A Comprehensive Study of DAO Governance: Challenges, Ideas, and Tools

Original Author: Tally

Original title: DAO Governance: Challenges, Ideas and Tools

Governance Philosophy and Challenges

The DAO has revolutionized the web3 landscape since hitting the headlines in 2016, when funds were stolen from the first and original DAO - essentially a decentralized hedge fund with no ridiculous premium, entirely funded by Members vote proportionally - the estimated value locked in these collectives is estimated to be around $15.2 billion.

Humans are social animals, and there is nothing more human than being part of an organization or collective. Many visionaries in the cryptocurrency space are seeking to “solve” a long-standing human problem: governance. Before diving into the details of this critical part of DAO, we explain again what DAO is and what it is:

Decentralization: means collective governance and multiple actors. Therefore, no one participant should have a disproportionate amount of governance power. This will ensure fairness and impartiality when members vote.

Self-Government: Defined as being independent and having the freedom to govern itself with the participation of the community.

Organization: Refers to a group of people working together in a structure suited to a specific common purpose or set of goals.

The goal of DAO is to implement frictionless direct democracy. Decisions are made directly through a specific form of community voting (aside from delegated voting, individuals can delegate their voting rights to others), without intermediaries or administrative obstacles. DAO adopts Any decision should directly reflect the preferences of DAO members. There are some rules that are encoded into some of the underlying DAO smart contracts and technical tools that support the full DAO stack, but these rules can be transparently accessed by the community and in some cases can be changed if the right proposal is made and modify.

background introduction

background introduction

Bitcoin and governance

Governance was never part of Satoshi's original white paper. In contrast to most modern blockchain ecosystems, the protocol never envisions a bitcoin treasury. Instead - Bitcoin's governance simply decides on the protocol parameters and the codebase, which is maintained on the Bitcoin Github.

The process of initiating change begins with researchers investigating a problem and proposing a solution. Researchers then share what they wish to improve with the wider community via the Bitcoin Developers email list, a Bitcoin Improvement Proposal (BIP), or a formal white paper. However, there is no governance agreement, which means that the process of changing the code is informal and based mostly on some vague concept of consensus between the core developers and other key stakeholders such as exchanges, nodes, and block explorers.

Possibly because the process for changing the Bitcoin protocol is not defined, the decision lacks legitimacy in the eyes of dissenting developers. This may be the reason some members choose to fork protocols (like Bitcoin XT, Bitcoin Cash, and Bitcoin SV), sometimes hoping that exchanges and other stakeholders will accept their forks as"real bitcoin"for real"for real"Bitcoin isn't always obvious at a glance. No cryptocurrency has any inherent value, instead, value comes from people believing and accepting it has value, and accepting it as payment for goods and services. In this case, exchanges have a lot of power because their choice of trading symbol "BTC" makes a huge difference in the wider acceptance that any given fork is "real" Bitcoin.

What does decentralization really mean?

Many (if not all) organizations are decentralized to some extent. Holding shares has the right to vote at the general meeting of shareholders. As a citizen of a democratic country, you have the right to vote. As a member of the local neighborhood committee, you usually also have some voting rights. Are DAOs some fundamentally different tools than these social organizations, or is DAO just another buzzword that really just refers to the governance of decentralized protocols?

In our view, the key distinction stems from two characteristics, one of which an organization can sufficiently satisfy to be considered a DAO. First, the rules governing the DAO are encoded into the organization's blockchain. This means that the governance of protocol changes is encoded into the blockchain itself, and that these rules can only be changed through the mechanisms specified within it. Second, it is decentralized and self-directing. The second characteristic can be tricky to grasp, so let's make the following analogy.

Imagine that an organization could be represented by a tower made of bricks. Now, rather than being a binary concept, decentralization is more fully embodied within a spectrum. To measure how decentralized an organization is, you have to ask yourself: How many bricks can we remove before the tower collapses? The greater the impact of removing a particular part of the tower, the less decentralized it will be. The more pieces you can remove from this tower, the more decentralized and autonomous it becomes. If ETH 2.0 shuts down without Vitalik Buterin, it will show that Ethereum is not very decentralized.

