Lesson sharing: How to build a low-budget portfolio?

Original author:The DeFi Edge

Compilation of the original text: The Way of DeFi

Original author:

Compilation of the original text: The Way of DeFi

If you invest wisely, cryptocurrencies can bring you life-changing wealth.

But if your budget is not much, how should you invest to get more benefits?

Next, I will introduce my game manual to the iron people, so that you can get the most out of even a small budget.

I will introduce the content below:

Wealth Growth and Preservation

Build a Low Budget Portfolio

Accumulate Airdrop

increase your income

written in front

Let's take a deeper look at how we do it!

written in front

In my opinion, most people should...

focus on increasing their income

reduce their expenses

Invest in blue chip cryptocurrencies with dollar cost averaging

Be patient and achieve your own small goals in 5-10 years

not invest in what they cannot afford to lose

This is the best path for 90% of people.

brutal truth

Gamblers in the currency circle will repeatedly go down the road of no return.

It's kind of like I have a little brother and I keep telling him he should avoid fights, but he's still looking for bullies around him.

Instead of watching him get the crap beaten by bullies, I might as well teach him how to fight.

How to maximize your wealth growth

Let's say you only have $3,000 to invest in cryptocurrencies, and you use it all to buy Bitcoin. Even if bitcoin has quintupled in price from when you bought it, that won't help you make enough life-changing money for most people.

You're figuring out how to make more money with a smaller budget.

When you have a smaller budget, you need to make some high-conviction bets on high-risk coins.

Here’s an investment framework for ironies:

