One article compares three heterogeneous blockchain networks: Cosmos, Polkadot, Avalanche

Compilation of the original text: The Way of DeFi

Compilation of the original text: The Way of DeFi

image description

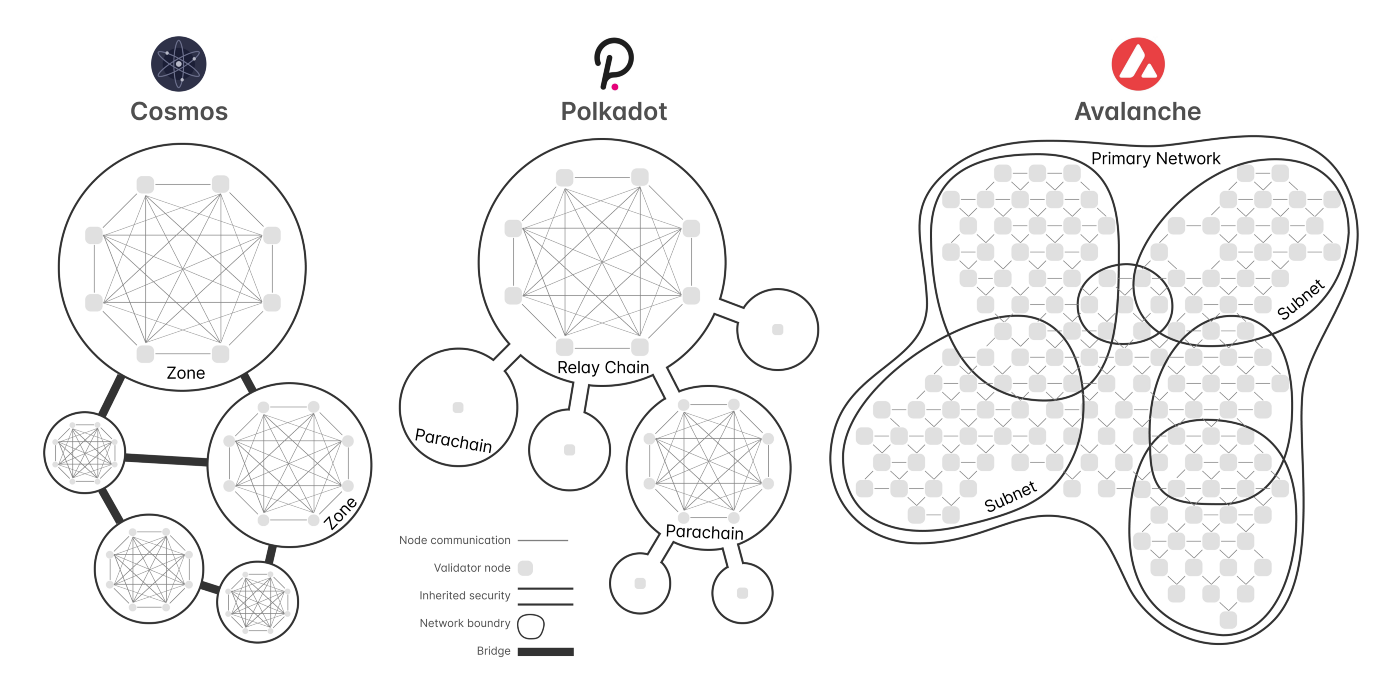

Interchain Economic Security Topology in Cosmos, Polkadot, Avalanche

It has become common knowledge that Bitcoin has opened Pandora's box and is becoming "digital gold" over time. Ethereum introduced programmable internet money and became a platform for cryptoeconomic innovation. However, Bitcoin, Ethereum, and their variants have key issues that prevent mass adoption of encrypted networks. We will first look at these issues and then use these points to compare the new generation of blockchain platforms.

1. Energy Efficiency: For an open decentralized computer network to function properly, its independent participants need to agree on a shared state. While doing so, the network should remain effectively consensus fault tolerant (Byzantine Fault Tolerant) despite imperfect information or the presence of malicious actors. Consensus that allows participation in open networks while preventing the same entity from operating on multiple identities (Sybil attacks) is handled through an admission method called proof-of-work (PoW) (first introduced by Cynthia Dwork in 1992, with for combating spam). This approach requires participants to use enormous computing power, which warms the planet, and some value is transferred to the power company. Clearly, there is an economic cost to securing a distributed computing network, and the new project uses an alternative proof-of-stake (PoS) mechanism to implement validator admission, i.e. by locking up token deposits to become participants. This deposit must be expensive enough to sufficiently discourage malicious behavior or offline. In fact, similar economies of scale apply to Proof-of-Stake (PoS) and Proof-of-Work (PoW): the cost of running a validator node shifts from OPEX (operating expenses of the mine) to CAPEX (opportunity cost of capital).

