Cross-chain talk: In-depth analysis of 16 cross-chain solution trade-offs

💡 Cross-chain bridges are not a new topic. Articles on the market have comprehensively classified and interpreted cross-chain bridges from the basic elements of bridges and cross-chain technologies. However, the current article's classification of cross-chain bridges is dazzling, which hinders people's macro understanding of the performance of cross-chain bridges.

💡 Dr. DODO aims to analyze and compare the performance of the bridges in all aspects based on the survey of 16 cross-chain bridges. Through comparison, people can more intuitively understand the differences between bridges and the problems they are trying to solve, thus reflecting the future development trend of cross-chain bridges. The focus of this article is to compare the performance of cross-chain bridges, not to give an in-depth explanation of the cross-chain technology itself. Readers can popularize the knowledge of cross-chain technology through the references cited in the article.

01 Literature review

The emergence of cross-chain bridges

What is a cross-chain bridge

Cross-chain bridge classification

Performance of cross-chain bridges

02 Comments on cross-chain bridge

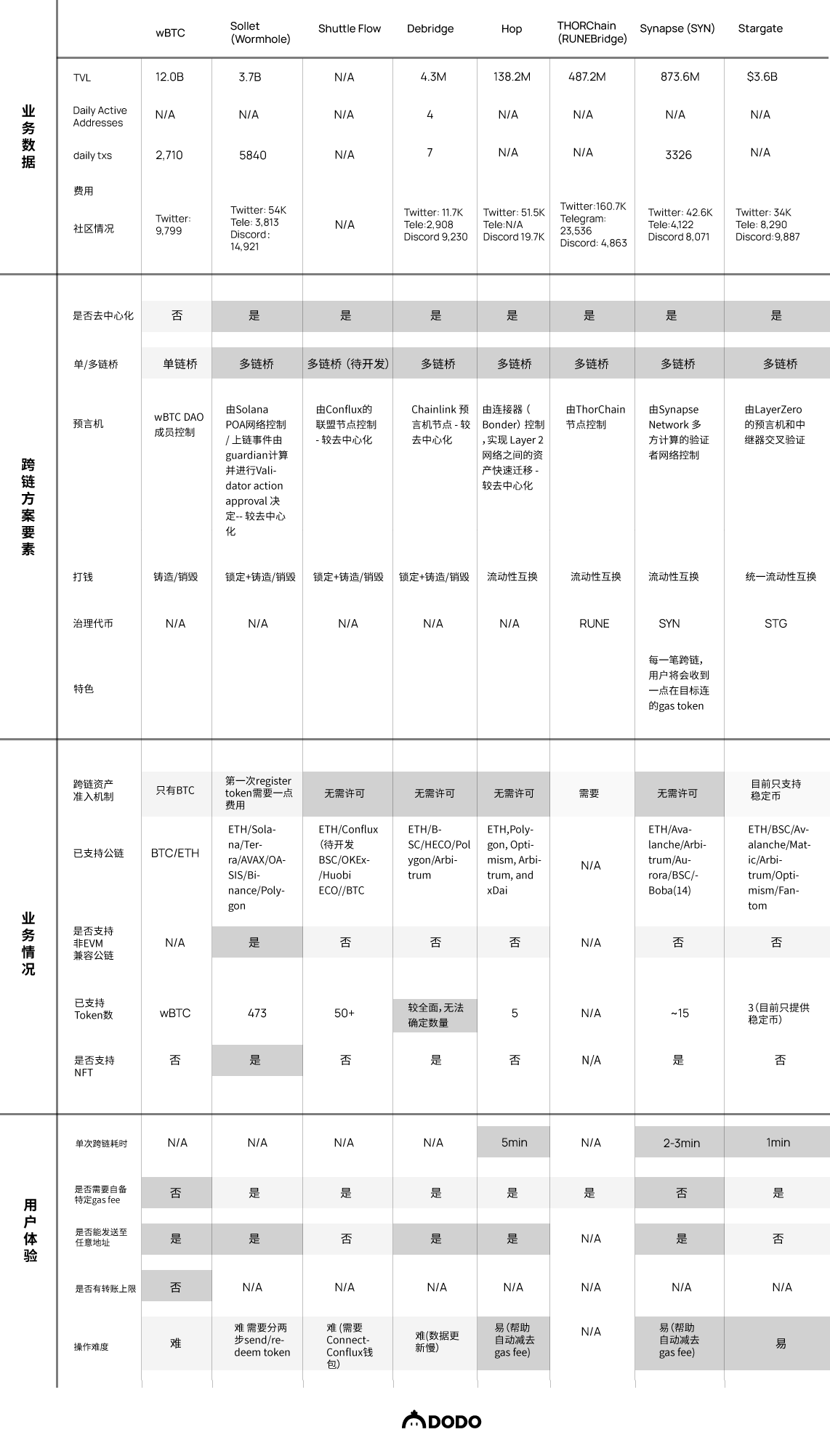

Cross-chain bridge product research form

Summary/comments on the 16 bridges surveyed

03 Development of cross-chain bridge

What problems are cross-chain bridges solving?

first level title

01 Literature review

The emergence of cross-chain bridges

According to the statistics of Blockchain Comparison, the existing public chains have reached115 articles. Different communication protocols, consensus rules and governance models exist between different blockchains. Haseeb Qureshi, managing partner of Dragonfly Capital, compared each public chain to a city. No matter how many skyscrapers (Rollups) can be built on Ethereum or need to connect with other cities, it seems that the emergence of cross-chain bridges has become Of course. At the same time, the booming DeFi, NFT and Gamefi on the emerging public chains encourage users to transfer funds between different public chains, making cross-chain bridges an inevitable product.

As a bridging tool between chains, the cross-chain bridge enables users to transfer assets and information between chains, and promotes communication and compatibility between multi-chain ecosystems.

According to the data on DeFi Llama, as of March 2022, the cryptocurrencies locked in cross-chain bridges are as high as $21.8B, of which Wrapped Bitcoin accounts for the largest market share, with a TVL of $10.2B, and Multichain ranks second, with a TVL of $7B. Arbitrum is the bridge with the highest TVL in the Ethereum ecosystem, accounting for about $6B, followed by Polygon, accounting for about $5B.

However, while the cross-chain bridge has become a rigid need in the era of public chains, it has also become a fierce target of hackers. On March 23, 173,600 Ethereum and 25.5M USDC were stolen from Ronin Bridge, with a total value of more than $600M. Ridiculously, the team didn't find out about this major loss until six days later. Immediately afterwards, the Stargate cross-chain bridge, a popular project of LayerZero, was discovered by the team to have a major security loophole in the underlying protocol when the TVL of the stable currency reached $3.6B.

These incidents are worrying, and it is true that not everyone is looking forward to the cross-chain bridge. Vitalik Buterin posted on Reddit:

The future will be "multi-chain", but not "cross-chain", because there are fundamental limitations to the security of bridges spanning multiple "sovereign regions".

How the cross-chain bridge will develop in the future, and whether there will be a multi-chain vs. multi-bridge game in the future is worth further discussion. But at this stage, the necessity of cross-chain existence stems fromthree aspects: Improve the utilization of assets, expand the boundaries of the protocol and the possibility of developing new functions, and unlock more gameplay for users and developers.

Let's take a closer look at what a cross-chain bridge is and how it meets the above three needs.

