync uses the zkEVM scheme to achieve EVM compatibility. For zkEVM, there are currently two main implementation strategies:

It directly supports the existing instruction set of EVM and is fully compatible with the solidity instruction set. Those using this approach include Hermez and the Ethereum Foundation zkEVM;

In general,

In general,The first strategy has better compatibility and higher security, but the workload is greater, Hermez adopts this scheme;The second strategy is more flexible and requires less work, but requires extra effort on adaptation, zkSync adopts this scheme. zkSync also develops two compiler front-ends for zkEVM: Yul and Zinc. When building its own compiler, zkSync chose LLVM. LLVM/Solidity compatibility issues are the main reason why zkSync 2.0 will not be launched as scheduled in August 2021. This is also the focus of overcoming problems during the current zkSync 2.0 testnet launch.

StarWare seems to be less compatible with Cairo, is this a StarkWare shortcoming? Not really.

StarWare uses the Cairo language to port the smart contract logic to Rollup. Although the new language increases the developer's entry cost to some extent, Cairo's many features can make ZK more elegantly integrated into the blockchain ecosystem, such as The Cario language has a supporting AIR (Algebraic Intermediate Code Representation) visualization tool to view the details of the proof, and can also safely and reliably generate zk-STARK proofs to ensure computational integrity. At the same time, the language design feels more in line with mathematical proofs Logic, more neat, also has a complete toolchain.

Plus, it improves security. The relative simplicity of Cairo's AIR makes both on-chain validators and off-chain attestation services less efficient and amortized, and auditing a single simple AIR is more secure than auditing multiple complex application-specific AIRs. With Cairo, we can rely on a single Verifier smart contract; it is no longer necessary to deploy a verifier for each application used.

secondary title

go to market problem

The model of ZK Rollup winning the market is almost the same as the so-called "Ethereum Killer" public chain. StarkWare is currently centralized, they are pushing for decentralization, zkSync is open source and decentralized (but not to a great extent), neither has a token. Similarly, Optimism and Arbitrum, the two major players in Rollup Technology's other lineup, also have no tokens.

zkSync will issue tokens, which can be confirmed from their source code, while Starkware and Arbitrum have not publicly stated their position, and Optimism recently hinted at releasing tokens.

However, for L2s to promote decentralization and win the market, issuing tokens is a must. Tokens are not only a good incentive tool, but also help to better govern the community. The main obstacle to issuing coins at present is the immaturity of the L2s cross-chain bridge, and the EVM compatibility has not been well resolved.

