Bankless: 5 Ways to Earn Fixed Rate Income on DeFi

Author: William M. Peaster

Original source: Bankless

Compilation of the original text: The Way of DeFi

Author: William M. Peaster

Original source: Bankless

Compilation of the original text: The Way of DeFiHow many times have you gotten into a pool that offered over 50% Annual Percentage Rate (APY) only to find out two weeks later that it had dropped to 25%?!)

This is because many yield opportunities in DeFi still depend on token emissions and available liquidity. (PS, if you haven't read last week's

Sustainable Yield Farming Guide

Other people's activities can affect your earnings.

For example:

But, in 2022, we have a lot of fixed income products. These are known as "set and forget" opportunities that offer steady and predictable returns.

I’ve written before on why fixed income is important to DeFi, but this article got me thinking about how many unique and creative ways there are to provide fixed income.

For example:

Element Finance splits tokens into principal and yield tokens, which trade at a discount.

Maple Finance lends to institutions at fixed rates and passes those rates on to retail LPs.

This makes the opportunity and risk profile more diverse. Let's learn how to earn fixed income in DeFi.Logan Craig

5 Ways to Earn Fixed Rate DeFi Income

picture:

Skills: Intermediate

Fluctuating interest rates defined the early DeFi yield landscape, attracting high-risk, high-return retail investors. But in an effort to bring DeFi to the masses, there is a thriving dApp space focused exclusively on fixed-rate income products. The Bankless strategy will show how to use 5 of these dApps to lock in stable DeFi income.

Goal: How to Get Fixed Rate Income

Skills: Intermediate

Effort: Less than 30 minutes (per project)

