Cross-chain talk: Differentiated competition of cross-chain aggregators

The term cross-chain comes from the fact that in a cross-chain transaction, the initial asset and the target asset are deployed on two isolated blockchains, and the execution occurs after crossing two or more independent blockchain networks.

With the congestion of the Ethereum network and high fees, the capital spillover effect is becoming more and more obvious. The emergence of cross-chain bridges has broken the blockchain islands and is broadening the development of the DeFi ecosystem. Smart funds have the opportunity to shuttle back and forth between major public chains, looking for higher-yielding "bonanza". However, opportunities are faced with costs. With the expansion of the multi-chain ecosystem, more than 100 cross-chain bridges have brought a wealth of path options, but it has also increased the complexity of choices for users. If you are interested in the performance, classification and future development trend of mainstream cross-chain bridges, you can check Dr.DODO’s"Cross-chain talk: In-depth analysis of 16 cross-chain solution trade-offs"。

Cross-chain infrastructure is one of the lowest-level constructions in the multi-chain multi-layer blueprint. Among them, the ** cross-chain aggregator carries the indispensable cross-chain aggregation transaction function of the cross-chain universe. **It has a clear goal, which is to reduce the difficulty of transactions, and use algorithms to provide users with optimal cross-chain options such as which one can provide lower transaction costs, which one will be faster, and which one will be more secure. Transaction path screening.

Besides that,What are the differentiated advantages of cross-chain aggregator products? How do they fulfill the asset cross-chain requirements? Why do we need a cross-chain aggregator?secondary title

Li.Finance

Tags: cross-chain function + aggregation transaction;

One sentence can explain Li.Finance (Li.Fi) features: it is1 inch and Paraswap with the function of cross-chain bridge. With the combination of cross-chain bridge and DEX aggregator, Li.Fi realizes the dual functions of cross-chain swap and cross-chain aggregation transaction (Cross-Chain Yield Farming Strategies). It undertakes the cross-chain function of assets on the chain of the cross-chain bridge. In simple terms, you can swap from any token on any (supported) chain to another arbitrary token on another chain.

The cost of this transaction process is actually quite high. Suppose a user wants to exchange BNB on the BNB chain from Ethereum’s ETH. During the entire transaction process, users need to exchange ETH for USDC, transfer assets to the BNB chain through the cross-chain bridge, and then exchange USDC for BNB. The cross-chain bridge handling fees and gas fees that users need to pay for the cross-chain are not a small expense.

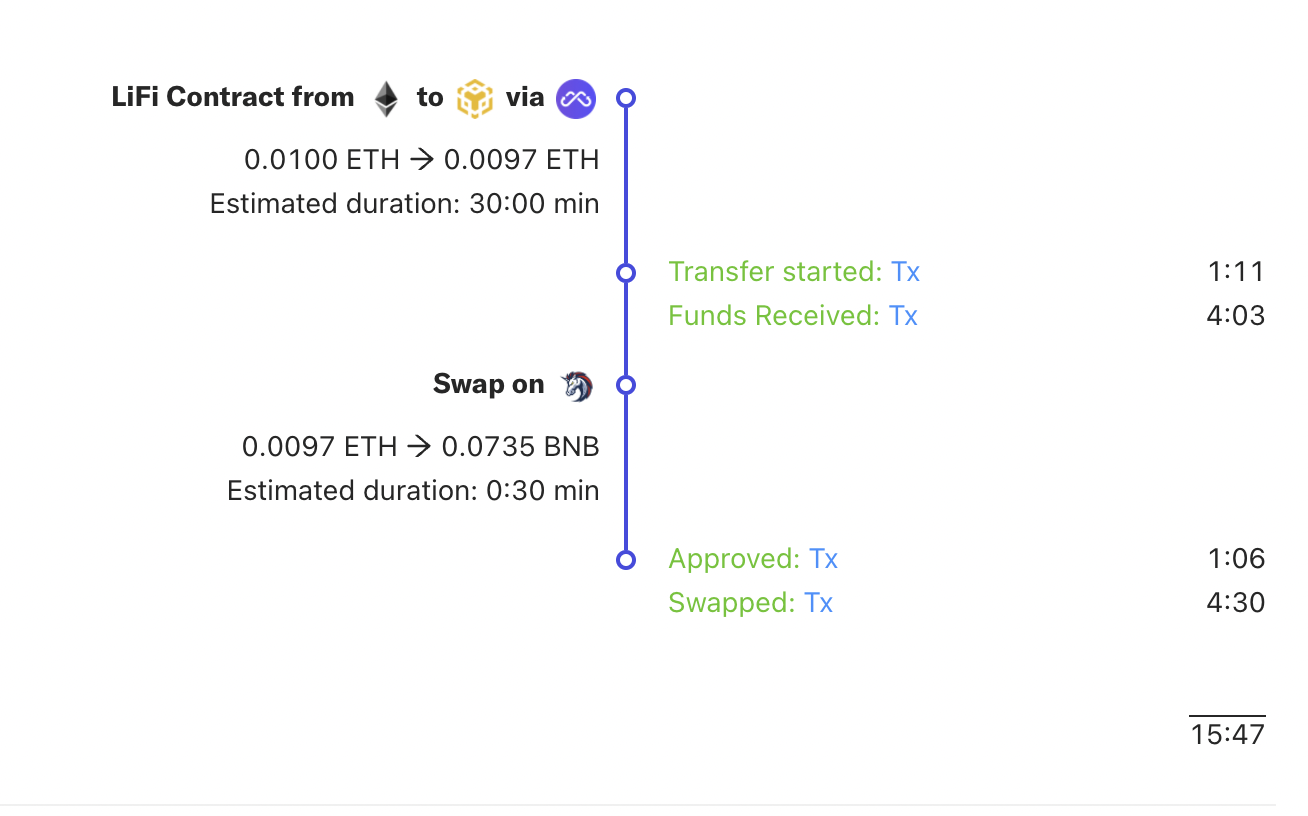

image description

Li.Fi transaction process

Li.Fi integrates cross-chain bridge capital resources, links DEX and DEX aggregator, and aims to break down the difficulty of decision-making. After receiving the user's transaction request,Li.FiIt will automatically evaluate the possibility of the request, and score the security and speed of the path according to multiple indicators, and give an optimal path.

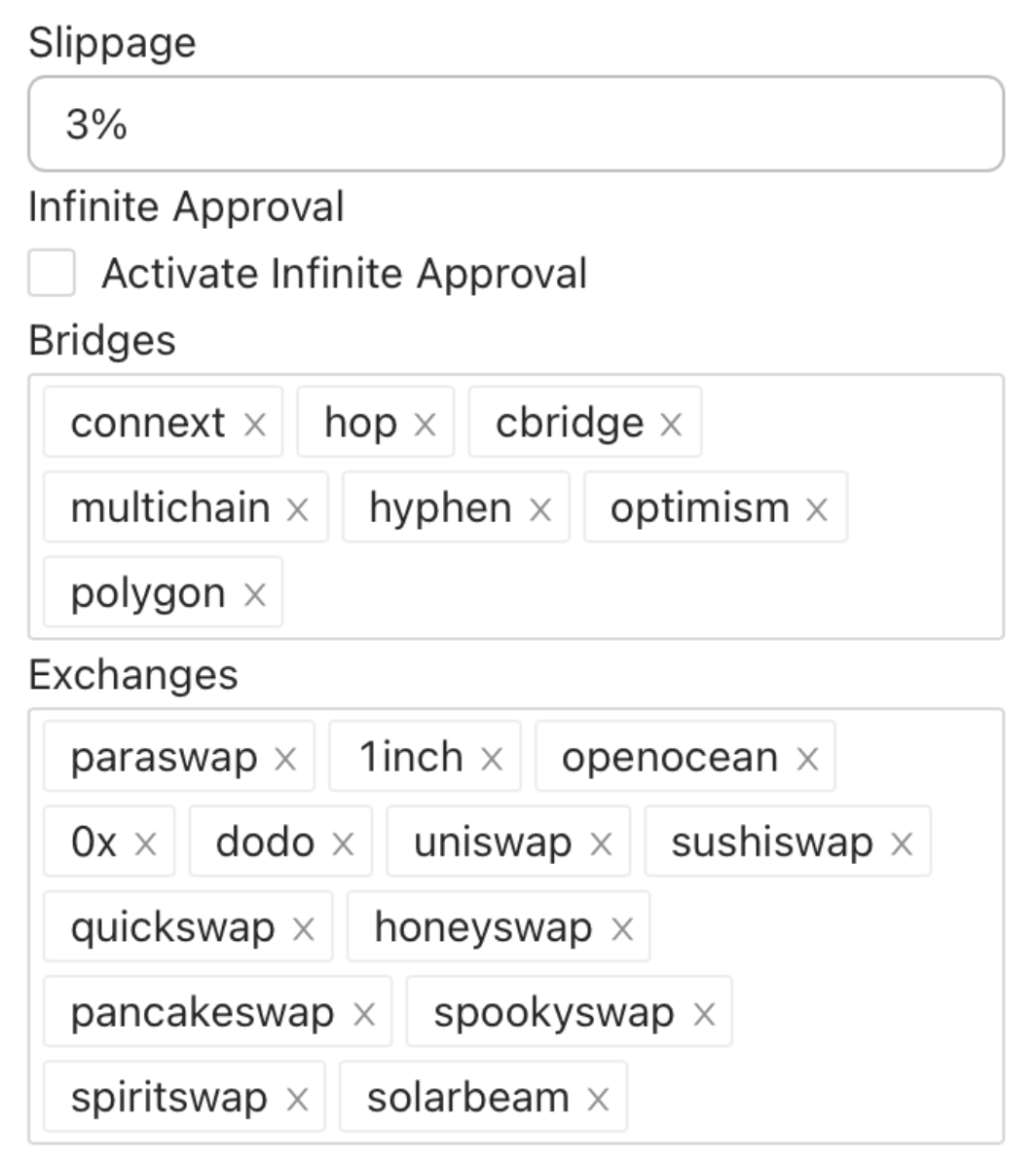

Reflected at the user level, the whole process is: enter the transaction, wait for a few seconds, obtain a fund transfer and exchange method, check the transaction process, sign several times to confirm the cross-chain and fund exchange, and complete the transaction.In terms of slippage fee setting, cross-chain bridge and DEX scheme selection,Li.FiIt also gives users a high degree of freedom.image description

