DAOrayaki: DAO industry progress (bi-weekly report)

Original Author: Paradigm

Original Author: Paradigm<> Gnosis treasury swap, mStable MIP 25 approved, Aave V3 is live on 7 testnets, and more!

Original: DAOs: Surprise Compound governance proposal, Maker's regulatory research, Wormhole bridge hack, Yearn's proposal to upgrade compensation system, Akropolis AIP-014, Balancer

DAO Industry Progress Bi-weekly Report Volume 18 - January 22 to February 5

Quick Facts:

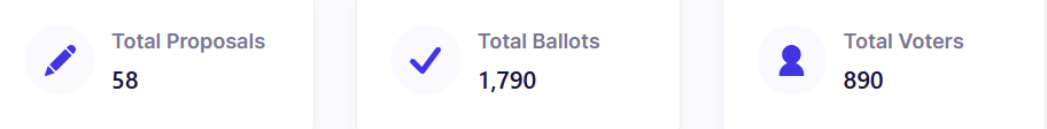

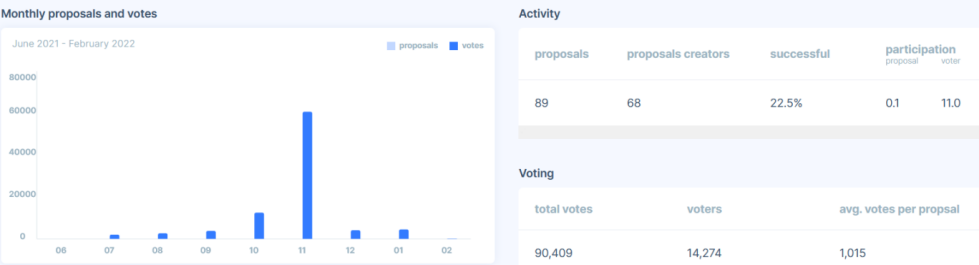

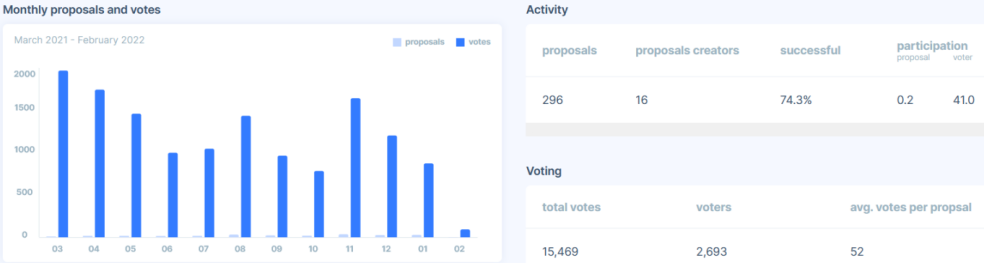

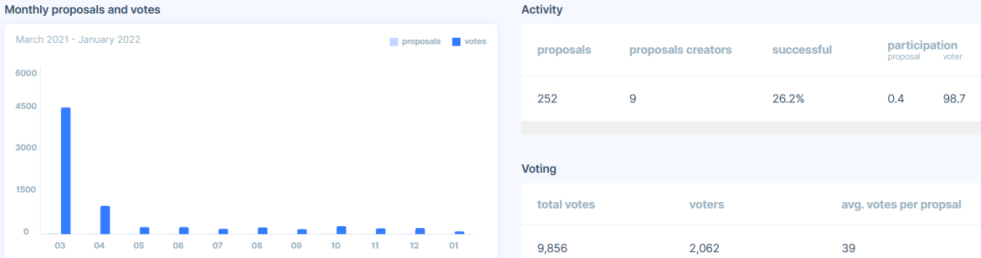

l DeepDAO.io: The number of people voting or proposing in the DAO now exceeds 500,000.

l Maker's KYC/AML regulatory research raises concerns about decentralization.

l Justin Sun introduced a surprising Compound governance proposal. GFX Labs proposes a contributor contract to the community. Proposal 084 went into effect, 083 succeeded, 082 implemented.

l After a successful proposal, Fei joined the Compound lending market. The DAO releases details of Turbo, a new product that expands Fei issuance and liquidity.

l DAOhaus launches Ceramic profiles.<>l Balancer DAO is considering transitioning to the ve token mechanism based on Curve governance. BalancerDAO<>BalancerDAO

GnosisDAO treasury swap. The community discusses the partnership with Polygon. BanklessDAO

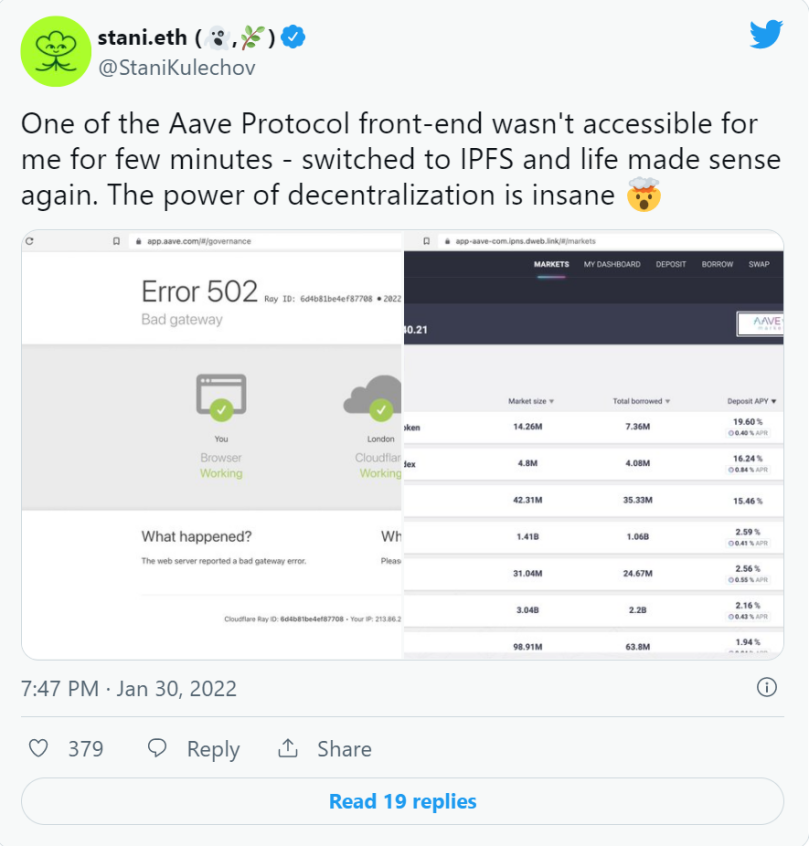

l Aave V3 runs on 7 testnets. The first cross-chain governance proposal has successfully updated Aave Polygon Market. Community Votes to Release Aave V3 on Evmos and Avalanche

l Akropolis AIP-014 balloting in progress. AIP-012 and AIP-013 have officially concluded and both passed a quorum

l Solana's wormhole bridge rescued after hack.

l GnosisDAO's GIP-13, 22 and 23 passed. GIP 24-28 are under discussion. A proposal to launch Aave V3 on the Gnosis Chain has been posted on the Aave Forum

l BadgerDAO's BIP 85: Added bveCVX and bveCVX LP as native in boost. A new podcast on security upgrades is available.

l Aragon 2022 DAO Research Update: What Do DAO Builders Need?

l The Nexus Mutual Signal Vote for Action TM-21 was live on Snapshot. Voting will be used to determine whether resources should be allocated to smart contract work required to implement formal on-chain governance voting.

l CLNY is now on Sushiswap on Gnosis Chain. 2022 Token Launch Auction Ends

l API3 Workathon 1.0 has launched: a five-week community initiative that encourages community members to team up and participate in a series of challenges.

l The Tranches battle in Idle is coming to an end. Lido and Idle demonstrate the stETH Perpetual Yield Part (PYT). Idle + Bancor.

l Lido's vote to initiate liquid staking on Avalanche is in progress. A proposal to gauge community sentiment towards LDO market makers and CEX listing demand was shared.

l Kyber Network reversed the decline of the entire market in January with a 57% increase.

l mStable MIP 25 has been approved. The proposal would upgrade smart contracts to allow direct deposits and withdrawals from any stablecoin on mStable to and from imUSD and imUSD vaults in a single transaction.

l The Yearn community discusses proposals to upgrade the Yearn compensation system.

l Synthetix released the Alsephina version.

l Yam's YIP-101 and 102 are voting live.

l Uniswap and NFTs proposal discussion.

l Gitcoin plans to conduct the 13th funding round from March 9th to 24th, 2022. Announcing the No Code Act Virtual Hackathon.

