New NFT Narrative: The Inflection Point of Web3 Brand Economy

This article comes fromDecentraliseThis article comes from

, the original author: Joel, compiled by Odaily translator Katie Gu.

Editor’s note: In the world of web2, we have seen a new model of brand economy: from increasing the amount of advertising by feeding users with content they are addicted to, to selling products through the trust model recommended by KOL, but there are also many problems : The cost of customer acquisition is getting higher and higher, the data is not accurate, and core consumers cannot be effectively motivated, etc. This article describes the possibility of NFT changing the status quo. NFT will not only be a product for hype and speculation, but will become a tool for all brands in the future to establish a real community, effectively reach consumers through on-chain data, and increase the stickiness of core consumers. It is very interesting.

With the advent of the Internet, we moved from a transactional economy to an attention economy. The development of the attention economy, with its firm grip on the public psyche, has changed the cultural narrative on a massive scale.

NFT represents the financial productization of attention. As more and more brands release NFT, this may change the business model in the next decade, and the cost of brands may be infinitely reduced.

To predict where NFT will go in the future, we first need to know how the business got to where it is today.

secondary title

Preexistence of NFT

Early on, human economies were resource-intensive, and ownership was not valued. Over time, it became the norm for people to take ownership of the work they gave themselves. Think about how the company went from salary payment to dividends, and now employee option incentives.

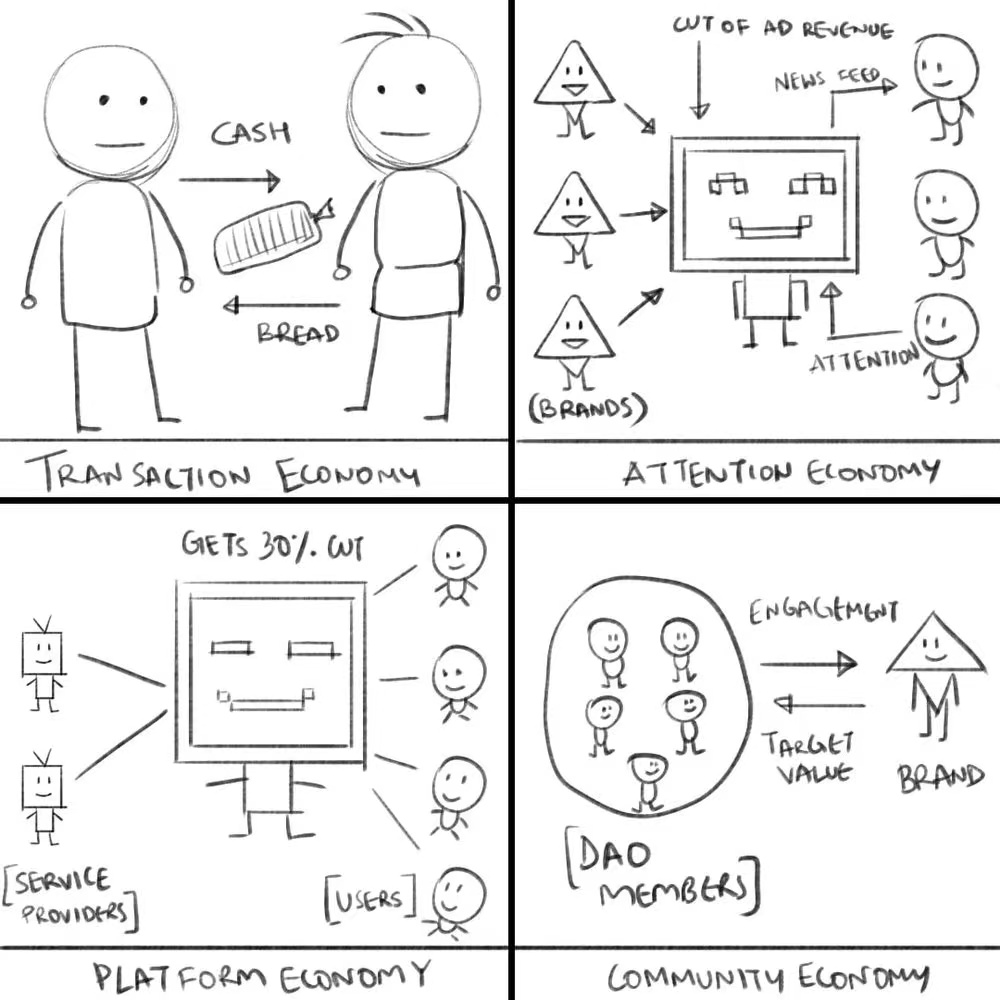

After analyzing resource expenditure and ownership, we conclude four stages of economic model evolution:transactional economy