2. Transaction delays: Bitcoin, Ethereum, and their variants employ the Satoshi Consensus, which requires waiting for multiple new blocks to be created to ensure that transactions cannot be recovered. Therefore, the Nakamoto consensus chain has high availability, but due to its probabilistic transaction finality guarantee, the transaction speed is low, which requires the waiting chain to be long enough. To achieve faster transaction finality, many blockchain projects use the classic Practical Byzantine Fault Tolerant (PBFT) consensus, which has its own weaknesses, including how large the validator set can be without slowing down the network, and how large the validator set can be without slowing down the network. Uptime or liveness aspects can be beneficial to security.

3. Computing throughput: The amount of computing work that can be done per second in a distributed computer network is throughput, which defines the extent to which the network can be expanded. A commonly used metric, "transactions per second," is misleading because transactions can refer to simple transfers or complex financial calculations; they require different amounts of computing power. Actual throughput is the amount of computational work that the network can handle per second as a function of network participants. To achieve overall high throughput, projects either adopt a vertical scaling strategy, which requires high-performance computing on nodes and optimizes node software, or a horizontal scaling strategy, which involves parallel processing by dividing the network into multiple parts.

4. Transaction costs: The blockchain must find a way to limit its execution, otherwise the network of nodes running the blockchain is vulnerable to denial of service attacks (DOS). To make this limitation, Bitcoin allows for a fairly limited scripting language, and Ethereum charges transaction fees based on the gas metering of smart contract executions. The problem is that whether you're doing a simple transfer or a complex calculation in a transaction, it's all being processed on the same network. As a result, when network traffic increases, transaction fees increase for even simple operations, so using the chain becomes exclusive to those with large wallets. Fees are paid to miners as an incentive for prioritizing transactions. While Bitcoin transaction fees will serve as the only incentive after issuance reaches the 21 million cap, in Ethereum their sole purpose is to prioritize transactions. Burning transaction fees is a mechanism to gain traction in new projects, and recently Ethereum has also started burning some fees, so as network activity grows, all token holders benefit from increased scarcity.

5. Decentralization: Contrary to popular belief, Bitcoin and Ethereum actually achieve very little decentralization due to the centralization of mining pools (as of November 2021, 90% of Bitcoin's computing power is powered by 11 miners). Pool control, 90% of Ethereum’s computing power is controlled by 16 mining pools). As the cost of mining increases in Nakamoto Consensus, it becomes more difficult to successfully produce a block, and the power to run the network is pooled so that it is concentrated in a small number of aggregated miners. Next-generation blockchains address this problem through various solutions that we will explore below.

6. Fair distribution: How do blockchain projects distribute ownership shares (tokens) as the network grows? Bitcoin’s token distribution creates a looping interdependence between the security of the blockchain, the mining ecosystem, and exchanges. This becomes a pattern for many projects: as miners join the network to earn token rewards, the network becomes more decentralized and more secure, which attracts more people to use it. As demand increases, prices rise, attracting more miners to secure the closed-loop network. However, as the cost of mining increases, it becomes increasingly difficult to successfully mine a block; thus, the distribution of tokens or power to run the network is centralized, thereby concentrating on a few aggregated entities running miners. Ethereum employs a different strategy: they pre-mine tokens, remove the total supply cap, sell some tokens to early investors and public sale participants, allocate some to their foundation for running grants and bounty programs , and start rewarding miners over time just like the Bitcoin model. Soon, Ethereum’s token issuance was concentrated in a handful of mining pools, and the largest token holders became exchanges. Ultimately, over time, fair distribution defines who has power in the network: the power to produce blocks (order, accept or review transactions), the power to fork the network, the power to decide on protocol upgrades, and investment and staking applications power.

