Web3 New Creator Economy Report: Detailed Explanation of 144 Creator Economy Platforms and 100 VCs

The goal of this Creator Economy report is to provide founders and VCs in the space with a general framework and insights to discuss the topic. We look forward to hearing your thoughts on what you found interesting, what you think we missed, or any other perspective on this new Web3 consumer economy.

Now, let's get straight to the point!

"The creators of Web3 will rebuild the global economy and bring us into a world of beauty, decentralization, freedom and trust. I can't wait.'' - Tim Draper, Founder, Draper Associates

Speedinvest fundamentally believes that Web3 is a technology that will redefine all verticals in the economy. Blockchain is already starting to run the backend of many software applications, and as part of Web3, blockchain is more likely to impact how we interact with the internet than mobile and the cloud.

From an economic perspective, this applies especially to how we create and transfer value online. Creators are now in the driving seat, with the opportunity to have greater control and individuality than ever before.

Bradford Stephens, co-founder and managing partner of Blockchain Capital said: "This is a movement from the people. What's exciting is this self-empowerment of individuals, it's life changing and a major shift in human life!"

Our 2022 Creator Economy Report includes:

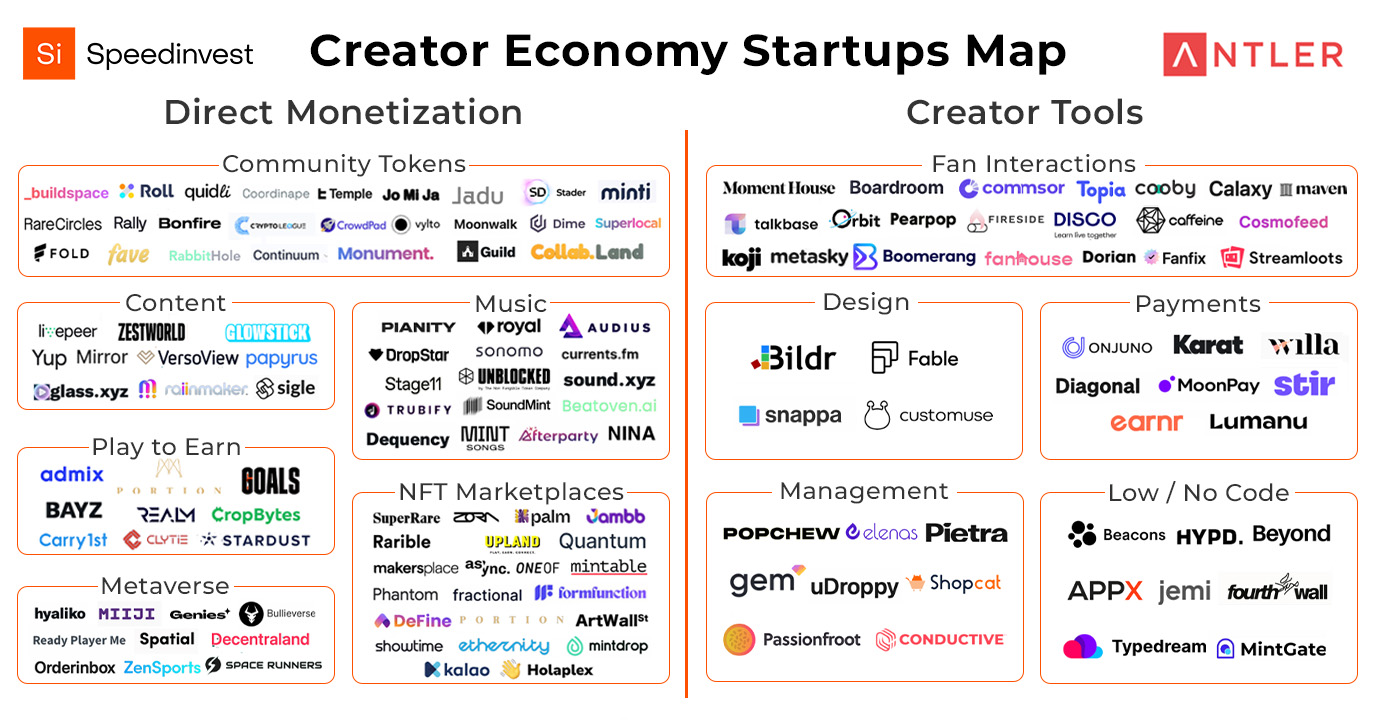

Map of 144 Creator Economy Platforms Leading the Trend

100+ VCs investing in creator economy

A fundraising guide with key points for investors to focus on when analyzing a company

