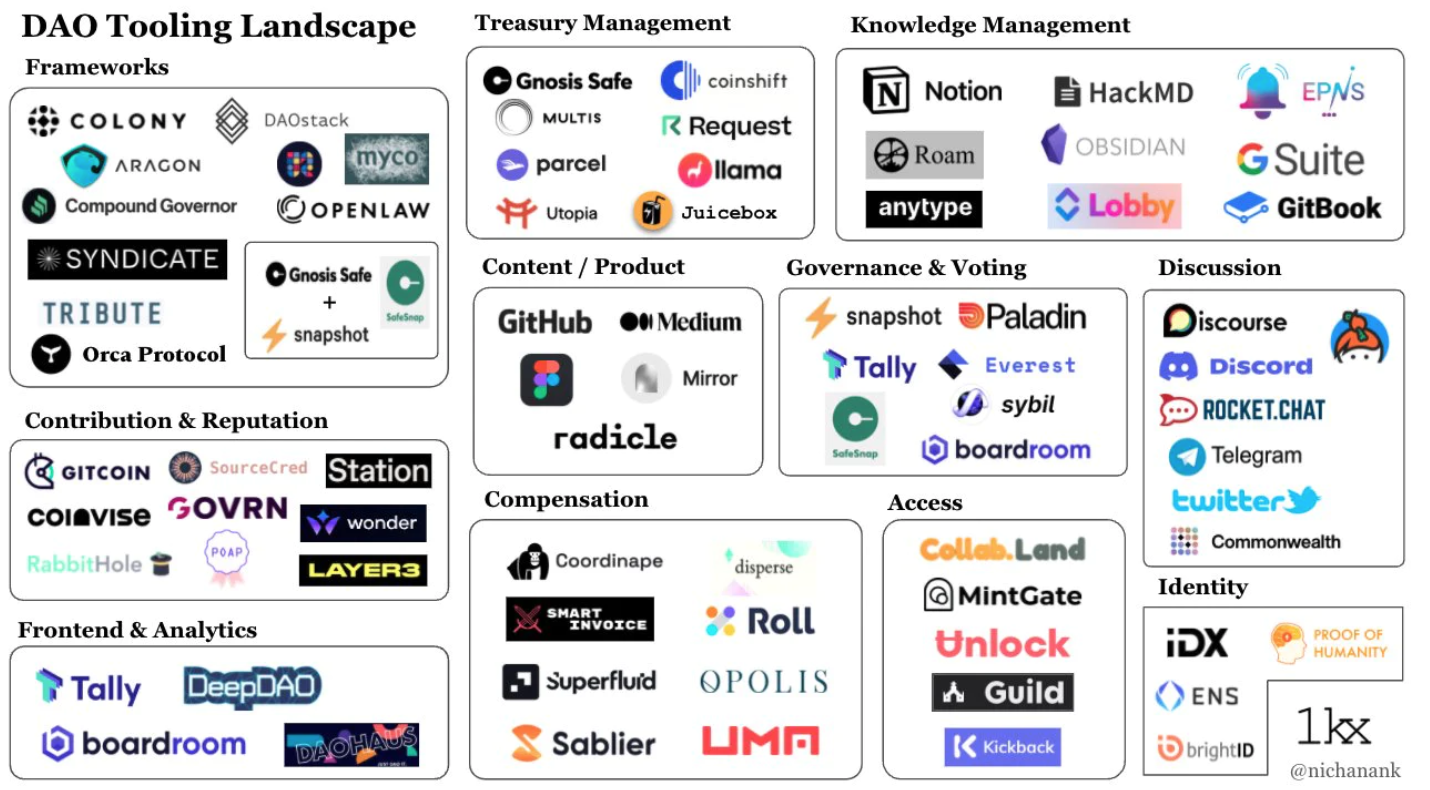

Explain the status quo of DAO tools in detail: How to better build DAO tools?

image description

text

Everyone at ETHDenver is either an investor or works as a DAO tool

There is no one who is an investor and works on a DAO tool.

But there are certainly some challenges.

With hundreds of founders now building DAO tools, what is their biggest challenge?

Without full-fledged DAOs, no one knows how to organize, manage, and motivate themselves, and those DAOs will look completely different in a few years.

Therefore, no one knows how to build a DAO.

We need more DAOs, not more DAO tools.

In this article, I base myself on being a member of multiple DAOs inMirrorBuilding DAO tools, and the experience of working closely with DAO operators in the past year, share some thoughts on DAO tools.

First, let's look at some of the challenges that current DAOs face.

