Read Ratio in one article, a stablecoin protocol that can release the potential of LP Token

On February 28, Ratio Finance, a new stablecoin protocol based on Solana, completed the public offering of its governance token RATIO on the crowdfunding platform Republic. A total of 960 investors participated in this round of public offering of Ratio Finance. amounted to US$3.06 million.

From a positioning point of view,

From a positioning point of view,Ratio Finance is a decentralized over-collateralized stablecoin, but unlike stablecoin protocols such as MakerDAO (DAI), the mortgage assets supported by Ratio Finance are not specific tokens, but the liquidity certificate tokens of some top DEXs (such as Raydium) in the Solana ecosystem, that is, our Often said LP Token.

DeFi has achieved considerable development in the past two years. Defi Llama data shows that as of March 1, the total value (TVL) of funds locked in DeFi protocols on major ecosystems has reached 208.5 billion US dollars, of which Solana The TVL figure was $7.3 billion.

Looking back at the development of DeFi, the emergence of automated market-making (AMM) decentralized exchanges (DEX) is undoubtedly the most impressive stroke. The AMM's constant product model allows users to participate in market making and earn income by simply adding assets of equivalent value on both sides of the transaction pair. Compared with the traditional order book model, the AMM model has lower market-making thresholds and lower management requirements. less, and more intuitive income expectations, thus effectively solving the liquidity expansion problem of DEX, and greatly boosting the development of the entire DeFi system.

When liquidity providers (LPs) participate in market making through AMM DEX, in order to determine the specific share of their liquidity positions in the pool, DEX will often return a certain amount of liquidity certificate tokens (LP Token) to LPs, and when When LPs need to withdraw liquidity from DEX one day in the future, they also need to take out a corresponding amount of LP Token as a withdrawal certificate. This means that although LP Token is not a specific token, it also has value in itself, and its value is supported by the combination of tokens locked in the DEX liquidity pool.

With the continuous development of AMM DEX in major ecology, the total value of assets in the form of LP Token is also rising. However, under normal circumstances, the normal state of these LP Tokens is to lie in the wallets of LPs and "sleeping". The reason is that there are not many new protocols that serve this asset class in the market. Outside of DEX , these LP Tokens are difficult to find other usage scenarios, especially in emerging ecology such as Solana.

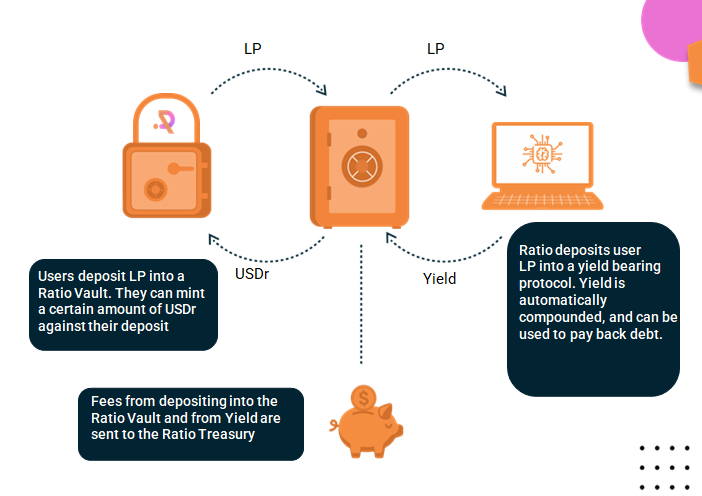

protagonist of this articleRatio Finance is such a new stable currency protocol that serves the Solana ecological LP Token and expands the usage scenarios for these assets.Specifically, Ratio Finance allows users to mortgage the LP Token of mainstream DEXs such as Raydium and Solfarm within the agreement, and lend the stable currency USDr. These USDr can be freely controlled by users, such as investing in a certain project that they are optimistic about, or switching to other stable coins to continue pair mining. When users want to withdraw their mortgaged LP Token, they only need to return the corresponding amount of USDr.

It is worth mentioning that Ratio Finance itself has designed a mechanism for automatic debt repayment of LP Token income. As time goes by, the USDr debt lent by users will gradually decrease with the accumulation of LP Token profits. In theory, as long as the user saves long enough, it is not ruled out that one day in the future there will be no need to repay any USDr debt at all.

For users,Ratio Finance actually provides a feasible way of leveraged mining. When the user deposits the LP Token of a certain DEX in Ratio Finance, the agreement will re-pledge these LP Tokens in the DEX, so the user can still enjoy all the handling fees and liquidity incentive income allocated by the DEX, "extra" The loaned USDr gives users the possibility to earn increased income.

For Solana ecology,Ratio Finance solves the problem that the liquidity of a large number of LP Tokens is not fully utilized, to a certain extent, improves the efficiency of overall ecological capital utilization, and contributes to the further expansion of Solana's ecological scale.

Some readers may ask whether the new mechanism adopted by Ratio Finance will bring new risk factors. We think this issue needs to be disassembled.

The first is portfolio risk. Using LP Token as collateral means that Ratio Finance binds itself with the risks of other DEXs, so the risk of this part must be magnified; the second is systemic risk, which mainly depends on the Whether Ratio Finance can guarantee sufficient collateral, we have explained earlier that the value of LP Token is supported. In fact, the volatility of LP Token is often lower than that of a certain token, so there is no need to worry about whether the system is stable; Finally, there is the risk of leverage. The risk of this part actually depends on the specific way the user uses USDr. If you use it to buy a certain currency, it will naturally be magnified. Mine, in fact, the risk impact is not great.