Outline some of the opportunities and challenges facing investors and creators

Creator Economy: Traditional Platforms Dominate

The creator economy is made up of people, like any of us, who have a passion or hobby that can be profitable online. But it's platforms that allow creators to earn income doing what they love. An example is YouTubers and TikTokers creating content for their followers.

This often results in limited revenue opportunities such as merchandise, subscriptions, ad revenue, or tips, and unfortunately in practice only the top 1% of creators with a large following can be sustainable.

Worse, today's platforms take a disproportionate share of the revenue creators generate. For example, a typical music artist on a streaming platform earns about 10% in licensing royalties, with the rest going to record labels.

They also do not offer creators the option to be discovered through their algorithms, and only a few offer direct ownership, enabling all stakeholders to profit from their contributions.

We believe this is where the next iteration of the category is headed.

Creators are no longer just products - they are the new economy.

The number of creators and the demand for content is growing

With the term "creator" now widely recognized, the creator economy market has reached $104.2 billion. The same study also states that 1 billion people will self-identify as creators within the next five years. In fact, a staggering 29% of US high school students say they want to be "content creators." And, there's no question it's becoming an increasingly viable career option in a world of niche entertainment.

Niko Bonatsos, investor at General Catalyst, commented: "Just as Silicon Valley became a way of thinking, millennials from around the world realize that tech entrepreneurship can be a career choice, and for the first time, Gen Z can rely on their online presence. Ingenuity makes a living.''

Given these facts, it's no surprise that the demand for content is on the rise and will only continue to rise.

Content from your hands

As we enter a "mobile-first" economy, consumers are increasingly turning online, directing their attention and dollars to their mobile devices. More than 5 billion Internet users now spend approximately 7 hours a day online on multiple social platforms - 93% of whom primarily use their mobile phones.

“Today, it’s hard to define mainstream without decoupling it from mobile,” said Robby Yung, CEO of Animoca Brands, “so it’s fair to say that in a post-mobile world, nothing is mainstream unless it’s on mobile.” .”

investors are paying attention

But this growth in the creator economy is also being fueled by record inflows of money from high-profile investors — $1.3 billion in 2021 alone. This includes companies like Andreessen Horowitz (A16z), Greylock, Bessemer, Northzone, and Atomico.

Online content publishers such as YouTube, Facebook and TikTok have also launched their own creator funds, giving them direct access to the space and helping them attract creators to their platforms.

Of course, this business strategy makes sense if we keep in mind that the quality of content on a platform determines its value and is directly responsible for attracting and retaining millions of users.

But despite these advances, most creators still face the same problems they've faced for years:Creators are still not fully compensated for their efforts, making it difficult to earn a steady income.

But that is changing.

The New Creator Economy: A Community-Owned Ecosystem

Platforms are becoming community-driven, making it easier for creators and their audiences to monetize their contributions.

But before we start exploring the next iteration of the creator economy through the lens of Web3, let's take a step back and look at the historical evolution of the industry.

Web1 - Information Economy = Few Creators → Only Consumers

Web1 refers to the first static version of the web, also known as the information economy. The user's role is largely limited to reading information provided by a very small number of content producers, and the user has no option to go back to those creators. Some examples are personal websites, AOL, and CompuServe - consumption only.

Ultimately, Web2 gives every user the opportunity to create content for the first time. But how?

Web2——Platform Economy = Creator: Blogger→Brand Representative

As people began to be drawn to the internet, Web2 saw the rise of "influencers" who started blogging and gradually built a massive reputation and online audience on platforms such as MySpace, Blogger, Soundcloud and Vinyl.