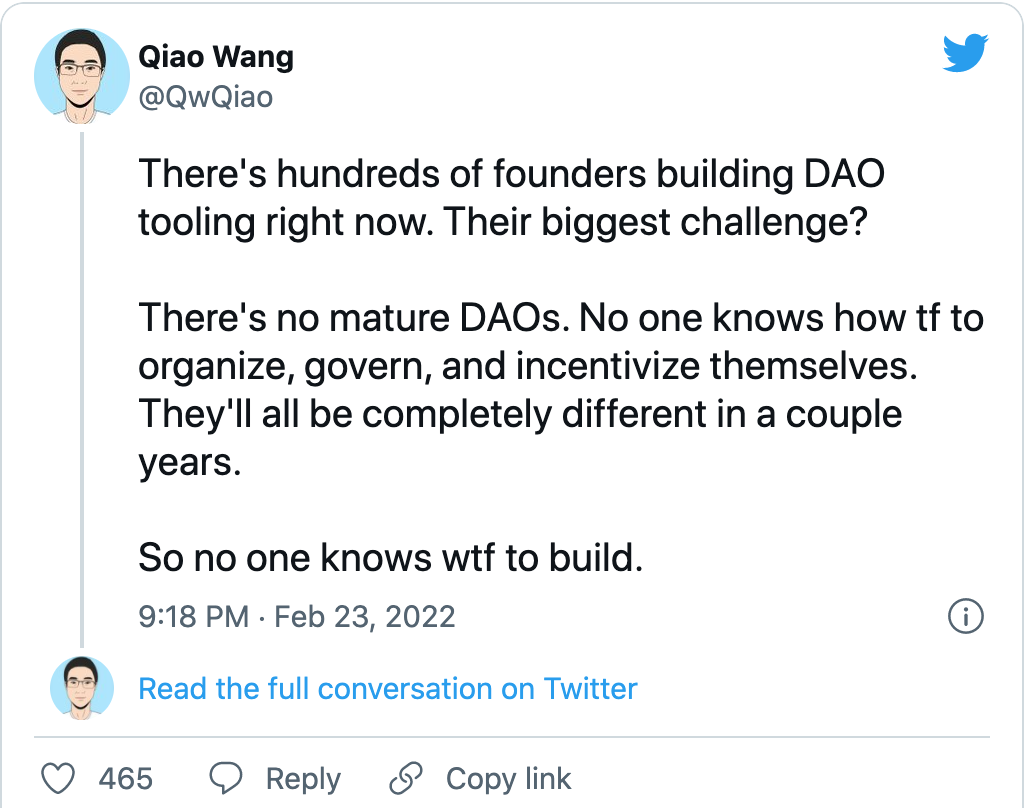

"DAO" is not a market

People think building a DAO tool is like you're building a tool for a business,it doesn't really mean anythingimage description

Source: https://coopahtroopa.mirror.xyz

Therefore, the first step in building a DAO tool is to clearly define the target audience.

Different DAOs have different needs

Most DAOs share the same core components:

financing mechanismcrowdfundingcrowdfunding、multi-signatureortoken sale。

multi-signatureto store assets and authorize transactions, usually throughGnosis Safe(if building on Ethereum).

group chatgovernance

governanceprocess, to make strategic decisions, such as how to useFund diversification、wait.、organizational structurewait.

The DAO operations team handles contributor onboarding, payroll, financial management, marketing/communications, etc.

However, depending on the type of DAO you're building, they're likely to prioritize a completely different set of features, affecting the product's roadmap. Here are a few examples:

Protocol DAO:fundsfunds, and some are hundreds of millions of funds. Because these are decentralized organizations, their reallocation of these funds for investment, compensation, grants, etc. requires the security, transparency and automation of smart contracts. Building for a protocol DAO requires a highly technical team who canconfrontational and risky environmentUse comfortably and produce code.

Social DAOs:Prioritize positive communication among members. Love it or hate it, Discord is currently the tool of choice for social DAOs. However, many DAO tools projects are trying to build a "Web3-native Discord", starting with a token-threshold chat function. I doubt a project can differentiate enough starting with a token-licensed chat feature, since Discord is already doing a good job, and it already has strong network effects. Instead, I think the project should focus on building a useful individual tool for DAO members (i.e. feedback on on-chain activity, NFT airdrop tool, custom governance product, contributor directory, project updates via feedback and email, etc.), using Individual tools to gather a sufficient number of DAO members, then layer in social features such as messaging, social graph, and notifications, and build a network that could eventually rival Discord.

