Talking about the half-life of DeFi games: How does the protocol complete self-salvation?

Original compilation: Captain Hiro

Original compilation: Captain Hiro

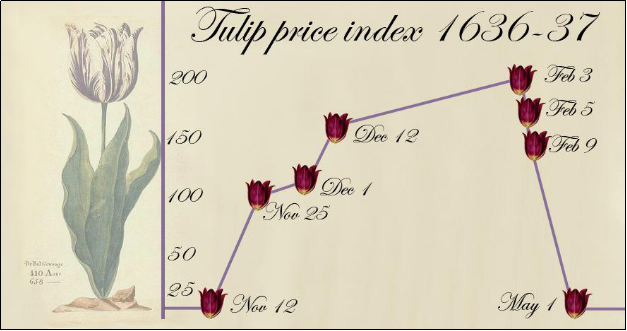

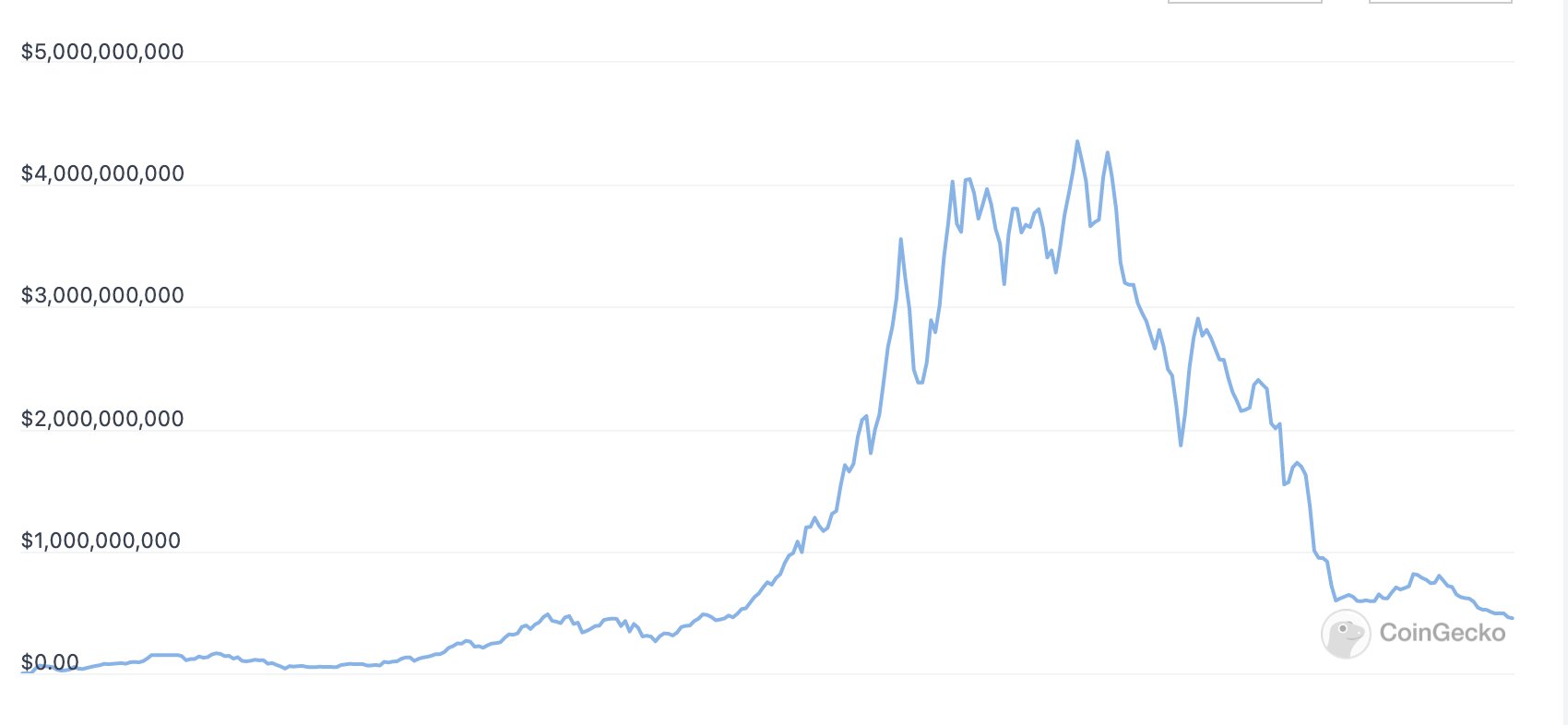

From the fanatical worship of (3, 3) to (1, 1), from the peak market value of 4 billion to the current market value of only 500 million, from 150 forked projects to the death of the entire forked group, the birth of Olympus DAO It has triggered people's imagination and talk about DeFi 2.0, and its "death" has made everyone wonder whether this is the status quo of DeFi.