Soon, these creators began monetizing their audiences through affiliate advertising and sponsorship deals — allowing them to be a channel for other brands and earn revenue in the process. However, they only act as conduits for these brands and businesses to reach potential customers, so there is usually no real loyalty to these companies.

This creates a power imbalance between platforms and creators in Web2. Creators came to rely on platforms that were the internet's new de facto gatekeepers.

Web3 - Ownership Economy = Creator + Audience → New Fairer Ecosystem

Today, the definition of creator has changed with the rise of Web3, as the power dynamic shifts from platforms to creators and their communities.

Harry Stebbings, founder of The Twen0 Minute VC and 20 VC Fund, said: "Seeing users gain more value individually and collectively is one of the most exciting aspects of Web3. It removes the need for traditional Web2 aggregators and gatekeepers Intermediation is the key to democratizing revenue creation in the digital world.”

The creator economy is no longer just about providing value to platforms. It's about a new form of direct creator-community relationship. Not only does it open up opportunities for creators to provide more services to fans, including financial gain, but it also allows creators and their communities to ultimately participate in the collective value they help the platform create.

This is the opportunity we see for new community-led creator platforms with the power to create self-sufficient networks and fairer ecosystems where people serve each other and serve the community as a whole.

This will lead to the success of the creator economy.

Jarrod Dicker, Partner at TCG, commented: "What Web3 really does is it opens up the possibility for creators to offer more. If we take the newsletter as an example, the concept in Web3 becomes 'when you can invest Why subscribe? In the case of Mirror.xyz, you now have the opportunity to invest in the initial stages of the publication in exchange for tokens or NFTs, so you actually own it.”

The new creator economy map: 144 of the latest creator-led platform startups

In this market map, we focus on the new Web3 creator platform, which not only supports creator (and community) ownership, but also ensures a fairer and circular distribution of benefits to all contributors to the community.

In this case, we divide the field into (1) companies that provide creators with direct monetization and (2) creator tools that allow creators to participate in this new economy.

The United States took the lead out of

When we look at the data, it's clear that the creator economy is by far the largest in North America. Of the 144 companies, only 18 are based in Europe. However, this is not surprising given the differences in the two consumer markets.

North Americans, especially those in the US, are generally less risk averse than Europeans. The American Dream promotes the idea that America is "the land of opportunity," and a high-risk, high-reward mentality is seen as a virtue. While the validity of this view can be debated, it has always served to spur innovation since the country is at the center of multiple tech booms and has a relatively high percentage of early adopter consumers.

The US also happens to be a cornerstone of the global media ecosystem and home to Web2 creator giants like Myspace, YouTube, Snapchat, and more. So it makes sense that the creator economy would take off in the US before Europe.

But times have changed.

Europe is catching up

Web3 creator economy startups are popping up across the continent.

Take France's Sorare, which recently raised $680 million led by SoftBank Vision Fund 2 to build the next entertainment giant, starting with football. Ledger, also French, makes digital assets more secure with their encrypted hardware wallets. Norway/Vietnam's Axie Infinity has also capitalized on the video game trend of making money from games by monetizing their games using NFTs.

Businesses like this pop up in Europe every week. Not only are they growing at a high rate, but they are also receiving strong investor interest and capital from European and North American investors.

Speedinvest investor Paola Vivoli said: "The idea of ordinary people making YouTube videos and earning a steady income is no longer a ridiculous pipe dream - it is a business model that works," which has begun to attract B2B startups. Attention of founders and European investors. They can now clearly see where the winds are blowing in the creator economy and where they want to get in. With this in mind, we expect the European ecosystem to continue to grow. It will have some catching up to do to reach the same level of maturity as the US. "

If we look at the European Web3 creator companies and tools in our map, broken down into their respective categories, we have identified the following companies:

direct monetization

Community tokens:CrowdPad

Metaverse:Miiji,Ready Player Me

music:Dropstar、Pianity、Sonomo、Stage11

creator toolsKalao.io

creator tools

Fan interaction:Talkbase

manage:Gem.xyz、Passionfroot

Payment:Earnr

Low/no code solution:Beyond

Check out the full list below, including information on their categories, phases and geographic locations.

