NFT financialization: How can holders maximize their benefits?

Compilation of the original text: Bai Ze Research Institute

Compilation of the original text: Bai Ze Research Institute

While NFTs have been around since 2017, they were originally used for a fringe use case within the crypto community (collecting cryptokitties). Yet four years later, we're witnessing the adoption of the technology by artists, designers, game developers, musicians, and writers.

Before the advent of DeFi, the only way for users to acquire cryptocurrencies was through ICOs, over-the-counter transactions, or centralized exchanges with strict listing requirements. For most of the fungible tokens (ERC-20) launched in the ICO craze, the market lacks liquidity. DeFi protocols followed and reduced the time for these tokens to gain liquidity, which allowed for the vibrant trading, lending, and leverage activity we see in the crypto market today.

Just like alternative tokens in the past, we can expect DeFi protocols to unlock liquidity for NFTs as well. We previously wrote about why financialization of NFTs matters, and outlined early protocols for intersecting NFTs with DeFi. Less than a year later, there is a set of financialization protocols available in the NFT marketplace. More importantly, we can now also develop a framework for evaluating each liquidity mechanism against different "types" of NFTs.

Each liquidity mechanism has trade-offs that make it more suitable for NFTs with certain properties. The unique and diverse nature of NFTs brings new challenges to finding liquidity. Some have practical uses, some are just "status symbols". Some are "rare" items and some are completely unique. When evaluating how best to find liquidity for a particular NFT, it is worth defining attributes under which to categorize different NFTs and matching those attributes to the liquidity method that makes the most sense.

In this article, I will:

In this article, I will:

Mapping the current NFT financialization landscape

Discuss the strengths and limitations of existing NFT liquidity approaches

Define NFT price tiers, and typical characteristics of those tiers

first level title

market

market

NFT marketplaces allow users to find buyers and sellers through order books and a simple sale or auction mechanism. They can be generalized (Opensea, Rarible) or specialized (eg SuperRare for art, Catalog for music, Pracel for virtual lands). The NFT market has a large number of buy and sell lists and bid orders, which is the most intuitive way for users to trade NFT. However, without active participants, the market ends up being illiquid.

auction

auction

Auctions are lucrative for creators and are a great way to gain liquidity for assets like artwork or rare items in collectibles. While high-profile auctions have played no small role in bringing NFTs into the mainstream, auctions as a means of price discovery are even less capital efficient than market sales because they require bidders to lock up funds. The capital lock-up between multiple bidders is always greater than or equal to the price at which the asset is ultimately sold.

aggregator

aggregator

image description

Image: Cross-Market Listing on Genie

Aggregators are most useful for NFT projects whose liquidity is spread across different markets. For example, crypto artists often hang their artwork on multiple art markets. In fact, artwork has the highest user cross-wallet activity compared to other NFT categories, suggesting that despite the NFT marketplace, users continue to follow artists (regardless of platform). Aggregators, on the other hand, allow users to browse the works of artists in different art markets.

Loan/CDP

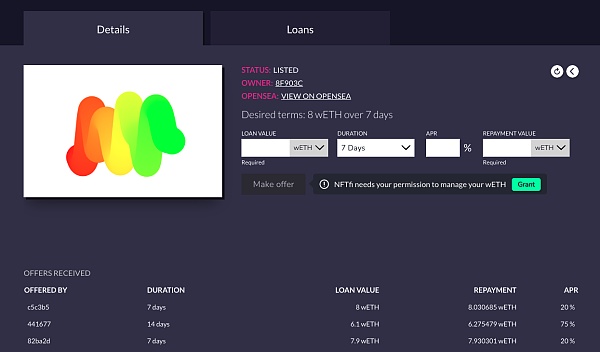

There are two main flavors of NFT mortgage protocols, with complementary tradeoffs.

image description

Image: Applying for a loan on NFTfi

There are also loan terms that let underwriters or DAOs with valuation capabilities come in and provide information. Gringotts is a community of NFT collectors, traders, and analysts who pool funds and issue loans through NFTfi. MetaStreet is building infrastructure on top of lending protocols for more efficient capital pooling and risk tranche, drawing inspiration from traditional securitization markets.

In P2P lending protocol solutions such as JPEG'd and DeFrag, lenders can provide liquidity directly to the protocol, and the protocol then automatically distributes funds to borrowers who have staked NFTs.

Unlike P2P lending markets, P2P lending protocols can provide instant liquidity because the protocol takes care of the matching process. However, this means they must rely on price oracles to automate loan terms. As such, eligible NFT collateral will be limited to those with quantifiable attributes that have reliable price feeds (those that are already liquid) or that can be algorithmically determined.

Taker takes a mixed approach and incorporates peer review into their protocol. Liquidity providers can form or join "Curator DAO" on Taker to collectively evaluate a certain NFT. This is a pricing mechanism that can be used in lending activities to provide instant liquidity to borrowers with the highest assessed value of assets.

