Overview of Sequoia’s crypto investment landscape: a total of 68 investments, and the layout has accelerated significantly

Written by: Karen

Written by: Karen

"Betting on the track is more important than betting on the racer", this is a brilliant summary of the investment style of Sequoia Capital and its founder Don Valentine.

As one of the oldest and most successful top venture capital firms in Silicon Valley, Sequoia Capital has overwhelmed Atari, Cisco, Yahoo, Google, Oracle, Nvidia, PayPal, LinkedIn, Stripe, YouTube, Instagram and other Internet and The brightest company in fintech.

In recent years, with the rapid development of the encryption field and the competition of traditional institutional giants, the attention to the encryption field has further increased. A new disruptive era may be slowly unfolding. At the same time, Sequoia Capital's strategy for this field has also changed from "early water testing" to "full embrace", and began to follow in the footsteps of Andreessen Horowitz (a16z) to bet heavily on the cryptocurrency field, including but not limited to investing in encryption companies, abandoning The 10-year cycle radically adjusts the fund structure, applies to become a registered investment advisor (IRA), launches hundreds of millions of dollars in encryption funds, releases NFT, etc. The recently popular Move-to-Earn game STEPN is co-invested by Sequoia Capital India.

This article will dismantle the layout matrix of Sequoia Capital and its entities in Europe, America, China, and India in the encryption field (including the Metaverse), and summarize the 68 projects or companies invested by these three entities in the encryption field.

These three entities have roughly the same number of investments in this field, all in the early 20s. Among them, Sequoia Capital India has significantly accelerated its layout this year, investing in Polygon, STEPN, the electronic signature protocol EthSign, and IndiGG, a subsidiary of YGG India. 11 projects, including the key infrastructure solution Web3Auth, the Polygon-based P2E game Ethlas, and the Flow-based cricket NFT market FanCraze, accounted for more than half of the entity's total number of crypto investments (21 deals). Sequoia Capital (Europe and the United States) has also accelerated its pace. This year, it has invested in EthSign, Solana's ecological NFT market Magic Eden, and LayerZero Labs, a full-chain interoperability protocol. Of Sequoia Capital China’s four investments in the crypto space this year, two are metaverse infrastructure companies.

In addition, Sequoia Capital and Sequoia India entities are relatively scattered in terms of investment categories, with investments in games, metaverse, cross-chain, trading platforms, NFT, DeFi, Web3, public chains, security, domain names, expansion, wallets, and storage. For dabbling, Sequoia China is relatively more focused on the underlying infrastructure.

In terms of DeFi and game investment, Sequoia has also begun to focus on projects on Solana. Among them, Sequoia Capital invested in the social blockchain game Faraway Games and the NFT market Magic Eden, and Sequoia India invested in games based on the Solana ecosystem STEPN, Blockchain browser and data analysis platform Solscan and Socean Finance, Sequoia China invested in the decentralized exchange protocol and wallet on Solana. In addition, Sequoia Capital and Sequoia India also put a small amount of attention on projects on Flow, Cosmos, Parallel Finance and Arbitrum.

Sequoia Profile and Architecture

Sequoia Capital is a venture capital firm founded in 1972 by Don Valentine (Don Valentine), the father of venture capital in Silicon Valley. Less than two years. The name "Sequoia" is Don Valentine's hope that the company can flourish and thrive like a redwood tree.

Don Valentine used Sequoia's first $3 million fund to invest in established game companies Atari and Apple, and typical investment cases later include Cisco, Google, Instagram, Airbnb, Stripe, and Yahoo. Although Don Valentine handed over control of the company to Doug Leone and Michael Moritz in 1997, his investment philosophy of "track racers are more important" and "value investing" had a huge impact on Sequoia and many investors. continues to this day.

While Sequoia has made a lot of money, the brilliant achievements of the invested companies are also obvious to all. In addition, according to Sequoia statistics, start-up companies that raised seed round financing through Sequoia are 4 times more likely to successfully raise Series A financing, and 99% of companies that received seed round financing from Sequoia in the past ten years are still operating or Acquired, Sequoia-backed Seed and Series A companies average about 2x higher valuations at the time of their next funding round.

Sequoia Capital currently has business entities in Europe, America, China, and India, in addition to Sequoia Capital Global Equities (SCGE) and Heritage Fund.

In 2012, after Michael Moritz resigned from his day-to-day duties, Doug Leone became the sole head of Sequoia. Earlier this month, Sequoia Capital announced that Doug Leone would resign as a senior steward and executive partner. Managing Partner Roelof Botha took over on July 5th. Doug Leone previously led investments in companies such as YouTube, 23andMe, MongoDB, Natera, Square and Unity.