ROI: up to +12% p.a., depending on opp

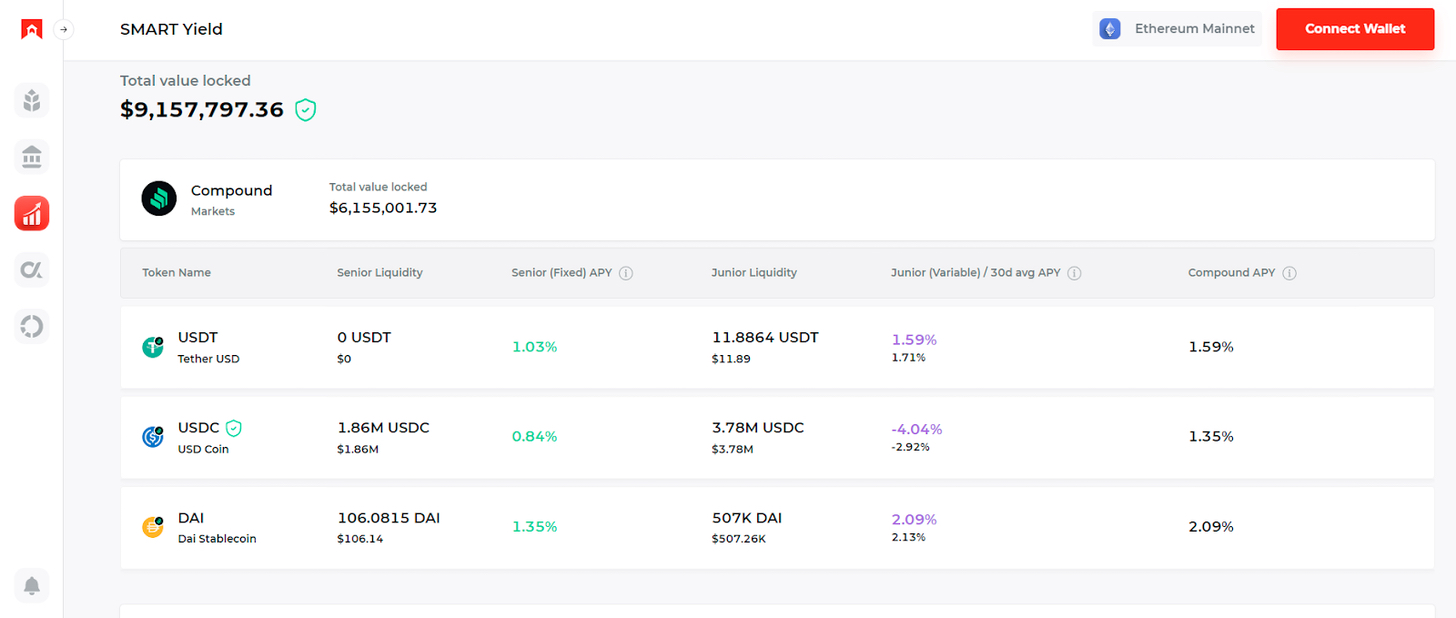

01 BarnBridge

BarnBridgeFixed Rate Income and How to Earn Them

Fixed rate income products are one of the key pillars of the mainstream financial system. These products allow people and institutions to earn a fixed amount of money for a fixed period of time (such as 6 or 12 months) by locking in an interest rate in advance.

Therefore, fixed income is great for pre-determining your income and managing your spending and savings. Now, as the DeFi ecosystem matures, getting into DeFi is easier than ever. Here are 5 Fixed Rate DeFi Income Opportunities You Can Consider Today!

is a decentralized risk-graded token protocol.

BarnBridge's flagship product, SMART Yield, offers fixed-rate or leveraged variable yields on stablecoin deposits.

SMART Yield lends these deposits across DeFi and turns the yield into senior bonds (NFTs called sBond) and junior bonds (ERC-20s called jBonds).sBond and jBond holders can profit at the same time, but jBond holders are responsible for making up for any losses caused by market actions. Thus, sBond's return is fixed income, while jBond offers a higher risk, higher reward opportunity.Earn regular income (up to 1.7%) with SMART Yield.

first go to

SMART Yield overview page

and connect your wallet

Choose from the available marketplaces (Aave and Compound) and click on your desired stablecoin (USDC, DAI, etc.).

02 Element Finance

Element FinanceNext enter your desired deposit amount and maturity date, then click “Enable” to approve BarnBridge to access your funds.

Press "Deposit" to finalize your deposit, after which you will receive the sBond NFT and start earning regular income. Note that this NFT is what you use to redeem your principal and interest via the SMART Yield app on the bond's maturity date.

Read the full BarnBridge strategy!

is a decentralized protocol for fixed and variable income markets.

PT represents the value of the base principal, such as ETH, and is redeemable after the token's term ends. Until the end of this period, PT trades at a discount to its underlying asset.

go toHowever, the value of PT eventually converges with the underlying asset on a 1:1 basis, so if you hold the token until the redemption date and buy discounted PT before maturity, you can get a fixed rate of return.Use principal tokens to obtain fixed income (up to 14.6%)