What is a cross-chain bridge

💡In most cases, when users want to cross assets from chain A to chain B, they need to first store the assets in the designated address of the bridge in chain A. Next, when the bridge detector receives this information, it will Cast an equivalent amount of wrapped tokens on chain B, or convert cross-chain assets into native assets of the target chain by establishing a fund pool on the target chain, and finally transfer the money to the user's account on chain B.

Asset cross-chainAsset cross-chainSeveral important roles and steps in the process:

Detectorconsensus mechanism

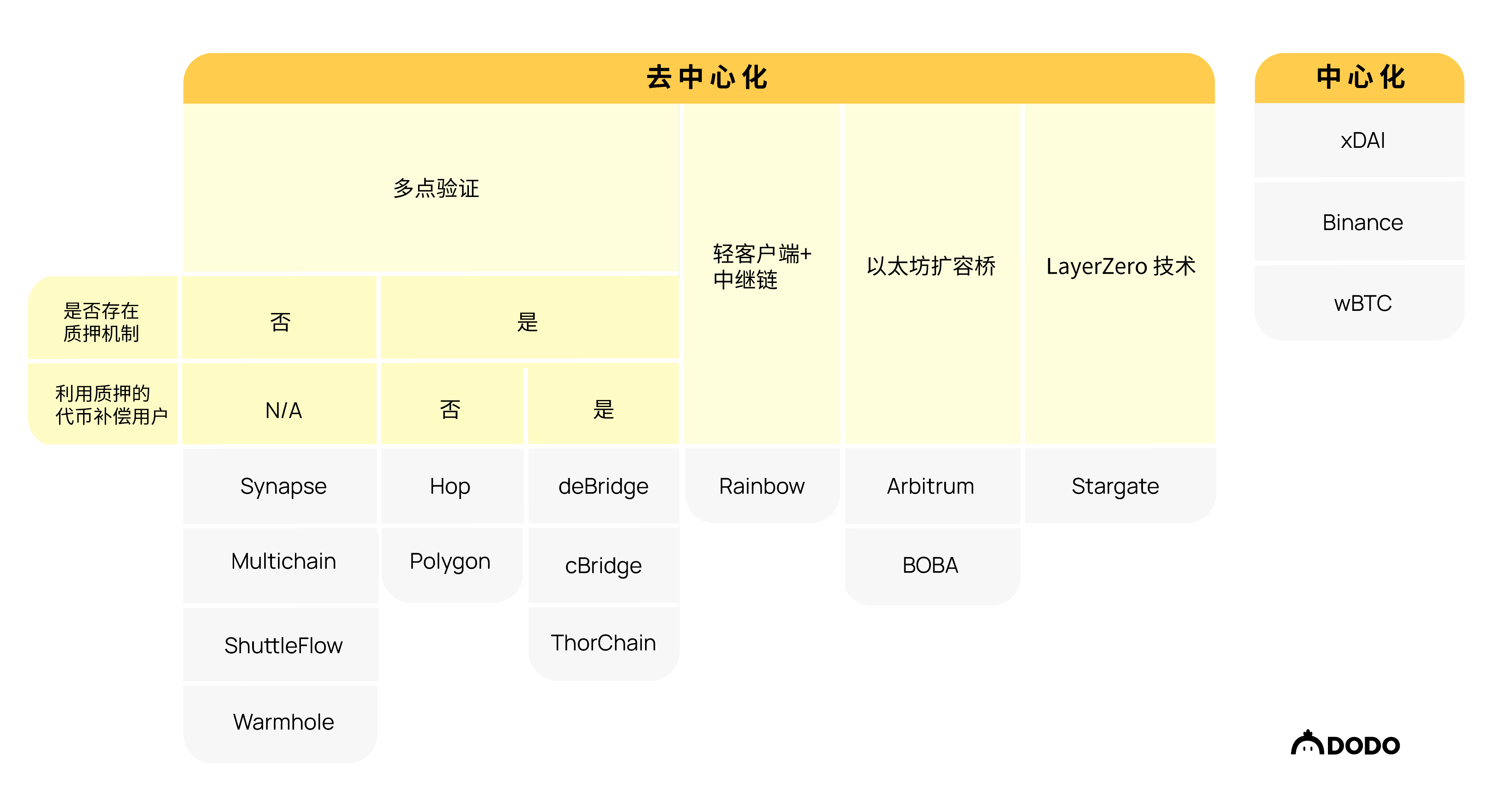

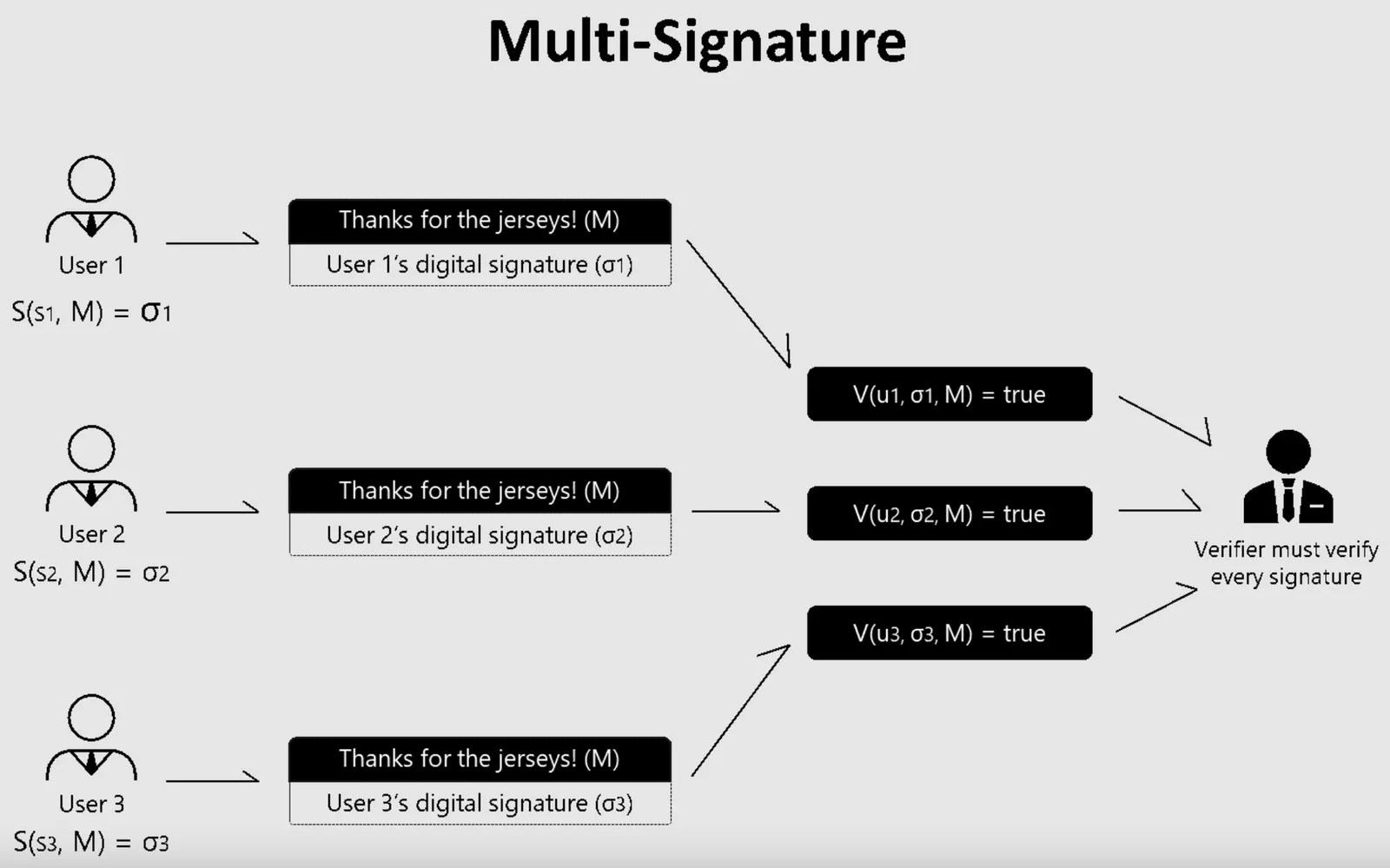

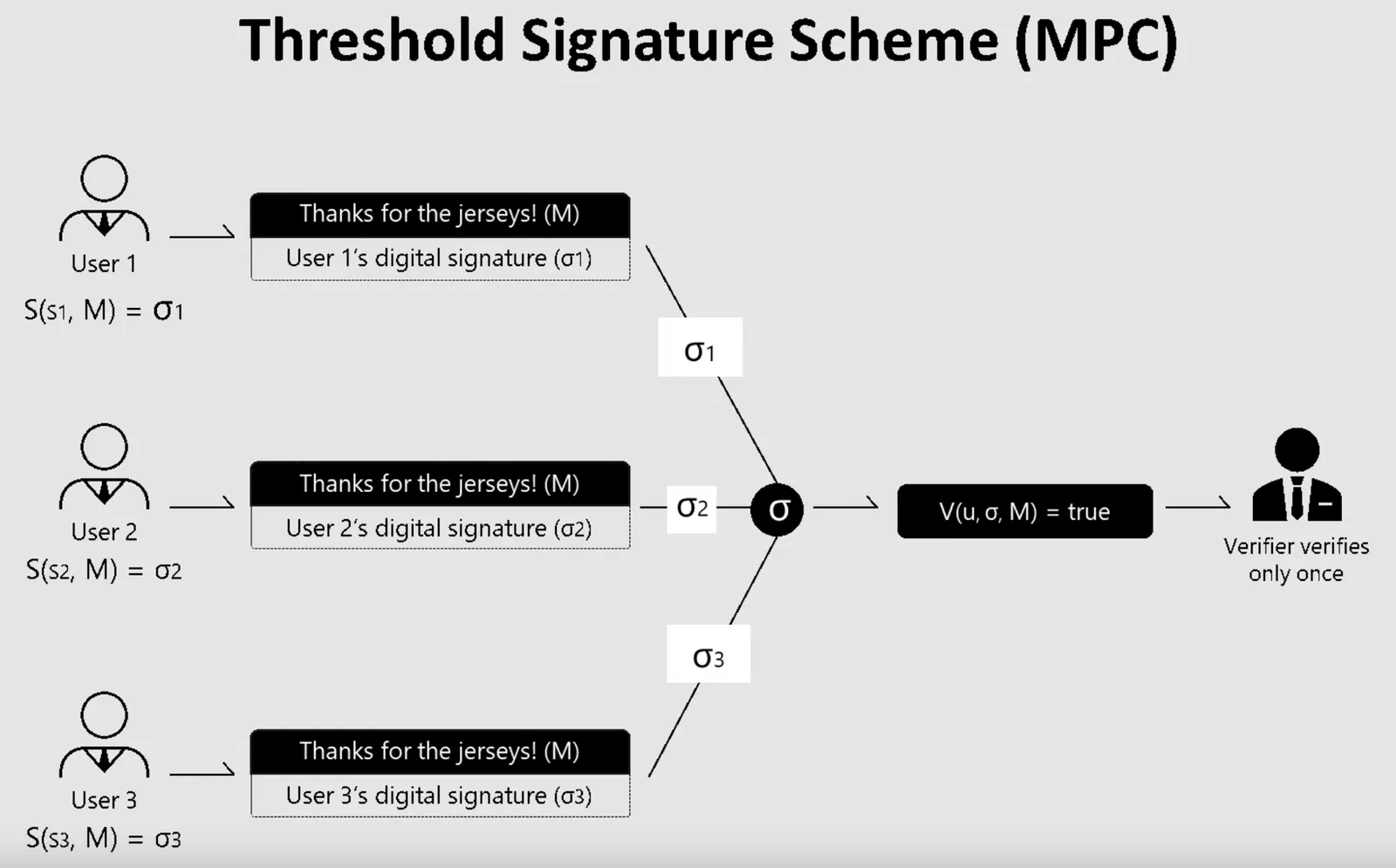

consensus mechanism: How to achieve consensus among validators? How do they cryptographically sign assets that need to be delivered to the target chain? Multi-signature or MPC threshold signature mechanism with higher security?

Incentive mechanisms: What is the mechanism to incentivize verifiers to deliver information correctly? Some cross-chain bridges reward verifiers with part of the transaction fees, or require verifiers to pledge governance tokens, and cut off their pledged funds after conveying wrong information.

Are user assets hosted on the bridge?When a user deposits assets to a designated address on the source chain, this address may be supervised by the verifier of the bridge, or controlled by a smart contract (that is, the factor of human intervention is excluded). In addition, the cross-chain bridge may also realize asset cross-chain by deploying a liquidity pool on the target chain. When assets are controlled by smart contracts or storage and liquidity pools, this article refers to them as asset non-custodial.

Asset cross-chain mode: Since each public chain has its own accounting books of original assets, how can users make assets separate from the original books and circulate in different bookkeeping systems? Rhythm player in the block0x76@BlockBeatsRegarding the question of whether assets are really transferred during the cross-chain process, it is pointed out that it is not the assets themselves that are cross-chain, but the value represented by the assets. This paper refers to the asset cross-chain mode as the "money transfer mechanism".

Classification method of cross-chain bridge

The current articles on the market classify cross-chain bridges based on the following methods:

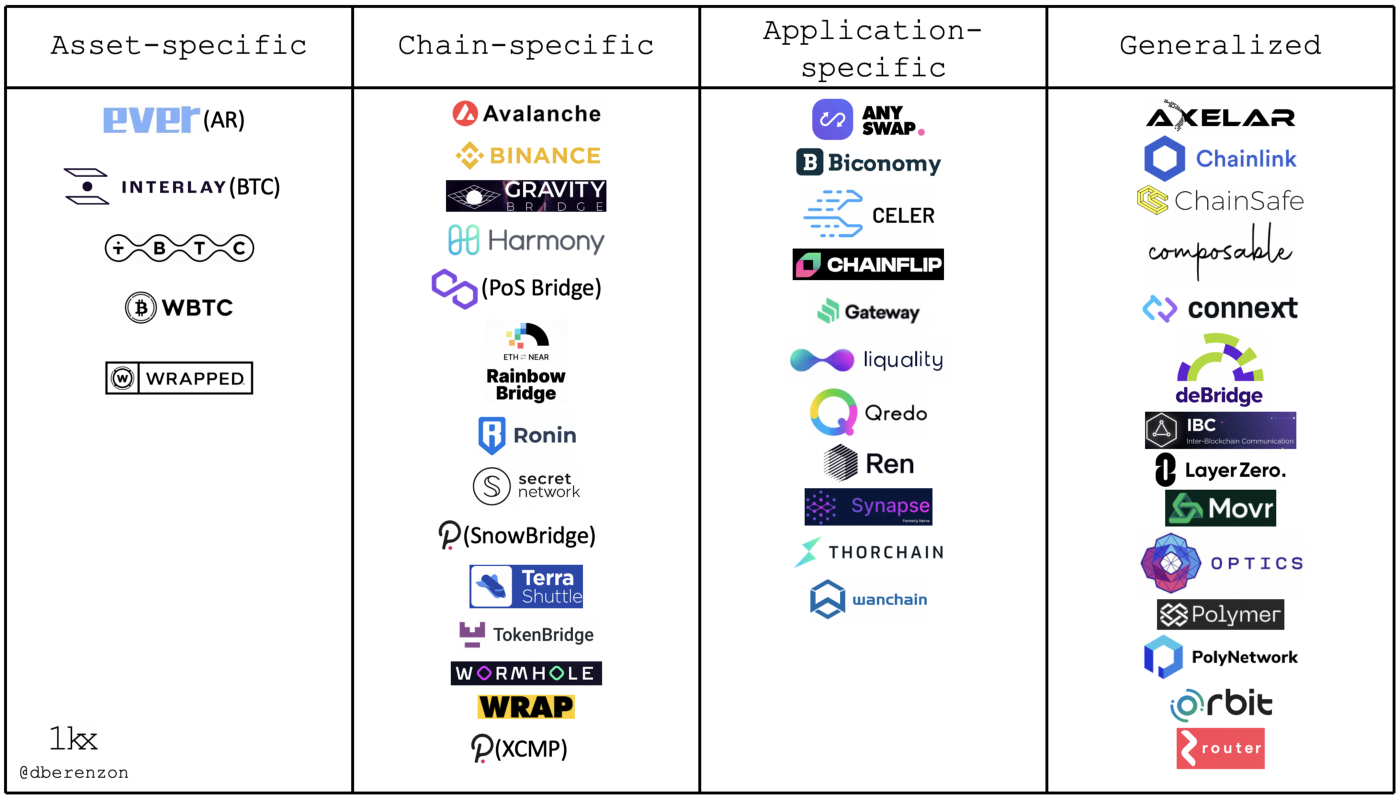

Research partner at @1kxnetworkDmitriy BerenzonAccording to the bridgeservice purposeDivide cross-chain bridges into four categories: those that focus on cross-chain assets, cross-chains between certain two chains, cross-chains that focus on applications, and universal cross-chain bridges.

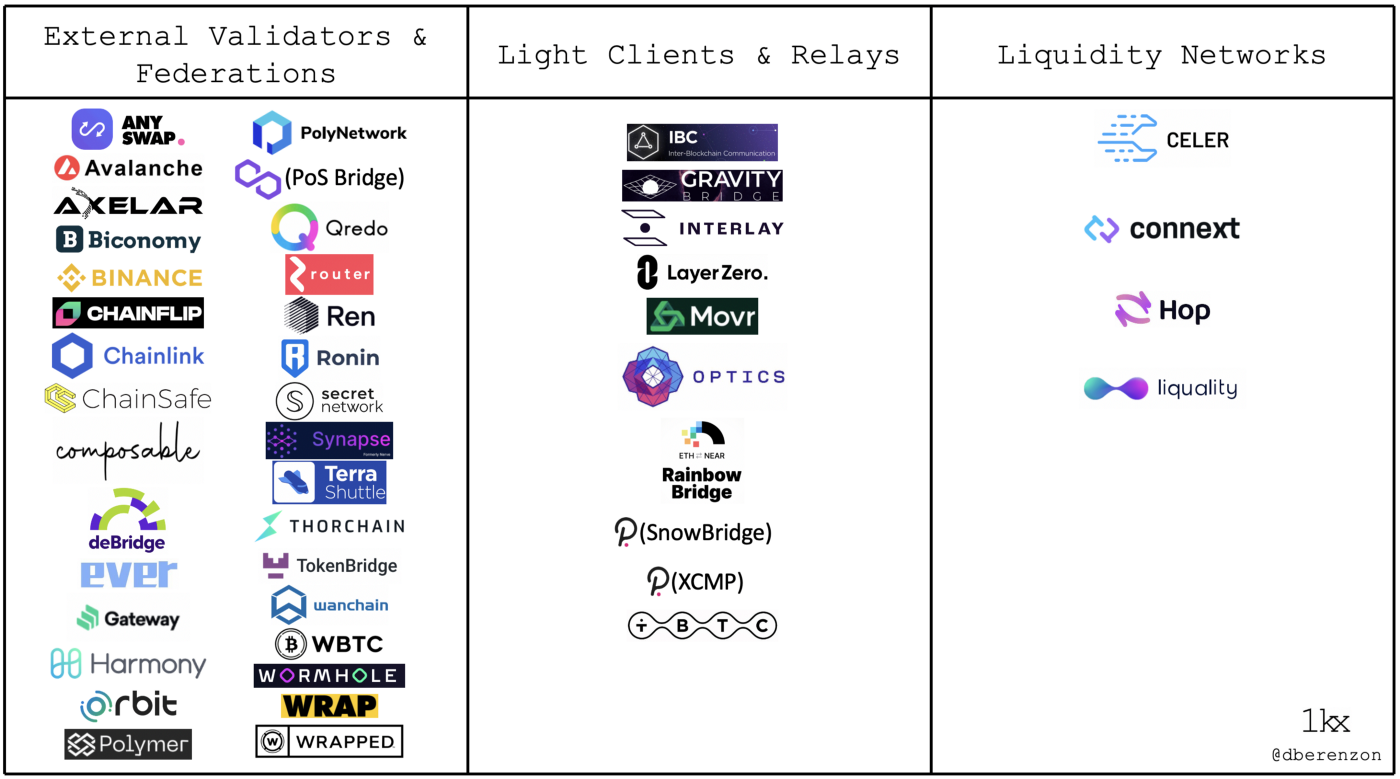

Dmitriy in turn according toAsset cross-chain verification mechanism/Technology: single-point multi-point verification, relay + light client/native verification, liquid network.

articles on the marketCash mechanismThere are various classifications, and this article selects Arjun Chand and Andre Cronje's explanation of the money transfer mechanism:

Arjun ChandThe article divides money into three categories:

Lock + mint: This type of cross-chain bridge will lock assets on the original chain and mint an equal amount of assets on the target chain.

Burn + mint: This type of cross-chain bridge will burn (burn) assets on the original chain and mint an equal amount of assets on the target chain.

according to

according toAndre CronjeThere are four types of money transfer methods:

Balance change: After the user locks the asset in the smart contract of the source chain, the oracle machine notifies the cross-chain contract on the target chain, so that the target chain transfers the asset to the user's receiving address.

Lock + mint/destroy: When the user locks assets in the address or smart contract specified by the cross-chain bridge, the cross-chain bridge will mint an equivalent amount of assets on the target chain and transfer them to the user's account in the target chain.

Liquidity replacement/two-way fund pool model: use the bridge to establish a fund pool on the target chain, and complete the cross-chain through the bridge's cross-chain assets, such as USDC (Ethereum) > anyUSDC is replaced by USDC (Fantom).

Packaging + minting/destroying: use the fund pool established by the bridge on the target chain and the source chain to perform two replacements, and complete the cross-chain through the cross-chain assets of the bridge, for example, USDC is replaced by anyUSDC (Ethereum) > anyUSDC is replaced by USDC (Fantom ).

In order to unify the classification of the money transfer mechanism, this article summarizes the technical documents of the cross-chain bridge, and divides the money transfer mechanism intothree: Liquidity replacement (need to deploy liquidity pool), lock + cast/destroy (no need to deploy liquidity pool) and atomic replacement.

