Bloomberg's "March Crypto Outlook": Bitcoin, Bonds and Crude Oil

This article comes fromBloomberg IntelligenceOdaily Translator |

Odaily Translator |

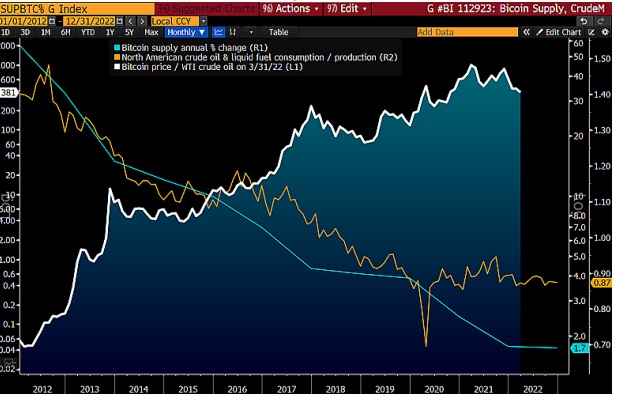

Crude oil prices broke through the $100 per barrel mark again after a lapse of 14 years, which seems to be a bullish benefit for Bitcoin in the later stage. As for the crude oil market, I am afraid that it will repeat the trend of first rising and then falling in 2008, and it will face the fate of collapse and recession.

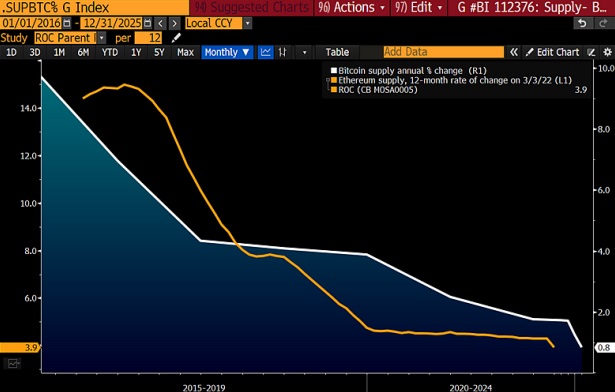

The last global financial crisis prompted the creation of Bitcoin and North America's transformation from a net importer to a top energy exporter. And this Ukraine conflict may mark the end of the old world's dependence on oil, and the new world will embrace new technologies, especially encrypted assets. At the same time, soaring commodity prices are fueling a global recession. Not only that, but with the proliferation of cryptocurrencies, the supply of Bitcoin and Ethereum is inelastic and not widely adopted.

secondary title

Bitcoin, Bonds, and Crude OilAs expected, Bitcoin could benefit from the bond-versus-oil standoff.

The Ukrainian conflict could mark another step closer to bitcoin’s goal as a global digital collateral. And soaring energy prices have made people realize the benefits of embracing technology, and the benefits of North America becoming a net oil exporter. Combining supply, demand, adoption, and human wisdom, Bitcoin will regain the upper hand in the PK with oil in 2022.

The battle between Bitcoin and crude oil and bonds, despite the sharp surge in crude oil prices, long-term U.S. Treasury bond yields have failed to reach last year's highs, which means that further deflation may pull Bitcoin higher. WTI has risen about 80% this year through March, while long-dated bond yields have held around 2.2%, which we think portends further declines in yields. And this time the Ukraine conflict has also raised the issue of safe investment transfers, and it has also triggered a contest between bonds and bitcoin.

Soaring energy prices are a classic sign leading up to a recession, along with falling long-term bond yields. If the stock market continues to fall, Bitcoin will also face considerable resistance, but the direction of the cryptocurrency is still stronger, and it will outperform most stock indexes in 2022.

Above: Bitcoin benefits from rising crude oil and bond prices.The surge in crude oil prices, the recession and the performance of Bitcoin.

Crude oil is likely to lose both in 2022, and this is a good opportunity for Bitcoin. About 14 years ago, the price of a barrel of crude oil topped $100 a barrel for the first time, and the implications were very similar to today.

