Data insights: The market started a violent rebound, who bought your BTC?

Original Author: Phyrex Ni

Original source:Medium

Original Author: Phyrex Ni

Original source:

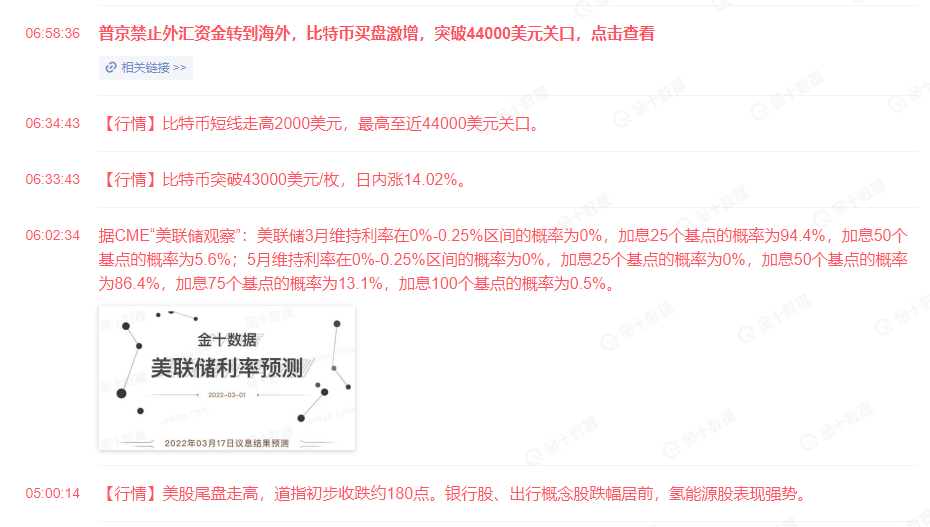

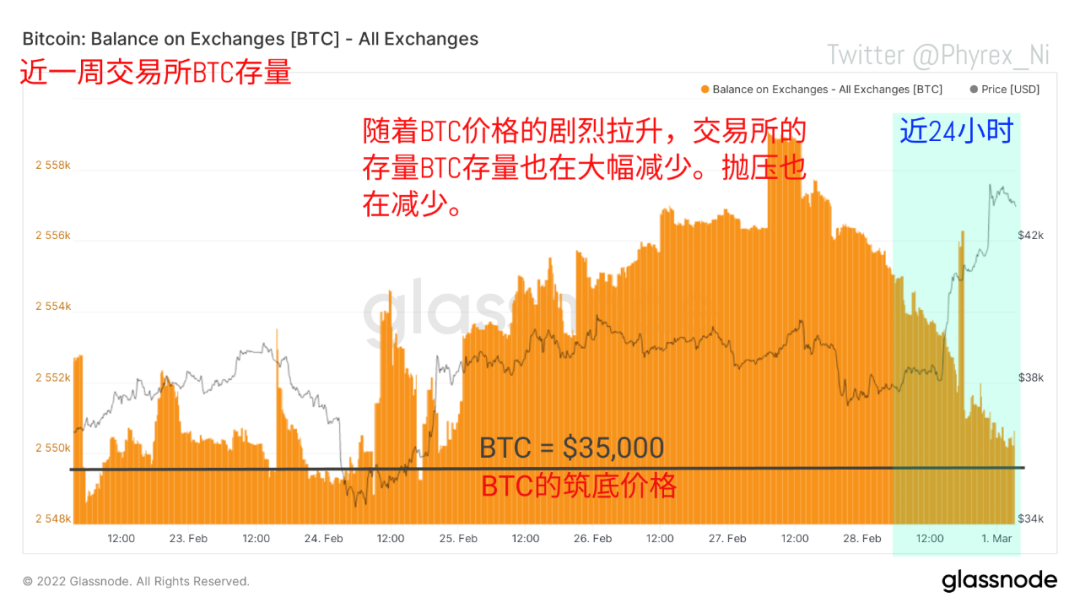

Since last night, BTC has entered into a crazy leading mode, which lasted until 8 o'clock in the morning. It once broke through 44,000 US dollars. Although it has fallen back to around 43,000 US dollars, it has risen by nearly 15% within 24 hours, and it is still leading the rise. It’s quite scary, so what is the reason or what kind of situation has led to such a rise in BTC, let’s take a look at the data, who bought your BTC?

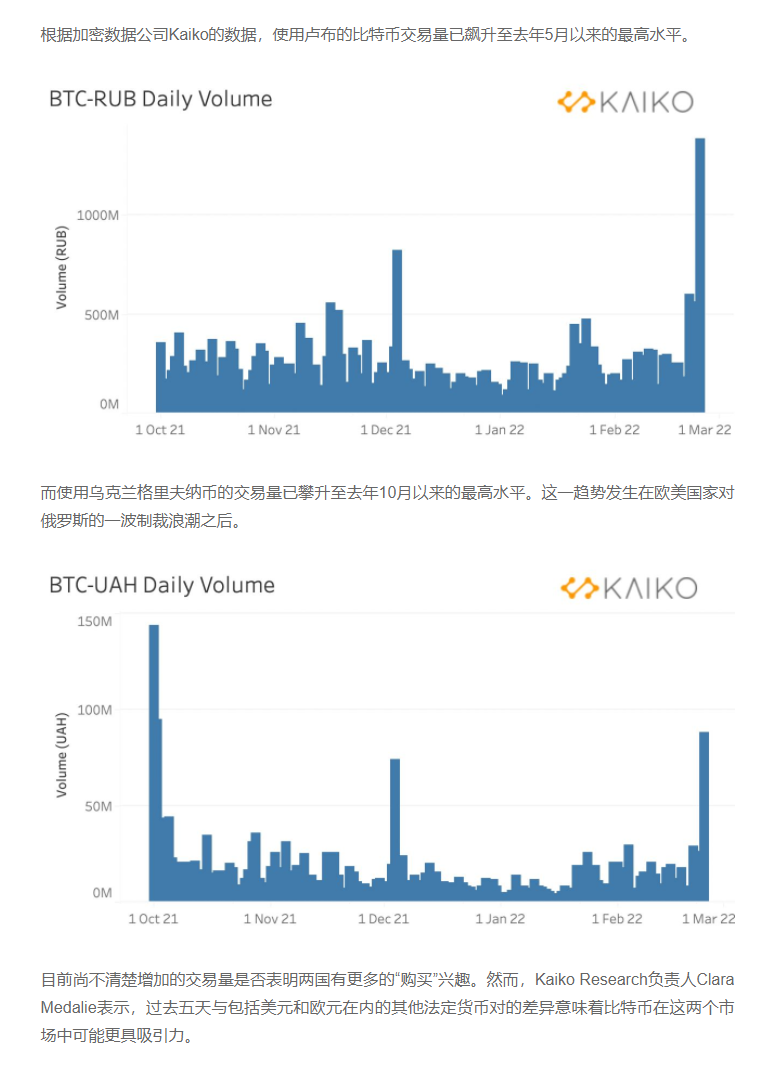

Who is the main buyer this time? It is widely circulated that Russia’s sanctions have led to restrictions on foreign exchange, the depreciation of legal currency, and the difficulty of withdrawing cash. This does not only happen in Russia, including Ukraine, which has migrated to its homeland. The public will also be impacted by fiat currency, so BTC assumes the role of a "safe haven asset". On the one hand, the price relative to the bottom does not lead to much downside space, and on the other hand, it will be easy to exchange for US dollars.