When users who are familiar with the stablecoin track see Ratio Finance, they may think of some similar projects in other ecology, such as Abracadabra (MIM). It is true that there are certain similarities between the two, that is, the collaterals supported are derivative assets from other DeFi protocols, but Abracadabra focuses more on the field of interest-earning assets, while Ratio Finance mainly focuses on LP Token. It can be seen from the official history article that Ratio Finance completed the design of the core logic of the protocol as early as July last year. At that time, agreements such as Abracadabra did not have the scale they are today. The inspiration and conception of the project were more by the team Original finish.

According to Ratio Finance's roadmap planning, the agreement will be officially launched on the main network and complete the audit work in the first quarter of 2022. Shortly after the mainnet goes live, Ratio Finance will launch an airdrop event Fairdrop for early experience users and investors who have chosen 12 and 18-month lock-up restrictions in the Republic public offering to reward the most loyal contributors to the protocol.

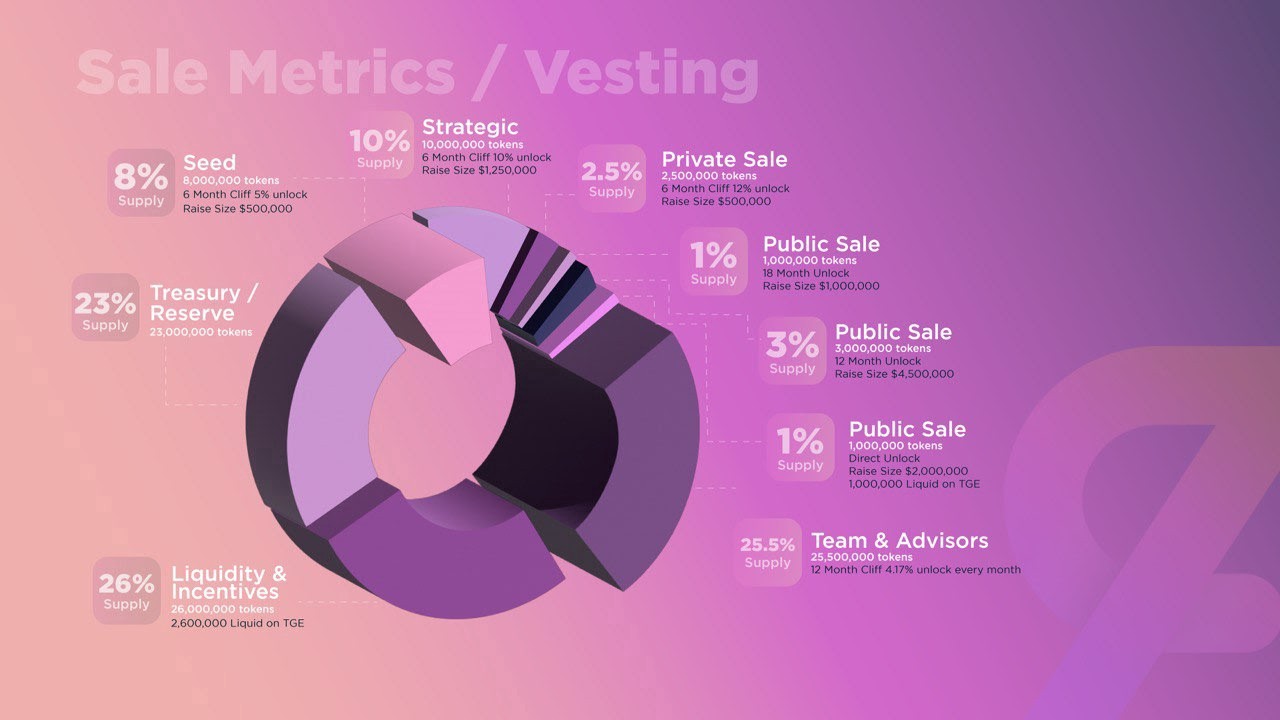

As for RATIO tokens, according to the officially disclosed economic model, the total supply of RATIO is 100 million pieces, of which 26% will be used for liquidity incentives, 25.5% will belong to the team and consultants, and 23% will be used as treasury reserves. , strategic round, and private equity round investors accounted for 20.25% in total, and the remaining 5% was used for the public offering of Republic.

In order to facilitate a reasonable assessment of the market value of RATIO, Ratio Finance has disclosed the specific valuations of different rounds of financing. The single currency cost of the seed round investment is 0.06 US dollars, the single currency cost of the strategic round investment is 0.13 US dollars, and the single currency cost of the private placement round investment is 0.2 US dollars. In summary, the single currency cost of the public offering round is divided into Three tiers - $1 (18 months), $1.50 (12 months), $2 (direct unlock).

On the whole, Ratio Finance has a relatively clear plan in terms of market positioning and product differentiation. The project saw that the LP Token assets of the Solana ecosystem have become a market that cannot be ignored, so it decided to build on this basis Some new combinations to try.

From the perspective of the derivation process of DeFi,The design of Ratio Finance is in line with one of the core spirits of DeFi 2.0 "improving the efficiency of capital utilization". Ideally, after Ratio Finance is officially launched on the mainnet, it is expected to become an important functional supplement and scenario extension for Solana DeFi, and the value of the protocol itself will gradually accumulate and amplify as more users get involved in these new scenarios.