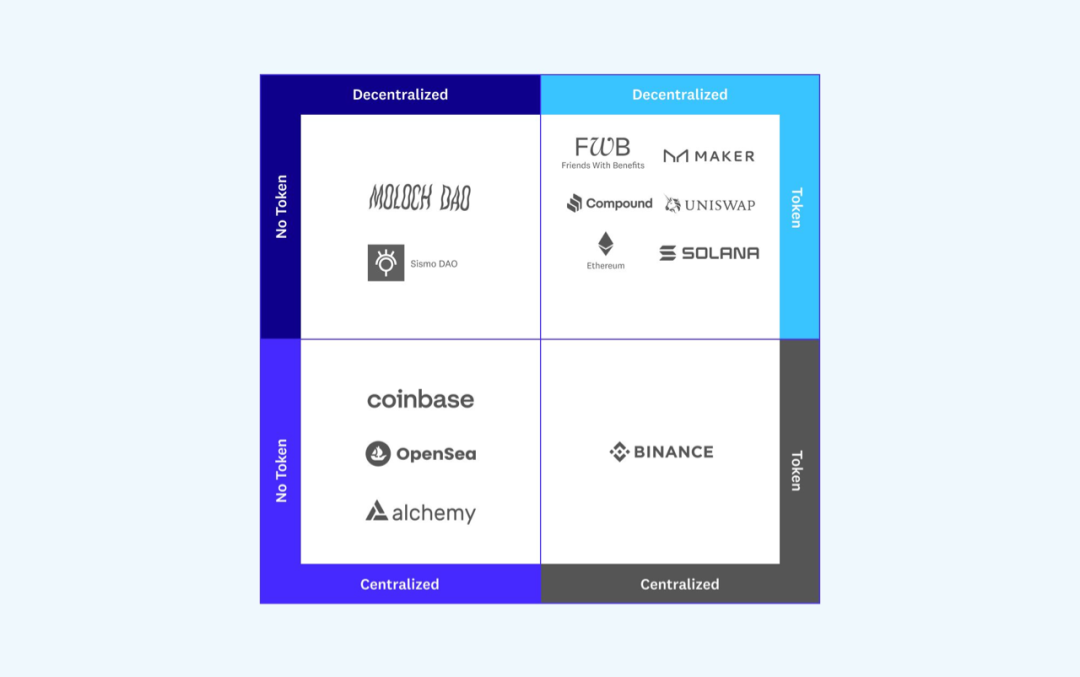

image description

image description

Source: a16z

They believe that the Go to Market (GTM) model of Web3 is very different from Web2, and the most innovative part is the introduction of tokens and the emergence of the new organizational form DAO. Each quadrant goes to market differently and can cover everything from traditional web2-style strategies to emerging and experimental ones.

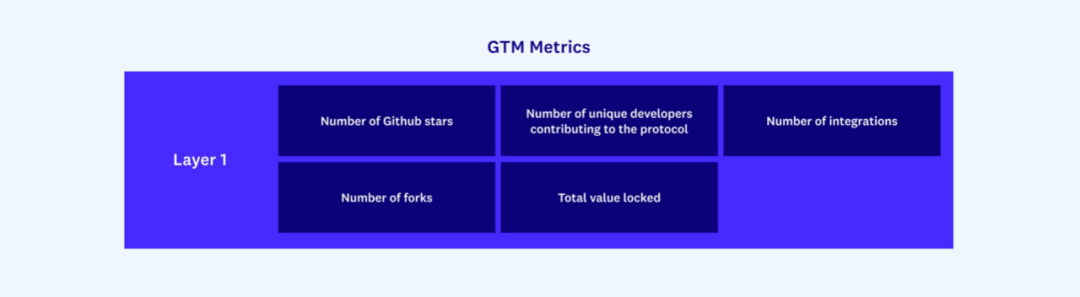

image description

image description

Source: a16z

At this point, since StarkWare is not open source, there is no comparison. From the data of March 2022, the situation of zkSync, Optimism and Arbitrum is as follows:

Judging from the number of favorites on Github, zkSync has the most. zkSync is 1.3K, slightly higher than Optimism's 0.9K and Arbitrum's 0.7K;

Judging from the number of protocol developers on Github, Optimism has the most. 43 for zkSync, 66 for Optimism, and 36 for Arbitrum;

Judging from the number of protocol forks on Github, Arbitrum is slightly higher at 355 times. zkSync and Optimism are comparable, 292 and 303 times respectively;

From the perspective of TVL, Arbitrum is now far ahead at $3.41b, while zkSync and Optimism are $148m and $562m respectively;

Compared with the more successful Ethereum "alternative chain" Solana, the number of Github collections of Solana is 7.7K, the number of forks is 1.8K, the number of contributors is 305, and the TVL is $7.46b.

secondary title

Towards Community Issues

It has been argued that the main difference between incentives in go-to-market versus go-to-community strategies can be summarized as the difference between value capture and value creation. For a product, it is its users that make up the community, and for a public chain or protocol, it is the applications that use it that make up the community. Therefore, it may be more accurate to replace Community with Ecosystem here.