Judging from the above two points of view, both may be the driving force behind the rise of BTC, so which party's "power" is the real buyer of yesterday's surge, we still have to start with the data.

Twitter @Phyrex_Ni

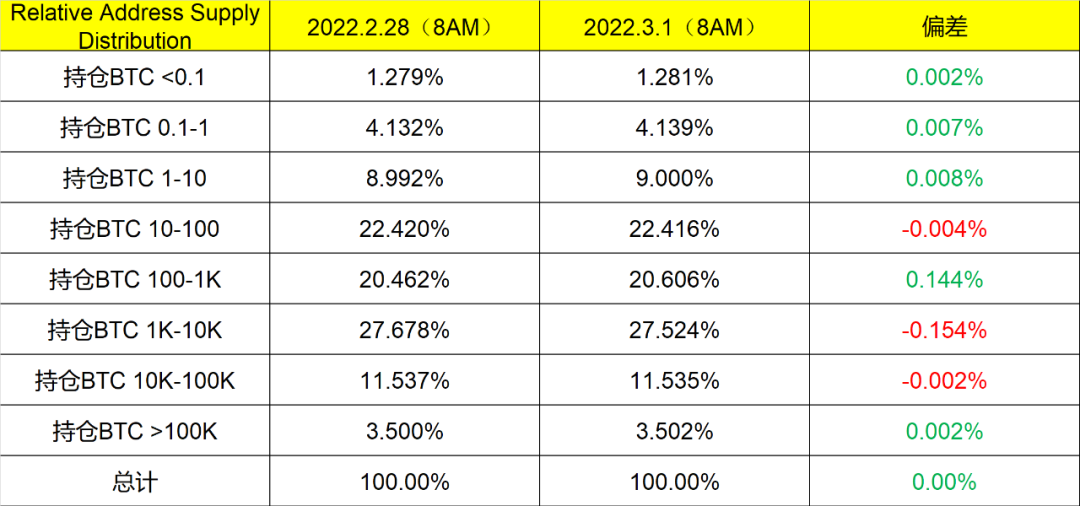

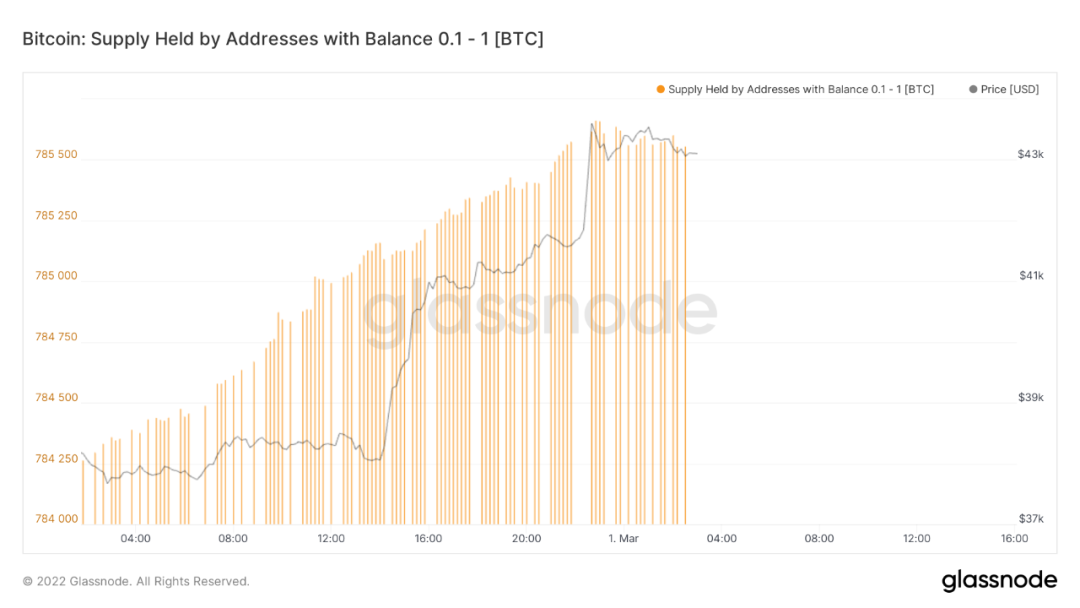

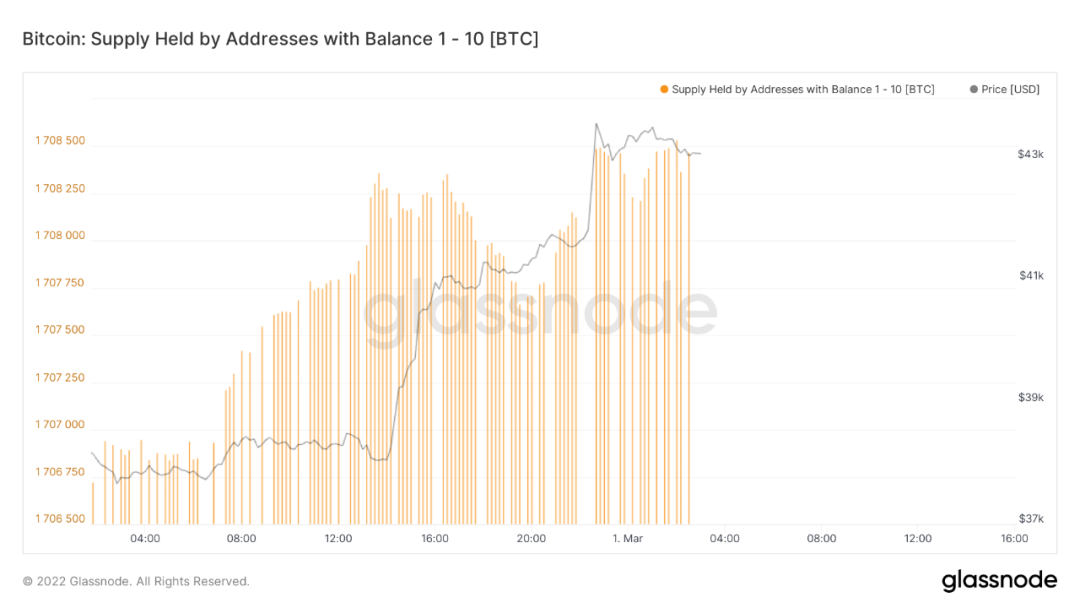

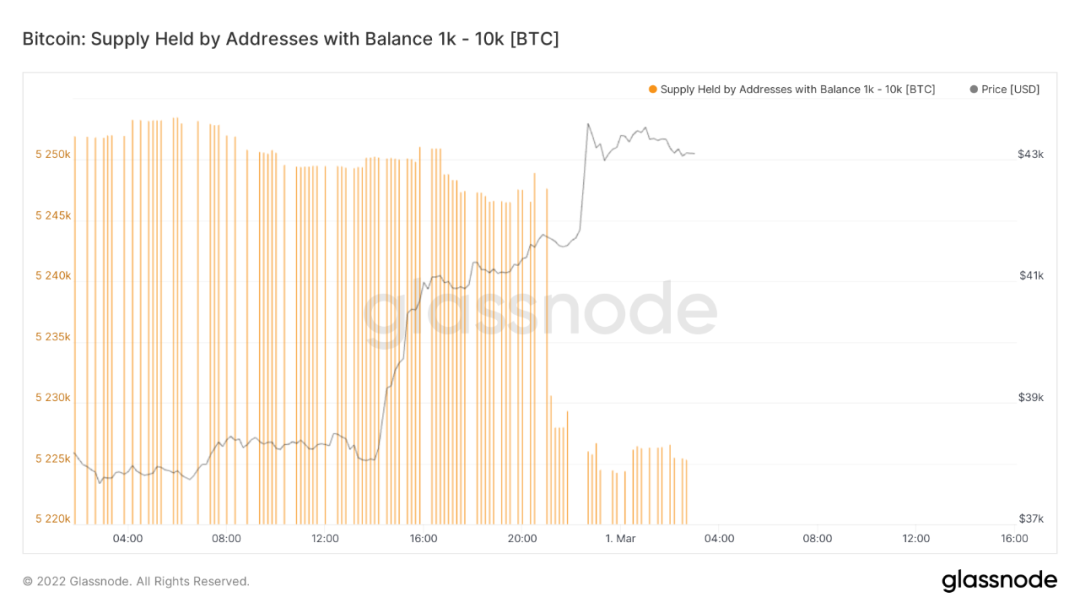

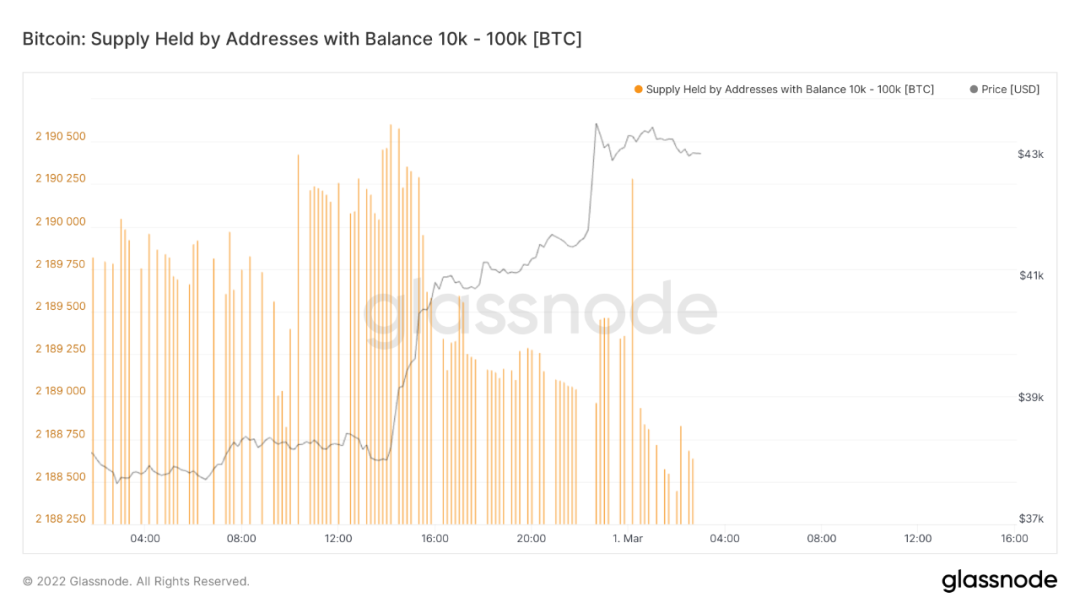

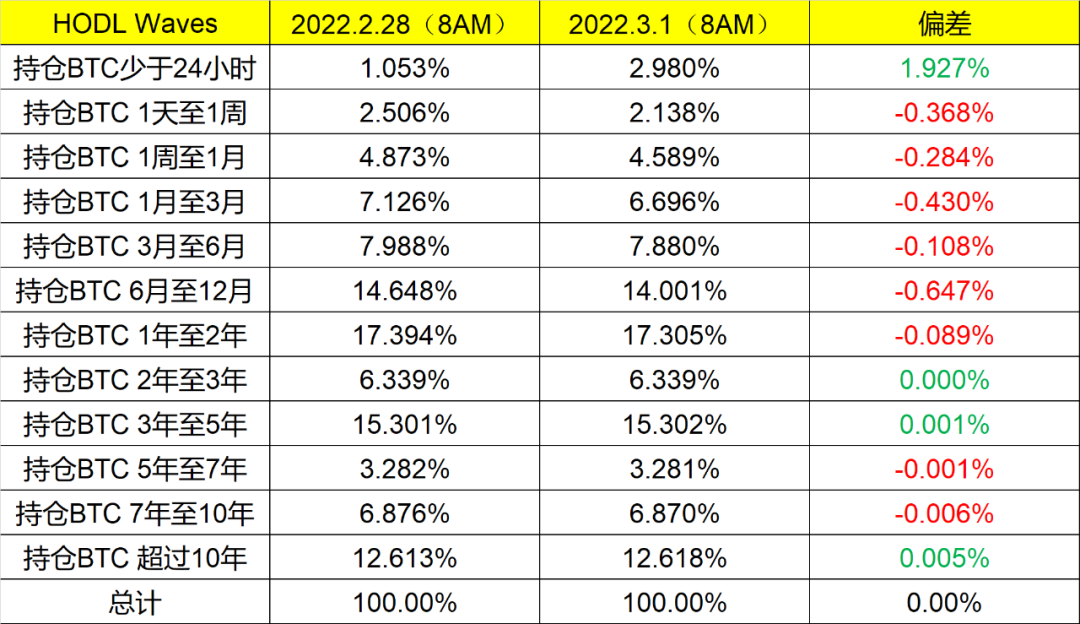

First of all, what we can see most intuitively is the 24-hour information of BTC from 8:00 am on February 28 to 8:00 am on March 1st. From the data, we can see that the change of retail investors is relatively the lowest. Of course, it is possible that a large number of retail investors’ chips are concentrated in the exchange without withdrawing cash, but if it is used as a “safe haven” property, the relative possibility of storing it in the exchange is relatively low in the face of US exchange sanctions. Same.

