What makes Lido the top ETH staking protocol?

Feb. 2022, Vincy

Data Source: Footprint Analytics - Lido Dashboard

LidoIt is a platform built on the Ethereum 2.0 Beacon Chain. Users do not need to lock ETH and can also get pledge rewards, and get Token stETH 1:1 to participate in other services in the DeFi market.

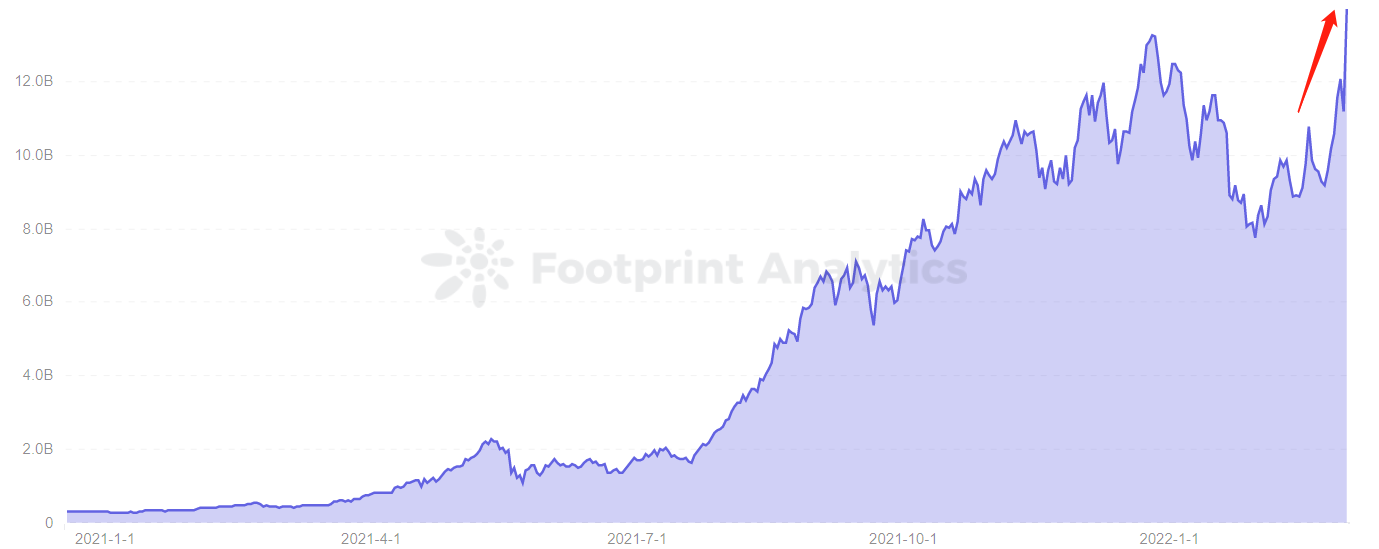

In just 3 months, Lido hit an all-time high with a TVL of $13.98 billion and surpassedAAVE、Convex Financeprotocol, ranking third among DeFi projects.

Let's analyze, is Lido with fast TVL growth a worthwhile platform to use?

