Starting from the history of GameFi, in-depth discussion on the mode and gameplay of chain games

Revised: Marina, Evelyn | W3. Hitchhiker

Revised: Marina, Evelyn | W3. Hitchhiker

1. Overview of GameFi

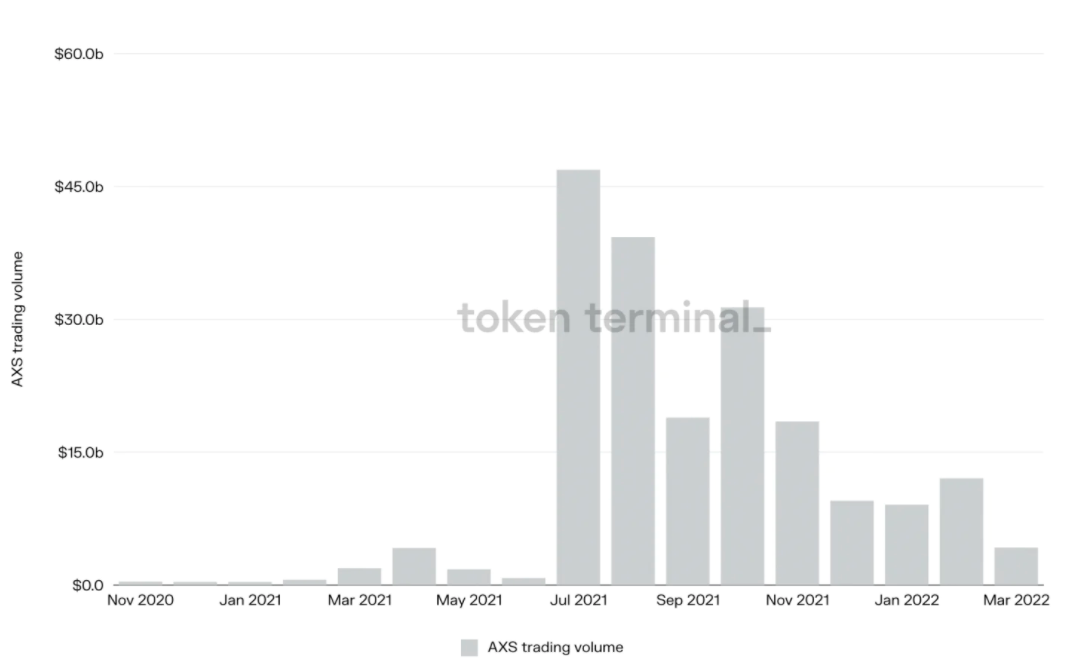

GameFi has become one of the hottest tracks in the encryption industry. according toNewszooAccording to the 2021 annual game industry report, the entire game industry contributed US$180.3 billion in revenue, an increase of nearly 1.4% compared to 2020; but at the same time, GameFi projects and games that make money through P2E are subverting the traditional game industry. Starting in July 2021, the success of Axie Infinity has piqued the interest of traditional game companies—giants like Ubisoft are entering the GameFi market.

According to the chart above, in mid-March this year Axie still had a market turnover of $4.2 billion. As expected, the reason GameFi took off so quickly is that gamers can make money by expending their time and energy, after all, who doesn't like the idea of having fun and earning money at the same time? For users who are not familiar with chain games, it is extremely risky to enter in a daze when the market is very hot. Therefore, this article will start from the historical development of GameFi, and discuss in depth the mode and gameplay of chain games, and the possible economic formation in the game. System, the impact of guild DAO and the future development direction of GameFi.

This article will also analyze the following points:

P2E:A game that drives player participation from the perspective of revenue

Chain change game:A game that uses traditional games and traditional models to achieve blockchain transformation through asset on-chain

3A masterpiece:Developed on the blockchain, the world view, narrative, playability, and economic system are grand and complex, and games that require a long development time

Games or IPs that contain creative NFTs:The definition of creative type is explained later

2. Briefly describe the development of blockchain games

At the Wuzhen World Blockchain Conference in November 2019, the founder of blockchain game publishing platform MixMarvel spoke about how cryptocurrencies could revolutionize the video game industry, with which GameFi also started its journey in China.

For Western readers, the term first appeared in a tweet in September 2020, when Andre Cronje, co-founder of yearn.finance, believed that the future of DeFi monetary policy will be biased towards gamification, and the funds pledged by users may become Gear in the DeFi game. At present, the industry is still imitating Tradfi, and may enter Gamefi, which is more gamified, in the future.

While GameFi only became popular last year, its history can be traced back to the king of cryptocurrencies, Bitcoin. Integrating BTC on the early "Minecraft" server, Gambit.com in 2013, games like "Bombermine" (Bombermine), and p2p services that allow players to monetize mainstream games through BTC can be considered GameFi Some of the earliest efforts in the field. Later, projects like Huntercoin also used blockchain technology to enable players to mine cryptocurrencies to earn money, rather than just payments.

In 2015, the emergence of Ethereum opened up new possibilities for video game developers, and the encryption industry has since opened the era of applications that can be developed on the chain through smart contracts, including blockchain games like CryptoKitties, which utilizes In-game assets are represented in the form of the newly defined erc-721 standard non-fungible token (NFT). NFT has inspired great innovation in the encrypted game industry, and blockchain games have grown wildly since then.

3. Detailed Explanation of GameFi Classification

I、P2E

Traditional online games make money by selling equipment/props, marketing and advertising in the app, but as a game player, you need to spend money to buy in-game items to get a better experience and the joy of winning, of course These costs go directly to the game operator's wallet. In addition to the experience brought by the time and energy spent playing the game, the items you buy will not bring you other economic benefits. Generally speaking, P2E (play-to-earn) is a game that promotes player participation based on revenue, which ushers in the era of a new game economy. Its characteristics are:

The degree of internal circulation in the economic model determines the duration of the system.

Scalability determines the upper limit. Scalability includes the expansion of the game (the possibility of the economic system going out of the loop) and the expansion of participants.