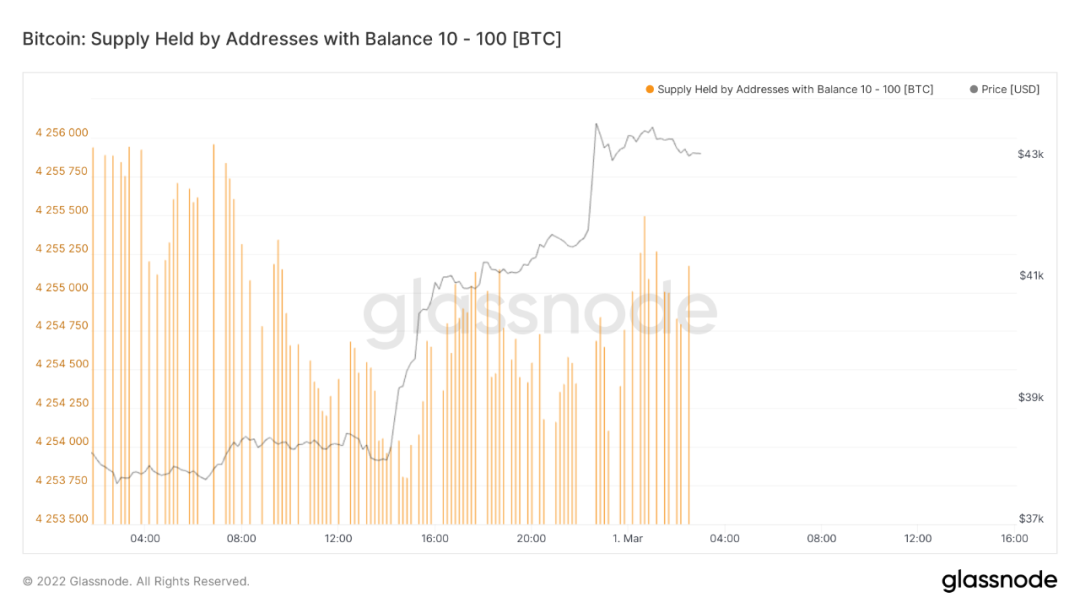

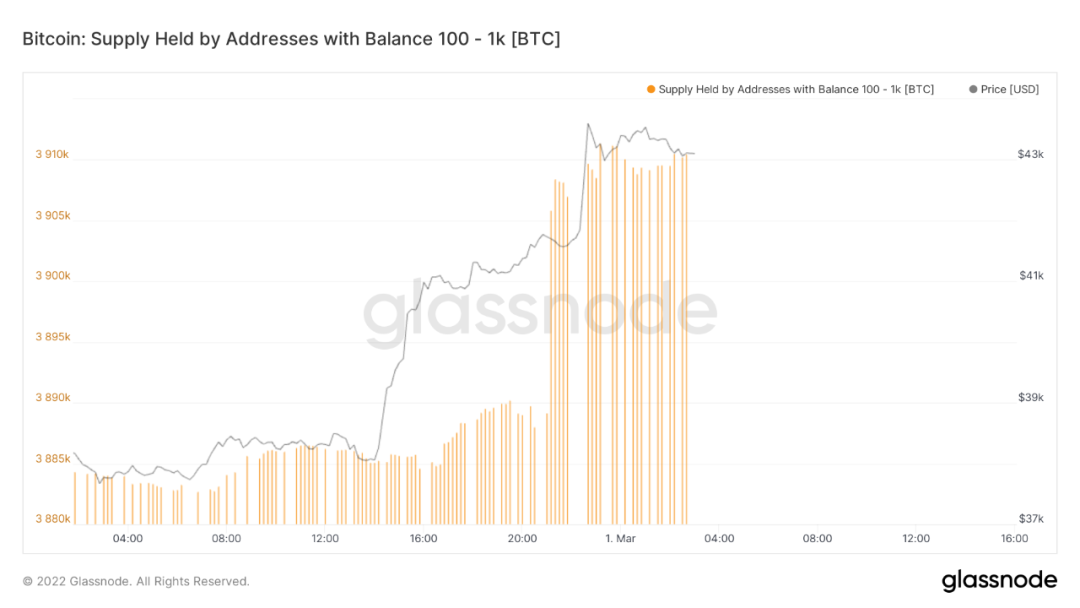

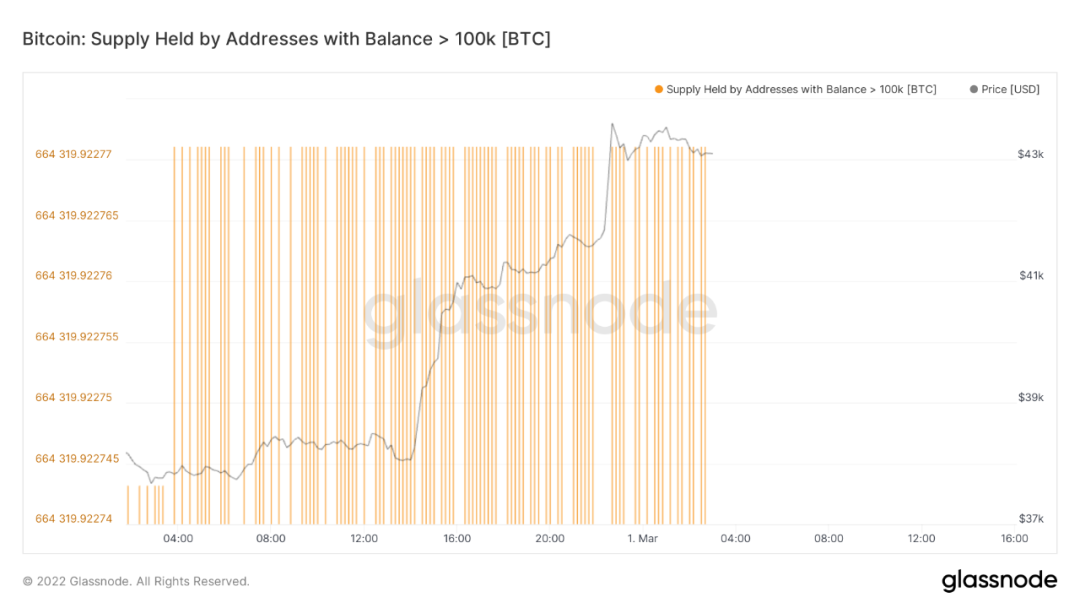

image descriptionThe biggest change is that the holdings are in the range of 100 to 1KBTC "young whale". This range is the main holdings increase range, while the main holdings reduction range is the giant whale account. Young whales, but there are still other scattered chips transferred to other ranges, but the relative number is very small. It is not enough to be an upward pull, so if you simply look at it from the perspective of new positions, it is not the buying behavior of retail investors.