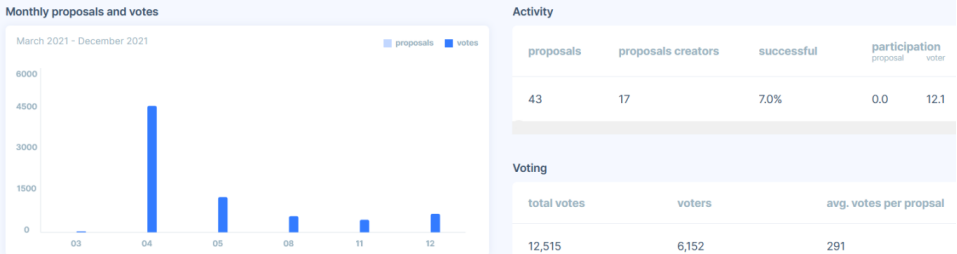

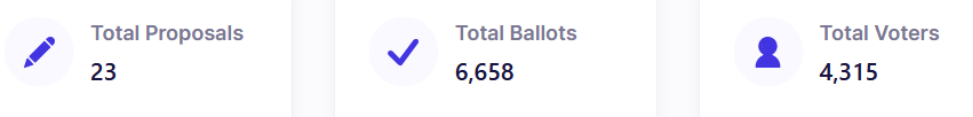

l The Tally DAO Challenge Report is now available.

l Gamestop and Immutable came under fire after grant money was immediately dumped.

l Inverse Finance approves the Inverse+ proposal to pursue stablecoin growth ambitions.

l The financial manager of Wonderland was exposed to have a history of fraud.

l The Osmosis and Sifchain exchange projects are facing bridge strategic conflicts.

l Binance lending project Qubit was mocked by hackers after 80 million exploits.

l Trading company mgnr has come under fire for extractive farming practices on Maple Finance.

l Assange DAO is the latest project raised using the Juicebox DAO crowdfunding mechanism.

l Syndicate launches tools to launch DAOs using legal documents.

l FriesDAO wants to launch a crypto-crowdfunded fast food restaurant chain.

l Active proposals: Aave, Akropolis, Badger DAO, Compound, Curve, Idle, Index Coop, LidoDAO, Nexus Mutual, MakerDAO, Synthetix, Yam Finance

l New and ongoing discussions: Balancer, GitcoinDAO, Synthetix, PieDAO, Uniswap, mStable, Yearn Finance, BancorDAO, GnosisDAO, PoolTogether, API3, KyberDAO, Kleros

l Humanode DAO's "Vortex" launch has been discussed.

l New MolochDAO grantee interview series.

l PoolTogether's DAO happiness survey.

l And more!

overview

DAO means "decentralized autonomous organization". It can be said that it is an open source blockchain protocol, governed by a set of rules created by its elected members, and executes certain actions autonomously without A middleman is needed.

“Instead of a hierarchical structure governed by a group of humans interacting in person and controlling property through a legal system, a decentralized organization is a group of humans interacting with each other according to protocols specified in code and enforced on the blockchain.” - Vitalik Buterin

DAO means "decentralized autonomous organization". It can be said that it is an open source blockchain protocol, governed by a set of rules created by its elected members, and executes certain actions autonomously without A middleman is needed.

Simply put, a DAO is an organization governed by computer code and programs. As such, it has the ability to function autonomously without the need for a central authority.

Simply put, a DAO is an organization governed by computer code and programs. As such, it has the ability to function autonomously without the need for a central authority.