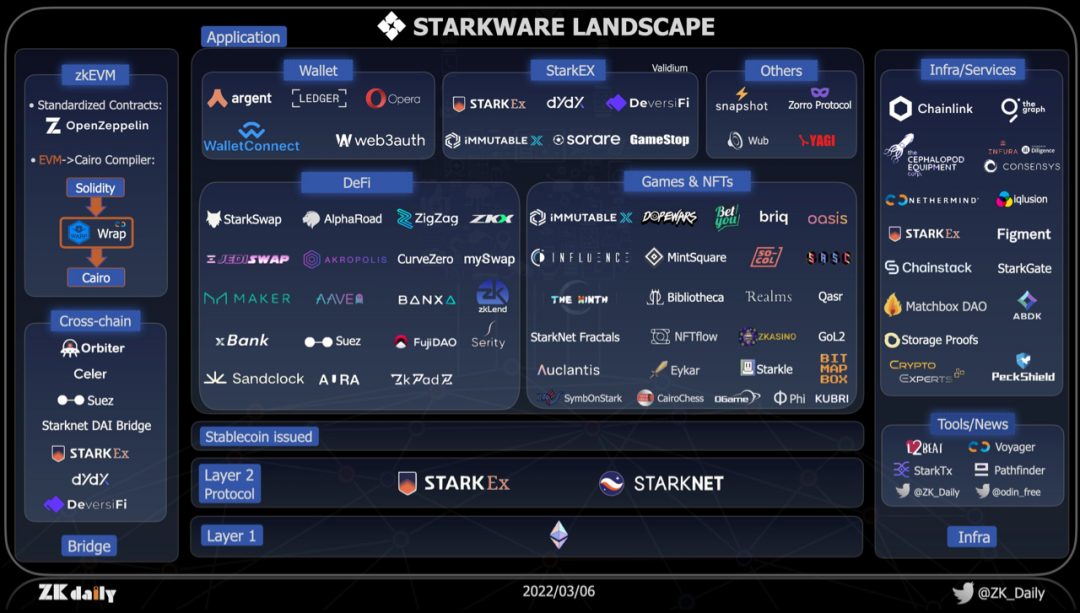

image description

StarkWare Landscape

image description

StarkWare Landscape

Source: ZK_Daily

The degree of ecological prosperity of the two is comparable, it can be seen thatzkSync has gained more support for cross-chain, DeFi and wallet applications, while StarkWare has a more prosperous Games&NFTs ecosystem.

For an L1s/L2s ecosystem, liquidity is equivalent to bandwidth, connecting different application scenarios to form a larger network, namely the Internet of Value. The definition of liquidity here is the value exchange between different applications. When the liquidity is good, the value loss is small, and when the liquidity is poor, there is a high value loss. In another case, if value exchange cannot be performed between different applications, then there is no liquidity. In an ecology, if liquidity can run through the entire ecology, like the Ethereum ecology, any application based on Ethereum can be priced and exchanged through Ethereum, this ecology is a normal operating ecology.

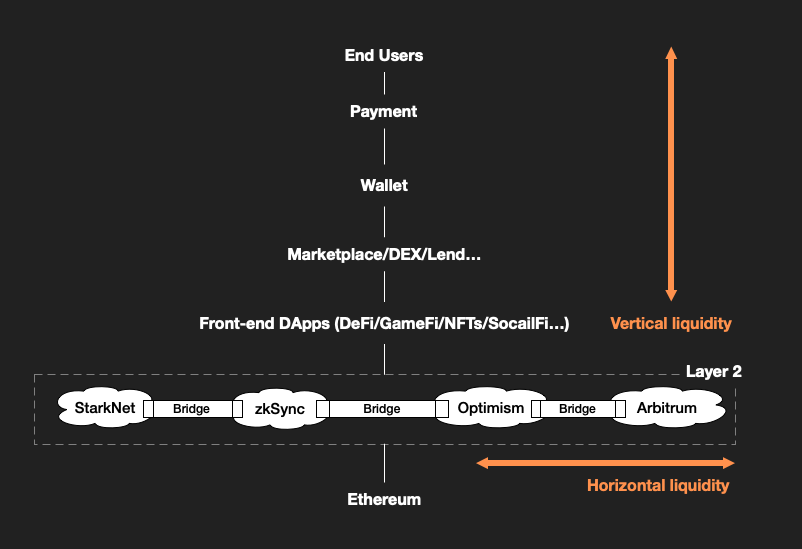

image description

L2 Ecological Value Flow Map

image description

image description

Source: ZK_Daily

To move towards the community (ecology), first of all, it is necessary to be able to open up vertical mobility internally, which requires support for composability, so that there is a unified standard in the ecology, allowing different application protocols to be integrated without permission, like Lego Like building blocks. It is easy to do this on Ethereum, but both StarkWare and zkSync have put in a lot of work on this due to the problem of zero-knowledge proofs, which is being resolved.

The prerequisite for the vitality of the community (ecology) is to have good lateral mobility, which requires the support of a useful bridge, which can bridge the liquidity of Ethereum at low cost, and more importantly, it can facilitate communicate with other L2 solutions and even L1 solutions. Whether for applications or users, a fast (high TPS) low-cost (low handling fee) secure blockchain is naturally attractive. When the migration cost is lower, the ecology will be more attractive to applications and users is stronger.