Customization options when placing an order with Li.Fi

Compared with cross-chain bridges,Li.FiThe following advantages of cross-chain aggregators are highlighted:

Cross-chain transaction paths are more diversified: The cross-chain bridge currently only supports stable coins and relatively simple public chain native assets, and the user's asset cross-chain transaction needs are often not met. In the process of asset cross-chain transactions, the role of DEX and DEX aggregator cannot be erased. Li.Fi integrates the three parties of cross-chain bridge, DEX and DEX aggregator, and provides DEX for token swap on both the source chain and the target chain. The scope of cross-chain currency exchange is wider, and the transaction path of required tokens is more likely to be successful bigger.

Breaking the liquidity deadlock and further improving capital efficiency: At present, DEX has multiple copies of the same, paired liquidity pool on each public chain deployed. If you multiply the number of copies of the liquidity pool by the number of different AMMs on each chain, you will find that this is very Inefficient and fragmented systems. The cross-chain aggregator creates a deeper liquidity pool under the same ecosystem by integrating transaction data from other platforms, which solves the existing inefficient and fragmented system.

After optimizing the transaction security, the transaction path is more efficient: When integrating with partners such as cross-chain bridges and DEXs, Li.Fi will first conduct technical assessment and review internally, which is equivalent to reducing certain "systematic risks" such as smart contract security; secondly, Li.Fi The bottom layer uses Connext technology, and uses algorithms to score the security, gas fee, speed and other influencing factors of each path to provide a smoother optimal route for transactions.

Aggregators do more than bridge. The essential function of the cross-chain aggregator is cross-chain+aggregation transactions. It opens up financial transaction functions such as liquidity mining and easy lending from the level of asset exchange, allowing users to aggregate the liquidity of different ecosystems. This is a fundamental component of a multi-chain world. In addition to improving capital efficiency, cross-chain aggregation is also another solution for on-chain liquidity management. Li.Fi currently relies on external channels for asset liquidity; in other words, the current integrated public chain, DEX, and DEX aggregator are the core elements that provide the advantages of cross-chain path transactions. In a sense, we think that Li.Fi has opened up the world of cross-chain aggregators. After all, compared with the other four aggregators, it precisely focuses on the cross-chain aggregation transaction track.

In the choice of security and decentralization, Li.Fi is obviously more inclined to the latter. Li.Fi's algorithm evaluation criteria have never disclosed the evaluation criteria for how to calculate the optimal path. What users know is the optimal path after a "centralized evaluation". Second, Li.Fi's smart contracts are open source, but the API interface is not. The Li.Fi backend interface has two "killer" kill switches. One is at the API layer, and the path calculation will directly ignore the cross-chain bridges that are under attack or at a "dangerous" level; the second is at the smart contract layer, when the protocol party encounters a hacker attack, Li.Fi or the project can be closed Integrated interface.