7. Governance: Changes to the network protocol can have significant impacts on all existing and future users, whether they realize it or not. In Bitcoin and Ethereum, improvement proposals lead to protocol upgrades and parameter changes, which are discussed, decided upon, implemented and applied by a core community of experts. If a group of miners is interested in pursuing a different direction than the majority, they can fork the protocol and start a new network, painfully leaving most network effects behind. Additionally, R&D funding allocations are often managed by central foundations, while alternatives are emerging as the community gathers around funding coordinating DAOs (Decentralized Autonomous Organizations). Larger groups of token holders or users do not really have a say in governance decisions, as they may not have expertise, interest, or awareness on the subject of the decision. Even if they did, they might have a little influence compared to large token holders, since votes are usually token-weighted. As new projects adopt fairer on-chain governance that more token holders can participate in (i.e. quadratic voting, time-locked voting, adaptive quorum bias, voting delegation, decentralized identity schemes for one person one Tickets) and off-chain signaling mechanisms, this is changing.

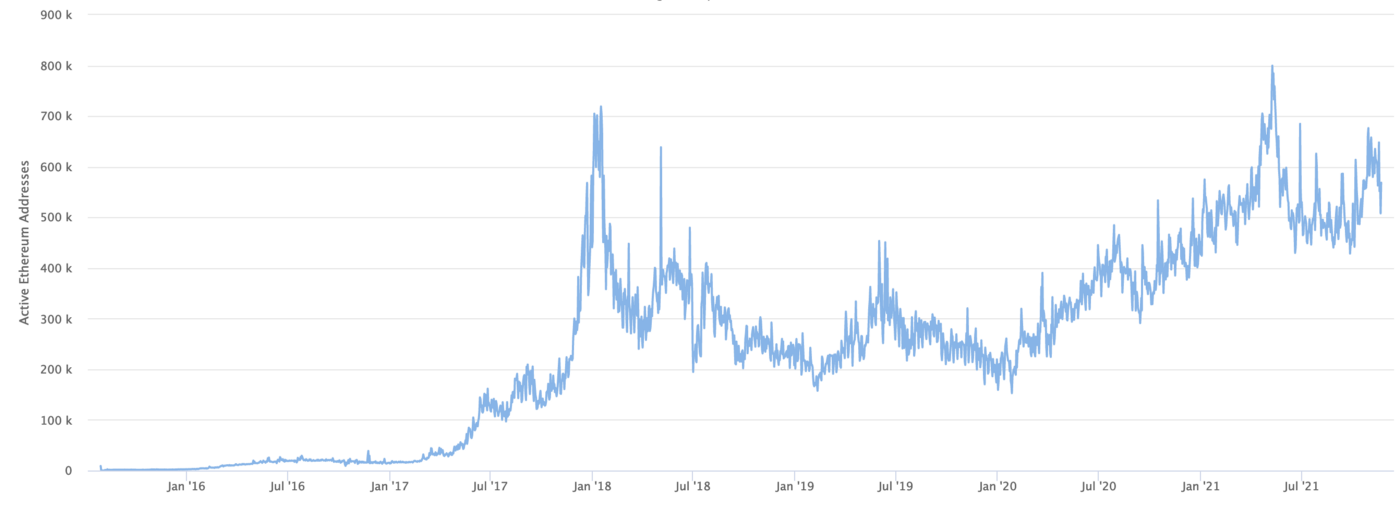

image description

Daily Active ETH Address丨Source: Etherscan

Today, Ethereum has an average of 500,000 daily active users, while popular web applications like Twitter have 200 million daily active users (400 times that of Ethereum), and Facebook has almost 2 billion daily active users (4000 times that of Ethereum) . Even adding Layer 2 and Bitcoin users, this is still a long way from network scale. Scaling is a critical challenge for an open decentralized internet, not a problem for tomorrow, but a priority here and now.

While newer versions of Ethereum are designed to address scaling issues, and its interim layer2 solutions are currently trying to meet growing demand, the next-generation platforms Cosmos, Polkadot, Avalanche (mainnet launched in 2019 and 2020) have reignited The promise of a truly decentralized internet. We will start by looking at the new version of Ethereum.

Ethereum as a new version of the EVM ecosystem

Since its inception, new versions of Ethereum have been changing by employing new scientific research as well as mechanisms invented by new blockchain platforms. The new version of Ethereum will use proof-of-stake, split the network into synchronous shards, and aim to increase aggregate computational throughput. Validators running the same Ethereum Virtual Machine (EVM) will be assigned to different network shards, generate blocks, accumulate different user activity data, and synchronize with each other through a relay chain called Beacon. However, trying to synchronize all shard parts means trying to achieve full replication, i.e. having a consistent copy of the database across all nodes. This is problematic because the point of sharding in distributed computing is to scale by not replicating all the data across the network. In a synchronous model or homogeneous network topology, when one shard (such as a popular DeFi shard) gets more usage than others, it will start to suffer from the same speed, cost, and scaling issues. Also, there is a new problem of efficiently synchronizing data between shards.