The benefit of loans with NFTs as collateral is that debt positions can also be represented as NFTs, which can then be inserted again into other financialization protocols. For example, NFTfi promissory notes can be further leveraged in hedging strategies.

liquidity pool

liquidity pool

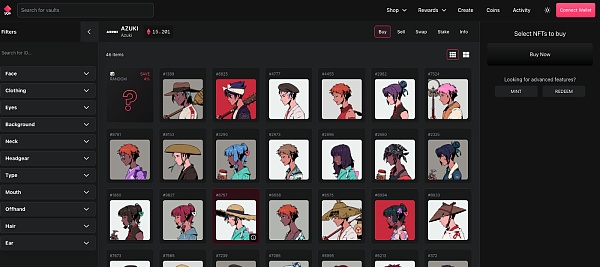

The liquidity pool allows users to deposit similar NFTs into the pool, mint a derivative Token, and redeem the assets in the pool at any time. NFT-LP protocols like NFTX and NFT20 effectively become marketplaces built on liquidity pools of “like” asset groups.

image description

Image: Azuki Vault on NFTX. All items have the same Buy Now price

The liquidity protocol does not have to find buyers for a specific NFT, but opens a buyer pool to those who want to buy any similar NFT, providing better liquidity than the general market. In addition, although representative ERC-20 derivative Tokens (such as NFTX's vTokens) can be traded in any number, a single NFT is not actually divided, and an NFT can be redeemed from the pool as long as you have a complete vToken .

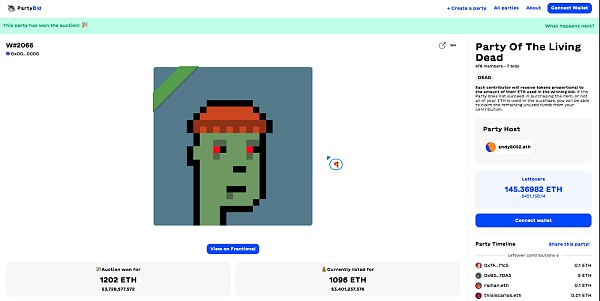

Fragmentation

Fragmentation

Fragmentation involves "breaking" an NFT into multiple parts, which can then be traded as fungible tokens (for example, 1 NFT becomes 10,000 tokens). By purchasing NFT "shards," more buyers gain exposure to the asset and its upside without having to purchase the full piece. "Shards" can be combined with other DeFi protocols, and can obtain a premium above fair market value through a buyout clause.

The limitation of this approach is the need to create new markets and provide liquidity for each NFT. This adds to the complexity of ownership and governance. This approach is more suitable for high-value NFTs and less useful for low-value/underlying assets.

image description

Image: On PartyBid, a group of people won the zombie punk auction at a price of 1202 ETH, and each contributor received a Fractional NFT decentralization Token in proportion

Szns takes a different approach, enabling the community to create lightweight governance DAOs that collectively manage decentralized NFTs. Album DAO starts with similar parameters for each community, and can define its own processes for buyouts, NFT management, token distribution, and arbitrary operations.

lease/loan

The leasing/loaning protocol allows users to lease out their NFTs in exchange for a stable fee (Twitter PFP Leasing) or future income (YGG lends AXIE Token to new players in exchange for future SLP earned in Axie Infinity). While reNFT and RenTable are more generic, there are also dedicated leasing platforms for specific NFT categories (e.g. Double for game assets, Landworks for virtual land) to support class-specific use cases Come together to rent adjacent virtual plots for large events.

image description

first level title

Other Price Discovery Solutions

algorithm

algorithm

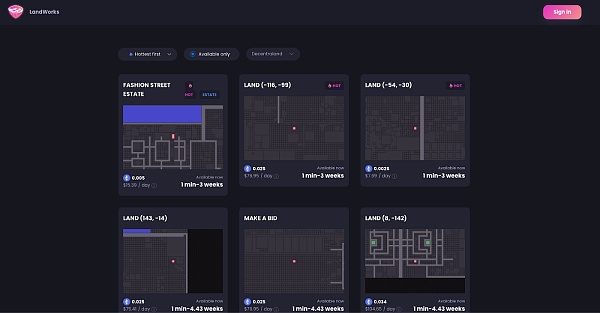

image description

Image: NFTBank's algorithmic valuation

This is a more capital efficient approach to pricing, as the fixed costs of developing a pricing model are amortized over time across the user's trading assets. However, given the relatively small amount of data available for top-tier projects, this approach is likely to be most useful for the valuation of low- and mid-tier projects for the foreseeable future. Data-driven approaches are also less useful for subjectively priced items, such as 1/1 artwork NFTs, for which cryptoeconomically incentivized evaluation protocols may be more suitable.

peer forecast

Peer predictions incentivize participants to answer questions about asset valuations honestly. Upshot incentivizes users to value NFTs using crowdsourcing. Abacus provides another way for sellers to discover spot prices for their NFTs, and it creates a liquid market for traders to speculate on the value of NFT pools.