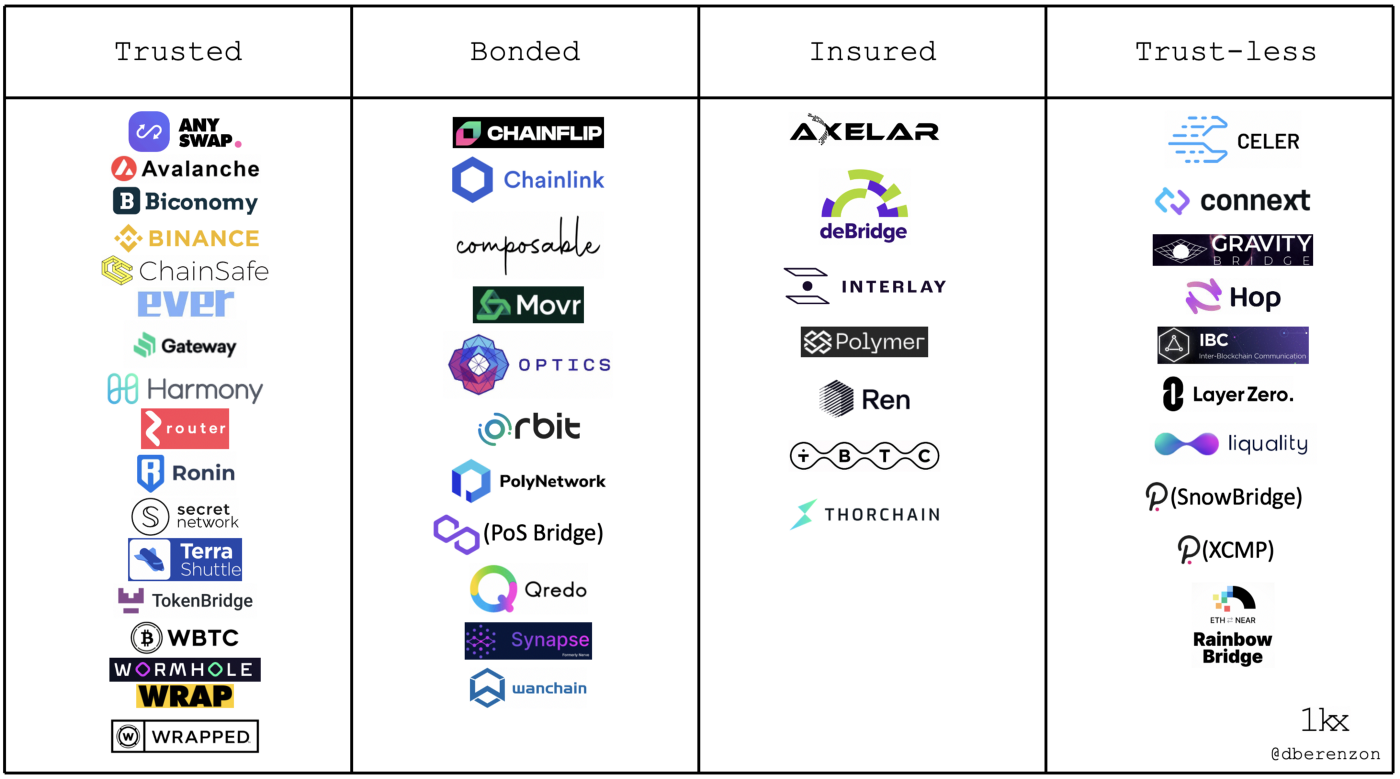

4. Bridge security: According to Dmitriy Berenzon's article, "trustless" bridges refer to bridges whose security is based on the underlying public chain, which is the most secure bridge, such as Arbitrum and BOBA bridges. The scaling solution on Ethereum - Optimistic Rollup. The "insurance" bridge, as the bridge with the second highest safety factor, returns its mortgaged funds to the user as compensation when the verifier makes a mistake. This mechanism gives users a better experience than a "debt" bridge that simply burns validator stakes without providing compensation. The final bridge that "requires trust" usually involves a centralized verification of transactions and management of user assets.

This article ranks the security of the bridges from high to low: trustless bridges > insured bridges > debt bridges (bonded) > bridges that require trust (trusted).

5. Others: Regarding other classification methods of bridges,Arjun ChandFurther subdivisions are made according to the function of the bridge, but this article will not go into details.

Cross-chain bridge performance

Now that we understand the basic elements of the bridge, and also understand the classification of the bridge’s service purpose, verification method, payment method, and security, we can see that different cross-chain bridges have different development cores. Dmitriy Berenzon evaluates the performance of cross-chain bridges from the following perspectives:

Security: The judgment of this article is that the security decreases from relay, multi-point verification to single-point verification; and in multi-point verification, the bridge (PoS) that requires the verifier to pledge is more secure than the bridge without pledge; in addition, when When the assets are hosted on the bridge, the security is reduced.

Speed: Refers to the delay in completing the transaction and the guarantee of finality. Some bridges focus on cross-chains between specific ecosystems (such as the Hop bridge that supports cross-chains between layer-2), which promotes faster cross-chain transactions.

Scalability: Different levels of difficulty for developers to integrate additional target chains.

Efficient capital: refers to the capital and asset transfer transaction costs required to ensure system security. For example, the upgrade of cBridge 2.0 is to reduce the threshold for liquidity provision and increase the depth of liquidity.

