Foresight Ventures Weekly Market Report: Affected by the market, the TVL of the public chain has a large retracement, and the financing in the primary market is active

Summary:

Summary:

The proportion of Avalanche TVL rose against the trend for three consecutive weeks.

This week, the number of financing projects in the primary market increased, and DAO tools and new public chain projects attracted attention.

secondary title

The total lock-up volume of the public chain

secondary title

Proportion of TVL of each public chain

Polygon lockup volume

ETH locked position situation

BSC locked position situation

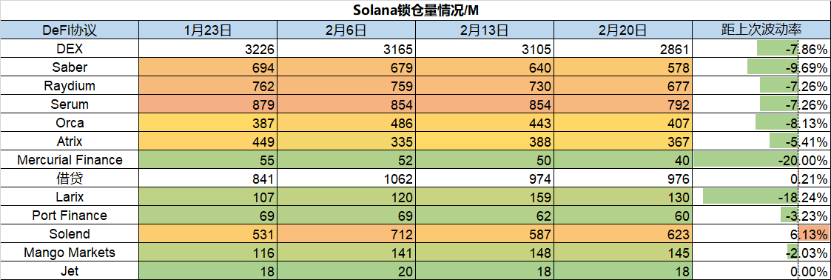

Solana lock-up volume

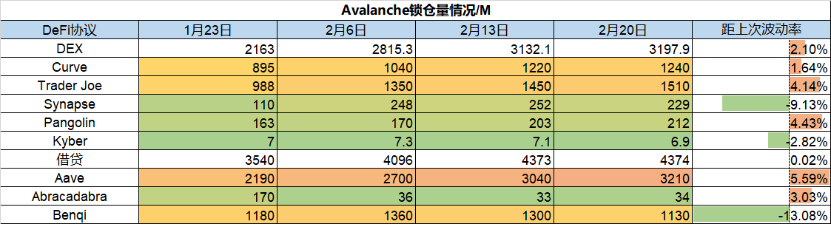

Avalanche lockup volume

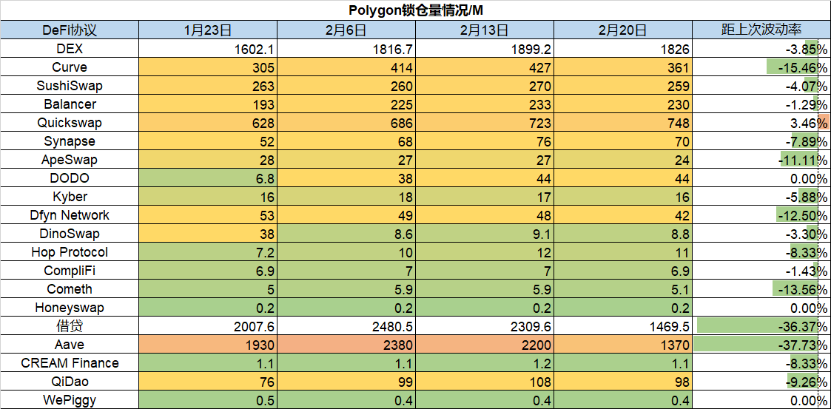

Polygon lockup volume

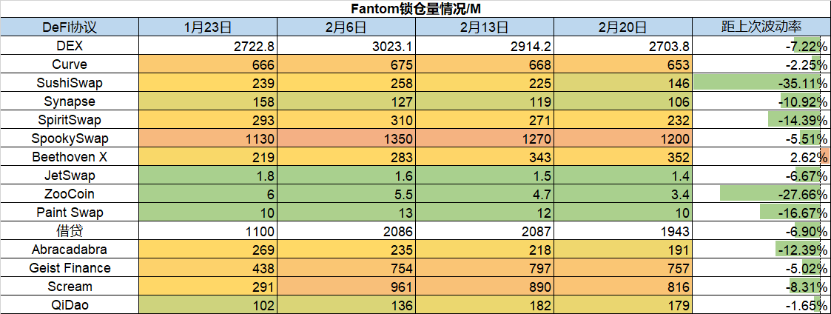

Fantom lockup volume

first level title

This week, the TVL of the Avalanche ecosystem has increased slightly, and the TVL of the other chains has decreased to a certain extent. Among them, the better-performing protocol is Loop Finance of the Terra chain. This protocol is a DEX application with a community publishing function. Users can publish encrypted Currency-themed articles obtain LOOPR tokens, and then the LOOP protocol lists the project tokens in the article on DEX for users to trade; and DEX will use 25% of the service fee income to repurchase the platform token LOOP and distribute to the pledger.

