Messari: Disassemble the DeFi track and find the Alpha of the sub-track

Original author:Dustin Teander

Original source: Messari

Compilation of the original text: The Way of DeFi

The main points

Original author:

Original source: Messari

Compilation of the original text: The Way of DeFi

The main points

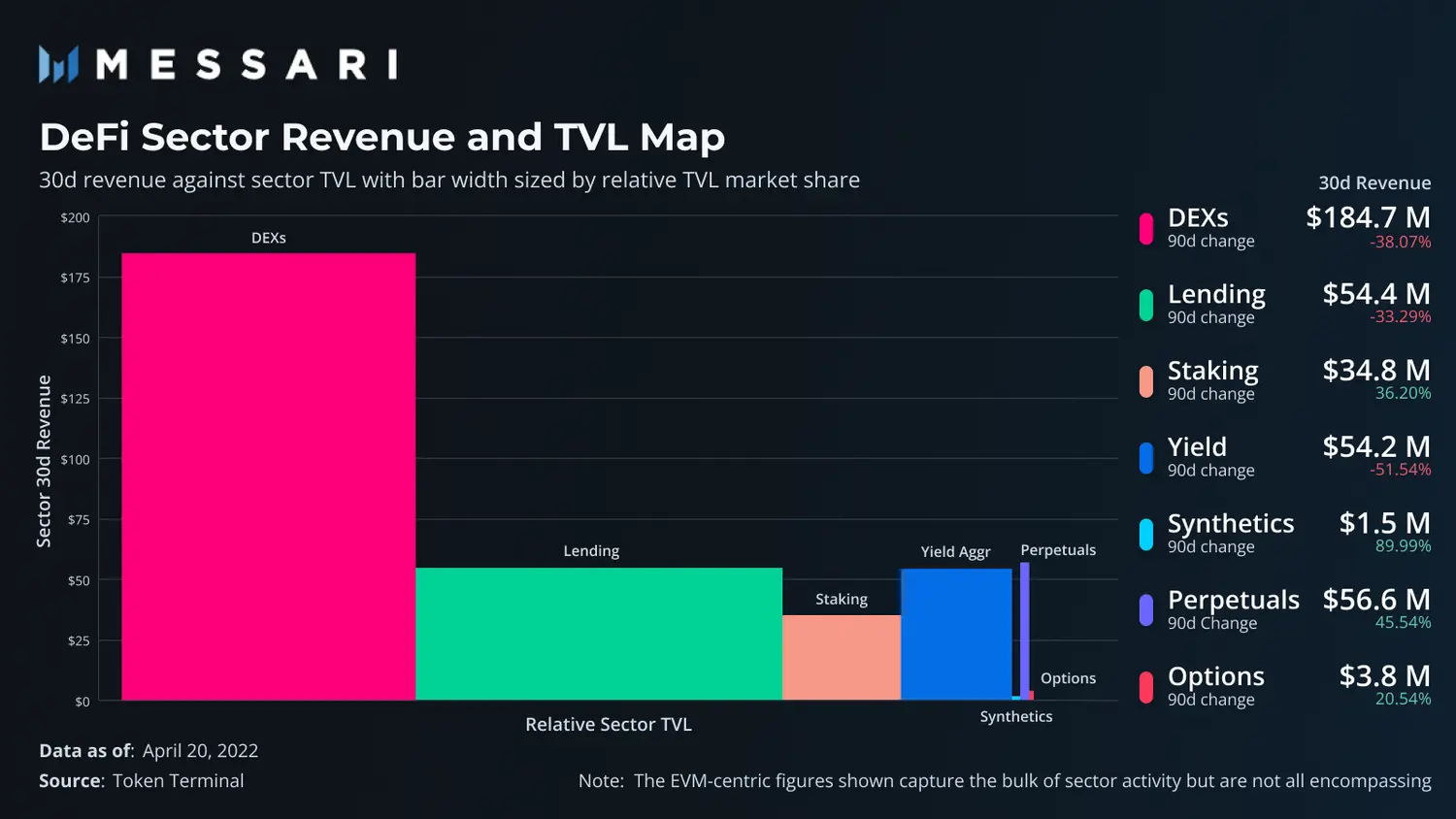

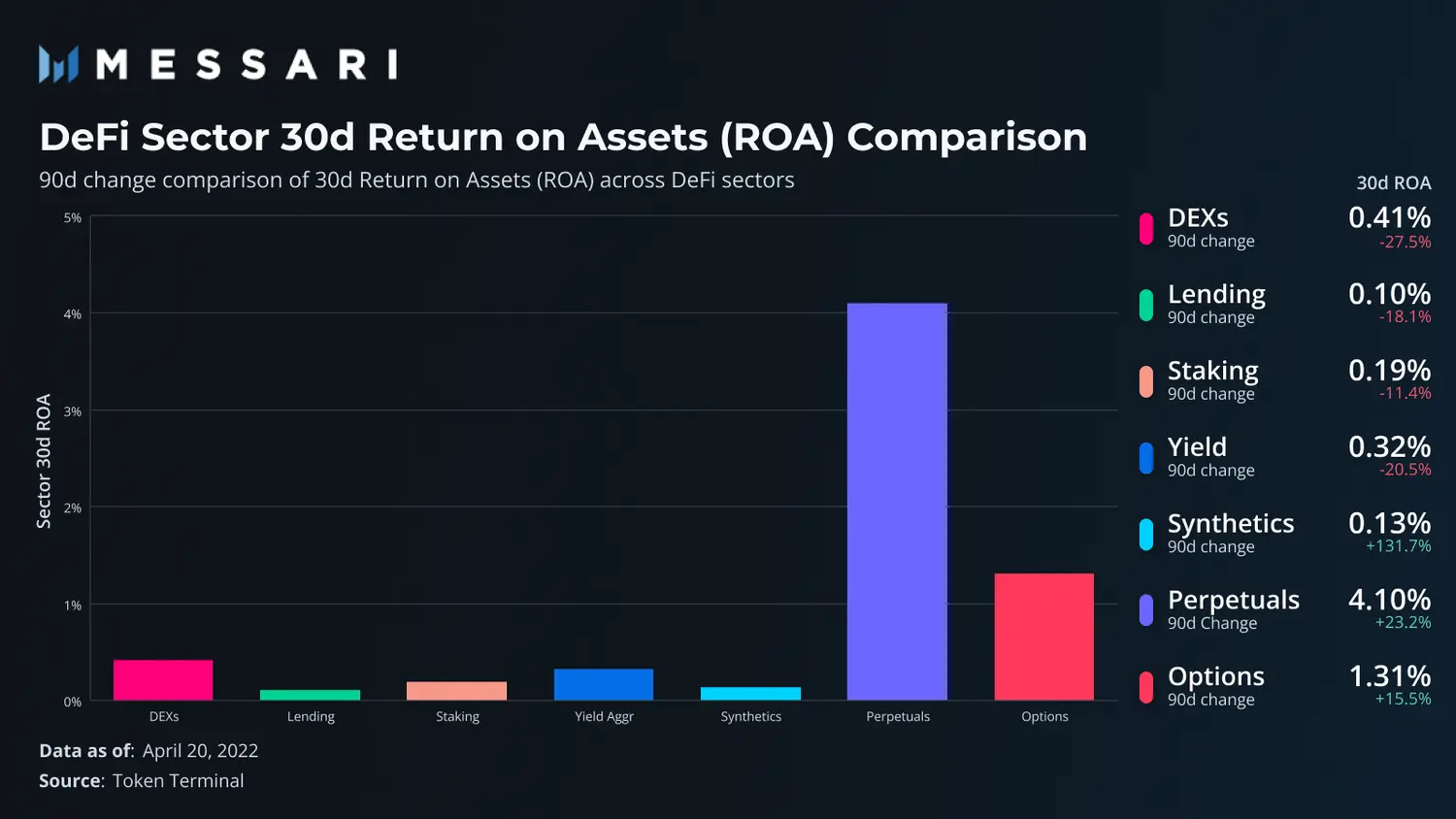

DEX is the sub-track with the highest income in DeFi, and DEX accounts for half of the revenue of the DeFi track.

The TVL of the lending agreement is nearly 25% higher than that of DEX, but it has nearly 1/4 less income.

Perpetual exchanges are becoming the preferred exchange for users to increase leverage. This year, perpetual exchange trading volumes have increased by 20%, while lending volumes have decreased by almost 50%.