The lower limit of playability is stabilized.

▶️ Take Axie Infinity as an example

There are two ERC-20 tokens included in the game:

$AXS(native governance token)

$SLP(Game breeding fuel, the total amount is unlimited)

1. The inner cycle of the economic model

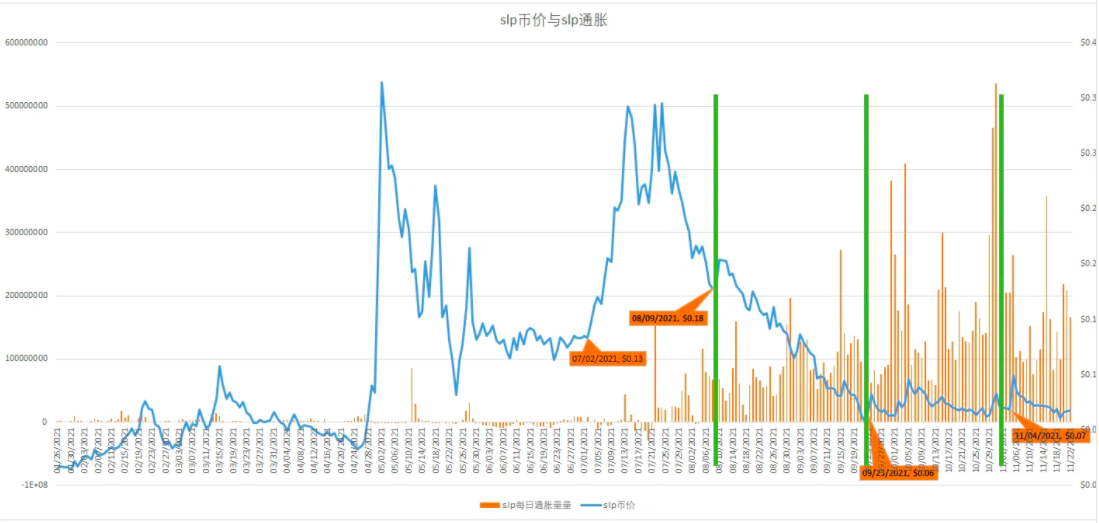

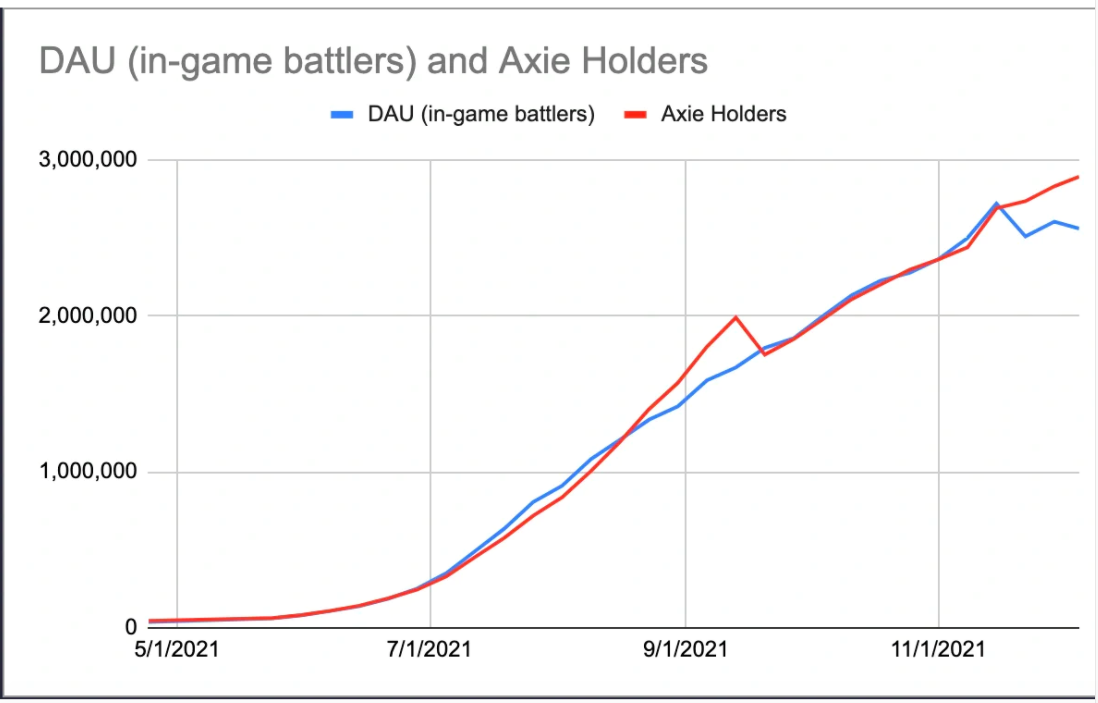

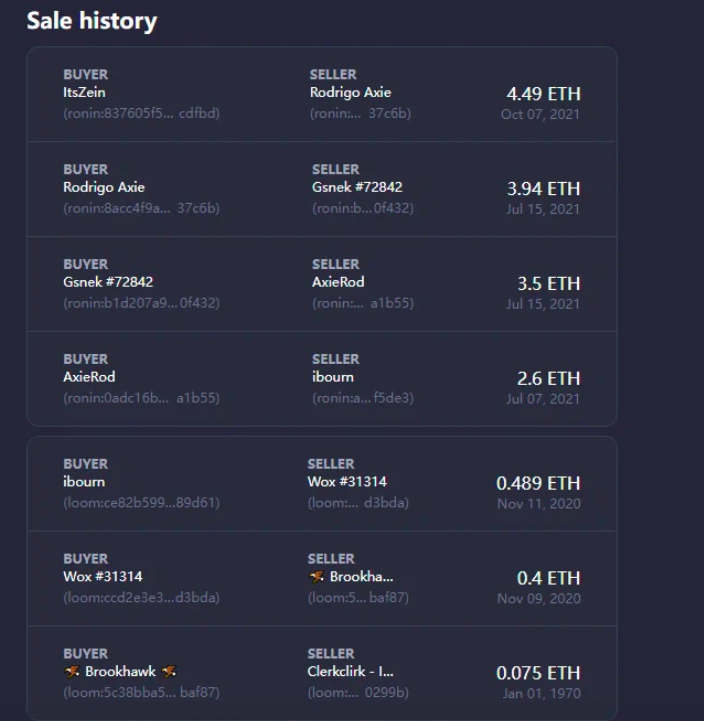

According to the time marked in the above figure, the first wave of market prices comes from the launch of the Ronin chain, which reduces the cost of interaction:

On July 1st, the breeding cost was adjusted, the $AXS fee consumed by each breeding behavior increased from 2 to 4, and the $SLP that needs to be consumed increased

On August 9th, the breeding fee was adjusted, $AXS was reduced from 4 to 2, and $SLP was doubled. And adjusted Axie's gold output to be halved

On September 23rd, the breeding fee was adjusted, $AXS was reduced from 2 to 1, and $SLP was doubled

On November 4th, Axie launched Katana, a decentralized exchange on the Ronin side chain, and can exchange gold earning for $ETH in the Ronin chain

2. Life cycle

▶️ According to Axie token inflation analysis:

When the game is in the early stage or when inflation is low, the price of the token will be quickly raised by adjusting a certain parameter in the economic model (because the balance of supply and demand in the game is destroyed). At the same time, players will flock in, and the game will enter a stage of rapid development.However, despite the accumulation of traffic, due to the influx of a large amount of funds, the investment payback period has gradually shortened, and the seeds of high inflation have also been planted.

When the game gradually declines from the peak, the rationality of **the initial economic model design determines the effectiveness of the adjustment, that is, the speed of the decline from the peak. **Axie's economic model failed to some extent. Neither adjusting the amount of gold or breeding costs could save the price of the circulating token SLP. As a result, the game began to enter a period of decline.Flows continued to accumulate, but funds outflowed.

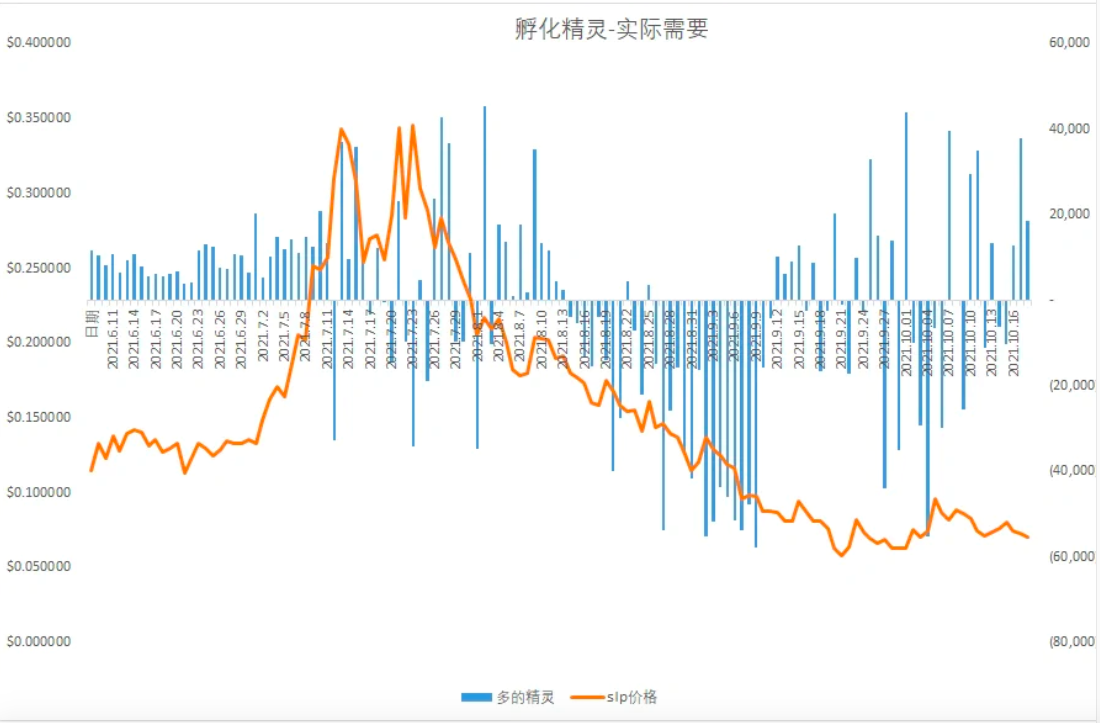

Think of multi-breeding elves as dealers and capital accumulation chips, and the dealer's chips gradually increase to pull up the currency price. As the number of breeding elves decreases, it means that either the retail investors are speeding up to take over the orders, or the dealers are not breeding and are preparing to retreat. In any case, it means that the game is starting to go downhill.

From September 23rd to November 4th, the currency price remained stable under the condition of high inflation. More importantly, AXS started staking mining, and expectations for the project’s scalability were born.

After November 4th, the Ronin sidechain launched the first DEX Katana on the chain to support the exchange of various assets generated by the application on the chain, deposit the traffic value of the game on the Ronin chain, and turn the bubble of slp inflation to Ronin.