While the transition to the new version of Ethereum is said to be fully complete in a year or so, so-called Layer 2 solutions — Rollup (Optimistic, zkSync), Plasma, and State Channels — have already been rolled out to provide support for the growing Ethereum community. Usage requirements provide efficiency and speed. The dilemma is that a Layer 2 trust model either has an intermediate central operator that defeats the purpose of decentralization and censorship resistance, or has multiple incentive operators (i.e. Polygon is built with Tendermint and runs on multiple validators, Matter Labs' goal is a network of validators using zkSync), which is similar to another decentralized blockchain with its own token (e.g. MATIC) and eventually competes with its layer 1. Therefore, these single-chain architectures will suffer from the same transaction cost problem as more users join.

Modular Blockchain Design

end gameend game"). In fact, this strategy lends itself to emerging modular blockchain designs, where blockchains can outsource data availability or execution to other blockchains. A general model of this strategy was developed by Celestia and EigenLayr. Additionally, Ethereum's new strategy is similar to the shared security model already used in Polkadot and Avalanche.

On the other hand, since Cosmos, Polkadot, Avalanche all have a bridge to Ethereum on at least one of their EVM-compatible chains, they are sometimes placed in the same "Layer 2" bucket, and these projects often refer to themselves as Layer 0 , as they provide the infrastructure for building interconnected Layer 1 blockchains.

Cosmos、Polkadot、Avalanche

Cosmos, Polkadot, Avalanche are designed to scale horizontally through an asynchronous heterogeneous network model, where application-specific blockchains have distinct virtual machines and can interoperate with other chains when needed. These infrastructure platforms provide the ability to build your own custom blockchain, allowing greater design space for decentralized applications and assets. Running your project as a sovereign chain rather than a set of smart contracts has three fundamental advantages:

Performance Isolation: Isolating your chain from other chains ensures that your user experience is not affected by unrelated high activity on the network, so it provides better performance and you can bridge to other chains when needed.

Predictable and customizable charges: Share charges on a permissionless network out of your control. Some applications' high activity on the network may increase your application's arbitrary charges. Having a custom fee structure allows you to have predictable fees and remove the infrastructure between your application and its users. You don't need ATOMs, DOTs, or AVAXs to use application-specific chains. Not forcing users to use infrastructure tokens to charge fees is critical for mainstream adoption.

Customizable Validators: Custom validator rules and requirements to focus your chain on its domain-specific needs. Your chain's validators can be compliant with certain jurisdictions (e.g. the EU's GDPR), can have high-performance hardware requirements, or have certain certifications to be a validator.

These next-generation networks also have bridges to Ethereum and soon to Bitcoin, and are developing bridges to each other to fully realize the vision of the Internet of Blockchains.