go to

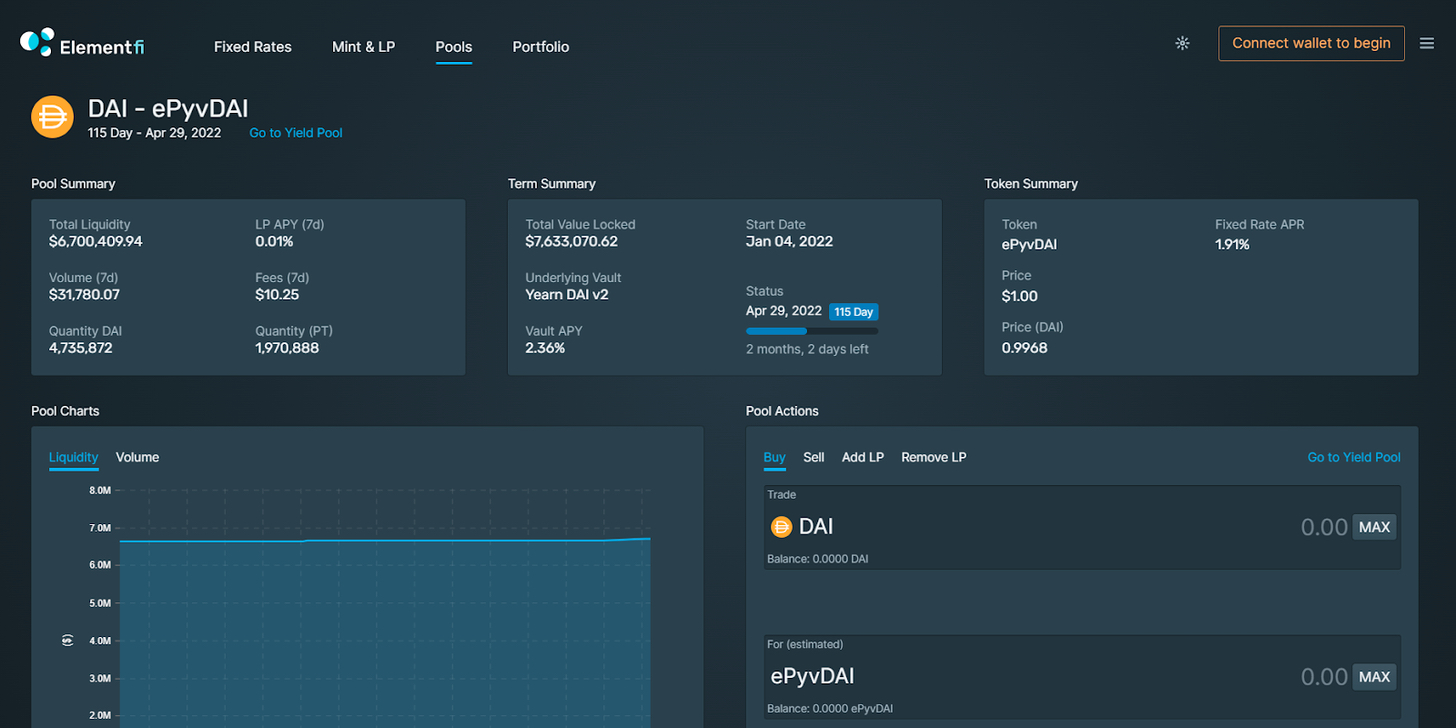

Element's Pools page

, and connect your wallet.

Review the available PT pools and click on the desired option.In the Buy UI of the Pool Actions menu, enter the amount of PT you want to buy and press "Buy".Confirm the purchase transaction with your wallet.

Now you can passElement's Portfolio Page。

03 Maple Finance

Maple FinanceTrack your positions, then redeem your PT after the expiry date for a profit.