Check out our list of creator economy startups。

The purpose of this list is neither to be exhaustive nor to rank startups, but rather to map the rapidly growing and expanding ecosystem of creator economy startups.

“The new creator economy encompasses everything creators have always wanted—ownership and a community-led platform where all community members are compensated for their time and contributions. Being a creator is very difficult. However, we believe everyone ultimately are creators in some capacity,” said Ollie Forsyth, Global Community Manager at Antler.

He continued, "We're excited to see how this space evolves over the next few years from all sides of game companies, where you no longer have to buy multiple avatars in a game. You can just have a handful of characters that can be played on multiple platforms." Content. Community tokens — issued based on our contributions — may allow many of us to have an additional source of income in the future — creating a new generation of wealth.”

If your business is not on the map and you would like to join, please write me on twitter @VivoliPaolamethodology

methodology

Our criteria for selecting and ranking startups are as follows:

direct profitcreator tools

creator toolsA platform that allows creators to operate, such as backend tools, analytics platforms, etc.

We focus on startups that are already generally established in the space, meaning they have received funding or are publicly fundraising. We excluded very large mainstream companies - such as Patreon, Snapchat, etc. - because our goal is to focus on and support the startup market.

Our primary data sources are Crunchbase and Pitchbook, supplemented by our own deal flow, and conversations with other VC investors.

The Web3 Investment Landscape: A Fundraising Guide

Right now, for founders looking to build these new creator platforms, information on what investors are looking for and tips on how to raise capital can be scattered, inconsistent and overwhelming.

For this reason, we decided to ask some investors for their thoughts on what to focus on when analyzing potential investments in this space.

1. Large TAM and scalability potential (i.e. volume!)

Investors look for volume at launch (transactions and transaction volume, payment volume, search volume, developer activity volume, number of wallets transacting on-chain, minting volume, etc.).

2. Community

2. Community

Examples of metrics that quantify the quality and health of network participation include:

Daily or monthly active users

180- or 90-day trailing averages can be used to measure a stable mature network

30-day or 7-day averages are better for real-time insights but can be subject to false signals due to market volatility

Monthly active wallets:Unique users with an active token wallet in the past 1 month

Trading Indicators:

Number of transactions

monthly active users

Peer-to-Peer Monthly Active Users

Total number of addresses, balance addresses, zero balance, zero balance ratio:This data represents the user's lifetime count and retention of the agreement. Zero balance addresses are those addresses where all tokens have been transferred out. Zero balance addresses / total addresses = zero balance ratio.

People generally hold cryptocurrencies but do not trade with them (however, crypto game tokens or community platforms should have higher activity rates and transaction counts) so this number should be much larger than the daily average of users

Remember, 80% of your users are probably just lurkers.

Silvia Oviedo Lopez, head of marketing at Canva, said: “I think the community angle is going to be the most interesting [part] for some time to come and really bring a new perspective to the creator economy. There’s a lot to figure out — but access, inclusion And consciousness feels like a big next step. I'm excited to see how things play out!"

3. Attract a Diverse Audience

In our view, a Web3 startup should not only be able to attract and grow existing audiences through constant engagement, but also be able to attract and reach new audiences, especially in new markets.

For example, if we take a blockchain-based game as an example, founders should consider whether the game is designed and built for gamers only, or whether they can go beyond that and design it in a way that incentivizes third-party developers to build on the platform .

4. Utility of NFT/Social Tokens and Fan Token Economics

Utility NFTs, or NFT 2.0, are NFTs whose valuation is based on the access, privileges, and opportunities they offer token holders. Besides the usual scarcity associated with NFTs, they have clearly defined intrinsic value and are broadly grouped into the following categories: community, fantasy sports, gambling, gaming, and social. Utility NFTs are considered the future based on user demand, and as such, founders need to understand how best to design them.

