Do you really understand the token economy of top DEX?

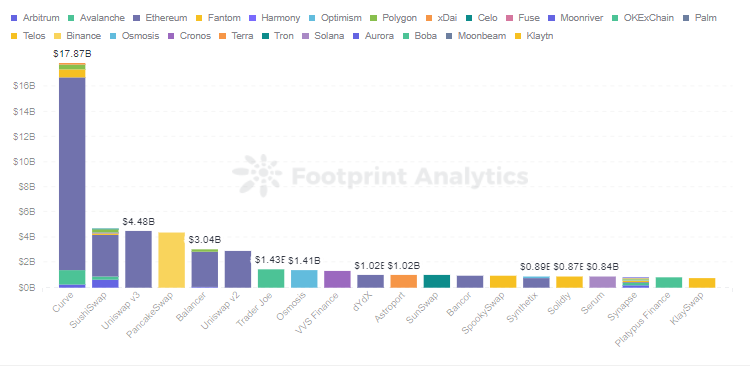

Data Source: Footprint Analyticsaccording toDeFidata, as of February 25DEX#1 category

There are 372 agreements, and the TVL is as high as 62.3 billion, accounting for about 30% of the total.

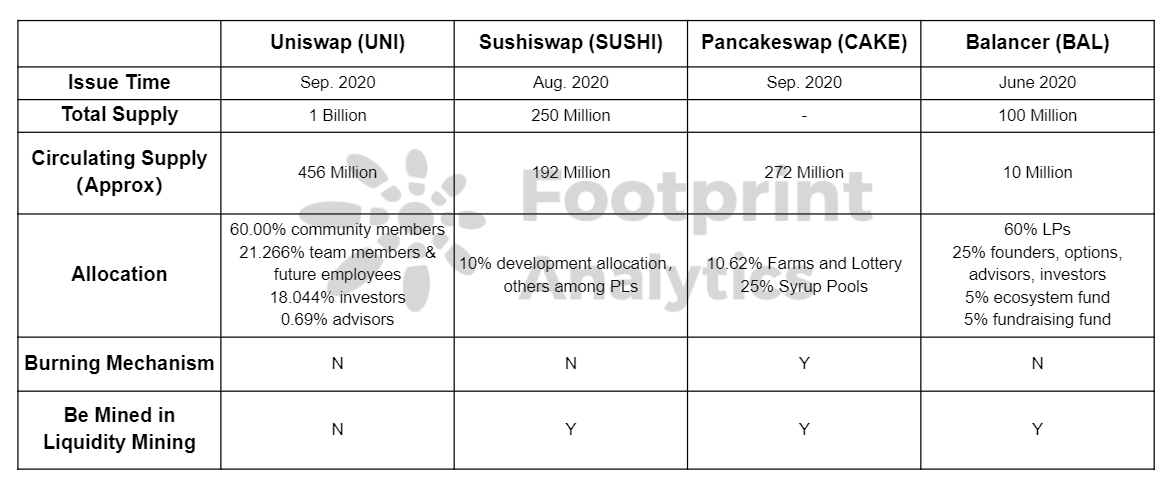

DEX's innovative AMM (Automatic Market Maker) model has shaken the order book model of traditional centralized exchanges. The gameplay of DEX has also become more abundant, and the provision of LP can also bring good benefits to users.Curve、Uniswap, Sushiswap, Pancakeswap, and Balancer. The models of many DEX platforms are roughly the same, but their Token economic models are not the same. Although Curve is the best, as a DEX that focuses on stable currency transactions, it is slightly different from other DEXs. This article will compare the token economic models of the other four DEXs.

Footprint Analytics - Top 20 Dex TVL in Different Chains

image description

Issue

UNI

4 The first one to go online was Uniswap, the pioneer of the AMM model, in November 2018. But it issued token UNI two years later, becoming the latest of the four projects. Balancer, Sushiswap, and Pancakeswap all issued their own tokens (BAL, SUSHI, CAKE) in 2020.