first level title

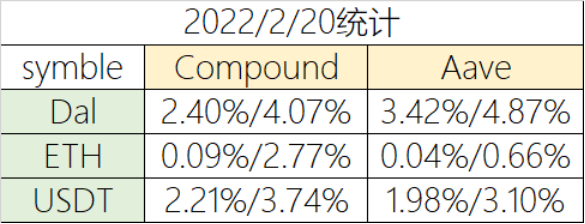

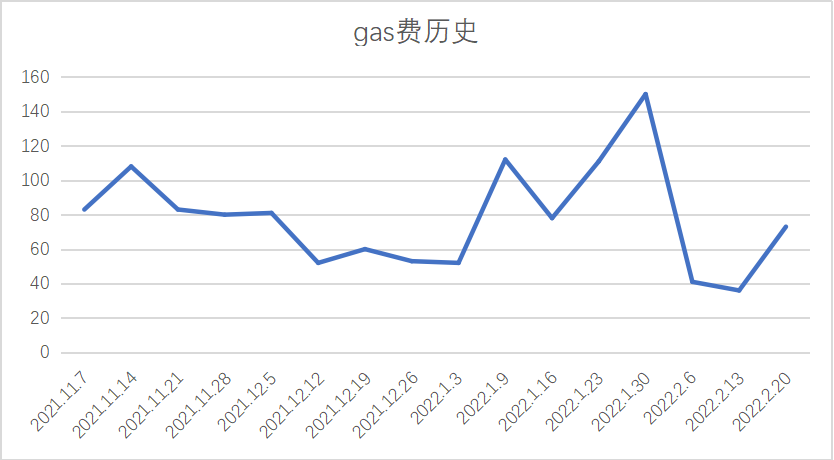

Lending interest rate and Gas fee

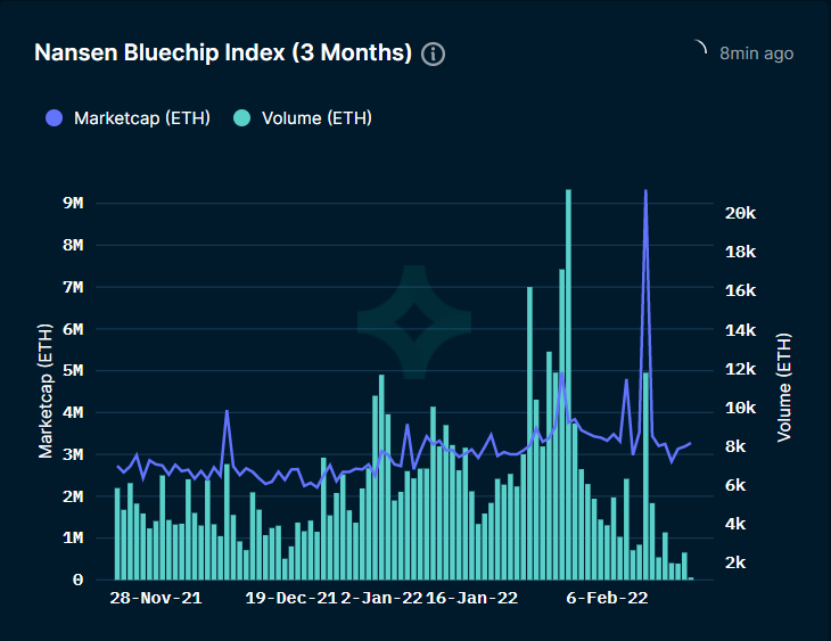

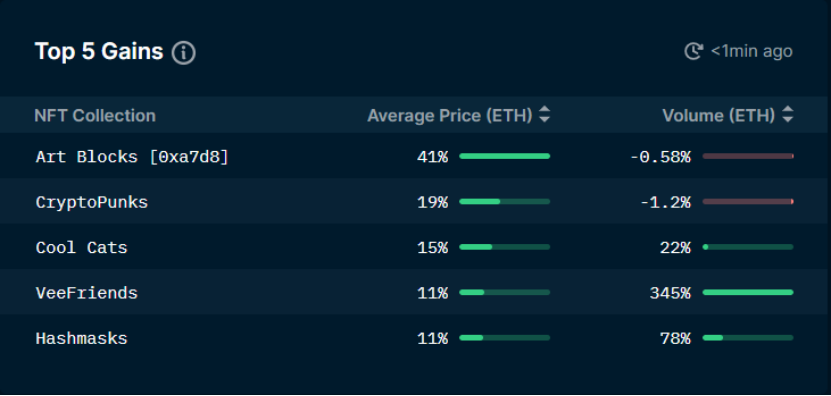

NFT Market Overview

NFT Market Overview

