After the merger of ETH2.0, what applications are worthy of attention?

Original author:@CroissantEth

Original author:

The subject of this post is for those who like to "think ahead".

Ethereum is changing, and changing fast. The next year will bring fundamental changes to the Ethereum network as we transition to Proof of Stake (PoS).

Here are some things to be aware of...

There has been a lot of discussion about ETH 2.0 recently. In this post, I will pay special attention to those projects that may change the rules of the game. The premise is that only ETH 2.0 and the upgrades it introduces will make things possible.

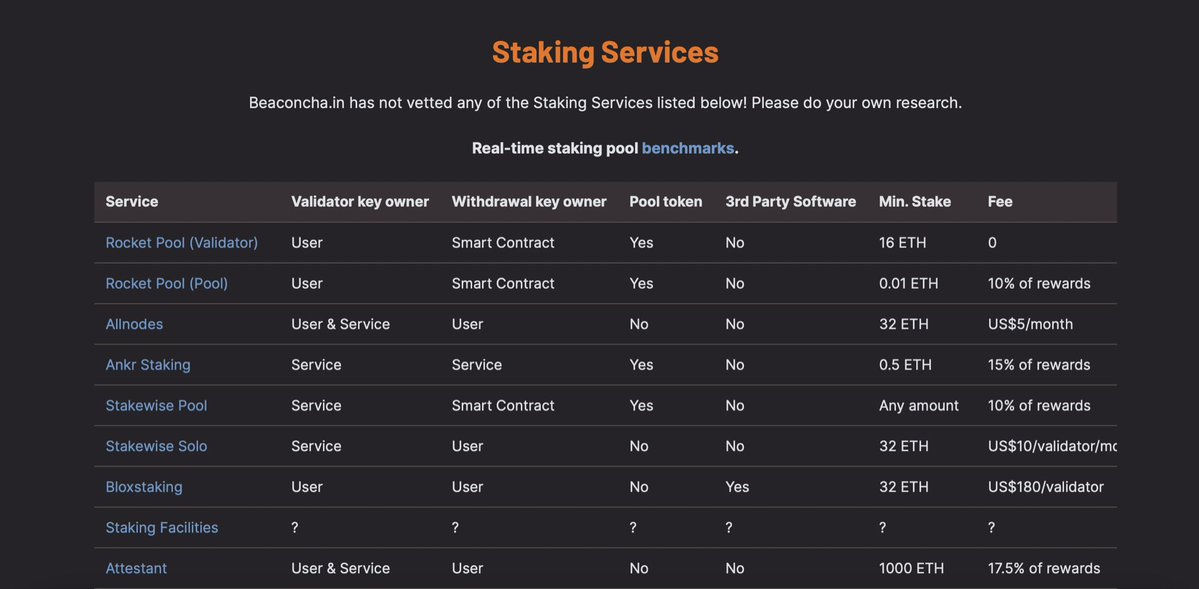

1. Staking pool

After Ethereum merges, stakers on the network will start receiving token release and transaction fees. Validator qualification requires 32 ETH to pledge to obtain. However, the "staking pool" model allows multiple small users to come together to become validators and distribute rewards.

Services like Lido Finance + Rocket Pool are bound to gain attention.

