In-depth analysis of the veToken token model: Can it become the "savior" of DeFi 1.0 tokens?

Original Author: Ben Giove

Original source: Bankless

Compilation of the original text: The Way of DeFi

Original Author: Ben Giove

Original source: Bankless

Compilation of the original text: The Way of DeFi

Valueless governance tokens. This is why most DeFi protocols are on the rise in 2020.

Token holders strictly only have governance rights. There is no other use.

Giants like Uniswap and Compound have used this model to grow their TVL into the billions. But their governance tokens, COMP and UNI, claim to be "worthless." There are no direct financial benefits to holding them -- such as the right to cash flow.

This model is not ideal, but necessary to avoid regulatory scrutiny. It allows for faster tokenization of these protocols. Of course, most valuation models assume that token holders will eventually vote in the cash flow.

But even then, a worthless governance model has diminishing returns. It lacks fundamental demand drivers. To make matters worse, the combination of worthless governance tokens and massive token releases is a recipe for disaster for stakeholders.

Then, the price will drop.

And now it's playing out. While these protocols have continued to grow over the past year, major DeFi 1.0 tokens with valueless governance token models have underperformed.

But a new token model is starting to emerge: veTokens.

The veToken model pioneered by Curve's CRV is injecting value into worthless governance tokens.

Is this the future of DeFi token design?

Is Poor Token Design Depressing DeFi Token Prices, and Is It the Solution?

You need to upgrade this new mechanism.

Bankless analyst Ben Giove dives into everything you need to know about veTokens in this article.

Why Traditional DeFi Token Models Are Flawed

Although 2021 is a banner year for the crypto market, with TVL continuing to show parabolic growth across multiple ecosystems, most DeFi tokens underperformed against benchmarks like ETH.

At first glance, this may seem puzzling, as many DeFi protocols have generated millions of dollars in revenue and seen huge growth in the use and adoption of their products.

However, I think the main factor behind the industry's underperformance is token economics. Early models of DeFi token design were fatally flawed and resulted in massive value destruction at the expense of retail investors.

Let's unpack this by looking at the supply and demand dynamics of the "TradToken" design.

Demand-Side Dynamics of DeFi Tokens

For projects launched before mid-to-late 2021, a common pattern we see in DeFi token design is the "valueless governance token" model.

In this model, token holders have full governance rights. While this may be a way of avoiding regulatory scrutiny, and governance is certainly a very valuable right, it means that holders have no claim on cash flow and the tokens do not serve any stakeholder in the protocol No utility or privilege is provided; this means that there is no underlying demand for the token other than speculation.

Supply-Side Dynamics of DeFi Tokens

As we all know, most of the growth of DeFi in the past year and a half has been driven by liquidity mining. While it is usually done at the product level, such as DEXs or money markets, many protocols also incentivize the liquidity of their native tokens through token releases. While it is important for tokens to have deep liquidity, these schemes are often extreme to attract yield farming farmers, causing skyrocketing inflation and perpetual selling pressure on the underlying token.

You don’t need a Ph.D. in economics to see why DeFi tokens underperform: they have massively inflated supply and no demand to help offset that.

There is hope, however, as alternative token models begin to gain traction and acceptance within the DeFi community.

The Rise of the veToken Model

One such model is the "ve" (voting escrow) model. Pioneered by Curve Finance's Michael Egorov, the ve model involves token holders taking the risk of locking their tokens in exchange for specific rights in the protocol, such as governance rights.

Driven largely by the "Curve Wars", despite being a "DeFi 1.0" token, the price of CRV and its largest holder, CVX, bucked the trend to outperform Q3 and Q4 2021 , with returns of 265.4% and 1085.7%, while DPI increased by 12.2%.

Due to this outstanding performance, DAOs in DeFi have or are planning to overhaul their token economics to move to a ve model.

This begs the question:

Why is this model so successful?

What benefits does it provide to the protocol?

What are the disadvantages of ve token economics?

Does a project switching to ve tokenomics mean its stats will go up?

Let's find out.

First veToken – veCRV

At a high level, the ve model is relatively simple: holders trade short-term liquidity in exchange for benefits in the protocol.

Let's explore this by looking at the pioneer of this model, Curve, in practice.

Curve is a decentralized exchange optimized for the exchange between "like assets" that are intended to have the same or similar prices. This includes facilitating transactions between stablecoins, such as USDC and USDT, or tokens and derivatives, such as ETH and stETH (ETH is staked on Lido).