Focus on growing your portfolio

Diversify to protect your portfolio

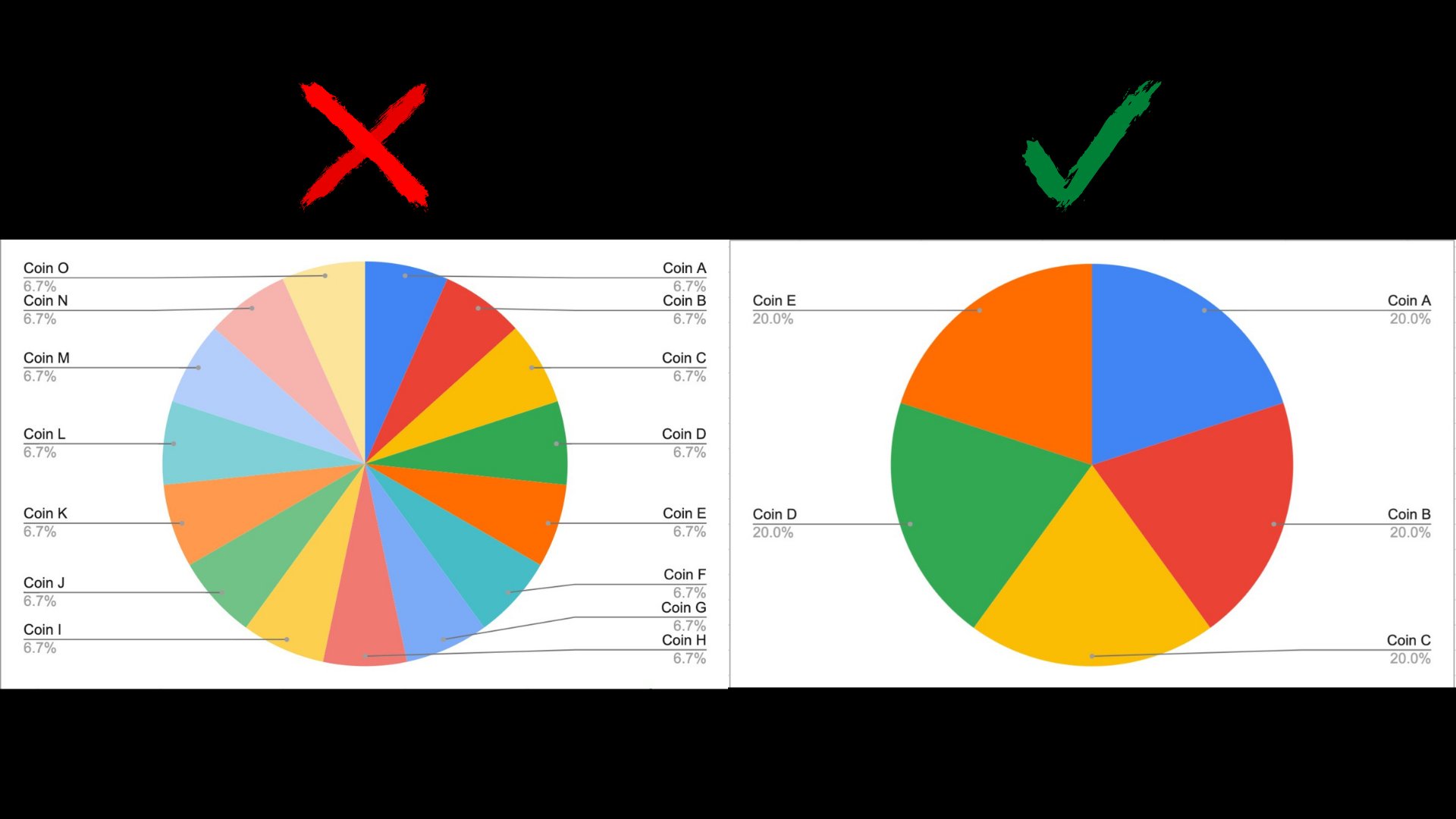

Since your portfolio is smaller, you should invest in fewer protocols.

The 5 stocks in Warren Buffett's portfolio make up 75% of his portfolio's total value.

Investing in 1~3 projects is too risky, because the project party running away or hacking will take away your income or even the principal at once.

I recommend ironies to invest in about 4-6 projects at the beginning.

Diversify your portfolio

You can start with a few cryptocurrency projects and hope that the value of the projects will grow so that you can make a profit. Later, your portfolio should become more diversified and balanced over time.

Because you don't want all your gains to be wiped out in one dip, right?

The Edgelord (March 22)

- ETH 15%

- BTC 15%

It's hard to create a "universal" portfolio, but here's my best attempt.

- Stablecoins 15%

- 30% for public chain projects.

- 25% for high-risk projects

Navigating the Next Wave of Narratives

Your goal is to anticipate the next narratives and try to navigate them.

Sol, Luna and Avax already skyrocketed? So, what is the next public chain project to explode?

Has DeFiKingdoms skyrocketed? So, what's the next GameFi game to hit?

Finding the right niche for yourself can help you take advantage of your next metagame and narrative.

Some ways to find gems

private group

Whale Watching Wallet

Focus on a sub-sector

Watch on-chain metrics like USD inflows

Some accounts focused on lower market capitalization currencies

Learn to use the incentive mechanism of the ecosystem to make compound profits

Find your strengths.

warn:

Project decision makers are great when a project is organic.

Beware of the kind of alpha you pay someone to recommend you:

You may become liquid capital for their exit.

You should learn to hunt your own alpha.

Try to build your own network and form your own strongest brain.

Finding Decentralized Applications (Dapps) in the Upcoming Ecosystem

This is a strategy I've used and I've had a lot of success with.

Find an emerging ecosystem whose Total Volume Locked (TVL) continues to grow:

Find the most reliable app

get on the bus as soon as possible

FTM -> Liquid Driver

Harmony -> DeFiKingdoms

Avax -> Wonderland

get profit

For example, in the last year:

Yes, I know that Wonderland is finally cool, but we need to realize that no one can hit it all, and risks can be seen everywhere.

The key is to take profits early.

Here's an example using LQDR:

Accumulate funds while things are still calm, but start to ferment or start publicity.

Position yourself and let the benefits come to you.

Don't chase profits, you may find out that you have been scammed, but it is too late.

But you might ask, "What if I don't have a time machine?"