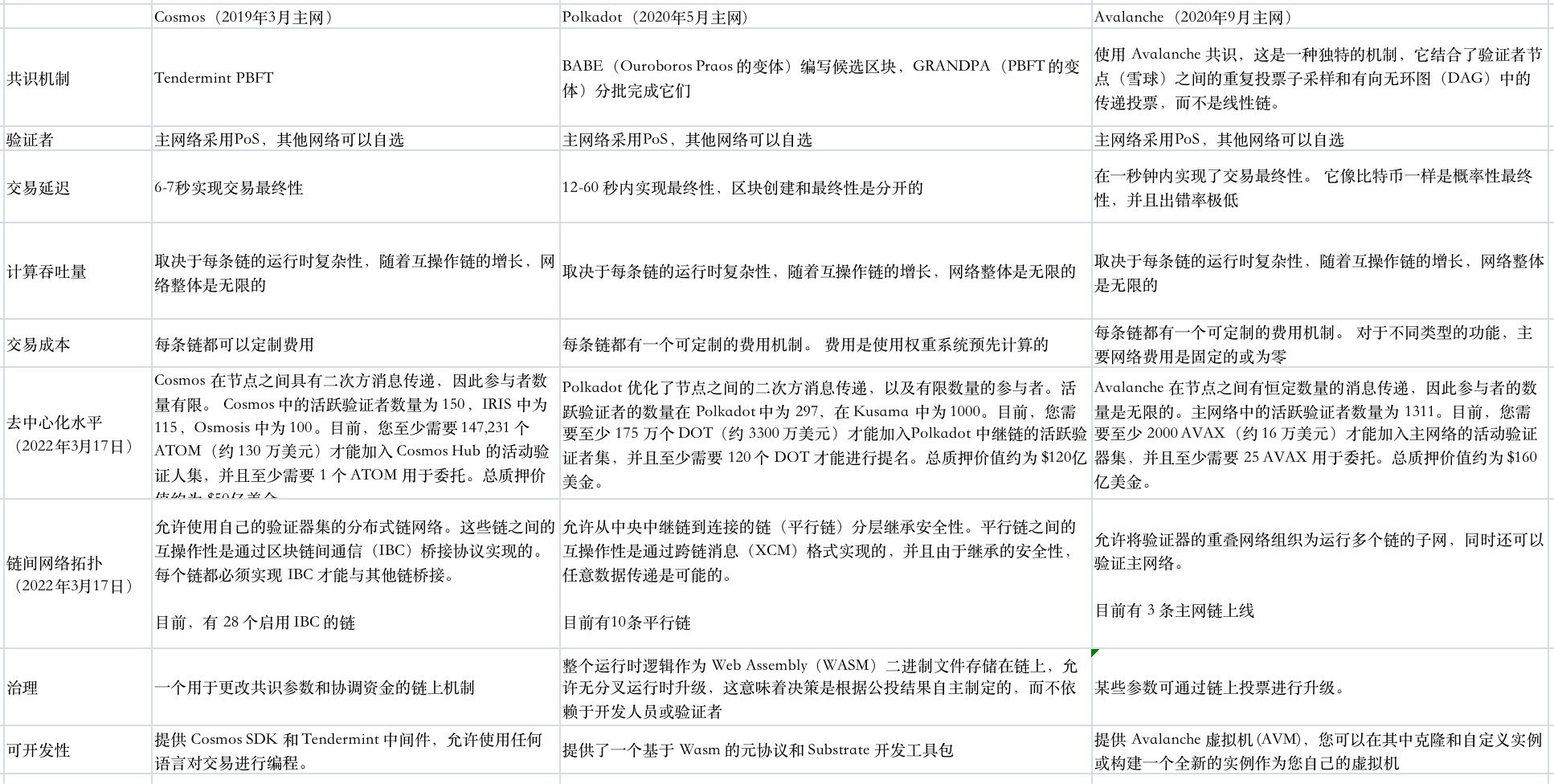

consensus mechanism

consensus mechanism

Safe and consistent replication of application state across an open network of machines is achieved through a consensus mechanism. While doing so, the network should maintain fault tolerance and efficient consensus despite imperfect information or the presence of malicious actors (Byzantine Fault Tolerance). Practical Byzantine Fault Tolerance (PBFT) used in Cosmos and Polkadot requires all participating nodes to communicate with each other so the network agrees on a decision with absolute certainty. It has low latency and fast finality, but it cannot scale to many participants in a global open network because the load on each validator node grows exponentially as the validation work increases. Bitcoin introduced the longest chain consensus mechanism (Satoshi Nakamoto Consensus), which allows for probabilistic certainty and extremely low error rates. It allows building a robust and scalable network over time, but is very slow.

Cosmos, mainnet launched in March 2019, uses Tendermint PBFT consensus, providing fast finality. However, since every node has to communicate with each other, it has quadratic messaging complexity and can complete one block at a time.

Polkadot, the mainnet launched in May 2020, separates block production and finalization in a consensus manner: BABE (a variant of Ouroboros Praos) writes candidate blocks, and GRANDPA (a variant of PBFT) finalizes them in batches. This hybrid consensus optimizes the complexity of secondary messaging to a certain extent.

The Avalanche mainnet went live in September 2020, using Avalanche consensus, a unique mechanism that combines repeated voting subsampling among validator nodes (snowballs) and Pass votes instead of linear chains. Since Avalanche consensus has constant messaging complexity, it allows for low latency and a large number of participants in the network. It has probabilistic finality like Nakamoto consensus, but it is configurable and has an extremely low failure rate.

Validator entry criteria

Consensus that allows participation in an open network while preventing the same entity from operating on multiple identities (Sybil attacks) is handled by proof-of-work (PoW) or proof-of-stake (PoS) mechanisms. Like all new projects, Cosmos, Polkadot, Avalanche all use proof of stake because of its energy efficiency and ability to provide a larger design space. There are also projects on these networks that have implemented lighter proof-of-work (PoW) mechanisms for a fair token distribution mechanism.

transaction delay

Cosmos can achieve transaction finality within 6-7 seconds.

