Traditional institutions run into the market, a quick overview of the crypto fund layout of venture capital institutions

Written by: Poplar

Written by: Poplar

As a venture capital giant in the encryption world, a16z has raised a total of US$2.2 billion in encryption funds in 2021, and a16z plans to spend a lot of money this year, continuing to raise US$3.5 billion for its new cryptocurrency venture fund, and for another fund focused on digital assets. Separate fund for asset startup seed investments raises $1 billion.At the same time, in recent times, especially since 2022, in addition to common investment institutions in the encryption industry such as a16z,The venture capital giants that shined in the traditional Internet era have also begun to appear intensively in the investment and financing events in the encrypted world

, and even directly set up related investment funds in the encryption field (some directly invest in encrypted assets), and the scale of funds of hundreds of millions of dollars is frequently seen in the newspapers.

Big step into the traditional giantsThe strong wind started at the end of Qingping. Recently, it has been likeTraditional VC giants like Sequoia Capital, Tiger Global, and even Bridgewater

, have successively played the role of "barbarians" at the door, triggering a new wave of investment in encrypted assets in the traditional financial world, and also providing incremental funds with richer and more diversified exposure to encrypted asset investment.

On December 8, 2021, Sequoia Capital changed its Twitter profile to "Mainnet faucet. We help the daring buidl legendary DAOs from idea to token airdrops. LFG" (We help courageous people create legendary DAOs, from ideas to generation currency airdrop)—although it has been changed back now.On February 18 this year, Sequoia Capital directly launched a cryptocurrency investment fund with a scale of 500 to 600 million US dollars. This is also Sequoia Capital's first industry-specific fund since its establishment in 1972. In addition to the cryptocurrency sub-fund, Sequoia Capital will continue to invest in cryptocurrency startups through its primary seed fund, venture fund, growth fund and expansion fund,

The funds have a total capital commitment of more than $7.5 billion.Overview of Sequoia’s crypto investment landscape: a total of 68 investments have been made, and the layout has accelerated significantly》)。

Overview of Sequoia’s crypto investment landscape: a total of 68 investments have been made, and the layout has accelerated significantly

At the same time, on February 5, Ark Invest applied to launch the venture fund "ARK Venture Fund", which will invest in companies involved in disruptive innovation, including companies related to encryption and blockchain technology, and the fund may also Invest indirectly in cryptocurrencies such as Bitcoin by investing in the Grayscale Bitcoin Trust (GBTC), with a minimum initial investment of $1,000 in the fund.

On March 22, according to Coindesk citing sources, Bridgewater Associates, with a total asset management scale of US$150 billion, plans to support an external encryption investment fund, thus starting to get involved in the encryption field. Indicates that he owns Bitcoin.