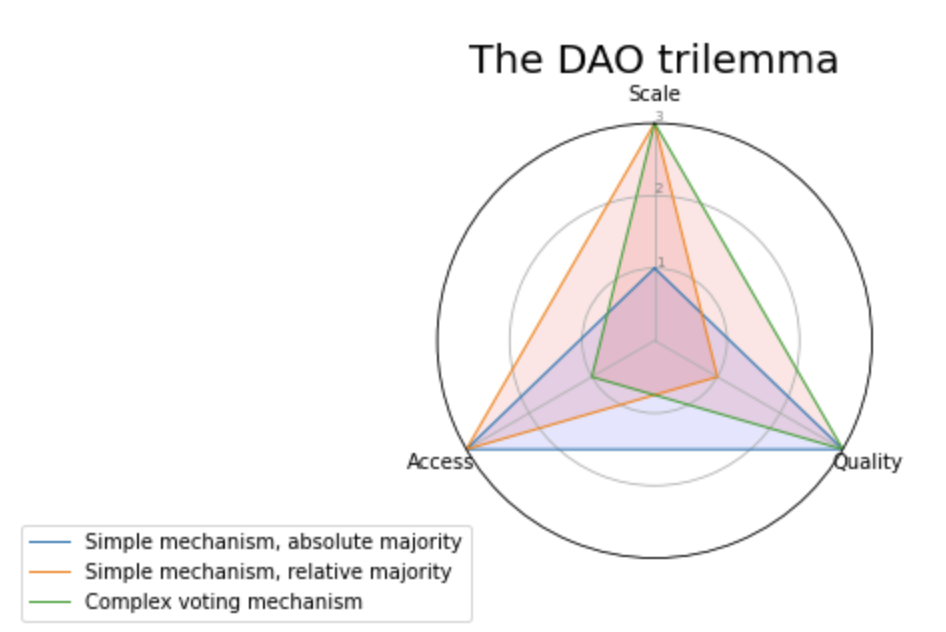

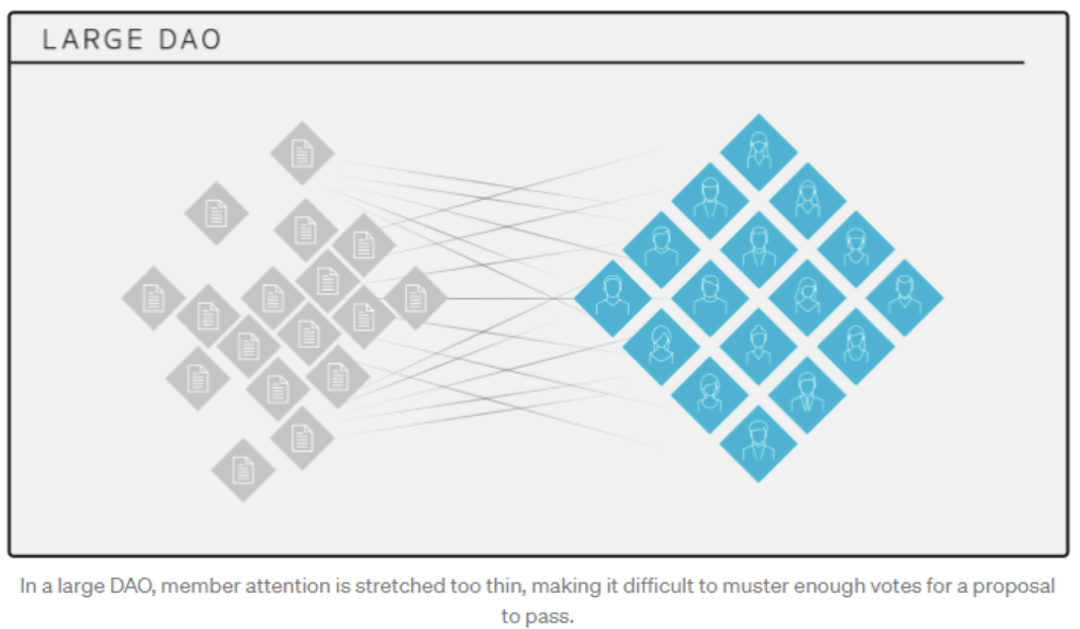

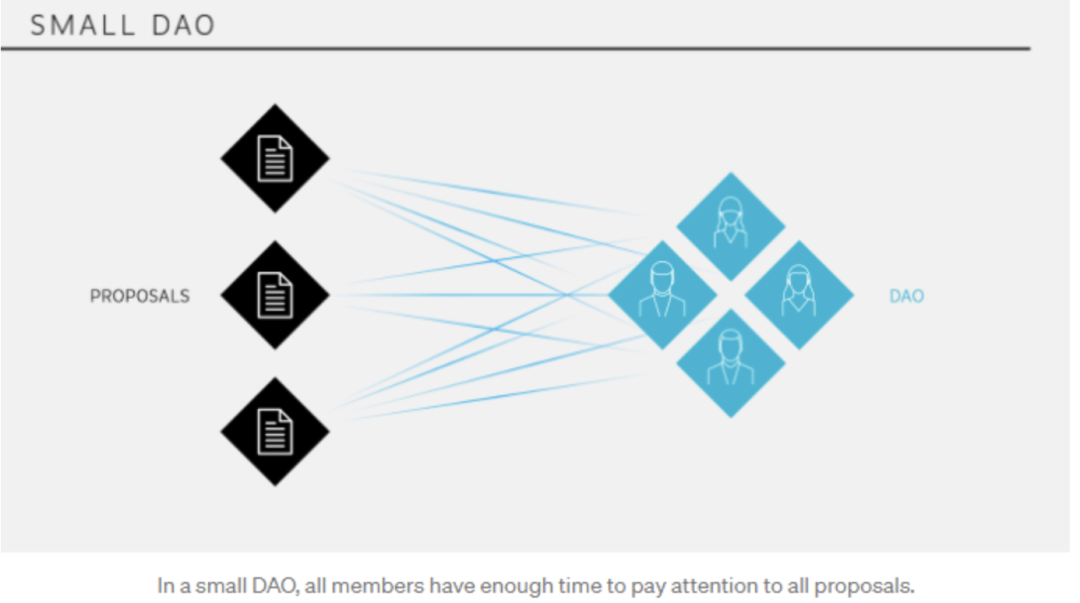

The DAO Trilemma - Scale, Quality, and Access

In a small DAO, all members have enough energy to read and vote on all proposals. The simple voting method will suffice here. Such as the absolute majority mechanism, 1 coin 1 vote. However, as the DAO grows, more and more proposals need to be processed and decisions are made, and this approach raises a series of problems because not all members of the DAO will be able to understand all proposals. Supermajority with simple voting, quality, and access can be maintained, but not scaled. A large DAO cannot function in a constantly changing environment if it requires an absolute majority for all decisions.

image description

Figure 1: Two out of three: scale, access, quality

To achieve both scale and quality, DAOs can employ more complex preference capture or vote weighting mechanisms, such as holographic voting or streaming democracy. This improves scalability while maintaining quality, but is harder for voters to fully understand and support, which reduces accessibility and thus the legitimacy of decisions. They are also more difficult to implement, especially when voting happens entirely on-chain.

Throughout this article, we will explore various governance systems designed to address the trade-off between scale and quality in various ways. We will make a broad distinction between aspects of governance related to member voting weight and methods of eliciting preferences.

Govern what?

Neither Bitcoin nor Ethereum has a vault embedded in their protocols. However, most (if not all) modern protocols have a vault controlled in some way by the community. We will therefore distinguish between protocol governance, which is concerned with making changes to the codebase itself, and funding governance, which involves decisions about how the DAO should use its resources. The main focus of this article is to give an overview of the mechanics, design decisions related to DAO governance, but we will first illustrate how the protocol and financial governance are in practice in the current state so that we have something to compare the many innovations against.

Protocol Governance Example

The protocol change process for the Ethereum protocol follows five steps. Each proposal is called an Ethereum Improvement Proposal, but most other blockchain ecosystems have similar naming conventions and processes (see here).

Draft - The EIP editor merges the EIP into the EIP repository after it is well formatted

Review – The EIP author marks the EIP as ready and requests peer review.

Final Notice - The EIP is ready for review by a wider audience.

Accepted - The core EIP has been in Last Call for at least two weeks and any technical changes requested have been addressed by the author.

Ultimately - EIP: Core devs decide to implement in various clients and release in a future hard fork or already released.

As shown in the previous step, the core developers of the Ethereum blockchain have the discretion to implement these changes.

Treasury Governance Example

The traditional treasury governance mechanism follows a continuous "proposal-voting" structure, where token holders can submit project proposals, and if approved by the community, funds will be withdrawn from the treasury. BitDAO - the world's largest DAO-managed treasury - can be used to illustrate some of the parameter considerations typically involved:

Proposal threshold: 200.000 BIT. To submit a proposal for consideration, the proposer must hold (including delegate).