The data shows that the current S&P 500 is very similar to the decline pattern of the financial crisis in early 2008. The conflict in Ukraine, combined with soaring crude oil prices, has dealt a blow to the global economy. If the 2008 financial crisis were to play out again, Bitcoin would be under pressure for the first time. When the S&P 500 falls rapidly, the correlation of most risk assets is completely corresponding, but the cryptocurrency is not the same, and it is more resilient than all other assets.

Bitcoin is very strong in 2022. As of March 2, the S&P 500 was down 10%, and while bitcoin's volatility in 260 days was roughly five times that of the stock index, its decline was less than half that.Bitcoin Value vs Crude Oil Liabilities and Ukraine Conflict.

One very important point of uncertainty about the future of Bitcoin is its "adoption". We see benchmark cryptocurrencies becoming digital collateral around the world. In addition, people's use of crude oil and liquid fuels is decreasing, and the cost is also decreasing, the output is increasing, and it is very likely to be replaced by new technologies and new energy sources. The chart shows the downward trend of Bitcoin supply and the oversupply of crude oil and liquid fuel production in North America, which is expected to reach 13% by 2023. The U.S. has gone from being a net importer to an exporter of increasing volumes—the number one killer of commodity prices.

For most commodities, rising prices dampen demand while also driving up supply, but Bitcoin does just the opposite. In the cryptocurrency market, despite increasing competition, there are still more than 17,000 cryptocurrencies that have been born, but Bitcoin, Ethereum, and crypto dollars (stablecoins) are still durable.

secondary title

40,Will the Ukrainian Conflict Be an Inflection Point for Bitcoin?Bitcoin at $1,000, Nasdaq at 14,000, Can Bitcoin Known as "Digital Gold" Continue to Rise?

After a sharp rise in 2021, Bitcoin is now experiencing "deflationary pressure", but it still has a good ability to withstand pressure. Bitcoin may be heading towards the global digital collateral, with the Ukrainian conflict breaking out, Bitcoin price reached $ 40,000, while Nasdaq hit 14,000 points.Compared with Nasdaq, Bitcoin has shown different strengths.

On March 2, 2022, the Nasdaq 100 Index fell by about 13%. If the market continues to fall, it may affect other risky assets (especially cryptocurrencies). fell 5%. Judging from historical data, the stock market usually does not perform better than cryptocurrencies. According to Bloomberg Intelligence analysis, Bitcoin may stabilize in the $40,000 range, while the Nasdaq 100 may fall further.

Above: Bitcoin rebounds quickly after entering the $30,000 range, but what about the stock market?

If the securities market recovers, it will help Bitcoin rebound more quickly. Importantly, Bitcoin "holds the floor" at key support levels while stocks continue to sink.Bitcoin Relative Volatility Is Falling, Still Outperforming Traditional Securities Markets

. In 2022, the correlation between Bitcoin and the traditional securities market is actually not high, and its performance is also better than the traditional securities market. Bitcoin's performance has been briefly downturned, and it has also lagged behind the securities market, but it is worth noting that Bitcoin volatility has begun to decline. Bloomberg Intelligence found two key trends for Bitcoin: one is outperforming the Nasdaq 100, and the other is a decline in relative volatility. The data shows that the relative volatility of Bitcoin is currently roughly three times the 260-day volatility of the Nasdaq 100 Index, compared to nine times when Bitcoin futures were launched in December 2017.

Above: Bitcoin and the performance of the U.S. stock market

As Bitcoin gradually became mainstream, some large asset managers began to consider allocating part of their funds to Bitcoin. Bloomberg Intelligence predicts that in 2022, this trend may face a test. If the traditional securities market enters an elusive bear market, Bitcoin seems poised to gain the upper hand.All assets will be subject to inflation.