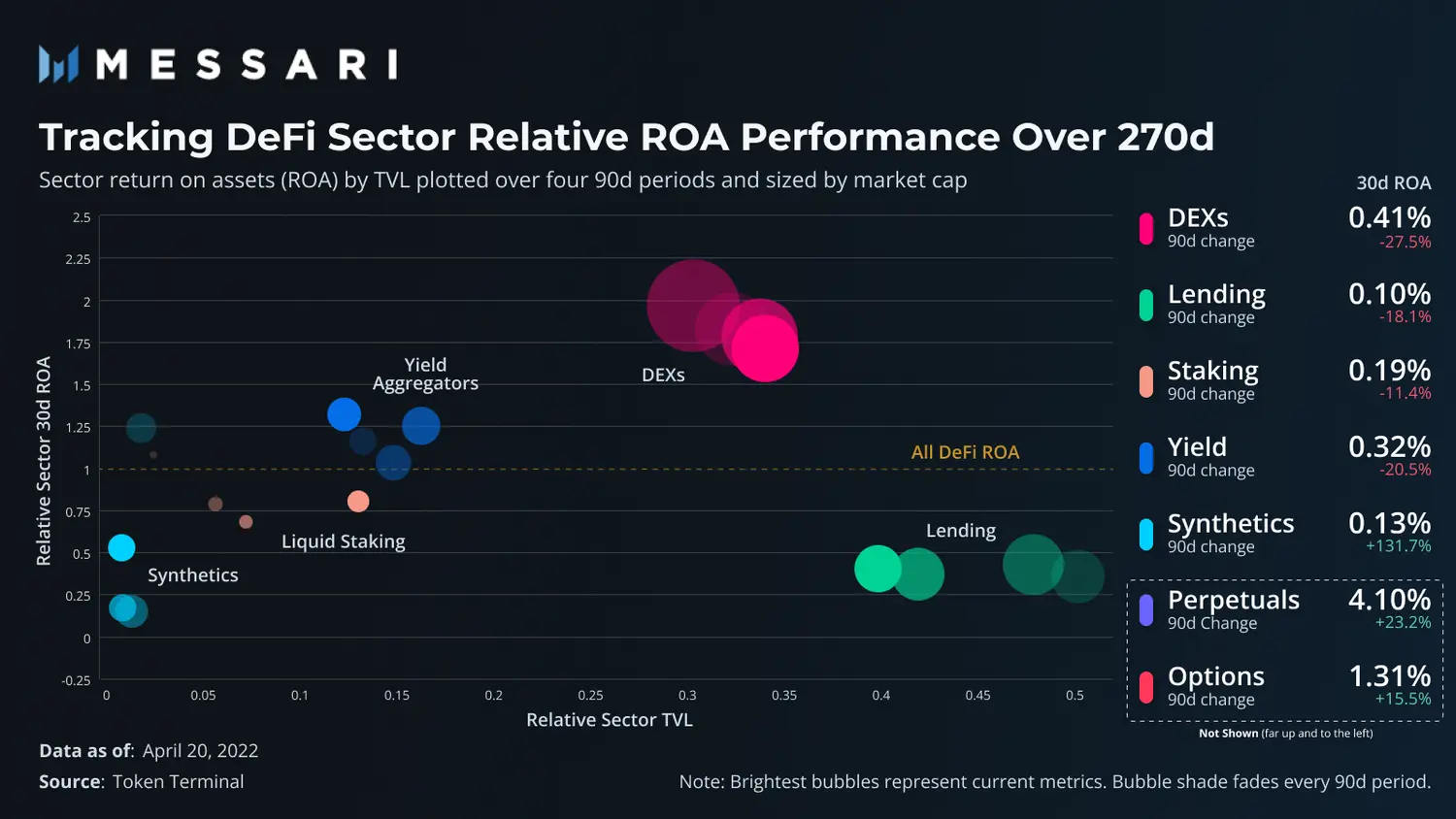

Due to the unique capital structure, the TVL of the derivatives track is 4-9 times that of other DeFi tracks.

Liquidity staking projects such as Lido are the fastest growing sector in TVL, up over 50% in the past 90 days, while DEXs and lending exchanges are both down over 14%.

DeFi is the largest and oldest track in the encryption field. Its market cap (excluding stablecoins) is about $70 billion, accounting for 10% of the L1 market. Given DeFi's fundamental role in the Crypto industry, understanding the various tracks in DeFi and their evolution provides valuable background experience for the Crypto industry.