SUSHI

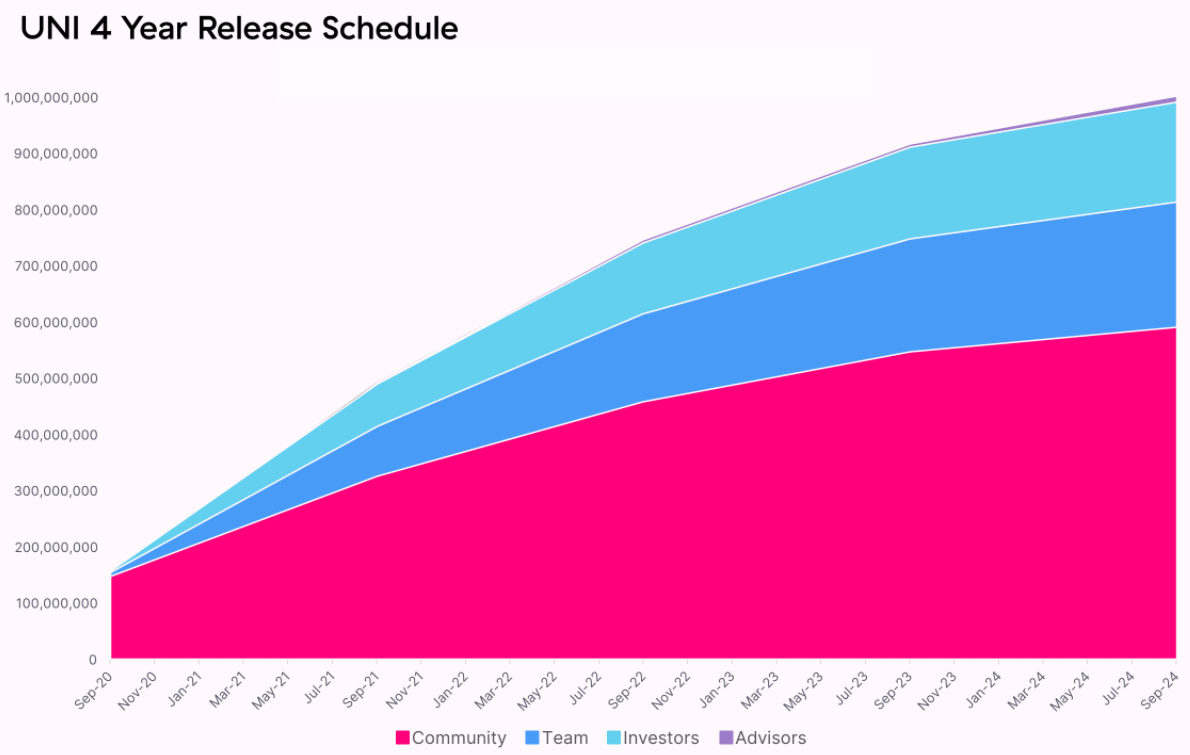

From September 2020, UNI will take 4 years to complete the initial issuance of 1 billion pieces, and after 4 years, it will be issued at an annual inflation rate of 2%, in order to ensure that UNI holders can continue to participate and contribute in Uniswap.

CAKE

Sushiswap basically copied the core design of Uniswap, but issued a governance token when it went online. When it was launched in August 2020, there was no limit to the circulation, which was revised to a maximum of 250 million after community voting. All releases will be completed through liquidity mining by November 2023, and block rewards will be reduced monthly before then.