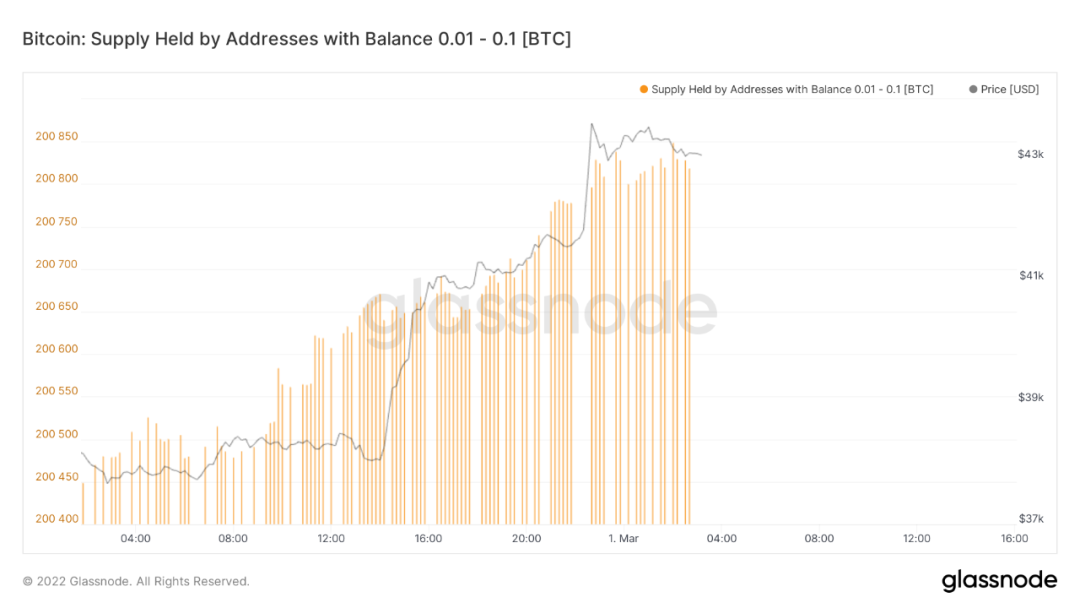

The current BTC rally is temporarily over, and many small partners are also asking a question, that is, is it because the newly purchased chips have not left the exchange that the data shows us the main positions of young whales? Question, it has been more than three hours since the end of the rise, we are looking at the retail data of the 10-minute line, we can find that,

The total purchasing power of retail investors is very limited, which is around 1,000 BTC.