secondary title

XY Finance

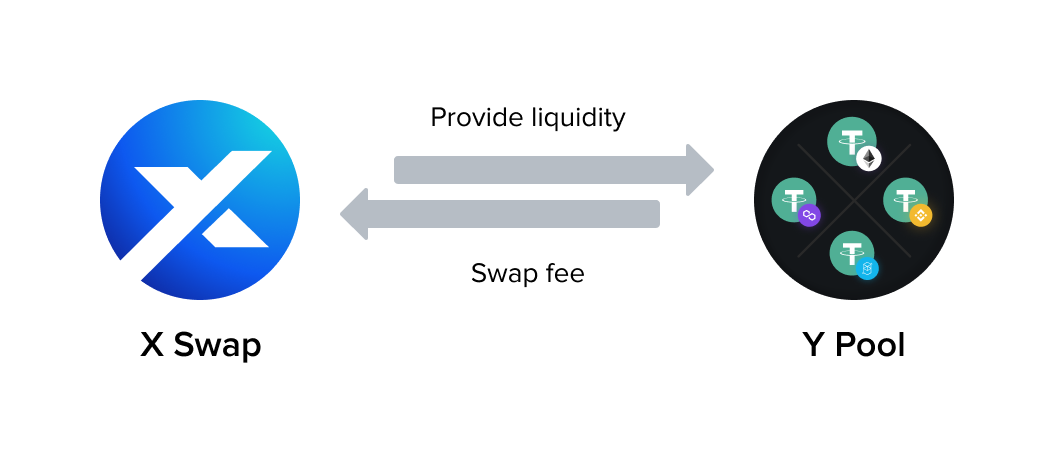

Tags: X swap + Y pool, linked metaverse

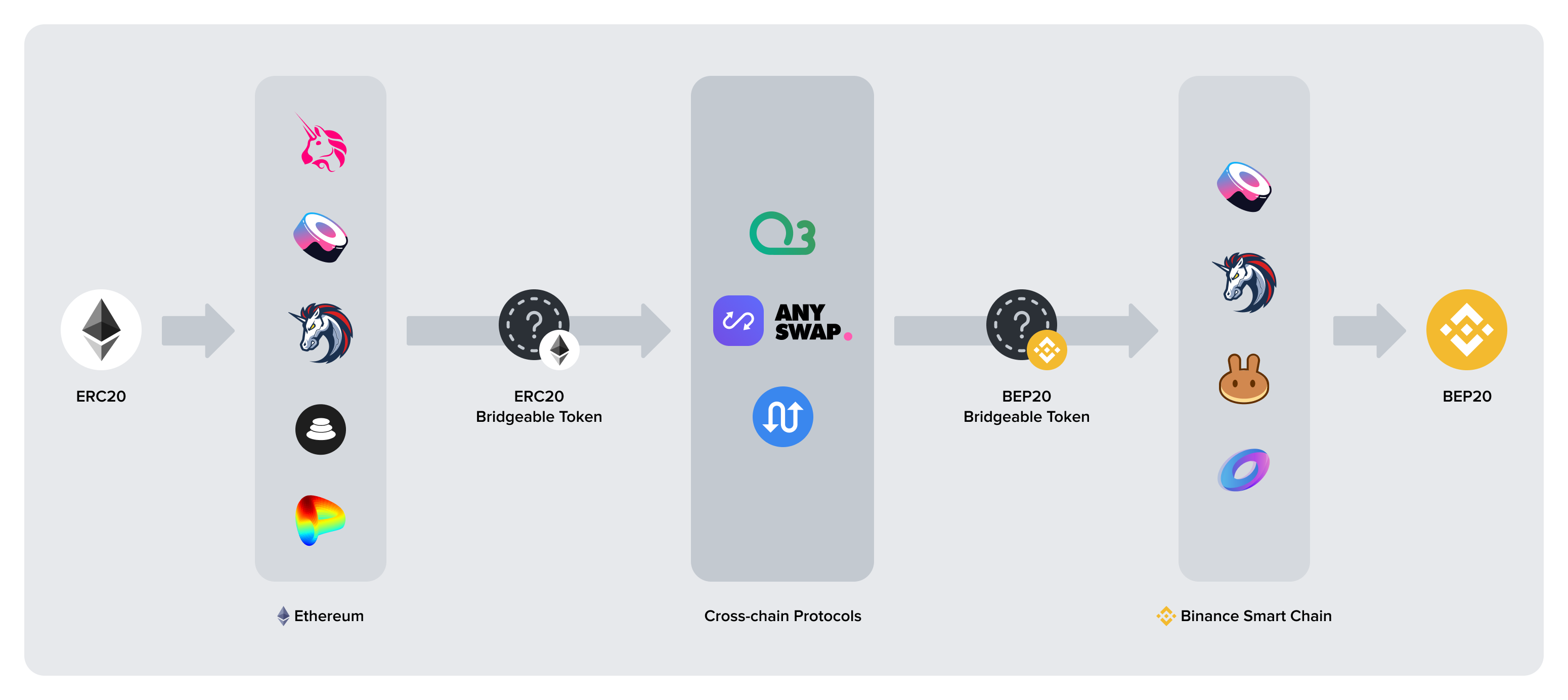

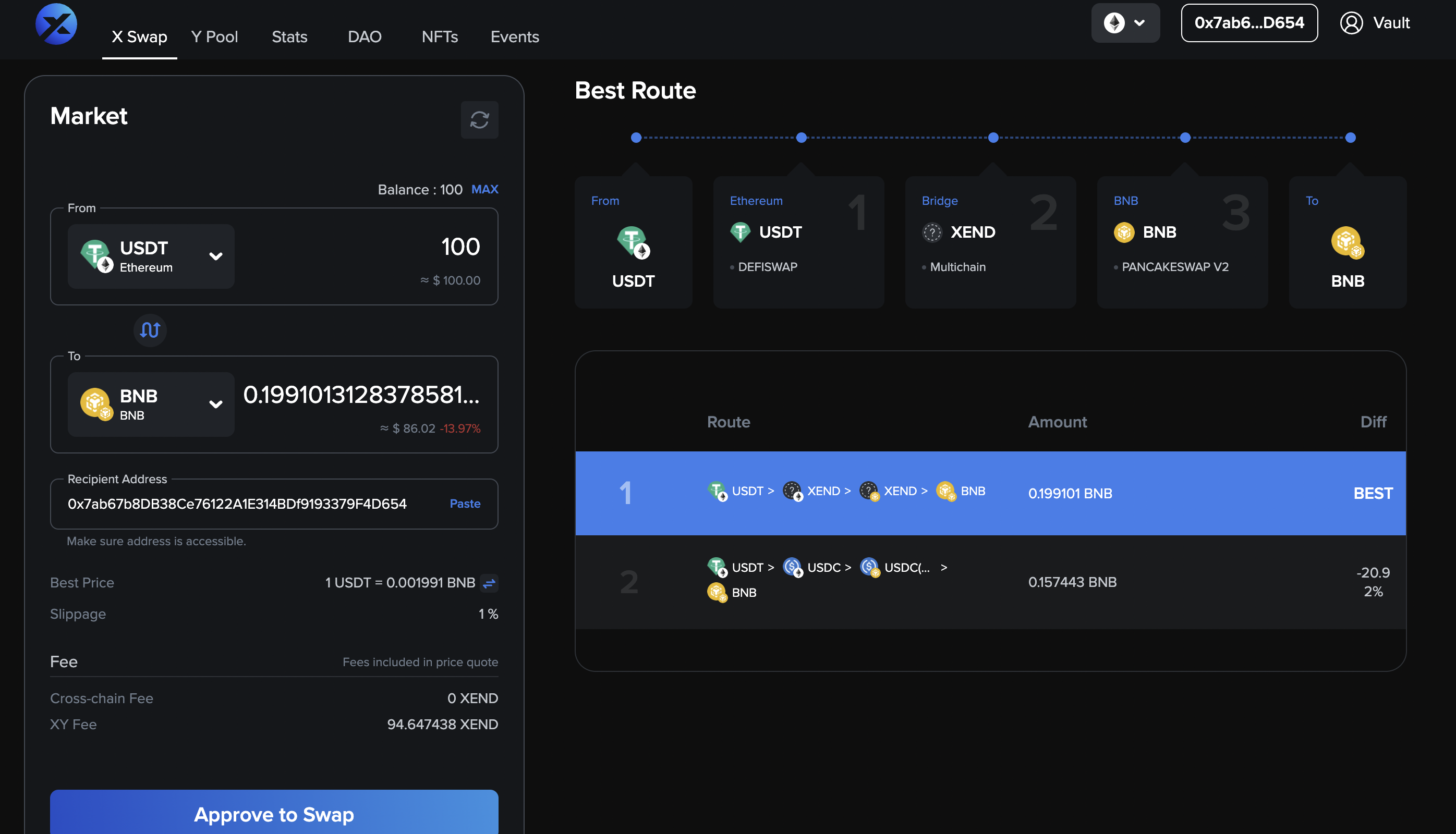

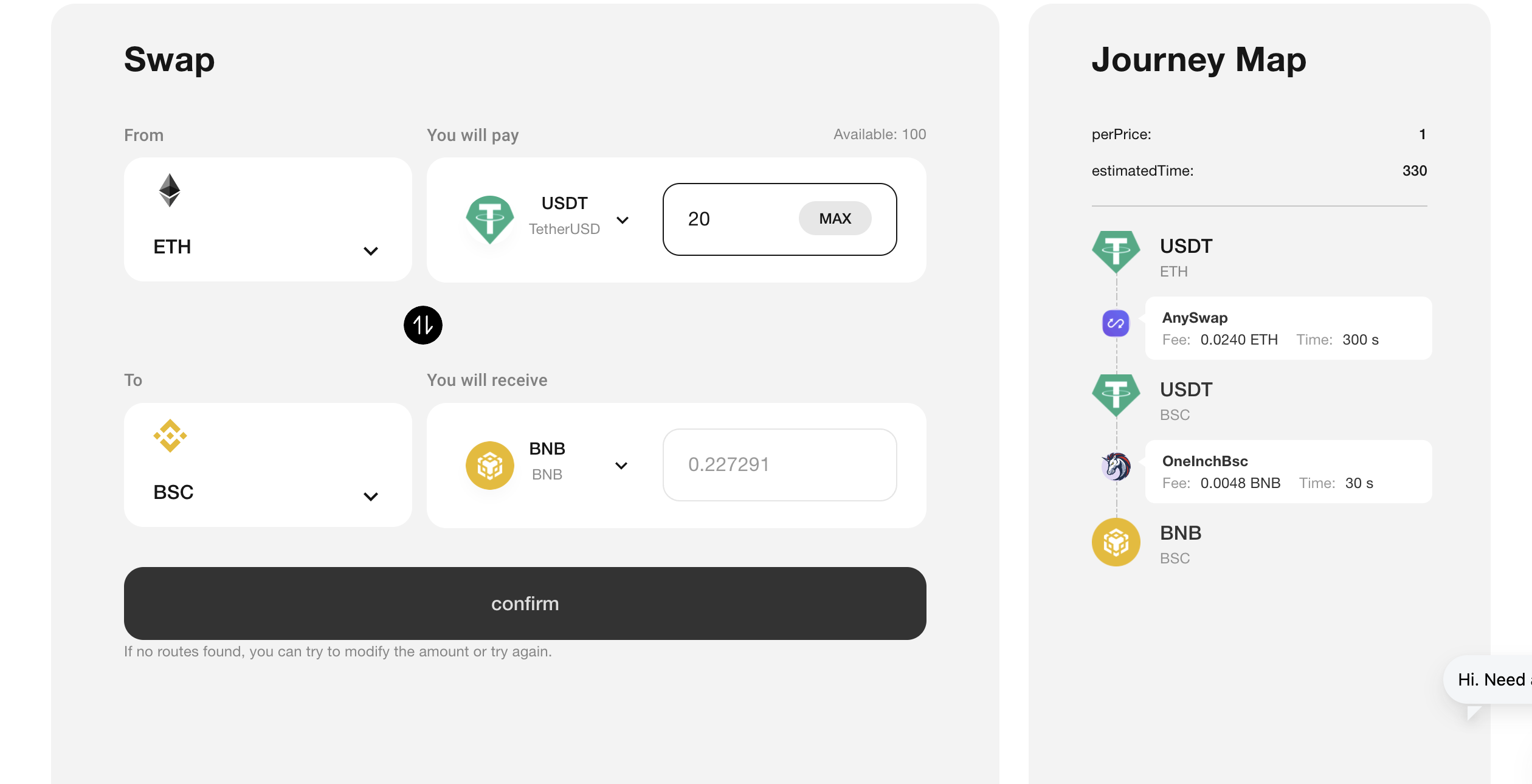

The project feature of XY Finance is the dual function of X Swap and Y pool. X Swap in XY Finance assumes theLi.Fiimage description

XY Finance cross-chain transaction path

asset liquidityasset liquidityAn upgrade of Li.Fi also forms a difference at the liquidity level. Y Pool is a single currency liquidity management pool, namelyA pool completes the liquidity management of the same asset on multiple chains.Currently, the tokens supported by Y pool are USDT and USDC. For example, the USDT Y Pool pool can receive USDT assets on various chains such as ERC-20 USDT, BEP-20 USDT, Polygon USDT, etc. Users can deposit ERC20 USDT, BEP20 USDT, and Polygon USDT into USDT Y Pool to obtain pool Token xyUSDT. These different USDT will be used to provide liquidity for X Swap. Holders of xyUSDT can earn Swap fees generated by X Swap, and get XY tokens as rewards by staking xyUSDT.