I'd choose to go to @defillama and see how dapps perform. I'll take a good look at it from there and see which projects have the most potential.

team

When I look at a project, I usually pay attention to a few things:

Metrics

route map

Token Statistics

route map

their marketing

community atmosphere

their seed investors

ecosystem momentum

unique value proposition

Focus your attention on a niche market

For example:

You don't have enough budget to spread your investments. Instead, you need to focus on a sub-sector that you believe in.

For example:

Learn about @MetisDAO's system

Mastering @Avalancheavax on GameFi

You know your industry better than the other 99% of investors.

GameFi Arbitrage

Some people make tens of thousands of dollars a month playing AxieInfinity.

A friend of mine playing games like @defikingdoms and @playcrabada does that, he doesn't have much money but they have time. He uses these times to learn about mechanics and arbitrage different heroes and NFTs.

Because not many people understood the mechanism, there was market inefficiency at that time. He invested in a cheap hero and NFT, leveled it up, and sold it.

make sure you get a profit

Hope some of your bets pay off.

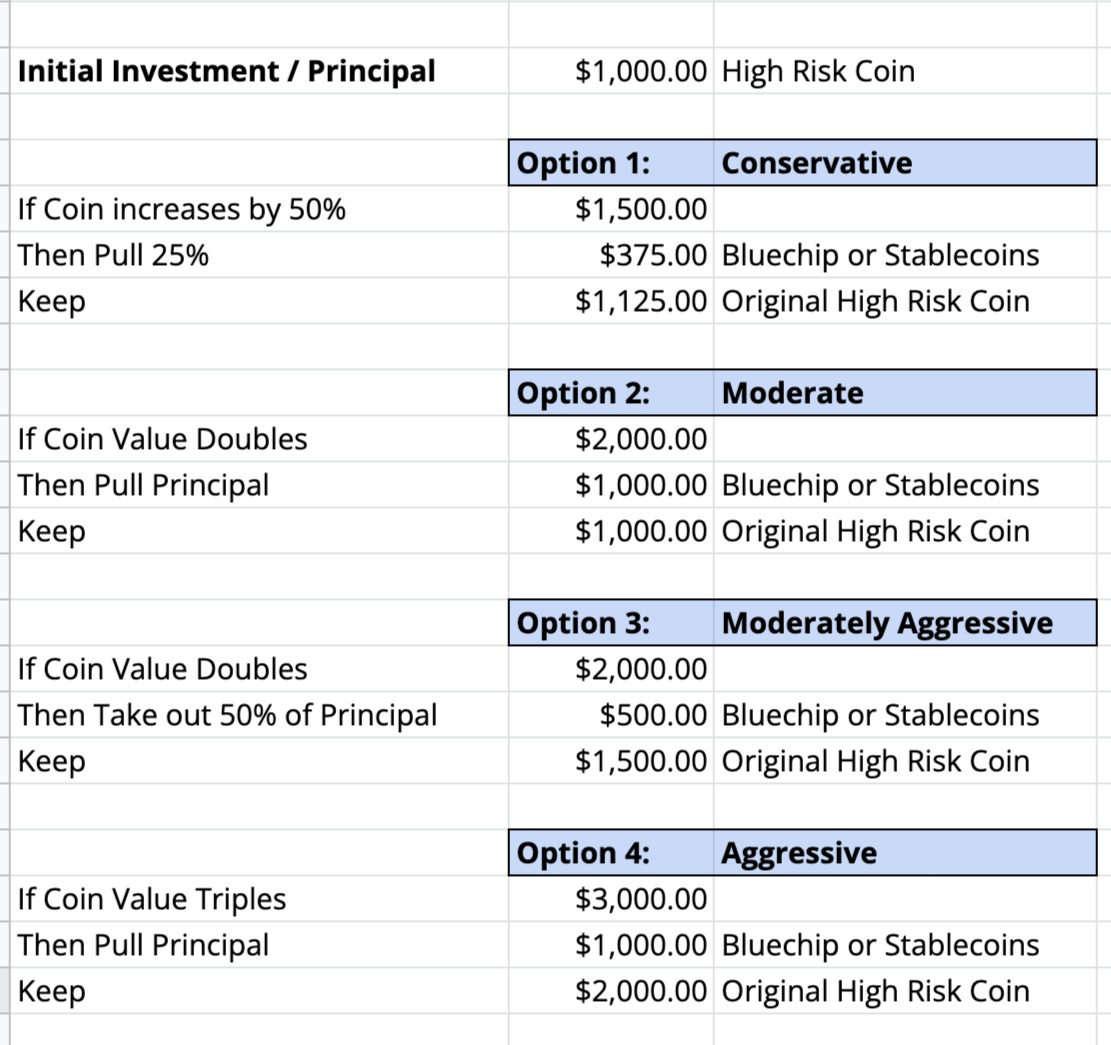

Take profits according to your risk tolerance.

Invest them in blue-chip cryptocurrencies or stablecoins to lock in your profits.

If you invest in a high-risk cryptocurrency with a starting capital of $1,000, then:

Option 1 (conservative): If the currency price rises by 50%, then sell 25% of the total position and exchange it for blue-chip cryptocurrency or stable currency, and keep the remaining currency;

Option 2 (moderate): If the price of the currency doubles, then sell all the proceeds to exchange for blue-chip cryptocurrency or stable currency, and keep the remaining currency;

Option 3 (appropriately aggressive): If the price of the currency doubles, then sell 50% of all proceeds to exchange for blue-chip cryptocurrency or stable currency, and keep the remaining currency;

Option 4 (radical): If the currency price rises by 3 times, then sell 50% of all proceeds to exchange for blue-chip cryptocurrency or stable currency, and keep the remaining currency;

chase airdrop

Sometimes the protocol distributes free tokens to users, a process we call an airdrop.

Why did the project party do this? In fact, this is a marketing strategy and a way for them to create topics.

Of course, the project party will only issue airdrops to addresses that meet certain parameters.