Polkadot as a whole can achieve finality within 12-60 seconds, and block creation and finality are separated.

Avalanche achieves transaction finality in under a second. It is probabilistic finality like Bitcoin and has an extremely low failure rate.

Computational throughput

transaction cost

transaction cost

As activity on the entire network grows, so do transaction fees. Cosmos, Polkadot, Avalanche have built specialized networks, and each chain has its own custom fee mechanism based on its own state growth.

Each Cosmos chain has a customizable fee mechanism.

Each Polkadot chain has a customizable fee mechanism. Fees are pre-calculated using a weighting system. Per-chain fee burning is optional.

degree of decentralization

degree of decentralization

The numbers below are from March 17, 2022.

Cosmos has quadratic message passing between nodes, so the number of participants is limited. The number of active validators is 150 in Cosmos, 115 in IRIS, and 100 in Osmosis. Currently, you need at least 147,231 ATOMs (approximately $1.3 million) to join the Cosmos Hub's active validator set, and at least 1 ATOM for delegation. The total pledge value is approximately $5 billion.

Polkadot optimizes quadratic messaging between nodes, and a limited number of participants. The number of active validators is 297 in Polkadot and 1000 in Kusama. Currently, you need at least 1.75 million DOTs (approximately $33 million) to join the Polkadot relay chain's active validator set, and at least 120 DOTs to nominate. The total pledge value is about $12 billion.

Avalanche has a constant number of messages passed between nodes, so the number of participants is unlimited. The number of active validators in the main network is 1311. Currently, you need at least 2000 AVAX (approximately $160,000) to join the main network's active validator set, and at least 25 AVAX for delegation. The total pledge value is about $16 billion.

Decentralization is also a function of validator staking and reward concentration (stake-weighted rewards), which typically follows a long-tail distribution - few validators have the most stake, and many validators have very little stake. Fair staking distribution remains an open question for blockchain platforms, with each project trying to achieve fairness in different ways. For example, since Polkadot's core is a PBFT-based consensus, there can be a limited set of active validators, but these active validators are equally rewarded through the Phragmén election method. Thanks to its novel consensus mechanism, Avalanche can have an unlimited number of active validators, and the average validator weight is gradually decreasing, increasing its level of decentralization.

Cross-chain network topology

The numbers below are from March 17, 2022.

Cosmos allows for a distributed network of chains with their own set of validators. Interoperability between these chains is achieved through the Inter-Blockchain Communication (IBC) bridging protocol. Every chain must implement IBC in order to bridge with other chains. Currently, there are 28 IBC-enabled chains covering areas such as DeFi, EVM smart contracts, social media, privacy, regenerative yield farming, and gaming. Bridges to Ethereum, Bitcoin, etc. are being developed.

Polkadot allows for hierarchical inheritance of security from a central relay chain to connected chains (parachains). Parachains do not have their own validators, they have collector nodes that collect transactions and generate proofs of state transitions for Relay Chain validators. Interoperability between parachains is achieved through the Cross-Chain Messaging (XCM) format, and arbitrary data transfer is possible due to inherited security. Currently, 10 parachains have different focus directions, such as DeFi, EVM smart contracts, social media, privacy and gaming. Bridges to Ethereum, Bitcoin, etc. are being developed.

Avalanche allows an overlay network of validators to be organized as subnetworks running multiple chains while also validating the main network. Different chains in the same subnet can transfer assets to each other (export-import) almost instantly. Subnet-to-subnet communication, where a chain in its subnet communicates with another chain in its own subnet, is currently handled through bridges (using the ChainBridge-Solidity contract of the EVM chain). In fact, the more subnets that have overlapping validators with other subnets, the higher the security guarantee that they can communicate with each other. This is because those validators that intersect will have a common stake in both subnets. If a group of validators behaved maliciously in one subnet, they would also risk validating stake in the main network and other subnets. While a subnet-to-subnet direct interoperability approach has not been announced, it would not be surprising to see the Avalanche Primary Network itself acting as an intermediary between all subnets. There are currently 3 mainnet chains online: X-Chain for transfers, P-Chain for Staking, and C-Chain for EVM smart contracts. Other chains and subnetworks are being built in the ecosystem. Also, like other platforms, there is the Avalanche-Ethereum bridge, which works through a trusted federation and is one of the most used of the 60 Ethereum bridges out there today.

governance

governance

Cosmos has an on-chain mechanism for changing consensus parameters and coordinating funds.