Voting duration: at least 7 days. This refers to the length of time between when a poll starts and ends.

Voting threshold: 1% of token supply (100M BIT). This refers to the minimum quorum in BIT tokens for a proposal to pass.

Some protocols allow proposals to go through several stages before being finalized. For example, the governance process of the Uniswap protocol is divided into three phases, each of which incorporates feedback received from the previous phase:

Temperature Check (Temperature Check): After a two-day window period, if there is a majority vote of at least 25k UNI, the proposal can enter the consensus review stage.

Consensus Check. This phase allows proposers to include"heat review"Feedback, and if the proposal involves partnerships, formal discussions begin.

Governance Proposal. The proposal should be accompanied by an executable chaincode. Committers must have at least 2 million UNI delegated to them and require at least 40 million UNI upvotes to pass.

Community Building, Proposal Discussion and Idea Formation

Another problem some DAOs face in optimizing incentivized participation is that for effective DAO governance, one needs a high level of user participation and a vibrant community to ensure good ideas are developed and refined. In practice, there are many working links to ensure this. Discord and online forums are often discussions or so-called "hot reviews" that involve the community in idea-forming"Good platform for gauging interest and reaction to a vague proposal. For example, Yearn finance requires at least 3 days of discussion on their forums before any proposal is submitted to Snapshot to ensure that only things that are well thought out and discussed actually lead to community votes.

Most DAOs run Discord servers and/or dedicated online forums to try and moderate discussions in specific channels. This is often also a person's first point of contact, and in order to successfully onboard a new member, it is important that the new member is treated with warmth and respect. Community managers can also play an invaluable role here to ensure effective communication between members and to ensure that any discussions are constructive, this often has a code of conduct or set of community guidelines that members need to follow

Information dissemination and communication is another key cornerstone of effective DAO governance. In the case of quorum-based voting, or any system that requires a floor of voter participation, lack of voter participation can paralyze the DAO, as no further action can be taken on any proposal if there is a lack of participation in a particular vote. This can be mitigated by clear and effective communication, reaching out to members in the event of any proposals and votes, and by clear time frames for all processes involved in proposal development and voting. It's also a smart idea to keep polls open for a few days (eg, 5 days in the case of yearn) to ensure people have a chance to participate. In addition, a vibrant discussion before the actual proposal is submitted often ensures high participation because voters know that voting is likely to happen quickly, and given the time people have spent thinking about these ideas, it is likely that they will eventually exercise their right to vote. more sexual.

voting weight

DAOs have conducted multiple experiments in governance, which makes some alternatives to simple"1 coin 1 vote"(1T1V) design emerges. The 1T1V design is rooted in the same logic as Proof-of-Stake — conducting a governance attack requires an evil actor to control a very large stake, at which point, if it does break the network, it will also hurt itself. This section will explore the advantages and disadvantages of the traditional 1T1V model, and then explore various alternatives emerging in the DAO ecosystem.

Equity-based voting - 1 coin 1 vote (1T1V)

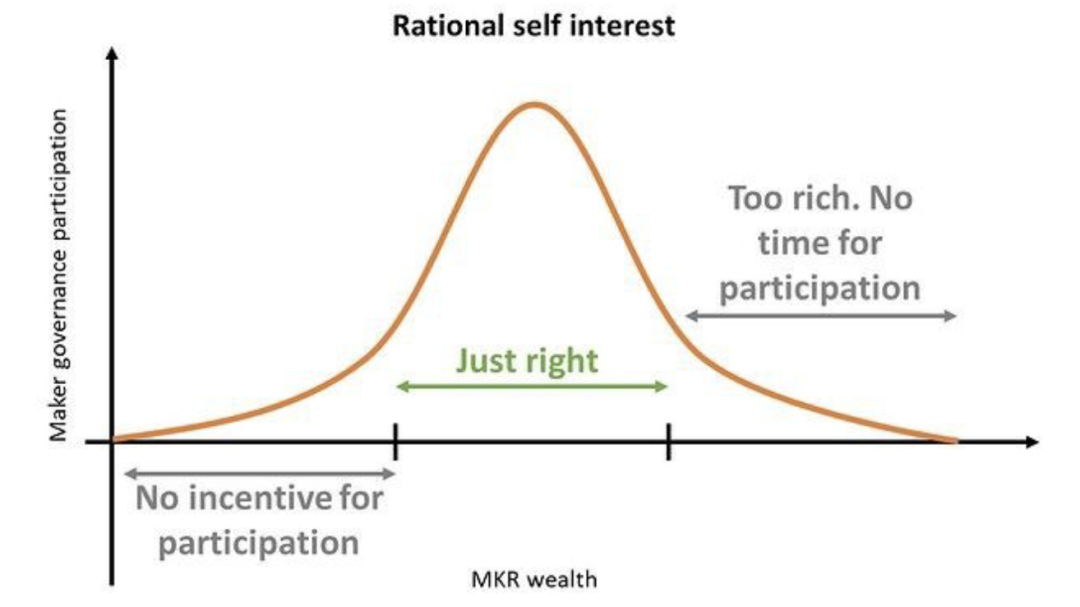

The most commonly used weighting scheme for voting is simply"1 coin 1 vote"system. Assuming that a large percentage of token holders do participate in governance decisions, the system would be expensive to Sybil attack. It also ensures alignment of incentives and action - if you hold a large amount of tokens with monetary value, then you will want the protocol to succeed, so you will participate in governance accordingly. From this perspective, the ideal conclusion is that the greater the stake, the stronger your incentive to participate, and thus improved governance decisions.

image description

Maker DAO Optimal Participation Incentives (Source: https://forum.makerdao.com/t/governance-forget-about-whales/4995)

Stake-based voting has at least three major disadvantages

Plutocracy constitutes a remarkable concentration of power. Many blockchain protocols have "whales," people who hold large amounts of tokens. This effectively means that the DAO's decisions are made by a small group of people, thereby nullifying the promise of distributing governance to the masses.

Someone who holds many tokens does not necessarily make the best decisions. For example, developers or other contributors may not hold as many tokens as wealthy early investors. Finally, using the number of tokens to measure one's stake in the system is a crude measure that may not capture other effects of token-based voting.

Low engagement. As the number of DAO members rapidly increases, the marginal influence of specific voters decreases, and the sense of meaningful participation decreases. This is one of the many reasons why the number of people participating in governance is usually very low in many DAOs, and one of the reasons for setting minimum quorum requirements (eg BitDAO requires 1% of the total token supply)

In what follows, we introduce various weighting schemes that address some of these issues in different ways. In the next section, we also introduce voting mechanisms that indirectly address these issues.