Like peers Uniswap and SushiSwap, Curve is governed by its own native token, CRV. However, what sets this protocol apart from the previous two is its token model. In order to participate in governance and reap the full benefits of holding CRV, Curve holders need to lock up their tokens. Each holder can decide how long they wish to lock up, which could be as short as a week or as long as four years, with governance rights proportional to the length of time they choose.

Lockers are issued veCRV (Voting Escrow CRV), which represent non-transferable claims on CRV, meaning their assets are illiquid during the lockup period.

Although holders give up liquidity, they compensate for this risk by obtaining special privileges in the protocol, because veCRV holders have the right to share the fees generated by the swap performed on Curve, increasing CRV release when providing liquidity , and, as mentioned earlier, governance rights.

This last benefit is particularly important because the release of Curve pools (called gauges) is determined by veCRV holder votes.

As "Curve Wars" sees, control over release is very valuable to protocols such as stablecoin issuers, as it determines the rate of return for a given pool, and therefore liquidity (and stablecoin protocols hook stability).

The benefits of this model

Now that we have a higher level understanding of the ve model via Curve, let's dig into some of the reasons why this model is beneficial for protocols.

1. Encourage long-term oriented decision-making

A major benefit of the ve model is that it incentivizes long-term oriented decision-making. This is because by locking up their tokens for a period of time (typically 1-4 years), holders are making a long-term commitment to the protocol.

This way, they have an incentive to make decisions that are in the long-term, best interests of the agreement, rather than their own short-term short-term interests.

In a rapidly evolving space like DeFi, the ability to cultivate a long-term oriented holder base is extremely valuable. Given the noise level during a bull run and the pressure to increase token prices by any means necessary, creating an environment where communities can resist these temptations can help protocols make clear, rational decisions that put them on a more sustainable path to success.

2. Greater alignment of incentives among protocol participants

The second way the ve model proves beneficial is that it can align incentives across a wide range of protocol participants and stakeholders.

Let's explore this idea again using the Curve example.

Curve, like other DEXs, uses third-party providers as its liquidity source. Like its competitors with active liquidity mining programs, Curve LP faces indirect exposure to CRV tokens, as CRV releases form part of each pool’s earnings.

However, what sets Curve apart, and the brilliance of the ve model, is that Curve LPs are incentivized to hold their CRV tokens rather than sell them on the open market. This is because, as mentioned earlier, if Curve LPs lock their CRV, they will earn a 2.5x higher CRV yield than an unlocked LP.

Although this mechanism is reflexive as LPs essentially lock up a token to earn more of the same, it serves a valuable role as it potentially commits more CRV to liquidity providers hands. In doing so, it helps align incentives between token holders and liquidity providers by increasing the overlap between the two groups.

This alignment of incentives between protocol users and their token holders can be extremely valuable, as these two groups often have competing interests.

For example, in the case of a DEX, both liquidity providers and token holders generate income by sharing the same swap fees. This could create conflict within the DEX community as they could lose liquidity and compromise the quality of their products by passing some of their fees on to token holders.

By not returning fees to their native tokens, projects risk unnerving and disengaging core supporters who wish to directly benefit from the project’s success. Given the fierce competition within DeFi, it is unlikely that any DEX will increase prices by increasing the fees it charges traders, meaning these two stakeholders are vying for a dwindling slice of the pie.

3. Improve supply and demand dynamics

The final reason why the ve model is powerful is by improving the supply and demand dynamics of project tokens, i.e. helping the data go up.

While putting too much emphasis on token prices can be dangerous to the long-term health of the community, tokens are the gateway into the community. Purchasing tokens is how people participate, support and share in the benefits of the project. Because of this, in order to attract and retain talented, value-adding community members, a protocol must have sound, or at least "non-falling" token economics.

As mentioned earlier, the first iteration of DeFi tokens, the “valueless governance token” model, creates perpetual selling pressure without underlying demand to help stem the downtrend.

Although ve tokens are not immune to market weakness based on their current performance, they still help resolve supply and demand issues. It provides an economically sound basis for these protocol tokens.

For supply, vote locking is a mechanism to remove tokens from the open market. This helps to offset the high releases produced by certain protocols, we have seen existing ve tokens being locked at a very high rate.

