Looking at OpenSea through eBay: How does the rise of the vertical NFT market split Opensea?

Original author:Tasha Kim

Compilation of the original text: The Way of DeFi

Original author:

Compilation of the original text: The Way of DeFi

For those of us who live in the ranks of Extremely Online, it's impossible to ignore the rise of NFTs over the past year. Celebrities including Snoop Dogg, Gwyneth Paltrow and Serena Williams have used NFTs, replacing their Twitter profile photos with cartoon images. It’s hard to imagine a brand that hasn’t sold a collection of NFTs (to name a few: Coca-Cola, McDonald’s, Dolce & Gabana, Burger King, Taco Bell, and even Charmin).

Additionally, NFTs have become their own cultural movement: for certain demographics, being associated with a particular crypto artist, owning a boring ape (or a fractional share), or even just a nimble Metamask transaction fills the psychology of belonging need. With the rise of NFTs, it has become increasingly clear that they represent not only a fleeting trend, but an entirely new form of consumer product.

The numbers speak for themselves. In 2021, NFT sales will reach $25 billion, a massive increase of 26,000% + Y/Y from "just" $95 million in 2020. Generic NFT marketplace Opensea has averaged GMV of $2.9B since July, up from just $8M GMV in January 2021 (44,000%+ Y/Y growth). In fact, Opensea is responsible for a whopping 98% of all NFT transactions.