Single voting with the lowest threshold - 1 person 1 vote (1P1V)

Given concerns about plutocracy and such centralization, some have advocated the use of"1 person 1 vote"system. The idea is generally that members have to prove that they do have an interest in the ecosystem, and that everyone who holds at least X amount of DAO governance tokens has equal voting power. In this system, however, nefarious actors can circumvent rule requirements by creating multiple addresses. Therefore, each address must have a minimum amount of tokens. This has led to innovative solutions such as blockchain-based registries and ERC-20 proof-of-existence tokens.

Kleros developed an ERC-20 registry called “proof of humanity,” whereby a specific offline identity is linked to an Ethereum address. This requires you to submit a video and a vouching from someone already on the registry to confirm that the individual wishing to register is indeed a real person and not already on the registry. Checking that a person's address is indeed on Kleros' human proof would be a way of whitelisting individuals with unique real-world identities.

Governor DAO proposes another solution, issuing unique personal non-transferable ERC20 based on biometrics"proof of existence"Token. They do this by hashing hundreds of data points collected in their onboarding portal, which are then linked indefinitely into the wallet. Those who pass the identification test receive the above"Proof of Existence" tokens, and connect them indefinitely to their wallets. This token represents a single source of identity, since the same user's sensory data will yield the same hash, thus precluding the user from generating another affiliated with a different The existence of the address proves the token.

Reputation based weights

One of the concerns with 1T1V governance systems is that they are vulnerable to governance attacks if voting participation is low. Malicious actors may borrow assets from the lending market to carry out governance attacks, voting for whatever outcome they like. We define a reputation system as an ownership weight system in which members gain non-transferable voting weight through their actions. We describe two such reputation systems below.

The first is a governance token reward based on r/cryptocurrency contributions. The community distributes MOON tokens for contributions. These contributions can be anything from analysis, links to interesting articles, and comments on other posts. While MOON tokens can be bought and sold, the voting rights of such tokens cannot be transferred. A key challenge with these types of systems is that it can lead to a concentration of voting power and can be easily manipulated unless the community is very large. For example, if there were no limits on likes and comments, users could set up multiple accounts and like their own posts in the subreddit to increase the amount of MOON tokens they received. The Oxford Blockchain Association DAO addresses these issues by setting a cap in which society members cannot hold more than 10% of the total supply of (non-transferable) governance tokens at any given point in time. However, to preserve incentives, contributions above the cap will be rewarded with tradable tokens (monetary incentives).

proxy vote

proxy vote

A major weakness of all the previously mentioned weighting systems is low participation, and it doesn't give more weight to people with more expertise. Many DAOs introduce voting incentives to encourage participation, but this is a costly and often ineffective way of increasing participation. Another approach is to allow voters to delegate their votes to other individuals who may have more time to investigate proposals. Like representative democracy, this allows organization members to participate in governance through proxy.

The main benefit is that reps may have more time or domain expertise to make better decisions. Advocates of delegated voting argue that this system allows active community contributors, experts and others of merit to be given greater weight. However, as we know from any representative democracy, the people who get the votes are not always those with the most ability, but those with the greatest appeal to voters. Additionally, delegates may not vote based on the preferences of the token holders who delegated them. This can still happen over time as token holders can re-delegate to other delegates"vote with your feet", if they want to do so.

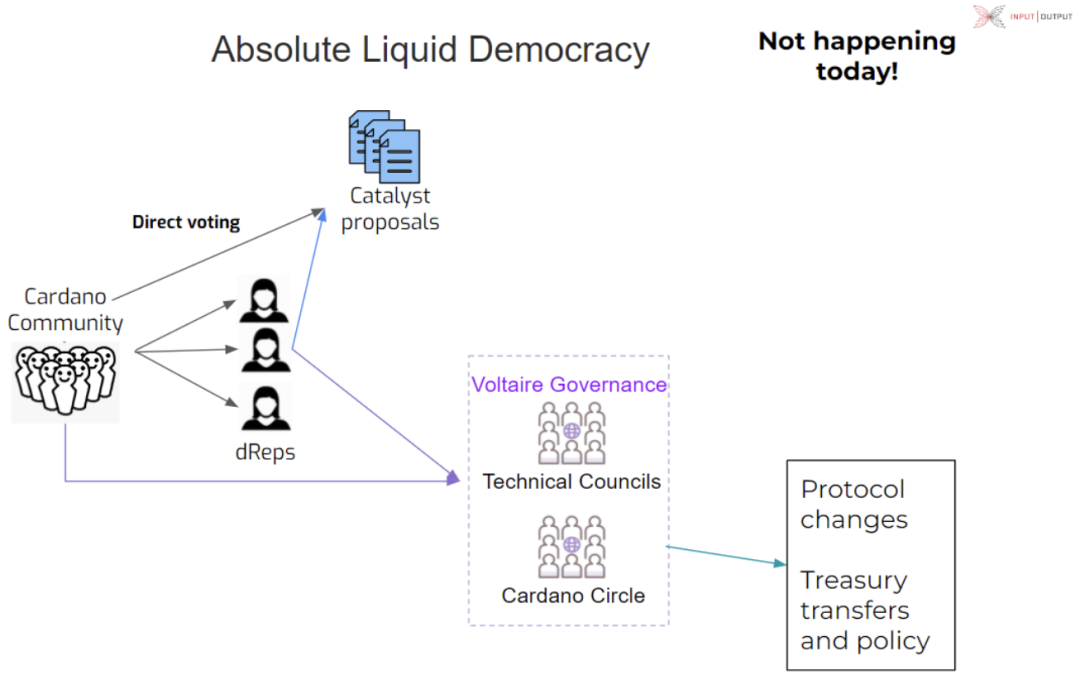

Liquid democracy

This refers to voting that combines elements of direct voting with proxy voting. Under a liquid democracy, individuals can vote directly as they wish, or they can vote fully with their voting rights in some domains while delegating their voting rights to representatives in other domains.

Streaming democracy is being implemented in the governance of the Cardano ecosystem. Although still experimental, the Cardano community plans to introduce a version of streaming democracy called Absolute Streaming Democracy. This means that token holders can divide their voting rights into several shares, possibly of different sizes, each share can be delegated to one or several different "dReps", and they get rewarded proportional to the amount of voting rights delegated to them. Proportional. This mandate can be revoked at any time, increasing accountability and empowerment. In the long term, dReps will represent token holders in protocol governance decisions, but in the current experimental phase, dReps will only be able to vote on Catalyst proposals on behalf of voters.