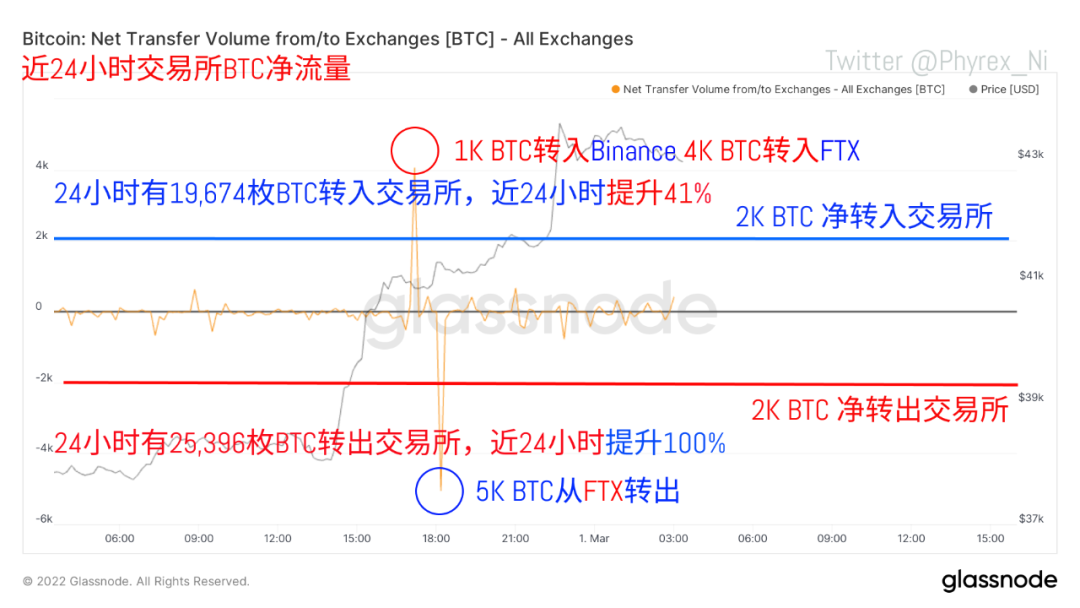

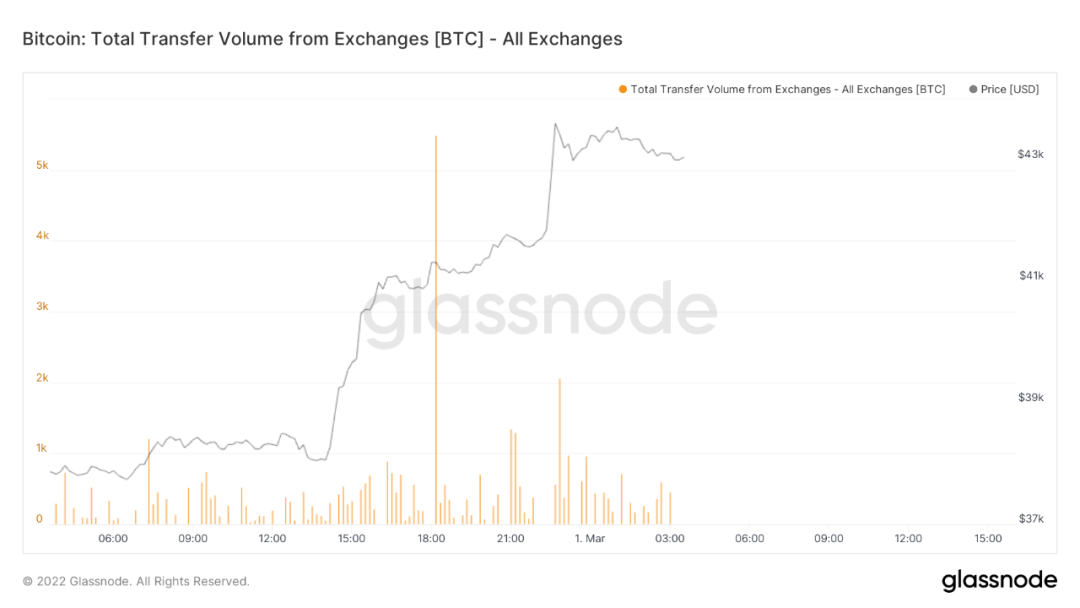

Then we look at the high-net-worth users, and the consistency with the data is still very high. Except for the baby whales who are increasing their holdings, almost all others are reducing their holdings, and the total holdings of young whales are about 25,000 BTC, so through Comparing the data, we can find that the support of retail investors for BTC is indeed on the rise, but after all, the price is too high, so the range of support is limited, and the real buying is still the young whale group with a high purity value.Then we continue to return to the topic of the exchange. Will there still be a large stock that has not been proposed for the exchange, which leads to our inability to intuitively find it on the chain, so let's look at the data and net flow of the exchange. Through the data, we can see that the outflow of the exchange is actually not high, only about 6,000 BTC net outflow, and compared with yesterday's trading volume, this is a fraction, so we still have to look at the net outflow.

Compared with the pure outflow data, it is roughly estimated that there are more than 30,000 BTCs. This data is consistent with our position comparison, so it is proved in many ways that

It can almost be confirmed that if the upward buying this time is not a large-scale purchase behavior of a certain exchange, then it is the young whales that are attracting funds, and the amount of the young whales’ accumulation and yesterday’s trading volume can also be relatively matched, so there is a high probability The above is the behavior of young whales, and the main shipment is giant whales.