The necessary condition for the community (ecology) to take off is the emergence of killer applications, which attract a large number of users and capital.first level title

How to invest in expansion ecology

The blockchain is the Internet of value, and the traditional Internet is the Internet of information. Information data is transmitted by bandwidth, and value exchange is undertaken by liquidity. The public chain ecology must first realize the flow of value, followed by the efficient flow of value, and then build applications that meet the needs of users based on the efficient flow of value, truly improve production efficiency, and finally establish an efficient, license-free, A blockchain world that is subject to censorship, democracy prevents evil, is open and inclusive, and is open and transparent.

Thanks to smart contracts, the application of blockchain is not limited to being a decentralized ledger, it has also derived non-homogeneous tokens for the definition of ownership in the digital world and homogeneous tokens as the cornerstone of governance The DAO as a new governance organizational structure and other new things. These innovations combine with existing Internet applications to further derive more application scenarios. However, the current blockchain infrastructure cannot well undertake the implementation of these application scenarios.

The first is the problem of expansion.Whether it is TPS or data availability, capacity expansion is required. ZK Rollup and Validium have made fruitful explorations on this point, and there are other Layer 2/Layer 1 solutions, such as Optimistic Rollup, Plasma, Solana, Celestia, etc. Expansion technology itself is the best investment target. At this stage, we can pay more attention to on-chain storage technology. After expansion, high TPS and reliable data availability will greatly improve the performance of the blockchain, which will allow more complex applications to be built on the blockchain. These applications can be divided into Internet chain reform and blockchain Two categories of originality.

Internet chain reform:The most obvious is in the GameFi field, such as real-time battle settlement on the GameFi chain, real-time communication on the chain, and large-scale payments can all be realized;

Blockchain original:The high-performance blockchain infrastructure allows for more frequent and intensive value exchange behaviors than before, which will greatly promote the cost reduction of value flows, and innovative applications should be those that can really improve capital utilization efficiency and thereby increase productivity . In addition, the high-performance blockchain makes it possible to realize the liquidity of the data capital market, which is a subversive innovation. As a factor of production in the information age, data can be fully flowed and applied, and the benefits can be distributed reasonably and fairly;

Next is the issue of mobility, which is divided into horizontal mobility and vertical mobility.

lateral mobilityIt refers to the transfer of value among different public chains/L2 ecology. When a new public chain/L2 ecology is formed, users need to have a useful value exchange tool if they want to migrate from the original ecology. This tool is sometimes called a bridge. At present, traditional bridge tools have some security problems, which may lead to the loss of users' funds, and sometimes even cause chain effects. Fortunately, there are some new bridge technologies emerging, such as LayerZero. It is believed that more and better technologies will emerge, such as zk bridges under proper research, which can solve many problems existing in current bridges. As a liquidity entrance for ecological value, bridges can generate more DeFi applications, thereby capturing more value;

vertical mobilityIt refers to the transfer of value in the same public chain/L2 ecology. The optimization of vertical liquidity contributes more to the efficient flow of value, thanks to various innovative DeFi applications, such as AMM, Yield Farm, Lending, etc. Efficient application will cause less value loss in this exchange process. The value captured in this link is undoubtedly huge, but the current solutions are not good enough. Most of the solutions provide liquidity by locking liquidity, and the utilization efficiency of funds is not high. Novel solutions in this area include Tokemak and dAMM, etc. In this regard, we can pay attention to more L2 applications;

Then there is the issue of data privacy.No company wants to disclose all its financial data so that the entire network can review every financial transaction. The data on the blockchain chain is in the HTTP era of the Internet, and all information is "transmitted" in plain text, and the emergence of ZK technology can usher in the HTTPS era for the blockchain. It is believed that almost every transaction on the blockchain in the future can be protected by zero-knowledge technology. At that time, blockchain technology will be able to penetrate into every corner of society, and bring transaction privacy while ensuring transaction detrust, tamper-proof, openness, security and transparency. The best way to open privacy protection should be in the form of a protocol, as a plug-in, built together with other protocols like Lego blocks, so that it can be configured, owned, and anti-censorship. In the foreseeable future, the privacy protocol will be called the protocol that every application must integrate.