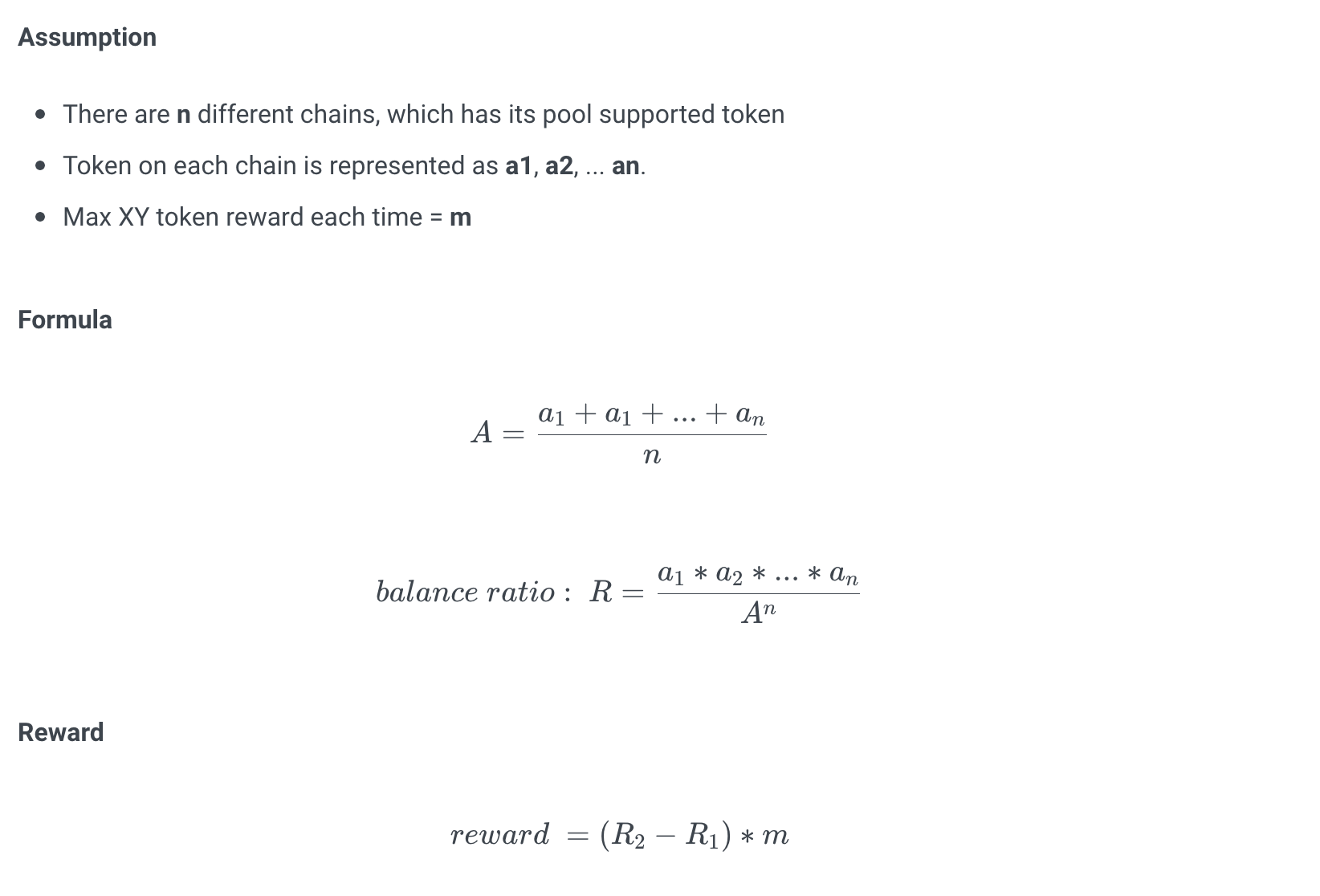

The transaction demand is very likely to transfer most of the liquidity to another chain, which will cause an imbalance in the proportion of assets in each chain in the pool. XY Finance thus introduced theRebalancing Incentivesimage description

XY Finance Rebalancing Incentive Formula

Assume that when the proportion of assets in the USDT Y Pool is unbalanced, the USDT on Ethereum is 0.1M, the USDT on BSC is 10M, and the USDT on Polygon is 50M:

1) Alice chooses to call the Rebalance function, and transfers 20M USDT from Polygon to the Ethereum pool, then the balance in each chain will become: Ethereum: 20.1M, BSC: 10M, Polygon: 30M;

2) According to the formula, the balance ratio (Balance ratio) is R2 = 0.75 = 75%;

3) Assume that the maximum reward amount (m) of XY tokens this time is 1000; the reward Alice will eventually receive is (0.75 - 0.0062) * 1000= 748.3 XY tokens.

4) USDT Y Pool will rebalance the proportion of USDT on different chains in the pool according to the algorithm formula.

The mechanism of X Swap and Y pool is essentially the management of liquidity on different chains, and encourages users to become asset liquidity providers and balancers on the chainimage description

Complementary mechanism of X Swap and Y pool

image description

XY Finance's trading interface

Another core of XY Finance isXY Token (XY Token)Overall,

Overall,X swap and Y pool have established a complete cross-chain exchange mechanism for XY Finance, coupled with the governance token XY, which encourages users to provide liquidity while also binding users to the long-term interests of the protocol.secondary title