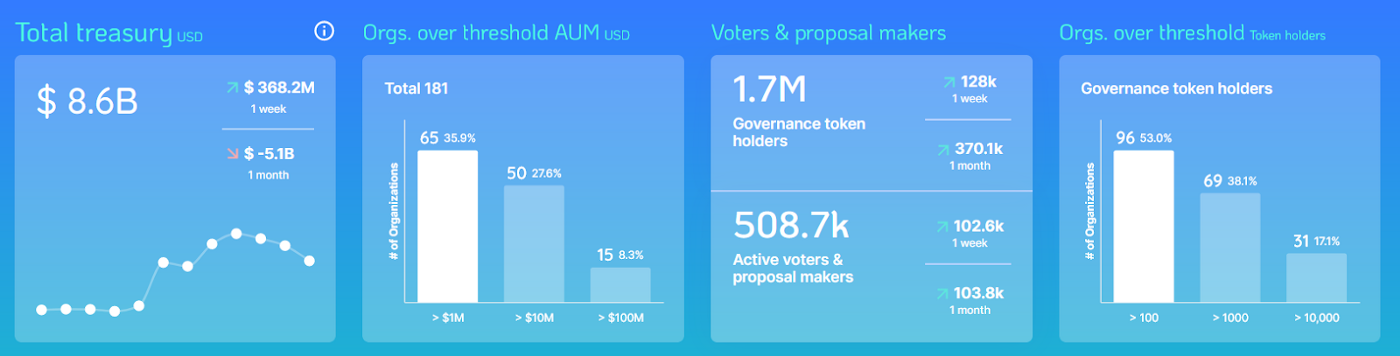

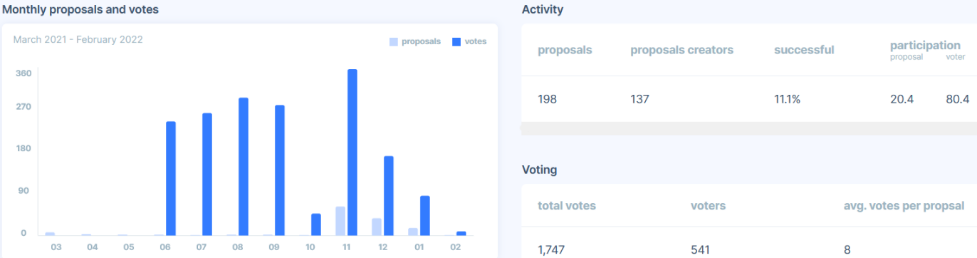

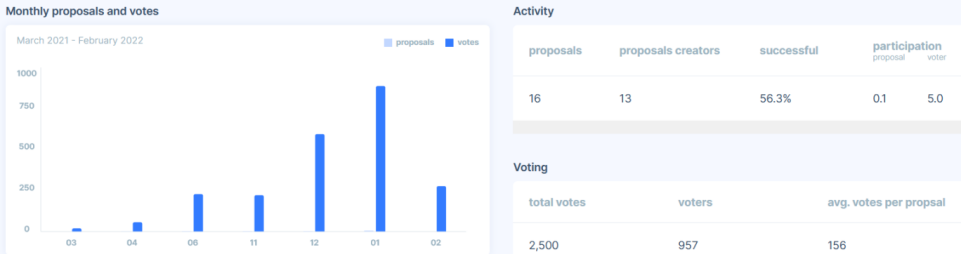

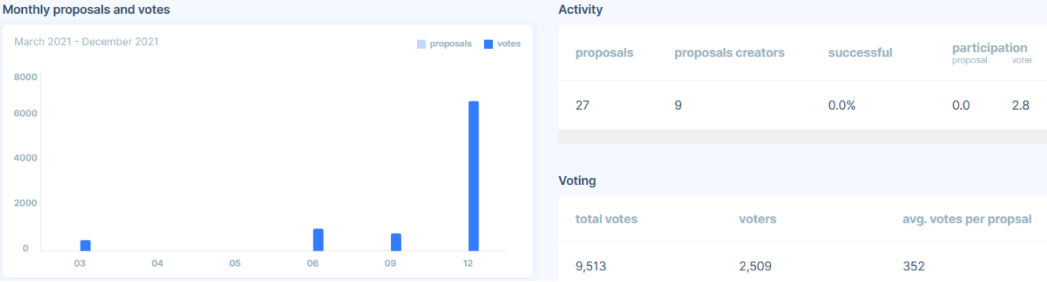

image description

Source: Deepdao.io

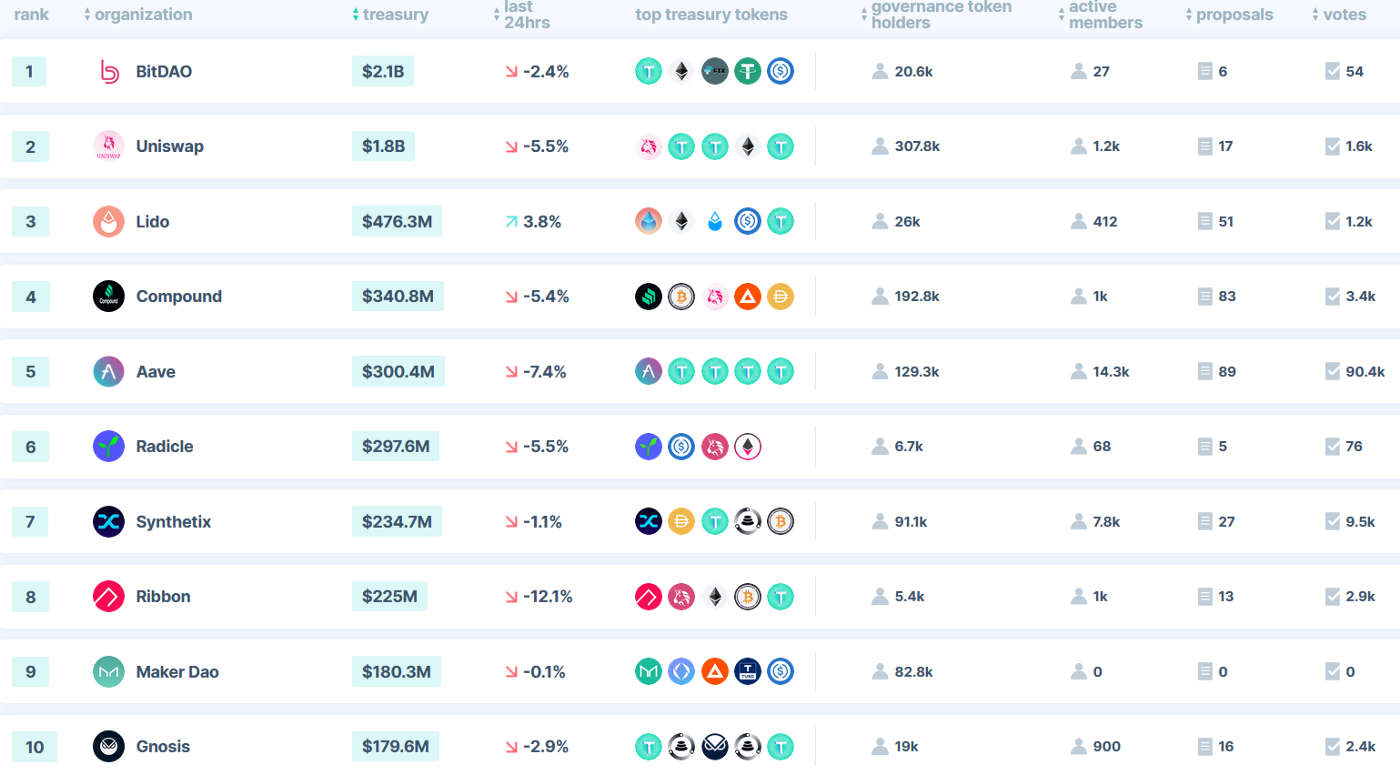

Top DAOs

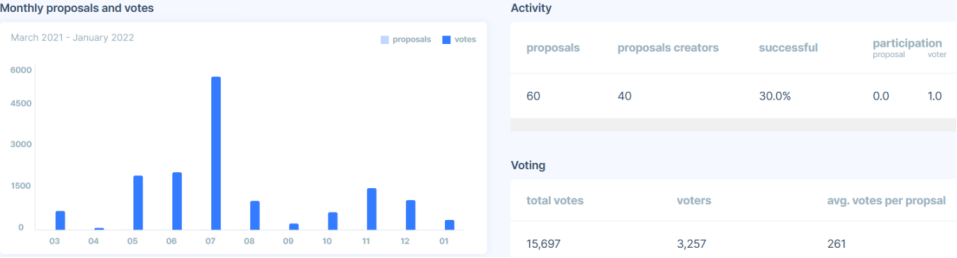

image description

Source: Deepdao.io

Source: Deepdao.io

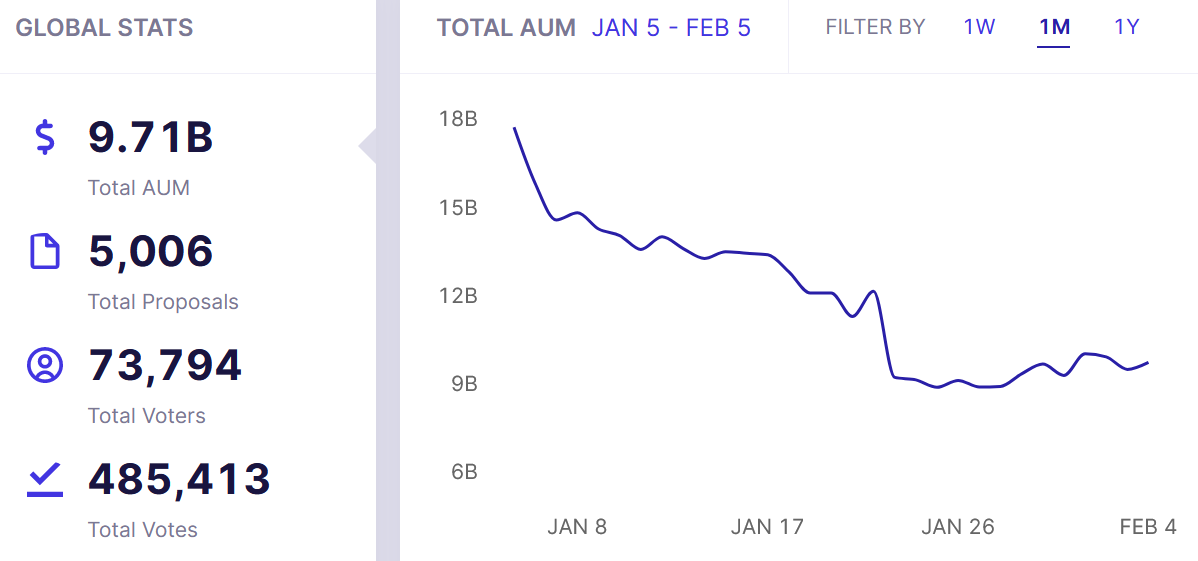

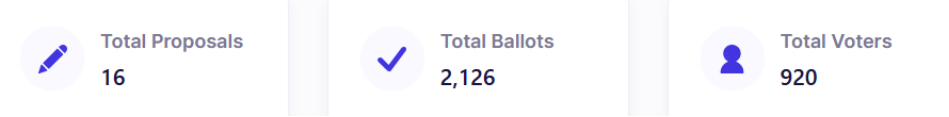

global data

Leading DAOs:

image description

Source: Boardroom

Read link:

DAOs Are Not a Fad - They Are a Platform | Jeff Kauflin & Isabel Contreras in Forbes

The promise of DAOs, the latest craze in cryptocurrencies | Tamara Helenius on the Commons Stack blog

Collaborative Economics: A Nonviolent Revolution Against Technocracy | 0xWicked on The DeFi Wonderland

2022 DAO Research Update: What Do DAO Builders Need? | the Aragon blog on the MolochDAOblog

MolochDAO Interview with Matt Garnett of EIP-3074 |

5 things DAOs need to fix to challenge traditional businesses | Andrew Nardez on Coinmonks

Web3 developer growth hits record high as ecosystem matures | Rachel Wolfson on Cointelegraph

How to Accept DeFi Governance Bribes | William M. Peaster on Bankless

Tally DAO Challenge Report

frame

1. Aragon

frame

2022 DAO Research Update: What Do DAO Builders Need? Three key insights from the latest research.

1. Complexity → Simplicity

3. Static→Adaptive

Colnoy

Recent blog posts:

Recent blog posts:

l CLNY Token Launch Auction: A Step-by-Step Guide

Closed Proposals:

l Mainnet CLNY Token Launch Proposal

The Commons Stack

Recent blog posts:

Recent blog posts:

Public Economics: A Nonviolent Revolution Against Technological Information: The first in a series that introduces collaborative economics designs and describes how the token engineering community, allied with the Commons Stack, uses these designs to start a public economy.

TS Project Showcase #1: Droplist by Chris::

Daohaus

HAUS Party LIVE!

Moloch

recent blog post

governance

Tribute Labs(OpenLaw)

governance

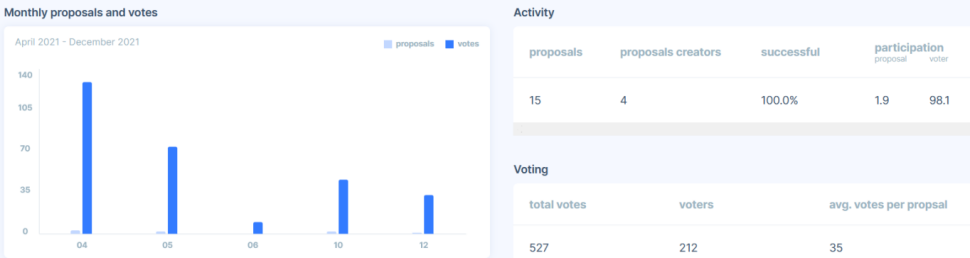

Aave

Deepdao.io

Boardroom

Active Proposals:

Active Proposals:

l ARC: Add FOX token (ShapeShift) as collateral

l ARC — Integrate Aave V1, V2 and AMM reserve factor, purchase CVX and deploy to earn income

l ARC — Add DPI as collateral on the AAVE ARC market

l ARC — Continue liquidity mining program on Aave V2 Ethereum market and introduce liquidity mining on Aave ARC market

l ARC: Avalanche Market — AVAX Risk Parameter Update

l Deploy Aave V3 on Evmos

Proposals that have been closed

Proposals that have been closed

l ARC - Enabling DPI Borrowing on Aave Markets [Ends February 4]

l Should UMA tokens be added as collateral on Aave? [Ends February 3rd]

l Launch Aave V3 on Metis Andromeda [ends February 3]

l Approved bounty for xSUSHI event [ends January 25]

l Added SEBA Bank to Aave ARC's whitelist [ends Jan 26]

l Launch of Aave on Boba Network [ends January 23]

On-chain voting:

On-chain voting:

l Add assets to Aave Polygon Market and update WMATIC risk parameters [executed]

New and ongoing discussions:

New and ongoing discussions:

l Start Aave V3 on Metis

l Launch Aave V3 on the Gnosis chain

l Start Aave V3 on Avalanche

l Add FRAX as collateral to Aave V2

l ARC: Add support for LUSD

The latest governance topics on the Governance Forum.

The latest governance topics on the Governance Forum.

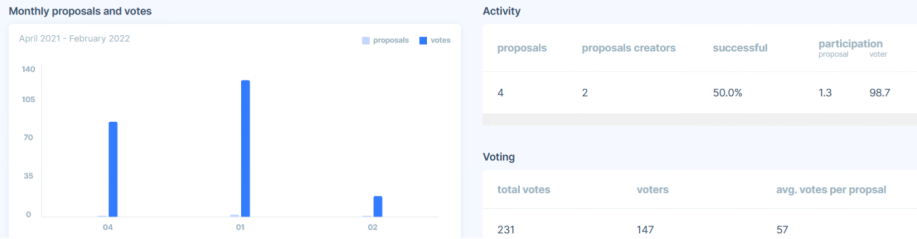

Akropolis

Active Proposals:

l AIP-014: Add Multisig signers and Multisig capabilities in crisis management

Closed Proposals:

Closed Proposals:

l AIP-012: Inflation | Guarding the Future

discuss:

discuss:

l AIP-012: Inflation | Protecting the Future (Token Economics)

l AIP-013: Vortex emission

source:

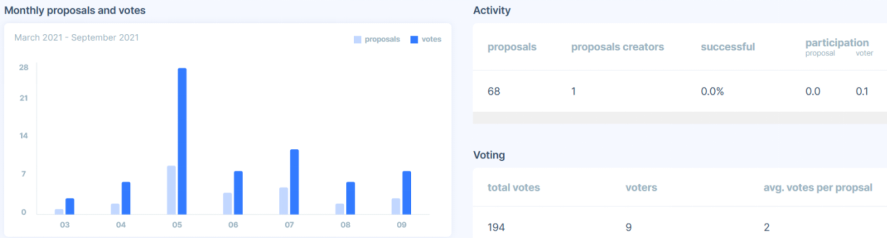

API3 DAO

source:https://deepdao.io

Recent blog posts:

Recent blog posts:

l API3 operational update: January 2022

l The transformation of Web3 to the first party oracle machine

API3 DAO Tracker: API3 DAO currently involves 4,699 members participating in 24 votes.

Official Proposal:

Official Proposal:

l [Second Proposal 20] Core Technical Team, February-April 2022

source:

The latest governance topics on the Governance Forum.

Badger DAO

source:https://deepdao.io

Boardroom

Active Proposals:

l BIP 85: Add bveCVX and bveCVX LP as native in Boost

Closed Proposals:

l BIP 84. DIGG Boost Recovery [Ends Jan 20]

New and ongoing discussions:

l BIP 85: Add bveCVX and bveCVX LP as native in Boost

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

source:

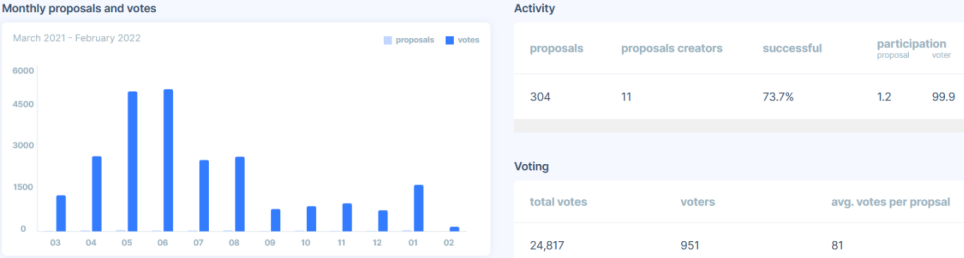

Balancer

Balancer

source:https://deepdao.io

Recent blog posts and news:

Recent blog posts and news:

l Beethoven X joins Balancer Labs bug bounty program

l 2022: the development prospect of Balancer

Boardroom

Proposals that have been closed:

Proposals that have been closed:

l BalancerDAO <>GnosisDAO Treasury Swap

New and ongoing discussions:

New and ongoing discussions:

l The partnership between BalancerDAO and Polygon DAO

l Proposal: Onboard Fire Eyes DAO as a strategic partner

l Introducing veBAL Tokenomics

source:

The latest governance topics on the Governance Forum.