Finally talk about the wallet, as the entrance to the blockchain world, the wallet plays an important role. If you want to use the Internet analogy, wallets are like browsers in the Internet era. Information interacts with people through browsers, and value interacts with people through wallets. It is said that this is the Netscape era of the blockchain, and the little fox may be the Netscape that flourished back then. Although their endings may be different, I think the current wallet is far from being easy to use. The most important of these is that value does not flow efficiently between different wallets. Although some compatibility issues may affect interoperability here, there is no doubt that we need a set of common standards to define this value interface.

The above is the infrastructure, which is the field of value generation and capture. Only when these problems are improved (may not be exhaustive), blockchain technology can usher in a real explosion, and the value Internet can connect everyone.

In the past public chain ecology, the value is mainly captured by the agreement, firstly the public chain itself, followed by the DeFi field, especially exchanges and exchange platforms. Here you can refer to the famous fat protocol theory. There has always been controversy about the fat protocol theory, but for now, the fat protocol theory is generally correct. In my opinion, this is because the era of blockchain infrastructure is far from coming to an end.

Infrastructure construction is long, difficult, and labor-intensive, but it is the field with the most moat effect.On top of infrastructure, applications that can bring huge benefits are called kinetic energy applications, and those that create the most value effects must be kinetic energy applications. Infrastructure is still kinetic energy, not a constant layer, just like Taobao used to be the kinetic energy of the Internet, but now Taobao as a platform is gradually becoming the infrastructure of Ant Financial. The core purpose of infrastructure is to pave the way for kinetic energy applications and reduce the adoption cost of kinetic energy applications.

The kinetic energy era of the blockchain has not yet arrived, and with the arrival of the kinetic energy era, there is no doubt that the fat protocol theory will become invalid (although there have been some problems). At the current point in time, betting on the infrastructure track that can reduce the cost of application adoption is a wise choice. Regarding the adoption cost of applications, this includes not only economic costs, but also efficiency, technical barriers and even belief costs (reflected in blockchain fundamentalism such as decentralization, trustlessness, and anti-censorship).

With the gradual application of ZK Rollup in the L2 era, and even the arrival of the L3 and L4 eras, the kinetic energy era of the blockchain will undoubtedly become predictable, so who is the protagonist of the kinetic energy era? That must come from areas that could be killer apps, such as gaming, entertainment, social networking, and virtual reality.Early betting in these fields is also a desirable investment method, but considering its difficulty and rate of return, it is not cost-effective at the current stage. When investing in these fields, you can fully consider whether they make full use of the new infrastructure, or retain full scalability for the new infrastructure, which can keep them fast enough and high in the era of fast-growing blockchain infrastructure. Value cost control and efficiency improvement, thus greatly improving their competitiveness.

secondary title

reference reading

Zero Knowledge Cryptography & the Next Digital Revolution

A rollup-centric ethereum roadmap

This article understands the comparison of transaction costs of the four major Layer 2 solutions

Ethereum’s Ultimate Scaling Explanation and Directory

Battle for zk-rollup: zkSync vs. StarkWare

Hanging Optimistic Rollups? StarkWare's L2 Track Revealed | Unitimes AMAes AMAs

StarkNet Chinese Developer Meetup (text version)

Exploring the road to Ethereum expansion: which solution is the future?

Go-to-Market in Web3: New Mindsets, Tactics, Metrics

Community ≠ Marketing: Why We Need Go-to-Community, Not Just Go-to-Market

Analyst Notes: Cracks in the Fat Protocol Theory

Fractal Scaling: From L2 to L3

Geometry presents: Slush, a proposal for Fractal scaling

recommended reading

A Look Under the Hood Into Ethereum Technology and Scaling Solutions

Understanding rollup economics from first principles

The ultimate guide to L2s on Ethereum

The best ways to invest in Layer 2

Blockchain Bridges: Building Networks of Cryptonetworks

About Zhongfu Linkage Investment

Founded in 2016, Zonff Partners is an investment holding group that achieves diversified business development through investment and mergers and acquisitions. It continues to focus on Web3, cutting-edge technology, medical health, new consumption, corporate services and other fields, and adheres to primary and secondary Ecological linkage, focusing on the investment strategy of industrial structure cycle, practicing the investment philosophy of in-depth research, technology-driven, and structured post-investment empowerment, committed to using capital and resource advantages to help companies maximize their potential, and jointly promote global business innovation and technological change .