In addition, Shen Nanpeng will continue to be in charge of the China business as the global executive partner and the founding and executive partner of Sequoia China. In addition, each Sequoia entity will continue to be led by a local managing partner, with Roelof Botha continuing to lead Sequoia's US/European entities and Shailendra Singh leading Sequoia's India operations.

Sequoia's Encryption Layout Matrix

Last October was a key turning point for Sequoia Capital. Sequoiaannouncedannounced

Fund structure adjustment, for its US and European businesses, abandon the 10-year fund cycle model of the venture capital industry, and reorganize into The Sequoia Capital Fund. This means that the fund’s investment in the company will no longer have a maturity date, and it will no longer be forced to end the relationship with the company due to the 10-year cycle mechanism, so that Sequoia can establish a longer-term deep relationship with these companies. You can also join the board of directors of the invested company to help the company develop better.

In addition, in order to increase the flexibility and flexibility of investment activities, Sequoia Capital also applied to transform into a registered investment advisor (RIA) like a16z, including the secondary market or initial public offering. In January this year, Sequoia Capital was approved by the US Securities and Exchange Commission to register as an investment advisory firm.

The transformed Sequoia Capital can then get rid of the 20% investment scale limit that is considered by the US Securities and Exchange Commission to be a high-risk investment field, and can increase investment in emerging asset classes to a greater extent, such as cryptocurrencies and seed investment programs.

Sequoia launches crypto-only fund

Sequoia Capital Partner Shaun Maguire is accepting The Block'sthe interviewthe interview

Shi said that the investment flexibility of Sequoia Crypto Fund is relatively high, and it will mainly invest in liquid tokens, including tokens listed on cryptocurrency exchanges and tokens that have not yet been listed. The investment scale of a single project is between 100,000 and 50 million US dollars , and plans to participate in processes ranging from staking to providing liquidity to governance.

In addition to the cryptocurrency sub-fund, Sequoia Capital will continue to invest in cryptocurrency startups through its primary seed fund, venture fund, growth fund and expansion fund, which have a total capital commitment of more than $7.5 billion.

Next, we summarized the investment projects of the three entities of Sequoia in the field of cryptocurrency through official channels, Crunchbase, CB Insights, IT Juzi, Qichacha and other public information.