first level title

02 Comments on cross-chain bridge

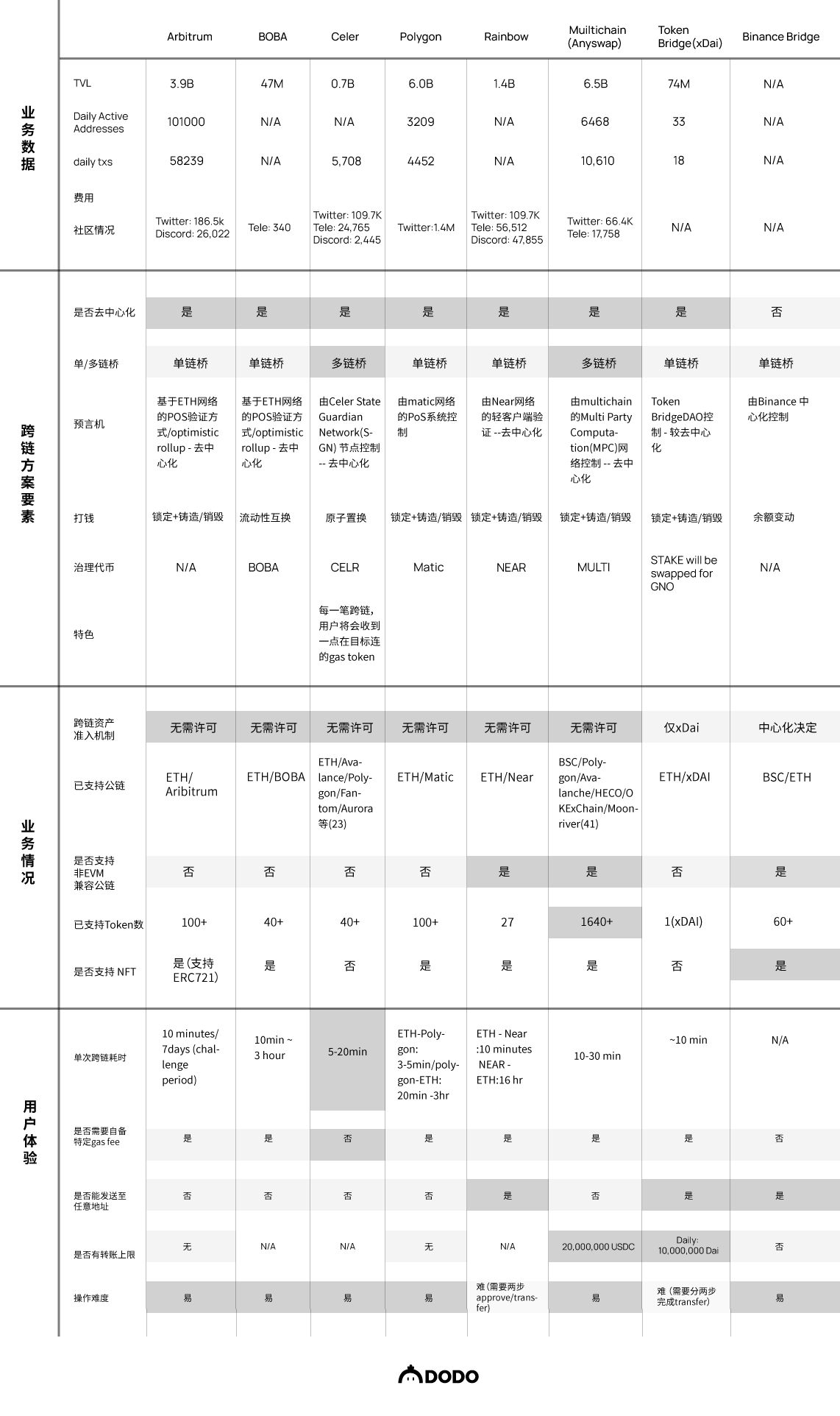

Research on cross-chain bridge products

By investigating the documents on the official website of the cross-chain bridge, this section will make a summary based on the commonality of the 16 bridges studied in this study, and compare the performance of the bridges. It should be noted that anyone should think critically when reading Whitepaper and bridge documents. Sometimes a newly launched cross-chain bridge project may be described in more complex language in order to highlight its own "features" Existing technologies and mechanisms, this paragraph aims to filter out complex languages and directly compare the differences in features between cross-chain bridges.

Synapse: At this stage, it is multi-point verification, and the threshold signature (TSS) is reached among the verifiers who perform multi-party computation (MPC). At present, anyone or project can apply to the Synapse community to become a verifier, and the next stage will be The introduction of the PoS pledge mechanism further improves security. In the process of making money, the Synapse bridge ensures that users obtain native assets by deploying a fund pool on the target chain. Assets are controlled by the Synapse smart contract, realizing asset non-custodial.

Multichain: Multi-point verification, the consensus is guaranteed by the multi-party computing MPC operation threshold signature (TSS) scheme, there is no pledge mechanism at present, the money transfer mechanism is locked + minted/destroyed, and assets are not in custody. In addition, the multichain V3 version has added the cross-chain method of multi-chain routing, and has used the way of deploying liquidity pools on multiple chains to complete asset cross-chain.

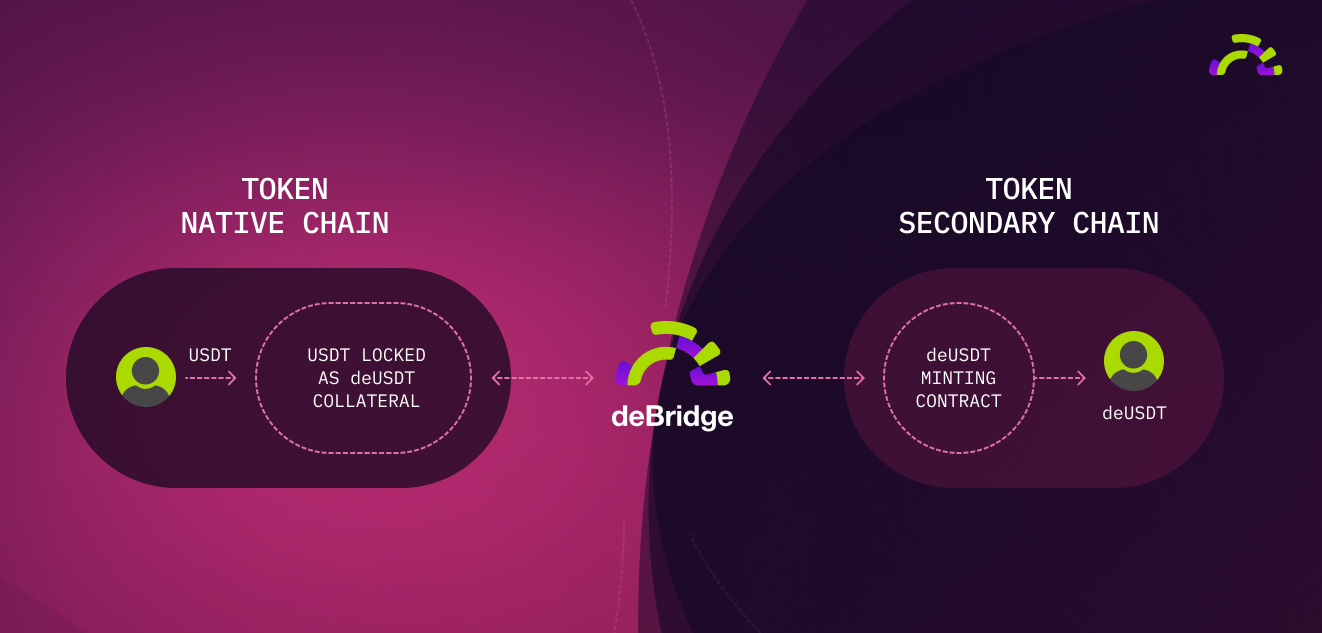

deBridge: for multi-point verification, consensus is reached by multi-sig, and the pledge mechanism is used to further ensure security; the money transfer mechanism is locked + minted/destroyed; assets are locked in deBridge's smart contract, and assets are determined to be non-custodial .

ShuttleFlow: Alliance nodes conduct multi-point verification, and consensus is reached through multi-signatures; the money transfer mechanism is locked + minted/destroyed; assets are stored in receiving addresses supervised by alliance members - judged as escrow.

Warmhole: Multi-point verification by 19 guardians, consensus reached by multi-signatures and security guaranteed by the reputation of the guardians; the money-making mechanism is locked + minted/destroyed; assets are determined to be escrowed.

cBridge: multi-point verification (Celer State Guardian Network), consensus and security are reached through multi-signatures and pledges; the money transfer mechanism is atomic replacement; based on the mechanism of atomic replacement, assets are determined to be non-custodial.

ThorChain: multi-point verification, consensus reached by multi-signature, the validator needs to bond enough governance tokens RUNE to run the node, and the validator will be replaced regularly to ensure security; asset transfer is realized through the liquidity pool, with RUNE as the Intermediate Assets; Assets are non-custodial.