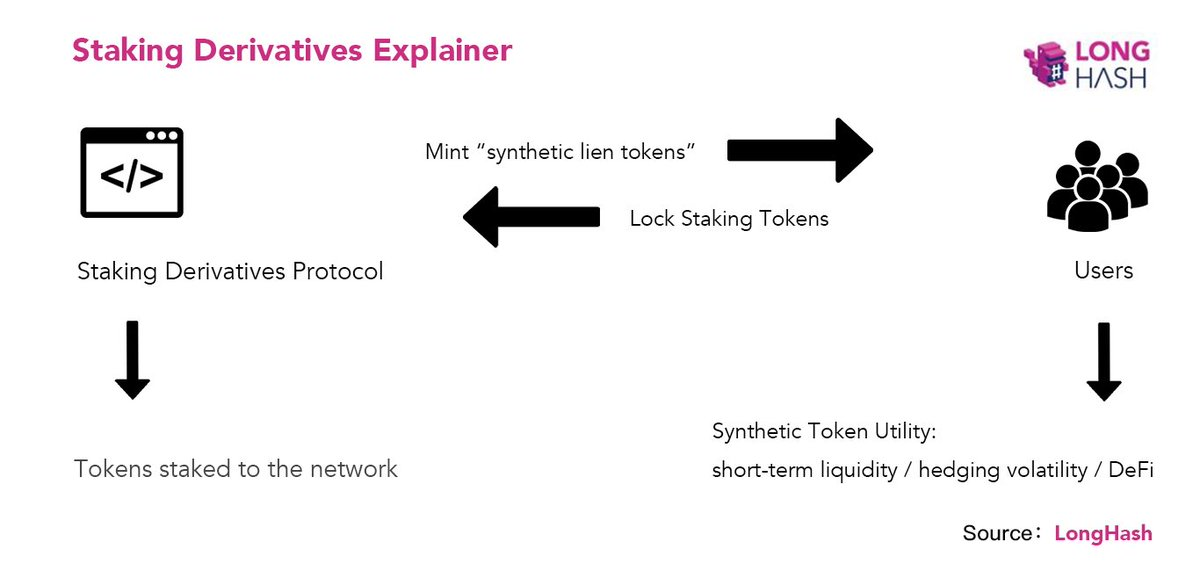

2. Pledge Derivatives

Staking derivatives are typically ERC-20 tokens representing the staked ETH.

Unlike normally staked ETH, staked derivatives allow staked ETH to be used in DeFi like any other ERC-20 token.

The combination of the safest + liquidity will absorb tens of billions of value.

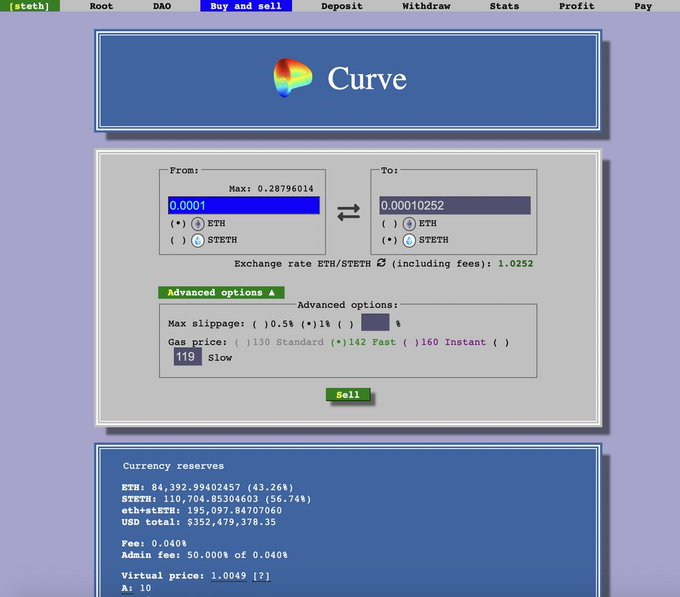

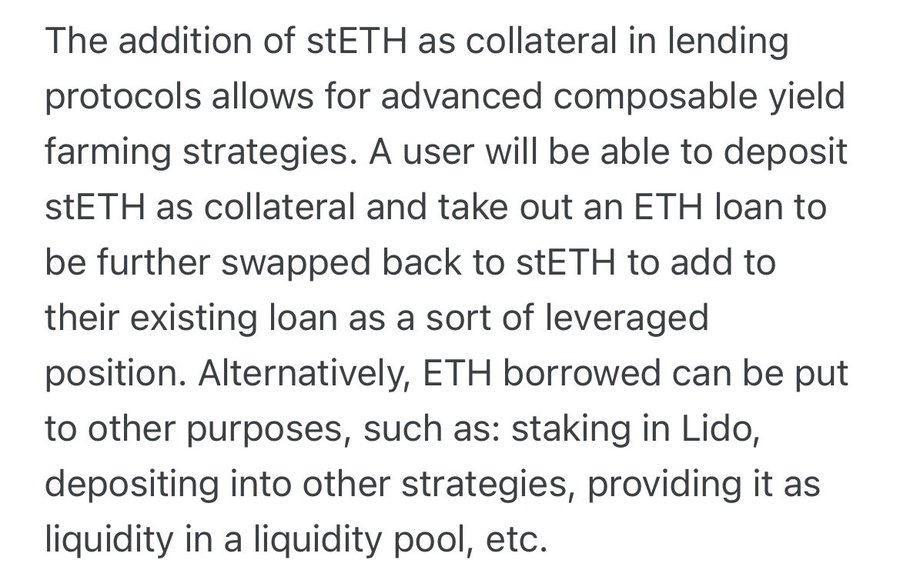

3. stETH strategy

Now that we’ve covered tokenized ETH staking, there are other use cases.

stETH is in high demand. The highest yield generating protocol will receive rewards from users trying to maximize yield.