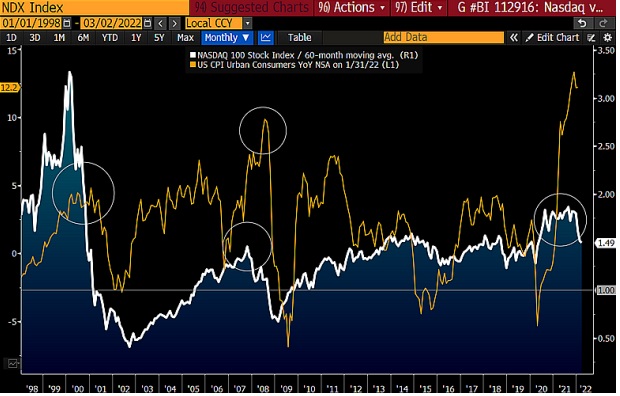

In 2022, most assets will lose value as U.S. inflation is at its highest level in nearly 40 years. However, in this case, it may push the price of Bitcoin to achieve new milestones. According to Bloomberg Intelligence data, the producer price index in the US market has exceeded the level of 2008, the Nasdaq 100 index is similar to the performance of the 60-month moving average, and the risk of mean reversion has increased. If risk assets don't fall and relieve some of the pressure on prices, the Fed may have no choice but to raise rates more aggressively.

The Nasdaq 100 has never traded below its 5-year moving average since the market recovered from the financial crisis in 2009, but now the market appears to be on the brink of collapse.

secondary title

The Dollar Wins the Crypto WarThe Ukrainian conflict has paved the way for the popularization and promotion of cryptocurrencies, especially the market position of Ethereum will be further consolidated.

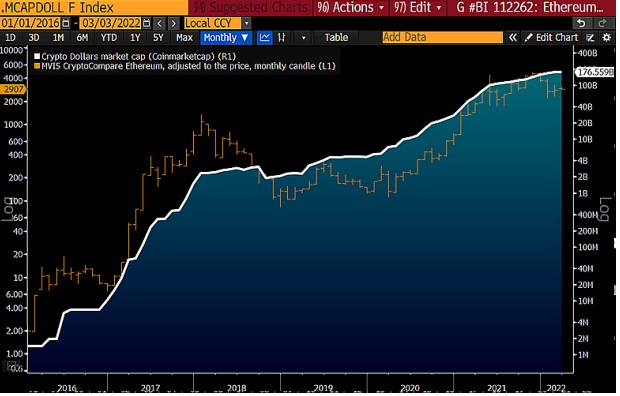

During the conflict in Ukraine, the value of Bitcoin and Ethereum, the leading digital currencies, and the value of the encrypted dollar (stable currency) will be further enhanced. As the digital currencies ranked first and second by market capitalization, although Bitcoin and Ethereum seem to perform better than traditional securities markets and have shown different strengths, as energy prices continue to soar, Bitcoin and Ethereum may face Greater recession risk, eventual dollar dominance could be further boosted through cryptocurrencies amid Ukraine conflict.Crypto dollar (stable currency) and Ethereum will usher in a new wave of big bull market?

Not only is the U.S. dollar proving its enduring value during the Ukraine conflict, it’s actually winning big in cryptocurrencies as well. A number of stablecoins have emerged on the Ethereum blockchain, and these dollar-based stablecoins have further bolstered the price of Ethereum, while a growing number of other cryptocurrencies are also being traded in dollars. On March 2, the market value of the top six cryptocurrencies on Coinmarketcap reached $176 billion, an increase of about 5 times from the beginning of 2021. Bloomberg Intelligence believes that it is almost impossible to prevent the market value of the top cryptocurrencies from reaching trillions of dollars.

Above: Focus on Ethereum and Crypto Dollar (stablecoin) trends

From the graph above we can see that there is a strong correlation between the price of Ethereum and the overall performance of the cryptocurrency market. If the Ukrainian conflict develops, it could further accentuate the value of decentralized, fixed-issue digital assets. If the Ukrainian conflict is resolved soon, most risk assets should also gain in value, and Ethereum can continue to rise as well.