If we take blockchain-based games and in-game NFTs as an example, game developers in Web3 have to worry not only about building a good game, but also about creating good enough economic incentives to support a strong and sustainable in-game economy. Is the gameplay engaging? Do the in-game mechanics make sense, and are the NFTs functional (other than collectible)? After all, the game must have a very good experience!

Sasha Kaletsky, co-founder of Creator Collective Capital, said: "In addition, some of the most successful NFT-based games today (such as Axie Infinity, Sorare) have a strong "money-making" element, which is culturally different from Western "freeware" in recent years. Games' culture is totally out of sync'

More importantly, for creator social tokens and NFTs, the structure of token economics should be able to create a sustainable economy (for example, the current debate around the "gap between rich and poor" in Web3 games), which is important for creators. Long-term adoption is critical.

“Social tokens are often only a small part of a creator’s main source of income, so creators tend to be very focused on how they monetize their fans via Web3. Nobody wants angry fans bombarding their comment section with money-losing fans (it’s happened before… )!” Sasha added.

5. GTM and Distribution Strategy

In Web2, however, the primary GTM stakeholder is the customer. In Web3, incentives through stakeholder supremacy mean that the entire community of contributors who make up the network become stakeholders - driving the need for new distribution strategies.

The opportunity for Web3 is to leverage tokens and the underlying decentralized technology to build and bootstrap these new networks.

So what this means in practice is that while the GTM strategies of Web2 companies start with products (i.e. come for tools), Web3 companies should take a more bottom-up approach and design token economics to attract and attract Participating community. This is what investors want to see.

At this point, it's important for founders to align their GTM strategy with the community they're building. Investors want to check that the founders have a solid understanding of their (future) community and the company's place in the Web3 environment, and can then define the ideal toolbox for a Web2:Web3 strategy (eg a mix of driving marketing and partnerships).

Coming soon: An in-depth look at go-to-market strategies and tactics in Web3 #watchthespace

6. Status, network and influence of key members/team

Investors today generally believe/expect "crypto-native" teams to be in a better position to build and win in this space than teams building social/consumer/gaming-first startups. However, evaluating a team building with Web3 is not that simple. The most "crypto-native" founders aren't necessarily the right people to build these new creator solutions which, depending on where you are, are actually mostly similar to consumer apps.

In this case, investors might want to see founders who are "native enough" to understand crypto and Web3 deeply, who have the right network to attract crypto engineers, but who are also so native that they don't understand what they might have to do with The experience of the average mainstream non-encrypted user talking to them.

Opportunities Investors See in Web3

2021 is a pivotal year for the industry as Web3 takes all industries by storm. This is a true sideways trend for investors across the board.

What we see today is an amazing combination of talent and capital flowing into the ecosystem, furthering innovation in the decentralized technology stack, and consumer-facing applications that are now disrupting all ecosystems. This can be seen in the large funding rounds raised by the following companies:

Blockchain-Based Fantasy Football Game September 2021SorareRaised a $680 million Series B round led by SoftBank, valuing the company at $4.3 billion in the largest European Series B round to date.

Payment infrastructure provider for crypto companiesMoonPayRaised $555 million in Series A funding in November 2021, led by Coatue and Tiger Global, valuing the company at $3.4 billion.

Forte, a platform used by game publishers to incorporate blockchain technology into their games, has raised a $72.5 million Series B round in November 2021, led by Sea Capital and Kora Management. In May, Forte raised a $185 million Series A round led by Griffin Gaming Partners at a $1 billion valuation.

The Company Behind NBA Top Shot and The Flow BlockchainDapper LabsRaised a $250 million Series D round led by Coatue and seeing participation from Andreessen Horowitz, Google's GV and Version One Ventures in September 2021, valuing the company at $7.6 billion.

Who else is investing in this space?

Web3 is getting more and more attention...but from whom? We've reached out to the broader ecosystem to give you a clearer picture of who's investing in this space, including their stage, geographic focus and check size.

Check out our list of creator economy investors。

What do investors actually think about the market?

With all eyes on the space as new opportunities continue to emerge, we asked some investors what they're most excited about and where they think the biggest opportunities in Web3 are unfolding - here are their answers .