NFT Collector DAO:Prioritize mechanisms for adding funds to its treasury, provide governance tools for investment decisions, and easily coordinate the allocation of funds. Most NFT collector DAOs on Ethereum use Gnosis multisig to secure their crypto holdings. One area of opportunity here is to build a social application that eases coordination between collators and abstracts on top of Gnosis multisig to automate how funds are distributed. For example, if community members vote on a governance proposal, if they reach 5 ETH, they can sweep the bottom layer of Squiggles, if the proposal passes, the tool will queue the transaction, and if the standard is met within the specified time, the transaction will be automatically submitted.Gnosis SafeSnap ModuleMake it all easier to do. as we are atConstitution DAO、andandPartyBidThere is a rapidly growing market of people interested in collective ownership of blockchain-based assets, as seen in financial flash mobs, and simply need the tools for their specific needs.

Building a common DAO tool is challenging because different DAOs prioritize different functionality. So narrowing the focus will become the dominant solution for a specific use case, and then the tooling continues to expand further from there.

image description

Source: https://twitter.com/nichanank/status

Current DAO tools do not have a clear business model

If your DAO tool is a protocol (i.e. a smart contract deployed on a blockchain network), its obvious business model is on-chain transaction fees. But most DAO tools are just UI written to the database. For the latter, there is currently no clear business model.

You could integrate Stripe and charge fiat transaction fees, but many DAOs are unregistered and unbanked, which can limit your potential market size. Another downside of fiat transaction fees is that you cannot generate on-chain revenue, which will limit your ability to eventually deploy the protocol, launch tokens, and hand over ownership to community members. This is a long-term risk, and if you don't start with the right technical and cultural foundation, your DAO will be difficult to integrate.

While there aren’t any best practices yet, there are some potential ways to monetize DAO tools, such as using USDC for monthly fees, NFT subscriptions, orutility token。

I think the lack of a clear business model for DAO tools is a near-term problem that will eventually be fixed. Especially as more activity and computation moves to L2 and low transaction fee blockchains, which will allow projects to earn money on-chain in new and creative ways.

Everyone is competing for the same amount of legal DAO

image description

SpongeBob knows what's going on

It's just that there aren't that many legal DAOs yet. Most DAOs are just for fun, they don't care about being long-term projects. When a new DAO tool launches, you typically see the same three to five DAO logos presented as clients on the landing page. I also think this is a major near-term concern, but will eventually be addressed as DAOs become easier to launch, manage, and scale.

Anyway, if you are building a DAO tool today, you should think deeply about your market strategy. This could include having a well-known DAO operator on the founding team, securing investment from high-profile DAOs and DAO operators, forming business development partnerships, issuing token incentives, and more.

Once you've acquired an initial set of target DAOs and built a product that gives them high engagement and retention, it might make more sense to focus on features that make it easier to launch the type of DAO you're focusing on so that you You can expand your market, rather than just rely on a limited set of customers to increase revenue.

While there are some challenges in building a DAO tool, I still think there is a ton of opportunity here if you think it through. Here are some high-level guidelines based on what I've seen work.

start with service

When every DAO tool is competing for the same amount of DAOs, you need a distributional advantage. One of my favorite methods is to start by offering services to different DAOs, so you can develop expertise in a specific area, build relationships with the core team, and eventually productize your service. A good example isLlama DAO。

andUniswap、AAVE、GitcoinandFWBWait for top DAOs to submit governance proposals on financial management. In no time, they were the go-to specialists in treasury management. They've also built a community of high-quality contributors, deep relationships with all of the top protocol DAOs, and now Llama DAO is productizing their service with their own protocol. During the service phase, participate in the DAO governance forum, contribute to working groups, apply for grants, execute bounties, submit pull requests, build the Dune dashboard, and publish proposals. Do whatever it takes to start developing the relationships and expertise that will inform how you productize your services.

Please don't be the founder of this type of DAO tool.

Never ask:

a woman's age

a man's salary

The founders of a DAO tool, which DAOs they have participated in

dominate a market segment

As mentioned earlier, DAOs have different needs. Depending on the type of DAO you are targeting, they will have different requirements, including protocols, interfaces, feature sets, marketing, business development, and more. Rather than building a mediocre product for a broad initial market, build the default product for a very specific niche. To do this, you have to consider the positioning of the DAO both vertically and horizontally.

Vertical focus is on a specific type of DAO (e.g. protocol DAO, social DAO, NFT collector DAO, etc.). The horizontal focus is on specific tools for different types of DAOs (e.g., governance, financial management, salaries, contributor onboarding, etc.).

I would start by building something at the intersection of a vertical focus and a horizontal focus (e.g. governance for a protocol DAO or contributor onboarding for a social DAO) and see that as your strategic starting point. Your first milestone is to become the default product in this market. If your DAO tool is a networked product (eg, social app, marketplace, collaboration tool), then you should focus on liquidity rather than scale early on.