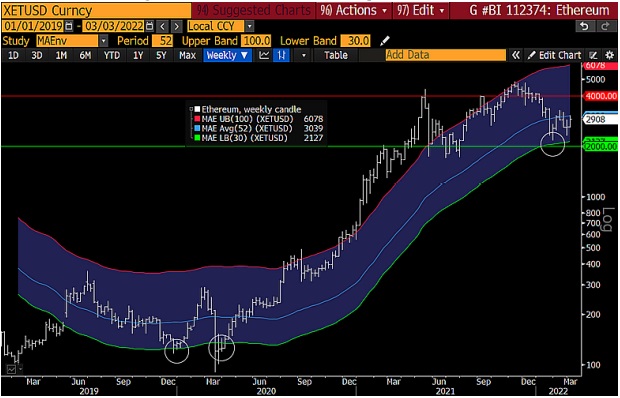

Compared with Nasdaq, Ethereum still has the upper hand. In the context of the current conflict in Ukraine, Ethereum's superior performance relative to the Nasdaq 100 index may be further expanded. Before the Ukraine conflict, ethereum, the cornerstone of decentralized finance (DeFi) and NFTs, rose for two main reasons: one was more stable market performance, and the other was declining risk relative to stock indices. Ethereum’s 260-day volatility peaked in 2018, when it was about 11 times the volatility of the Nasdaq 100 Index, but since then, this risk measure for Ethereum has been declining, and Ethereum’s 260-day volatility is currently The volatility is less than three times the volatility of the Nasdaq 100 Index. Of course, the increase in volatility in the Nasdaq 100 is largely due to geopolitical conflicts that increase recession risk and stock market volatility.

Above: Compared to Nasdaq, Ethereum volatility is actually declining

In fact, we will find that the market performance so far in 2022 is very similar to the first quarter of 2008, when crude oil prices first broke through $100 a barrel, but then entered a downturn period of financial crisis and sharp reversal of risk assets.The main risk of Ethereum? low tide.

The demand for Ethereum has started to rise, and the dynamic demand for Bitcoin has declined, so it can be inferred that there will be an upward trend in subsequent prices. Generally speaking, there is no big problem with bullish fundamentals, but it should be noted that the current may still be in a period of mid-market adjustment in a continuous bull market, that is to say, the market may still go lower. If the stock market continues to fall, the ether Fang is still likely to return to the low level.

Above: Ethereum could still revisit the $2,000 range if stocks fall

If the stock market falls rapidly, Ethereum may even repeat the mistakes of the summer of 2021 and return to around $1,700. However, if traditional securities markets do well, Ethereum could reach the $4,800 range by November 2022.Declining supply vs. increasing adoption.

Bitcoin and Ethereum are still in the early adoption stages, and increasing demand while decreasing supply can have some impact on price action. Unless there is a sharp reversal in the market, it will be difficult to defend against the proliferation of emerging technologies, nor will it stop prices from rising.

By 2024, only 900 bitcoins should be mined per day, after which the daily mining capacity will be halved. According to an analysis by Bloomberg Intelligence, Bitcoin production is expected to drop to 1% of total production by 2025.

There is also a downward trend in the supply of Ethereum, which is due to the implementation of EIP-1559 in 2021, so Ethereum is burning ETH every day. In fact, Ethereum has become the basis for revolutionary technologies such as NFT and DeFi protocols, while Bitcoin is becoming the "benchmark digital currency" for digital collateral around the world.

secondary title

Talent and Stablecoins Power DeFi

DeFi growth thanks to stablecoins and developers, this section is provided by Jamie Douglas Coutts, Bloomberg Intelligence Contributing Analyst.

In the field of DeFi, "Intellectual-Capital" (similar to "Smart Money") can not be affected by price fluctuations, and they will continue to solve complex problems that have not been solved in the traditional financial industry. As a volatility buffer and income tool, stablecoins are attracting more and more users who are just entering the cryptocurrency and digital asset market.A bear market is unlikely to deter "Intellectual-Capital" entry.

