Bankless: Ethereum may become the first profitable blockchain

Author: Lucas Campbell

Compilation of the original text: The Way of DeFi

Author: Lucas Campbell

Compilation of the original text: The Way of DeFi

Profit = Total Revenue - Total Expenses

Some people think this formula doesn't apply to blockchains. "Blockchains are not businesses - they have no profit margins"

I think this is wrong.

The profit formula applies to blockchains as it does to households, Fortune 500 companies, nonprofits, and nation-states.

To be sustainable in the long run, the network must sell more than it consumes.

But what does blockchain sell?

Blockchain sells blocks! This is income.

How Much Does Blockchain Cost? safety! Issuance and Transaction Fees.

But here's a dirty little secret: Blockchains are bleeding money. None are profitable. At current levels of security, none are sustainable.

But for the first time in crypto history, a chain is about to become profitable. And not just a little profit. Instead, make a fortune.

The author of this article, Lucas, digs into the data to show us.

Blockchain business model

The first profitable blockchain

Blockchain business model

The value of the dollar benefits from the dominance of American hegemony.

The Visa Network is valuable because it serves as the rails of the financial system connecting billions of economic participants. The problem, as crypto-natives understand it, is that they are not “safe” in a sociopolitical sense. These centralized institutions provide the “settlement” layer, but at the end of the day, the settlement layer is controlled by a centralized institution, be it a government or a company.

Blockchain offers a neutral alternative. The business of the blockchain is to act as a secure settlement layer for value while remaining neutral through decentralization. Blockchains do this by selling blocks, which settle a limited number of transactions in each block at certain time intervals. For example:

Bitcoin sells blocks that can hold 1 MB transactions every 10 minutes.

Ethereum sells blocks every 15 seconds and can accommodate 80 KB transactions (equivalent to 4 MB every 10 minutes).

Blocks process transactions and facilitate the economic activity of users. This can include sending and receiving funds, exchanging tokens, taking out loans, collecting digital items, and anything else of value that can be programmed.

