What is the advantage of DEX aggregator 1inch over DEX?

March 2022, Simon

Data Source: Footprint Analytics 1inch Dashboard

1inchfinancingfinancing, this financing was led by Amber Group with a total financing of up to 175 million US dollars.

1inch asDEXAggregators look a bit like Yearn. Yearn integrates major lending agreements through various strategies to help users obtain one-stop more competitive interest rates, and 1inch allows users to obtain more effective swap paths by aggregating a series of DEX protocols.

There is no lack of innovation in the blockchain world, and Lego attributes are constantly piling up. This article will useFootprint AnalyticsWhat is 1inch as another Lego component built on DEX?

What is 1inch?

1inch is mainly composed of DEX aggregator and liquidity protocol (formerly Mooniswap). As a DEX aggregator, 1inch mainly uses Pathfinder as a routing algorithm, aiming to find the optimal swap path for users.

image description

Source - 1inch

1inch claims to be the DeFi aggregator with the largest liquidity, the lowest slippage, and the best exchange rate. It currently supports 7 chains, including Ethereum, BSC, Polygon, Avalanche, Gnosis, Optimistic, and Arbitrum.

image description

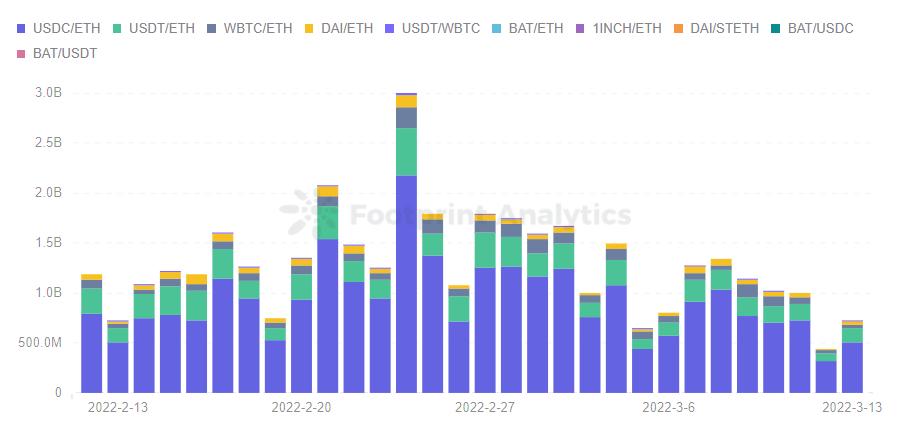

Footprint Analytics - 1inch Top 10 DEX pair by Volume

1inch's Difference

In addition to the usual DEX functions, 1inch has many more optimized features:

Flash

image description

Source - 1inch

The effect will be more obvious for users who need to swap large amounts, because swaps on a single platform are more likely to have higher slippage. And 1inch's split between different protocols in a short period of time can minimize slippage.

Users can even use mortgage tokens such as Aave and Compound on 1inch, and complete things that users have to complete through complex paths such as packaging and unpacking in one step through Pathfinder. At the same time save time and gas cost.

limit order

Cryptocurrency transactions allow 7*24 hours, but it is impossible for users to trade at the best price for 24 hours. 1inch's limit order allows users to swap at the set price within the set time, and the transaction can be completed when the market price matches the set data.

The method of setting a specific price can also be thought of as setting a stop loss point. The user sets the price to an amount lower than the market price, and when the price drops to the set value, the order will be executed to stop the loss.

OTC

Users can also choose OTC transactions (over-the-counter transactions) at 1inch. Since the price is pre-determined, there will be zero slippage for the user. Users can specify the price and receive the exact amount before the transaction.

Gas Token CHI

1inch develops CHI token, which is a gas token that can help users save transaction fees. It allows users to mint hoards when prices are low and use them when prices are high. It is a bit like buying a discount coupon, which will be destroyed when used, which can help users save up to 42% of the gas fee.

However, due to the invalidation of CHI tokens due to the London upgrade of Ethereum, 1inch began to issue 1 million 1inch gas fee refunds in September last year.

P2P transaction

If users can find a suitable counterparty, they can customize the prices of the two currencies in swap. Users only need to fill in the address of the other party and set the time of the transaction to settle the secure transaction between two untrustworthy people.

A note on 1inch?