: Money exchanged for goods or services. Most of human history has been based on a transactional economy. Think barter, the Silk Road or the eventual form of colonization. The transactional economy is the backbone of all of the above. Their focus was on local markets before technologies such as ships and trade routes, which continued until the advent of the printing press.attention economy

: The printing press drastically reduced the cost of reproducing information. But it wasn't until the 18th century that there was a market for books and that literacy rates rose substantially. Newspapers were the forerunners of today's platforms. The attention economy is when you sell "attention" rather than goods to third parties. Last year alone, YouTube earned $29 billion from advertising influence. They cost next to nothing to produce and have high customer stickiness. You can scale the attention economy to the size of a country like Facebook did, without worrying about the cost scaling up.platform economy

: The platform economy connects sellers and service providers with potential buyers. Amazon raked in nearly $489 billion in revenue as a result. Following the same pattern, Uber's revenue will grow from $100 million in 2013 to $13 billion in 2020. The value of the platform lies in discovering and trusting suppliers on the platform. Most of the mobile apps we use every day now have a platform. The cost lies in the management of the supplier and the trust of users with a large enough user base.community economy

: The community economy is the evolution of the cooperative. The Internet gave us access to global markets (2010), and smart contracts allowed us to trust each other without intermediaries (2020). We have been in the stage of exploring alternative economic models. This is what DAOs are about, they connect individual autonomy with economic opportunities that didn't exist before.

Are shareholder-driven companies a community economy? GameStop may barely fit this definition, but now let's go back to the NFT topic.

secondary title

The present of NFT

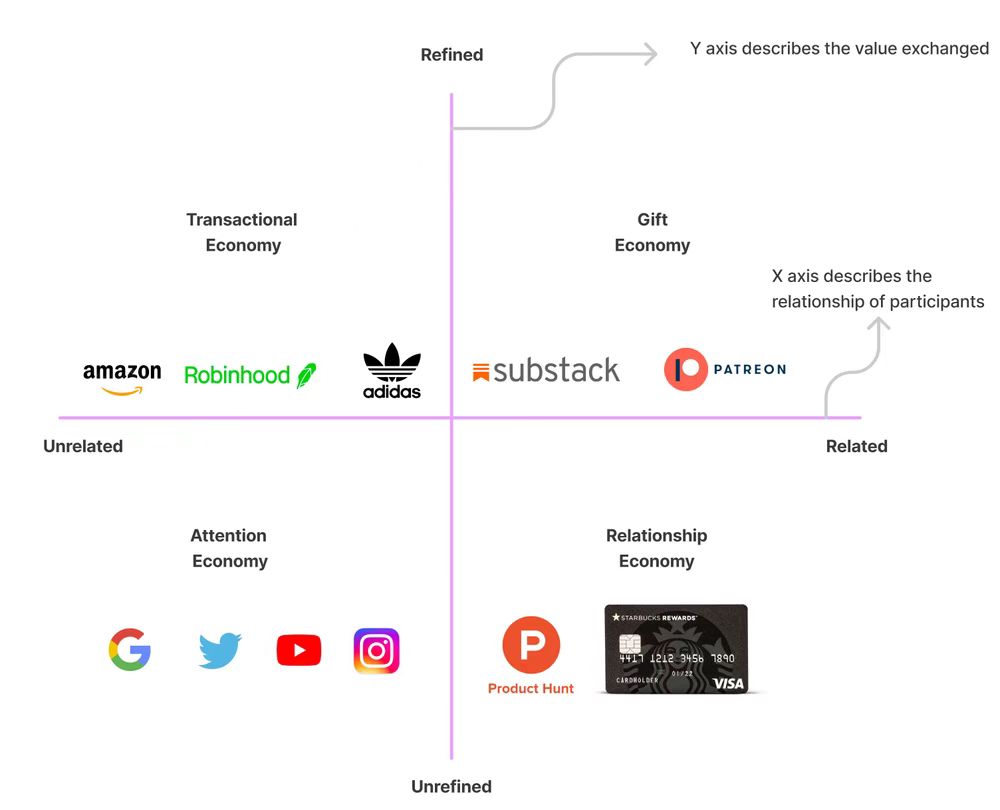

Let us use charts to analyze the differences in the quantification of brand value under different economic models. The x-axis represents relationships, which are relationships between parties in a transaction. The closer the relationship, the harder it is to strike highly quantified and fully negotiated deals. On the y-axis, we break down economic interactions. It refers to the extent to which a seller can determine value before a transaction, and how quickly a customer accepts a transaction. Think of Amazon's delivery service, you know what you're buying and when it's going to arrive at your door.