Bancor

source:https://deepdao.io

Proposals closed:

Proposals closed:

l Increase ICHI trading liquidity from 750k BNT to 1 million BNT

l Whitelisted Poolz Finance (POOLZ) with 50,000 BNT trading liquidity

l Creation of a pool for the new Reserve Rights (RSR) token contract with a transaction liquidity limit of 750,000 BNT

l Increase the transaction liquidity limit in the CHZ pool from 20k BNT to 50k BNT

l Whitelisted Digital Fitness (DEFIT) with 50,000 BNT transaction liquidity limit

Interim check: Which platform should Bancor use for weekly community calls?

l Whitelisted Streamr Network (DATA) with transaction liquidity limited to 50,000 BNT

l Increased transaction liquidity limit in WOO pool from 750k BNT to 1M BNT

l Increase the trading liquidity limit in the TRAC pool to 1M BNT

l Proposal Addendum: Incentivize users to migrate to V3 by matching token-side LM rewards with up to 50,000 BNT per pool

l Whitelisted PHTR token with 100k BNT trading liquidity

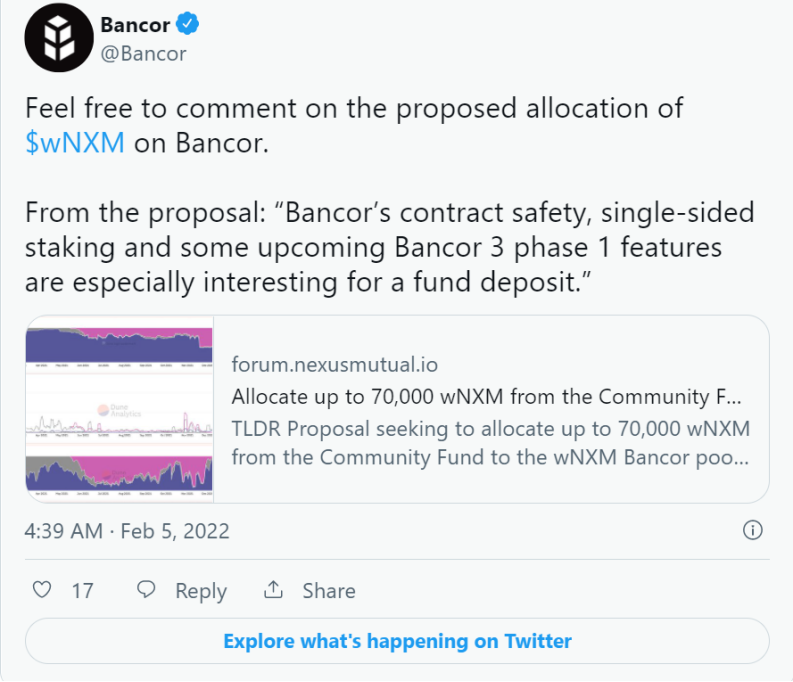

New and ongoing discussions:

New and ongoing discussions:

l Proposed to whitelist Tempus Finance (TEMP) with a trading liquidity cap of 100,000 BNT

l It is recommended to gradually increase the transaction liquidity limit in the wNXM pool from 2M BNT to 10M BNT, with an increment of 1M BNT

l Proposal: Increase the trading liquidity limit in the REQ pool from 1 million BNT to 1.75 million BNT

l Proposal to increase transaction liquidity limit in SHEESHA pool from 50,000 BNT to 250,000 BNT

l Proposal: Onboard rETH 250K trading liquidity

To read more about the different proposals and participate in the decision-making, check out the forum.

Compound

Deepdao.io

Tally

To read more about the different proposals and participate in the decision-making, check out the forum.

Justin Son returns to catch voters off guard with compound proposal: Like previous encounters, Son is using borrowed governance tokens in an attempt to increase adoption of the TUSD stablecoin.

Earlier this week, defi and governance consulting firm GFX Labs raised the alarm about a suspicious COMP lending transaction. It is reported that Justin Sun, famous for launching the Tron blockchain, borrowed 90,000 COMP tokens and reached the prescribed threshold for submitting governance proposals.

Compound Proposal 45

This mirrors a previous proposal, Compound Proposal 45, in which Sun also borrowed COMP tokens to meet the stated proposal threshold and vote in support of TUSD integration. While the proposal has broad support from voters due to its low risk, as TUSD is settled without accepting it as collateral, the current vote could be more contentious.

The proposed maximum 80% loan-to-value ratio for TUSD would mirror the wider use of USDC, which also seeks to add COMP incentives to the TUSD lending pool. Sun will benefit both directly (he is typically the largest TUSD liquidity provider across the protocol) and indirectly (he was also reportedly involved in a new ownership syndicate that purchased TUSD issuer Trusttoken in 2020). TUSD has been integrated between Aave and Maker for over a year without loss, but this still affects Compound as the protocol will be exposed to credit risk from other stablecoin issuers.

As the proposal largely sidesteps these criteria and surprises voters, we may see waves of principled opposition, even if changes in the target parameters are acceptable in themselves. Sun's recent public responses suggest that the importance of these soft governance standards is becoming better understood.

Boardroom

Active Proposals:

l 084 TrueUSD Market Upgrade Payout [Ends February 9th]

Proposals closed:

Proposals closed:

l 082 Dynamic Risk Parameters - Quarterly Update Event [ends January 22]

New and ongoing discussions:

New and ongoing discussions:

l Bug Bounty Program for Composite Proposals

l Multi-chain strategy

l GFX Labs offers to become a contributor

l FRAX Listing Proposal

l Add market: FEI

The latest governance topics on the Governance Forum.