▶️ According to the data analysis of Axie holders (users):

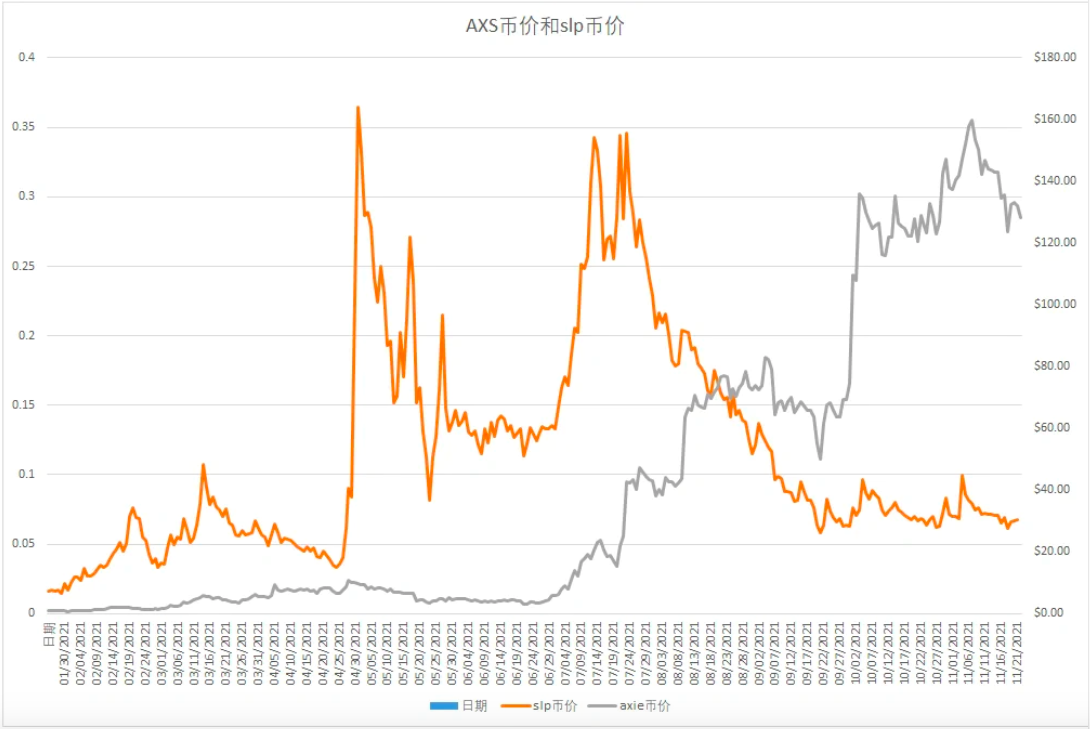

May-July is the initial stage, the user growth is slow, the bubble is consumed in the form of breeding elves, the supply of production materials exceeds demand, and the supply and demand of gold tokens are roughly balanced

From July to September, the guild intervened in large-scale promotion, the growth rate of users accelerated, the development of the game accelerated, and new producers began to take over from consumers in the previous stage, which promoted the rise of currency prices. However, a large number of new producers entered the market to form a large-scale selling pressure, and the trend of oversupply of gold tokens gradually intensified, and the price of the tokens reached its peak and then began to decline.

From September to November, the game entered the final stage, the growth rate of users slowed down, the threshold consumption of new producers was not enough to catch the selling of early producers, the oversupply continued, the game was heading for a collapse, and the currency price fell.

From November to today, the growth rate of users has declined again. But the new story absorbed the bubble of stock producers, and the currency price began to stabilize. Wait until a new pattern emerges to enter the next stage again.

Observation indicators:

Gold Token Inflation

Admission of funds

Growth rate of NFT (means of production) holders

Landing of the new story

3. Expansibility

The scalability of the game itself

"The web3 game has built economic systems of different sizes through its token economic incentive mechanism. As the first promoter, the project party can propose the world design, theme, player type, player operation, player world, and game assets of the game. etc.; on this basis, in order to attract more participants, game tokens or limited NFTs can be distributed to participants, early supporters and players.

What connects the early participants is its economic incentive mechanism,early allocation modelOften determines the loyalty and future support of the community. The game that really develops may not be a very grand game at the beginning. Perhaps starting from a certain point, there is a brand new mechanism that can attract a group of loyal community users, such as players, builders, investors, etc., and continue to make breakthroughs on this basis. When the game develops to a certain level, there will be composability and user creativity, which will lead to some games having stronger ecological resilience. "

battle V2 gameplay update, increased playability,in the presence of traffic itself, to weaken some of the attributes of earn. After the introduction of land, the new value of the means of production sprite is given again, byUser Acquisition TransformationCreate for users, increase user stickiness in this way

user scalability

In the early days, with the increase of blockchain games, the time and money of participants have a greater probability of decentralization. At the beginning, blockchain games will also have the same situation as defi. Whichever defi protocol has the highest income, the funds will flow there. In this situation, how to focus on players becomes more and more important.

The guild forms a community culture through the guild. Players are not only investors in the project, but also form interest binders through the guild. And form a social network through guilds to improve user stickiness.But how to prevent the guild from doing too much so as to harvest non-guild retail investors and even project parties is also an important measure

Lower the barriers to entry and simplify and popularize the game. The games are mainly light games. Because in the later stage, whether it is the spontaneous joining of users or the push joining of guilds, it takes relatively low time and learning costs. At present, the large game group is still dominated by young people who like this type of game, and other groups have little motivation to join.

With the accumulation of game players (traffic), the game has the opportunity to attract more builders (I personally think that the source of user creation comes from a stronger consensus on value), thus deriving a larger game ecology. So early economic incentives are important. Because the economic mechanism determines the traffic, and the traffic determines the degree of attraction to the builders. The entry of the builders brings a better game experience, and a better game experience brings more traffic, thus starting to enter a positive cycle.

4. Limit the path of P2E becoming a fund

**From the perspective of the project party,** To judge whether the project party will become a "sickle", it can be judged from the following indicators:

Project side token unlock time: If the project side token unlock time is too early and too much, the project side will become a big player, and the possibility of profit fleeing will increase;

Protocol income when the project absorbs incremental funds: The distribution of protocol income generated is an important indicator. It is undoubtedly unfair if the project party accumulates a large amount of income during the process of capital influx instead of distributing the income to token holders of. If the project is understood as a company, the agreed income is the company's net profit, and the net profit must be distributed to all shareholders. In this way, the project party can enjoy the benefits of value-added shares by occupying a large number of shares through the identity of the founder, and the operation is turned to make the cake bigger instead of increasing the proportion of the cake.