Fluidity, in this context, refers to the quality of experience a user experiences when engaging with a product. In networked products, liquidity often depends on the number of other relevant users participating in the product. For example, if you're building a social app for a DAO, the quality of experience for that app depends on whether people engage with what you're posting, and whether there's enough interesting content to engage, and the same goes for collaboration tools.

A recent example is,ClubhouseThere was only one audio room at the beginning, and everyone was a designated speaker, and the main speakers were composed of founders, operators and investors in Silicon Valley. Every time someone opened the app, a Slack notification was sent to the Clubhouse founders, and one of them rushed to open the app and greet the new user in the audio room. As more people join, there are usually at least a few relevant people chatting in the audio room. This creates fluidity and ensures that most people have a good experience when using the app. Over time, Clubhouse created different personas for speakers and listeners, it allowed people to create their own rooms, and it expanded to other networks beyond Silicon Valley. Many networked products start with this restrictive approach to drive mobility (e.g., Facebook and Tinder versus college students, Amazon versus books, Uber and AirBnB expanding city by city, etc.).

Most networked products don't need to scale very early on, they just need a minimum viable network for a specific market in order for initial users to have a good experience. So think about your strategic starting point, liquidity, what's driving it, and how you're going to measure it before you scale it up.

DAO tools should feel more like a multiplayer game than enterprise SaaS (software as a service).

From there, you can expand by providing adjacent tools and/or distributing to different types of DAOs.

Focus on retention and business development

Once you define your initial market and the factors driving liquidity, you can start thinking more deeply about product and distribution issues.