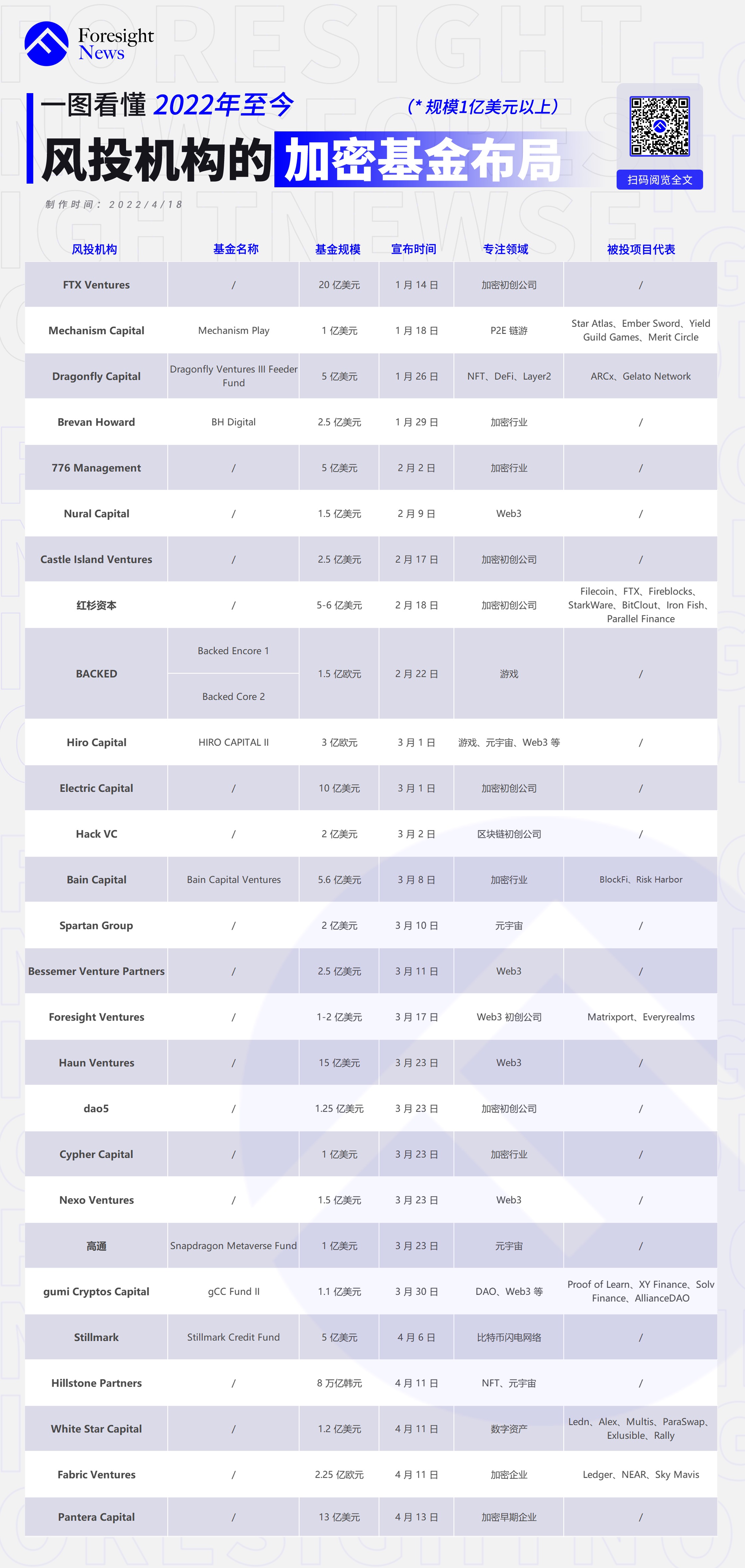

This year, venture capitalists’ encryption fund layout

FTX Ventures

Let's sort out the timeline together, which venture capital institutions have officially announced their own encryption funds this year.

Mechanism Capital

On January 14, the cryptocurrency trading platform FTX announced the establishment of the venture capital department FTX Ventures and launched a $2 billion venture capital fund. Amy Wu, a former partner of the venture capital firm Lightspeed, was appointed as the head of the venture capital department. Encryption industry startups provide support from 100,000 to hundreds of millions of dollars.

Ikigai Asset Management

On January 18, 2022, the cryptocurrency investment institution Mechanism Capital launched a $100 million "Mechanism Play" fund, focusing on game project investment in the P2E game industry, and directly cooperating with studios to develop new games. In addition, former Apple App Store games Business Manager Steve Cho also joins the team to co-lead the fund.

Blockchain Founders Fund

On Jan. 22, crypto hedge fund Ikigai Asset Management launched its first $40 million blockchain venture capital fund, having previously held stakes in private blockchain companies through its flagship fund, the Ikigai Opportunities Master Fund.

Dragonfly Capital

On January 25th, the Singaporean venture capital fund Blockchain Founders Fund launched BFF II Fund and completed a fundraising of US$75 million. Participating institutions include NEO Global Capital, AppWorks and The Sandbox COO Sebastien Borget, GSR, LD Capital, Metavest Capital, TechMeetsTrader , Zipmex, Baksh Capital, Octava, Aria Group, etc., BFF II's investment strategy aims to invest in pre-seed and seed-stage projects, and then invest up to $5 million in future financing rounds.