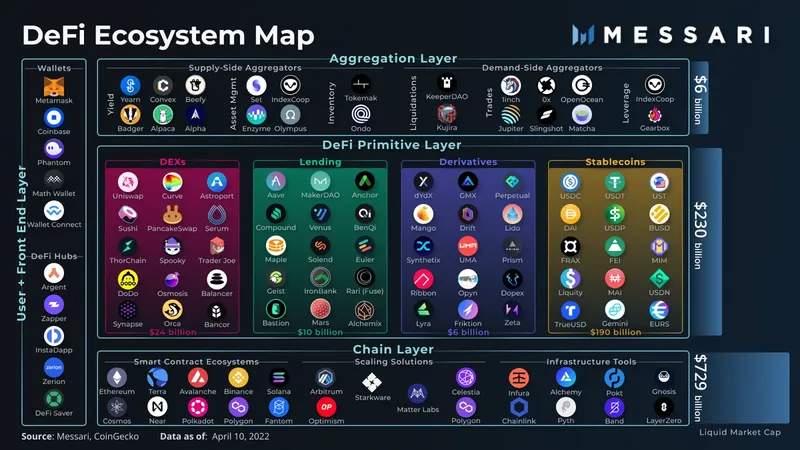

DeFi can be disassembled as shown in the figure below, and they can also be divided into finer details.

1. Bottom layer: public chain layer

The bottom layer of the DeFi ecosystem is the public chain layer. Smart contracts such as Ethereum, Solana, and Avax provide the infrastructure on which DeFi operates. Additionally, there are extensions that improve the speed and efficiency of underlying smart contract transactions. Infrastructure tools complete this layer and provide DeFi applications with API access to the network, data, and even liquidity.

2. Middle layer: DeFi core layer

The DeFi core layer sits in the middle and constitutes the main value of DeFi today. DEXs, lending, derivatives, and stablecoins form the core of DeFi. Each category has its own unique revenue model and revenue efficiency. The income generated by this layer is the main source of DeFi revenue. Since these sub-tracks form the basis of DeFi, understanding their revenue models is the first step in mastering the DeFi framework.

3. Upper layer: aggregation layer

On top of the DeFi core layer is the aggregation layer. Aggregators fall into two camps. Supply is the aggregation of funds into a single pool, which is then distributed to other projects. Example: yield aggregator. The difference between demand classes is to focus on users' needs for services such as DEX trading or credit. User needs are aggregated or sent to the best DeFi native projects to improve execution efficiency.

The amount of capital locked in a track can be used to measure its importance in the DeFi ecosystem. According to the amount of locked positions and the level of income generated, it can be clear which sub-tracks are of great significance and which sub-tracks are best at converting locked positions into income. Since the derivatives track can be subdivided, it can be divided into: liquid pledge, synthetic assets, perpetual contracts and options.impermanent loss。

Track 1: DEX

Currently, speculation has been the number one use case for cryptocurrencies. As a result, DEXs gain enormous value by facilitating the exchange of tokens needed for speculation. DEX transaction fees range from 3 basis points to 100 basis points of the transaction volume. The transaction fee income of DEX is the largest organic income of DeFi, and the total amount is equal to the sum of all other industry income.

DEX makes income more efficient. Liquidity Providers (LPs) provide funds to the pool and expect to earn transaction fees in return. Compared with the lending agreement, DEX has about 1/3 less locked positions, but the income obtained is nearly 4 times. Different from the lending agreement, the LP of DEX will encounter