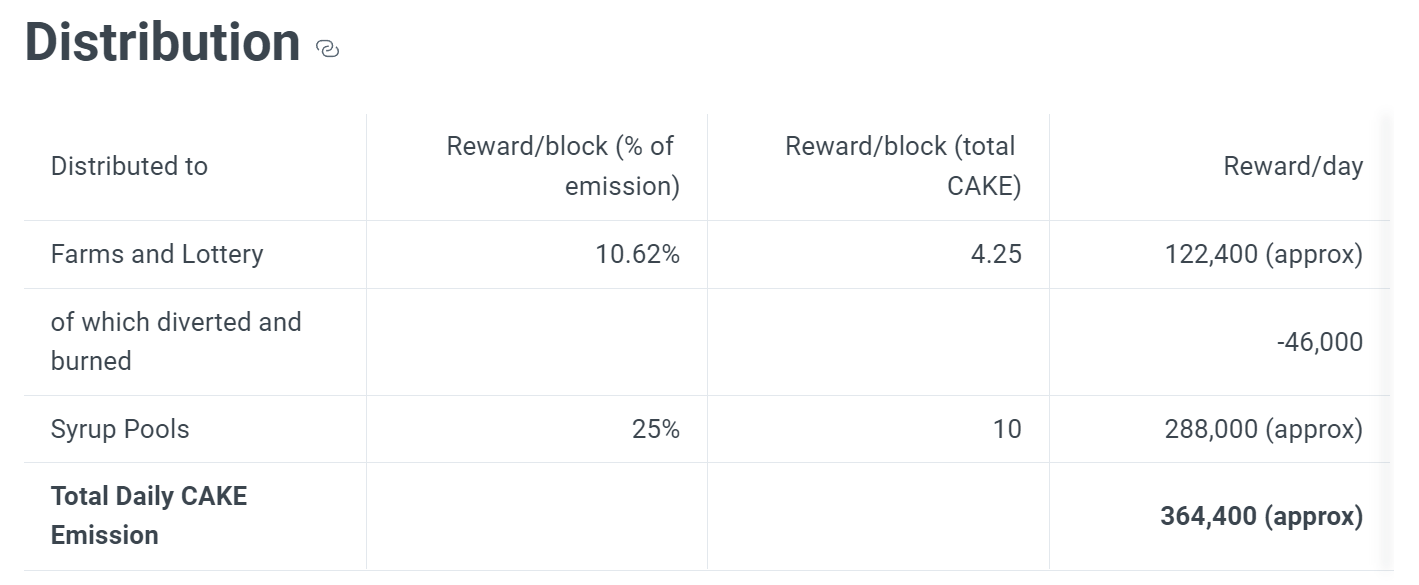

Pancakeswap is a DEX built on BSC. In order to keep LPs able to get incentives all the time, CAKE does not set a hard line, but it does not suffer selling pressure like UNI, mainly due to its deflationary mechanism.Footprint AnalyticsAt the source, the output is reduced by reducing the number of CAKEs minted in each block. After the issuance, a series of destruction mechanisms are also set up. For example, 20% of the CAKEs will be destroyed when buying lottery tickets. according to

BAL

According to the data, the current circulation of CAKE is 272 million pieces.