From the perspective of large households (guilds),

Raise the threshold for profit sharing: Give incentives to real contributors, let real contributors settle down, instead of rewarding capital that flows back and forth. At present, a relatively realistic measure is that current coins cannot participate in the distribution of project profits, and can only enjoy the benefits of price increases. Reduce the amount of the currency and weaken the influence of the entire large account.

Nationalization of large households: The project party becomes a guild by itself, and uses its information advantages to absorb and release bargaining chips. The relative profit purpose is weakened, and the influence of the project party on the market is increased.

Observation indicators:

User Component Analysis

User Game Time Analysis

II. Chain game change:

By putting traditional game assets on the chain, the assets can be traded through the blockchain. It is believed that chain-reformed games are relatively more realistic than other types of games at present, and have a certain degree of playability. The game economic model has been tested and updated by the traditional game market (currently all kinds of game economic models on the market are generally similar, only the model, skin , with different backgrounds).

1. The advantages of blockchain reform over traditional games:

The free circulation of assets will introduce part of the income of project parties into productive players

In order to become a chain game, assets need to be on the chain. Assets on the chain mean that assets can be traded and circulated freely on the chain. In traditional mobile games, assets are generally bound to accounts and cannot be freely circulated to ensure that players The funds spent are recharged to the project party rather than other players.

After the free circulation of assets is opened, player output will inevitably form a negative premium relative to official sales, official income will be cut, and part of the income will go to productive players, forming a P2E cycle in the game. This part of the P2E income ceiling should be the official selling price of the same resource. When the price of the resource sold by the player is equal to the official selling price, the P2E income reaches the upper limit.

Using NFT and Token as the driving force may increase the life limit of the game

In traditional games, there is no chain change, and the main means of maintaining vitality is to stimulate player consumption and extend the income period through operations such as opening new server areas. However, the final income of the game economic system is imported to the project side, and some players lose their krypton gold motivation or choose to just spend time. The high probability of the withdrawal of this part of players is permanent. In the end, the narrative of the new game or the background will be weakened, and no new players will enter the game and go to the end of life.

After importing such games into the chain, there will definitely be NFTs and Tokens. If the acquisition model of NFTs and Tokens is linked to the model of in-game competition, it will increase the incentives of competition, increase user viscosity from economic benefits, and reduce the turnover of players. speed. Because the economic model of the chain reform game itself must include a competition model, the risk of introducing Token into this competition model is low, and the system of Token and the game itself is no longer isolated, which can stimulate players to participate in the competition.

2. Observation points of chain reform games:

In addition to general observation points (website traffic, number of users, etc.), observations can also be made from the following dimensions:

The resources produced by production players and the negative premium of the official resource selling price

If the negative premium is small, the value is close to the value of the officially sold resources. Considering the relatively stable consumption of the output resources in the game, the supply and demand relationship of the endogenous system is normal.

If the negative premium continues to expand, consider that the internal demand of the game has weakened and the supply has increased.

The floor price of NFT with output capability, intensive association with Token, and a predictable upper limit of the total amount

In addition to blue-chip projects, the liquidity of NFT itself on the market is currently poor, and the continuous decline in the floor price can consider weakening buying.

The relationship between Token and NFT empowerment:

Token is used as an incentive reward for competition. Players invest in income-generating demands, and Token will form a selling pressure, while some NFTs must be used as a carrier that can reduce selling pressure and lock liquidity in order to reduce the speed of system inflation. If the empowerment relationship is not exquisite, " The on-chain system of “Token-NFT” may crash before the game, and the game loses the meaning of being on-chain and returns to traditional games. At the same time, players who entered with the “NFT-Token” system as the starting point flow out.

The project party has launched continuous and long-term discount activities to seize the income of life-style players:

When the negative premium of resources produced by living players is very close to the official selling price, the project party launches activities to seize revenue, destroying the original system supply and demand relationship. Considering that the project party has a strong desire to increase revenue and at the same time lead to resource depreciation, players will eventually need to continue due to the overflow of resources. In and out.

III, 3A masterpiece

Developed on the blockchain, the world view, narrative, playability, and economic system are grand and complex, and games that require a long development time. Such as Illuvium, Star Atlas, QBIT, etc.

Problems with 3A masterpieces:

3A masterpieces were established late, and the development period required is longer. If GameFi breaks out in 2022, there are no projects that have landed on the market in the first quarter. Due to the huge world view, system, and picture quality of 3A masterpieces, it is very likely that the launch will continue to be delayed.

3A masterpieces need to pre-sell NFT to raise funds. NFT itself is of high value. If you need to continue to raise funds through NFT, there is a high probability that the price of NFT will drop due to excessive distribution before the game is launched. At the same time, it will not be good for NFT sales in the later stage of the game. Influence.

A 3A masterpiece may launch a pre-version (browser mini-game) to stabilize the value of NFT. This type of game is mainly output. Since the game's endogenous economic system has not yet been launched, NFT mining Token will inevitably form a selling pressure. Sacrifice the hype value of Token to maintain the value of NTF, forming a value transfer.

There are three narratives in the pre-version of the 3A masterpiece:

A. The expected narrative of the 3A masterpiece landing (as long as it does not land).

B. The P2E narrative of the pre-version of the 3A masterpiece.

C. The hype expectations of the 3A masterpiece itself.

If these narratives are established, 3A masterpieces will be classified as P2E games, but the narrative is stronger than general P2E and plate games.

Ⅳ. Games or IPs containing creative NFT

NFT completes traffic accumulation through games, but at the same time, NFT also has a "universe". For example, land NFT can also be used in other games under the same background. After the traffic accumulation of this type of NFT is completed, the value will not decrease due to the decline cycle of the game, which means that there will always be a place to go and a point of generating income, and future games can even be created based on this type of NFT.

The generation of this type of NFT represents the transformation of users from participants to creators. Therefore, the greater the game's accumulation of traffic, the easier it is for the NFTs created by users to form a value consensus, and the threshold value created by this part of land or users will be higher. .