impermanent loss

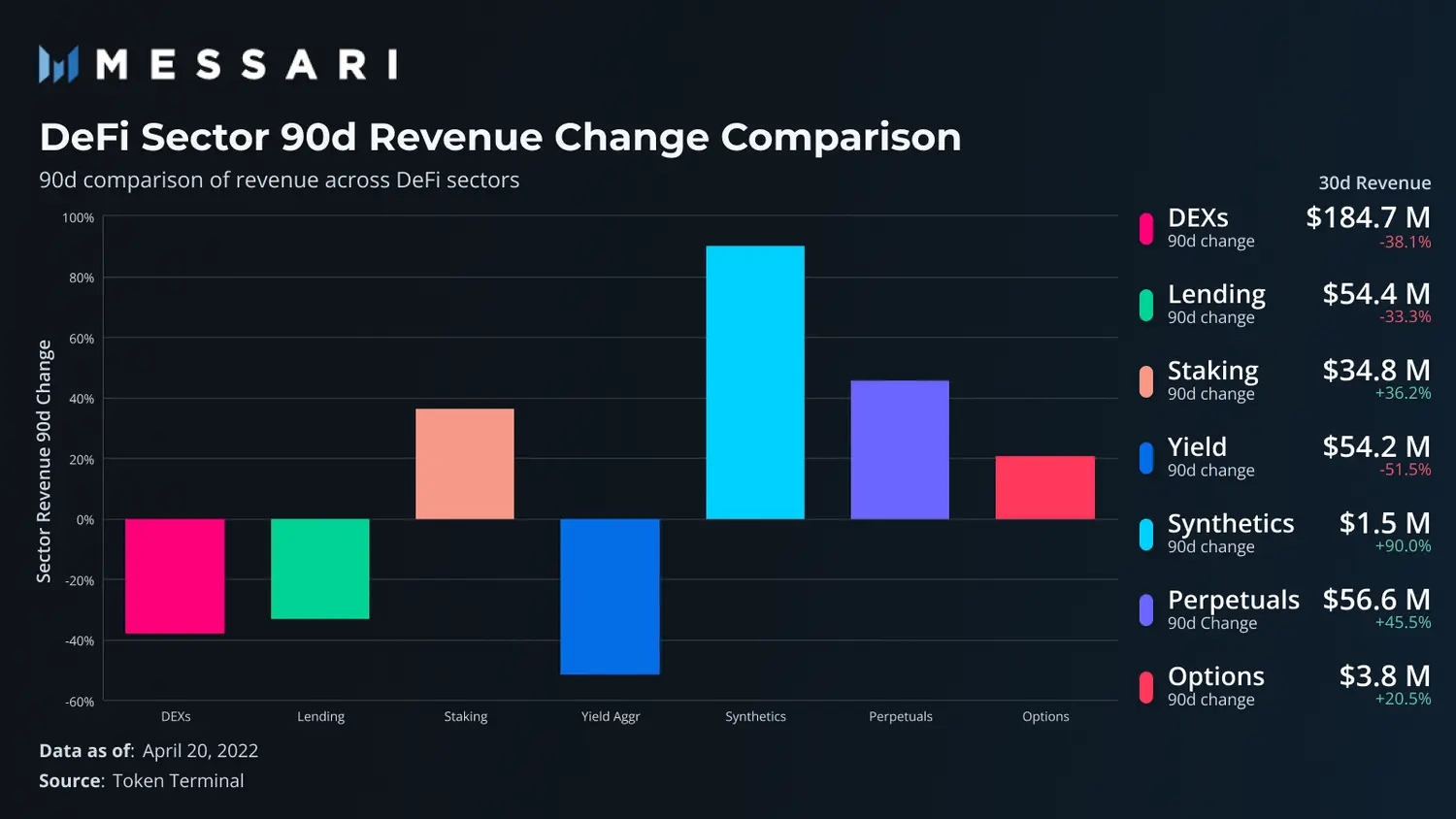

Although the rate of return of DEX is relatively high, like other sub-tracks in DeFi, the income of DEX has increased fluctuations. Users are more active (thus speculatively driven) when the price of the coin is rising. Therefore, income will go through various ups and downs with the cryptocurrency market. DEX revenue has been declining over the past 90 days.

Track 2: Borrowing

Nearly half of all DeFi deposits (44%) are locked in lending projects. The deposit in the loan agreement is used as collateral for the loan, that is, the user needs to deposit more assets than the loan. The lending protocol is a safe but inefficient overcollateralization system.

If the loan is too risky relative to the collateral, the deposit (collateral) will be liquidated to pay off the debt. While this would keep the overall system stable, it would be too capital inefficient. In order to increase revenue like other sub-tracks such as DEX, lending projects must use more capital to make up.

In the past users accepted the inadequacy of the lending protocol as it was the only source of on-chain leverage. At present, with the popularity of perpetual trading, the situation has changed. Since the beginning of the year, the ratio of [Perpetual Protocol Transaction Volume/Lending Protocol Total Loans Issued (Rolling 30 Days)] has doubled and is now at an all-time high. In addition, the relative deposit share of the lending track has declined over the past 360-day period.

Track 3: Staking

Liquidity staking and proof-of-stake (PoS) chains are seamlessly integrated. Liquidity staking does not directly send tokens to node validators, which will lose their positions in DeFi. Users who pledge their property can get both the usual pledge rewards and the rewards of derivative tokens.