O3 Swap

Tags: four-tier architecture, one-stop transaction

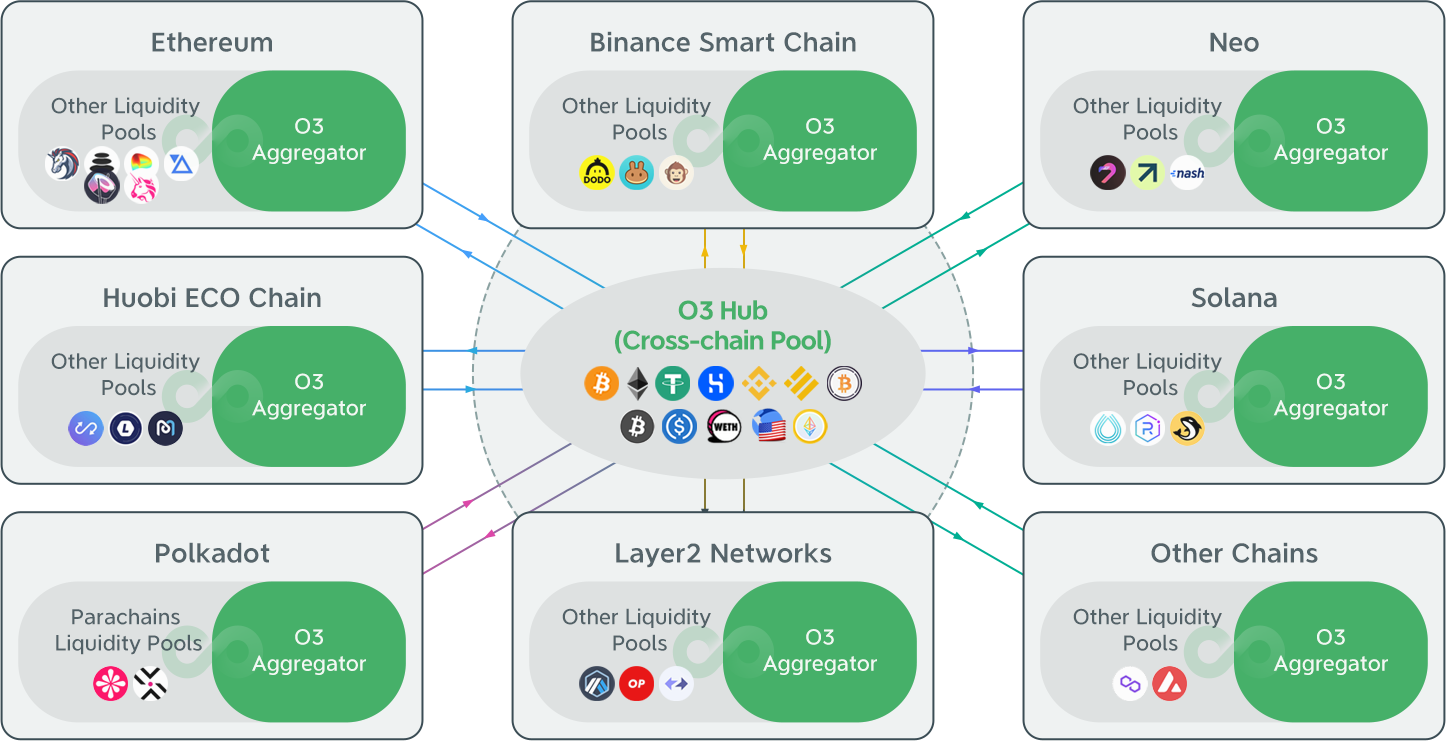

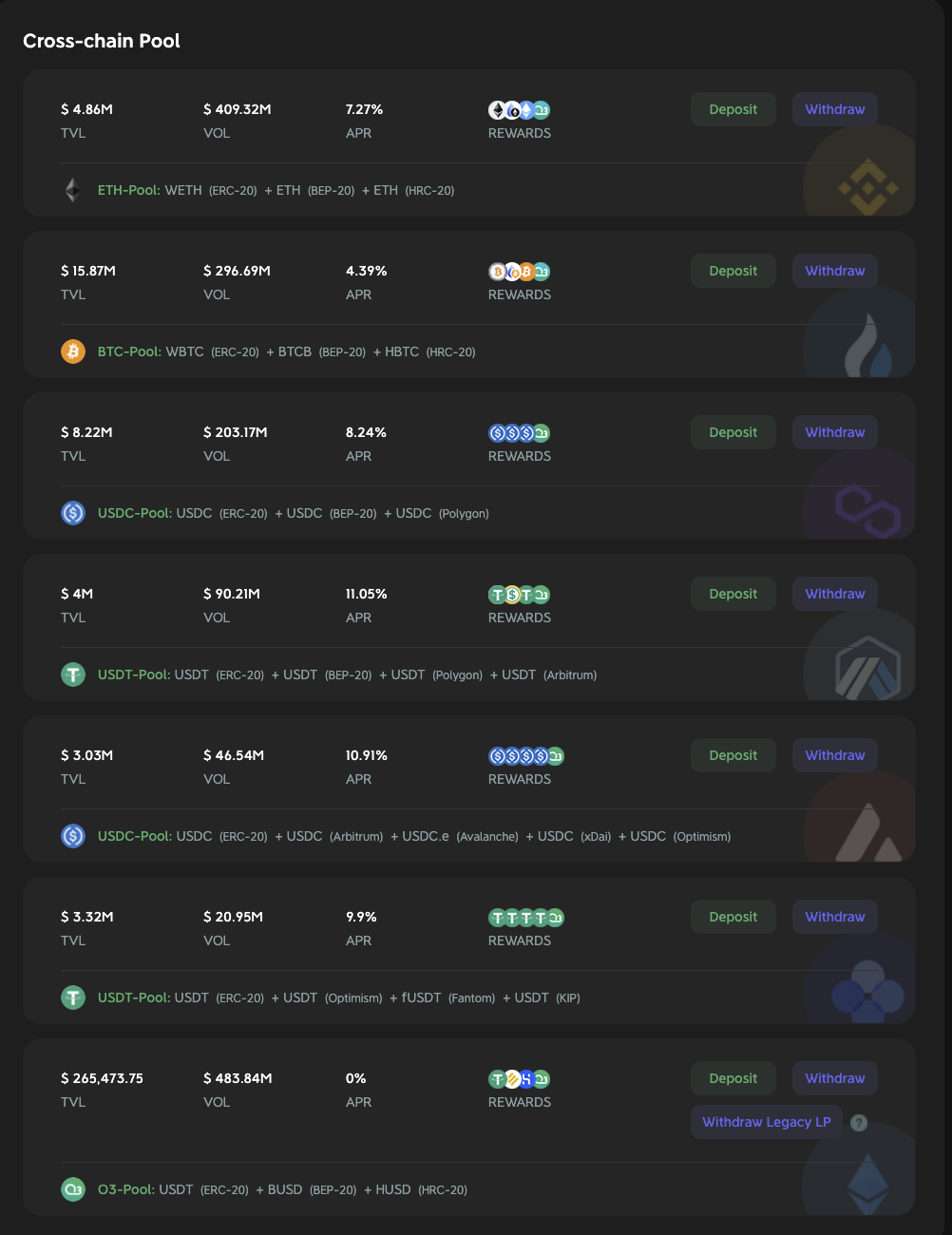

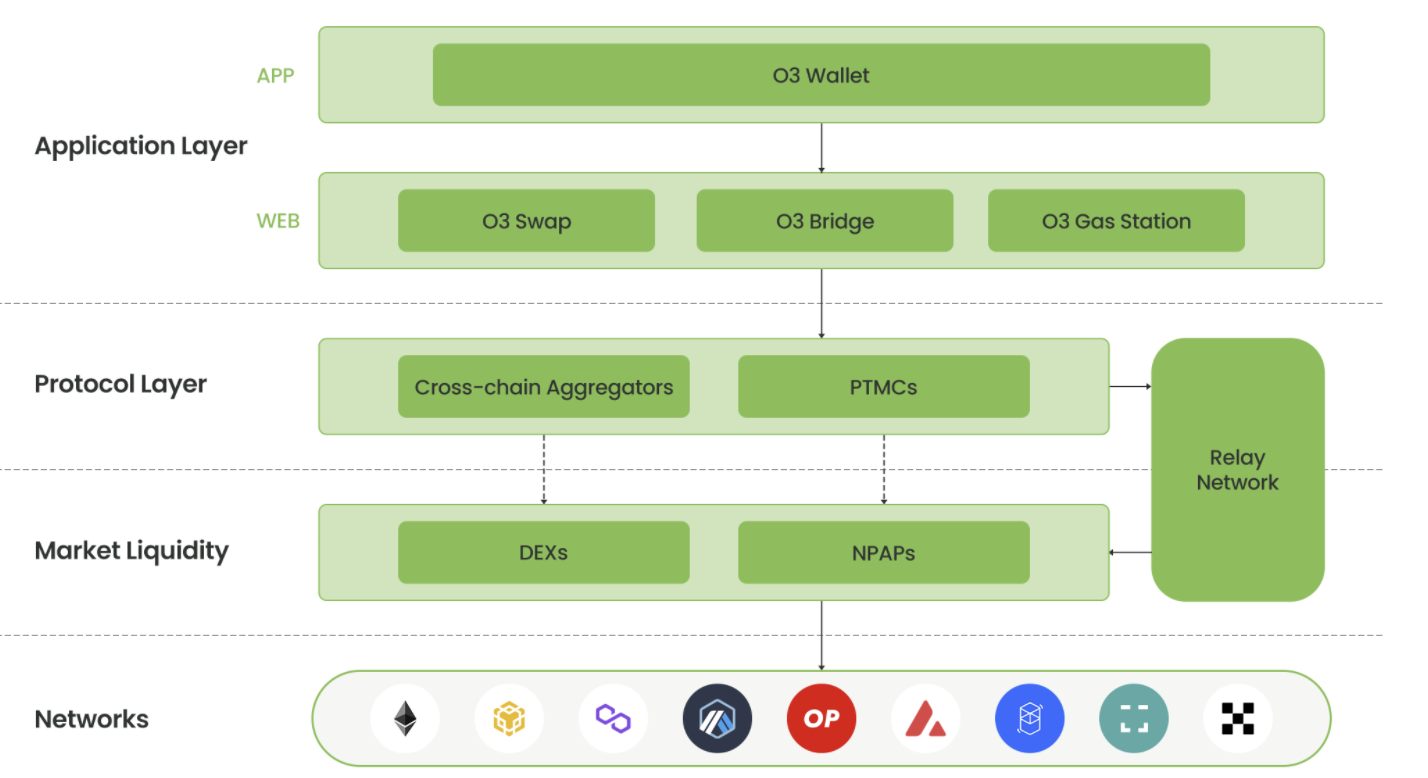

A cross-chain transaction aggregator similar to XY Finance is O3 Swap. Created by O3 Labs in 2017, O3 Swap is a cross-chain aggregation protocol based on PolyNetowork.The core functional modules of O3 Swap are O3 Aggregator and O3 Hub, and the combination of the two completes the cross-chain aggregation transaction service.image description

O3 Hub Architecture

image description

O3 Hub Cross-chain Pool

It is not difficult to see that O3 Swap has the basic functions of a cross-chain aggregator, that is, liquidity aggregation and cross-chain exchange; coupled with the issuance of O3 Swap Token, the line of decentralized governance and community-driven development is clear. Only relying on these two points, it is not possible for XY Finance to launch a highly differentiated competition. So what is unique about O3 Swap?

first of all it'sFour-tier architecture design. The newly announced O3 Swap V2 (O3 Interchange) version demonstrates the desire to createOne-stop cross-chain transactionimage description

O3 Swap V2 version design

The V2 design is more complex in architecture. O3 Swap is responsible for aggregating DEX and DEX aggregators on the source chain and target chain, bringing more diversified token options for cross-chain swaps. O3 Bridge consists of two parts: PTMCs (linked token management contract) based on the protocol layer and NPAPs pool (nativeToken & peggedToken AMM Pools) at the liquidity layer, which is a cross-chain asset transaction channel. 1 click Outside the transaction process, users can also purchase gas fees for transaction in O3 Gas Station. The horizontally rich and expanded product line enriches the playability of the application and brings users a one-stop trading experience.