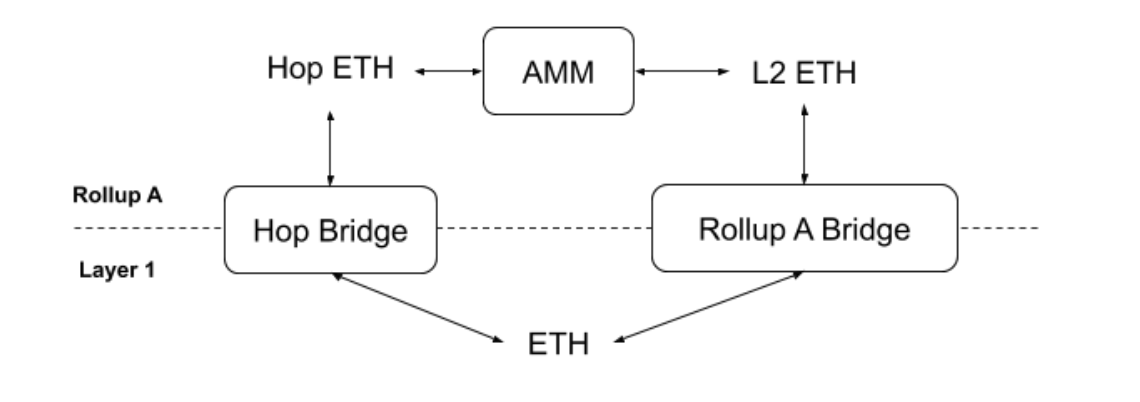

Hop: Bonder runs the node for multi-point verification. Bonder needs to pledge assets to participate in the verification transaction; the Hop bridge ensures that users obtain original assets by deploying a fund pool on the target chain; the assets are determined to be non-custodial.

Polygon/Matic PoS bridge: Multi-point verification, multi-signature consensus, implementation of pledge to ensure security, money transfer mechanism is lock + mint/destroy; user assets are supervised by Polygon's Predicate Contract - judged as custody.

Rainbow: It is completed by light client + relay verification, and the security is guaranteed at the same time; the money transfer mechanism is locked + minted/destroyed; user assets are stored in the TokenLocker contract, and assets are not managed.

BOBA: BOBA is an Optimistic Rollup, the verification of the transaction is executed by the smart contract, and the money transfer method is liquidity swap, and its security is equivalent to the underlying network-Ethereum; the address of user asset custody and BOBA network supervision.

Arbitrum: Arbitrum is one of Ethereum's expansion solutions - Optimistic Rollup. Transaction verification is performed by smart contracts; its security is equivalent to the underlying network - Ethereum; user asset custody and Arbitrum supervised addresses.

xDai bridge: Controlled by TokenbridgeDAO members, multi-signature consensus is reached; the money transfer mechanism is locked + minted/destroyed; assets are escrowed.

Binance bridge: As a centralized exchange, Binance can transfer user assets to different chains through balance changes. Users need to host assets on Binance.

wBTC: wBTC, as a DAO focused on BTC-encapsulated assets, centralizes verification of user information and execution of transactions; the method of depositing money is locking + production and destruction; user assets are hosted in wBTC.

Stargate: A cross-chain bridge built on LayerZero. The "verifier" is assumed by two roles: the oracle and the repeater. When the information provided by the two matches on the target chain, it means that the verification/cross-chain is successful; The method is to exchange liquidity through a unified liquidity pool; assets are not in custody.

Cross-chain bridge performance comparison

Everyone's interpretation of the cross-chain bridge technical documentation may be slightly different, so the classification of cross-chain bridges in this article is slightly different from Dmitriy Berenzon's table. However, the logic for judging the verification mechanism of the cross-chain bridge is consistent. Readers can make a judgment on the verification mechanism and security of the bridge step by step according to the following questions:

1) First of all, is the cross-chain bridge centralized management, multi-point verification, or using relay + light client to verify cross-chain information?

2) If it is multi-point verification, does the verifier need to pledge to provide services? In addition, once the verifier does evil, will the pledged assets be destroyed, or compensated to the user to protect the user from loss?

3) Are the assets deposited by users in the original chain hosted at the address supervised by the cross-chain bridge, or are they deposited in smart contracts or liquidity pools?

Based on the above problems and ideas, this article next reviews and compares the performance of 16 cross-chain bridges:

Among these 16 bridges, Synapse, Multichain, deBridge, ShuttleFlow, Warmhole, cBridge, ThorChain, Hop, and Polygon PoS bridge are all multi-point authentication. It is worth noting that in the consensus mechanism of multi-point verification, the difference between multi-party computation (MPC) and multi-sig (multi-sig) lies in the formation of the "private key". The multi-signature mechanism requires several verifiers to have a complete private key to sign the transaction, while multi-party computing eliminates the concept of a single private key, requiring verifiers to jointly form a private key to complete transaction verification, so that verifiers are not independent Have a complete private key to ensure security.Alice KlockoThe comparison chart in the article shows the difference between the two mechanisms intuitively.

Among these 9 bridges, deBridge, cBridge, ThorChain, Hop, and Polygon all require validators to pledge to run nodes to provide services for transaction verification. Compared with the rest, there is no pledge mechanism, or the "reputation" of validators is used to guarantee. Relatively higher security. In order to further improve user experience and ensure that user assets are not lost, cBridge, deBridge, and ThorChain are called "insurance" bridges. It means that when the node does evil, the funds pledged by the verifier will not be destroyed, but returned to the user as compensation. From the user's point of view, this kind of bridge gives users a more assured cross-chain experience than when the pledged funds are only destroyed when the verifier does evil.

Compared with multi-point verification, that is, users still need to trust the verifier, the light client + relay chain adopted by the Rainbow Bridge perfectly realizes decentralization. However, while achieving decentralization, Rainbow Bridge sacrifices scalability. Due to the high development cost of deploying light clients on each chain, Rainbow currently only serves cross-chain assets between Ethereum and Near.

The two "bridges" of BOBA and Arbitrum are relatively special, because they are both Layer-2 expansion solutions of Ethereum - Optimistic Rollup, so the underlying security is equivalent to that of Ethereum. Although such a bridge possesses higher security, when users want to cross-chain from Layer-2 back to Layer-1, they need to go through 7 days of challenge time.

In contrast, the difference between xDAI, Binance, and wBTC and the other 13 bridges lies in their centralization: from transaction verification to custody of user assets. While it’s hard to believe that Binance would deliberately do evil against its own reputation, centralized management somehow goes against the desire for decentralization in Web 3.

Stargate is a popular cross-chain project based on the LayerZero basic protocol since March. In order to make readers more familiar, Stargate is similar to Rainbow Bridge in terms of verification methods, that is, asset/information cross-chain is completed by deploying light clients and utilizing relay chains. But the innovation of Stargate is that it introduces two verification subjects, the Oracle and the relay chain, and there is no need to reach a consensus subjectively, but objectively - when the transaction information provided by the two matches, it indicates that the cross-chain is successful . At the same time, the "ultra-light client" it proposes greatly reduces the difficulty and cost of deployment. further more,0xivecottIt explained that Stargate provides users with native assets by deploying a unified liquidity pool, which solves the pain point of users receiving encapsulated assets and improves capital efficiency.