As with the algorithmic approach, valuation costs are averaged across a large number of asset transactions through peer forecasts.

first level title

Define price class

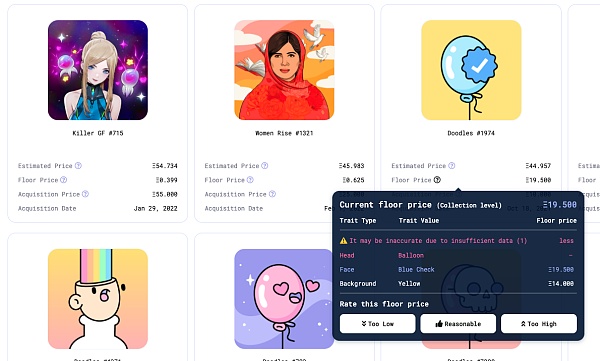

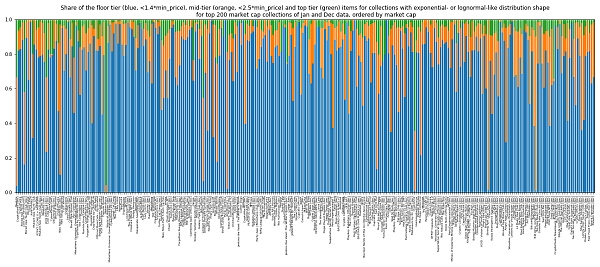

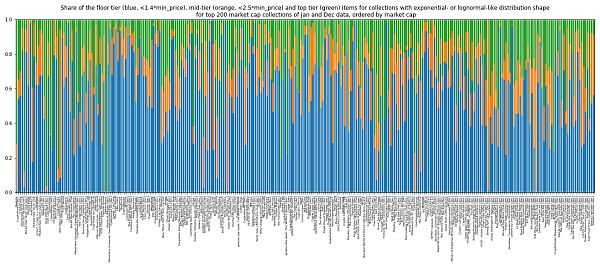

A rough framework for thinking about NFT prices is the price "tier" they belong to. By setting the price range, we can plot the price distribution:

low level:Most of the performance is homogeneous, making it especially suitable for liquidity pools, which effectively act as "on-site AMMs", users can earn income through the trading activities of on-site assets, and enjoy the deepest liquidity compared to other levels Sex. We define low-level price items here as prices between reserve price and reserve price * 1.4

intermediate:Intermediate NFTs may have attributes that make them more valuable than other tiers, but are not the most valuable items. We define this group as prices between reserve price * 1.4 and reserve price * 2.5.

top level:Top-tier projects can include general blue-chip collectibles (eg Fidenzas, Autoglyphs, CryptoPunks), or work by famous crypto artists (eg XCOPY, Beeple, Hackatao). But for our purposes, they are some of the rarest and often most sought after items in any collectible. For example, Alien Punks, Black Suit Board Apes, and Matrix CrypToadz. We define top-tier here as prices at and above reserve price * 2.5.

The following is based on NFTbank data on December 15, 2021 and January 15, 2022: the former contains 279 projects, totaling approximately 2.4 million NFTs, with an estimated market capitalization of 3.7 million ETH. The latter contains 540 projects totaling approximately 14.2 million NFTs, worth an estimated 8.9 million ETH.

image description

Image: share of NFT projects divided into bottom (blue), middle (orange), and top (green)

image description

Image: Market share of NFT projects divided into bottom (blue), middle (orange), top (green)

At first glance, financialization protocols for lower-tier projects appear to have the lion's share of the market, but there is a lot of untapped value in finding liquidity solutions for mid-tier and top-tier projects.

Mapping NFT price tiers to liquidity methods

image description

future

future

In addition to the development and adoption of NFT financialization projects described in this article, I would like to note the following:

specialization.composability.

composability.Protocols can leverage each other to further leverage idle assets. For example, NFT liquidity pools can reuse assets within an AMM, rent them out, or use them as collateral for loans. Alternatively, NFTs used as loan collateral can be leased for the same duration. Locked NFTs can be used to leverage liquidity or offset loan repayments.

Service DAOs.A community of analysts, appraisers, underwriters, and liquidity providers will continue to emerge to drive demand for financialization protocols. These can be formed within the community of the protocol itself, or within the community of NFT collectors. The service DAO will play a key role in helping the protocol guide adoption, improve valuation capabilities, and rapidly increase NFT liquidity.

New NFT derivatives.For example, Putty is a put options market that allows users to trade put contracts on any basket of NFT or ERC-20 Token. NFT holders can hedge downside risk by purchasing put contracts.

In this article, we define price tiers and provide some data about their market share, so that users can apply NFT to the most suitable liquidity method.

Although the trading volume of the NFT market has declined somewhat in the past month, the potential of NFT has not yet been fully released. Many still view NFTs as an illiquid asset class. But as we’ve seen with previous waves of innovation, as applications proliferate, there will soon be a wave of “infrastructure-building” that can enhance those applications and unlock more complex use cases for NFTs .

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.