3. The economic system expected to be formed in the game:

I. Limited NFT and unlimited NFT:

For example, land and Odaily are relatively limited.

For example, tools and spaceships are relatively unlimited. Although the total amount of different types of NFTs is limited, different types of NFTs can be produced.

Unlimited is mostly used as a barrier to entry. In order to allow the influx of incremental funds, the price of this part of NFT fluctuates in a certain range when the game is in a balanced stage. When the game declines, this part of assets will also decline on a larger scale, but in The increase in the game development stage must not be too large (I personally think that this part of the preliminary idea is that the price cannot be determined by the market, and the project party should set the guide price. Because of the existence of Axie, the rapid influx of funds in the early stage will accelerate the collapse of the economic system) , because price rises lead to high barriers to entry, insufficient incremental funds, and difficult project development. At this time, if the project party chooses to regulate and control the price, the decline in the price of production materials will inevitably lead to the depreciation of the token, and enter a negative environment under the interaction. spiral. With the withdrawal of a large amount of stock funds, the project is heading for collapse.

Limited NFT can be divided into profitable and non-profitable:

Profitable: Taking LOK as an example, the project party releases the land in the early stage, obtains funds, and players obtain shares. With the help of shares, players can obtain income. These individuals think that the income of U standard is better than the income of currency standard. The value of land is actually highly linked to the value of the game, because land is a share.

Unprofitable: The overall price is the market's expectation of the game's next stage, and does not fluctuate with the rise and fall of the game at the current stage. This requires the game to be highly scalable.

II. The limited NFT-Token is integrated into the game and forms a system with strong correlation:

If Token is regarded as a reward for players in the game, then there will inevitably be selling pressure for players who do not need to participate in governance. And the difficulty of obtaining Token should not be too high, otherwise the stickiness to bottom players will be low.

At this time, a carrier that can lock certain Token liquidity and restrict selling pressure is needed. The limited NFT is a good carrier, and the selling pressure is introduced to NFT to form a DeFi 1.0 model. For example, holders of limited NFT need to pledge part of Token to guarantee the value of NFT (in-game output rate, resource rate, etc.), so that NFT holders (middle class) can absorb part of the selling pressure from "civilians". And it must be fully integrated into the game system to interact, so that NFT holders will have the driving force to absorb selling pressure.

At the same time, there needs to be a complete consumption system for Token in the game, and the economic system in the game should be regulated on the premise of reducing player loss (many games have raised the upper limit of consumption, but they have been criticized by players, causing players to choose to quit due to increased consumption).

III. There are enough players to divide labor in the game, and the balance between supply and demand is reached.

Producer: Provide resources slightly lower than the official price and obtain certain benefits at the same time.

Consumers: Oligarchs, consume a lot of in-game resources and the number is growing slowly, and because the gameplay exists in the game.

NFT holders: Under the premise of a control path, participate in the micro-control of Token selling pressure.

Ordinary players: The reference of oligarchs, because of the participation in the game, the selling pressure generated or the income obtained is not very strong, but the number is huge.

IV. Deduce the development cycle of the game:

Initial cycle:Producers and consumers flood in, and the project party does not snatch the producer's income; the supply exceeds demand in the game, and the output of the producer and the same product provided by the project party form a negative premium.

Consumption cycle:The influx of producers is reduced, and the consumption of consumers is increased; the demand in the game is greater than the supply, and the output of producers and the negative premium of the same goods provided by the project party are reduced.

Oligopoly cycle:After a round of large consumption in the game, players form resource oligarchs. Squeeze the income of ordinary producers, and stock producers will withdraw. It is worth noting that in non-competitive games such as some P2E games, oligopoly cycles may not form.The prerequisite for the formation of an oligopoly cycle is that resources have an upper limit of output and competition within a limited time period.

Stimulation cycle:After the in-game oligopoly is formed, the project party will break the oligarchic structure of a single server or continent by increasing competition (such as server merging, new server opening, server transfer, etc.), increasing consumption, and producers re-influx.

There are 3 possible crash cycles after the stimulus cycle ends:

Loop crash cycle:3-4 cycles until finally there is only one oligarch left and no further stimulation can be performed.

The project party and the oligarchs broke up and collapsed:The project party lowers commodity prices (forming inflation) and snatches the oligarchs' income. Eventually the oligarchs quit.

No new traffic crashes:While stimulating, there is no influx of new players, and the output of producers and oligarchs enters a state of internal consumption until it collapses.

Red flags:

Stimulus cycles occur without a significant increase in flow.

The project party and the oligarchs rob the remaining income.

Before entering the stimulus cycle, oligopoly suppression led to negative growth in player traffic.

Resource output shows a long-term negative premium, which cannot stimulate consumption.