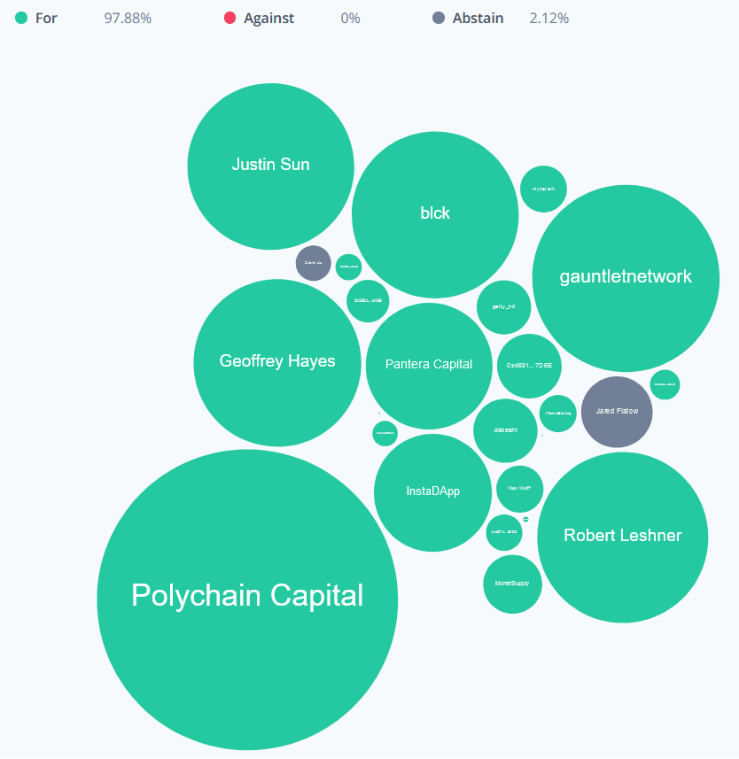

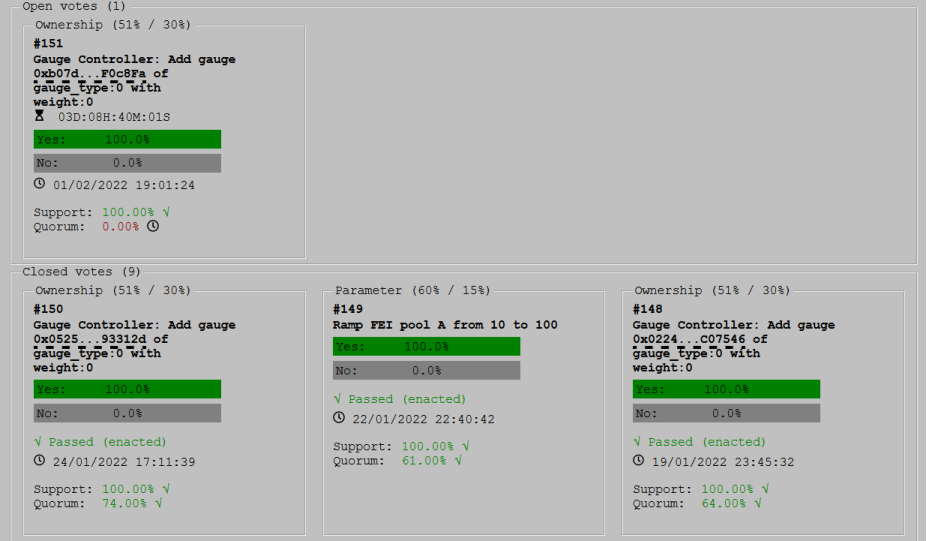

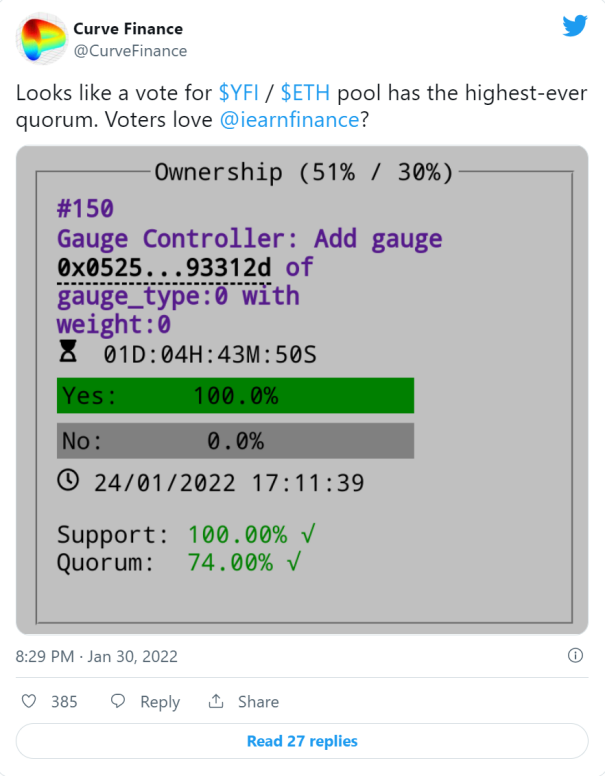

Curve

Deepdao.io

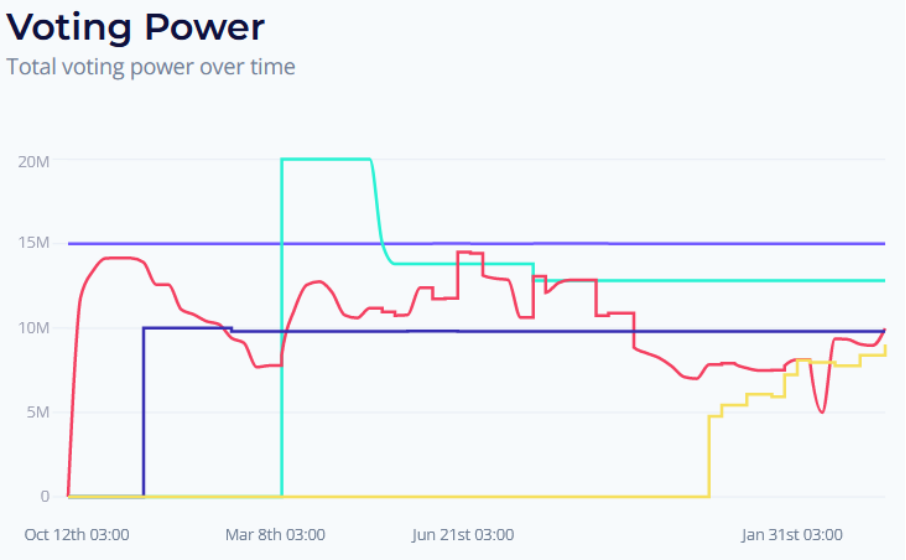

Voting. Power:

The latest governance topics on the Governance Forum.

Activity Snapshot Proposal:

l Launch the RocketPool rETH mining pool to promote decentralization.

l Will CRV continue to hit new highs in 2022?

New and ongoing discussions:

New and ongoing discussions:

l [Discussion] Get CVX positions

l It is recommended to add DYDXETH Gauge

l It is proposed to increase the parameter of USDN mining pool A to 500

l Curve Fantom NFT —— Solidly / Solidex

To read more about the different proposals and participate in the decision-making, check out the forum.

Curve Wars | Curve Market Cap:

Gitcoin

Tally

Tally

Boardroom

Proposals closed:

l Gitcoin DAO — Workflow Accountability Process [closes Jan 25]

New and ongoing discussions:

New and ongoing discussions:

l How does DAO prioritize edge wheels?

l Introduce the Management Committee

l Moonshot collective workflow budget request Q2 2022

l [Proposal] DAO Operational Workflow Budget - Q1 2022

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Builderband Meeting #9 [2022/1/26]:

Gnosis

Boardroom

Proposals that have been closed:

Proposals that have been closed:

l GIP-13: Should Gnosis DAO continue to deploy CowDAO and vCOW tokens?

l GIP-22: Partnership agreement between BalancerDAO and GnosisDAO [ends January 28]

New and ongoing discussions:

New and ongoing discussions:

l GIP-27: Gnosis Guild

l Distribution of funds to Gnosis Ltd

l GIP-26: Cooperation with 1inch to increase GNO:1INCH liquidity

l GIP-28: Allow GNO holders to vote even if their GNO is invested/staked/locked in a smart contract in a different protocol/network

Find the latest GnosisDAO proposal here.

Find the latest GnosisDAO proposal here.