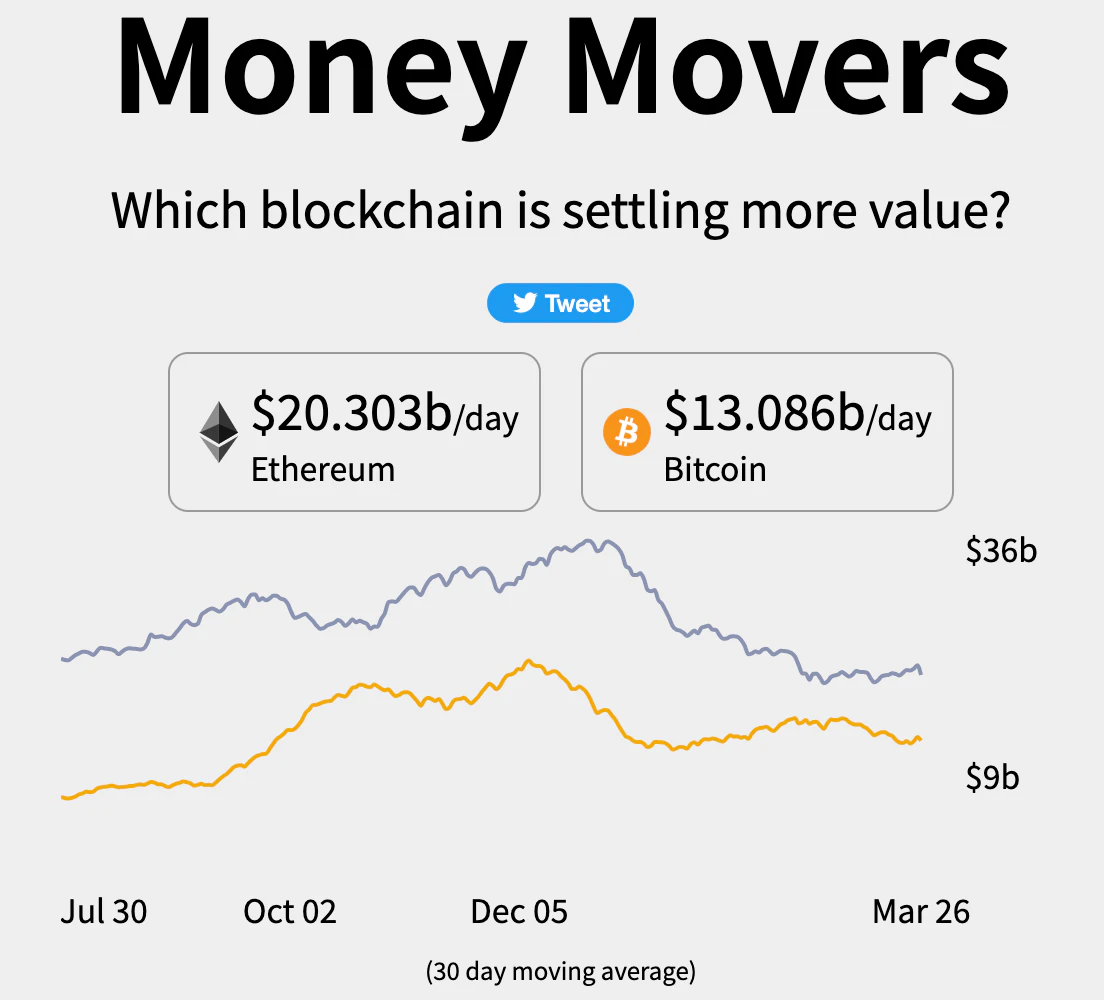

A weaker blockchain means transactions can be reversed or censored by malicious/attacking entities. Therefore, insecure networks are not viable settlement layers for value, especially at the scale at which they process tens of billions of dollars per day.

source:Money Movers

image description

source:

The more secure a blockchain is, the more confidence others have in settling transactions, driving demand for block space. Being a secure blockchain is a fundamental priority if the blockchain is going to be a global settlement layer.

But for security, the blockchain needs to pay for it. To do this, a blockchain incentivizes a group of participants to allocate resources—usually in the form of computing power (PoW) or money (PoS)—to the network by issuing tokens to keep it safe and secure from attack.

This makes security a major cost of blockchain.

Here, we can derive the core business model of the public blockchain. Blockchains earn revenue from transaction fees, while their costs are what they pay for security through issuance. simply put:

Net Profit = Transaction Fees (USD) - Issuance (USD)

Therefore, we can analyze "successful blockchain businesses" by looking at the amount they spend securing the blockchain versus the amount of revenue they bring in through transaction fees. If blockchains pay more for security than they bring in, they run a deficit.

“L1 economy. Every L1 chain needs to be secured. It costs money.

You pay for protection in two ways.

1) Inflate your money supply

2) Taxation of block space sales

If your inflation costs exceed your tax revenue, you're at a loss. Deficits are unsustainable. "

One of the things you can do as a crypto investor is find the most profitable blockchain business and invest in it. The best blockchain sells its blocks for the greatest value because people are willing to pay for it, which means it has a product-market-fit settlement layer.

People are willing to pay thousands of dollars for an iPhone because they believe it is a product superior to the alternatives. Last year, the iPhone accounted for less than 40% of global smartphone revenue but more than 75% of profits.

The same is true for blockchain. Entities are willing to pay higher transaction fees for a block as long as the block provides the best product (secure economic opportunity).

The question we should be asking - who is the Apple of blockchain?

Which blockchains are profitable?