We don't yet know how Olympus will fare in the coming months, and we don't know if it will survive the next few years. But after it sparked a lot of interest and innovation, we might be able to draw some lessons from it.

When I first came into contact with DeFi, I noticed that it has many similarities with games. All DeFi projects are actually GameFi. Since it is a game, it will naturally face customer losses, and they all have their own half-life. I've never been an avid gamer myself, but I've still noticed countless similarities between DeFi and gaming: the isomorphism of activity (i.e. both are about maximizing rewards), the nature of competition between players, Overlapping communities, same analytics skillsets. In the interviews of cryptocurrency venture capital companies and projects, it is inevitable that game-related questions will be involved-Line, Warcraft, Civilization 6, Left 4 Dead, Fortnite, Chess, Go, Poker, Bridge. Therefore, seeing why some games are eliminated can be a very good predictor of the future development of a DeFi project.

In fact, what DeFi newbies may not have figured out is that these protocols that allow you to earn a lot of money in mining are not really an investment. The token swap you do is not a real transaction. If investment is understood as investment based on fundamental analysis, then the DeFi mining and aping we see cannot be classified as investment, but speculation and gambling.

So this turns every protocol in DeFi into a gambling table where there are winners and there are losers because it's a zero-sum game. But transactions are not necessarily zero-sum, and investments are not necessarily zero-sum. The emergence of a new protocol is the opening of a new casino, and the innovation of a protocol is equivalent to inventing a new game.

You might complain that DeFi isn't really zero-sum. Yes, when the funds are sent to DeFi mining in batches through various aggregators, so that you can save gas fees, earn fees on your LP tgt, and so on.

But let's be honest, that's not what you think when you come into the game blindly. You are afraid of being preempted to take more profits, you are afraid that others will smash the market early, and you care more about the price of tokens than the long-term vision of the agreement. These all sound nonsense, because your hearts are longing for profit maximization.

A fork is the start of another game round, another hand of poker, another game of chess.

gamegame. A game is said to be solved if and only if the optimal strategy for any player is found. Obviously, on an inductive level, games that can be hacked are no fun. Tic-tac-toe is a solved game: two perfectly rational players play tic-tac-toe, and the result is guaranteed to be a draw. If they bet money on it, neither would win, and in fact, playing tic-tac-toe would actually waste their time (opportunity cost), so playing tic-tac-toe would be a net loss for them. Therefore, when someone invites you to play tic-tac-toe, the rational thing to do is say no.

Connect Four is also a solved game. Also, it has been mathematically proven whoever goes first wins. If players are going to bet on this game, the player behind will lose money all the time. Therefore, if someone offers you to play Connect Four as the second hand, you should also refuse.

Although solved games have a strict mathematical definition in game theory, we can intuitively feel that as we play more and more games of the same type, our performance in the game will become better and better, so we also It will get closer and closer to the optimal strategy of the game. In short, we learn as we play, and evolutionary game theory captures this intuition. Interestingly, evolutionary game theory was invented and proposed out of the need to explain altruistic behavior in Darwin's theory of evolution - this is why Olympus tried to meme the (3,3) strategy, if all miners are rational is the optimal strategy. Alas, but humans are irrational.

Considering that humans are not rational, it is not entirely accurate to use the mathematical definition of optimal strategy to describe the final state of the player simply stopping the game because he knows the rules of the game. The death of the Olympus fork project is not because the protocol is hackable (that is, miners have figured out the optimal strategy based on the mathematical structure of the protocol), but because miners have figured out the optimal strategy based on how they actually mine.