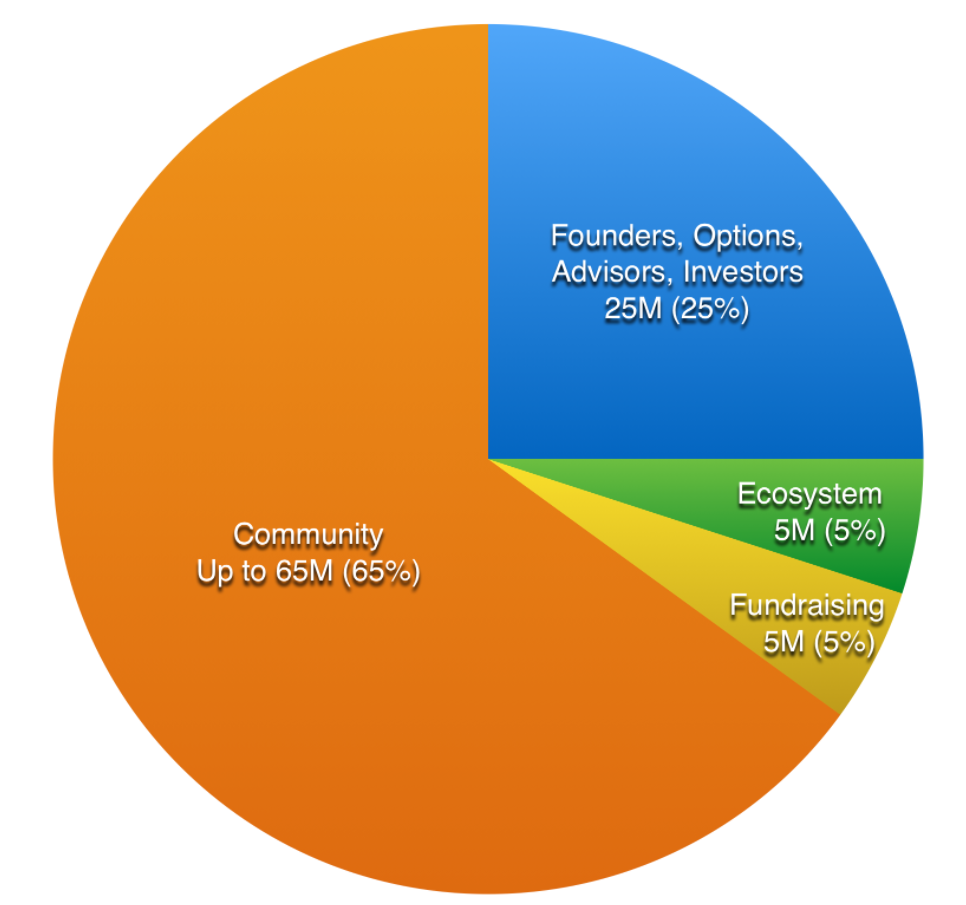

Balancer will be officially launched in March 2020, and liquidity mining will start in June. Its characteristic is that LP can customize the proportion of assets in the pool when providing liquidity, and supports market-making combinations of multiple assets.

The maximum supply of BAL is 100 million. 7.5 million BALs are distributed through liquidity mining every year, and it takes 8.67 years to complete the distribution at this rate. The release speed of BAL is much slower than other projects, which can reduce its selling pressure in the secondary market.

Distribution

UNI

The distribution method of tokens reflects the degree of decentralization of the project to a certain extent.

Among them, 600 million coins in the community have been airdropped 150 million coins to old users, and they have been released through 4 pools with 5 million liquidity mining rewards each. The remaining 430 million coins will also be released in 4 years by decreasing year by year.

UNI 4 Year Release Schedule

SUSHI

image description

CAKE

Since CAKE is an unlimited supply, its distribution is slightly different than a limited supply. 10.62% was allocated to Farms and Lottery and 25% to Syrup Pools.

CAKE Distribution

BAL

image description

By increasing the proportion of BAL held by the community, Balancer lowers the governance rights of the project and more actively achieves decentralization.

BAL Distribution

image description

Acquisition and Use Cases

Users who want to obtain these tokens can obtain them through contributions in exchanges or communities. In addition, besides UNI, it can also be obtained through liquidity mining. CAKE In the Lottery interface, you can also divide the CAKE in the prize pool by drawing lottery tickets with luck.Compound、MakerDAO、YearnAs governance tokens, holders of these tokens can participate in community proposals or votes to determine how the protocol works. There is also no shortage of external use cases, especially when UNI is

UNI

etc. can be used in both, followed by SUSHI. CAKE has a wide range of protocol use cases on BSC, and it can continue to mine other tokens by depositing in external protocols. In addition, the use cases of different tokens also have their own characteristics.

SUSHI

UNI does not have the ability to capture protocol fees. Although the capture ability can reduce the selling pressure, since the 4 liquidity mining pools of UNI have stopped mining in November 2020, the potential selling pressure that may exist has also been alleviated.

Compared with UNI, SUSHI has added token economic incentives, and users who pledge SUSHI (xSUSHI holders) will have long-term dividends for handling fees. 0.25% of the 0.3% commission paid by traders will be allocated directly to LPs, and the remaining 0.05% will be used as incentives for SUSHI stakers.

CAKE

The more transaction volume of the agreement, the more benefits the stakers get, and combine the long-term value of LP and the agreement. However, as more and more SUSHI are dug out, the ability of the same amount of SUSHI to capture income will gradually be diluted, which also forces LP to continue to provide more SUSHI.

BAL

In Pancakeswap, you can use CAKE to mine more other tokens or buy lottery tickets in one stop, and you can also participate in the new IFP on the chain.

Although BAL has fewer use cases on other mainstream protocols, Balancer announced in early February that it plans to refer to Curve's token mechanism to design veBAL for community governance and revenue capture.