Preference Inducing Mechanism

There are many possible deviations from the simplest preference-inducing mechanism ("yes, no, and abstain"). We will propose some alternatives and compare them with the baseline mechanism.

Benchmark: Quorum-Based Direct Voting

This is the most basic voting protocol, where each member casts one vote to express their preference for a particular proposal or decision. There are three possibilities; yes, no or abstain. An absolute majority is required for voting to pass. Weights can be assigned in any of the ways described in the previous section, but there are usually additional restrictions.

Quorum threshold. Requires a minimum percentage of governance rights (in the case of weighted voting) or the percentage of voters participating in the vote to meet a minimum threshold to pass. A very common scheme is called quorum-based voting, which requires 60% of the total governance tokens to vote. For example, for a DAO with 1,000 circulating governance tokens, users with a total of at least 600 tokens are required to participate in the voting to pass.

Special majority requirements. This refers to the majority requirement for anything other than 51% of the voting power. For example, it may be required that the voting power for a proposal must be greater than 15% of the voting power for a proposal, or that at least 75% of the votes are in favor of the proposal.

In a Q&A on DAO voting, Clement from Kleros argues that quorum-based voting “leads to tactical voting” — people lie about their true preferences, and the best decisions don’t actually act. Additionally, the point of a DAO disappears when a large number of proposals do not reach quorum weight, which can lead to a situation where only very popular proposals are passed. Given the large number of proposals that may be voted on, and the variety of proposal types, this voting scheme is vulnerable to the disillusionment of some voters. Some people may care more about certain proposals than others, and the inability to express those preferences prompted the introduction of holographic, quadratic, or belief-based voting.

Holographic Voting

Holographic voting was first proposed by DAOstack to balance meaningful participation with scale. In a small DAO, all members can consider all proposals, but without some additional mechanisms, this is not possible as the DAO grows, as shown in the diagram below.

To understand how the GEN token works, first assume that the X-DAO (it could be any DAO) has a ground rule that all proposals must pass with an absolute majority, i.e. more than 50% of the total governance token supply. Now, if this DAO chooses to use the GEN prediction community, then predictions can show their belief in the proposal by "supporting" or "against" it using GEN tokens. To be clear, GEN tokens can only be used for staking, i.e. governance tokens that cannot be used for voting. A good prediction is to predict that the community "supports" proposals that the DAO eventually approves, and "against" proposals it rejects. To incentivize "good" predictions, correct bets are rewarded with more GEN tokens, while wrong bets result in a loss of GEN tokens.

As mentioned earlier, the general rule of X-DAO is that proposals must be passed by an absolute majority. However, this is not easy to achieve at scale, which is why "boosting" was introduced. If there is a sufficient number of GENs predicting that the betting proposal will pass, thereby satisfying the dynamically adjusted "boosting" condition (the more proposals are boosted, the harder it is to boost), then the required threshold will be lowered from an absolute majority requirement to a relative majority ( More than 50% of the participating voters), and the voting time for the proposal will be greatly shortened. Here's what the governance process looks like for DAOstack itself. The following is the process of DAOstack's own governance.

initiated. To submit a proposal, the proposer must have a minimum reputation.

enhanced. GEN holders (predictors) place bets by betting for (against) proposals they think voters will approve (disapprove).

vote. Voters vote on proposals. Predictors are rewarded if they correctly bet that a proposal will be approved/disapproved.

On-chain execution. Approved proposals are executed on-chain.

quadratic voting

quadratic voting

Under quadratic voting, voters can use their voting power to cast multiple votes on a proposal. However, each additional vote on a proposal becomes more and more expensive (in terms of voting power) at an exponential rate: $cost = votes²$. This means that voters have an incentive to spread their votes across multiple proposals, rather than casting all their votes for the proposal they like. For example, 1 vote for the same proposal will cost 1 token, 2 votes will cost 4 tokens, and 3 votes for the same proposal will cost 9 tokens. This system is being used in funding decisions for Gitcoin and Hackerlink.

Such a system can be combined with many of the weighting schemes described in the previous section. For example, it can be directly applied to 1T1V system. Alternatively, it could embed a 1P1V system, meaning that DAO members who meet minimum token holding requirements and have unique proof of identity can be allocated an equal set of voting power budgets, which they can allocate to competing proposals.

The problem with quadratic voting is that it can be difficult to understand and thus limit participation. If the benefits of quadratic voting are unclear to voters, it could face a lot of resistance, which would negate many of the theoretical benefits it could provide. Additionally, people can game the system by spreading their funds across multiple addresses, buying extra votes for themselves more cheaply. Unless there is human proof or integrated proof exists, this is vulnerable to such bad attacks.

vote of faith

Conviction voting is a unique proposal where someone's share of voting weight is proportional to how long they hold that particular voting preference. Proposals are therefore judged on the aggregate preferences expressed by community members over a specified time span. In contrast to voting that occurs at discrete points in time, time suddenly becomes a continuous variable. This does not prevent members from changing their preferences, but it incentivizes people to hold long-term beliefs, as their voting weight increases proportionally to this. As a result, those with consistent, long-term preferences accumulate more governance influence, and it becomes more difficult for new money to guide governance decision-making.

Leaving aside the question of how exactly this works in practice - let's briefly outline the advantages of this voting scheme. Conviction voting is extremely resistant to short-term vote fluctuations and collusion, as impulsive short-term changes of mind can result in large losses of voting power. Additionally, those who only want to buy short-term governance rights for themselves through tokens will have difficulty because this requires so-called “voting rent-seeking.