Lido supports multiple mainstream public chains with innovative Tokenomics

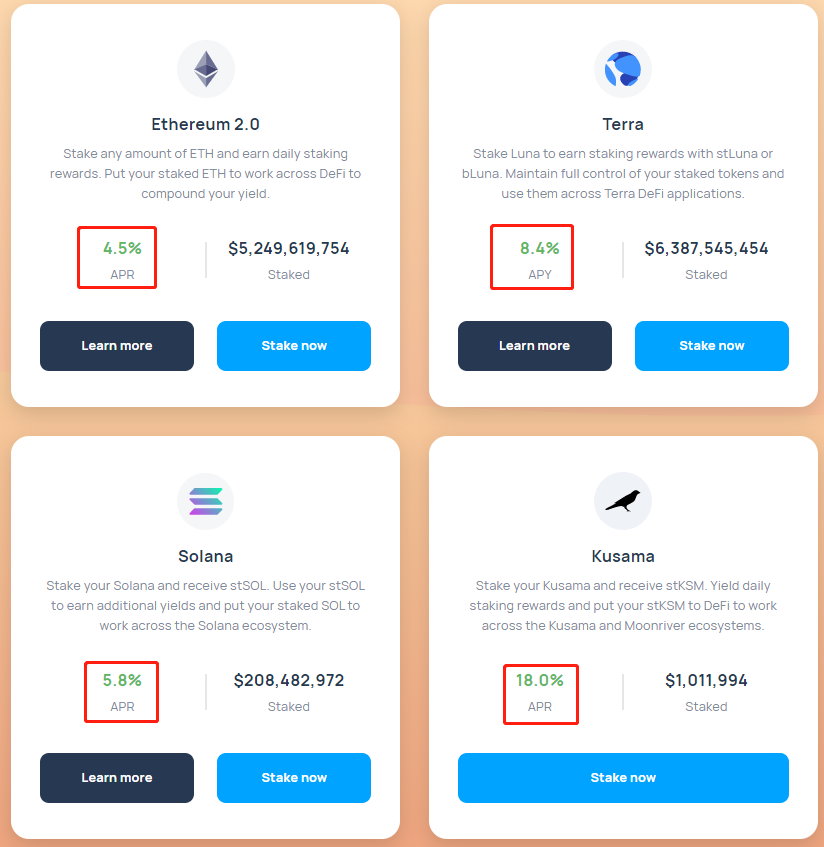

andTerra、SolanaandKusamaimage description

Footprint Analytics - TVL of Lido

image description

Screenshot Source - Lido website

image description

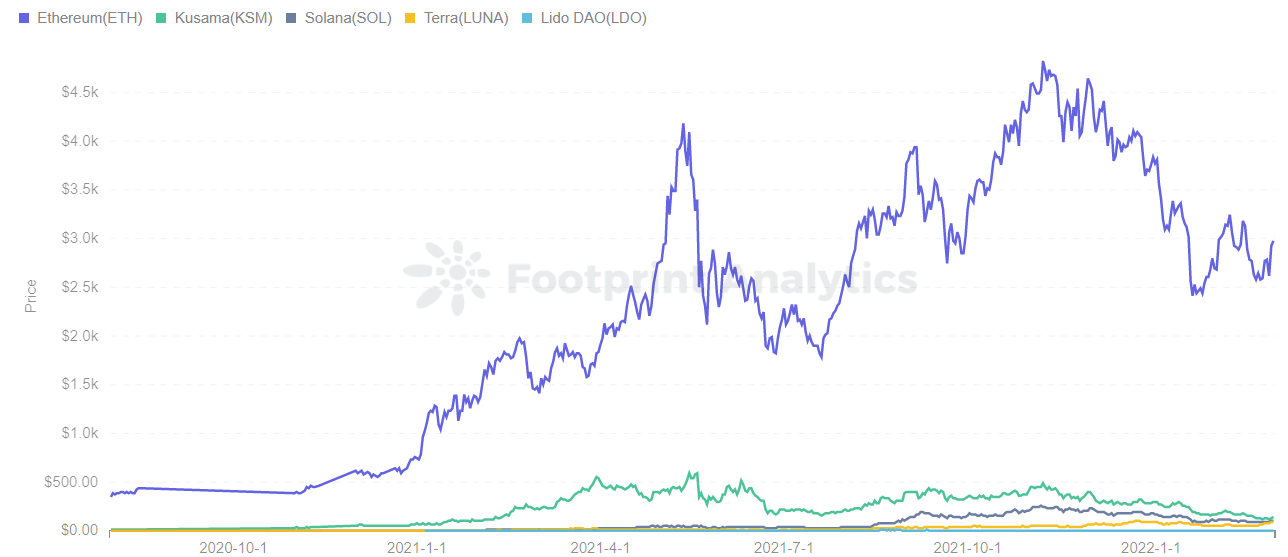

Footprint Analytics - ETH & KSM & SOL & LUNA & LDO Token Price

This makes Lido different from agreements such as MakerDAO and Liquity. For example, MakerDAO gets DAI as a reward for depositing ETH, while Lido pledges ETH, SOL, Luna and other Tokens to obtain derivative Tokens of the same price, and can enjoy not low annualized returns. And it is not affected by the price of native Token LDO. This means that Lido is a good interest-bearing staking service protocol.