Broadhaven Ventures co-founder Michael Sidgmore

Financialize everything. “Web3 is financializing everything, and its core theme is ownership. Any asset can now be (A) tokenized and (B) you can create business models where tokens become the basis for someone to invest in that creator/asset/platform Why. So it's becoming an investment decision. Also, not just anything is becoming investable, but how we spend our time is becoming an investment decision. You can now to make money, and by doing so, you can now make decisions on your own time. You are incentivizing people through asset ownership as part of their process of actually increasing their income, being part of a community and bringing others into that community kind of way."

Speedinvest investor Dominik Tobschall

No part of the economy will be affected. “Speedinvest fundamentally believes that Web3 is a technology that will redefine all verticals in the economy. Blockchain is already running the backend of many software applications, and as part of Web3, it is much more More likely to affect how we interact with the internet."

Leer Hippeau investor Meagan Loyst

New tool links Web2 engagement to Web3 loyalty. '' Overall, loyalty is higher. Creators will have the ability to reward their most loyal fans through continued engagement, which is not necessarily pegged to $$$. I'd love to see tools emerge to help link Web2 engagement to Web3 loyalty - being able to retroactively identify your biggest fans by attending your event/concert, spending in your merch store, socializing - This can enable the newer Web3 platform of layered loyalty. That way you're not starting from scratch with your fanbase, and you can reward someone who's been with you from day one. ''

Index Ventures investor Rex Woodbury

Creator life cycle. "I'm excited about three main segments: 1) creative tools, 2) creator discovery, and 3) creator monetization. I think of these as the creator lifecycle. The first category is technology that unlocks new forms of expression - I'm excited about VR, AR, and low-code/no-code creation tools. The second is how people find audiences online; the best tech is better at forming communities. The last includes ways creators can make money .We see NFTs, social tokens, and other new Web3 innovations reshaping monetization."

Ann Miura-Ko, co-founder, Floodgate Ventures

Creator lifespan. “I’m most excited about platforms that allow creators to meaningfully engage with audiences without being on an endless content hamster wheel. As creator audiences grow, their insatiable appetite for creator content could become a challenge. A life-consuming endeavor. I’d love to see platforms that allow creators to “make money while they sleep.”

Mattia Mrvosevic, Partner, Eterna Capital

Redistribution of wealth and optimization and security of data. "The opportunities I'm most excited about in Web3 are (1) redistribution of wealth through things like game money-making games and token economics applied to real-world use cases, (2) optimizing data and information flows, and (3) making information secure. Tamper-free and more secure."

Framework Ventures investor Brandon Potts

Experimenting with token fungibility as a distribution mechanism is where new ideas flourish. “Most of the disruption in this new creator economy right now is in the distribution mechanism where you create and capture value, and then redirect it to the core community, your earliest supporters, to acknowledge the value they provide. As a distribution Mechanisms, the fungibility of tokens is the disruptive aspect that attracts new founders and creators, and how exactly they experiment with this distribution and add that extra layer of utility is what excites me the most, as this is where original ideas thrive The place."

Nicole Quinn, General Partner, Lightspeed

metaverse. "In the creator world, I'm most excited about the direction we're all heading in the metaverse. Web3 is a mashup of 3D worlds, social games, NFTs, and ownership of virtual goods. It stands for community, branding, and ownership."

Opportunities and challenges creators see in Web3

Finally, we turned to the key players in this new iteration of the space and asked some of the creators what they're most excited about and what challenges they might face going forward - here are their answers:

Chance

Caspar Lee, Co-Founder, Influencer.com and Creator Collective Capital

Deeper and longer-lasting relationships - across platforms. “In addition to greater monetization potential, community ownership gives creators the opportunity to bring their audiences across platforms and protocols, creating deeper and longer-lasting relationships.”

Jim Shepherd, Head of Talent Engagement, Snapchat

Provide multiple opportunities. “The creator economy is at an inflection point, as content creators are moving beyond simply partnering with brands and growing their businesses by adding numerous revenue streams. As a result, platforms are evolving rapidly to offer opportunities in more and more directions. Creators, in turn, are leveraging these new tools to directly connect with fans and build their communities. A by-product of this has been the emergence of a variety of content formats—long and short videos; spontaneous moments captured with cameras; Performance content; interactive events, or vlog style, creators are even making their own AR.”