DAO Voting Tool

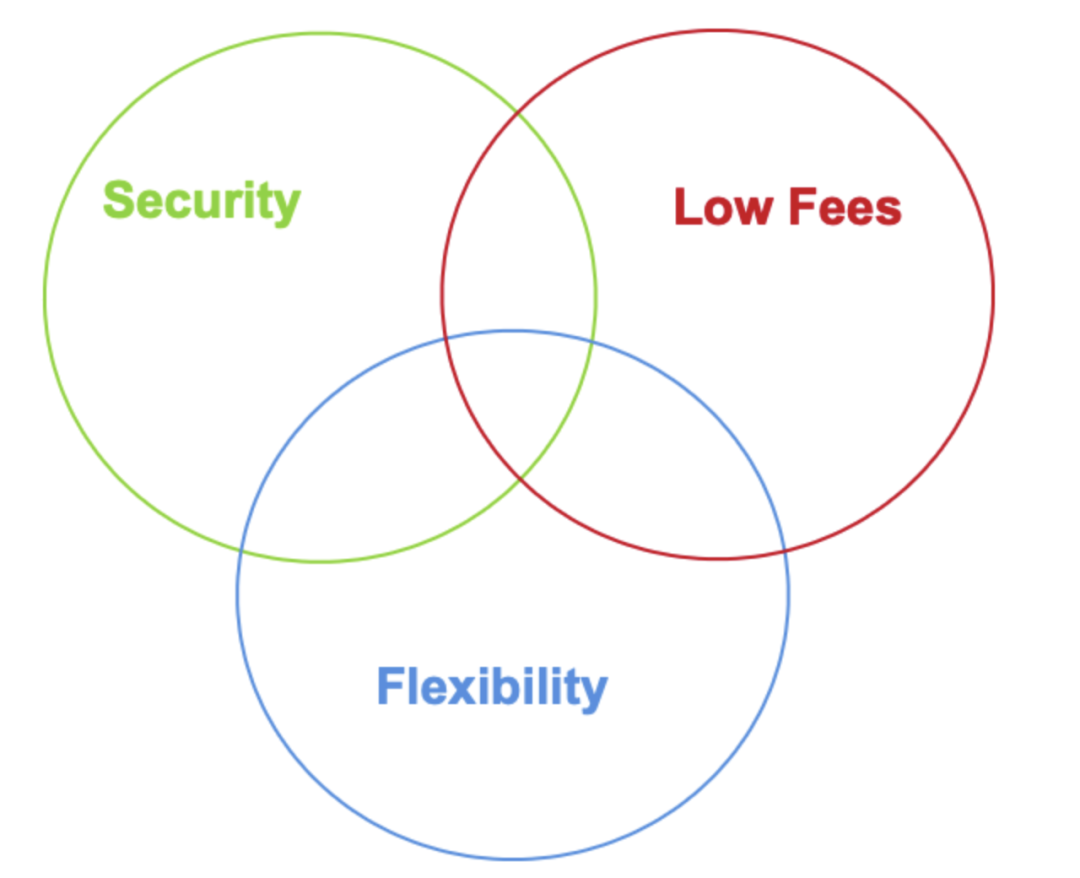

A plethora of tools exist designed to simplify voting in DAOs, and in general one must distinguish between on-chain and off-chain voting. In particular, we'll discuss some of the different voting tools and discuss the trade-offs in security, cost, and flexibility.

The Trilemma of Voting Tools

Off-chain voting using Snapshot and IPFS

Snapshot is a protocol that handles DAO off-chain voting through the decentralized file storage medium IPFS (Interplanetary File Storage System). It is a"Off-chain gas-free multi-governance client with results that are easy to verify and hard to challenge". (Snapshot). If a specific DAO wanted to use Snapshot to process their proposal votes, they would need to create an ENS (Ethereum Naming System) domain where they could add a record on ENS to allow viewing of votes at that specific address. Users only need a wallet address with the currency required by the protocol to participate in voting. There's a ton of customizability and flexibility about how users are whitelisted for voting, they might just need to hold the desired governance token, perhaps a membership NFT or through interaction with the contract. Snapshot supports multiple voting systems; quadratic voting, direct voting, etc. Users can vote by connecting their wallets to Snapshot's website, which will link them to any public proposal. This level of flexibility is especially useful for protocols that adjust how they vote over time and require a high degree of customizability.

The reason Snapshot does not charge fees is because of its lightweight stack, which does not rely on the consensus of a distributed set of nodes operating the same ledger to record votes, but instead handles votes as signed messages that are easily verified online because they is uploaded and stored on IPFS. Off-chain voting has the huge advantage of circumventing the transaction fee problem, which is currently particularly vexing for Ethereum users. Charging users high voting fees is a huge disincentive to participation in governance in the first place and severely constrains the scaling and growth of any DAO. One potential downside is that one has to place some trust in Snapshot in handling votes honestly, correctly implementing the required vote weighting scheme, and uploading the correct signing information. Of course, it is inevitable that some mistakes will occur here. Additionally, poll creators must be provided with a trustworthy, correct interface for displaying poll results. The snapshot.io website that users interact with must also be secure. Snapshot outperforms any on-chain tool in terms of low cost and is currently the most widely implemented DAO voting tool.

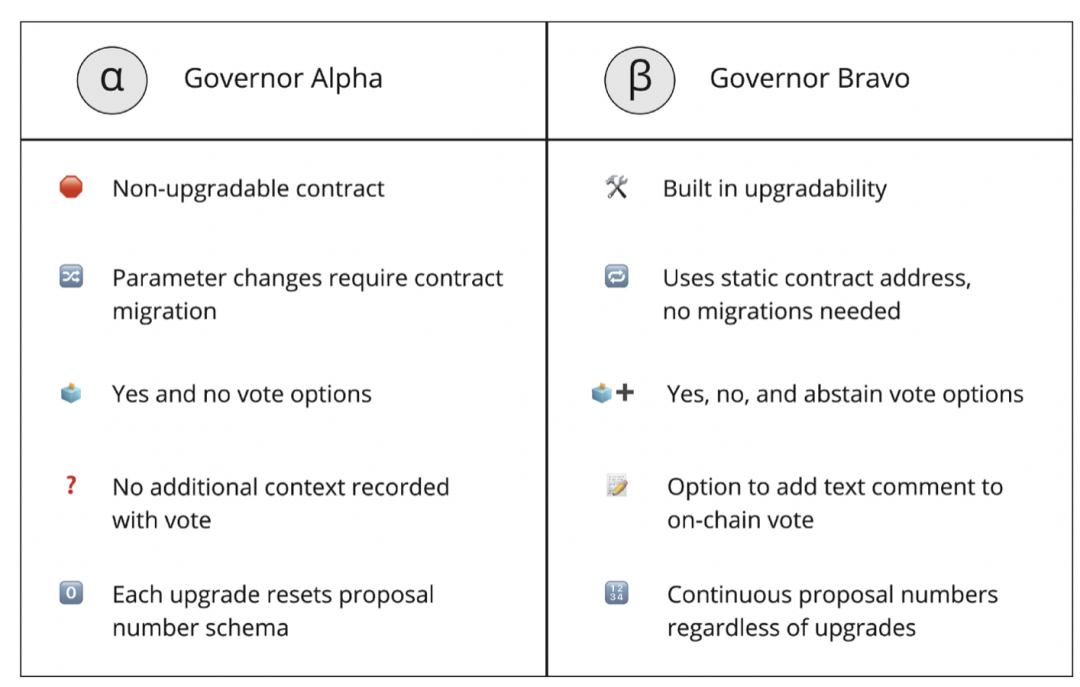

On-Chain Voting Tool

There are various smart contracts that are specifically designed to handle on-chain voting. The most widely adopted is "OpenZeppelin" or "Compound Bravo". These on-chain voting schemes are often associated with frontends like Tally or Sybil, which point to specific contract addresses when users submit votes. The degree of flexibility and customizability of a full on-chain implementation is rather limited, and the cost remains high. For example, the Compound Alpha implementation had some shortcomings, including difficulties implementing upgrades and parameter changes. Several new features have been added in the Bravo release that overcome previous limitations, outlined below.