Brevan Howard

On January 26, according to The Block, crypto venture capital firm Dragonfly Capital is raising $500 million for a new fund, Dragonfly Ventures III Feeder Fund, after Dragonfly launched a $225 million fund in March 2021, focusing on NFT, DeFi , Ethereum Layer 2 solutions and related businesses, etc. In the past year, he participated in the financing of DeFi credit scoring agreement ARCx, smart contract automation project Gelato Network, and Web3 investment company Folius Ventures LLC.

776 Management

On Jan. 29, hedge fund Brevan Howard, led by billionaire Brevan Howard, set aside $250 million to invest in the crypto space through its BH Digital unit.

Nural Capital

On February 2, 776 Management, the venture capital firm of Reddit co-founder Alexis Ohanian, has raised $500 million for two new funds focused on the cryptocurrency industry.

Infinity Ventures Crypto

On February 9, according to Blockworks, Nural Capital's encryption fund plans to raise $150 million and bet on Web3. First Light Fund plans to invest directly in crypto-focused hedge funds and venture capital managers, as well as token investments and direct equity investments in the blockchain space.

Castle Island Ventures

On February 9, according to CoinDesk, Web3 investment agency Infinity Ventures Crypto raised $70 million for its first fund, with participation from Circle, Digital Currency Group and Animoca Brands. The fund will invest in Web3 startups in Asia and the Americas.

Cherry Ventures

On February 17, the new fund of Castle Island Ventures, a digital asset company, completed a financing of US$250 million. Investors include endowment funds, asset management companies and family offices. transformative companies, including startups involved in building monetary networks, financial services and internet architectures such as Web3.

BACKED

On February 18, Berlin-based venture capital firm Cherry Ventures announced the launch of the first encryption and Web3 fund "Cherry Crypto I", with a fund size of 30 million euros. The fund will construct a concentrated portfolio investing in only 30 companies or projects, including decentralized networks or companies.

Hiro Capital

On February 22, according to VentureBeat, the encryption investment fund BACKED announced that it would raise 150 million euros (about 169.7 million U.S. dollars) in funds, which will be used to invest in European games and technology companies. Half of the funding will go to Backed Core 2, a new seed fund, and the other half to Backed Encore 1, backing its existing portfolio.

Electric Capital

On March 1, European venture capital firm Hiro Capital announced the launch of the HIRO CAPITAL II fund with a scale of 300 million euros, which will focus on investing in games and metaverses. Founded in 2018, Hiro Capital mainly invests in games, IP, metaverse technology, Web3, e-sports, creator tools, wearable devices, AR and VR.

Hack VC

On March 1, according to Forbes, Electric Capital raised $1 billion for its two funds, which will invest in cryptocurrency start-ups. Tokens, another $600 million fund was raised in February and will be used only to buy tokens.

OP Crypto

On March 2, according to FINSMES reports, encryption venture capital firm Hack VC launched a new fund of US$200 million, which will focus on investing in early-stage encryption, Web3 and blockchain startups. The fund is led by managing partners Alex Pack and Ed Roman co-leads and is backed by institutions such as Sequoia Capital, Fidelity, and angel investors such as Marc Andreessen of a16z and Chris Dixon.

Bain Capital

On March 8th, OP Ventures Fund I, a fund of OP Crypto, a venture capital company focusing on blockchain, completed a financing of US$50 million. Billionaire Bill Ackman, Solana co-founder Raj Gokal, Terra founder Do Kwon, and Polygon co-founded Joining investors Sandeep Nailwal, billionaire Alan Howard and Animoca Brands, the fund will focus on investing in virtual worlds, games, social media and decentralized finance.

Spartan Group

On March 8, Bain Capital Ventures, the investment company of Bain Capital, an American private equity investment company, launched a $560 million encryption fund, which will invest in about 30 companies in the next few years, and has invested about $100 million so far. funds;

Bessemer Venture Partners

On March 10, according to The Block, encryption venture capital firm Spartan Group will launch a $200 million metaverse fund, which will focus on projects built in the metaverse, especially virtual worlds that support "digital ownership." The fund will mainly focus on the infrastructure layer, experience layer and "value-added layer" of the metaverse. The "value-added layer" includes projects "outside" the metaverse, such as game guilds and NFT markets.