first level title

03 Development of cross-chain bridge

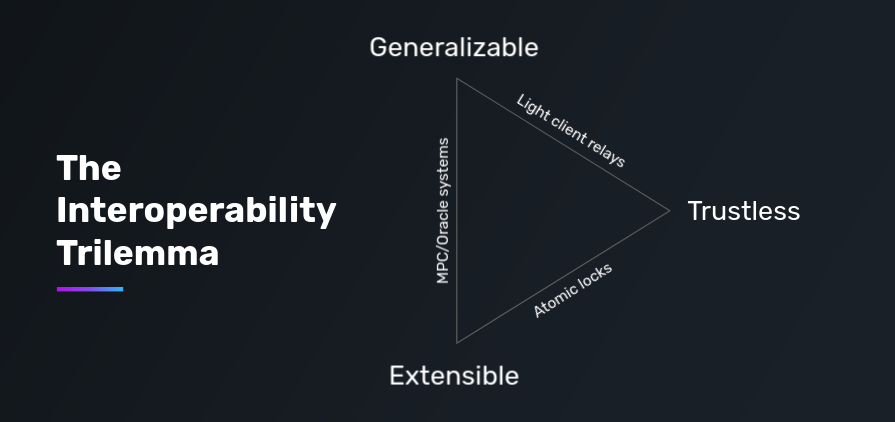

The development of cross-chain bridge projects may revolve around the "Interoperability Impossible Triangle", or it may be optimized based on the five performances mentioned earlier in the article: security, speed, scalability, capital efficiency, and status. But what needs to be written in front is,The development goals of cross-chain bridges are not uniformFor example, the development of Multichain focuses on scalability, and now there are as many as 33 public chains connected to it, and on this basis, Multichain V3 optimizes the money transfer mechanism. Native assets, not encapsulated assets. The Hop bridge focuses on asset transfer between Layer1-Layer2, rather than competing with Multichain on scalability. This paper argues that,Each bridge has its own development core. After setting the development goals, it will further optimize safety, speed, capital efficiency and other aspects.

As mentioned at the beginning of the article, Vitalik's concerns about the future of cross-chain bridges come from the security of bridges when crossing sovereign areas. Indeed, no matter what trade-offs bridges serve in terms of purpose,Security is an important direction for the cross-chain bridge R&D team to continuously optimize and upgrade. For example, the Synapse bridge proposed in the project that as the project enters the second and third stages of development, validators will be required to pledge to improve security; in addition, cBridge 2.0 uses a decentralized validator network (SGN) to process node information. Compared with the only Gateway role in version 1.0, version 2.0 improves security.

The improvement of security can also be optimized from the money transfer mechanism: Most asset cross-chain models adopt locking + minting/destroying, so what users get on the target chain is usually a cross-chain asset (wrapped token), such as deBridge’s deUSDT. Since the issuance of encapsulated assets involves three stages, the risk factor is also superimposed by the original assets, cross-chain bridge security, and the stability of encapsulated assets. In this way, it seems that users who exchange packaged assets not only bear more risks, but also have poor asset liquidity.

The realization of asset cross-chain through the liquidity pool can be understood as one more step than the locking + minting/destroying model, that is,Deploy a liquidity pool on the target chain to replace the encapsulated assets of the bridge with the general assets of the target chain. Such a mechanism bypasses the efficiency problem in the locking casting mechanism and improves the cross-chain speed.For example, the Hop Bridge helps users convert Hop Bridge's encapsulation assets (Hop ETH) into general assets (L2 ETH) on Rollup by deploying a fund pool on Rollup.

It seems convenient to complete asset cross-chain through liquidity, but there are also certain problems. PassThe potential problem of asset transfer through the liquidity pool may lie in the depth of liquidity and the split of the liquidity pool.For example, in the upgrade of cBridge 2.0, liquidity providers do not need to run their own nodes, but instead allow liquidity providers to entrust funds to the SGN verification network and obtain cross-chain fee income. This mechanism lowers the threshold for liquidity provision , thereby improving capital efficiency.

From the user's point of view, the final optimization of the cross-chain bridge falls on whether it can provide a smooth cross-chain experience, For example, whether the cross-chain speed is fast enough, whether there is a transfer limit, whether one-click cross-chain can be realized, whether to help users reserve/clear gas fees, whether the obtained assets are general assets of the target chain, etc. By looking at the cross-chain bridge product comparison chart, users can choose the corresponding cross-chain bridge according to their own cross-chain needs.

So what will the development of cross-chain bridges look like in the future? Instead of being obsessed with making up for the shortcomings of the cross-chain bridge, it is better to start from the perspective of the user's purpose of asset cross-chain:

Cross-chain aggregation: Imagine if you want to transfer assets from Ethereum to Arbitrum. Through the cross-chain bridge product comparison chart, you know that both deBridge and Synapse are connected to Arbitrum, but you cannot determine which cross-chain bridge to use for real-time cross-chain It costs less and is faster. Then the cross-chain aggregator may have a good prospect - helping users to avoid DYOR (Do Your Own Research), and providing services to filter out the optimal cross-chain path and cost within seconds. Dr.DODO's next article will make a detailed comparison of cross-chain aggregator products, so stay tuned.

Developers may also consider theEmbed other financial services in the cross-chain bridge, such as the cross-chain + transaction that Li.Finance is doing, and the cross-chain + lending solution proposed by the leading DeFi protocol Aave in the V3 version, or Sushi’s proposal to integrate the cross-chain bridge Stargate launched by LayerZero. In this way, users can complete DeFi-related activities while crossing the chain without going to a third-party platform.

In addition, the anyCall function recently launched by the cross-chain project Multichain also looks very practical and eye-catching. anyCall is a general cross-chain message transmission protocol, which can send cross-chain messages from chain A to chain B by calling the native contract on the target chain. In practical applications, Curve seized this opportunity, throughIntegrate anyCallMore effectively help veCRV holders on different blockchains to distribute the rights and interests of CRV rewards. Specifically, when Curve is connected to anyCall, it can calculate the user's reward weight on the target chain in a timely manner and mint corresponding rewards. In this way, there is no need to deploy the liquidity pool rewarded by CRV in advance, which greatly improves the capital efficiency.

refer to

refer to

https://medium.com/1kxnetwork/blockchain-bridges-5db6afac44f8

https://medium.com/dragonfly-research/secure-the-bridge-cross-chain-communication-done-right-part-i-993f76ffed5d

https://www.chaincatcher.com/article/2070549

https://www.odaily.news/post/5174721

https://www.theblockbeats.info/news/29369?search=1

https://www.tuoniaox.com/news/p-509054.html

https://andrecronje.medium.com/multichain-dapp-guide-standards-and-best-practices-8fabe2672c60

Bridge Documents

cBridge: https://cbridge-docs.celer.network/introduction/sgn-and-cbridge

deBridge: https://docs.debridge.finance/

Wormhole: https://docs.wormholenetwork.com/wormhole/existing-applications/token-bridge

xdai bridge: https://docs.tokenbridge.net/xdai-bridge/about

RUNE bridge

https://rebase.foundation/network/thorchain/specification-document-walkthrough/whitepaper

https://docs.thorchain.org/thornodes/overview

BOBA: https://docs.boba.network/developer-docs/011_running-replica-node

Arbitrum: https://developer.offchainlabs.com/docs/bridging_assets

Polygon: https://docs.matic.today/docs/develop/ethereum-matic/pos/getting-started/

Stargate: https://stargateprotocol.gitbook.io/stargate/

Synapse: https://docs.synapseprotocol.com/

Rainbow: https://docs.near.org/docs/develop/eth/rainbow-bridge

Multichain: https://docs.multichain.org/

ShuttleFlow: https://shuttleflow.io/

Hop: https://docs.hop.exchange/js-sdk/getting-started

Whitepaper

https://shuttleflow.io/static/media/SF-whitepaper-en-v1.0.bbd9b706.pdf

https://hop.exchange/whitepaper.pdf

https://www.dropbox.com/s/gf3606jedromp61/Delta-Solving.The.Bridging-Trilemma.pdf?dl=0

https://wbtc.network/assets/wrapped-tokens-whitepaper.pdf