On the one hand, Governor Bravo supports upgrades and parameter changes. Previously, Governor Alpha contracts were deployed as fixed values for all key governance parameters such as proposal submission thresholds, quorum thresholds, or voting periods. Bravo, on the other hand, allows governance to adjust parameters after deployment. This simplifies the workflow for interfaces such as Tally, as interfaces do not need to update their site in case of parameter changes, which previously required contract migrations.

Despite the improvements brought by Governance Bravo, there is still very limited flexibility and support for implementing more personalized voting schemes such as holographic or faith-based voting. Additionally, the cost of on-chain voting, especially on Ethereum, remains high.

The OpenZeppelin implementation is a modular system of Governor contracts that allows deployment of on-chain voting protocols similar to those described in Compound's Alpha & Bravo, but also allows for a greater degree of customizability in different aspects of the protocol. For example, it allows implementing delegated voting. However, the downside regarding high fees is similar (at time of writing, the average gas fee over the past 7 days on crypto.com is ~$23). This is substantial and cannot be ignored.

Snapshot has promised to combine the best of on-chain and off-chain; by resorting to layer 2 on-chain voting and nearly gas-free execution. Snapshot X (formerly StarkVote), a project in collaboration with the StarkWare team, is a voting framework built on top of StarkNet (second layer ZK-Rollup). Voting is completely secure and on-chain, but Snapshot claims that voting on Snapshot X costs about 1000 gas, or about 50x to 100x cheaper than on native Ethereum. The core innovation lies in the use of Proof of Storage to verify balances, these calculations are quite expensive in layer 1, but can be greatly reduced by adopting layer 2 technology. If this is what the Snapshot team promises, it could prove beneficial in every way; firstly, the process is completely decentralized and trustless, requiring no intervention by intermediaries who transfer votes to IPFS such file storage platform. In addition, this is completely open, anyone can interact with it on the chain, no need to go through the Snapshot client, but at the same time people can integrate Snapshot X with the existing Snapshot client, when implementing the DAO governance protocol Offers a high degree of customizability and flexibility. While layer 1 on-chain voting tools, despite being secure, trustless, and open, are severely limited due to the costs they incur, Snapshot X appears to offer a promising, cost-effective alternative. This seems to satisfy all three characteristics of a great DAO voting tool: security, low fees, and flexibility.

Innovative DAO Financial Protocol and Governance Model

Most blockchain protocols follow traditional funding decision-making mechanisms through a centralized process in which applicants send applications to the company that developed the protocol. Many also allow proposers to submit project proposals to the community along with budget requests, which are then voted on in one or more rounds using platforms such as Snapshot. However, some protocols go even further when it comes to money management. Here, we highlight two innovative financial governance models.

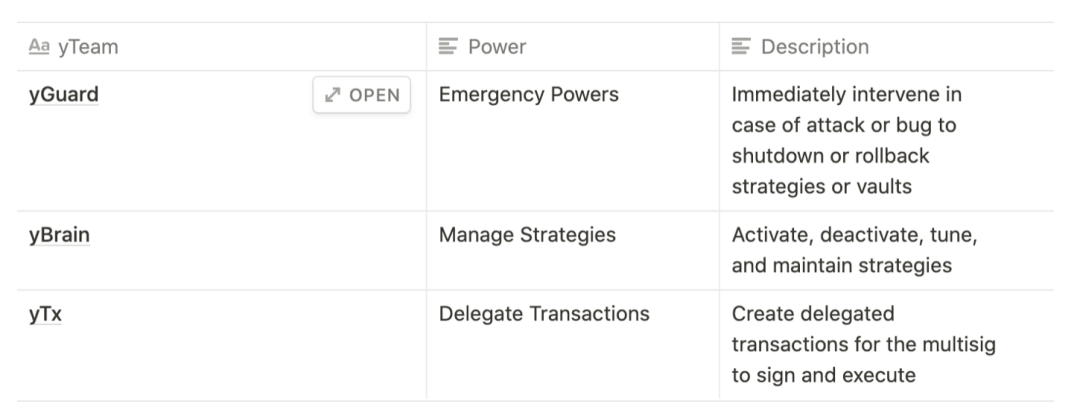

Yearn Finance: Workflow and Multi-DAO

Yearn considers himself a"Multiple DAOs"structure, managed through restrictive authorizations. As such, it aims to eliminate overly bureaucratic protocols while staying true to its principles of decentralization. The aim is to strike the right balance between decentralization and executive efficiency. In Multi-DAO, there are several Decentralized Autonomous Organizations (DAOs) that contribute to the protocol in unique ways. These organizations include:

“YFI holders vote for changes to the protocol or protocol governance structure

yTeams focus on a specific aspect of an agreement or related operation

Multisig members enforce or veto any on-chain decision" (Yearn Governance)

Token holders are the foundation; they have the final say on which yTeams exist, what kind of work they do, and who owns Multisig rights. They can vote on any proposal and thus control the decisions made by the protocol. This is what it means for yearn to be governed by a restrictive mandate - it's token holders delegating their power to different groups that formulate whatever the community desires and improve and govern yearn.

Token holders create and vote for proposals including Yearn Improvement, Yearn Signaling, and Yearn Authorization proposals, which are used to make any type of decision. For example, this could include proposals to use treasury funds, change multisig rights, change specific smart contracts, or change the standard fee structure in the Yearn protocol. Within this framework, there are also many teams with specific roles and powers, some examples are as follows:

This means that expertise is optimally distributed by giving yTeams very specific tasks and narrowing one person's area of responsibility as much as possible. Therefore, power is also distributed among different teams.

yTeams (from Yearn docs)

Operationally, Yearn has revolutionized by leveraging independent workflows to efficiently deliver high-quality work. These workflows are usually run by a specific yTeam. Therefore, the entire ecosystem can be seen as a collection of independent projects with specific goals and workflows, which means that it is highly decentralized and scalable in terms of governance structure.