Foresight Ventures

On March 11, venture capital firm Bessemer Venture Partners has committed $250 million from existing funds to invest in Web3 projects in three core areas: consumer decentralized finance (DeFi), infrastructure and other "supporting" technology".

Haun Ventures

On March 17, Foresight Ventures stated that it will invest 100 million to 200 million US dollars in Web3 startups and projects in the next three years, including NFT and blockchain infrastructure. Previously, Foresight Ventures has invested $10 million in the primary cryptocurrency market and over $100 million in the secondary market.

dao5

On March 23, Haun Ventures, a venture capital firm led by former a16z partner Katie Haun, has raised $1.5 billion in funding to support the development of Web3. Haun Ventures will invest through two funds, a $500 million early-stage fund and a $1 billion accelerator fund.

Cypher Capital

On March 23, former Polychain partner Tekin Salimi launched a US$125 million crypto venture capital fund "dao5", which will provide approximately US$500,000 to US$2 million in pre-seed and seed round financing. In addition, Salimi also plans to transform the fund into a DAO, in which DAO5 tokens will be minted and issued to the fund's investment team, advisory committee, and portfolio company founders. The legal entities that make up the fund will be dissolved and the assets of the general partners will be There will be a permanent migration to an on-chain vault owned and managed by DAO5 token holders.

Nexo

On March 23, Dubai venture capital firm Cypher Capital launched a $100 million blockchain fund to invest in blockchain, cryptocurrency and other digital asset projects. Cypher Capital plans to partner with and expand the blockchain ecosystem, including visionary innovators and other venture capital partners, to create a holistic community and foster the growth of the entire ecosystem. In addition, Cypher Capital will launch its 10,000-square-foot blockchain, encryption and digital asset center in Dubai in the next few months.

On March 23, crypto platform Nexo launched a $150 million internal Web3 investment fund. The company’s venture capital arm, Nexo Ventures, plans to deploy the funds into areas such as blockchain-based games, DeFi, and NFTs. Tatiana Metodieva, head of corporate finance and investments at the venture arm, said the fund will drive the continued adoption of digital assets and the expansion of the Web3 ecosystem.

Qualcomm

gumi Cryptos Capital

Chip supplier Qualcomm created the Snapdragon Metaverse Fund, a $100 million metaverse investment fund, designed to support companies using AR, mixed reality and VR to build metaverse worlds. The fund will deploy capital through a combination of Qualcomm Ventures’ venture capital investments in XR companies and a grant program from Qualcomm Technologies, Inc. to fund a developer ecosystem for XR experiences in gaming, health and wellness, media, entertainment, and more. education etc.

Stillmark

On March 30, according to CoinDesk, crypto venture capital firm gumi Cryptos Capital (gCC) set up a US$110 million early-stage fund "gCC Fund II", which will invest in about 50 companies through stocks and tokens, with each project investing 500,000 to 5 million US dollars, the areas of interest include DAO, guilds, Web3 applications, games, etc. Currently, Web3 education platform Proof of Learn, NFT aggregator XY Finance, NFT financial platform Solv Finance and Web3 accelerator and developer community AllianceDAO have accepted it invest.

Newman Capital

On April 6, Stillmark, a venture capital arm of Alyse Killeen, plans to raise $500 million for the new fund "Stillmark Credit Fund", focusing on supporting investment in Bitcoin Lightning Network infrastructure.

Motus Capital

On April 8, Newman Capital, an alternative investment company, announced the launch of a $50 million investment fund. The new fund focuses on three key areas: technology investment, Web3 applications, and art and collections.

Hillstone Partners

On April 10, according to CoinDesk, Motus Capital, an encryption investment company jointly established by three former Citi executives, confirmed that the size of its encryption fund is around US$100 million. Motus Capital's growth fund and income fund are limited to qualified investors.