NFT market value and trading volume

mdnice editor

first level title

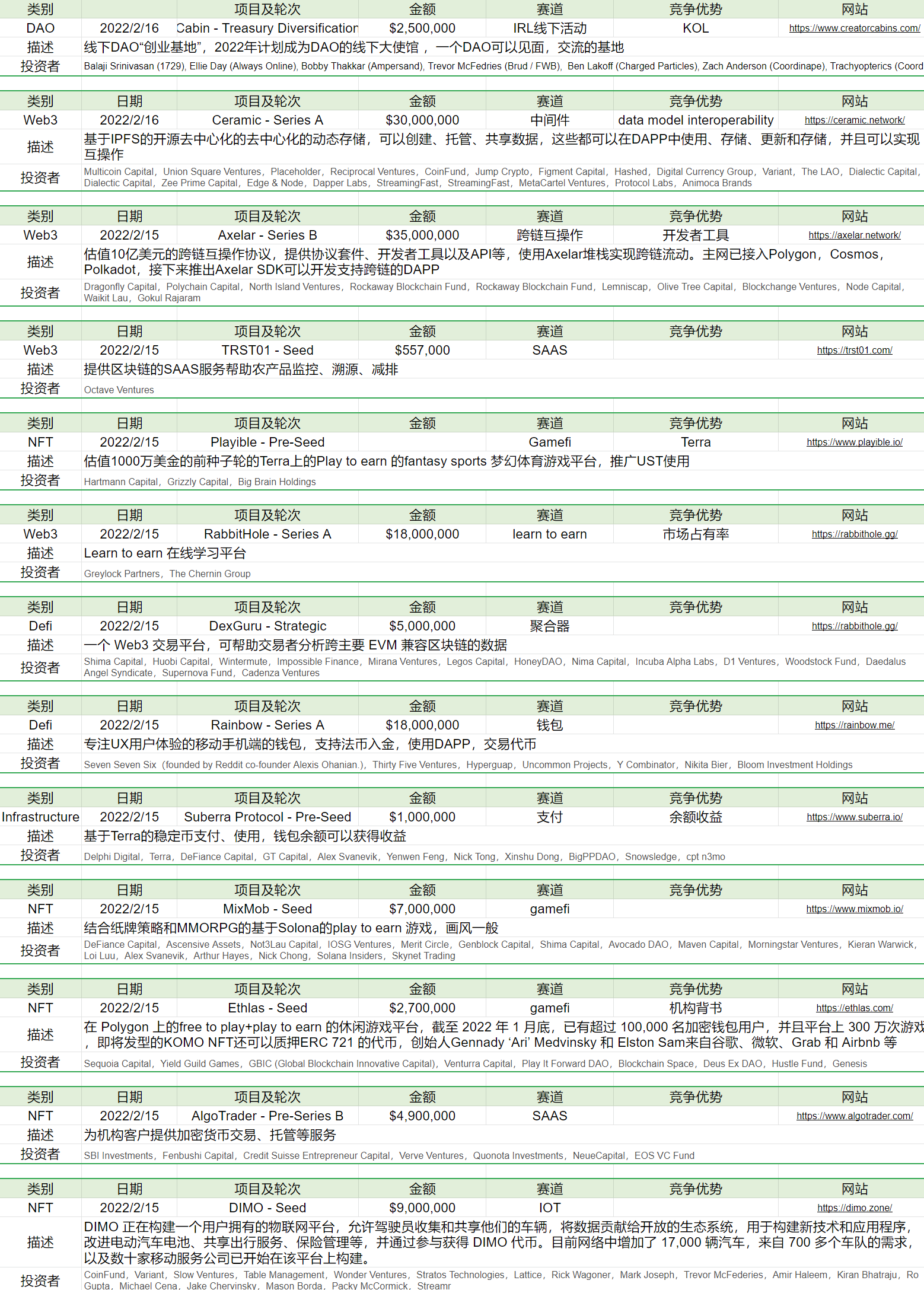

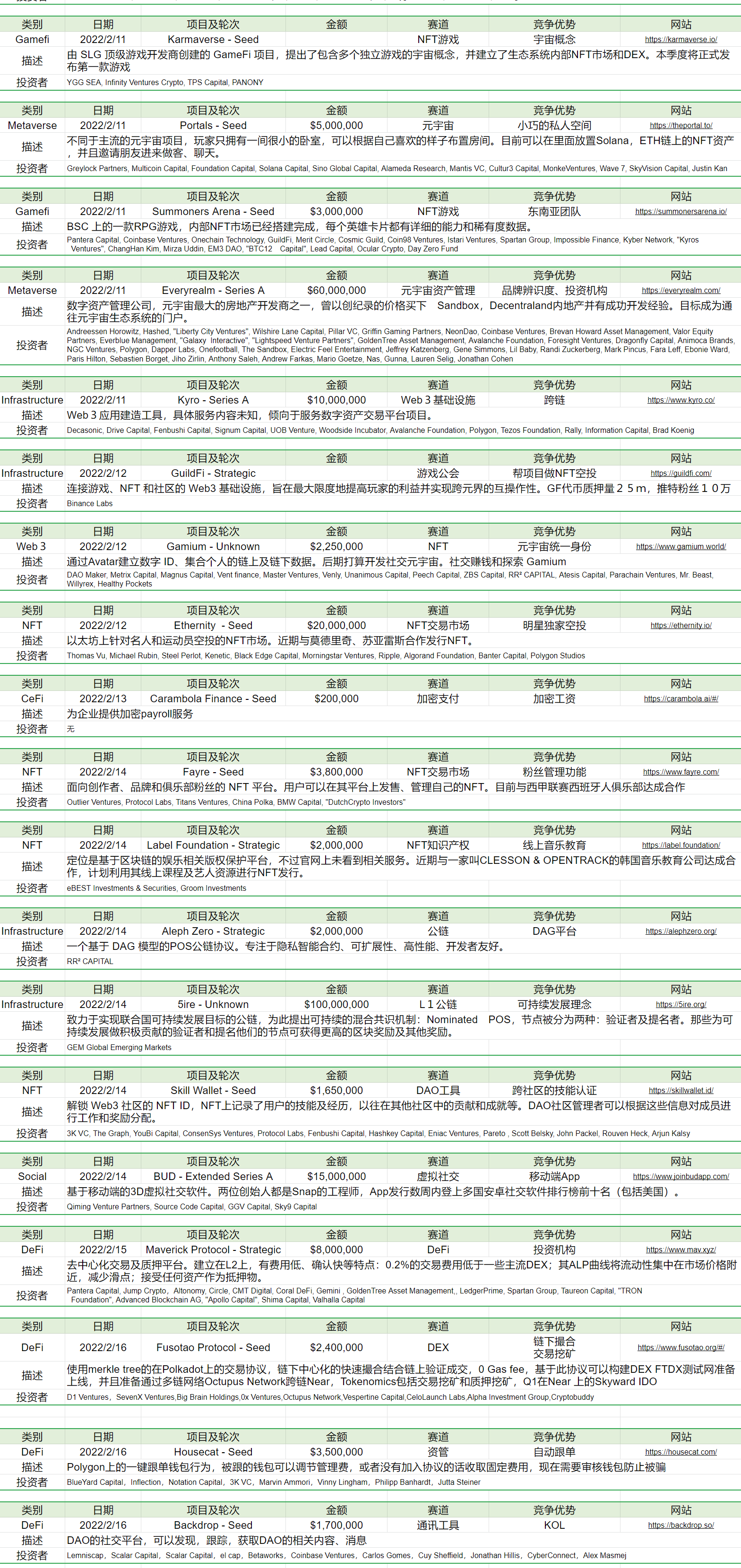

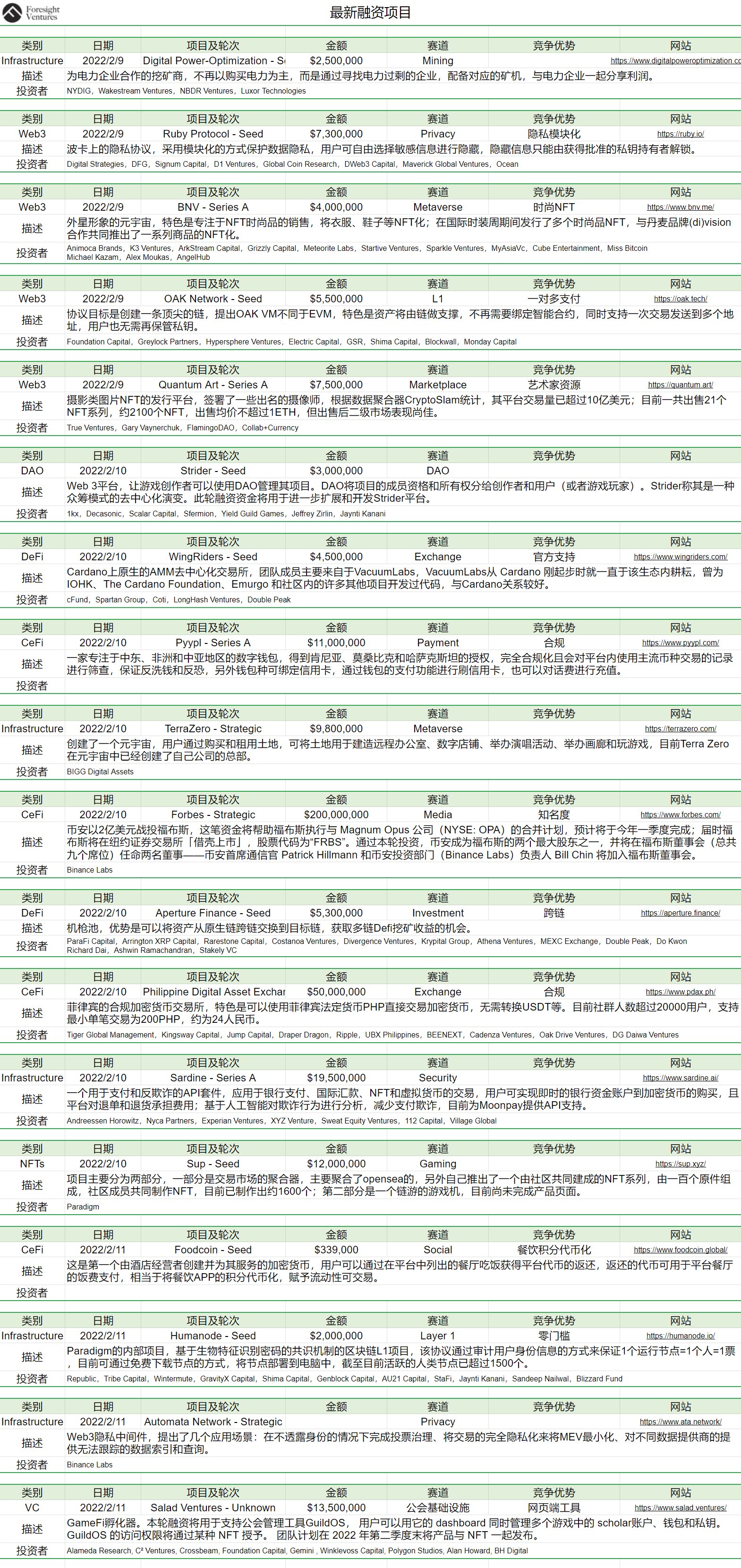

The latest financing of the project

Disclaimer: All Foresight Ventures articles are not intended as investment advice. Investment is risky, please assess your personal risk tolerance and make investment decisions prudently.

mdnice editor

Foresight Ventures backs innovative and disruptive Web 3 projects. We believe that the future of innovation will be defined by crypto. As early investors, we want to participate in the growth of the project and provide extensive support from our ecosystem.

Official website:foresightventures.com

Official website:foresightventures.com

Twitter: twitter.com/ForesightVen

Medium: foresightventures.medium.com

- END -