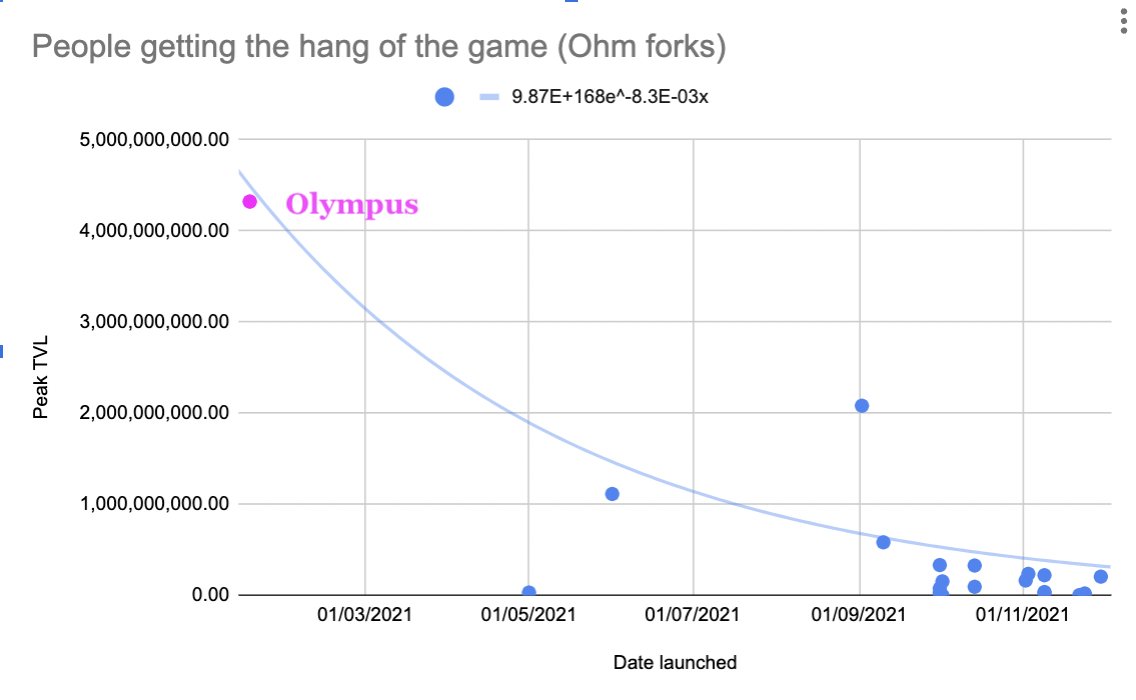

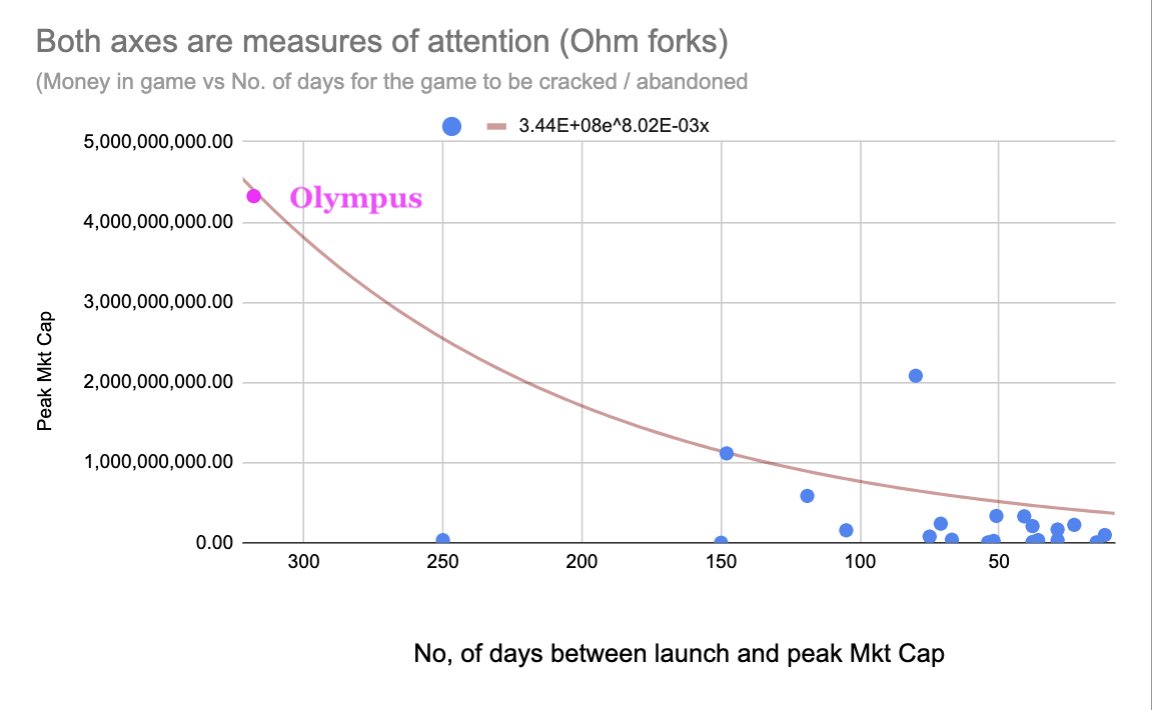

If we think of DeFi protocols as games, then there is reason to think that as more forked projects emerge, people will play better and the game will be conquered faster and faster. In other words, the time it takes for a game to be hacked gets shorter and shorter.

We can see this in the graph below:

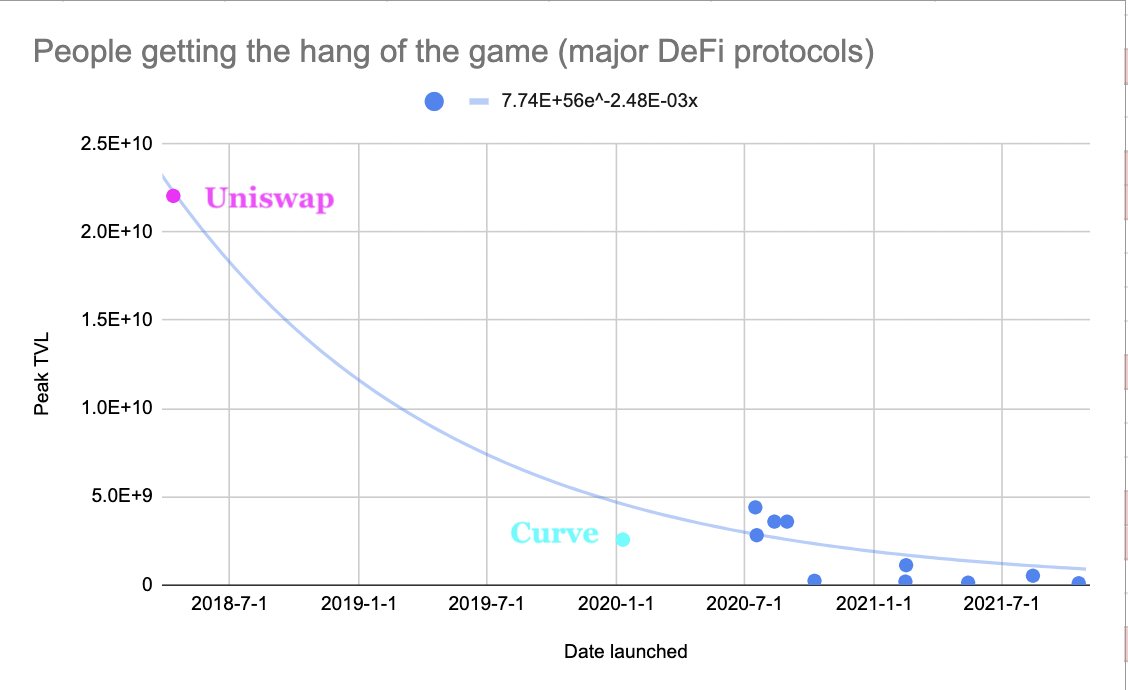

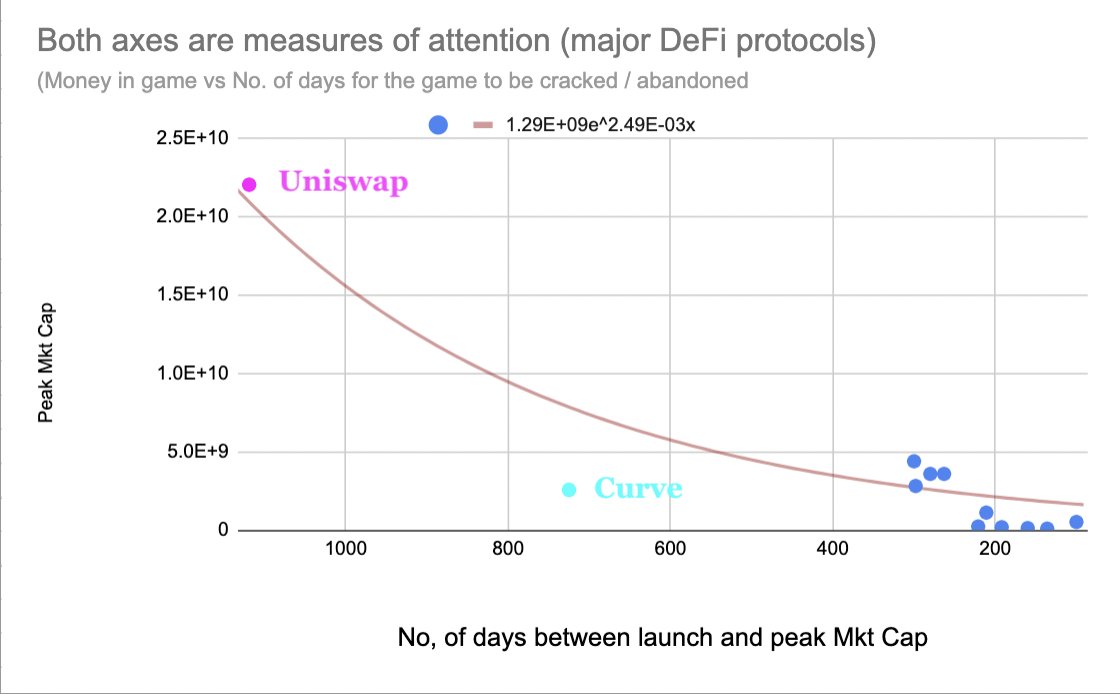

We can also see this decay behavior when we look at the main raw DeFi protocols:

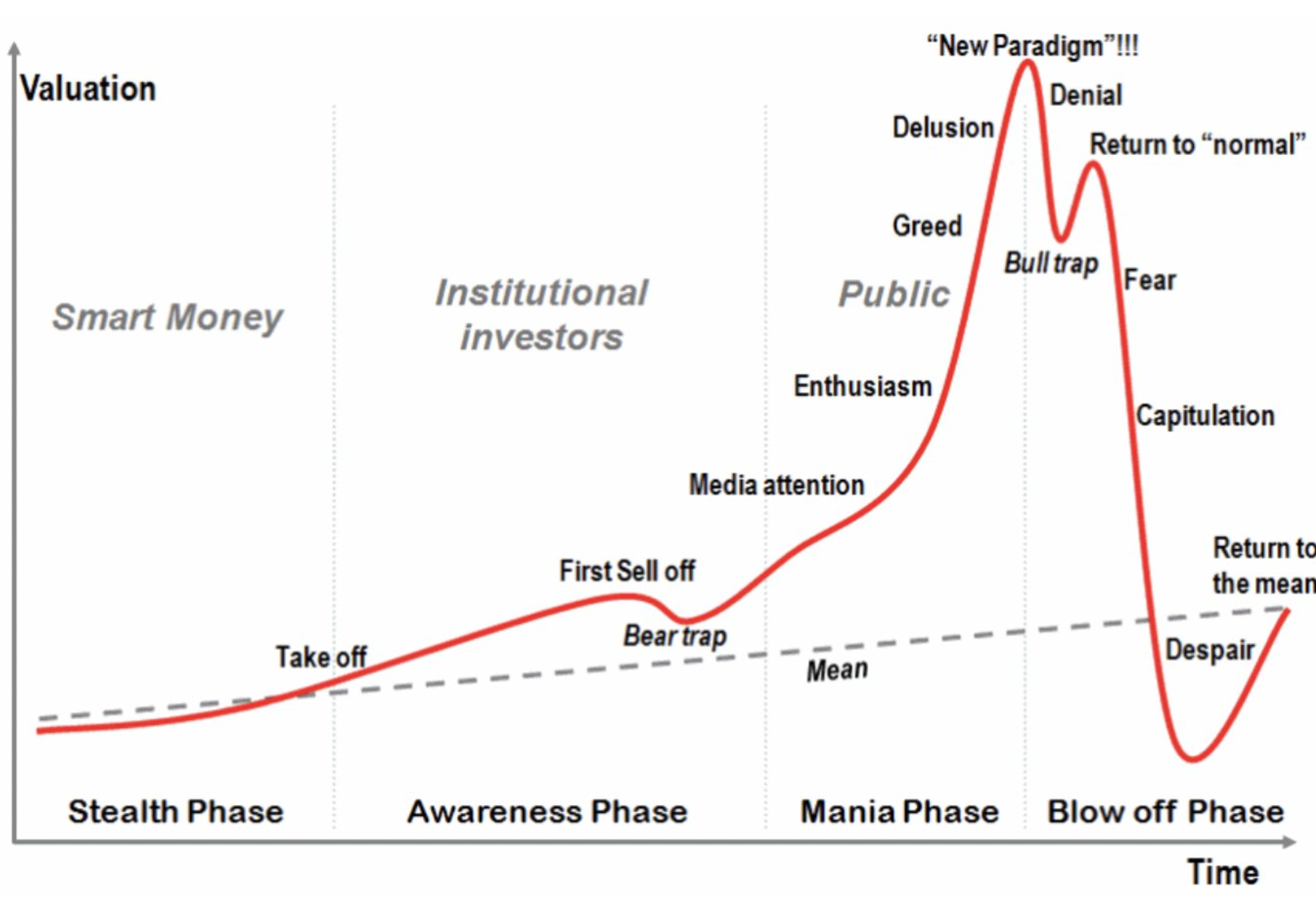

Whether a DeFi protocol can be hacked is different from whether it exhibits wild hype. The crazy hype looks like this:

We might call Olympus a solvable game, and all instances of it certainly exhibit hyped mania, but mania is not a necessary condition for a protocol to be solvable. A protocol that exhibits hype mania is not necessarily a solved game. If people just lose interest in it and the price of the token plummets, then it's irrelevant if the protocol is solvable, if I don't care about the protocol, I don't care if everyone knows how to mine and win more much profit.

However, if a protocol gets hacked, it will definitely show the downside of the hype cycle.

A protocol that hasn't been cracked is likely to show a feverish ascent phase - because people don't know how to mine better, and they all think they might win. And once the protocol goes wrong, people will want to quit because they think their strategy is not the best strategy, or they have already lost. But if a protocol is unbreakable, miners are more likely to stick around just because they think they might win. So an unbreakable agreement is a game where the fear and capitulation part of the hype curve stretches outward. An unbreakable protocol is a game with an infinite half-life. While new iterations of the same protocol will continue to be rolled out, newer game versions may not necessarily offer as many rewards as previous protocols.

Projects are of course interested in making their protocol unhackable - because if a protocol is hacked before their tokens are unlocked, the fear and capitulation phase of the hype curve will happen before the team's tokens are unlocked. Given the nature of a solvable game such that no player returns to the game, once the protocol is compromised, the team may be left with nothing after building a protocol that at one point has a large reward.

How can a protocol make itself as invulnerable as possible? I can think of three approaches:

1. Make it unsolvable:It's like chess or Go. This is of course assuming that unsolvability implies unsolvability. In DeFi protocol design, this can manifest as a massive increase in degrees of freedom and the number of things you can do with the protocol.