Yield strategy + stETH is a tasty combo.

4. Cross-Rollup architecture

Cross-chain stuff is cool, but what about cross-rollup tools? This is something people don't pay close enough attention to. dApps that bridge the gap between Optimistic Rollups and zkrollups will have a bright future.

For example, Hop Protocol

5. Relay service

Rollups use calldata. Calldata is expensive, and one of the most expensive operations on the Ethereum network is writing to storage. For Rollups like Arbitrum & Optimism, a robot network that supports bundled txs will be very helpful in reducing costs.

6. zkProofs

For example, GnosisDAO + Argent

It's not just the season of ETH 2.0, but the season of zkproofs. This is the result of years of research. Zkproof technology can scale ETH to incredible levels. These dApps are already live and will help billions of users use ETH

For example, zkSync, Loopring

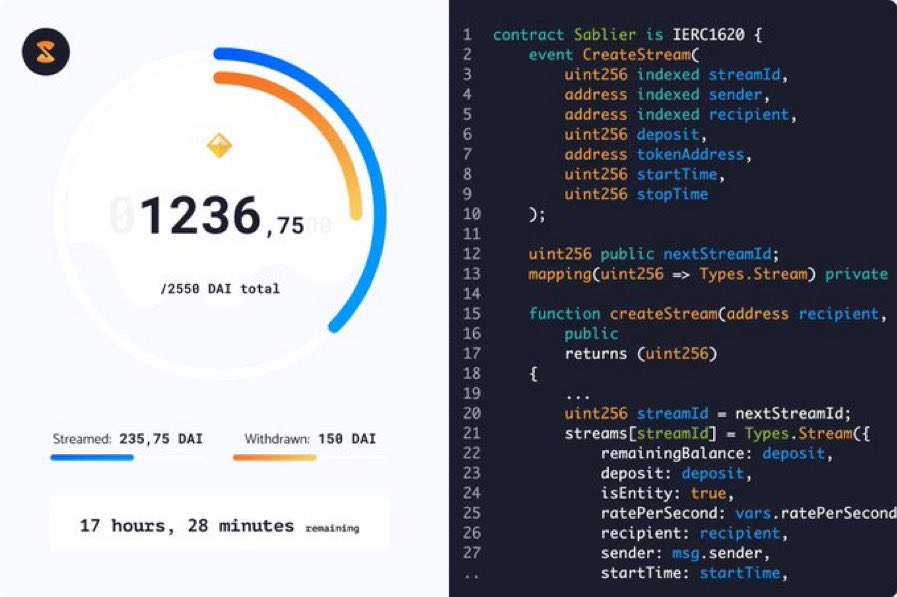

7. Streaming/Payments

Layer 2 scaling will lay the groundwork for real growth of L2 native dApps. This is where something like streaming will really shine. Once they are further adopted, users will flock to these solutions with unparalleled UX.