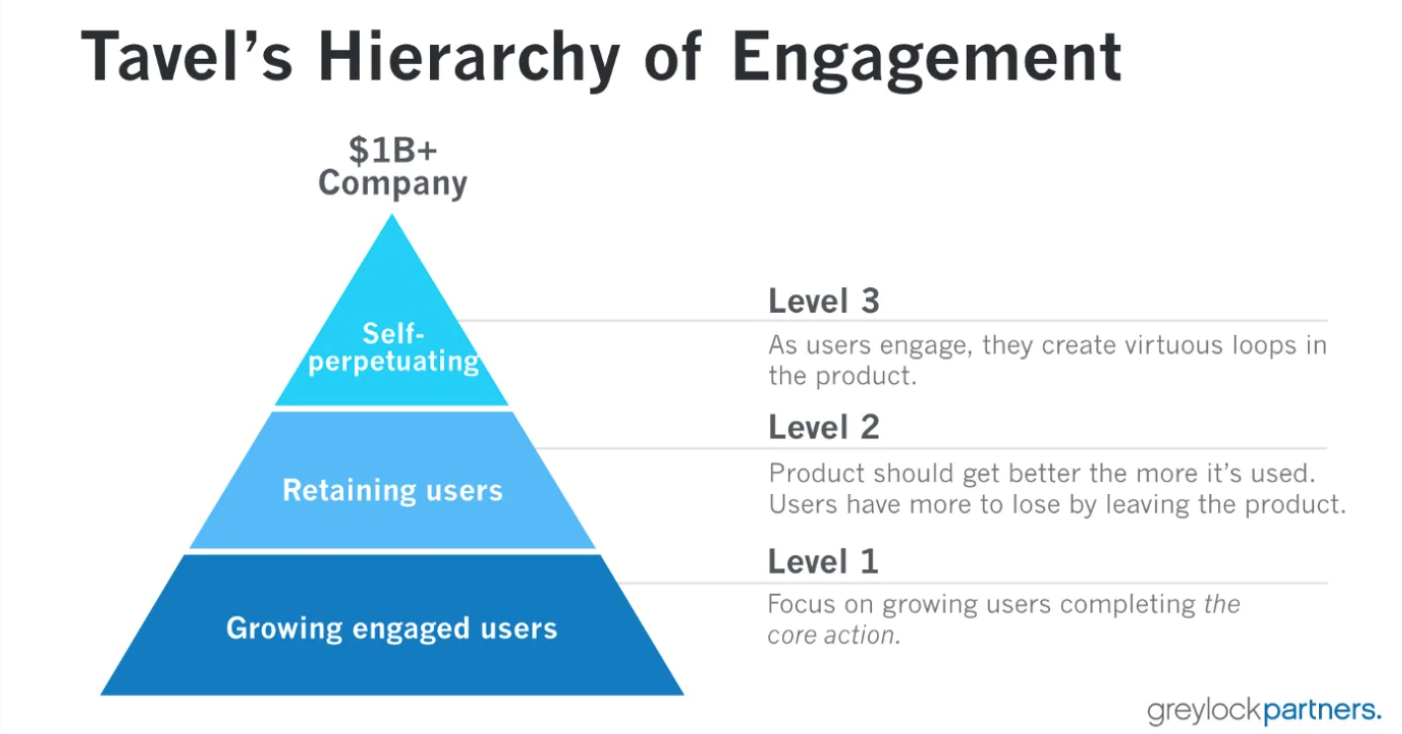

On the product side, you should focus on improving existing features and adding new ones so that your initial set of users and DAOs are engaged with the product on a regular basis. If they keep using your product, great! How engaged are they? How does it compare to other products? If not, are they using other products? Why? Do they need a new feature? Are existing features unavailable? Are there any products they use to handle this use case? If not, maybe it's not a core issue for them. Observe customer behavior, collect feedback, and understand the wider market. Also, think about your product'sParticipation level, and buildParticipate in the cycle, such that each user's engagement leads to a) further engagement in the future, and b) more engagement by other users.

image description

image description

Source: https://andrewchen.com/investor-metrics-deck/

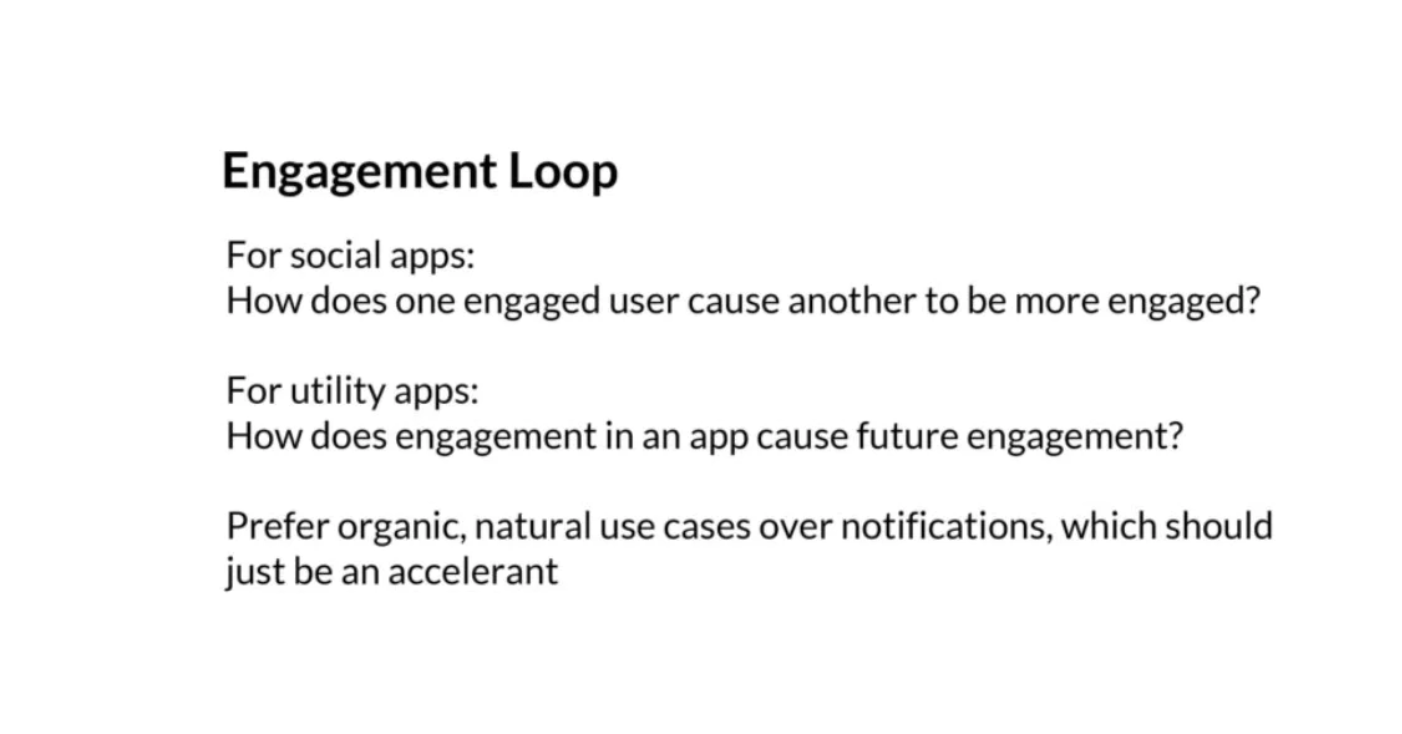

Participate in the cycle

For social apps: how does an engaged user get other users more engaged?

