Running out of oil? Can the bleak situation of Sushiswap be reversed?

This article comes fromTwitter, the original author: 0xHamZ

Odaily Translator |

Odaily Translator |

The plunge in Facebook's stock price has caused the technology giant's market value to plummet. Obviously, under the attack of Wall Street's short money, the "technical bulls" lost.

So, will the same situation happen in the encryption industry? What happens if a crypto project suffers a "funding short"?

Sushiswap, the once glorious DEX project, seems to be in trouble now. As shown in the figure below, the transaction volume of Sushiswap has shrunk very seriously. What caused this problem? Let's dig a little deeper.

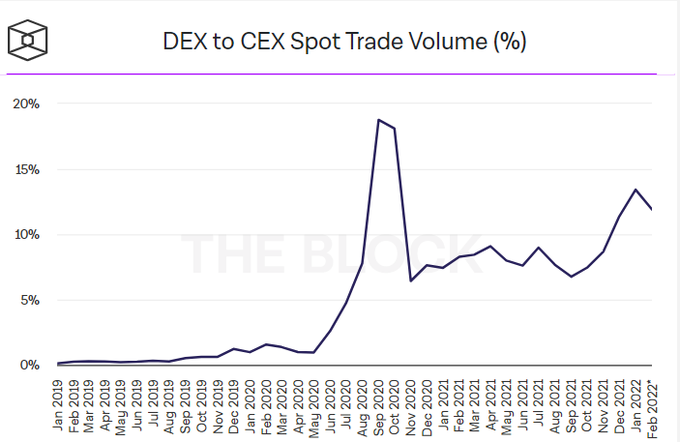

First, let’s take a step back and understand the current state of the crypto trading industry. At this stage, in terms of spot transactions, the trading volume of DEX accounts for about 10-15% of the trading volume of CEX. If analyzed based on the Technology Acceptance Model (TAM), DEX has indeed maintained a relatively rapid growth rate, but we cannot understand the role of AMM (Automated Market Maker) technology in the growth of DEX. Judging from the current situation, it is very difficult for DEX spot trading market share to further increase.

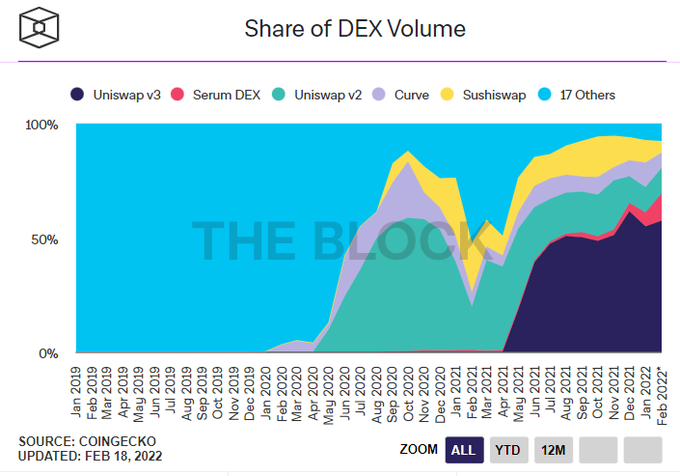

In the DEX market, it is easy for us to get lost. For example, people often focus on "who has the largest market share", "which chain has the best performance", and "which chain has the most convenient transaction". But it is undeniable that in the current DEX field, Uniswap still occupies a dominant position.

The reason why Uniswap can take the lead in DEX is mainly due to the following advantages:

1. Lowest transaction fee;

2. Highest brand awareness;

3. Uniswap V3 provides better liquidity concentration.

Curve (CUV) also has a place in the DEX market by allowing users to trade between DAI and USDC with a low-latency, low-fee algorithm designed specifically for stablecoins. Like Uniswap or Balancer, Curve allows cryptocurrency users to buy and sell assets at potentially better prices to earn yield.

Today, the AMM market is very competitive, and over time, some AMMs will continue to cut fees to attract users. If an AMM reduces the fee from 5 basis points to 3 basis points, I believe no one will object. Let's take a look at what Curve did, they removed key liquidity pools such as CRV/ETH and CVX/ETH from Sushiswap and migrated to the Curve protocol.

Sushiswap may no longer be profitable.

Sushiswap is also a DEX, which is essentially a "forked DEX" of Uniswap. The innovation of Sushiswap is to use its native token to incentivize/reward liquidity providers (LP), who can generate transaction fees, and will gradually let the community own the protocol over time.The idea itself is really good, but the problem is,。

Now no one wants to use Sushiswap

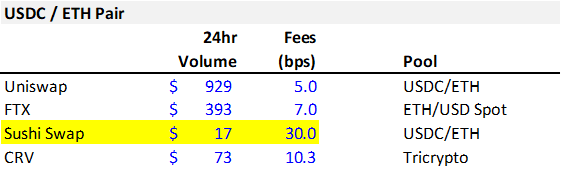

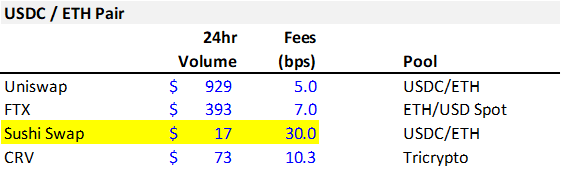

Let's take a look at the ETH/USDC pair - the most traded pair on Sushiswap. Now, Sushiswap is stuck between CEX, Uniswap, and Curve because it has no product/market fit. Sushiswap is actually an "expensive version of Uniswap" based on inflation tokens, but now it has become a "sandwich biscuit" (as shown in the figure below).

For now, DEXs inspired by Sushiswap, such as Trident, Bentobox, and Onsen, have attracted more attention from bulls and have received a lot of funds as a result. In fact, the so-called "technology" often requires a trade-off between competitiveness and value, either by lowering rates to attract users to gain more competitiveness, or to bring more value to users, and most AMMs also Following this rule (let us know if you have exceptions).

Frankly, there are no bad assets, only bad prices.What you have to focus on is not what you buy, but what you can sell.

If we look at the valuation data given by Token Terminal (as shown in the figure below), we will find that Sushiswap has always been the "cheapest" DAO.

I once valued Sushiswap at 17.5 times its net sales, but this indicator figure is obviously exaggerated, mainly for the following reasons:

1. The 7-day annualized fee has risen sharply due to market fluctuations;

2. The current lock-up volume will not drop significantly;

3. Sushiswap can no longer earn more on the ETH/USDC liquidity pool, but the fee it charges is 6 times that of Uniswap.

So, what will the ending of Sushiswap be like? Here are a few assumptions:

1. No one should be willing to use Sushiswap;

2. Sushiswap cannot obtain financial support and has no strategic use cases;

3. Compared with competitors, although Sushiswap has a large amount of excess returns, compared with other competitors whose locked positions are growing, Sushiswap’s valuation has no room for growth;