Lido's various investment methods

Users who want to independently participate in the pledge of Ethereum 2.0 need to pledge 32 integral multiples of ETH, which is very unfriendly to retail investors. However, Lido is more humane in terms of the number of pledges. Users can participate in Ethereum 2.0 by staking any amount of ETH.

As of March 1, the total pledge of ETH is 1.98 million. Taking pledged ETH as an example, analyze how to earn more income on the Lido platform.

Users pledge any amount of ETH and get 1:1 Token stETH, which can earn 4.5% APY. Compared with AAVE, depositing ETH can get 0.2% APR, and the income is negligible.

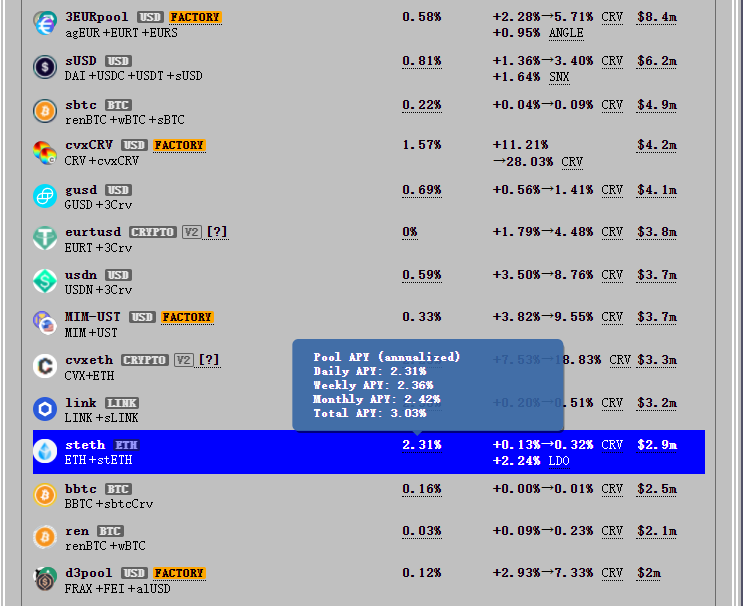

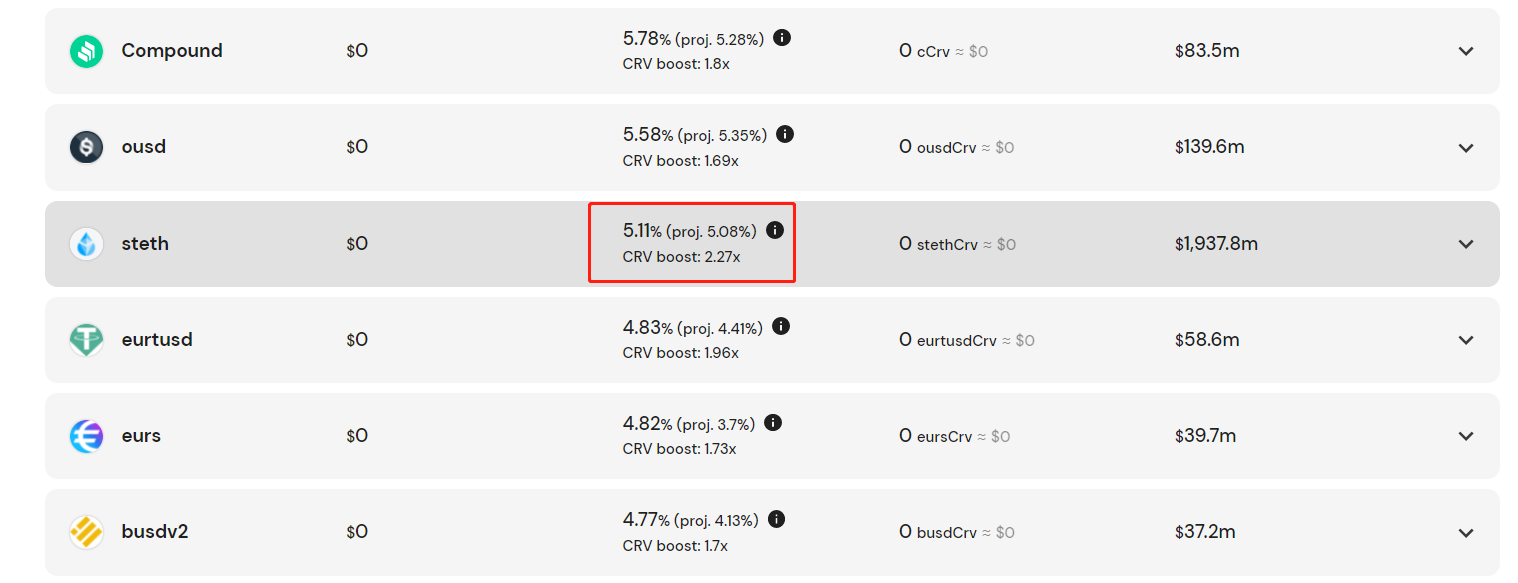

Turn the original interest-bearing stETH asset certificate into liquidity, and participate in other DeFi protocols (such as Curve, AAVE, and Convex Finance) to earn more income. The operation is as follows:

image description

Footprint Analytics - Curve website

image description

Footprint Analytics - Convex Finance website

To sum up, users who pledge any amount of ETH on the Lido platform for other DeFi platforms can get 12% to 14% APR, which is a considerable income for users. Curve and Convex Finance are the top 5 protocols in the entire network. Not only are the risks controllable, but they also have no liquidation risks. They are completely single-currency pledge models.

Lido's pros and cons

Advantages of Lido:

Friendly and flexible to Xiaobai

Can be pledged to external contracts to get higher APY

Single currency pledge mode

punishment mechanism

punishment mechanism

Lido is a platform built on the Ethereum 2.0 Beacon Chain (a brand new proof-of-stake blockchain), which is stored on the Beacon Chain after raising the Token pledged by users. It has a reward and punishment mechanism. When a rebase occurs, the supply of Token will be algorithmically increased or decreased according to the staking rewards in the Beacon Chain. A rebase occurs when an oracle reports Beacon statistics.