For utility apps: How does participation in an app affect future participation in more people?

Advocate through organic, natural use cases, rather than notifications, which may just be a facilitator.

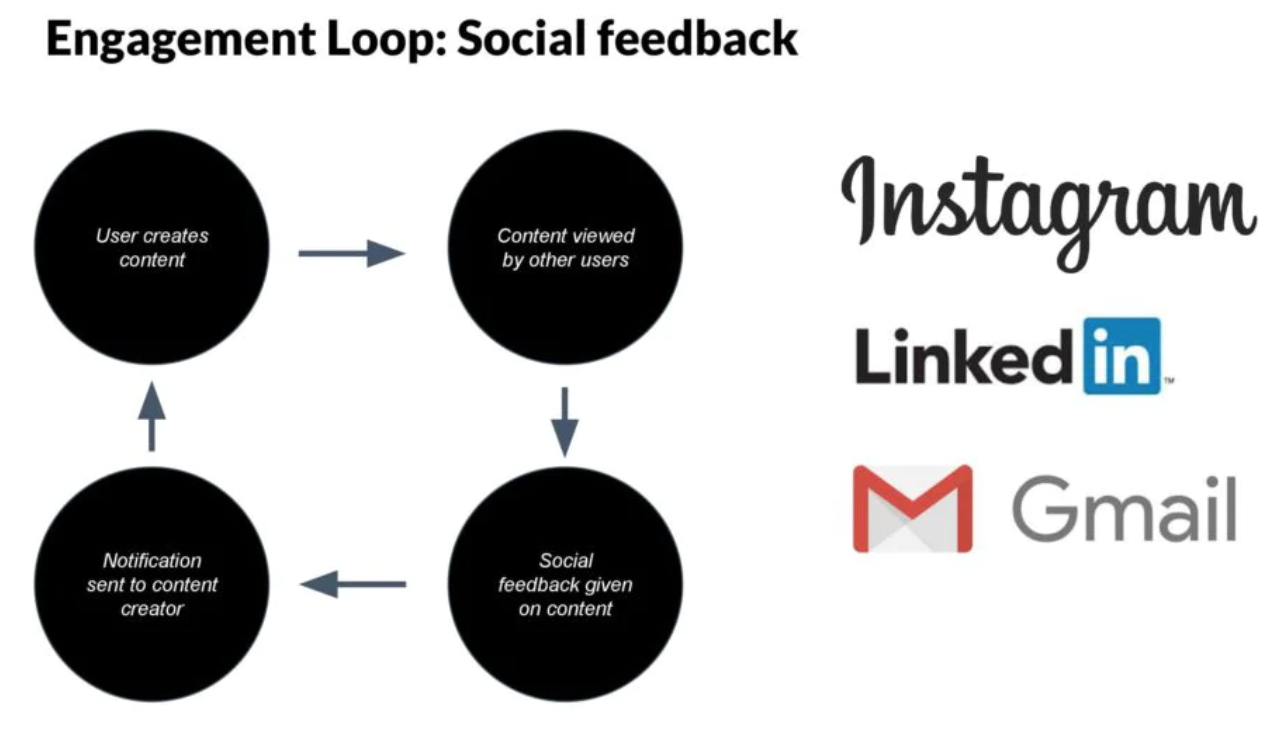

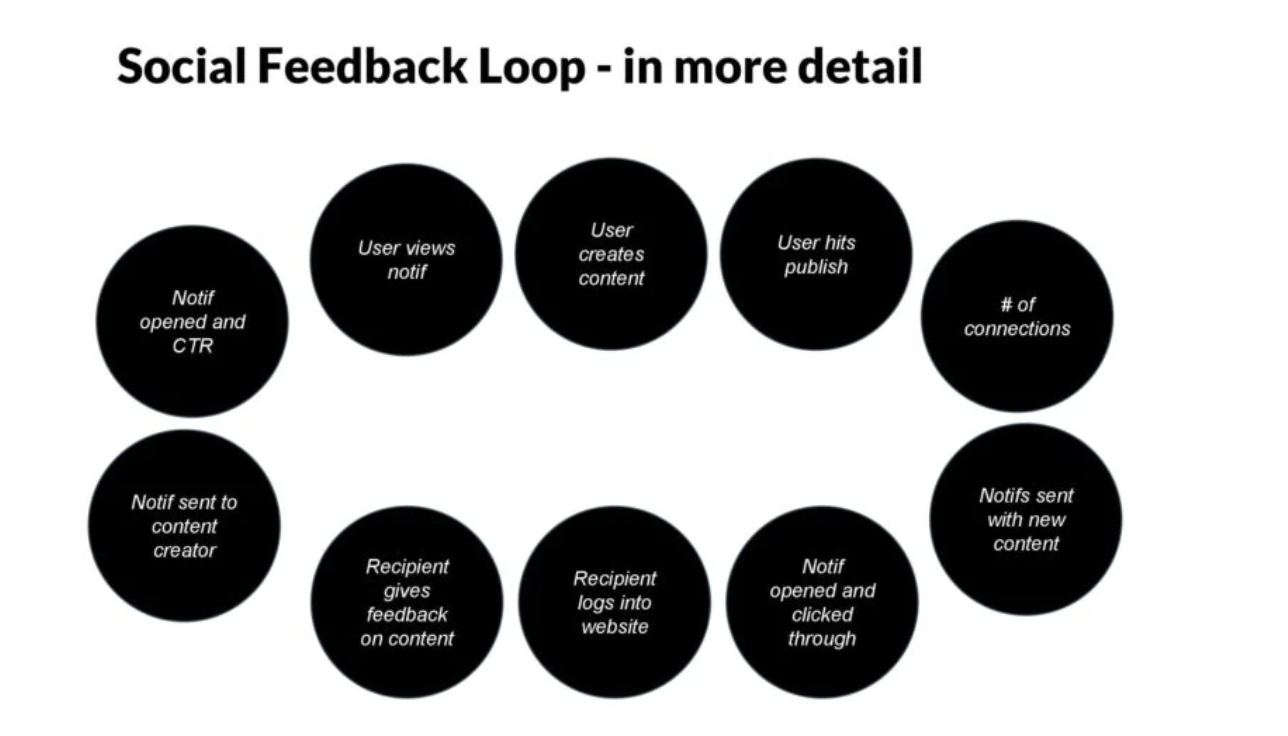

Many times, engagement loops are driven by social features like follow graphs, content, profile pages, notifications, etc. These are scalable ways to keep users coming back often.

image description

Source: https://andrewchen.com/investor-metrics-deck/

image description

Source: https://andrewchen.com/investor-metrics-deck/

Once you map out your core engagement circles, identify which steps you want to prioritize, iterate on, and layer in other engagement circles to strengthen your network. It's also important that you consider how to build these capabilities in a way that optimizes composability across the Web3 ecosystem. For example, put the content,and,andEncode social graph relationships into NFTs. Building in this way allows you to create a protocol that other projects can integrate for their own use cases, which helps the ecosystem and drives your protocol growth.

In terms of distribution, joining a DAO is more like doing an enterprise sale than it is Increase average revenue per DAO Increase the number of clients of your DAO You can increase your average revenue per customer by increasing your price/take rate to offer more features, and by driving more engagement. But given the limited number of DAOs currently on the market, if you don't build a system to admit and retain DAOs at scale, you may hit a ceiling early on. In the early days, you can rely on relatively manual business development efforts. But over time, you need to invest in more scalable strategies, such as token incentives, developer tools (such as SDK, API, documentation,subgraphwait),andandecosystem investment. Each of these growth strategies is probably worth a separate post, which I'll save for another time. One of the best growth strategies