DeFi has become a "falling out of favor" narrative? When will the next DeFi bull market come?

Compilation of the original text: The Way of DeFiSean Lippel

Compilation of the original text: The Way of DeFi

For decentralized finance (DeFi). How have we developed today, and how will we develop in the future.

During my long flight back from ETHDenver, I put together some thoughts, so it's time for a post to describe them.

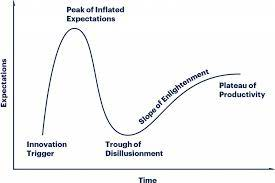

trough of disillusionment

We are now nearly two years into the #DeFi summer that ignited the 2020-2021 bull market. Today, blue-chip DeFi (what many call DeFi 1.0) is at the trough of disillusionment.

DeFi has become an "out of favor" narrative - the crypto market and its ever-expanding narrative, coupled with its tail of chasing hot money, has moved on to the next big thing. Social Tokens, Metaverse, GameFi, DAOs, pfp NFTS, Music NFTS and more have captured new hot headlines…

The share previously occupied by DeFi. And these competing narratives are less bookish and more culturally relevant. Plus, chasing new narratives has made some retail investors and traders a fortune!

DeFi has even been questioned by its earliest supporters — a prominent cryptocurrency investor recently questioned my unwavering focus on DeFi funds.

FinTech Collective believes that "DeFi will be cut into pieces". On crypto twitter, jokes abound about the dreaded DPI (DeFi Pulse Index)/ETH (Ethereum) ratio with apparently no end in sight.

Why did DPI bottom out when ETH itself became such a productive asset after EIP-1559?

On the other hand, DeFi TVL is not affected. DeFi Total Value Locked (TVL) continues to experience unfettered growth on a nominal and absolute basis. The total notional value locked in Ethereum DeFi is $115 billion. Including all other smart contract blockchains, the TVL of DeFi is close to $200 billion.

DeFi is unimpressed. Very nourishing to move forward. walk my own path. Focus on yourself. Strive to thrive. As a bank equivalent, DeFi currently ranks 19th among one of the largest banks in the US by total assets at $195.6 billion.

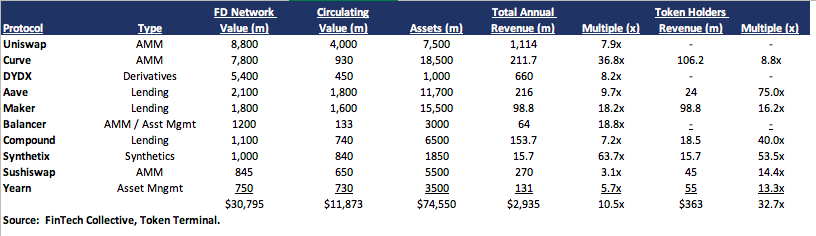

DeFi Network Value and Protocol Revenue - The current top 10 DeFi protocols have a combined FD network value of $31 billion. By my estimate, they generate $2.9 billion in annualized revenue on-chain, of which ~$365 million goes to token holders as staking dividends (sushi) or burns indirectly (MakerDAO). Yes, most of the revenue does go to liquidity providers. But a 10.5x FD value/revenue multiple and a 32.7x float value/token holder yield multiple aren't expensive, and for something growing 20x year-over-year, it's grossly undervalued.

We are still so early - the total stock market cap of global banking/financial services is about $20 trillion. Fintech, really just innovation on the front end, already accounts for an $80 billion market cap (4% penetration). The top 10 DeFi protocols, representing a true paradigm shift and a complete mid- and back-end rewrite of the entire financial system, have a network valuation of just $31 billion today (1.5% penetration/market share).

I don't think it's crazy to assume we have 100x+ growth in DeFi based on these metrics...

A standard crypto-style pullback — most DeFi tokens are now down 80-85% from their “peak of inflated expectations” highs.

MACCUS (Maker, Aave, Curve, Compound, Uniswap, Synthetix) are all experiencing standard pullbacks and you can expect pumps.

Regulatory risk is real in the US — there is no doubt that top DeFi protocols are already busy dealing with issues from the SEC and global regulators. The recent $TIME fiasco isn't helping. Small lawsuit by congressional staff also won't target @PoolTogether_

But, in the long run, the regulatory risks are overblown — and ultimately, consumer choice and sovereignty will win. Look at other tech-driven market disruptions from ride-sharing to hotels. Also, let's not forget that DeFi isn't just about Jerome and America!