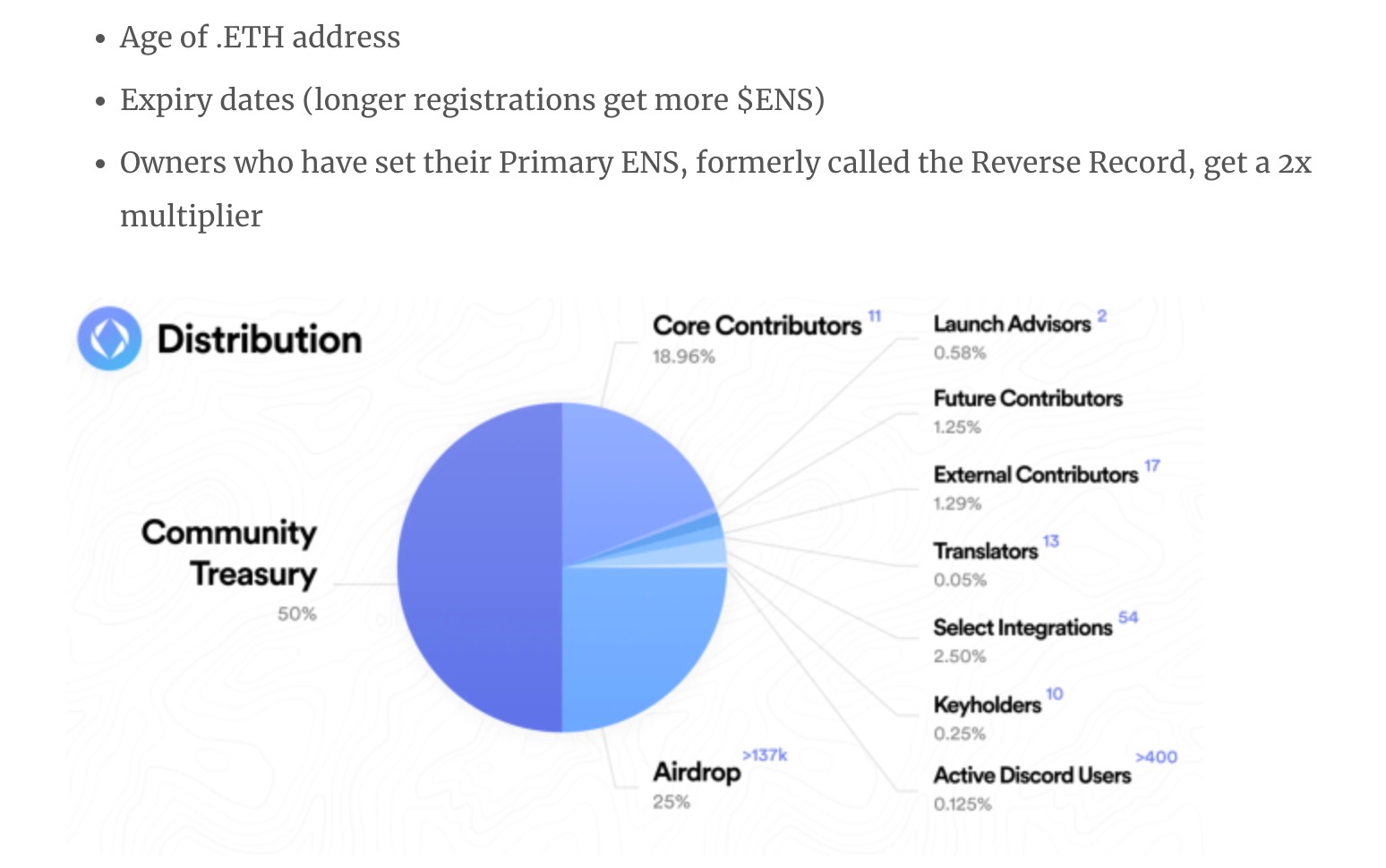

Here are two famous examples of airdrops:

Looksrare: A competitor to Opensea. They did an airdrop to users with more than 3 ETH trading volume on Opensea.

ENS: The project party airdrops to anyone who owns it. The person with the ETH address. The age of the address + a longer expiration time gets a higher amount.

Metamask

Arbitrum