Buyers usually know the value and price of a Rolls-Royce or Gucci product, and they rarely need to double-check because brand trust is already established and the value proposition is clear. Trust in attention economy platforms tends to be low. We rarely buy branded products directly from those platforms. Attention economy platforms are already optimized for KOLs because they strike the right balance between personal content and commerce.

People with sufficient influence (and trust) sell products directly in the form of subscriptions. Representative examples include Substack (note: a self-media platform similar to the US version of the official account, but the news is received in the form of paid subscription emails) and Patreon (note : a platform for content creators and artists to crowdfund their work and products). The problem is that the content of these KOLs can be biased, which is why community is important in modern business.

Like Product Hunt (Note: A platform for discovering new products, developers can submit their own works, and the website will generate a daily list based on public votes, where you can learn about novel services, interesting applications, interesting hardware, etc.) Such communities transform the relationships among participants, from strangers who meet by chance on the Internet to collaborators driven by a shared vision.And for token and NFT-based communities, price is often the glue that brings people together, and the community reduces friction in transactions.

As information asymmetries are minimized, the final price usually appears in an open auction. The Web3 project community has taken this to an extreme. Most teams simply run a governance committee rather than outsource it. Individuals who are interested in tasks can complete and submit them through community governance rules and get paid in tokens.Owning tokens also makes contributors belong to the network both spiritually and financially, increasing user stickiness.

secondary title

The future of NFTsNFT takes this model to the extreme. Since the average cost of NFT is higher than that of homogeneous tokens, ordinary retail participants do not have enough idle funds to buy multiple NFTs, so they can only all in or all out.

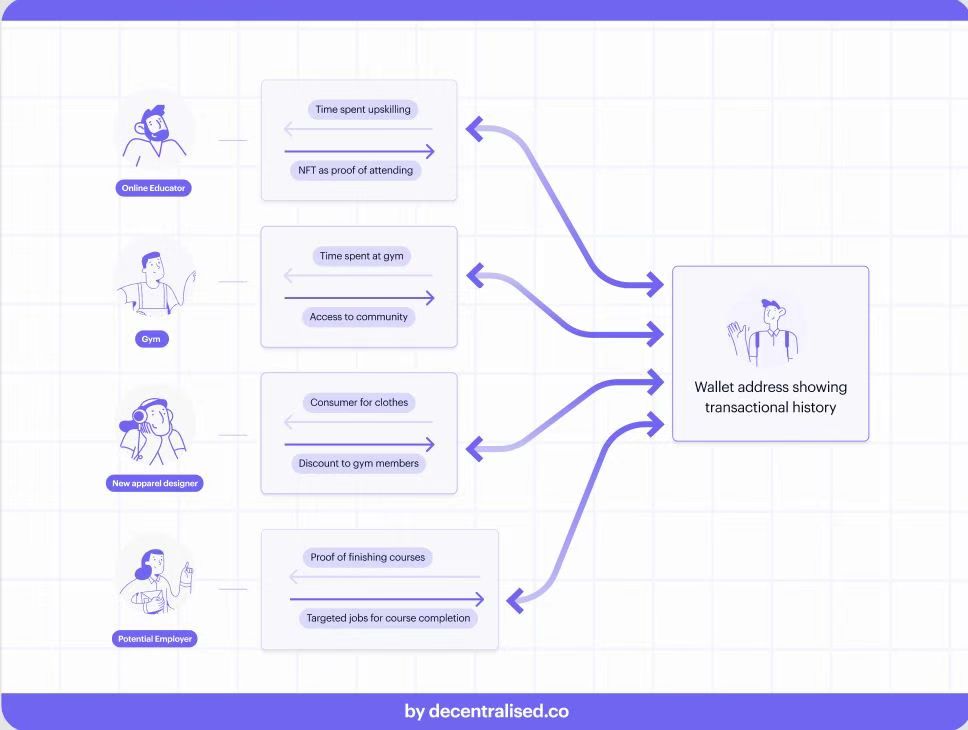

Looking ahead, major brands may use NFT as a way to stimulate high-end consumer groups.We can think of NFT as an on-chain certification of participation. Because NFT can unlock new customer privileges. Historically, brands have owned all the data related to users, while independent third-party developers have not been able to directly incentivize those users, which is possible with NFTs.

image description

Multiple business entities can offer unique discounts based on wallet historyOf course, NFT is not just used to unlock customer privileges, and current membership cards can do the same.