For all long-term fundamental investors - until 2020, institutional capital contains < 5% in cryptocurrencies. Today, we're at a sweet spot of 15 - 20%. This has led to heightened retail investment driven by small cycles and momentum. DeFi networks are incredibly complex and nuanced —…

They have novel and difficult-to-assess qualities. Almost every day I discover something new about @MakerDAO. Institutional investors need time to do their jobs. To make matters worse, most funds are still not structured to...buy tokens. They can chase Circle equity at a $900M valuation, but cannot invest in @MakerDAO at a $180M valuation, MakerDAO brings MKR holders $100M+ annualized income. Thanks to Sequoia and Tiger for their hard work in making this possible. Looking forward to more attention...

For many reasons, DeFi protocols cannot enable protocol fees in the first place. We can still earn 5 - 25% from TradFi financial products, and I dare say that for established brands, DeFi protocols will be able to open up protocol fees of 5 - 50bps at scale. In a worst-case scenario, DeFi token holders have the option value of controlling tens of billions of dollars in DeFi treasury bonds. Those worthless DeFi governance tokens might not be so worthless after all.

These missing pieces will blow open these doors - over-collateralized loans, automated market makers, stablecoins and synthetic assets (the core primitives of DeFi 1.0) get us off the ground. The protocol-controlled revenues and advanced token economics (Ponzi economics?) that DeFi 2.0 brings us around the track before we completely trip over ourselves. We don't need any more embedded leverage. What we really need is scalability, real-world asset connectivity, and an identity layer for DeFi.

Layer 2 scaling will unlock new DeFi primitives - We now have 6+ Layer 2 scaling solutions fully in production and operational. We can now begin to imagine the possibilities of high-throughput, composable, and scalable DeFi architectures. Low cost, streaming payments and machine-to-machine payments via @Superfluid_HQ. Decentralized perpetual contracts and options on Dydx rival FTX in speed and performance. Login to the site with your ETH wallet and unlock walled content via @UnlockProtocol, pay per article.

DeFi with real-world impact - A real-world asset is any physical object that can be represented on-chain. Real estate, invoices, and even Spotify payments represent trillions of dollars of DeFi untapped assets, which also brings faster and cheaper capital to SMEs.

Bringing real-world assets into DeFi will also reduce the overall associated risk of the assets powering these new systems, thereby reducing overall systemic risk. Plus, we'll end up tethered to real-world economic activity, not just self-referencing. Identity and Compliance Layer — Whether you agree or disagree with KYC and AML, there is no doubt that DeFi needs some kind of identity layer to allow institutional-scale capital to participate. It doesn't have to be gross! We have the technology and capabilities today to make identity and compliance in DeFi based on decentralization and zero-knowledge proofs. At a minimum, we need to verify that participants are not on sanctions lists. This will unlock another $100 trillion+ in qualified DeFi participation...

This is not just an Ethereum DeFi love story - yes, I believe in censorship resistance from state attacks and maximum decentralization. I also don't like blockchains that can be turned on and off. But even in L2 season, the demand for computing for financial applications will exceed what Ethereum itself can provide. Competing layer 1s such as Solana, Terra, Algorand, Cosmos will play an important role, especially in application specific use cases. Some primitives need to be cheaper and faster than what ETH 2.0 + Layer 2 can provide.

The Embedded DeFi Argument

DeFi isn’t going away, in fact, it’s more likely to be “embedded” into all the cryptocurrencies you use in the future. That piece of virtual universe land you want to rent. You need a short-term USDC loan to hedge your $500,000 worth of BAYC. The Axie NFT that you want to trade in exchange for a new video game bundle NFT. This will all happen through DeFi primitives. Over time, NFTs, GameFi, and DeFi will merge into one. They will be each other's biggest use cases.

This all sounds great, so when is the market bottom? - Hard to say. I think we're pretty close to a meaningful bottom. Maybe we still have 20-30% downside to go, but that pales in comparison to the asymmetric risk-reward that DeFi is about to see…

in the next ten years. We may be in for a while of consolidation before entering the next phase of the DeFi bull market. But expecting DeFi tokens to eventually go to zero like a lot of crypto tweets - well, that's just plain stupid.

I hope you enjoyed this long post. I've been cobbling together something substantial to complete my "DeFi is a Continuum" piece, which I've been writing for 3 years now.

Now back to doing what I do best and getting more involved.