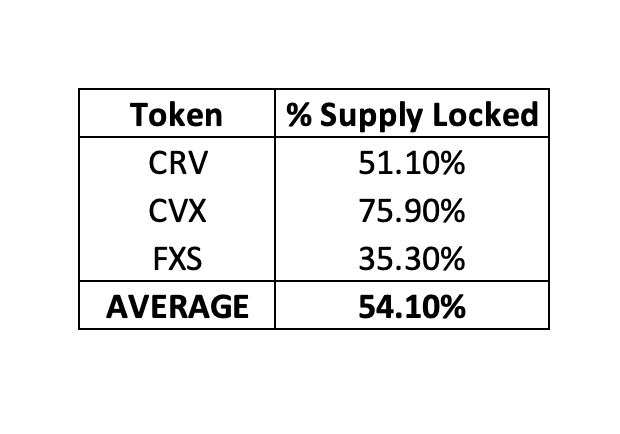

As shown above, between the three largest vetokens by market cap (CRV, CVX, and FXS), an average of 54.1% of the circulating supply of these tokens is vote-locked.

Although somewhat reflexive, the ve model has also been shown to generate demand for the underlying token. Due to the utility required for voting lock-in, which can provide holders with compensation for their illiquidity risks, whether cash flow from fees or bribes, increased yields, discounts, or governance rights, vetokens have managed to create some demand because these are valuable rights that holders want.

As discussed earlier in the article, this is also the driving force behind the Curve wars.

This is a rabbit hole well beyond the scope of this article, the Curve wars are driven by demand among DAOs to control governance rights that can only be used through voting locks. Not only does this create demand for CRV and CVX, but it solidifies the DAO's position as a long-term stakeholder in the protocol.

But vetokens are not a panacea. They have drawbacks.

Disadvantages of veTokens

While the protocol may implement the veToken model in hopes of instilling a permanent "data ascent", there are still some things to consider.

1. Lack of liquidity

While removing liquidity from token holders provides an incentive for them to make long-term decisions, it can also pose challenges to the protocol.

For example, it runs the risk of concentrating ownership on apathetic stakeholders.

If a locker loses confidence in the direction of the protocol, which is not impossible given the rapidly evolving and often years-long potential lockup period, they will not be able to exit their investment at this point. This can lead to misalignment of incentives, as apathetic stakeholders will be able to exercise governance power. This can lead to incentive misalignment, as the aforementioned lockers will be incentivized to make decisions centered on extracting as much value as possible from the protocol as quickly as possible, rather than emphasizing long-term value maximization.

2. Sell votes (for specific protocols)

The second challenge posed by the ve model is voting or bribery.

Bribes are all the rage in DeFi, with platforms like Votium and Hidden Hand (formerly Votemak) offering tens of millions in bribes for various protocols in the Curve, Convex, and Tokemak ecosystems, respectively.

Although they have proven useful in that they provide a cheaper way for the protocol to attract liquidity than traditional release-based schemes, and increase voting lock-up by providing holders with some sort of steady cash flow Attractiveness, but bribery has the potential to introduce new systemic risks into the protocol, undermining the long-term incentives brought about by vote locks.

For example, while less of an issue for Curve and Convex as they just direct liquidity without managing risk, bribes have the potential to undermine protocols that do require active risk management to function properly.

For example, if a single lending marketplace like Compound switches to a bribery-enabled ve model, some items could potentially be purchased as collateral on the platform.

Given that money markets are as safe as their weakest collateral, this could lead to an exotic or dangerously illiquid token listing, increasing the likelihood of a bankruptcy event and undermining the protocol's security, stability, and trust in users between.

Price performance of vetokens

It's one thing to examine the theory behind a ve model, but quite another to see if it causes tokens that are or plan to use a ve model to outperform.

In the table below, we measure the price performance of each token since either the launch date of the ve-token implementation or the announcement stating their intention to switch to this model. We also measure the price performance of the two benchmarks ETH and DPI over the same period.

As we can see, seven out of eight coins have outperformed ETH and DPI since their launch or announcement date. While this data may be skewed in some ways, due to the many launch announcements in recent weeks and the ease of beating benchmarks over a shorter period of time, it does indicate validation of the market's model and investors.

The Future of ve Token Economics

The ve-token model has become a popular alternative to valueless governance token regimes in DAOs, encouraging long-term oriented decision-making, aligning incentives among protocol stakeholders, and creating more favorable supply and demand for price appreciation dynamic.

While we haven't seen clear tradeoffs like illiquidity and vote sales, the ve model feels like a step in the right direction for DeFi token design.