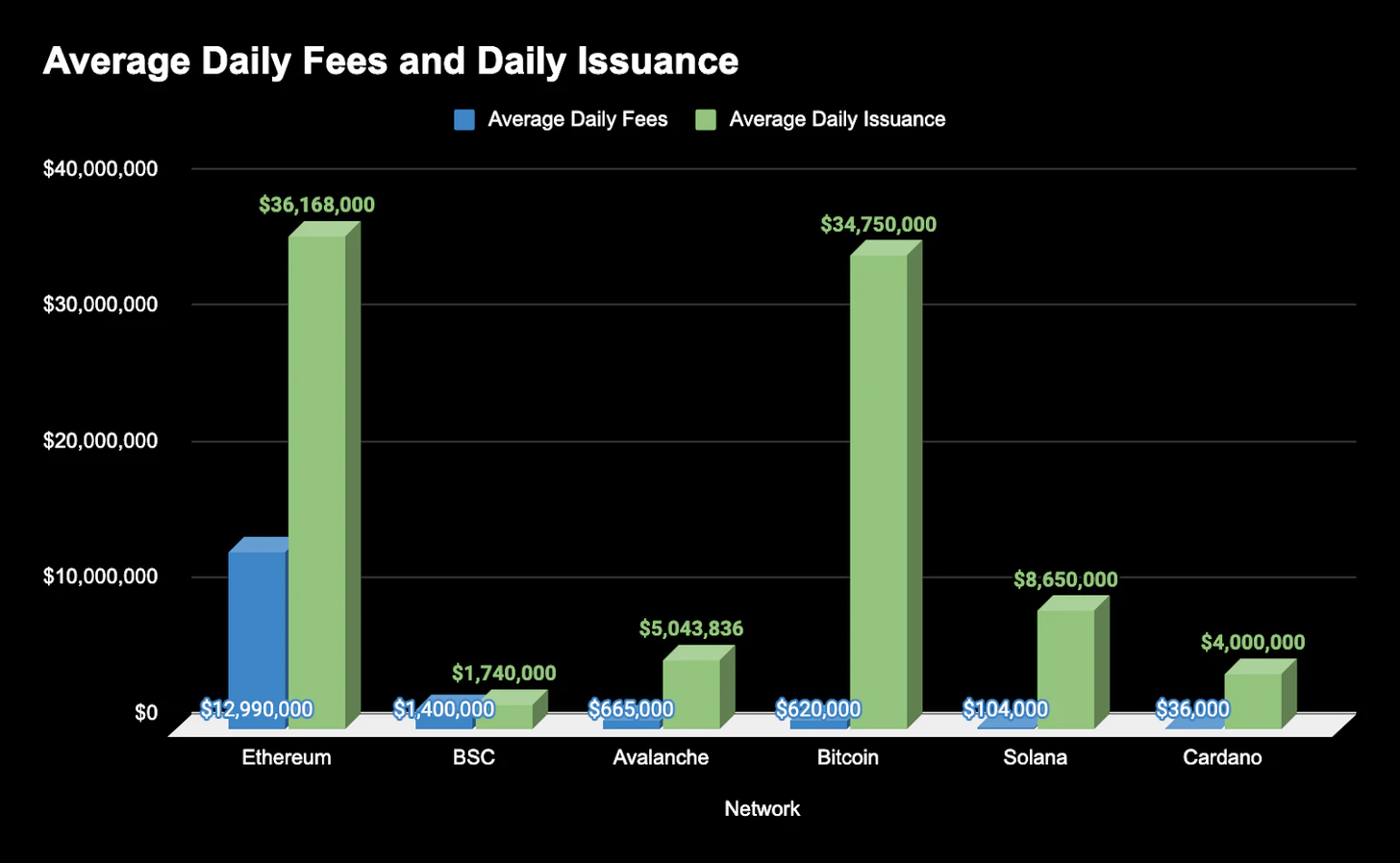

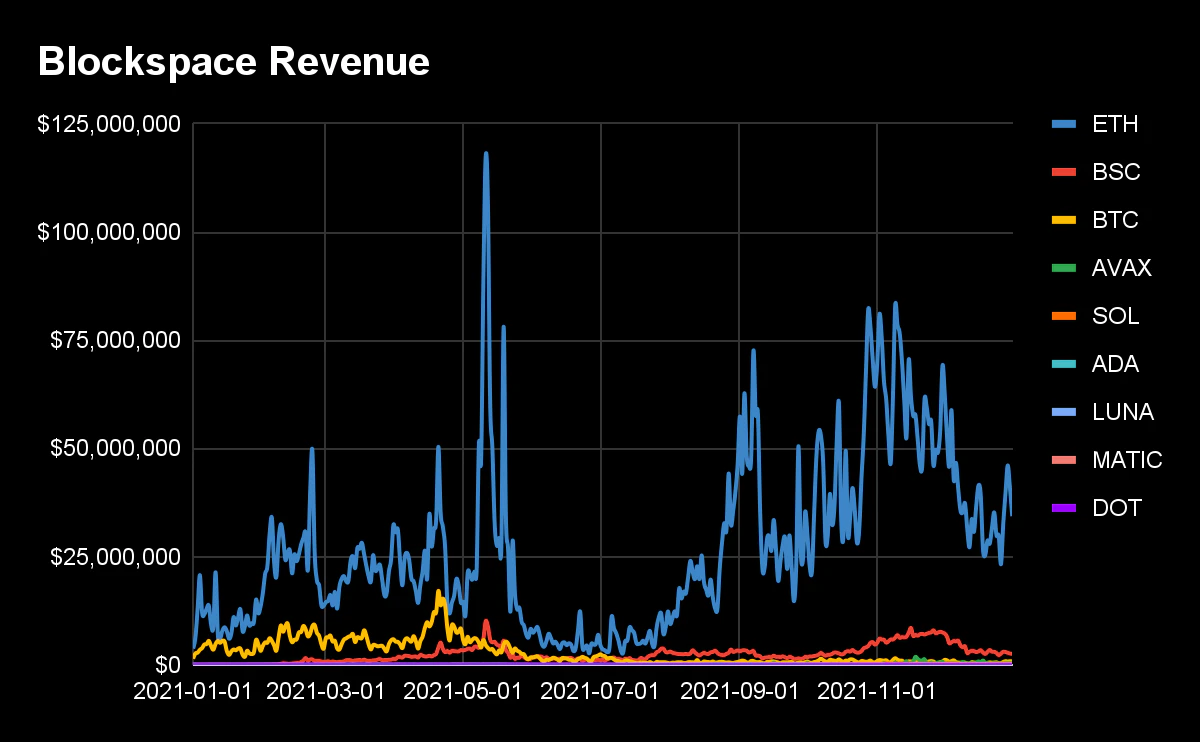

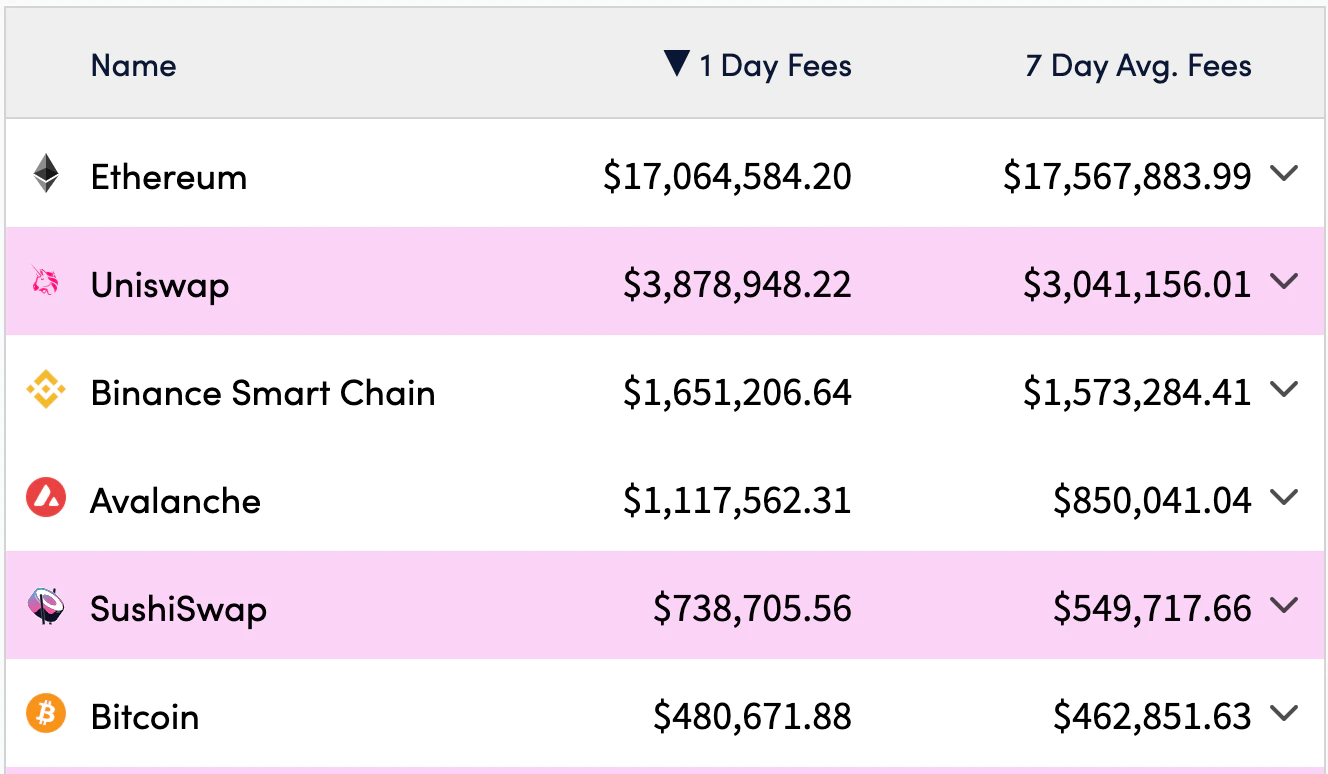

You can see this in the image below.

Data Sources:CryptoFees&MoneyPrinter

Data Sources:

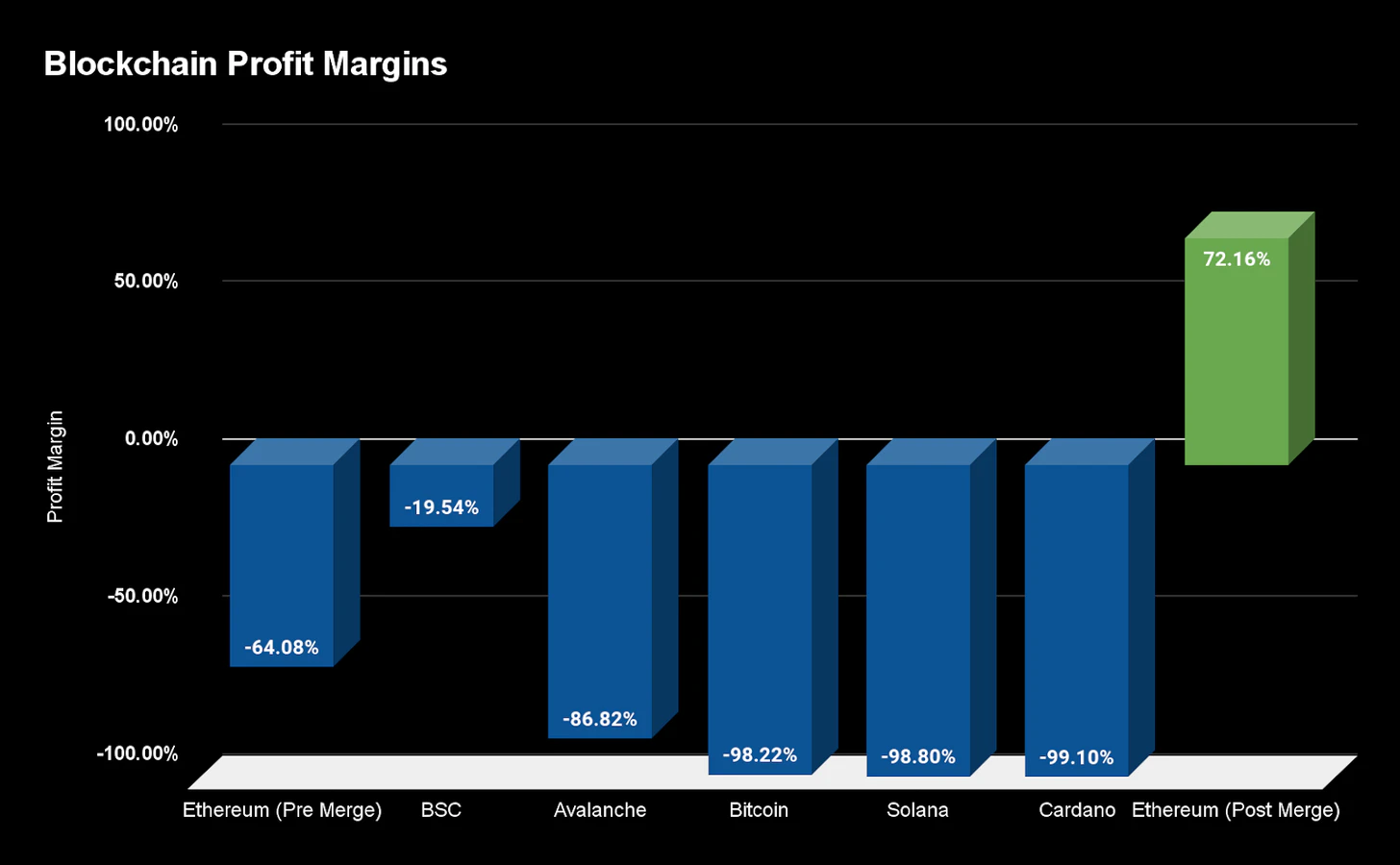

Ethereum brings in nearly $13 million in transaction fees per day, making it the most valuable blockchain by this metric. On the other hand, however, the network distributes $36 million in ETH to miners every day in order to generate these blocks. As a result, Ethereum currently has an operating loss of -64%.

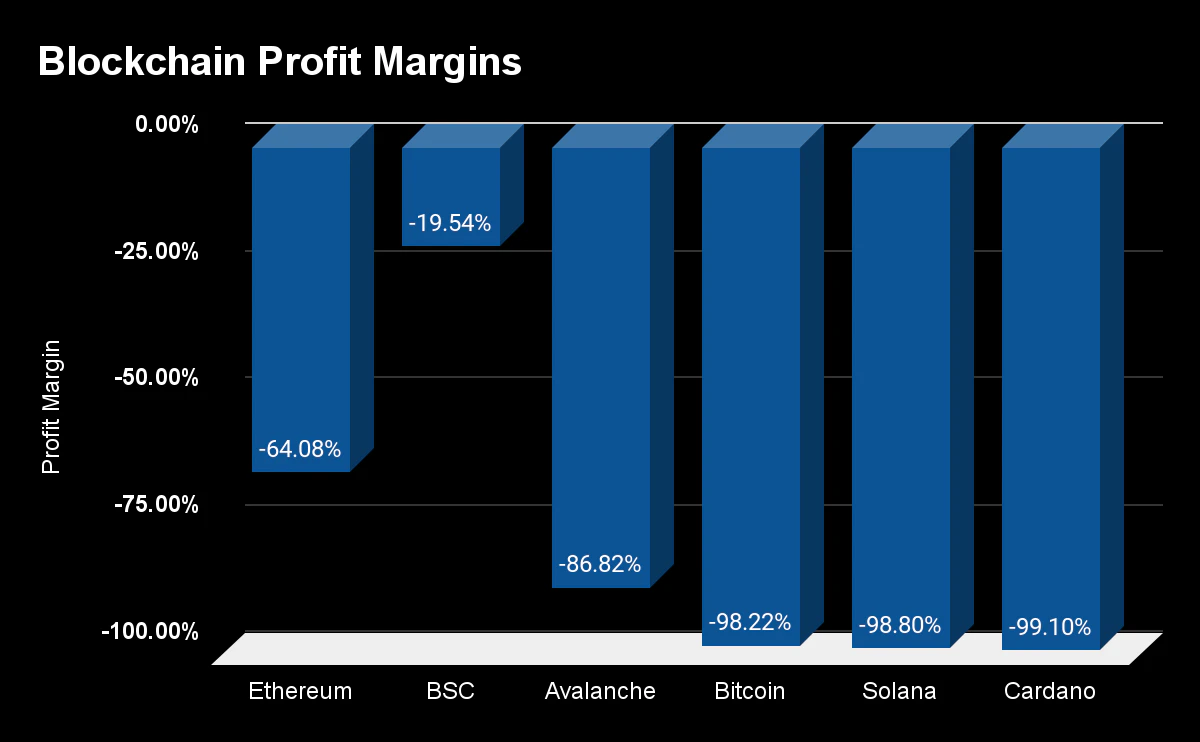

image description

Average daily profit margin over the last 7 days

"Time to emulate BNB."

The reasons are as follows:

But this is where this analysis gets nuanced. In fact, I think it's almost reasonable to exclude chains like BNB from profitability comparisons of other Layer 1 blockchains.

The reasons are as follows:

Recall that block space becomes valuable when transaction settlement is guaranteed to exist. And that certainty costs money.

Binance Smart Chain (BSC) is secured by only 21 validators. This is a closed, permissioned entity group. In other words, the centralized BSC chain is profitable because it does not pay for its security. These 21 validators could easily collude to make anyone's transaction irrelevant, making the blockchain significantly less valuable than the most decentralized and censorship-resistant network.