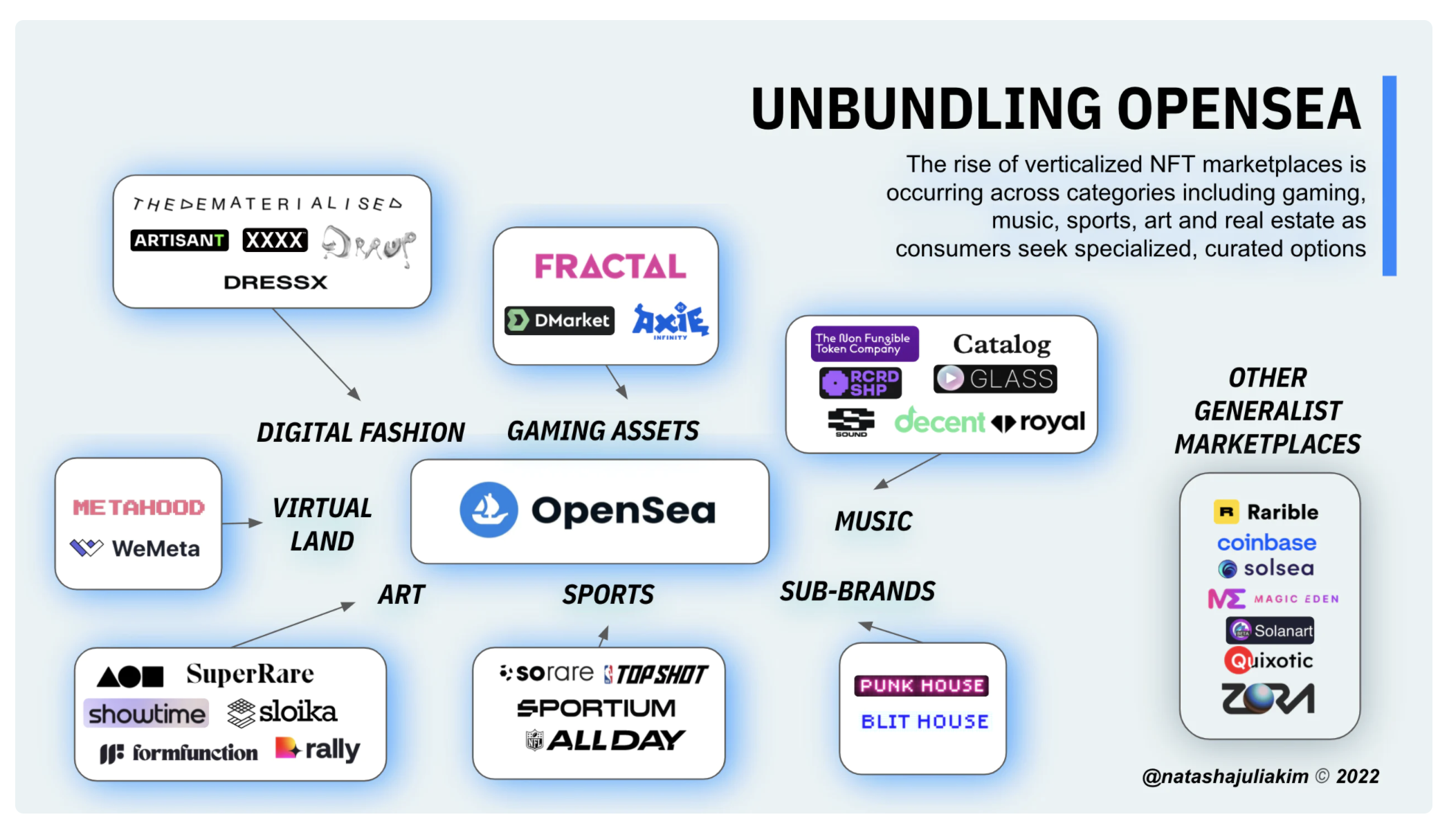

However, as the NFT market ecosystem heats up, with an increasingly diverse customer base and use cases, it will be challenging for a market to maintain such a large market share. This is not a new phenomenon: something very similar happened to the web2 generalist market (most notably eBay), as a new generation of professional players began to take their place as dominant. We're starting to see a very similar trajectory emerge in web3.

Now talk about the split of Opensea.

To understand how Opensea unraveled, it's helpful to look at how its web2 counterpart eBay took a similar path in the 2010s. In the early 2000s, eBay became a force. Since its inception in 1995, the P2P market has grown rapidly, and by 2001 had the largest user base of any e-commerce site. By 2013, its GMV had reached $83 billion, and eBay had cemented its reputation as the online store for everything: a place to find limited-edition collectibles, clothing, electronics, real estate, books, and more. In addition to the sheer volume of transactions, the practice of listing items on eBay has become a cultural touchpoint and even the subject of a strange song by Al Yankovic.