Investcorp Holdings

On April 11, Hillstone Finance's parent company, Hillstone Partners, announced that it will establish a joint venture in Dubai with Royal Strategic Partners (RSP), the UAE subsidiary of Abu Dhabi Capital Group (ADCG), and will set up a joint venture worth 1 trillion won (about 811 million U.S. dollars). ) joint fund, which mainly invests in NFT and metaverse fields.

On April 11, Bloomberg reported that Investcorp Holdings, an alternative asset management company in the Middle East, established a new fund aimed at investing in technology startups in the blockchain field. The fund, called eLydian Lion, will invest in blockchain infrastructure, trading platforms, DeFi and data analytics companies, among others. Investcorp did not disclose how much it plans to raise for the fund.

Ubisoft

On April 11, Ubisoft committed to invest $60 million in White Star Capital's second encryption fund. White Star Capital plans to raise $120 million for the fund. Other investors include family offices.

Fabric Ventures

On April 11, Fabric Ventures plans to stop the fundraising of its two funds, one of which focuses on investing in early-stage companies with a ceiling of 125 million euros (about 136 million US dollars); the other focuses on investing in the B round Subsequent funding rounds will be capped at 100 million euros (approximately $109 million). Fabric Ventures said the fund will support "founders who take the open economy from concept to scale." Fabric Ventures has previously invested in Sky Mavis, the parent company of Ledger, NEAR and Axie Infinity.

Fidelity Investments

Fidelity Investments

On April 12, Fidelity Investments (Fidelity Investments) announced the launch of two exchange-traded funds (ETFs) targeting the encryption industry and digital payments as well as the metaverse, namely "Crypto Industry and Digital Payments ETF" (FDIG) and "Fidelity Metaverse ETF” (FMET).

Pantera Capital

Among them, FDIG will provide opportunities to invest in companies that support the broader digital asset ecosystem, including companies involved in encrypted mining and trading, blockchain technology and digital payment processing, without directly investing in cryptocurrencies; FMET will provide Access opportunities for companies that develop, manufacture, distribute, or sell products or services related to building and the Metaverse.

On April 13, Pantera Capital’s first blockchain fund plans to stop fundraising in the next three to four months. The committed investment amount is about 1.3 billion US dollars, which has doubled the initial target of 600 million US dollars. . Pantera Capital said in an investor conference call that it plans to launch a second blockchain fund in 2023, still focusing on early-stage investment, token private placement financing, and venture capital institutions. Franklin Bi, Director of Portfolio Development at Pantera Capital, also said that a larger, more diversified growth-stage fund with a longer investment period may be launched in 2024.

Namco

Symphony Digital

On April 13, the Japanese game giant Namco announced the launch of the "Bandai Namco 021 Fund", which will invest in Japanese and overseas blockchain companies, as well as start-up companies engaged in Web3 and metaverse-related businesses, with a total investment scale of 30 billion yen (about 23.9 million U.S. dollars), and plans to invest 1 billion yen a year. The purpose of this fund is to expedite the decision-making process, build the IP metaverse and create new entertainment.

On April 15th, Symphony Digital, a digital asset investment platform serving institutions and family offices, completed the US$40 million fundraising of its first fund "Symphony Digital Opportunities Fund". Animoca Brands participated in the investment, aiming to generate income through DeFi. Provide enterprise-level digital asset services.

Before 2021, only Grayscale in the entire encryption industry acts as an intermediate channel for qualified investors and institutions to intervene in the Crypto market, realizing a weak connection between investors and encrypted assets, and opening up a channel for direct entry of incremental OTC funds .

Now, with the continuous launch of encrypted asset-related ETFs, and the rapid changes in the market's perception and attitude towards encrypted assets under continuous innovation (DeFi, Web3) and volume growth, the "institutional" attribute of the entire encryption industry is obviously increasing. One of the most direct manifestations is undoubtedly that the above-mentioned large-scale venture capital funds focusing on cryptocurrencies with a capital scale of hundreds of millions of dollars are being launched intensively.