If BSC really pays for high security, its cost will definitely be higher. In comparison, Bitcoin spends $34.75 million per day on 1 million miners, and Ethereum spends $36 million on 276,000 validators securing the beacon chain (before the merger!).

It is also worth highlighting that there have been reports that BSC has suffered from fake and spam transactions, which may have disproportionately reported higher revenues. (Of course, there are rebuttals to these claims -- it's hard to categorize the truth).

But the fact remains that with the exception of Ethereum and BSC (is it really a layer 1?), almost all major layer 1s are running at losses of about 90% or worse.

Each L1 builds an impressive, scalable infrastructure layer while issuing billions of dollars each year to secure blocks - but what about the demand for blocks?

Again, this is a tradeoff. Transacting on Avalanche or Solana is much cheaper than Bitcoin or Ethereum, but this affordability comes at a price. These chains are not bringing in enough revenue to exceed their expenses.

How do you assess demand for your product? Product sales revenue.

How do you assess the need for blockchain? Revenue from block space sales.

Revenue is the real test of block space demand. Not the number of blocks sold.

What about Bitcoin?

Even though issuance has been decreasing over the past decade — three Bitcoin halvings — the Bitcoin network is still running at a -98% loss. While the network plans to effectively rely on transaction fees by the end of the decade (more than 95% of all BTC will be mined after the 5th halving), the network isn't even close to breaking even. This is something to watch over the years as circulation tends to zero and the network only pays its revenue for security.

The reality is clear: it is difficult to build a profitable blockchain business.

Even the Ethereum blockchain, which has the most valuable blocks, cannot maintain profitability in its current state, and Bitcoin is far worse — on par with the alternative Layer 1.

Why it's okay (for now)

It is still early days for blockchain as a technology. Mass adoption has yet to happen, and the technology itself still has a lot of room for optimization, so it makes sense that blockchains aren’t profitable right now — they’re still reliant on themselves.

This is very similar to the Internet companies in the 90s. Amazon was founded in 1994 but didn't turn a profit until 2001, when it reported a $5 million profit on $1 billion in revenue.

It took seven years for the now trillion-dollar company to eke out profitability.

For context, Bitcoin has been around for 12 years, while Ethereum will be celebrating its 7th anniversary this July. It's like the year 2000 of the blockchain.

Which begs the question... will blockchain become profitable in the same time frame as Amazon?

The road to profit

So what is the path to blockchain profitability?

There are two main levers:

Increase transaction revenue

Reduce security costs

1. Increase transaction revenue

The main way blockchains increase transaction revenue is by increasing block utility; increasing the value of what can be done within each block. This can be achieved by building valuable applications on top of the network, increasing the possible surface area on the network and the utility available to users.

For example, on Ethereum, anyone in the world can swap $1 million in ETH for $1 million in DAI on Uniswap. This could be very valuable to someone. They're happy to pay a $10 fee to settle the deal. In fact, maybe they're willing to pay up to $1,000. Perhaps in times of stress and volatility, they might be willing to pay $10,000 to have their trades processed instantly. A rational participant is willing to pay slightly more for a block than the value they can extract from the block.

As the application layer becomes more active, blocks become more valuable as applications (think DeFi, NFT) create economic opportunities within the block.

Block space revenue is almost directly related to the number of valuable applications on the network and the opportunities they have.

This is even more apparent when we look at Bitcoin. Bitcoin really has only one application - Mobile Bitcoin. As such, it struggles to generate significant block space revenue, as indicated by its -98% profit margin.

A use case can only generate so much revenue.

With a smart contract platform, an unlimited number of applications can be built, allowing block space revenue to scale beyond a single application-specific blockchain.

We can see this happening now, as multiple smart contract platforms have surpassed Bitcoin in fee revenue, including several Ethereum applications. The market is willing to pay more to exchange tokens on Ethereum than to transfer Bitcoin.

The key point here is that blockspace revenue increases with blockspace utility; more optionality. Blockspace utility scales with more tokens, more applications, and a more active ecosystem.

All of this depends on the decentralization and security of the network.

As mentioned before, if transactions can be reversed or censored, then block space is less valuable, and fewer applications will make a long-term home in such a network.

2. Reduce security costs

Increasing block space utility must largely happen organically. You need developers, applications and users. You can only incentivize inorganic usage in the long run.