Some people got airdrops worth 5 or even 6 figures as a result.

People are expecting two big airdrops this year:

If I had to guess, using Metamask's wallet alone won't get you the airdrop. They may focus on users using the in-wallet swap functionality.

The Cosmos ecosystem is full of airdrops

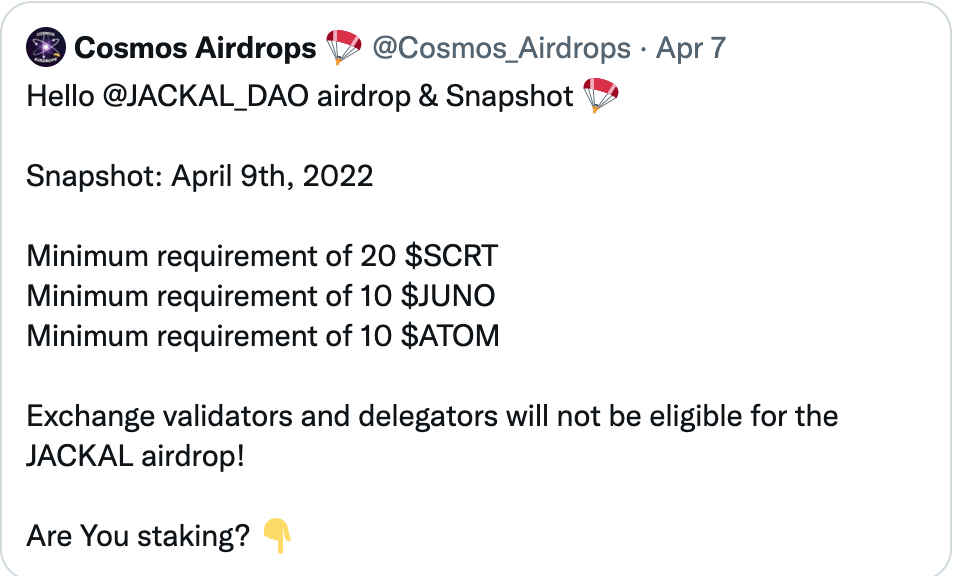

Now there is an ecosystem that has a lot of airdrops, and that is Cosmos.