in Web3 is to launch a well-executed DAO, which we'll cover in the next section. One of the new properties of Web3, blockchain and cryptocurrency economic networks is that they enable new internet-native organizational structures, which is basically what DAO means. Today, we have joint stock companies, of which, superstructuresuperstructure(Hyperstructure)。 The elements of a self-sustaining protocol DAO include: A smart contract-based protocol with value capture mechanisms such as transaction fees A token that represents governance and equity in the protocol A governance process for making updates to the protocol Build a valuable product/protocol integration developer ecosystem Community initiatives that keep DAO members engaged and activate new members (eg, working groups, community calls, onboarding meetings, IRL events, hackathons, etc.). I recommend looking into protocol DAOs like Yearn, Uniswap, Curve, AAVE, Compound, and Index Coop to see how they actually work. Read their docs, use the protocol through the UI, dig into the governance forums, check out their GitHub, hang out on Discord, join a working group, apply for a grant, execute a bounty. I want you to notice the common patterns of these DAOs and understand the framework they use to make strategic decisions (digging into the governance forums helps a lot with this). Many of these projects are based onProgressive decentralized gameplayto become a DAO. Web3 is about decentralizing power and handing ownership over to a wider range of stakeholders. Becoming a DAO is the best way to do this. In a future article, I will share case studies on how top projects evolved into protocol DAOs. While there are certainly some challenges building DAO tools today, you still have quite a few opportunities if you narrow your focus to become the dominant solution for a specific use case, and expand from there. What you need is to take the time to identify gaps in the market, focus on liquidity rather than scale early on, and gradually decentralize.become a DAO