Polkadot's entire runtime logic is stored on-chain as Web Assembly (WASM) binaries, allowing forkless runtime upgrades, meaning decisions are made autonomously based on referendum results, rather than relying on developers or validators. Governance modules include token-weighted voting, rotating committees, time-locked token voting, and an adaptive quorum bias mechanism.

Certain parameters of Avalanche can be upgraded through on-chain voting. An extended governance mechanism based on its unique consensus is being developed.

Developability

At the core of all blockchains, there are the following components: database, p2p network, consensus mechanism, transaction processing mechanism, and state transition function (runtime or virtual machine). Cosmos, Polkadot, and Avalanche provide these core components and let developers build their custom state transition functions.

Cosmos provides the Cosmos SDK and Tendermint middleware, allowing transactions to be programmed in any language. You can build your own virtual machine and grow your own validator community. In order to get your chain live, you need to build a validator community from the ground up and attract validator communities from your existing chain. You can also deploy smart contracts on EVM compatible chains (Ethermint or CosmWasm).

Polkadot provides a Wasm-based meta-protocol and a Substrate development kit. You can develop your own virtual machines using provided modules such as accounts, assets, governance, EVM and building custom modules. You also benefit from Substrate's free execution model of on-chain scheduling, off-chain workers, and fee-free transactions. Your chain goes live after you win a slot in a parachain auction, which provides the inherited security of the relay chain. Alternatively, you can grow your own validator community. You can also deploy smart contracts on EVM compatible chains (Moonbeam, Acala) or use Ink smart contracts.

Avalanche provides the Avalanche Virtual Machine (AVM), where you can clone and customize an instance or build a brand new instance as your own virtual machine (a modular SDK for VM development has not yet been released). In order for your chain to go live, you need to launch a subnet and attract validators - who have already validated the main network - to run your chain. There is a subnet evm code that can be used to start a custom EVM chain. You can deploy smart contracts on the EVM-compatible C-chain.

Heterogeneous blockchain network topology

Cosmos Ecosystem

Cosmos Ecosystem

The Cosmos ecosystem has a distributed network topology, with different blockchains for different purposes having their own set of validators, and these chains communicate with each other through bridges when needed. This topology has been criticized for the fact that the least secure chain determines its security (when the most secure chain receives assets from the least secure chain, it becomes less secure). However, it also makes the entire network resilient, as the security of no single chain is critical to the survival of the entire ecosystem. But how is the Cosmos ecosystem different from almost any blockchain that connects other chains? Cosmos has a "no strings attached" policy that allows projects like Binance DEX, Oasis, Terra, Nym, and others to develop and launch their own application-specific blockchains using Tendermint.

speechspeech)。

Polkadot Inherited Security Topology

Polkadot has a hierarchically inherited security topology that works well for arbitrary data communication between its parallel chains (parachains), but these parachains rely on leasing security from a central relay chain. Polkadot parachains do not require building a community of validators, but instead lease security from the relay chain. They do this by winning a slot in an auction (about 100 slots in total) and locking up Polkadot's DOT tokens (they crowdfunded their DOT funding). When these domain-specific parachains are connected and synchronized to the relay chain through their collection nodes, their functionality is immediately available. One criticism of this mechanism is that different chains may not require the same level of security, and furthermore, no single chain should be critical to the survival of the ecosystem. While the Polkadot narrative popularizes the idea of parachains without validators today, one can use Substrate to launch a blockchain and grow a community of validators without relying on a central relay chain (see Compound Gateway). Additionally, parachains can grow their own community of validators, unlock their DOT funds at the end of the lease period, and use bridges when cross-chain communication is required. Additionally, there can be multiple relay chains that benefit the entire Polkadot ecosystem. Hierarchical topologies are likely to survive, as supporting cross-chain communication with inheritance security is more efficient than using bridges between parachains.

Polkadot has developed the Cross-Consensus Message Format (XCM), a common format not only for communication between parachains, but also for communication between different smart contracts, bridges, and Substrate trays . XCM works with Vertical Messaging (VMP) and Cross-Chain Messaging (XCMP), which allows message exchange from the Relay Chain to Parachains and back, and it allows Parachains to exchange messages with other Parachains on the same Relay Chain. Messages in XCM are programs that run on the Cross Consensus Virtual Machine (XCVM) (see Gavin Wood's article series). This abstraction for programming networks and building composable interchain applications can also be used for other heterogeneous blockchain networks.