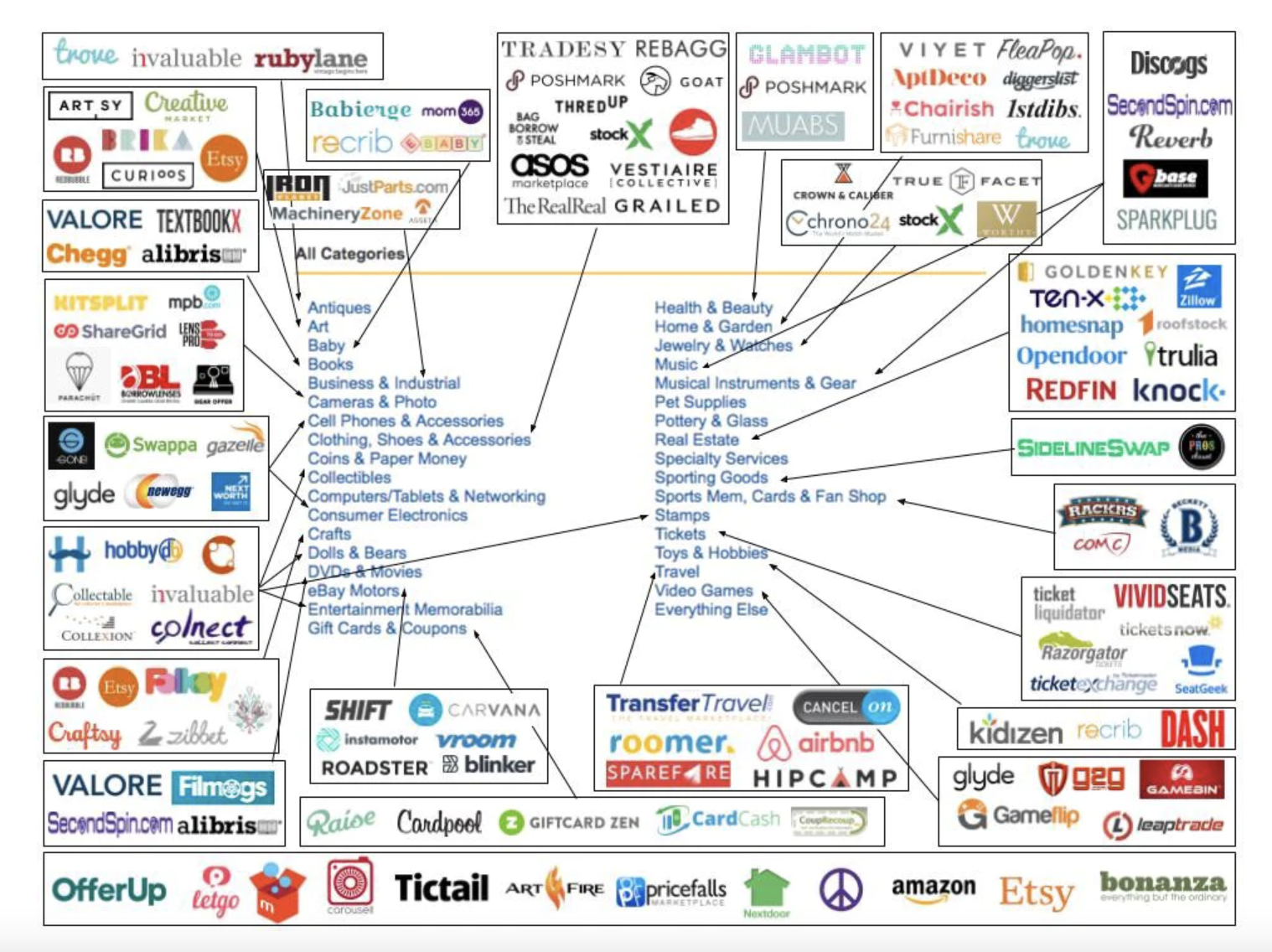

However, the company's growth began to stagnate, with GMV essentially flat from 2013 to 2016. Turmoil in executive leadership and the messy breakup of subsidiary Paypal are at least partly to blame. But another key shift occurred during the same period: a growing number of vertical markets displacing the subsectors eBay once dominated. Once migrating to one platform for all their needs, consumers are increasingly spreading deals across specialty market verticals including lodging (AirBnb, VRBO, Hipcamp), fashion (Net-a-Porter, The Real Real , StockX) and home goods (Chairish, 1st Dibs).

image description

A full look at eBay's unbundling, courtesy of Justine and Olivia Moore

Justine and Olivia Moore spotted this trend in 2018 with an incredibly detailed visual of the company looking to break up eBay at the time. It’s worth noting that among these verticals, Etsy, 1stdibs, Airbnb, Chegg, and Zillow are worth a combined $130B+ today, several times higher than Ebay’s current valuation of $32B. What can be seen from this? Splits are valuable.

Convert to NFT

Just as eBay was the dominant generalist market in the early 2000s, Opensea is starting to claim the same title for digital assets (aka NFTs) in the 2020s. Opensea is both a traditional incumbent (founded in 2017) and a whale in the market (responsible for 98% of all NFT transactions prior to LooksRare).

What are the differentiating factors between the web3 markets? NFT platforms must master many of the same metrics as top web2 marketplaces, including offering competitive transaction rates, strong merchandise management, authenticity, brand/community reputation, and a balance of supply and demand between buyers and sellers. Arguably, many NFT marketplaces have so far failed to meet all of these web2 standards, instead being driven by overwhelming consumer interest in NFTs. As the space becomes more competitive, platforms will be forced to improve their product offerings and experiences.

looking to the future

Furthermore, verticalized NFT marketplaces are only likely to succeed if they can offer something that generalists cannot; this could be exclusive listings, projects too small or too new to be recognized by others, or even white label NFTs created by themselves. Choosing the most appropriate L1 and L2 blockchains to build on may also play a role, at least initially, with an eye toward future products that can support multiple chains.