There are also some things that have to be paid attention to when trading 1inch:

The split caused the gas fee to be too high

from

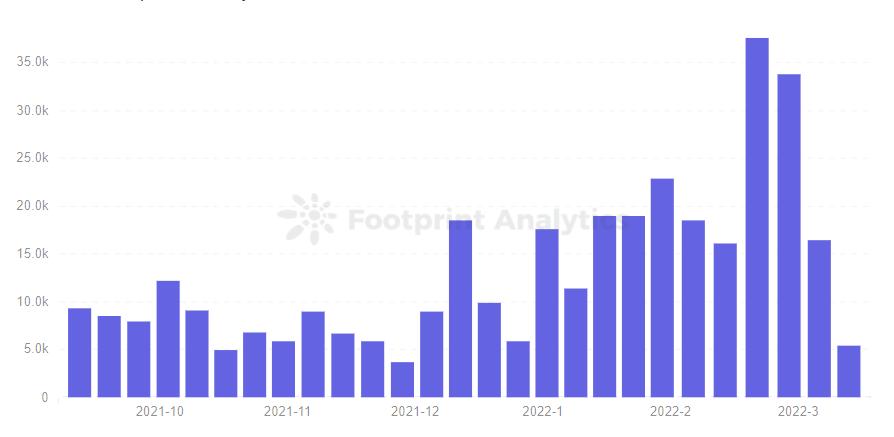

fromFootprint Analyticsimage description

Footprint Analytics - 1inch Volume per Trade by Week

1inch will help users estimate the gas fee that will be generated after the transaction is split, and the user can also choose the option with the lowest gas to reduce the transaction being split.

Positive slippage problem

Since the currency price may fluctuate during the transaction, when the actual transaction price is lower than the user's quotation for confirming the transaction, 1inch will not refund the user's overpaid amount to the user. This leads to users wanting to get a preferential price through 1inch, but instead pay more for the price difference on 1inch.

1inch has acknowledged the problem of positive slippage, and announced that it will implement part of this part of the surplus to the recommendation plan on the chain, and part of it will be converted into USDC and stored in 1inch Network DAO Treasury.

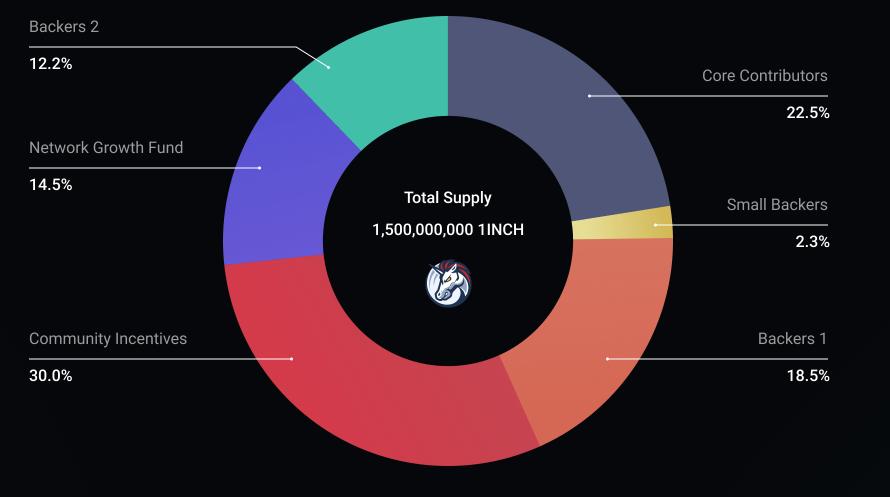

Token

1inch will issue the token $1INCH in December 2020. Users who hold the token can vote on various settings of the protocol's pool governance and factory governance under the DAO. Users who pledge $1INCH can also get the positive slippage harvested by the platform.

image description

Source - 1inch

More than 50% of the top DEX platform tokens are allocated to the community. For example, 60% of $UNI is allocated to the community, and 65% of $BAL is allocated to the community. In comparison, the decentralization of $1INCH is much inferior.

In the later period, the proportion of core personnel is gradually released, which makes people worry that a higher proportion of project parties will control the price, and the purchase of $1INCH needs to be carefully considered. fromFootprint Analyticsepilogue

Footprint Analytics - Token Price and Trading Volume

epilogue

Among the many DEXs, 1inch provides a more efficient solution for users who do not know how to choose a DEX for swap. 1inch tries to help users save more money, but too many splits can sometimes backfire.

With the development of Layer2, it may benefit the development of DEX aggregators by reducing the price of gas fees. When users no longer worry about the high gas fee caused by multiple transactions, users will prefer the split swap method that can obtain more benefits.

This work is original by the author, please indicate the source for reprinting. Commercial reprinting needs to be authorized by the author, and those who reprint, extract or use other methods without authorization will be investigated for relevant legal responsibilities.

This article comes fromFootprint Analyticscommunity contribution

The Footprint Community is a global, mutually supportive data community where members leverage data visualizations to co-create communicable insights. In the Footprint community, you can get help, establish links, and exchange learning and research about blockchains such as Web 3, Metaverse, GameFi, and DeFi. Many active, diverse, and highly engaged members inspire and support each other through the community, and a worldwide user base is built to contribute data, share insights, and drive the community forward.

The above content is only a personal opinion, for reference and communication only, and does not constitute investment advice. If there are obvious understanding or data errors, feedback is welcome.

Copyright Notice:

This work is original by the author, please indicate the source for reprinting. Commercial reprinting needs to be authorized by the author, and those who reprint, extract or use other methods without authorization will be investigated for relevant legal responsibilities.