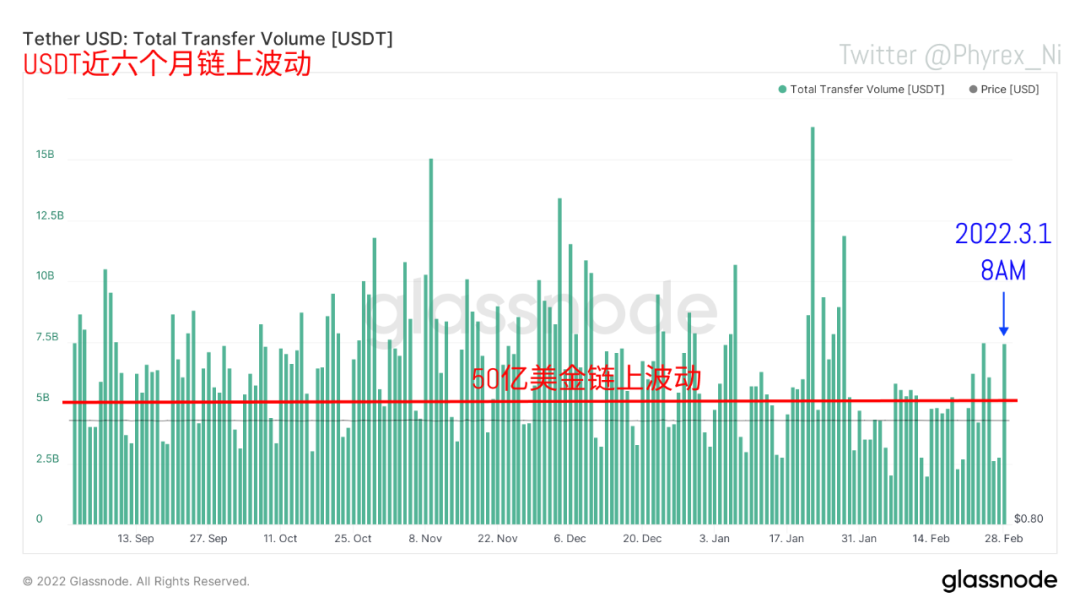

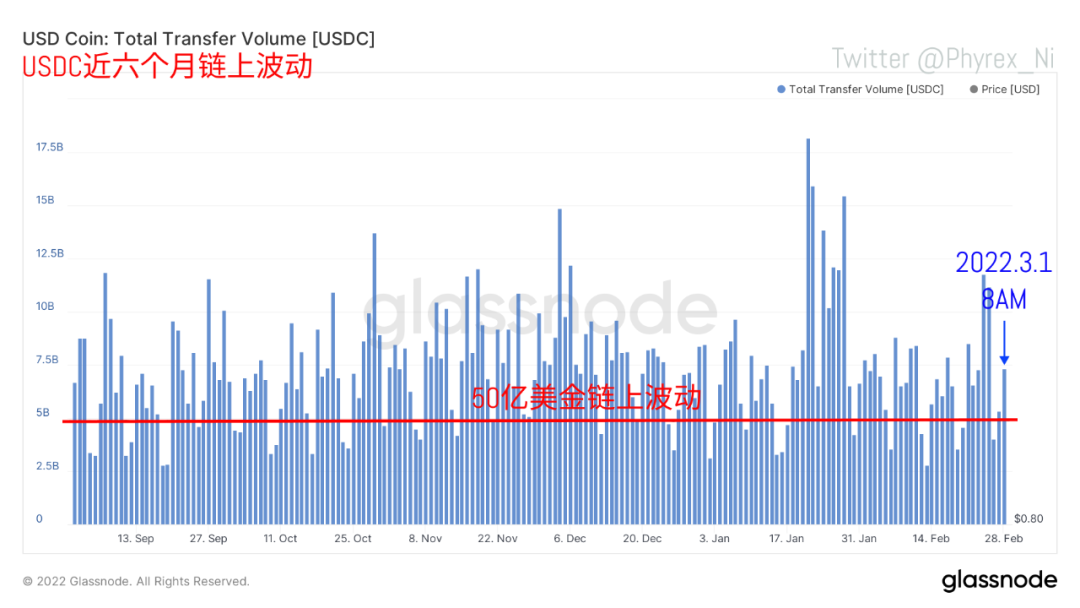

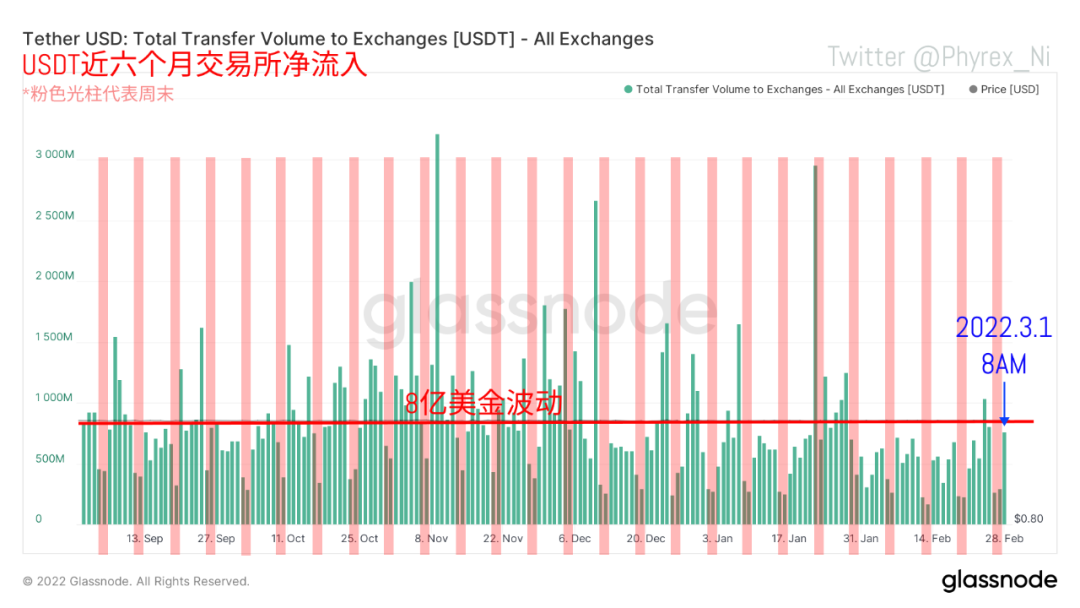

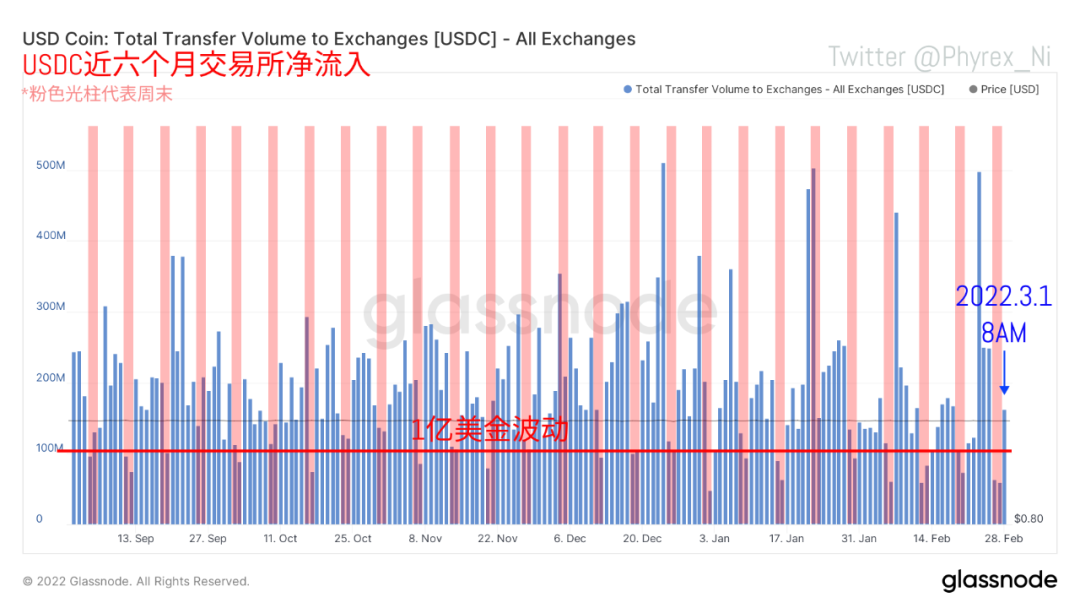

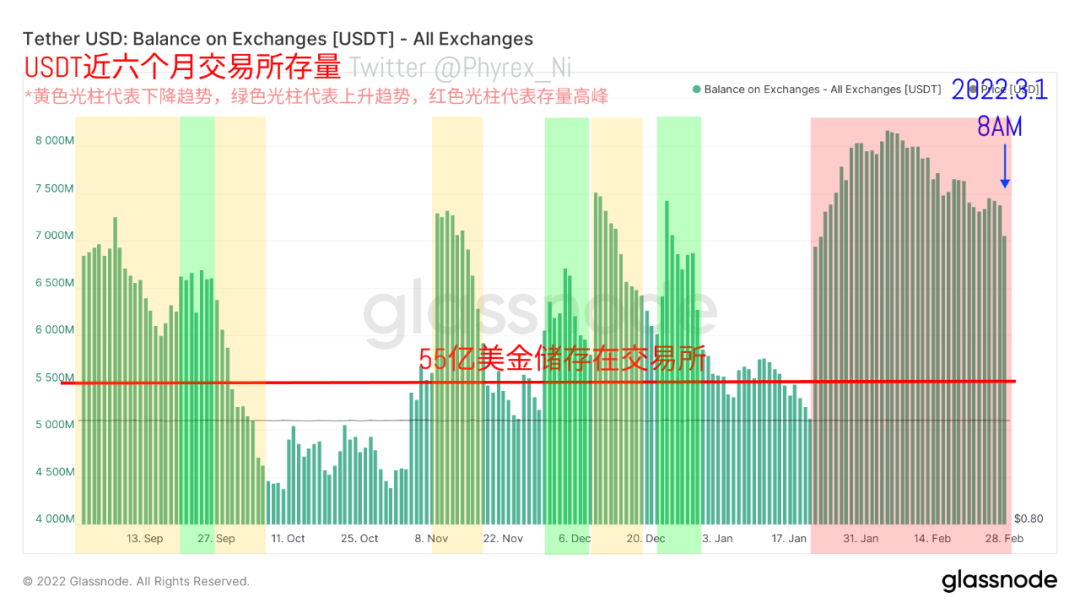

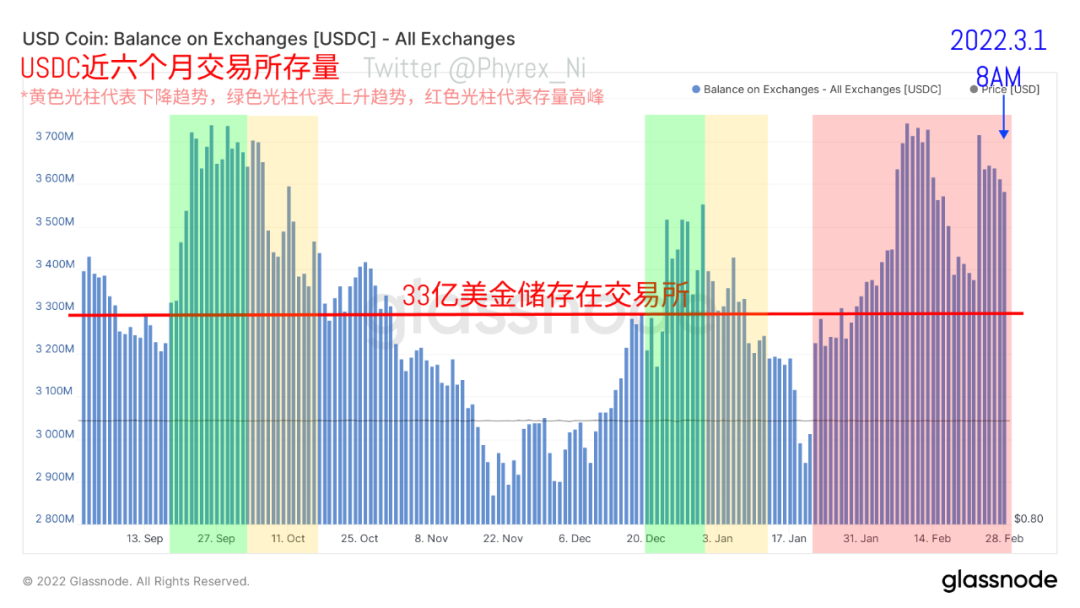

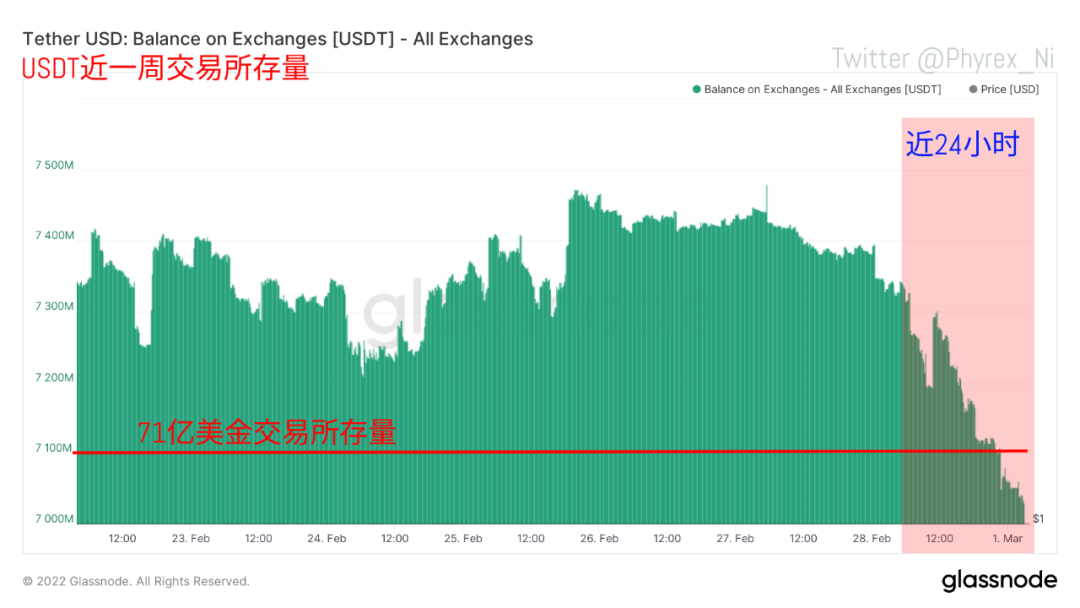

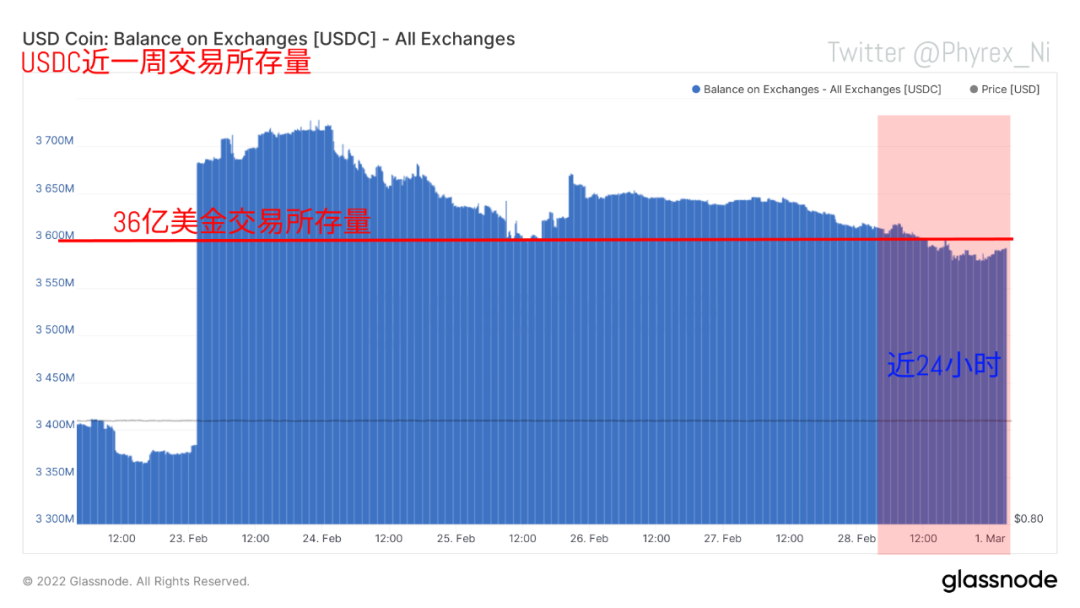

After knowing the main force of buying, we will further analyze what is the source of the main force's funds and which force is buying. This starts with the data of funds. First of all, we still look at the traditional capital situation. The amount of funds on Monday is relatively good regardless of USDT or USDC, but USDT is more prominent. On Monday, it directly reached the relative highest point of the same period last week, while USDC was relatively poor, even not exceeding the same period last week.The amount of funds on the chain directly affects the new funds transferred to the exchange, so it is obvious that USDT’s exchange funds are ahead of USDC in all aspects, and will naturally become the main force of purchases , and then looking at the daily data of the exchange, there is still a relatively large reduction in USDT, although USDC also has a reduction, but the magnitude is less. In view of the stock of the exchange, the probability that the funds from the reduction of holdings will be used for buying is very high.The ten-minute data can be found more clearly. Compared with the data of the same period yesterday,, and the reduction in the stock of funds also means that a large amount of transferred funds have also been consumed,

in conclusion:Therefore, the total consumption of USDT alone exceeds one billion US dollars, and although USDC is relatively small, there are about 100 million funds entering the market, so it is obvious that the main purchase fund this time is USDT.in conclusion:Through a series of data comparisons,It really has little to do with retail purchases in Russia and UkraineAddresses with less than 10 BTC are indeed showing an upward trend, and the main force of buying this time is still the young whales using USDT, and the way of buying is a large number of purchases through exchanges, and a large amount of stock funds are used

Twitter @Phyrex_Ni

, but in the process of rising, it was not as smooth as we saw.image description。

In fact,