Therefore, the main path to sustainable blockchain development will be to reduce issuance over time, thereby reducing fees on the network.

The biggest tradeoff when you reduce issuance is that you spend less on security. Unless the price increases, every time the network reduces issuance, validators/miners have less incentive to continue operating and the network becomes less secure. This doesn't happen every time, but there is a risk if network demands are not balanced.

Blockchains must contend with the trade-off between issuance and block size. Many alternative layer 1 blockchains have opted for larger block sizes to support more total transactions with lower fees per transaction. Increasing a chain's block space supply reduces its price and has so far proven difficult to generate significant revenue for the chain.

Additionally, the trade-off of increasing throughput at the base layer tends to create a more centralized system, reducing the confidence behind the monetary premium of the chain’s native currency.

Blockchains must balance the supply of block space they generate with the consequent issuance. Blocks with faster block times/larger blocks (essentially more throughput) have to issue more coins to achieve security at this scale.

If you want greater scale, you have to pay for greater security.

You can see this effect in the issuance rate of the smart contract chain:

Ethereum: 4.20% inflation

Solana: 9.15% inflation

Avalanche: 26.6% inflation

An important note here: Ethereum is currently proof-of-work, which is a capital-intensive security mechanism. Ethereum will go Proof-of-Stake later this year, and newly issued ETH will be reduced by 90%, bringing the annual inflation rate to about 0.4%.

Let's talk next...

Layer 2 (Layer2)

Layer 2s (L2s) can play an important role in increasing the net income of the blockchain.

On CryptoFees.info, you'll notice that Ethereum L2 generates $50,000 to $100,000 a day for itself in block space sales. This is L2-native revenue, collected by L2 operators (maybe later democratized by native L2 tokens).

Importantly, L2 creates its own demand for Ethereum L1 block space. L2 must consume L1 block space to "settle" with the main blockchain. You can find Arbitrum, Polyon, Optimism on UltraSound.Money's ETH burn leaderboard.

A key part of L2s is that they don't need to issue tokens to pay for security. They inherit their security from the L1 they settled on. This makes deploying L2 a trivial matter, as most of the hard questions about blockchain sustainability are solved by utilizing resources from L1.

L2 operates like solar panels for economic activity. They offer low fees to users and bundle user transactions into a package for batch deployment to L1. This is where L2 usage translates into L1 block space demand, and why the vibrant L2 ecosystem is bullish on L1 fees.

The bull case for Ethereum’s scalability roadmap is that it sells block space not to users, but to other blockchains (Layer 2). While individual users find Ethereum's fees prohibitive, L2 blockchains are insensitive to L1 gas prices and consume block space as more and more users join.

The first profitable blockchain is coming

Ethereum is the first blockchain to embark on a path to sustainable economic development through The Merge. Later this year, probably in June/July, the network will switch to proof-of-stake and reduce its issuance by 90%.

The interesting part of The Merge and Ethereum's shift is that it's not just a pure issuance reduction.

Along with increasing security efficiency, there has been a fundamental change in how the "security budget" is spent. Given the shift in consensus algorithms and the improvements it possesses, Proof of Stake makes Ethereum more secure while allowing the network to issue fewer tokens.

With network issuance reduced by 90%, Ethereum will be distributing less than $4 million in ETH per day to stakers. The important part to note is that ETH fees don't change with the merge - they stay the same.

This means that later this year, the network will distribute $4 million in circulation per day while generating $13 million in revenue, generating $9 million in net profit and a +72% margin.

Ethereum, the first profitable blockchain!

It is worth emphasizing that ETH has also completed the three-point asset thesis through the merger and fully transitioned to an interest-bearing asset.

All transaction fees generated by the network will be paid to ETH holders via EIP 1559 (buyback) and staking (dividends). As a result, ETH staking yields will soar into double-digit APYs, driving more demand for the asset as investors race to absorb those yields, while the network becomes more secure with increased staking.

Ethereum is expected to be the first profitable blockchain.

It happens in months, not years. As we've written before...it's not priced.

Will other chains follow Ethereum?

A lot depends on the quality of the products they sell.

How much will the market pay for their blocks?

Will they still buy when token incentives dry up? Will they still buy when transaction fees increase?

We'll find out in the months and years to come.