Despite the decline in prices of many leading DeFi protocol tokens, the influx of “Intellectual-Capital” into the DeFi market is unlikely to stop. In 2021, the number of developers working on DeFi will increase by 76%, which is equivalent to an increase of 500 new developers working on DeFi projects every month. While a continuation of the bear market may cause this growth trend to slow, it is unlikely that the trend of increasing developer numbers will reverse. During the last sustained bear market in 2018-19, the number of developers working on DeFi did not decrease. Unlike the previous bear market cycle, however, DeFi market risk has improved, with algorithmic stablecoins and on-chain derivatives now largely in production and with billions of dollars locked up.

Above: DeFi development growth and price trends basically coincideCrypto dollars (stablecoins) are playing the role of "DeFi gold".

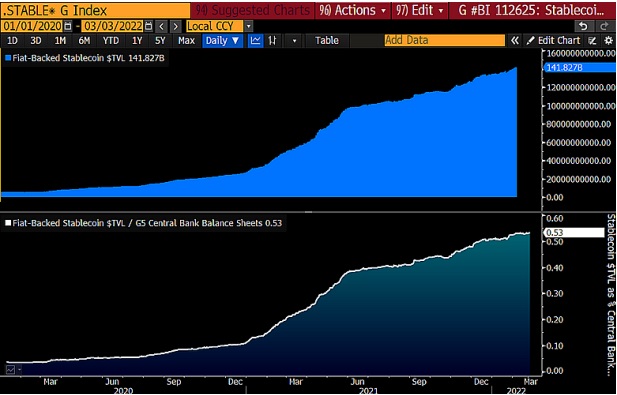

Over time, many people who did not believe in DeFi in the past found that more and more fiat currencies were "ruthlessly" converted into stable coins. The data shows that the total number of stablecoins backed by fiat currencies in circulation has reached $141 billion, a fourfold increase from 2021. The main driver of this growth is people looking for higher yield returns in DeFi and risk hedging in a bear market.

Above: Stablecoins backed by fiat currencies as a percentage of central bank balance sheets

The monetary quantitative easing policy led by the Federal Reserve has reached an unprecedented level, which has led to the increasingly important role of stablecoins in the global liquidity system. At this stage, the size of stablecoins backed by fiat currencies accounts for 0.53% of the balance sheet of the central bank. If the growth of the stablecoin market in 2022 is similar to that in 2021, it is expected that by 2023, the scale of stablecoins backed by fiat currencies will It accounts for 2.3% of the central bank's balance sheet.

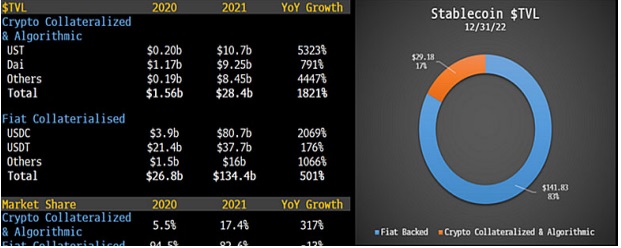

Stablecoin alternatives are reducing regulatory risk. Decentralized stablecoins are still in their infancy, but the rise of such stablecoin alternatives could reduce regulatory risk. Issuers of stablecoins backed by fiat currencies need to be regulated and should be gradually integrated into the scope of banking supervision, but doing so may affect the permission-free and open nature of DeFi.

Algorithmic stablecoins, such as the UST issued by the Terra protocol, will develop rapidly in 2021, with a market value soaring to US$10.7 billion, an increase of 5,323%; there is also a stablecoin DAI based on an encrypted mortgage model, which has increased by 791%. The positions accounted for 17% of the entire stablecoin market. Among all fiat-backed stablecoins, USD stablecoins are the fastest-growing, although Tether’s stablecoin market share has begun to decline.