read about

Element Finance's complete strategy

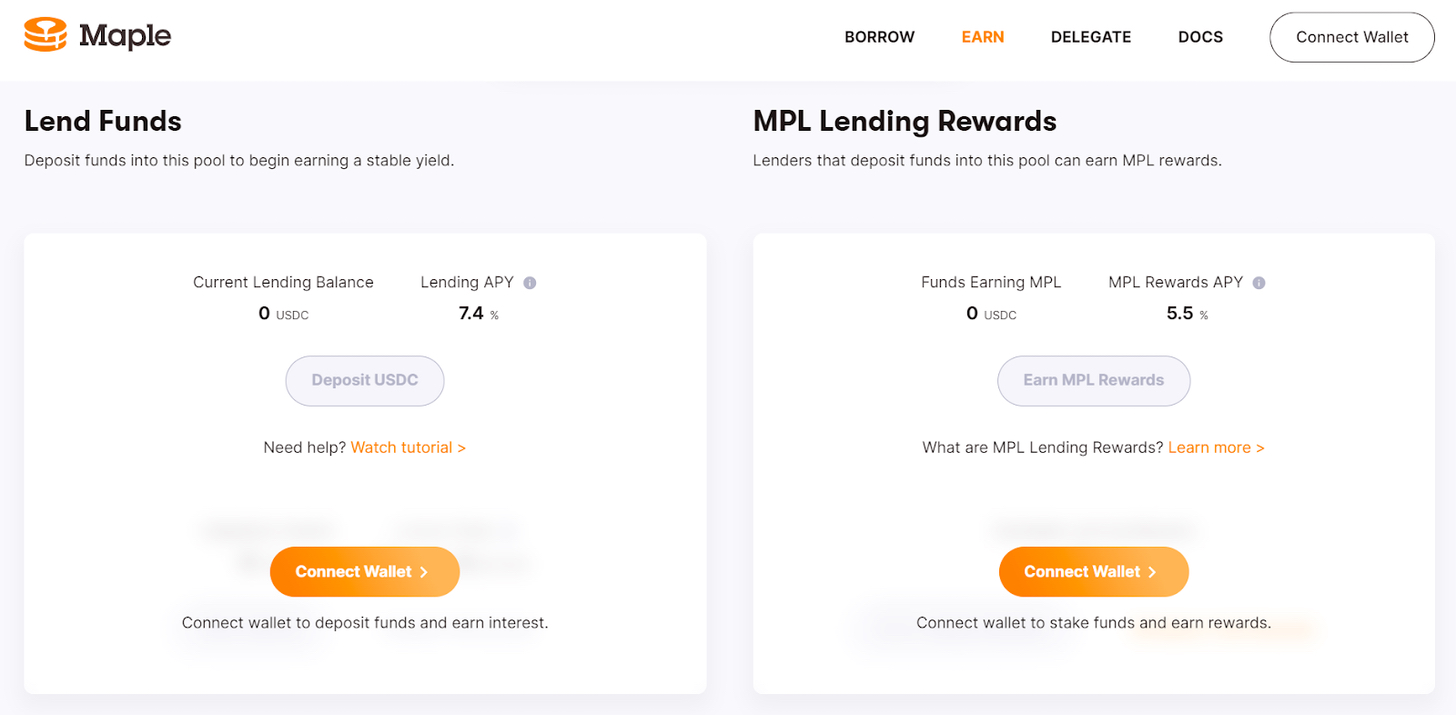

is an undercollateralized business lending protocol.

Borrowers pay interest on their loans, generating fixed-rate benefits for Maple's lenders.

go toMaple's liquidity pools are not always open for deposits. As of press time, the Orthogonal Trading - USDC01 pool is the only pool on Maple that accepts deposits.Earn fixed income (up to 7.4%) on Lending with Maple.

go to

Orthogonal Trading - USDC01 Mining Pool

and connect your wallet.

Click "Deposit USDC" and initiate an approval transaction to give Maple access to your funds.

Next enter your desired deposit amount and press "Deposit" to complete your loan transaction.

04 Notional Finance

Notional FinanceYou will then receive Maple LP Tokens (MPT), which you can then consider staking via the same Orthogonal Trading UI to earn additional lending rewards in Maple’s native token, MPL.

Keep in mind that Maple lenders face a 90-day lock-up period, so don't deposit any funds you might need within that three-month window.

Read the full strategy on Maple Finance.