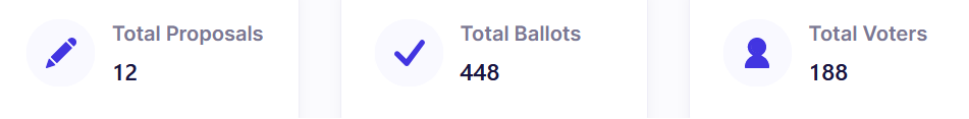

Idle

Deepdao.io

Tally

Recent blog posts and news:

l Lido + Idle: stETH's leveraged income and deposit protection

Boardroom

Active Proposals:

l Batch Battle - Final

Proposals closed:

Proposals closed:

l [Temperature Check] - Batch's $IDLE meter

l Battle of the Batches - Playoffs #3

l Battle of the Batches - Playoffs #2

l IIP-18: Upgrade the idle governor Alpha to the compound governor Bravo

New and ongoing discussions:

New and ongoing discussions:

l Battle of batches: choose which assets to integrate next

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Index Coop

Recent blog posts:

Recent blog posts:

l Know Your Unbanked DeFi Innovation Index (GMI) Token: Maple Finance (MPL)

Boardroom

Active Proposals:

Active Proposals:

l [COMPOUND-84] TrueUSD market upgrade

Closed Proposals:

Closed Proposals:

l IIP-129: Metagov Delegation Request - Delegate Aave to EOA to enable DPI borrowing and DPI on ARC AIP

l [Compound-83]

l Fund balancer DAO in the first quarter of 2022

l BalancerDAO <>l [AAVE-57] Revert ENJ parameter changes and enable FEI as collateral on Aave V2

GnosisDAO Treasury Swap

l IIP-128: The first round of priority recruitment

l IIP-119 DG2: Start iMATIC, iETH, BTC2X, iBTC FLI on Polygon

l IIP-127 DG1: Enable layer 2 indexing (LAYER2)

l IIP-126 DG1: Launch of Total Crypto Market Cap Index (MCAP)

l [AAVE-55] Enable FEI as collateral on Aave V2

New and under discussion:

New and under discussion:

l IIP-129: Metagov Delegation Request - Delegate Aave to EOA to enable DPI borrowing and DPI on ARC AIP

l Index Committee - term ends 28 February (poll)

l IIP-116: Redirection of DPI, MVI, DATA and BED income to operating accounts

exist

existhereFind the latest Index Coop proposals.

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Kleros

Deepdao.io

Boardroom

There have been no active KIPs for weeks.

discuss:

discuss:

l Implementation of 'test cases' to check expertise before going to court

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Kleros Online Meetings - Kleros Justice Fellowship:

KyberDAO

There have been no active proposals in recent weeks.

Find all proposals here. Check them out on GitHub.

Lido

Recent blog posts:

l Use Easy Track to optimize DAO governance

Boardroom

Active Proposals:

Active Proposals:

l Lido for Avalanche — joint proposal of Hyperelliptic Labs and RockX<>WETH pair

Proposals that have been closed:

Proposals that have been closed:

l Allocation of funds for LEGO sponsorship of the Unbanked podcast/newsletter

l Proposal: Sponsor the Bankless Podcast/Newsletter

New and ongoing discussions:

New and ongoing discussions:

l Referral program white list [Ethereum]<>l RFC: Allocation of treasury assets to Univ3 wstETH

WETH pair to promote Compound listing

l LIP-12: On-chain part of post-merger reward distribution

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

MakerDAO

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Maker’s regulatory research raises concerns about decentralization: While Maker remains committed to maintaining permissionless access to DAI, it has growing regulatory risks as it forays into real-world assets and institutional lending protocols.

While DAI was originally backed only by ETH, the inability to satisfy stablecoin demand using only that asset led Maker to support a growing number of collateralized assets and lending arrangements. Maker’s collateral portfolio has grown to include a large number of fiat-backed stablecoins such as USDC, in addition to other large crypto assets such as LINK and bridging crypto tokens such as WBTC.

DAI’s stablecoin support is problematic from several angles. It reduces public perception of DAI censorship resistance (stablecoin issuers are at risk of being forced to freeze Maker funds), involves potentially considerable credit risk for the issuer, and does not contribute any revenue to offset the risk. Therefore, while it provides an important avenue for balancing the supply and demand of DAI, reducing excessive stablecoin support is a key priority in Maker governance.

While borrowing rates continue to fall, standard crypto vaults appear unable to make up the difference, and Maker has identified real-world assets (RWA) and institutional vaults as key sources of future supply growth. RWAs include loans against real estate and invoice financial collateral, while institutional vaults allow reputable counterparties such as trading houses to obtain large lines of credit at low fees.

Each of these mechanisms provides the benefits of sustainable income and diversification of credit risk, but they also introduce new legal and regulatory issues. For example, some RWA or institutional vault onboarding processes may create a "client relationship" that falls within the scope of financial regulations.

This brings us to MakerDAO's current controversy over KYC regulations. Maker recently funded a $4,500 grant to explore potential regulatory risks, specifically KYC/AML recommendations issued by the Financial Action Task Force, an intergovernmental regulatory organization. While this initially attracted little attention, it garnered more attention after Yearn contributor Banteg surfaced it on Twitter. Aside from some banter about the issue (like the tweet below), many people have real concerns about imposing KYC regulations on defi.

On the one hand, regulatory research can be a valuable way for protocols to mitigate risk and maintain their core values such as permissionless access and decentralization. But research may also indicate a tacit acceptance of regulation, as many in the crypto space strongly oppose KYC and financial oversight in principle.

Active Polls (2 Polls - Closes February 7th)

l Community Green Light Poll - Stable Note (2 to 10-year US Treasuries)

l Community Green Light Poll – STABLE-TBILL (U.S. Treasuries Up to 12 Month Maturity)

Closed polls (16 polls - closes January 24)

l Community Green Light Vote - OGN (Origin Protocol)

l Community Green Light Voting — OUSD (Origin Dollar)

l Community green light voting - RBLD (Robinland Holdings)

l Community favor voting — TUSD-PSM (TrueUSD)

l Community Green Light Voting — USDap (BondAppetit)

l Approval vote to revise core unit budget, ORA-001 (Oracle Gas Costs) (MIP40c3-SP45)

l Approval vote for admission to Technical Operations Core Unit (TECH-001)

l Approval vote of the Strategic Finance Core Unit (SF-001)

l Approval vote for collateral departure process (MIP62)

l Core Unit Budget Approval Vote, SNE-001 (MIP40c3-SP47)

l Approval vote for the MakerDAO Critical Infrastructure Vulnerability Reward Program (MIP64)

l Maker Keeper Network (MIP63) approval vote

l Approval vote for external content production core unit (MKT-001)

l RWF-001 (MIP41c4-SP27) Instructor Entry Approval Vote

l Approval Ballot to Revise Core Unit Budget - Sustainable Ecosystem Expansion (SES-001) (MIP40c3-SP55)

implement:

l Recognized representative compensation, increased emergency shutdown threshold, MOMC parameter changes, core unit DAI budget flow correction [approved on February 4th]

New and ongoing discussions:

New and ongoing discussions:

l MIP4c2-SP15: core unit resignation process revision

l MIP40c3-SPX: modify the core unit budget

l MIP60: Transfer of Intangible Assets

l [Signal Request] gbMKR, a proposal in favor of long-term MKR holders

There are a lot more!

There are a lot more!

Read more about the different proposals and participate in the decision-making.

Governance ForumandGovernance Forum

mStable

Boardroom

Closed Proposals:

Closed Proposals:

l MIP 25: save the unpacker

MCCP 14: Whitelist Abachi Multisig for Staking V2

l MCCP 13: Increase the cache of BUSD and GUSD feeder pools

New and ongoing discussions:

New and ongoing discussions:

l MIP 25: save the unpacker

l [RFC] Reforming the Governance Fee Process

l [RFC] Stop COMP and stkAAVE liquidation

l [RFC] Add FEI to mUSD basket combination

l MCCP 16: Fee restructuring for swaps and redemptions

l [RFC] Use of Solv Finance for community and long-term MTA bonds

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

AMA with Nexus Mutual — mStable:

Nexus Mutual

Deepdao.io

Active Proposals:

l Signal Vote TM21: Use 8000 ETH in the fund pool for the second wNXM repurchase

discuss:

discuss:

l Proposal: TM21 Action

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Vote on governance proposals here to determine the future of the protocol.