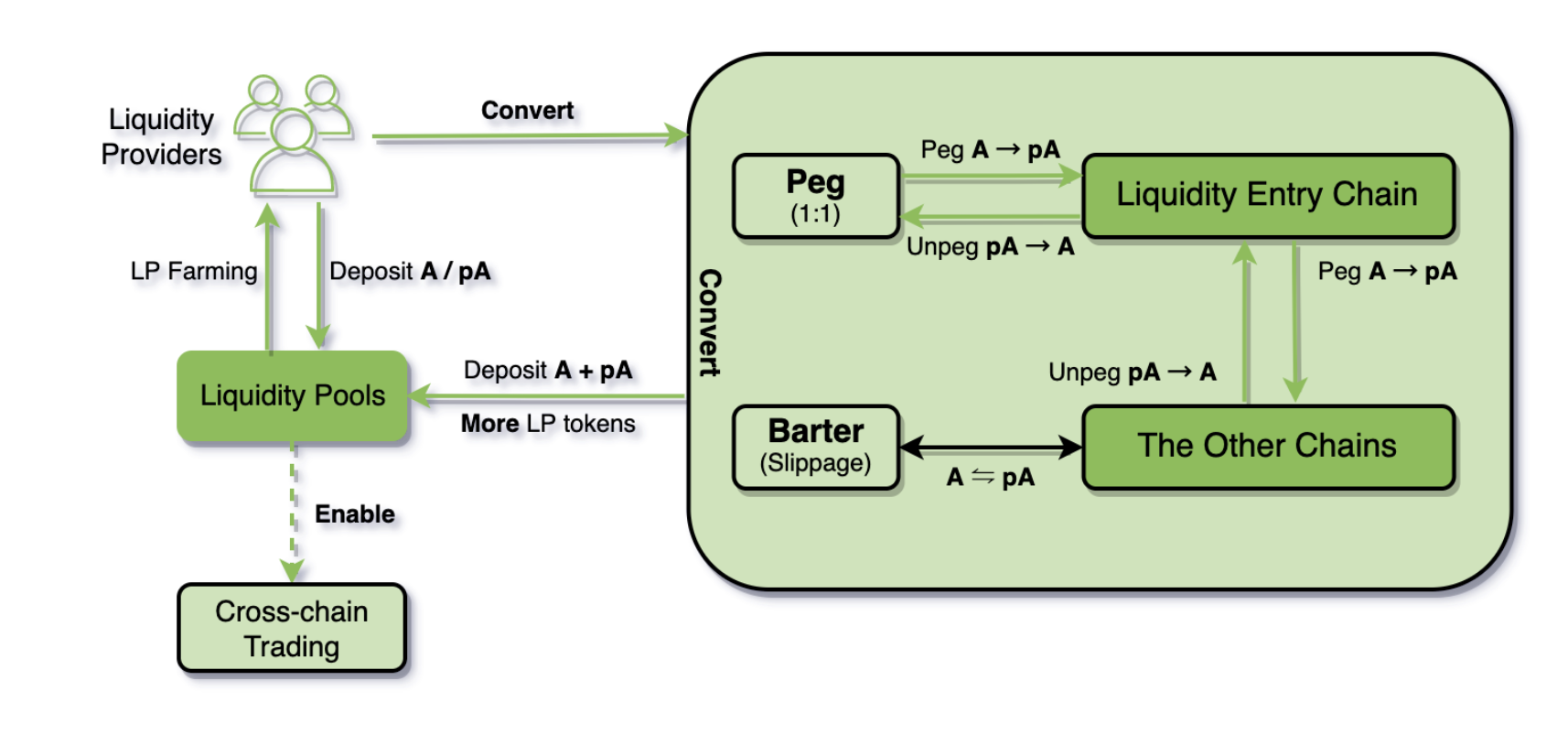

Secondly, the liquidity layer of the V2 version has made further breakthroughs. The liquidity layer consists of two parts, one is the DEX integrated by O3 Aggregator, which is similar to Li.Fi. DEXs such as SushiSwap and PancakeSwap will take on the responsibility of the same-chain exchange function. The other is O3's uniqueNPAPs Pool, which is an AMM pool composed of Token and anchor tokens (pToken) based on the burning-minting mechanism. Token enters from the Liquidity Entry Chain (Liquidity Entry Chain), and users can mint an equivalent amount of pToken on the Liquidity Entry Chain or other chains. Each pToken on each chain corresponds to an independent PTMC running on PolyNetwork.

image description

O3 V2 version liquidity solution

In the AMM pool, the initial ratio of Token:pToken is 1:1. However, as users conduct Barter transactions to arbitrage, the balance in the pool will be broken. However, the user's arbitrage behavior has become a means to adjust the balance of the O3 liquidity pool.

1) Assuming that the liquidity entry chain of Token A is the Ethereum main network, the number of Token A in the pool is greater than the number of pA at this moment;

2) Subsequently, the user finds that the number of Token A in the BNB chain pool (m) is lower than pA (n);

3) The user chooses to exchange m Token A for n pA, and then unpegs n pA from the Ethereum mainnet (unpeg) to obtain n Token A;

4) The Ethereum and BNB pools will be balanced again, and the arbitrage profit obtained by users will be (nm)*Token A.

secondary title

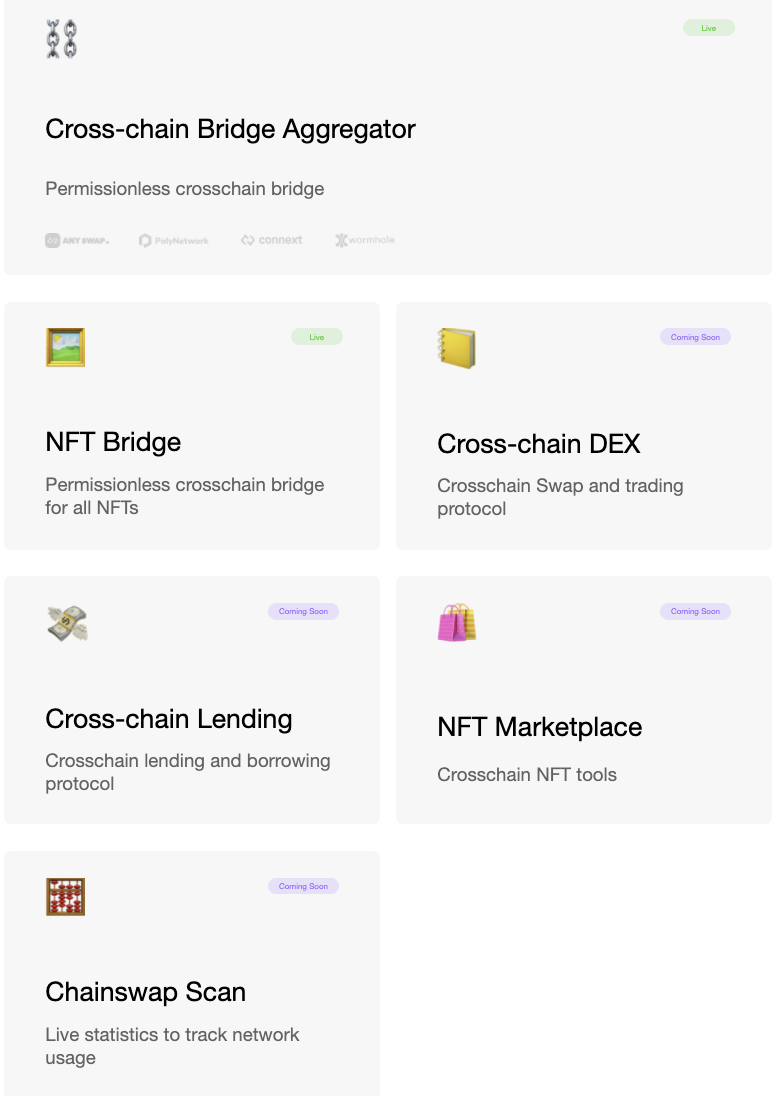

ChainSwap

Tags: assets, data, application cross-chain system

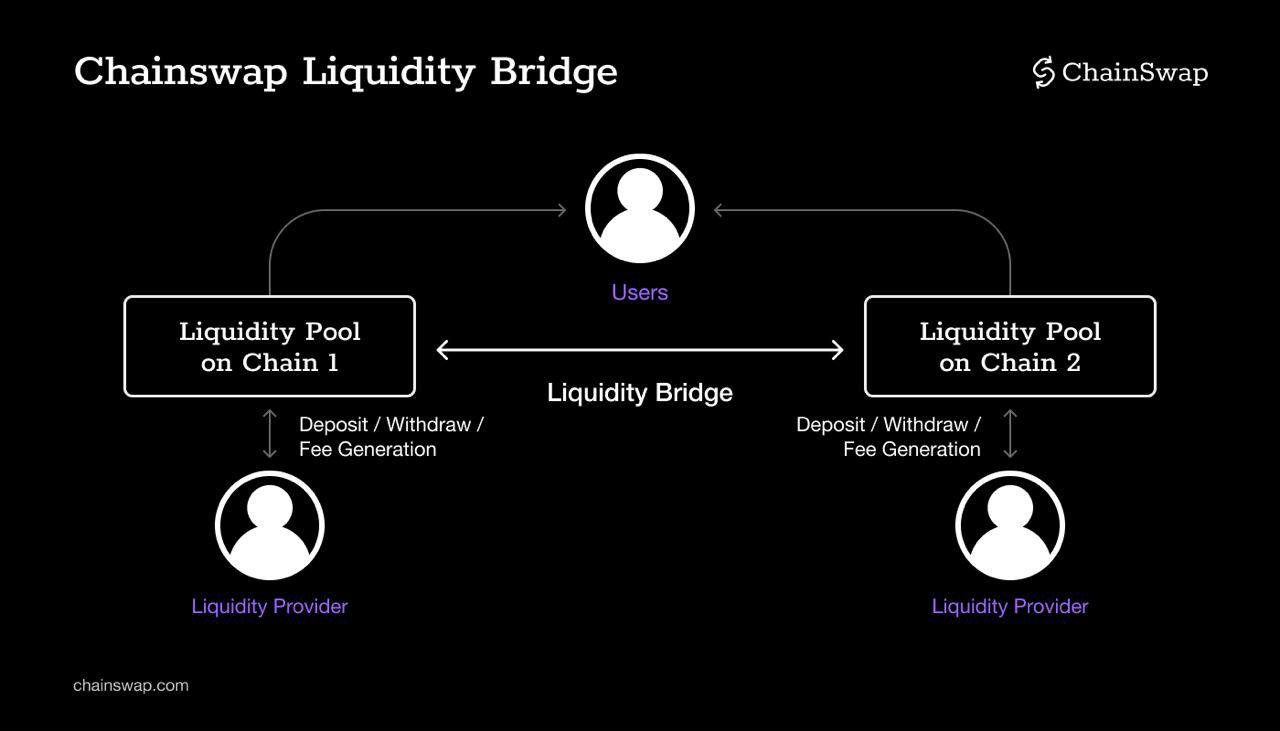

So far, it can be clearly found that the cross-chain aggregation business is the support point for XY Finance and O3 Swap to gain a foothold in the multi-chain universe. The same is true for ChainSwap. However, in addition to multi-chain multi-asset cross-chain aggregation, ChianSwap will build a huge cross-chain ecological hub - ChainSwap Hub.