looking to the future

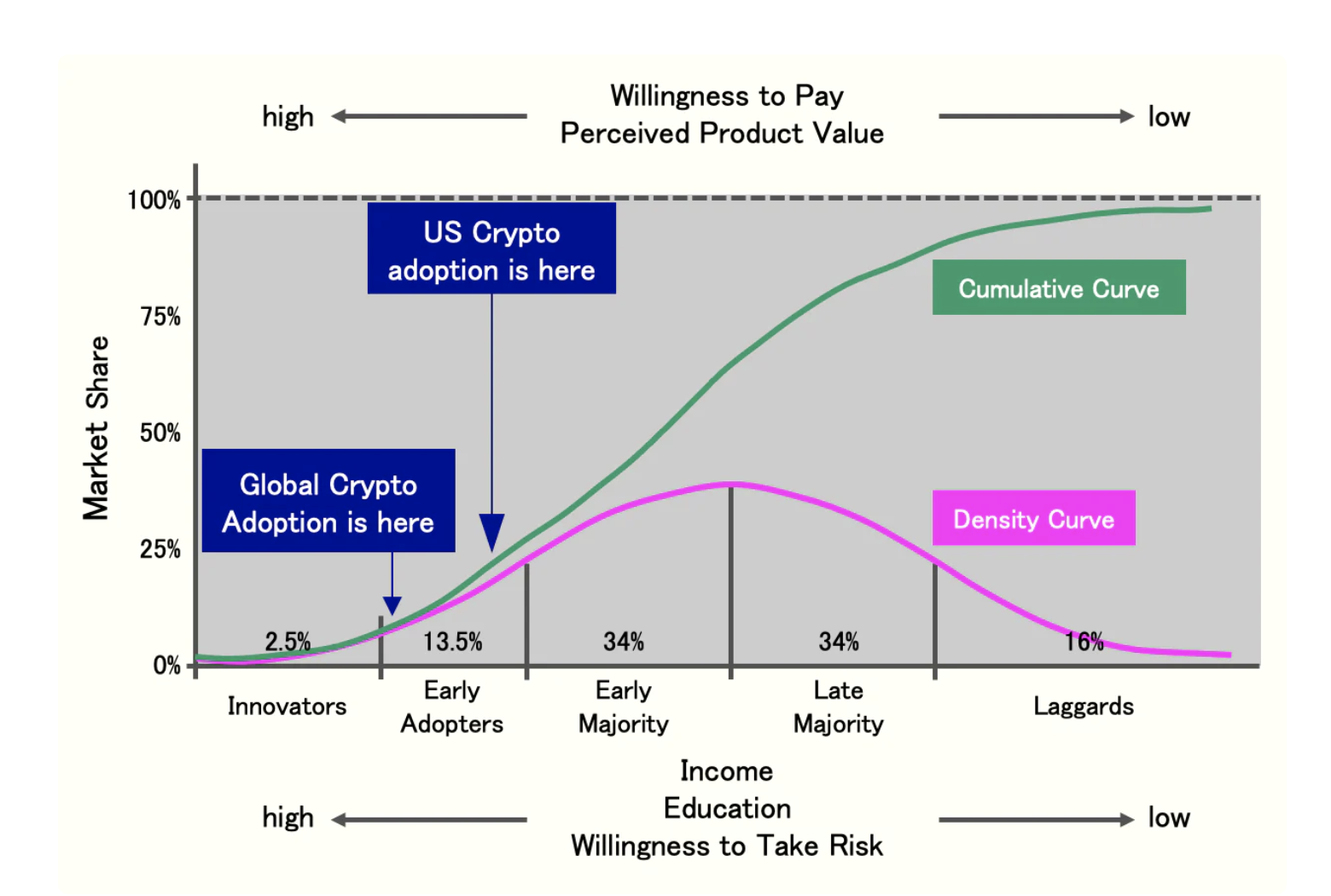

Despite the obvious cultural relevance and appeal of NFTs, we are still in the early days. Crypto wallet provider Metamask, the primary way consumers buy NFTs, achieved 21 million MAUs in early January 2022. The milestone was widely celebrated by Crypto Twitter, but still only accounts for 0.7% of Facebook MAU (2.9 billion) and 6% of Twitter MAU (331 million). Data for June 2021 indicates that approximately 13% of Americans and 3% of individuals globally have purchased cryptocurrencies. From a different perspective, this is roughly what Internet adoption in the US looked like in 1996. Only 2% of Americans have bought or sold NFTs, and a full 66% of respondents have never heard of the term before.

Charting U.S. and Global Cryptocurrency Adoption (via Hootie Rashidifard)

To date, NFT marketplaces tend to have larger AOV and LTV than many web2 marketplaces, given NFT's higher margins and pricing. For example, the average purchase price for Opensea in January 2022 is $32,000. Higher pricing allows the NFT marketplace to maintain comparable GMV and net income to web2 peers on a lower customer base.

Because of this, it is debatable how much consumer adoption of cryptocurrencies these vertical NFT marketplaces need to scale if they are to successfully profit from a relatively small customer base. At the same time, the number of individuals willing to pay more than $3,000 for digital goods is limited. In order to exceed this ceiling, the NFT market will need to attract both early-majority and late-majority adopters at more accessible prices.

I like vertical NFT markets that combine utility, curation, competitive acquisition rates, and great UI/UX. The next great NFT marketplace could build a brand as strong as any traditional marketplace or brick-and-mortar boutique. As the situation heats up, NFT vendors will become not just destinations for transactions, but homes for communities and digital identity signals.