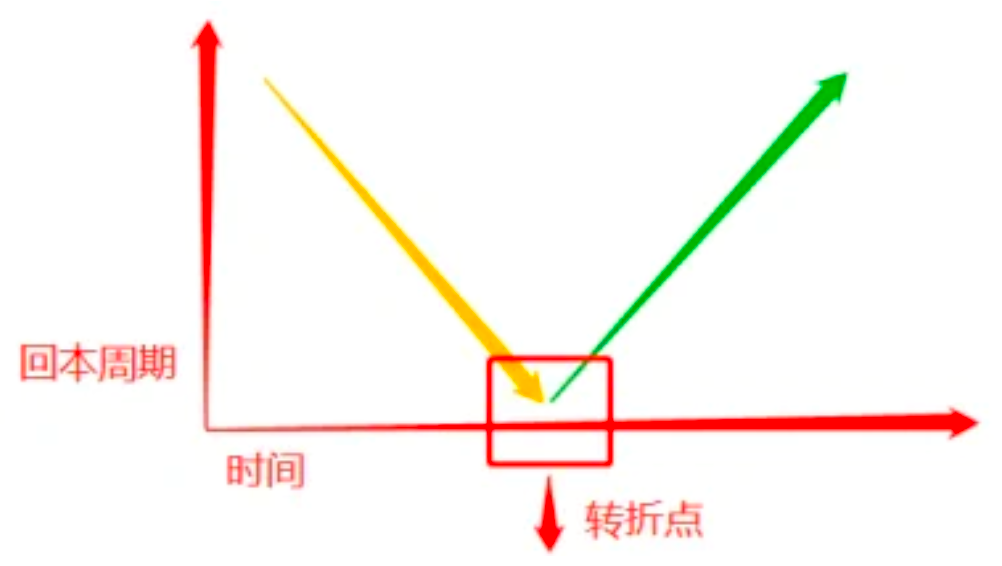

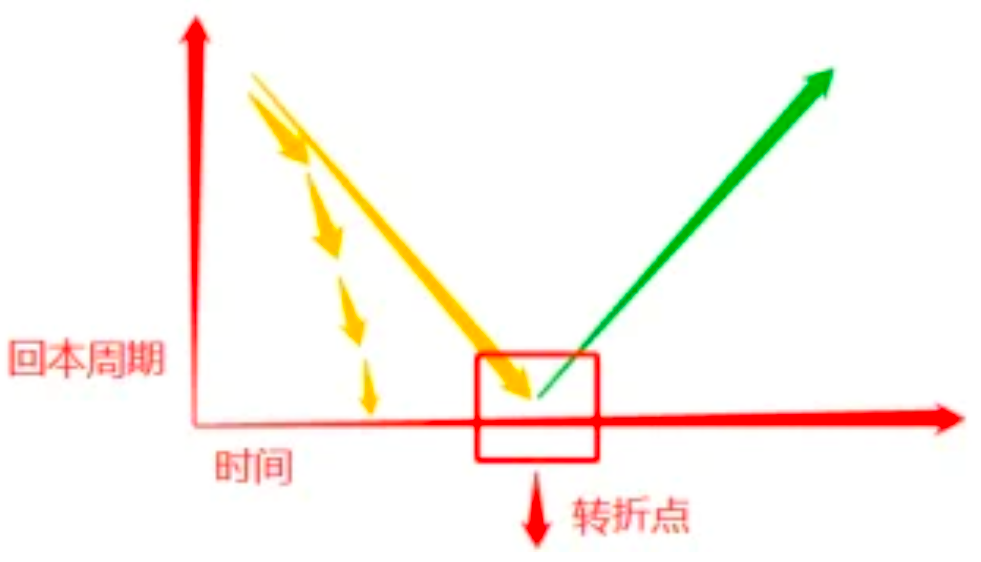

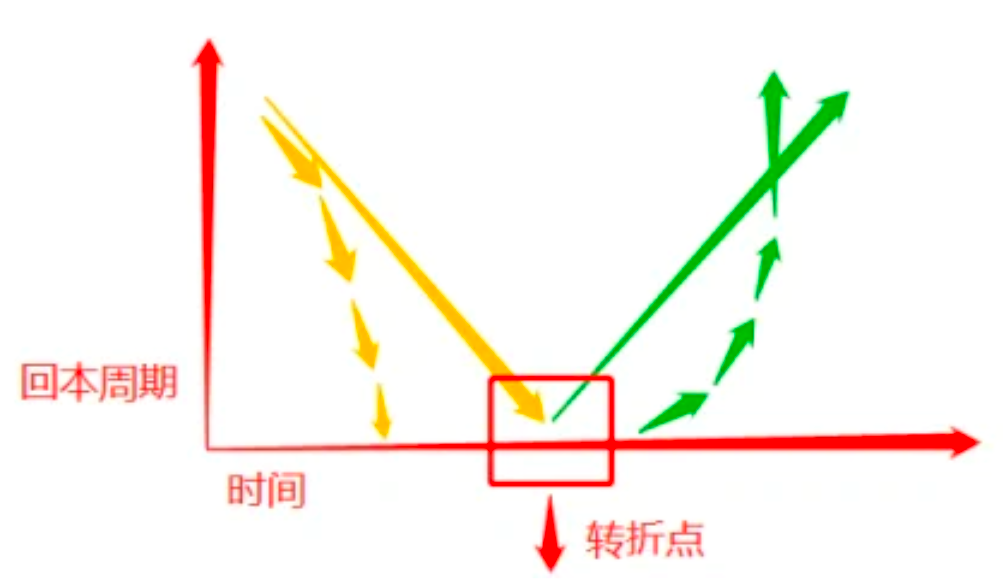

As shown in the figure below:

NFT income and payback cycle are in a downward parabola, and have passed a turning point.

In the early stage of the yellow line, the acceleration may gradually increase:

There are 3 possible crash cycles after the stimulus cycle ends:

The above are relatively dangerous situations.If you can fluctuate around the turning point for a long time, the game cycle will be relatively extended.

best cycle:

The law of the development of things will always go from prosperity to death. But there may be exceptions: namelyThe fourth category of games includes creative NFT games or IP.

definitiondefinition*: NFT completes traffic accumulation through games, but at the same time there is a universe for NFT, such as land NFT is common in other games under the same background. After the traffic accumulation of this type of NFT is completed, the value will not decrease due to the decline cycle of the game, and there will always be a place to go and a point to generate income. Even future games can be built based on NFT. *

The generation of this type of NFT represents the transformation of users from participants to creators. Therefore, the greater the game’s accumulation of traffic, the easier it is for the NFTs created by users to form a value consensus, and the threshold value created by this part of land or users will be higher high. "

▶️ Take the Axie land as an example:

Although the game has gone from the peak to the trough, the land carries the traffic accumulated in the game development process, and the value contained in the traffic is locked in the NFT of the land, which does not fall with the game's trough cycle.