secondary title

Risks and Benefits of Crypto Tax Uncertainty

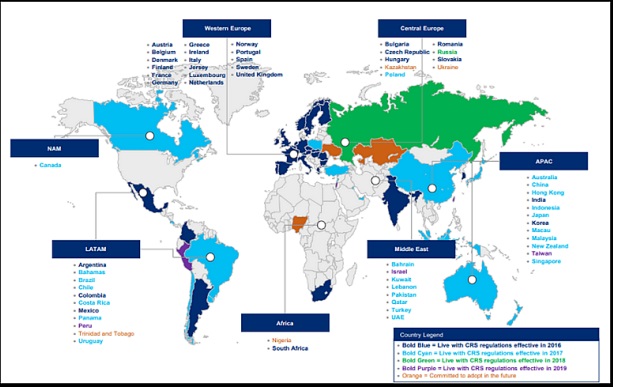

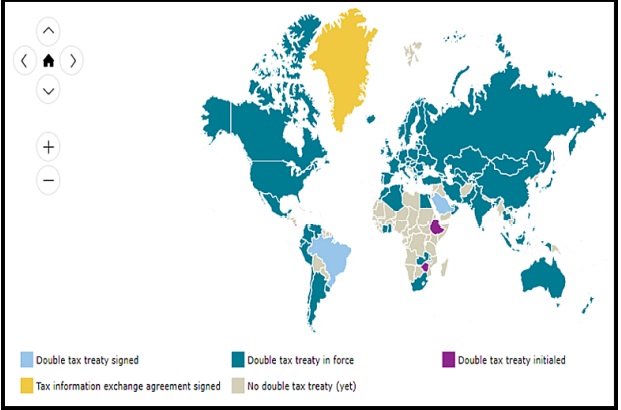

Many countries around the world are likely to begin taxing cryptocurrencies, with mixed results for multinational corporations, according to Bloomberg Intelligence Contributing Analyst Andrew Silverman.

For multinational companies like Tesla and Wynn Resorts, with different tax policies on cryptocurrencies in various countries, they may face financial risks. Take Wynn Resorts as an example, they will use digital renminbi, but the United States does not seem to recognize this digital form of central bank currency. In addition, under the new global tax compliance policy, Tesla may be double taxed.Digital yuan could pose risks for U.S. companies

. Companies such as Wynn Resorts, Las Vegas Sands, Qualcomm (Qualcomm), Texas Instruments (Texas Instruments) have large businesses in the Chinese market, and they may face tax issues. From the perspective of the United States, Chinese customers who use digital yuan instead of traditional yuan transactions do not fall under the category of "cash payment". In addition, the digital yuan allows for demurrage after the trigger date, so it may cause other problems such as currency devaluation, which means that companies may need to track every digital yuan they own to ensure that their assets do not disappear.

Since the U.S. does not consider the digital yuan a currency, normal foreign exchange tax rules will not apply and U.S. companies may have to account separately. Therefore, the United States may regard the digital renminbi as a property, just like Bitcoin.Multinational companies may face more compliance, and double taxation issues.

Companies such as Tesla, Square, and Coinbase hold large amounts of cryptocurrencies on their balance sheets, and they may face tax compliance regulations in different countries and lead to double taxation. In fact, it is difficult for G20 countries to agree on the taxation of cryptocurrencies, but one potential solution is to include cryptocurrencies in common reporting standards. If regulators have access to information about businesses with crypto ownership, then it will be taxed.

On the other hand, even if cryptocurrencies are not taxed, companies usually need to fulfill their tax declaration obligations, even in some countries/regions that do not tax cryptocurrencies, and failure to declare may result in penalties.Certain countries may allow crypto tax avoidance.

Since cryptocurrencies are new, many countries need to understand them in depth, which means that certain tax rules may not apply to cryptocurrencies for a certain period of time, especially in some countries where taxation of income categories has not been discussed / region, which may become a safe haven for cryptocurrency tax avoidance. However, there are also anti-avoidance rules in most countries, but it is not yet known whether cryptocurrencies are included in them. If cryptocurrencies are to be included, it may need to be renegotiated to prevent companies from avoiding taxes through cryptocurrencies.