The problem with this is that it's not clear how you can actually do this. What would it look like to replicate the complexity of chess or Go in financial Lego? Is this possible?

2. Continue to build the protocol on it:Olympus' V2 bond and reverse bond. The trouble with this is that you have to keep building and building and building.

3. Let the protocol evolve itself:Like how new tokens and projects evolve on top of successful products, Convex on top of Curve, or how you build DeFi protocols on top of Ethereum, which keeps games running on Ethereum. The great thing about this is that you are outsourcing your work.

The third point is particularly interesting. I read somewhere before on the "base layer topic" that successful protocols are necessarily ones where you allow others to build on top of you.

Also, the third point seems to have a symbiotic relationship with decentralization. Decentralization is important to a project because it means you as the founder can leave without being abandoned.

From a founder's perspective, I need to make it clear that "decentralized = can exit".

In practice, one may need to do all three of the above, and these tricks of increasing uncrackability should be implemented before the hype cycle's frenzy peak, lest your dev team be locked into a project token that is past its prime . While implementing the protocol at the height of the hype cycle may still introduce new interest, projects would prefer that their market cap stabilize before the peak of the hype.

An interesting development of Treasure DAO is that there is still a DeFi heart under its skin, but it looks like it can be marketed as a game. As outlined in its 43-page white paper, it has a large number of operations in the protocol, which provides players with many reasonable strategies.

(I can't find a link to the 43 page white paper anymore. I suspect the reason they got rid of the white paper is that they don't want people breaking the game prematurely - they don't want someone hacking it prematurely).

Original link