You can follow them through twitter accounts like @Cosmos_Airdrops

You look at some of the requirements for the airdrop and you see a pattern.

Hello @JACKAL_DAO airdrop and snapshot

Snapshot: April 9, 2022

Minimum requirement is 20 CRTs

A minimum of 10 JUNOs is required

Minimum requirement is 10 ATOMs

Exchange verification nodes and delegators will not be eligible to participate in the JACKAL airdrop!

Are you staking?

warn:

Some perpetrators are using airdrops as a way of scamming and phishing:

They airdrop fake tokens

They try to get you to a fake phishing site

Do your due diligence on airdrop tokens, and whenever there is an airdrop, go to the official website to see if they are legitimate.

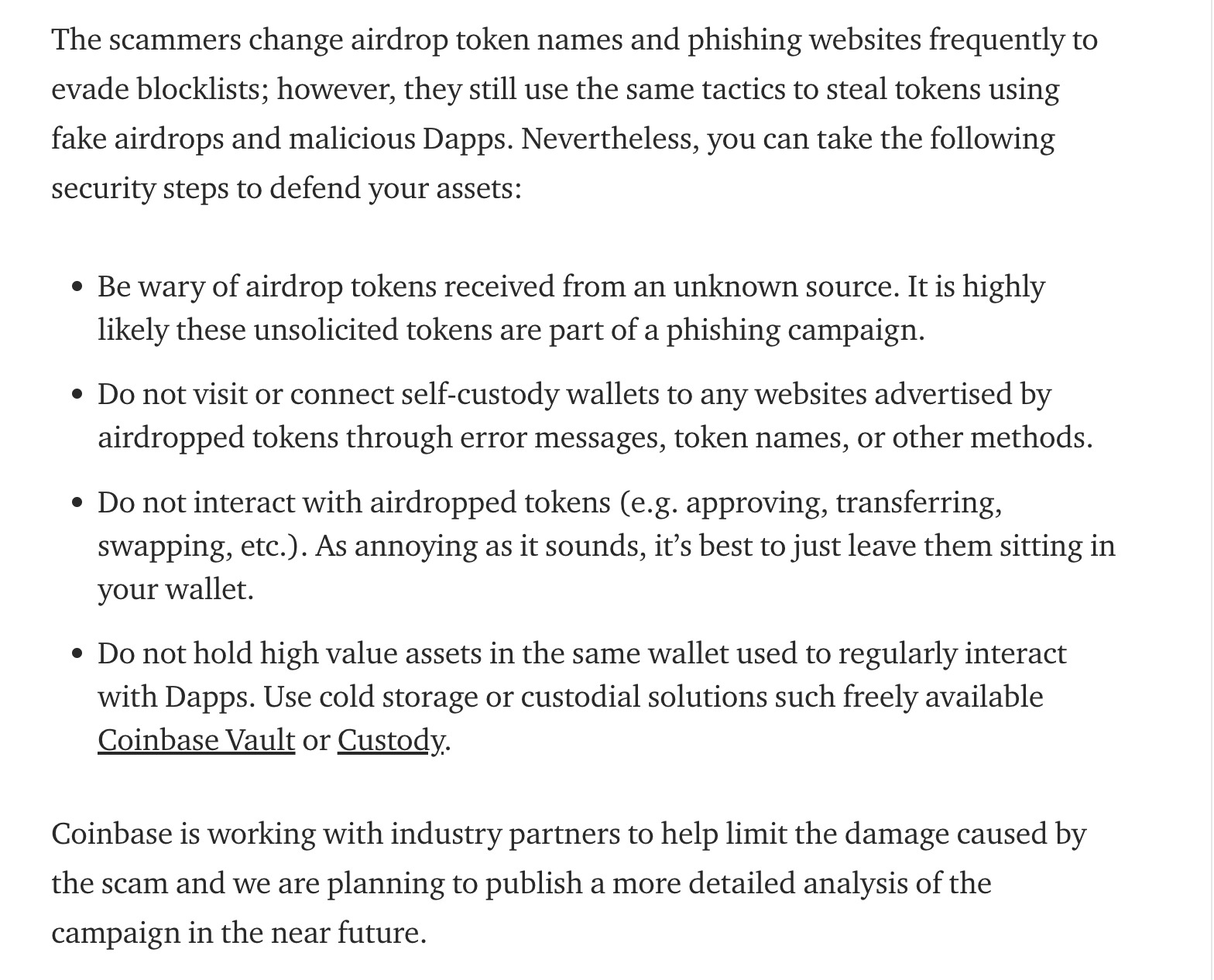

Scammers often change the names of airdrop tokens and phishing sites to evade blocklists; however, they still use the same tactics of using fake airdrops and malicious dApps to steal tokens. Nonetheless, you can take the following security steps to protect your assets:

Be wary of airdrop tokens received from unknown sources. These unsolicited tokens are most likely part of a phishing campaign.

Do not visit or connect self-custodial wallets to any website that is advertised by airdropped tokens through misinformation, token names, or otherwise.

Do not interact (e.g. approve, transfer, swap, etc.) with airdropped tokens. While this sounds annoying, it is best to keep these coins in your wallet.

Do not keep high-value assets in the same wallet that you use to interact with dapps on a regular basis. Use cold storage or a custodial solution like Coinbase Vault or Custody, which are freely available.

Coinbase is working with industry partners to help limit losses from this scam, and we plan to publish a more detailed analysis of the campaign in the near future.

lower your fees

If you are using Coinbase, using Coinbase Pro will give you cheaper fees.

If you are on Binance, holding BNB tokens can lower your transaction fees.

Want to bridge or swap tokens? You need to do your research to find the cheapest way

Remember, every penny you save is every penny you earn.

Money is my army, every dollar is a soldier of mine. I never again put my money into battle without any preparation or any defensive strategy. I send them to siege, send them to money prisons and eventually get them all back.