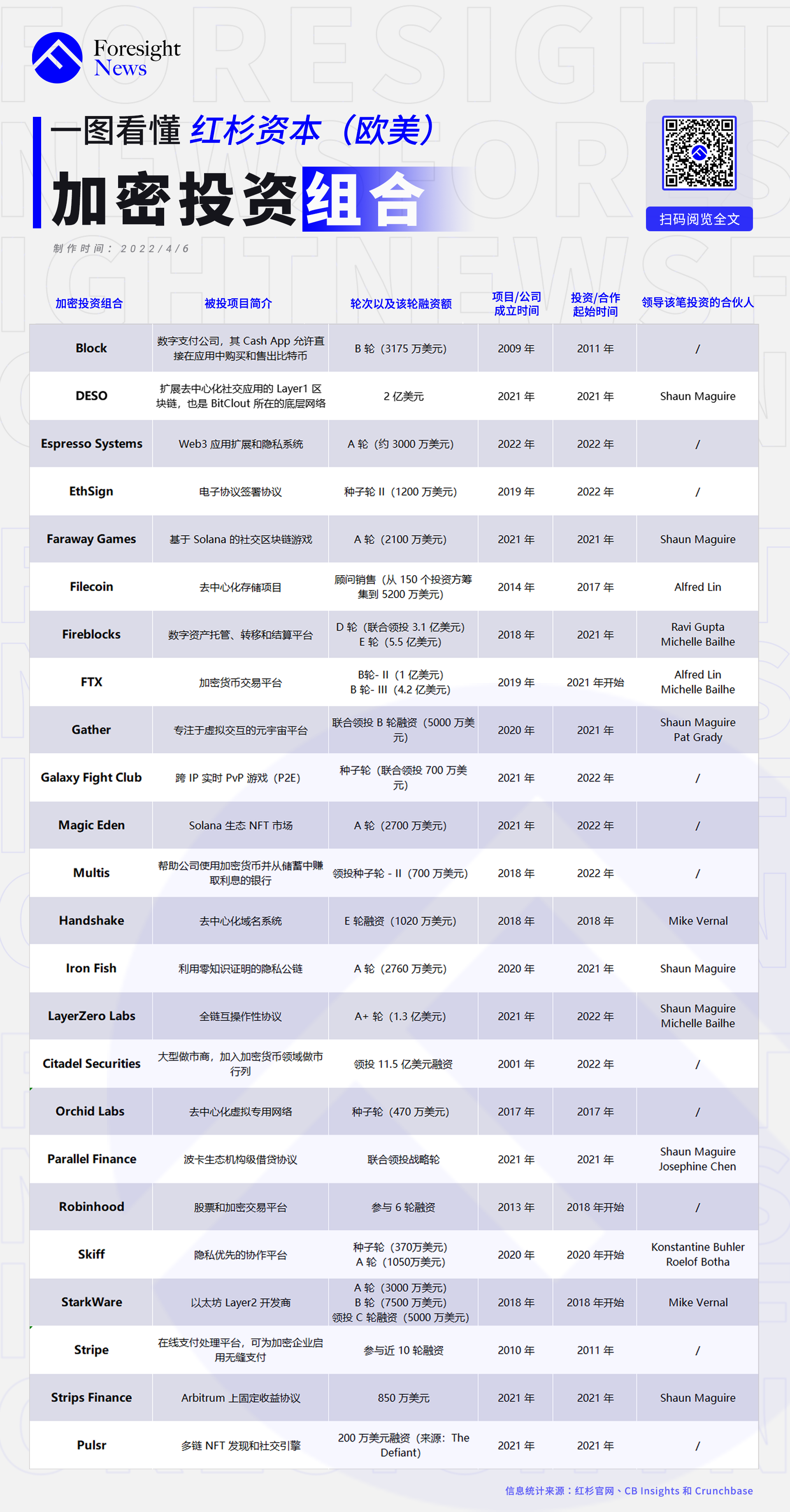

Sequoia Capital (Europe and America)

In the investment classification on Sequoia Capital’s official website, the “Encryption” category is specially set up. Currently, there are 12 selected encrypted investment portfolios published on the official website, including DESO, the underlying Layer1 blockchain where BitClout is located, and Solana-based multi-person investment portfolios. Game projects Faraway Games, Filecoin, Fireblocks, FTX, domain name system Handshake, privacy public chain Iron Fish, LayerZero, Parallel Finance, privacy collaboration platform Skiff, StarkWare, Strip Finance.

Sources of information and statistics: Sequoia official website, CB Insights and Crunchbase

According to incomplete statistics, Sequoia Capital has invested in a total of 25 projects in the encryption field. Among them, the five encryption investments made public in March this year include Web3 application expansion and privacy system Espresso Systems, electronic agreement signing agreement EthSign, Solana ecological NFT market Magic Eden, Skiff, a collaboration platform with limited privacy, and LayerZero, a full-chain interoperability protocol, have completed a total of 7 investments in the encryption field this year.

Leaving aside Block, Robinhood, Citadel Securities and Stripe, Sequoia Capital first began to test the water encryption field in 2017, when Filecoin raised $52 million from 150 investors through an advisory sale (a single token price of $0.75) , the highest increase once reached 313 times, and the increase was more than 30 times based on the current price. The current fully diluted valuation of Filecoin has reached 48 billion US dollars.

Of course, after Sequoia Capital discovers investment targets with better potential, it will also add multiple rounds of investment. The round directly led the financing of US$50 million. Also making additional investments are digital asset custody, transfer and settlement platform Fireblocks, mainstream encrypted trading platform FTX, and privacy collaboration platform Skiff.

In addition, Sequoia Capital also (jointly) led the investment in Metaverse platform Gather, Fireblocks, game Galaxy Fight Club, encrypted savings project Multis, Polkadot ecological lending project Parallel Finance, and StarkWare.