Cardano: Project Catalyst

Catalyst is the name of the Cardano ecosystem governance sidechain, Catalyst is the name of a series of experiments aimed at advancing on-chain governance of the Cardano ecosystem.

The first difference between the Catalyst and benchmark models is that proposals cannot be submitted on a rolling basis. Conversely, some funding rounds can only submit proposals within a specific timeframe to address the challenge of community voting decisions.

Challenges correspond to priority areas identified by the community and contain descriptions of the types of proposals that can be submitted, objectives, key performance indicators, and total amounts. In the current iteration (fund8), there are a total of 22 challenges addressing specific priorities identified by voters in the previous iteration, such as"Africa Grows, Cardano Grows"($250.000) and"The Great Migration of Ethereum"($500.000). Leveraging Cardano's unique multi-asset capabilities, native protocols can be initiated within Catalsy"Catalyst Natives "Challenges, which allow the community to submit proposals to solve specific challenges, and challenge jars where teams compete.

According to Cardano's radical philosophy of inclusivity, holding ADA is not a requirement to become a proposer or accept rewards for reviewing proposals as a community advisor. The process from submission to funding decision is described below.

Proposers submit draft proposals to a suitable challenge through the platform. The proposal outlines the problem, solution, team members, and budgetary requirements. They can only be submitted within a fixed window and must be completed by a certain deadline.

A Community Advisor (CA) is anyone who registers as a CA by the final submission deadline. CAs write comments on proposals they like along three lines. Relevance, feasibility and auditability. For each dimension, CA provides a score (1-5 stars) and a brief justification.

Reviews written by CAs for this round are scored by veteran community advisors (vCAs) who have worked on CAs in past funds. By majority decision, a proposal may be rated as"filter"、"or"or"excellent", which determines the reward given to the CA that wrote that review. The total budget allocated to reviewer rewards is shared based on the share of ratings made by a certain reviewer. New initiatives have been taken to create a system where well-done CAs and vCAs can build a reputation over time.

or"yes"or"no"votes, using 1T1V direct voting, there is no minimum quorum.

After the voting is over,"be opposed to"and"be opposed to"Proposals with the largest margin of votes receive their requested funding from the Challenge Prize first. Project proposals receive funding sequentially until Challenge funds run out. Additionally, Community Advisors (CAs) who write comments on proposals that are ultimately approved are rewarded with bounties — similar to how holographic voting rewards successful bets.

Approved proposals that were not funded in the challenge they submitted (received at least 15% more 'yes' than 'no') may be funded under the same mechanism as in 5 if there is remaining funding from other challenges .

Summarize

Summarize

references:

references:

Bibliography

Nakamoto, Satoshi. “Bitcoin: A Peer-to-Peer Electronic Cash System”, 2008. https://bitcoin.org/bitcoin.pdf.

Encointer — Money by the People, for the People. https://encointer.org/. Accessed 9. March 2022.

„A History of Bitcoin Hard Forks“. Investopedia, https://www.investopedia.com/tech/history-bitcoin-hard-forks/. Zugegriffen 9. März 2022

Rochard, Pierre. “Bitcoin Governance“. Medium, 16. November 2020, https://pierre-rochard.medium.com/bitcoin-governance-37e86299470f.

“How Does Ethereum Governance Really Work? — Everything You Need to Know by Cryptotesters“. Cryptotesters.Com, https://cryptotesters.com/blog/website-2jk0tzuj5-cryptotesters.vercel.app/blog/ethereum-governance. Accessed 9. March 2022.

Nabilou, Hossein, und Assistant Professor of Law &. Finance at University of Amsterdam Law School. “Bitcoin Governance as a Decentralized Financial Market Infrastructure“. Stanford Journal of Blockchain Law & Policy, June 2021. stanford-jblp.pubpub.org, https://stanford-jblp.pubpub.org/pub/bitcoin-governance/release/2.

“Governance — Forget about Whales“. The Maker Forum, 4. November 2020, https://forum.makerdao.com/t/governance-forget-about-whales/4995.

Hackl, Cathy. “What Are DAOs And Why You Should Pay Attention“. Forbes, https://www.forbes.com/sites/cathyhackl/2021/06/01/what-are-daos-and-why-you-should-pay-attention/. Accessed 9. March 2022.

Capital, Accelerated. “DAOs and Democracy: Voting Mechanisms in Web3 🗳️🏛️“. Accelerated Capital, 30. July 2021, https://acceleratedcapital.substack.com/p/daos-and-democracy-voting-mechanisms.

Arsenault, Eric. “Voting Options in DAOs“. DAOstack, 15. December 2020, https://medium.com/daostack/voting-options-in-daos-b86e5c69a3e3.

Emmett, Jeff. “Conviction Voting: A Novel Continuous Decision Making Alternative to Governance“. Giveth, 18. November 2019, https://medium.com/giveth/conviction-voting-a-novel-continuous-decision-making-alternative-to-governance-aa746cfb9475.

monetsupply. “Understanding Governor Bravo“. Tally, 1. July 2021, https://medium.com/tally-blog/understanding-governor-bravo-69b06f1875da.

Hussey, Decrypt /. Matt. “What Is Snapshot? The Decentralized Voting System“. Decrypt, 4. June 2021, https://decrypt.co/resources/what-is-snapshot-the-decentralized-voting-system.

Snapshot Docs, Home. https://docs.snapshot.org/. Accessed 9. March 2022.

CoinYuppie. In-Depth Analysis: 7 Common Voting Mechanisms of DAO — CoinYuppie: Bitcoin, Ethereum, Metaverse, NFT, DAO, DeFi, Dogecoin, Crypto News. 12. January 2022, https://coinyuppie.com/in-depth-analysis-7-common-voting-mechanisms-of-dao/

Governance and Operations | Yearn.Finance. https://docs.yearn.finance/contributing/governance/governance-and-operations. Accessed 9. March 2022.

Governance — OpenZeppelin Docs. https://docs.openzeppelin.com/contracts/4.x/api/governance. Accessed 9. March 2022.

Project Catalyst fund 8 launch guide. IOHK. Accessed 9. March 2022. https://drive.google.com/file/d/1gVMQkv6xIq-gLS2HGUyhYo5MihRpFWKg/view

Project Catalyst fund8 launch — Town Hall #1 February 2022. IOHK. Accessed 9. March 2022.https://youtu.be/rNZJvzjgduM