Viewpoint: For games with creative NFTs, in the early stages of the game, whether it is P2E, chain reform, or 3A masterpieces, it is necessary to accumulate traffic during the initial game process. When this part of traffic settles and a consensus is reached, the game entersfourth cycle: creative cycle。

Creative cycle:The traffic in this cycle is enough to carry the construction of various games. The value of NFT is not a single one that fluctuates with the changes of a certain game. NFT is in an evergreen state, breaking away from the shackles of a single game, forming a large cultural universe. At the same time, the entire universe The upper limit of is the upper limit of economic benefits.

But it is a pity that there is no such type of game on the market. Axie has only completed the initial traffic accumulation. Sandbox has not experienced the path of the previous game and has not achieved traffic accumulation. Naturally, it will not form a value consensus.

The current suggestion for investment is to try to capture NFTs that may enter the creative cycle, which is in line with the starting point of long-term holding.

From a short-term investment perspective, the cycle of the yellow line in the above figure is a good choice for "short-term flat and fast".

4. The significance of the union to GameFi

I. Views on DAO:

In the DeFi Summer of 2020, DAO has been popular for a while, and there is even a saying that the end of DeFi is DAO. However, judging from the one-year bull market trend, DAO has not exploded, and it can even be said that no applications have landed. Judging from the current mature DeFi projects (Uni, AAVE, COMP), it is difficult for DAO to land. Investors have a large number of bargaining chips, and decentralized governance is ultimately just de-retail governance.

Although PeopleDao failed in November 2021, it opened up a new world of DAO. From the establishment of the project by the initiator to the public fundraising, the entire project is relatively fair, and the governance rights and donations correspond to each other. They are all on the same starting line. In addition to de-institutionalization, this is also the spirit of fairness pursued by native users of the currency circle. Although it ended in failure, PeopleDao itself will become a symbol.

From the perspective of People, the initiation of DAO itself requires a carrier. Theoretically, if this carrier can provide strong cohesion (things that individual retail investors cannot do, the bigger the cohesion, the stronger the cohesion) and the right amount of economic benefits, the higher the upper limit of this DAO will be. If the controllable economic interests are too large, the governance of DAO itself will be very chaotic, and the oligarchy within DAO will also be formed. (This comes from the observation of leading DeFi projects such as UNI)

II. The Significance of Guild DAO to GameFi

At present, it is believed that games are a good carrier, and the game union is an organization with a great sense of honor, strong cohesion and certain economic interests. The following groups of people will appear in this organization:

Banner figures: president, early promoters. Also an early investor.

Management: the person responsible for managing the daily work and ensuring the operation of the guild.

In-depth participants: Provide suggestions for the operation of the guild, deeply participate in daily activities, relatively vague or do not pay attention to the concept of income, devotees.

Ordinary participants: This part of the body is the largest, and they join for economic purposes or sense of honor, in order to obtain benefits that lone wolves cannot obtain.

This kind of game guild itself is considered to be able to exist across games when it is supported or driven by revenue.

Different game mechanics will produce different user structures:

Games with gold as the core: Ordinary participants hope to get rewards through the guild with a faster entry threshold or a low-paying way.

Games with competition at its core: Ordinary participants can accomplish things that cannot be done through guilds and at the same time obtain benefits that ordinary players cannot obtain.

Regardless of the mechanism of the game guild, if the players gathered in the game guild can cross the game, it can become a larger moat for the guild. The guild comes with its own traffic. This part of the player's operation process is more skilled, and the large group will promote the early development of the game.

If the current game has a low moat, the guild is the main moat in the early stage of the game, and this moat will be transmitted to the game itself, forming a complementary effect. GameFi and guilds are ultimately inseparable.

The role that the guild may play in GAMEFI:

Three-party checks and balances, the guild acts as a balance point between retail investors and project parties. Strengthen the voice of retail investors in front of the project, and at the same time help the project party to control retail investors. It is similar to a voting proxy but at the same time maintains a certain influence on the project side and has binding attributes to retail investors.

III. Prospects for Guild DAO:

DAO wants to transcend the existence of the game itself, and the income in the process of DAO migration surpasses all other conditions. Therefore, it is necessary to solve the problem of unbalanced income in different games. If a relatively stable income distribution can be achieved, DAO itself will also will become a symbol of value. In addition, the guild DAO only attracts large players and scholars and cannot survive in this "competition", because any mature small team can build hundreds or thousands of robots to simulate users, and these "users" can simulate real users. player behavior. Therefore, the value capture of guilds also requires other forms of effort (such as e-sports).

5. Prospects for future GameFi projects

From the perspective of time,

In the short term (1 to 5 years), the financialization of games or the assetization of in-game props/equipment will create a combination of GameFi + DeFi; in addition, the Internet game user base is huge, and with the addition of more key industry organizations , will attract more non-encrypted users and further expand the GameFi market;

In the long run (5-10 years or even longer), with the rapid development of high technology, various infrastructures such as AR, VR, and the improvement of transaction speed on the chain and the improvement of computing and data storage, the concept of Metaverse has begun to land. Games that mirror real life will also thrive, perhaps as featured in the movie Ready Player One.

The most attractive to Internet users is the Play to earn mode; the chain reform mode allows users to quickly become familiar with the differences and innovations of blockchain games on the premise that the game is playable; although 3A masterpiece games need more time to conceive and Creation, but it presents a more grand narrative and a sense of exquisiteness; what we are most looking forward to is games that include creative NFT/IP. Once in this mode, a certain game project can no longer limit the circulation of NFT, and can even collide with more The new gameplay of multiple GameFi is also the direction that GameFi needs to think about and research in the future.

Overall, GameFi is only just beginning to gain mainstream market attention, not to mention the possibility that the huge user base of the traditional game market will shift to blockchain games in the future. The success of Axie Infinity is a good example of the growth of this market. The addition of DAO also injects more resources and benefit distribution methods into this track. No matter which mode it is, if you want the game to be favored by more users, you must not only improve the playability of the game itself, but also consider the design of the economic model, lower the threshold for user participation and gain benefits at the same time. This is The most essential difference between GameFi and traditional online games.