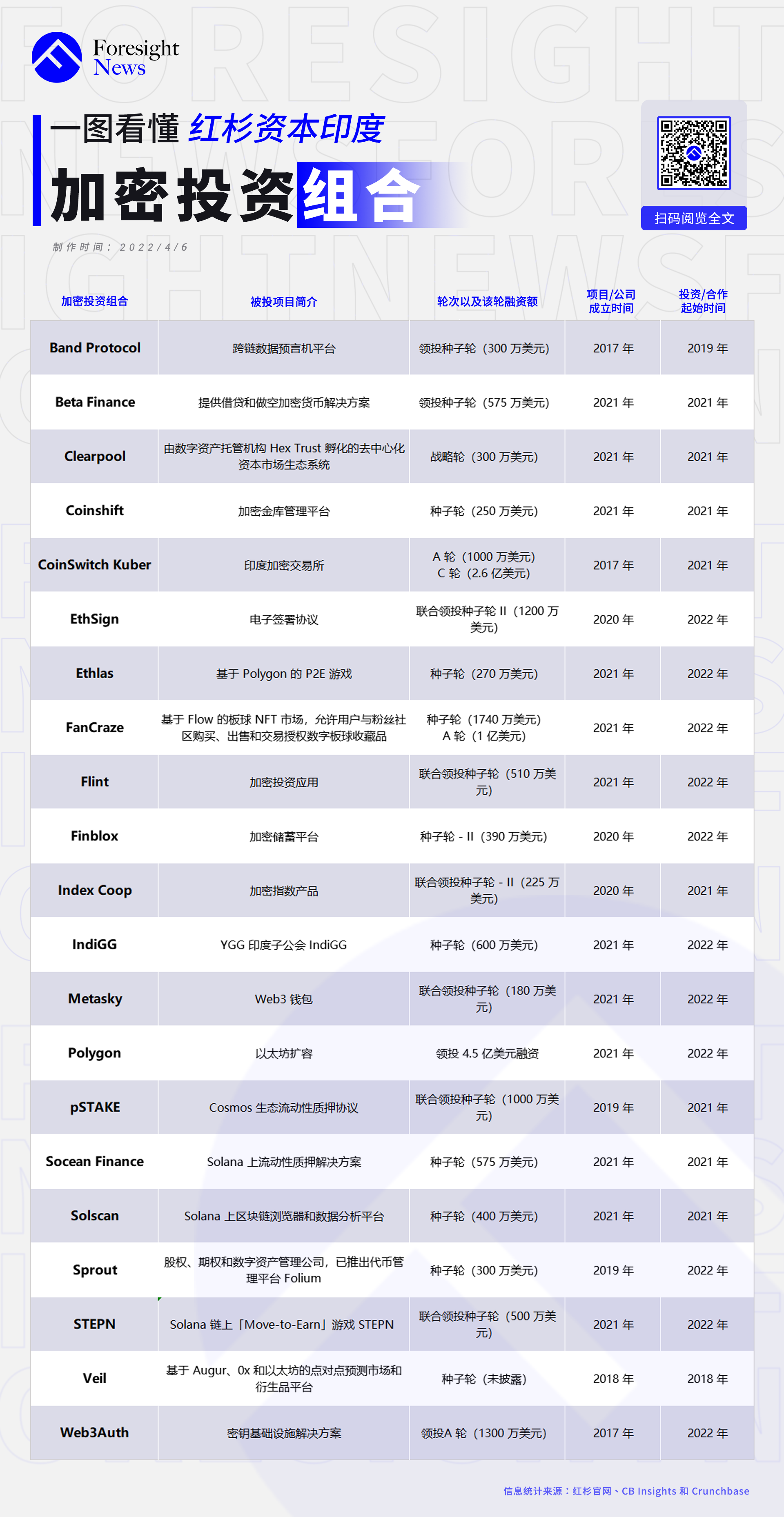

Sequoia Capital India

According to Crunchbase statistics, Sequoia Capital India raised a total of 3 billion US dollars through 8 funds, with 557 investments. Combining CB Insights and Crunchbase data, Sequoia Capital India has 21 investments in the field of encryption, of which 11 were invested in this year alone, and 5 of the 11 investments made public in March were investments in the field of cryptocurrencies. It can be seen that Sequoia Capital India's deployment in this field has been significantly accelerated.

image description

Sources of information and statistics: Sequoia official website, CB Insights and Crunchbase

Among these investments, Sequoia Capital India conducted two rounds of investment in Indian crypto exchange CoinSwitch Kuber and Flow-based cricket NFT marketplace, leading (or co-leading) projects including Band Protocol, Beta Finance, EthSign, Polygon , pSTAKE and STEPN etc.

Among them, Sequoia Capital India has achieved huge (potential) returns in its investment in STEPN. Currently, GMT has nearly 250 times the increase compared to the IEO price ($0.01).