Users can obtain BPT (Phantom Pool Tokens, a certificate for providing liquidity) after 80/20 BAL-ETH provides liquidity and lock it for 1 week to 1 year to obtain the corresponding veBAL. Similar to veCRV, veBAL can vote on the reward share of the pool, and will distribute 75% of the protocol revenue to veBAL holders.

image description

Footprint Analytics - DEX Token Economic Model

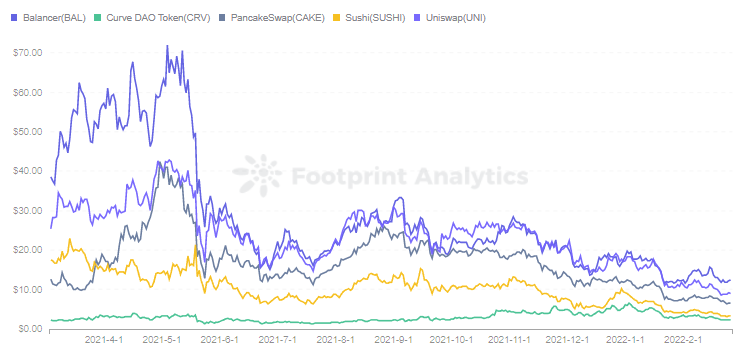

Footprint Analytics - Price of DEX Token

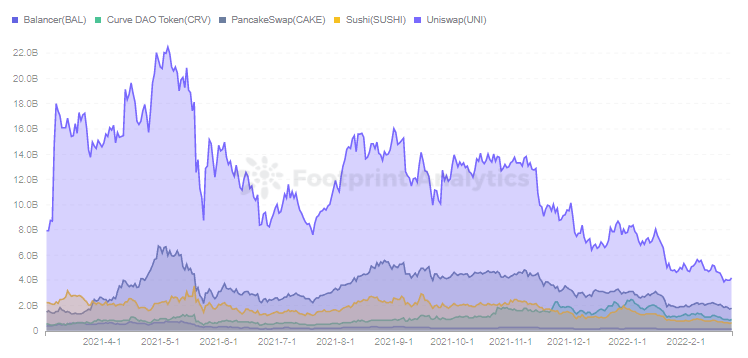

But in terms of market capitalization, the established DEX is still in the forefront. UNI ranks first with US$4.2 billion, and BAL ranks last (US$130 million) due to a circulation of only 10 million.

Footprint Analytics - Market Cap of DEX Token

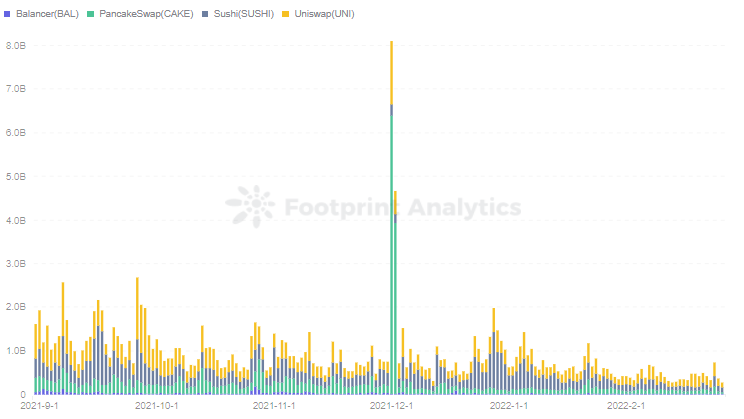

From the perspective of daily trading volume, the daily trading volume of UNI, SUSHI, and CAKE are all in the forefront, while BAL is relatively less active due to the small number of external use cases.

Footprint Analytics - Trading Volume of DEX Token

image description

The economic models of different tokens are clearly reflected in the data, such as the sell-off caused by the early issuance of SUSHI without a cap. Therefore, it is very necessary for users to have a detailed understanding before holding.

At the same time, it also caused us to think about whether a platform issuing tokens through liquidity mining is to quench the thirst of the agreement or to add to the cake.

Copyright Notice:

This article comes fromFootprint Analyticscommunity contribution

The above content is only a personal opinion, for reference and communication only, and does not constitute investment advice. If there are obvious understanding or data errors, feedback is welcome.

Copyright Notice:

This work is original by the author, please indicate the source for reprinting. Commercial reprinting needs to be authorized by the author, and those who reprint, extract or use other methods without authorization will be investigated for relevant legal responsibilities.