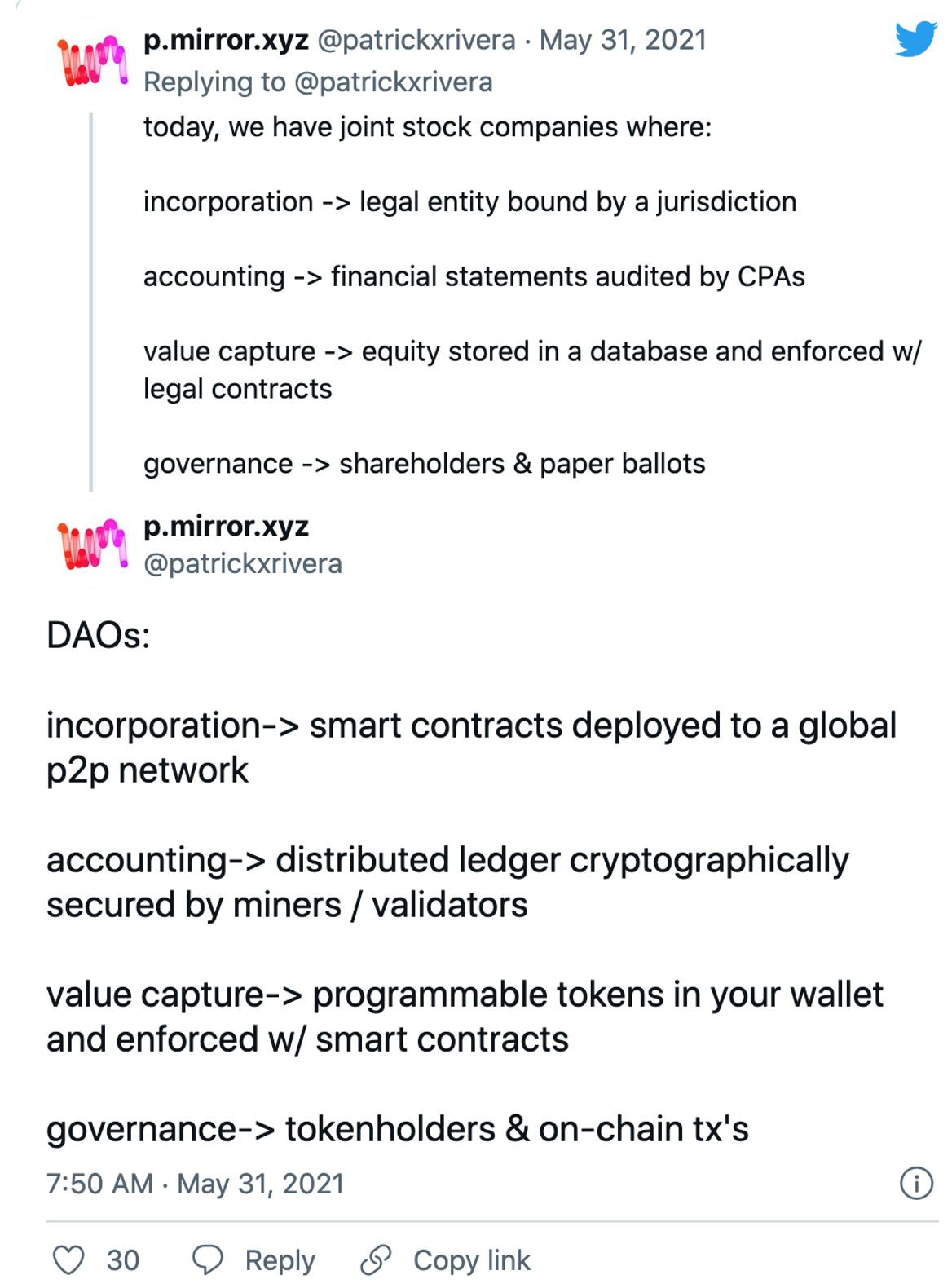

Formation: A legal entity bound by a jurisdiction

Accounting: Financial statements audited by a certified public accountant

Value capture: Equity is stored in a database and enforced through legal contracts

Governance: Shareholders and written votes

For DAOs,

Founded: smart contract deployed to global P2P network

Accounting: distributed ledger, cryptographically secured by miners/validators

Value Capture: Programmable Tokens in Wallets and Enforced via Smart Contracts

Governance: governance of token holders and on-chain transactions