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

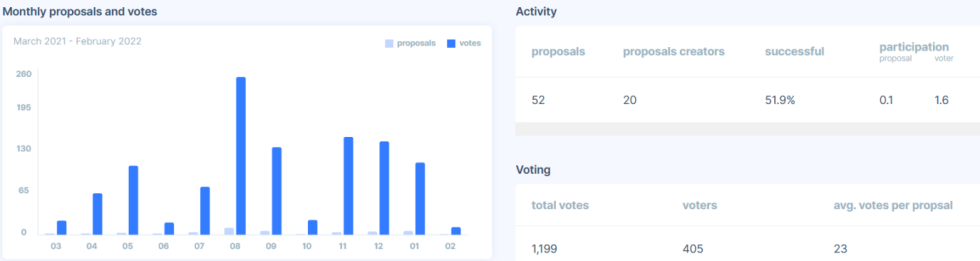

Synthetix

Deepdao.io

Recent blog topics and news:

Recent blog topics and news:

l WETH/SNX rewards on L2

Boaedroom

Active Proposals:

Active Proposals:

l SIP-209: Update ExchangeRates for backward compatibility

l SCCP-163: Update Optimism Chainlink oracles to OCR

l SIP-202: target equity ratio

Proposals closed:

Proposals closed:

l SIP-201: Allows governance of L1 when OVM is inaccessible

l SIP-185: Share of Debt

source:

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Pie DAO

source:https://deepdao.io

Tally

Boardroom

Proposals closed:

l Temperature check - should Uniswap provide Voltz with v3 additional usage license?

New and ongoing discussions:

New and ongoing discussions:

l Uniswap and NFT

l Temperature checks - should Uniswap incentivize liquidity through optimism and arbitration?

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

To read more about the different proposals and participate in the decision-making, check out the Governance Forum.

Yam Finance

Deepdao.io

Tally

Active Proposals:

Active Proposals:

l YIP-101: Suspend Rari circuit breaker implementation

New and ongoing discussions:

New and ongoing discussions:

l YIP-102: Multi-signature replenishment

source:

Check out the latest YIP discussions here.

Yearn Finance

Recent blog posts:

Recent blog posts:

Boardroom

There have been no active proposals for these weeks.

discuss:

l [Proposal] Streamline contributor compensation

Check out the latest YIP discussions here.

MISC

Check out the latest YIP discussions here.

SushiSwap at the Crossroads

It's been an eventful few weeks for SushiSwap, as internal strife continues to spill out into the open, sparking calls for major changes to the popular DEX. Thus, SushiSwap finds itself at a crossroads. Three big questions remain to be answered:

1. What the hell happened?

2. Where does sushi come from?

3. What are the revelations and lessons learned from this failure?

There have been some forum posts urging an answer to the first question, see this post from SushiSquad and this proposal from Shipyard Software, creator of the Clipper DEX.

Regarding the second question, several key stakeholders provided answers that the community is considering:

1. Alex Woodard of Arca and Dean Eigenmann of Dialectic proposed to reorganize Sushi DAO, including:

l Establish a legal entity for SushiSwap.

l Create a community-chosen committee to replace Sushi's previous "benevolent dictator" model.

l Formalize product, operations and development teams and open source contributor models across Sushi's product line.

1. Daniele Sesta of the Abracadabra/Popsicle Finance/Wonderland Ecosystem proposes "DAO to DAO" to effectively integrate SushiSwap with "Frog Nation".

A Sushi and Frog Nation alliance would be a huge win. The synergy between the Frog Nation project and Sushi is incredibly complementary. Sushi needs to go back to where it started. This is everyone's DEX, the one people choose to use. Popsicle Finance is a liquidity manager, Abracadabra offers MIM stablecoins, loans and leverage, and Wonderland strives to be the largest DAO in existence. Sushi can get the authorization it needs to thrive and become the largest DEX on all chains.

1. The motivation of community member hhk to release "SGP-0: Sushi ORGv2" is as follows:

l Create a lifecycle process for future proposals to clarify and simplify governance.

l Implement SafeSnap to allow off-chain voting to be performed from the Snapshot chain.

l Establish a representative committee to improve transparency and internal governance.

l Develop a code of conduct.

The third question above—lessons learned from this failure—generated a lot of discussion on Twitter and elsewhere.

The main conclusion: Governance, especially decentralized governance, is a mess. However, this ordeal with Sushi brought home the importance of organizational structure and transparency in the context of DAOs.

As Adam Cochran points out, Sushi is a case study of why DAOs need to establish processes related to power transfers without risking complete chaos. Second, as the Orca protocol points out, DAOs need to carefully structure themselves to handle growth.

Fei and Rari Capital to Merge Following Successful Governance Vote

The conversion of RGT to TRIBE is now open, and a "ragequit" mechanism that allows tribes to convert to the FEI stablecoin at a fixed price is being implemented.

With successful governance votes from the Fei and Rari communities, the FeiRari merger is finally live. For token holders in the newly merged organization, there are some key actions and decisions to address in the coming days.

Holders can visit jointhetribe.xyz to begin the process of converting RGT to TRIBE, but do not rush as there is currently no planned expiration date for the conversion process. However, the Fei protocol also offers TRIBE holders a “ragequit” option to redeem their tribe for $1.07 in the FEI stablecoin, valid only for the next few days until December 26.

While the TRIBE price was lower than the redemption price before the merger took effect, Fei's team multisig quickly closed the gap by redeeming 10 million TRIBE tokens and immediately buying back 10.5 million TRIBE with the FEI received. This swift action helped the protocol avoid unnecessarily paying around $500,000 in arbitrage profits.

Rari<>According to Alex Kroger's handy Dune dashboard, a little over 6% of the fully diluted Horde supply has been redeemed via the ragequit function (about 12% of the circulating supply). Providing easy access to exit liquidity helps ease potential internal tensions among those unhappy with the merger. For projects with large amounts of liquid assets or equity, this ragequit mechanism will hopefully make mergers and acquisitions more welcoming to the target community.

CityDAO

Fei Merger Passed: The Controversial Rari Capital and Fei Protocol Merger Is Underway! Twin proposals from both communities passed - 93% to 1% among RGT holders and 90% to 0% among TRIBE holders.

Back in July, Scott Fitsimones tweeted about a DAO to buy and tokenize land in Wyoming, and now there is a DAO with $7 million in its treasury and 40 acres of land in Wyoming. If you're not familiar with the CityDAO story: read this recap

This week, CityDAO took another step forward with the proposed CityDAO Council. As one might expect, owning and tokenizing land titles is fraught with legal challenges, and now that CityDAO has begun scaling in earnest, the community is looking to formalize things to ensure their experiments can continue to thrive.

The CityDAO Council will be elected by citizen NFT holders and take over responsibilities from the existing "core team", focusing first on approving the CityDAO Charter and implementing the DAO LLC Operating Agreement. Read more details: The Basics of CityDAO

And, next month, the first parcels of CityDAO land will go up for sale.

l The mirror protocol of the Terra ecosystem faces possible malicious self-transaction proposals:

l Debt DAO seeks to partner with OlympusDAO to help launch their DAO funding protocol:

l The Ethereum Foundation announced a huge allocation of funds to client teams:

Trading firm mgnr has come under fire for extractive farming practices on Maple Finance:

l Discussed the launch of the Humanode DAO “Vortex”:

l Syndicate launched a tool to launch a DAO with legal documents:

l FriesDAO wants to launch a crypto-crowdfunded fast food restaurant chain:

Come and subscribe to Paradigm!

—————————————————————————————————————————

Primary source:

Primary source:

1. Project blog and forum

2. Research Articles

3. Conference room

4. Snapshot