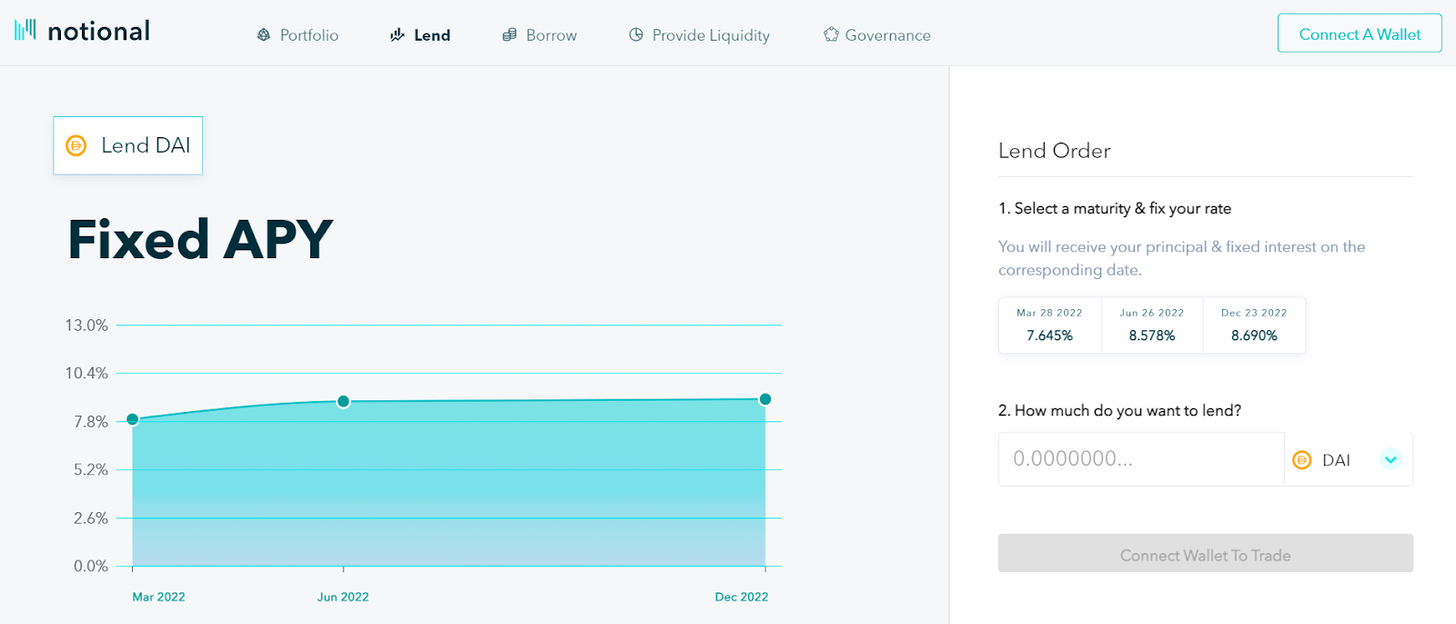

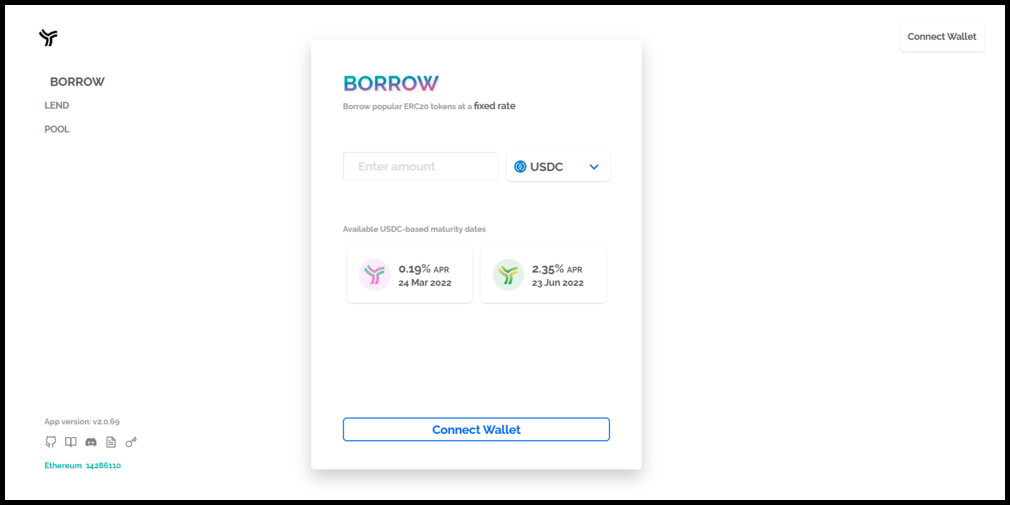

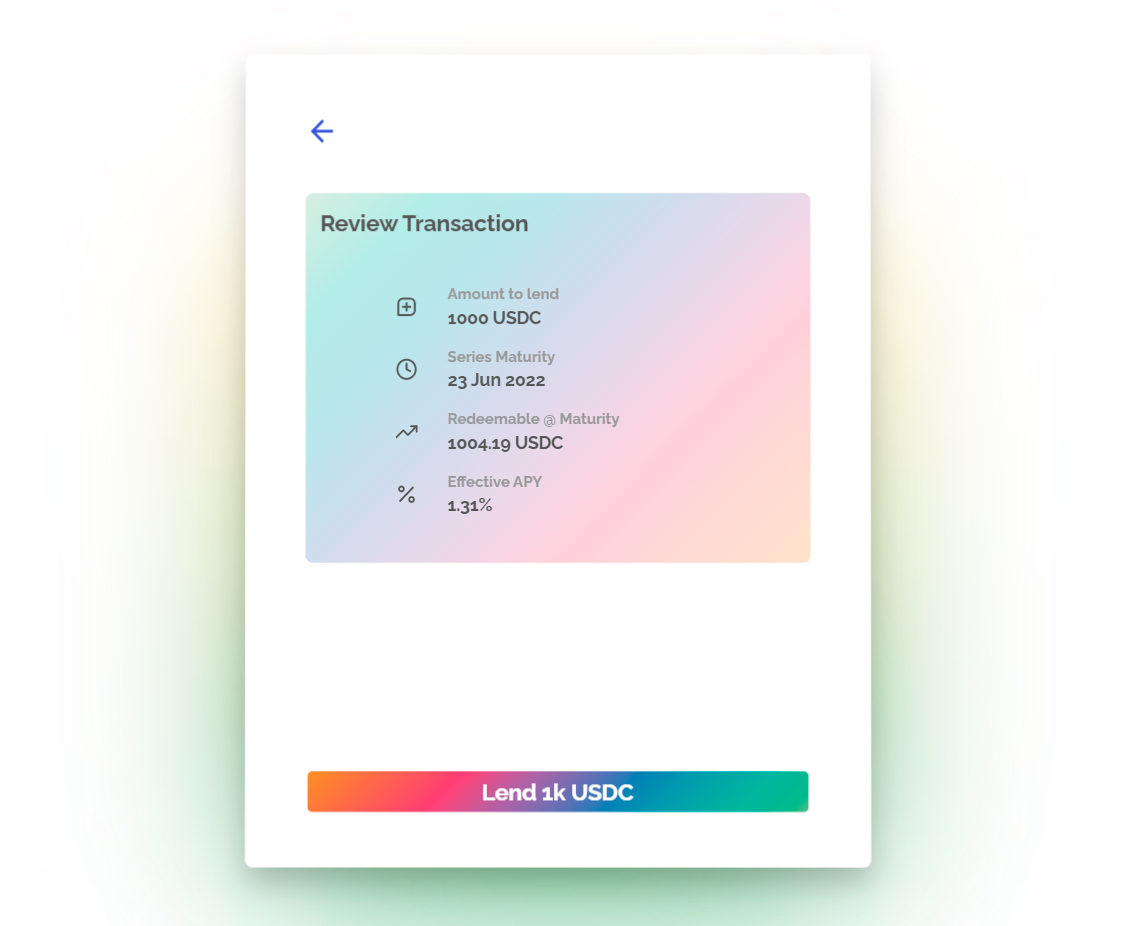

It is a decentralized fixed-rate lending agreement.

Notional has its own liquidity pool, which consists of fCash denominations and settlement tokens such as fDAI and cDAI.

EnterSo someone who wants to borrow money to earn fixed income can buy fCash tokens from Notional, similar to how Element’s principal token works.Earn regular income (up to 8.7%) with fCash.

Enter

Notional Lend Dashboard

and connect your wallet.

Click on the market of your choice, for example DAI, then configure your desired maturity date and deposit amount.

05 Yield Protocol

Yield ProtocolPress "Confirm" then "Enable" and complete the approval transaction to give Notional access to your funds.

After that, submit your last deposit transaction and you're done.Once the maturity date is reached, you can redeem your underlying assets with your fCash.It is a decentralized fixed-rate lending agreement.

The project revolves around

fyTokensExpand

, which is an “Ethereum-based ERC-20 token that can be redeemed one-for-one for the underlying asset after a predetermined maturity date... If you have a fyDai token, you can redeem one Dai after the maturity date.”

To take out a loan via Yield Protocol, you simply purchase fyTokens of your choice.These special tokens do not earn interest themselves, but are purchased at a discount, thus locking in a fixed income if held to maturity.Use fyTokens to earn fixed income (up to 1.29%).

go to

Yield's Lend Dashboard

and connect your wallet.

Review the details of the transaction, then click Lend and sign the subsequent approval transaction.

in conclusion

After making a deposit, you can manage your vault by clicking the icon on the bottom left of the Lend dashboard, and proceed from there.