What NFT can achieve in the future is to reach the permissionless community goal in a value-added way.

Charlie Munger famously said, "Show me the motivation, and I'll show you the result."

Web2 platforms will keep us hooked on what's on the screen because their motivation is based on selling ads. The more time you spend staring at an interesting video, the more likely the platform is to show you an ad, which is why they're built around variable rewards.Brands can use on-chain data to target users, offering them perks and access to communities they might benefit from, rather than slowly pushing users to buy things they may not need. Of course, there are privacy concerns here as well. For example, can a person who attends a specific geographic location in real life be tracked on-chain? This is why solutions like zero-knowledge proofs are becoming increasingly important.

secondary title

Growth driven by NFTs

You might think it's crazy for me to suggest that we're going to move from running our economy on advertising to one driven by user data. But several factors may have contributed to the shift. Hardware or operating system changes since the release of iOS 14 can reduce ads. In fact, several platforms have experimented with NFTs.

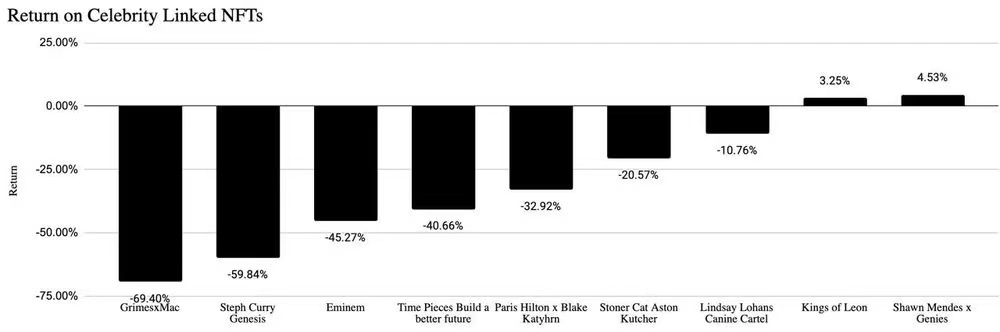

Time Magazine publishes a collection of over 4,600 NFT collectibles that give holders access to the magazine. Famous WWE star John Cena released 500 NFTs to his 16.2 million Instagram followers, and only about 37 people bought them. Melania Trump tried to issue NFTs, but she bought them back herself. Ubisoft, one of my favorite games, tested an NFT release with sales of just $400. The vast majority of NFTs related to celebrities have shown a downward trend since their release.

I think NFT-based community building requires a lot of thinking about user positioning.

When LooksRare launched, there were 22,000 holding addresses. About 18,000 wallets currently hold these tokens. About 80% of them have held LOOKS for more than a month. This is the case because LooksRare is targeting users who are actively transacting on the NFT platform.

Another example is LobsterDAO, whose DAO was launched thanks to "offering NFTs in proportion to user activity in community chats." The community has released around 7 DeFi primitives, using NFTs for verifying users’ identities and rewarding tokens in exchange for performing certain actions like staking or increasing liquidity. For the team, the gifted tokens are the cost of acquiring users who have participated in DeFi-related discussions.Startups should see that NFTs provide social capital to their key users. A recent update to Twitter Blue allows users to verify if they own an NFT. As user preferences evolve, newspaper advertising models may face the same fate. Twitter allows users to display NFTs they hold as profile pictures,

Startups will soon be able to airdrop NFTs with predefined perks, such as premium users, contributors, and product ambassadors, effectively generating interest and curiosity from third-party users. Another way is education. As learning models evolve from universities to digital media, we will see certifications based on on-chain optional learning become more prevalent. If a platform is digital, users can be accessed simply by checking their assets on-chain. Bankless is another launch platform that runs as a DAO using on-chain assets.

secondary title

Come for NFT, stay for the community

Remember when I defined NFTs as an economic representation of your attention at the beginning of this article? I think this is the most overlooked aspect of the ecosystem today. Most NFTs represent some kind of subculture or meme color, which gives people a sense of belonging, such as mfers. This is what happens when brand = identity.

Deep down, we're all looking for the same thing, a tribe we belong to, an identity.Sometimes users go to great lengths to establish their dominance (social status) in the "tribe", sometimes it costs a lot of money.