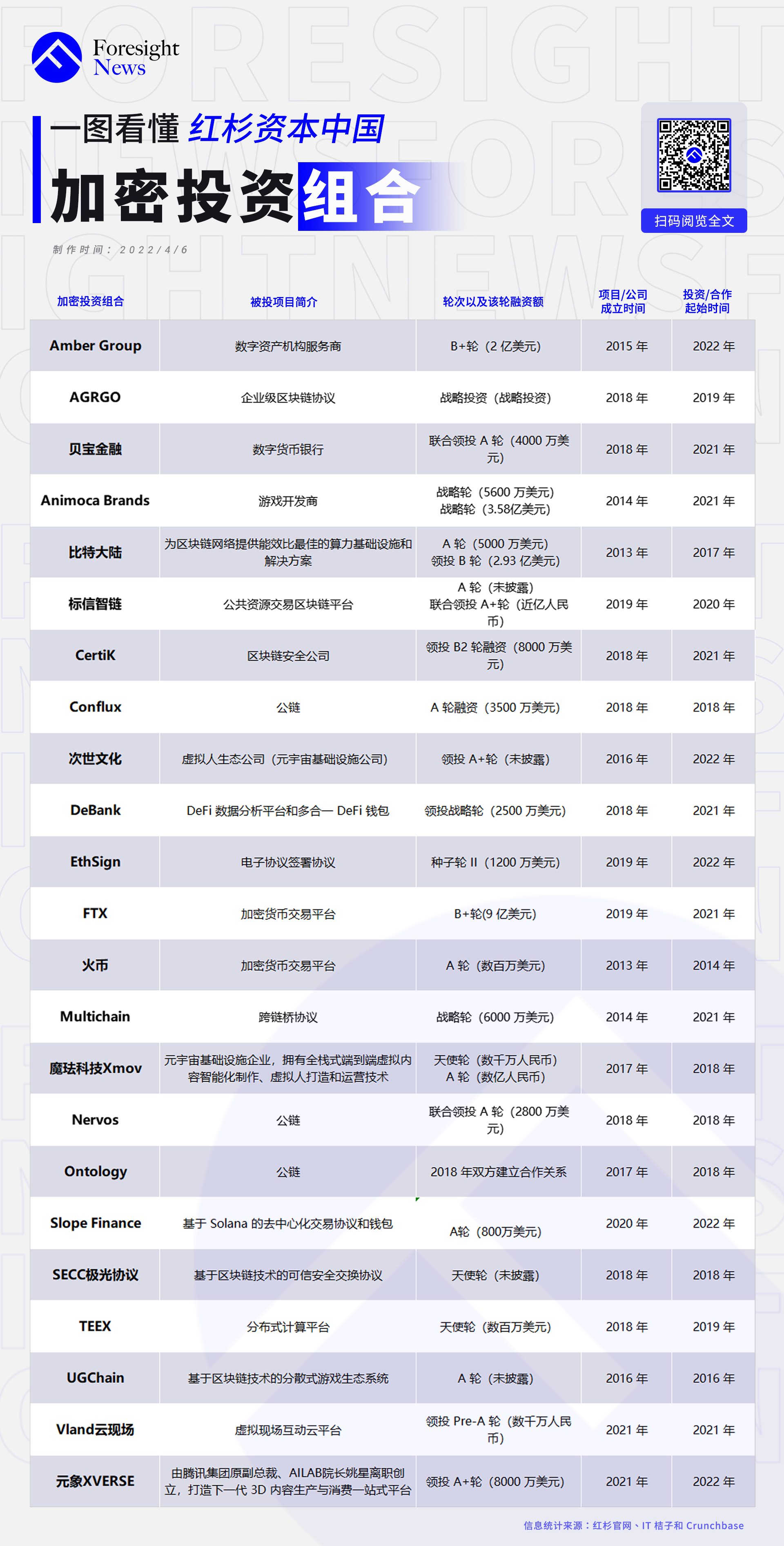

Established in 2005, Sequoia Capital China has invested in hundreds of companies and projects in different fields, including Alibaba, JD.com, Vipshop, Meituan Dianping, and NIO. In November last year, when Shen Nanpeng accepted an exclusive interview with LatePostexpressexpress

, Artificial intelligence, high-end manufacturing, medical health and other deep technology and hard technology fields have exceeded 80% of Sequoia China's investment portfolio.

Sequoia Capital China also invested this year in two metaverse infrastructure companies, Next Generation Culture and Yuanxiang XVERSE. Among them, Yuanxiang XVERSE was founded by Yao Xing, the former vice president of Tencent Group and the dean of AILAB, aiming to build the next generation A one-stop platform for 3D content production and consumption.

Sources of information and statistics: Sequoia official website, IT Orange and Crunchbase

summary

Shaun Maguire said

If starting to invest in encryption projects is Sequoia’s test of the encryption field, then adjusting the fund structure and launching an encryption-specific fund is definitely a sign of Sequoia Capital’s full embrace of the encryption field.