For example, Sablier + Splits

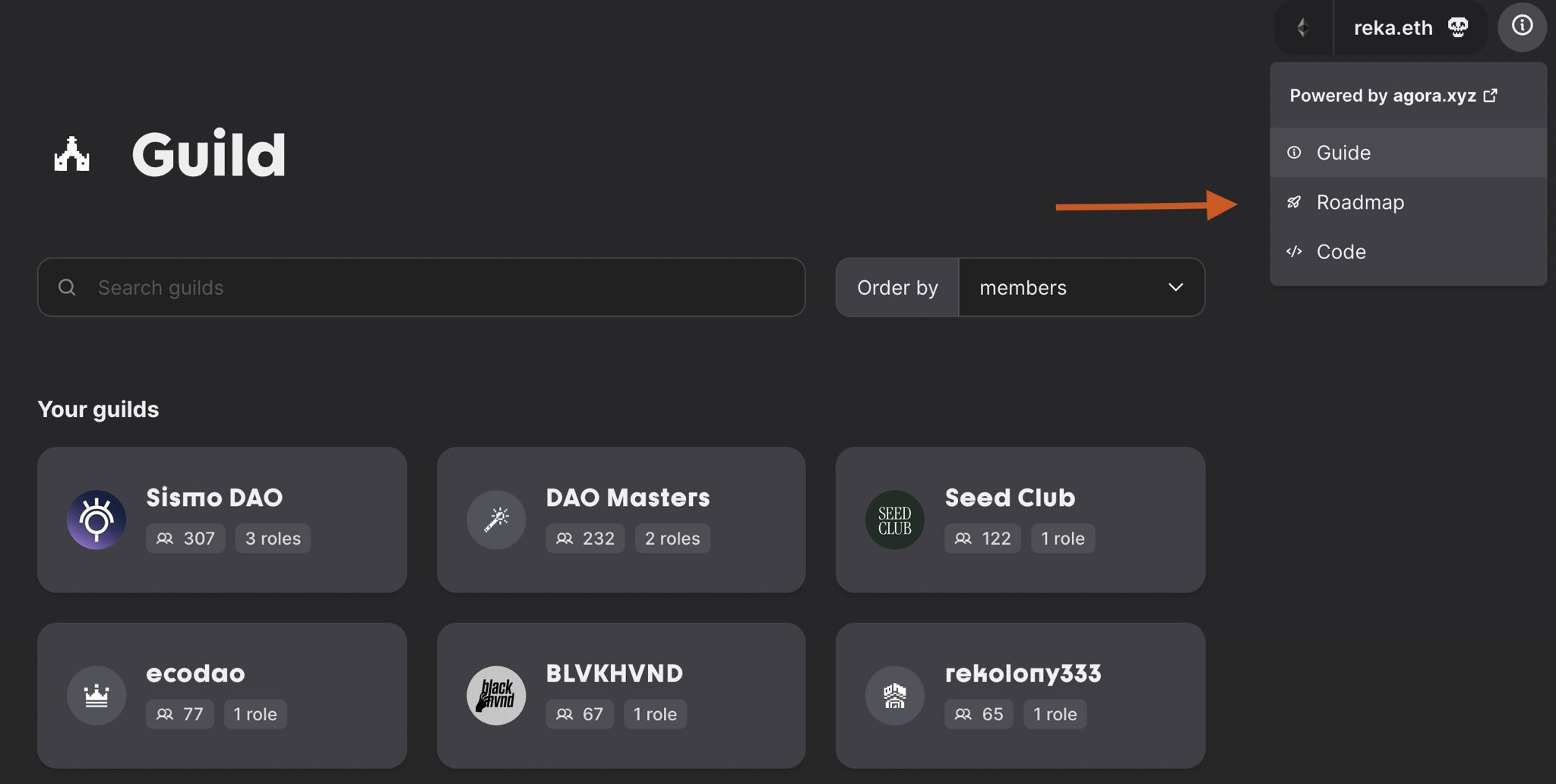

8. Multi-chain governance

Tokens are not the best choice for voting because they:

- Subject to chain security risks

- not conducive to participation

The race is on to establish the next industry standard for cross-chain DAO tools. There are many unique ways to achieve this.

For example, Guild

9. Privacy

When you mention zkproof, you have to mention privacy, right? Our privacy should be the most important thing to us. zkproofs enable zero-knowledge verification of arbitrary functions without revealing underlying information. this is very important.

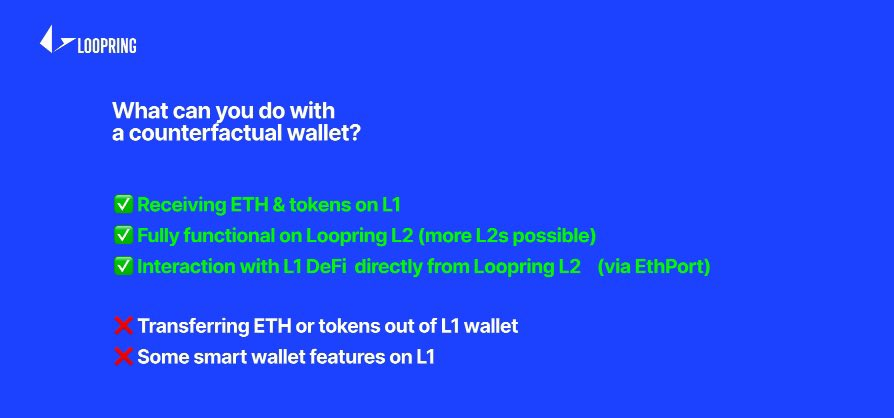

10. Counterfactual wallets

Counterfactual wallets will enable users to spend ETH directly to L2 while avoiding the high gas cost of initial L1 deposits This technology will be used by top CEX and DeFi protocols to bring a large number of new users

For example, Loopring

11. Cross-chain account

Many proof-of-stake blockchains have been quietly working towards a cross-chain future. Cross-chain accounts will allow different blockchains to easily interact with all smart contracts on ETH. This will help free up billions in...

For example, Cosmos

Back to basics?

Everything I've described in this post could be the spark we need for our next trend. If they play out accordingly, this could lead to a refreshing new chapter for ETH.