Lido owns nearly 90% of the circuit's market share. It earns income by splitting the staking rewards of the original project.

With the impending Ethereum merger and the rapid rise of emerging PoS networks like Terra, liquidity staking is the fastest growing area of TVL. This track has grown over 50% in the past 90 days.

Track 4: Yield Aggregator

As the name suggests, yield aggregators such as Yearn sit at the aggregation layer of DeFi. A user deposits funds into a project. This agreement then deposits funds in various core layer tracks, such as DEX, lending market and liquidity pledge, and the income ultimately depends on the returns that the core layer projects can provide. However, since core layer projects are rewarded with tokens, they are usually able to provide higher returns.

Core projects usually reward users in the form of governance tokens in addition to normal income. Yield aggregators sell these reward tokens immediately and increase their position in the initial staked tokens. This is a compounding process, since the size of the reward is usually tied to the amount invested.

Relying on the core layer provides some momentum for the limited growth of the aggregator. The income of the core layer mainly comes from the demand for loans and transactions. Therefore, yield aggregators long can only benefit from this demand. Investing too much capital will not increase the demand at the core layer, and increasing investment may not necessarily generate more income.

Track 5: Synthetic Assets

Not all assets are on-chain. It is also impractical to own all on-chain assets in one chain. Users deposit deposits on the Synthetic Protocol, which are then or minted into corresponding assets. Any asset, be it a stock or its token, can be minted as long as there is a reliable oracle price.

Synthetic protocols can power the deployment of other protocols. For example, Synthetix's support for Kwenta. Kwenta is a protocol for perpetual contracts deployed on Optimism. Kwenta can obtain liquidity from Synthetix, which enables Kwenta to complete transactions of some specific assets with low slippage.

Synthetix generates revenue from swaps on its synthetic assets. However, compared with other industries, it is difficult to obtain high income due to the relatively small number of synthetic assets. Both the high collateral ratio and the current low acceptance have resulted in slower penetration of the track. However, penetration may increase in the coming months as other collaboration protocols on L2 such as Kwenta attract more and more users. There are some indications that synthetic assets have become the fastest growing revenue track.

Track 6: Perpetual contracts

The most traded asset on CEX is a derivative product called a perpetual contract. They are popular because they look and feel like normal tokens (and have the same price). Its design does not require any traders to actually hold or deliver tokens. After removing the delivery limit, the exchange can provide traders with long leverage. This asset is popular due to its inherent multiplier effect.Since Q3 2021, perpetual contracts have grown significantly on-chain. On-chain protocols like dYdX, Perpetual Protocol, etc. run a simple exchange where traders can access these products permissionlessly. Similar to spot DEXs, these perpetual exchanges charge transaction fees per transaction.Unlike spot DEXs, perpetual exchanges charge fees based on leveraged trading volume (notional trading volume). Therefore, compared with other DeFi, the return on assets (ROA) of the perpetual agreement is significantly improved. Essentially, the revenue per unit TVL of the perpetual agreement is nearly 10 times that of a DEX, and more than 40 times that of a lending agreement.

Track 7: Options

Options are on-chain

slow start

. While options are Robinhood's most popular product, retail investors prefer other forms of leverage, such as perpetual contracts. But lately there has been a growing interest in decentralized options vaults (DOVs). DOV takes user deposits and uses this to underwrite smart contracts, which are then sold to other parties. In exchange, the buyer pays a premium that is sent back to the DOV as proceeds.

The proceeds generated will become project revenue. Protocol providers typically take a cut of the proceeds and may also charge a fee for deposits.

Options can come in a close second in terms of capital efficiency. Each unit of TVL can generate four times the income. While the yield looks high, also realize that DOV is the second-lowest revenue-generating track mentioned in this report and can only wait for options demand to increase to expand the revenue base.

As L2, multi-chain, and modularity begin to reshape the entire industry, it becomes very important to understand the industry and current dynamics of DeFi. For now, DEXs may continue to dominate the DeFi space. Not only do they account for nearly half of DeFi revenue, but they are also attracting more and more TVL.hereLooking at various tracks, the biggest change that has occurred is that the increasing popularity of perpetual agreements is eroding the market share of the lending industry. The ratio of [perpetual agreement transaction volume/total loan amount issued by lending agreement (rolling 30 days)] will describe the trend.