As parachain communities grow, they may also want to have their own set of validators so that they can become relay chains that rent out their security guarantees to other chains. While nested security sharing mechanisms can become complex, all child parachains will share a common finality guarantee and the total number of state transitions per second will increase, expanding the total computational throughput of the entire Polkadot network.

Avalanche's Overlay Network Topology

Avalanche has an overlapping network topology. Every Avalanche validator node must secure the main network while securing other subnets. A group of validators forms a subnetwork. One subnet can validate multiple blockchains, and each blockchain is validated by only one subnet. In other words, a validator node may be a member of many subnetworks. When you launch a new chain, you have to provide incentives to attract a subnet of validators who are already running the main network and possibly other chains. If your chain is attracting new validators, they must be able to run the main network as well as the subnets that run your chain. Overall, the subnetwork architecture supports an overlapping network of validators (see diagram above), derived from the novel Avalanche consensus mechanism. Since the Avalanche consensus does repeated subsampling among its validating nodes, it does not require all nodes but a small subset of nodes to communicate with each other, which results in lower complexity of message passing in the network. Therefore, even if the network grows to thousands of validators, the bandwidth and processing power requirements of each node remain the same. Therefore, chains built on Avalanche are more inclusive than Polkadot and Cosmos in terms of validator participation, since the participation of each chain is unlimited. How many chains a validator can run depends on the complexity of the chain runtime/virtual machine design and is still an open question.

application

application

Heterogeneous blockchain networks Cosmos, Polkadot, and Avalanche provide a broad design space for their core infrastructure innovations. To this day, Ethereum has been the birthplace of cryptoeconomic innovation. In fact, the teams building on these new networks originally created glorified versions of what existed on Ethereum (decentralized exchanges, automated market makers (AMMs), lending, stablecoins, aggregators, insurance, NFT platforms etc.), but there are also projects that find new use cases by leveraging this new infrastructure.

On the Cosmos network, Osmosis combines transaction privacy (decrypting transactions using a threshold to prevent front-running) with cross-chain AMM functionality and implements IBC to bridge with other chains. Celestia encodes block data to improve the security of light clients, which is a key component to enable chain interoperability between autonomous chains and their different security levels in a distributed chain ecosystem. Regen enables a crypto-economic platform to incentivize regenerative agriculture and leverage data from sensors and satellites and audit ecosystems. Nym enables mixnet, which prevents network traffic analysis by adversaries capable of monitoring entire networks. Nym uses Tendermint and Cosmwasm smart contracts to control directory services, node bindings, and delegate mixnet staking. Penumbra supports privacy-preserving cross-chain network transactions. Tendermint is also used by large projects like Binance DEX and Terra. Greater value will be unlocked when these independent blockchain networks begin to interoperate through IBC.

On the Polkadot network, the Acala parachain is a DeFi hub that provides functionality from AMMs to lending to stablecoins. Moonbeam is an EVM-compatible smart contract chain. Subsocial is building a decentralized social networking platform. Robonomics is building autonomous robot services. Bit Country is a platform to launch a virtual world/metaverse for your community. Integritee and Phala use a Trusted Execution Environment (TEE) to enable decentralized confidential computing and encrypted data storage. Polkadot's development framework, Substrate, is also used independently (not as a parachain) to run blockchains such as Compound Gateway. While all parachains are designed to be compatible with Polkadot's cross-chain ecosystem, they should really leverage the Substrate framework's incredible composability, memory efficiency, and self-upgrading meta-protocol governance capabilities to enable new use cases.

in conclusion

in conclusion

Heterogeneous blockchain networks Cosmos, Polkadot, Avalanche provide extraordinary infrastructure to realize the blockchain Internet, which shows that the asynchronous heterogeneous network model works effectively, and it is an improvement over Bitcoin and Ethereum. They will eventually house millions of daily active users and enable the Web 3 vision of user ownership and control.

The coexistence of these major architectures is healthy for a truly decentralized internet, as they have their own design choices and trade-offs. Understanding the similarities and differences of these new infrastructures today will help build systems for the future. Projects using this infrastructure will go beyond smart contract applications to become scalable production-quality systems with their own specialized chains and communities, and demonstrate previously unimaginable use cases. Since this could happen in a vacuum, we still have open questions: how do we ensure that liquidity flows efficiently across chains, rather than being isolated within specific chains? How will those open organizations that operate across chains prevent the emergence of multi-chain whales and ensure a fair distribution of wealth and power?

Special thanks to Sam Hart, İstem D. Akalp, Engin Erdogan, Joe Petrowski for their feedback and review.