From assets to applications, from proxy networks to intermediate chains that support cross-chain functions, the four pillars of ChainSwap support an all-round cross-chain ecosystem。

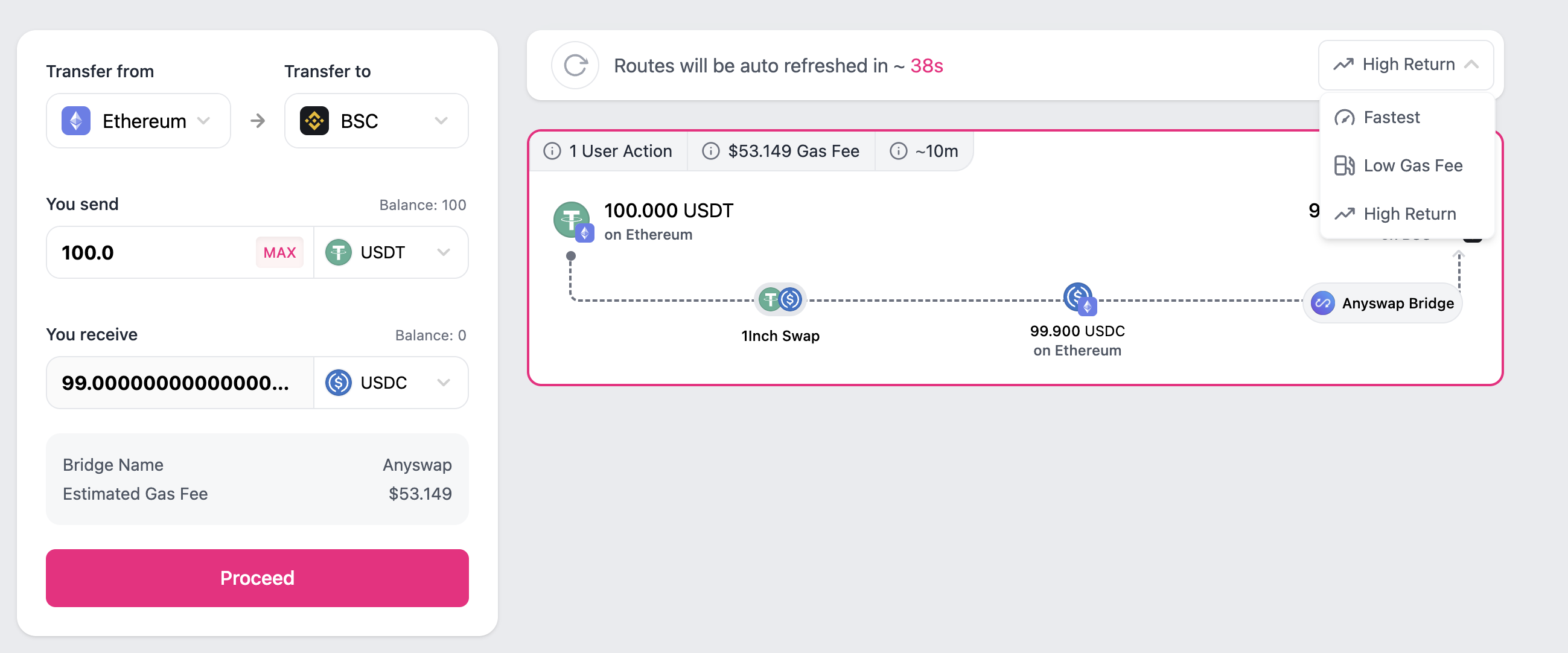

ChainSwap Bridge Aggregator is responsible for asset cross-chain aggregation business. Like other cross-chain aggregators, the API interface integrates the data and backend work of various cross-chain solutions (currently supports AnySwap, PolyNetwork, Wormhole and cBridge), and the integration with Rango (multi-chain DEX aggregator) is also revealed ChainSwap is empowering various applications and building an intelligent center.

image description

text

Another function of ChainSwap Bridge Aggregator is to bring together ChainSwap's native projects, such asChainSwap native bridge V2, its pre-set decentralized currency listing model can optimize the management process and improve the efficiency of currency listing. Of course, according to ChainSwap's documentation, they plan to build Liquidity Bridgetext

image description

secondary title

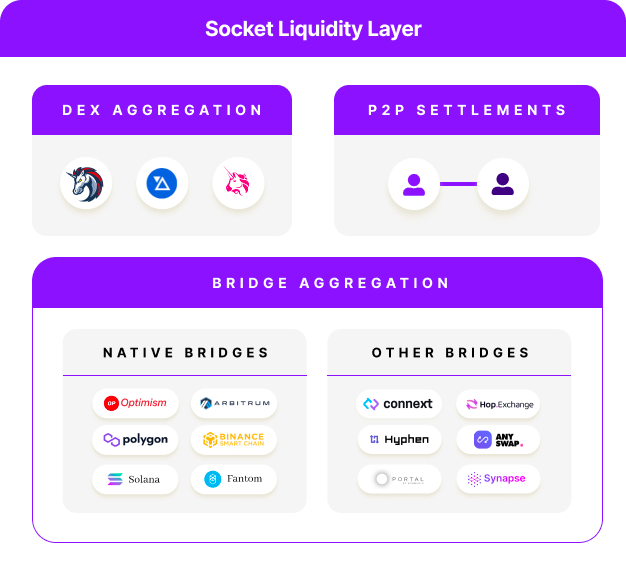

Bungee

Tags: peer-to-peer settlement, cross-chain communication protocol

FundMovr completed its rebranding in February of this year, changing its name to Bungee. The business route is very simple. It is nothing more than taking advantage of the cross-chain aggregator, aggregating the cross-chain bridge, DEX and DEX aggregator, finding the available route, and according to the maximum output of the target chain, the lowest gas fee for transactions and transfers, and the fastest bridge Time and other factors to meet the requirements of user assets cross-chain.

One of Bungee's strengths in terms of user experience is that,Three categories of applicable routes are listed for the userimage description

text

image description

Socket liquidity layer distribution

As a new project that is still in the testing stage, Bungee has fewer path options and the depth of liquidity is not enough. Putting this aside, let's go back to the team behind it, Socket, to see the deep business logic of Bungee.

Socket has entered the multi-chain ecology from a technical point of view. It creates a metalayer to achieve multi-chain shared liquidity and state unification of dApps. Protocols can integrate API interfaces to completeSeamless two-way transmission of cross-chain assets and information. Currently, bottom layers like Zapper, Zerion, and Ambire Wallet are all supported by Socket API. Developers can also use Socket as the basic layer of the technical architecture, and after custom optimization, build an interoperable dapp.

In our opinion, Bungee, as a native project of the Socket team, is in factAn external output of the team's technical core, a brand example, is a starting point for opening a cross-chain communication protocol.

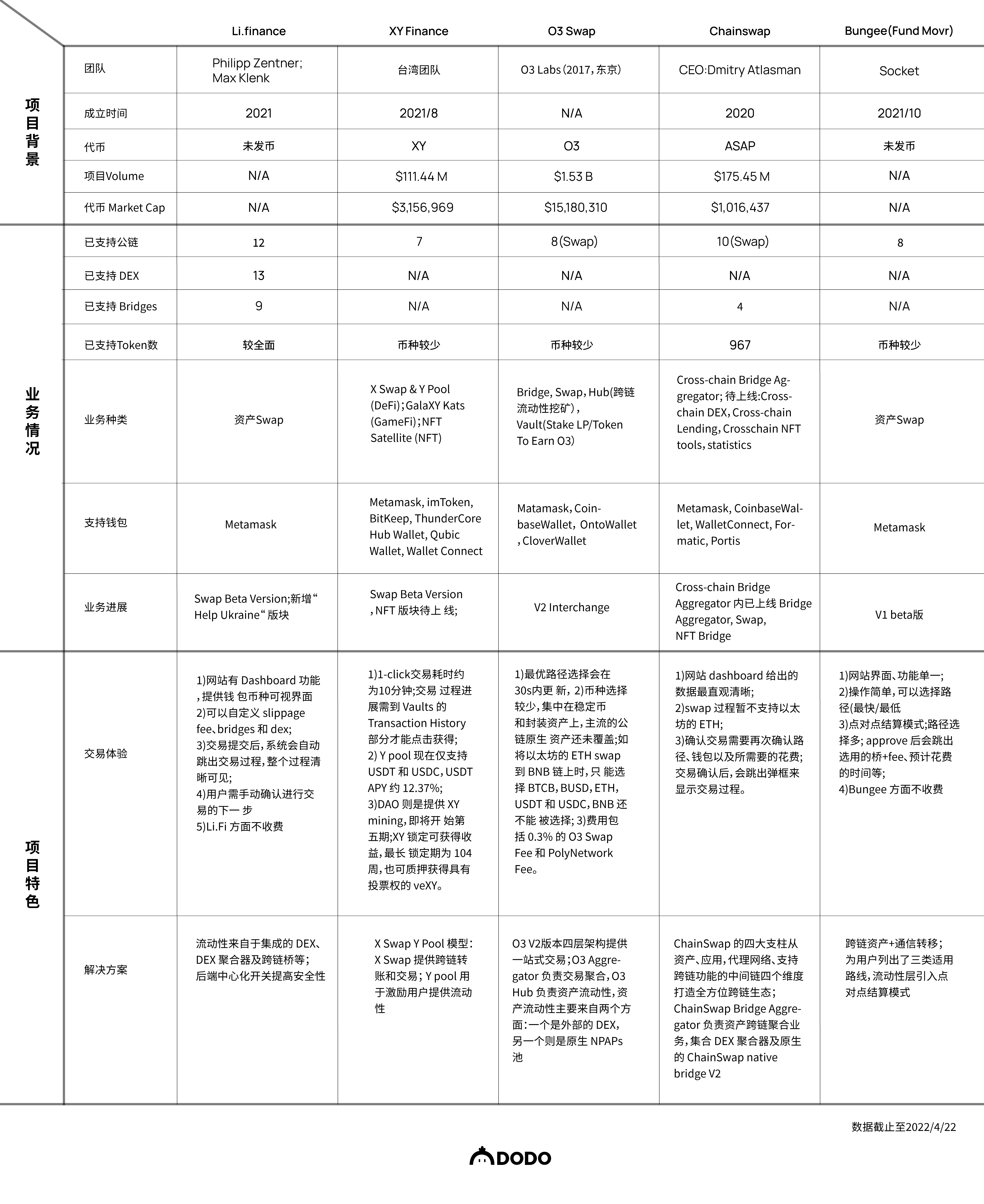

image description

text

The product comparison table can also be viewed by clicking on the following Google Docs link:https://docs.google.com/spreadsheets/d/1X9PIr4QRP9ATixgrOzVQPvRjCUtGl5R5-TLtlvnTmwg/edit#gid=1377539171

Back to another question from the beginning:Why do we need a cross-chain aggregator?We summarize a few key points as follows:

1) Efficient liquidity makes the transaction cost of cross-chain aggregators cheaper

The cross-chain bridge has a single function and can only be responsible for the back-and-forth "transportation" between stablecoins and native tokens. The lack of composability will be far from meeting the actual needs of users. When the cross-chain bridge uses encapsulated assets as intermediate tokens to solve liquidity problems, the increased transaction complexity is reflected on users as unnecessary overhead and poor user experience. More importantly, when users are comparing the advantages and disadvantages of various cross-chain bridges and DEXs, they are paying the cost of repetitive and inefficient work.

