Financing of 10 million US dollars, the loan agreement "Moonwell" has locked up 240 million US dollars

According to official sources, the DeFi lending protocol「Moonwell」Recently completed $10 million in financing with a valuation of $90 million; this round of financing was co-led by Hypersphere Ventures and Arrington Capital, and other participating institutions include Lemniscap, C Squared, Mirana Ventures, Robot Ventures, Signum Capital, KeyChain Capital, and FMFW, etc. .

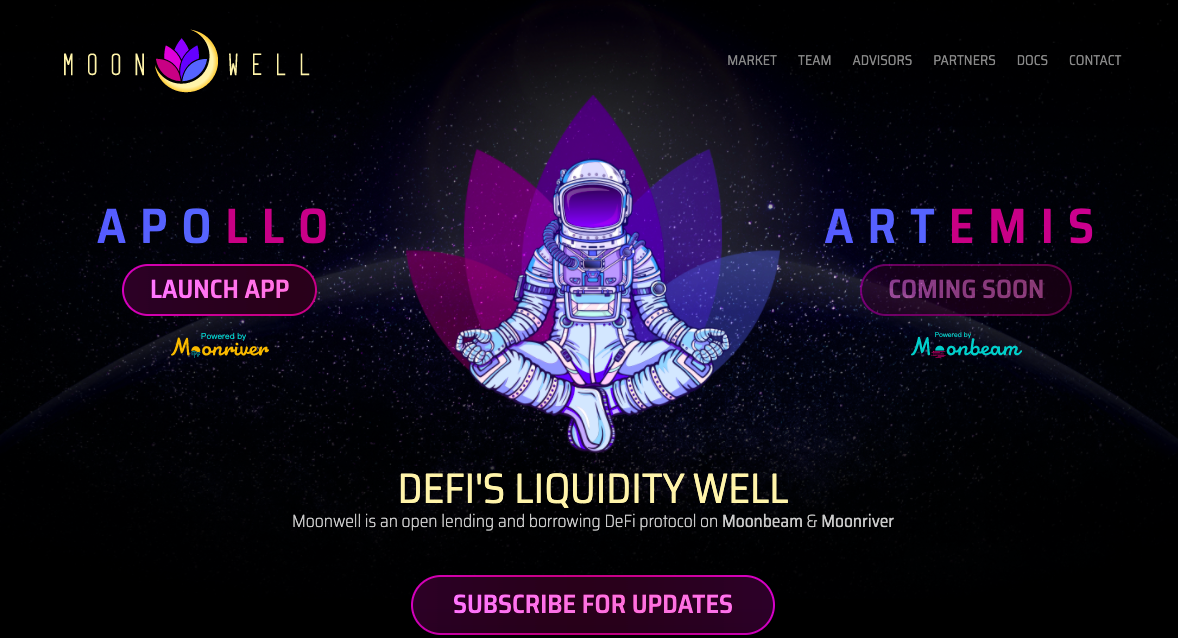

Moonwell It is an open lending DeFi protocol based on Moonbeam and Moonriver, similar to lending products such as Aave, MakerDAO, and Compound, allowing users to overcollateralize and lend cryptocurrencies.

At present, the scalability of the Ethereum network is poor. Some DeFi protocols usually choose new ecological public chains (Solana, Avalanche, Fantom, etc.) for construction. Why did Moonwell choose Moonbeam?

Moonwell officially explained that Moonbeam is the first parallel chain on Polkadot that is fully compatible with the Ethereum Virtual Machine (EVM). It not only has the scalability and interoperability of Polkadot, but also has the ease of use of Ethereum. The developer community is friendlier. And, since Moonbeam is EVM-compatible, users of Ethereum, Fantom, and other EVM-compatible chains will be able to use familiar tools like MetaMask to interact with Moonwell.

“Moonwell will likely be the first open lending protocol, not just for Moonbeam, but for all parachains. This will help spark Moonbeam’s vision to be a meeting place for XC20 and ERC20 assets. We are led by the team at The belief in the Moonbeam ecosystem, and the depth of their overall experience and knowledge on DeFi,” said Ninos Mansor, partner at Arrington Capital.

As a "tradition" in the Polkadot ecosystem, projects are usually deployed on the leading network to test new features, and Moonwell is no exception. On February 10th of this year, Moonwell Apollo launched Moonriver (Moonbeam Pioneer Network); in just over a month, the total locked value of the platform has reached 240 million U.S. dollars, and currently supports six types of asset lending: MOVR, BTC, WETH, USDC, USDT, Frax.

According to the official plan, Moonwell Artemis will be launched on Moonbeam in April this year.

In terms of tokens, Moonwell adopts a dual currency system, namely: MFAM (Moonriver network) and WELL (Moonbeam network).

MFAM is the native governance token of Moonwell Apollo, which can be pledged in the Moonwell security module to obtain income. When Moonwell Artemis starts, the governance token WELL will be issued and distributed to project investors, Moonwell users and other Moonwell community members; WELL will not come with voting rights, but holders can stake in the agreement to obtain benefits.

In terms of team, the Moonwell core team is composed of several former Coinbase and Google engineers. Among them, co-founder Luke Youngblood is a former senior staff engineer of Coinbase and chief engineer of AWS. He has built Coinbase price oracles and pledge reward infrastructure, and participated in the construction of Tezos verification node infrastructure and launched the Tezos network. In addition, Moonwell is also working withRome Blockchain Lab(RBL), which built Benqi, the lending protocol on Avalanche.