income is not stable

The balance of stETH will be updated at 24:00 UTC every day. If the balance of stETH increases, you can get a certain reward; if the balance of stETH decreases, you will lose a certain amount of Token stETH. However, the annualized income of staking on Lido is 4.5% (in the case of staking ETH), this income does not conflict with the rewards and punishments on the Beacon Chain, and the two are calculated separately.

The Footprint Community is a global, mutually supportive data community where members leverage data visualizations to co-create communicable insights. In the Footprint community, you can get help, establish links, and exchange learning and research on blockchains such as Web 3, Metaverse, GameFi, and DeFi. Many active, diverse, and highly engaged members inspire and support each other through the community, and a worldwide user base is built to contribute data, share insights, and drive the community forward.

This article comes fromFootprint Analyticscommunity contribution

The above content is only a personal opinion, for reference and communication only, and does not constitute investment advice. If there are obvious understanding or data errors, feedback is welcome.

Copyright Notice:

This work is original by the author, please indicate the source for reprinting. Commercial reprinting needs to be authorized by the author, and those who reprint, extract or use other methods without authorization will be investigated for relevant legal responsibilities.

The Footprint Community is a global, mutually supportive data community where members leverage data visualizations to co-create communicable insights. In the Footprint community, you can get help, establish links, and exchange learning and research on blockchains such as Web 3, Metaverse, GameFi, and DeFi. Many active, diverse, and highly engaged members inspire and support each other through the community, and a worldwide user base is built to contribute data, share insights, and drive the community forward.