2) The user experience of cross-chain aggregators is better

The cross-chain aggregator aggregates the cross-chain bridge, connects DEX and DEX aggregator, shortens the time for querying the required token exchange path, and users can choose any method to carry out the entire asset exchange process. For users, cross-chain aggregators have greatly improved in terms of usability, convenience, and capital efficiency. All cross-chain bridges, DEXs and DEX aggregators can be aggregated together to find all available routes, and then help users to Optimal way to move funds between different blockchains.

3) Cross-chain aggregators reduce development, decision-making and management costs

The development of cross-chain bridges is still immature, which means security risks, insufficient liquidity, and large maintenance costs. As a third party, the cross-chain aggregator maintains all cooperative cross-chain bridge bridging functions and handles user decisions programmatically. For technology developers, cross-chain aggregators are a "backup" solution.

4) The cross-chain aggregator business is not limited to asset cross-chain

The cross-chain aggregator does not only point to the liquidity aggregation and aggregation cross-chain bridge protocol required for asset cross-chain, XY Finance, O3 Swap or Linkage Metaverse, or to create a one-stop trading platform, ChainSwap, Bungee also Extend its tentacles to cross-chain communication such as data and applications. The issuance of XY Finance and O3 Swap, in addition to serving as rewards for liquidity providers, also shows that the decentralized governance and community-driven models are developing.

5) Two-way transmission of assets and information, the cross-chain aggregator is an important component of the multi-chain universe

Taking Web 2 as an example, the cross-chain aggregator is a bridge version of the Haitao Buyer website and a small component in the multi-chain ecosystem. It breaks the barriers of two-way seamless transmission of assets and information, and creates a more flexible user experience. If the characterization of the cross-chain aggregator as limited to the cross-chain part of assets is too narrow, it is more like a function key. Whether it is from a technical level, or focusing on cross-chain aggregation transactions, or expanding business based on this, what we are trying to open is the door to the multi-chain transaction universe. You must know that the DeFi world has huge energy, asset efficiency is the most intuitive and straightforward core demand of users, and asset cross-chain is the fattest piece of meat.

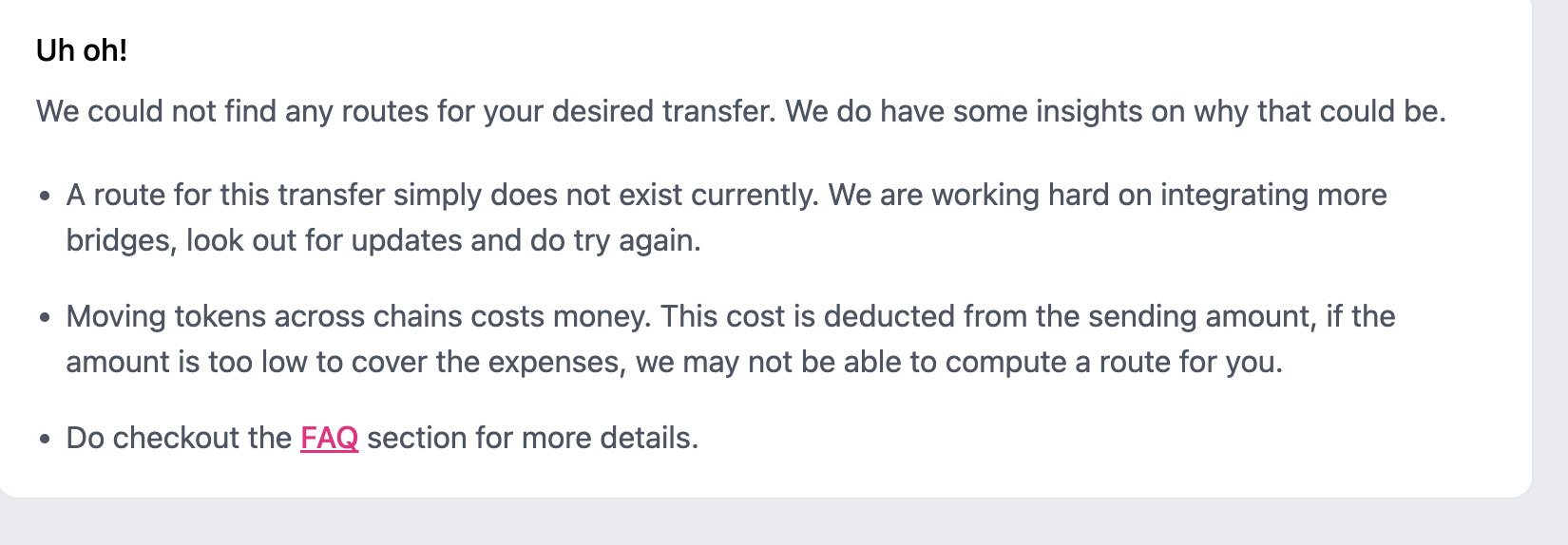

image description

*This is the prompt that appears when Ethereum’s USDT is swapped to BNB’s BNB on Bungee, but the prompt that the transaction path cannot be confirmed does not appear only on Bungee.

The cross-chain bridge track is being reshaped, expanding possibilities. The birth of the popular project Layerzero has broken the deadlock of the current cross-chain bridge from the underlying architecture. The emergence of cross-chain bridge comparison tools such as BridgeEye is improving the cross-chain infrastructure. Based on THORChain (Ryan Watkins called it an alternative exchange New projects such as cross-chain DEX THORSwap, a decentralized cross-chain liquidity protocol with custodians, and SwimProtocol, which combines Wormhole bridge technology and AMM mechanism, also provide a new development idea for cross-chain liquidity to break blockchain islands.

How to manage on-chain liquidity is a topic that cannot be avoided in the future development of cross-chain aggregators. Focusing on the moment, there are Li.Finance who choose external agreements as liquidity sources, and XY Finance and O3 Swap who choose to build native liquidity pools. ChainSwap and Bungee, the former chooses to polish the native cross-chain bridge to increase token supply, and the other chooses peer-to-peer settlement to improve capital efficiency. On the other hand, the four cross-chain aggregators other than Li.Finance take the cross-chain aggregation transaction as the starting point, and continue to explore the composable way of cross-chain liquidity. Tracing back to the source, cross-chain aggregation transactions are one direction of the future development of capital efficiency and on-chain liquidity management in the DeFi world, but it is not the only one. Its development and DeFi development complement each other. In our opinion, when more public chain ecology emerges and multi-chains become possible, cross-chain aggregation transactions are likely to become a routine business in the DeFi ecosystem, and DeFi's exploration of on-chain liquidity, such as cross-chain liquidity mining DeFi innovation trends such as similar incentive policies, "active market maker" trading mechanism, and LaaS (Liquidity as a Service) may inspire the future development direction of cross-chain aggregation.

At the same time, hacking incidents caused by contract loopholes are happening frequently. In addition to the aforementionedLi.Fidisclaimer

Reference:

https://docs.li.finance/official-documentation

https://docs.xy.finance/

https://docs.o3swap.com/o3-swap-litepaper

https://docs.chainswap.com/

https://medium.com/bungee-exchange

https://docs.socket.tech/socket-overview/what-is-socket

https://min.news/en/tech/4eebf1f343c816c1b7f3579dc1e799c7.html

https://chain-swap.medium.com/chainswap-progress-updates-e9fe960797c0

https://chain-swap.medium.com/chainswap-development-progress-report-token-listing-decentralised-and-off-bridge-token-swap-b7fae4630d4e

disclaimer

about Us

Copyright Notice

Without the authorization of DODO Research Institute, no one may use without authorization (including but not limited to copy, disseminate, display, mirror, upload, download, reprint, excerpt, etc.) or allow others to use the above intellectual property rights. If the work has been authorized to be used, it shall be used within the scope of authorization, and the source of the author shall be indicated. Otherwise, its legal responsibility will be investigated according to law.

about Us

More information

More information

Official Website: https://dodoex.io/

FAQ:https://dodoex.github.io/docs/docs/

GitHub: https://github.com/DODOEX

Telegram: t.me/dodoex_official

Twitter: https://twitter.com/BreederDodo

Reddit: https://www.reddit.com/r/DodoEx/

Discord:https://discord.gg/tyKReUK