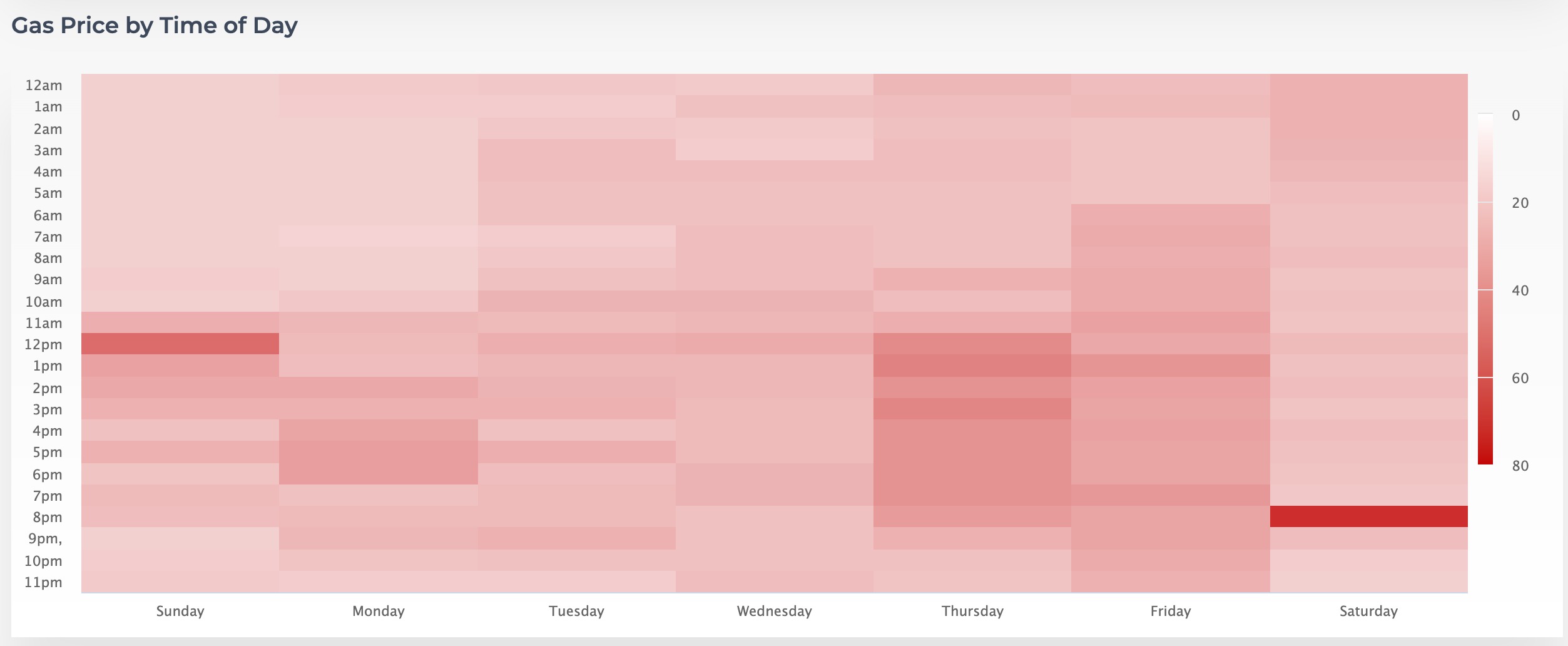

Lower your gas costs

Gas fees change at different times of the day, and different days of the week.

Think about it, it's like you're driving on a highway, often facing rush hour.

If you need to make a transaction, do it during off-peak hours.

Using DeFi in a cheaper ecosystem

If you're new, using an ecosystem like Fantom will be easier on your budget. Transaction fees here are only pennies, and trying to use DeFi on the Ethereum mainnet will kill your budget.

Improve your off-site earning power

I cannot stress this enough - find ways to earn more income.

Let's say your goal is $1 million in cryptocurrency. It's much easier to have $100,000 in your hand and get a 10x portfolio.

If you start with $1k, then you need to try to get to $1 million with 1000x trades.

If you already have a good job, negotiate for a higher salary, or move to a better paying job.

Or try creating a second income stream.

Keep buying cryptocurrencies consistently.

You want to buy the bottom when it plummets,

But you have very little money, and inflation is killing your disposable income.

Here's a 2022 playbook for online side hustles.

(Don't worry, I won't sell you anything)

Capture short time windows for asymmetric bets

Right now is a golden age for cryptocurrencies, and there is a short window. Regulation will eventually come and things will get more difficult.

Learn to stay focused.

Learn to delay gratification.

If you play this game well, then you can completely lie and win in the next few days.

Maybe you will ask, "brother, can you recommend me some small cap coins?"

My answer is, "no".

My current total assets are too large, and I can freely adjust the price of small-cap coins with a little investment.

I'll be accused of selling my tokens

Whales/bots also buy and dump from you

This is a no-win situation for me, and I'd rather teach you how to find the gems yourself.

Share a learning curve with you

Rarely have I seen someone achieve financial success in their first cycle.

They usually don't start to enter the state until after 2-3 cycles.

You're going to make mistakes every cycle, it's part of the process.

You need to learn from it and upgrade your mental trading system.

Why do people fail?

cognitive bias/emotion

Take the advice of the wrong people

Think something is alpha, but it's not

Everyone Thinks They're a Better Investor Than Theyself

Summarize

Trading is difficult.

Summarize

Avoid FOMO

Airdrops can be profitable

Focus on growing your wealth

lock a sub-sector