Max Fosh, Creator

challenge

challenge

Blake Michael, Creator

Adoption barriers. "When I talk to creators, I think there will be a barrier to adoption. Web3 is something some creators know about, but few know exactly where and how to act, and what it actually means for them."

Rally.io, CEO Bremner Morris

For middle-class creators, there's still a long way to go. “There is still a long way to go for the growing ‘middle class’ of creators – the top echelon of creators is earning most of the revenue generated by the creator economy. However, as platforms improve discovery and creation creators are becoming more and more accustomed to having financial relationships with fans, and middle-class creators will reap the rewards."

Sandy Lin, Creator

Sustainability and longevity. '' Sustainability and longevity is another huge pain point. 77% of creators rely on brand deals for the majority of their income, but brand deals can vary from month to month. Partnerships are a lucrative source of income, but creators should think about long-term success. We’re seeing more and more creators leveraging NFTs, subscribing to communities, and building brands to augment their revenue streams. "

Jade Darmawangsa, Creator

Creator burnout. "Finding the balance between producing really good content that we love and making money because we need to pay the bills is really hard. This sometimes leads to creators working like crazy for not much benefit - important It’s up to us to take care of ourselves.”

A more sustainable future powered by creativity

As we look at the new direct creator-follower relationship and the future of the creator economy, we're very excited about the new "native" ways creators can earn revenue, funded by and with their communities, We think of it as the emergence of new and more sustainable economies.

NEA investor Danielle Lay said: "Creators can move from fee-based compensation to accumulating wealth through equity in the communities they build. Web3 enables creators to finally be compensated like their entrepreneurs. In order for equity to To sustain the value of both creators and their communities, platforms will need to help creators design token economics. We can learn how to manage tokens through monetary policy. In order for a currency to store value, people need to trust it and need to observe the currency inflation, the goods/services that consumers can exchange for money need to be valuable to the user.”

The new creator economy will not only change the way content is created, but it will also open up a whole new world of technology and monetization opportunities that were simply not possible with Web2.

We're excited about the untapped potential of new Web3 creator platforms and creator tools that support these new creators' direct relationships with communities and build for mainstream consumers, unlocking the next 100 million users.

"Our focus is on the opportunity at the intersection of consumers and cryptocurrencies. Opening the market to mainstream users and bringing the masses to Web3 is one of the most exciting investment opportunities of our time," said Paola Vivoli, investor at Speedinvest.

Thank you for reading our article, we hope you enjoy it. We're very excited about how the future of the Internet is shaping up, and we remain passionate about supporting the next generation of platforms.

Special thanks to the following people for their contributions:

Caspar Lee (Creator, Influencer.com, Creator Collective Capital), Blake Michael (Creator), Bremner Morris (Rally.io), Sarah Nöckel (Northzone, Femstreet), Niko Bonatsos (General Catalyst), Sasha Kaletsky (Creator Collective Capital), Jim Shepherd (Snapchat), Max Fosh (YouTube Creator), Rex Woodbury (Index Ventures), Nicole Quinn (Lightspeed Ventures), Tim Draper (Draper Associates), Sandy Lin (TikTok Creator), Meagan Loyst (Lerer Hippeau) , Ann Miura-Ko (Floodgate Ventures), Danielle Lay (NEA), Michael Sidgmore (Broadhaven Ventures), Kieran Hill (20 VC), Harry Stebbings (20 VC), Sameer Singh (Network Effects Advisor and Atomico Angel), Mattia Mrvosevic (Eterna Capital), Jarrod Dicker (TCG), Brandon Potts (Framework Ventures), Robby Yung (Animoca Brands), Bradford Stephens (Blockchain Capital), Courtney Chow (Battery Ventures), Jade Darmawangsa (creator), Dominik Tobshall (Speedinvest ), Sam Nasser Zare (SoftBank)