The Anti-Populist DAO Vision: Is Popular Rule a Possible Reality?

Original author: 0xfbifemboy

editor's note

editor's note

This article is a good critique and reflection on current DAO practices. Among them, the most appreciated points of the SeeDAO publicity association are:

First, set aside the blind superstition and conceptual admiration of DAO and Web3 in the current capital market and public opinion, and discuss DAO from a practical standpoint;

Second, it proposed that "large-scale voting does not work" in the DAO and pointed out the reasons in practice in detail and sharply;

The following is the full text:

The following is the full text:

Today let's discuss some issues of the governance structure in DAO.

I fundamentally do not believe in popular rule.

That's not to say I don't believe in representative democracy, general voting rights, or other cornerstones of modern liberal democracies, but at a fundamental level, I favor a model of governance that approaches a Singapore-style meritocracy. I do not believe that ordinary people can make informed, high-quality decisions that optimize the outcomes of collective opinion in the long run.

This line of thinking is in direct conflict with the principles embodied by most Decentralized Autonomous Organizations (DAOs). Typical implementations allow anyone to purchase governance tokens and participate in voting. Within each DAO, the organizational structure tends to be flat rather than hierarchical. Finally, administrative decisions are often made by a relatively large group of people"at the top"co-execution.

All of these practices conflict with how I think effective organizations at any level (company, city, country) should be run. In this article, I want to outline my thinking.

The main problem with a typical DAO

Ideal use cases for on-chain governance and management

I make no claims as to the originality or provenance of these ideas. In fact, many seem to basically agree that DAOs as commonly conceived violate fundamental principles of organizational efficiency. That being the case, there may be marginal value in collecting these thoughts here, for future reference, and as a way to stimulate discussion.

first level title

Mass voting doesn't work

Many DAOs allow anyone to buy their governance tokens from a DEX and immediately start participating in governance voting. Immediately visible issues include:

Most token holders have little knowledge of the operational details of the DAO;

Most token holders simply don't care about The DAO or any related protocol or project;

Most token holders will not participate in governing votes;

Most token holders are not very smart, probably not as smart or capable as the DAO team members;

Most token holders are not well equipped to make informed decisions about voting mandates;

Most token holders buy governance tokens for short-term speculative profits and do not vote for the long-term interests of the DAO.

A natural objection is that if the majority of token holders don't participate in governance, or perhaps just add some noise to the process, then their influence is essentially zero. I do not find this objection to be convincing. Even if apathetic token holders do have a small marginal effect, you still introduce a lot of unnecessary on-chain structure and bureaucracy, as well as introduce risk vectors (governance attacks, excessive concentration of voting power), but hardly any benefit.

Even as a check on abuse of executive power, collective voting power is meaningless unless there is a fully automated way for community-led governance votes to programmatically modify owner multisigs. Fundamentally, the outcome of governance voting relies on the execution of DAO team members, so popular voting is simply not an effective solution to prevent treasury or protocol abuse.

describedescribe, and I won't restate his argument here.

first level title

The existing corporate structure has been well optimized

or"flat"or"no grade"organized in a way. Teams are highly fluid, leadership roles are not well defined, and decisions often go through multiple rounds of discussion with overlapping subsets of team members.

Simply put, this model doesn't work. This is an extremely inefficient picture. Why did things end up like this? I don't believe there's any good way to tell. I believe DAOs are made up of people in their early 20s with little experience in traditional jobs and therefore no experience with typical corporate structures or the challenges of scaling an organization.

Let me be clear: I'm not saying that Alphabet, Pfizer, and GE are maximally optimized, i.e. as efficient as humans can imagine. Instead, I make a more subtle claim that building and scaling organizations is an incredible task, and that traditional corporate structures, which have operated iteratively for thousands of years, may have been reasonably close to the asymptotic value of the current human possibility.

(Anyone who's ever been involved with a fast-growing start-up will almost certainly agree -- you'll watch it devolve into an insane bureaucratic mess while accepting that even massive efforts won't be able to meaningfully stop the process, and at To some extent, operating at scale is impossible without accepting these bureaucratic dregs).

By failing to harness the accumulated wisdom of human experience, DAOs expose themselves to problems we already know how to solve:

Lack of accountability due to uncertainty at key decision points

Unproductive, time-consuming discussions and unclear resolutions due to lack of top-down hierarchy

Overall poor execution due to lack of coordination and focus on DAO-wide incentives

That's not to say that these issues are always (or even often) properly addressed in traditional companies. They are not. However, in most DAOs I've seen, they are definitely unnecessarily magnified.

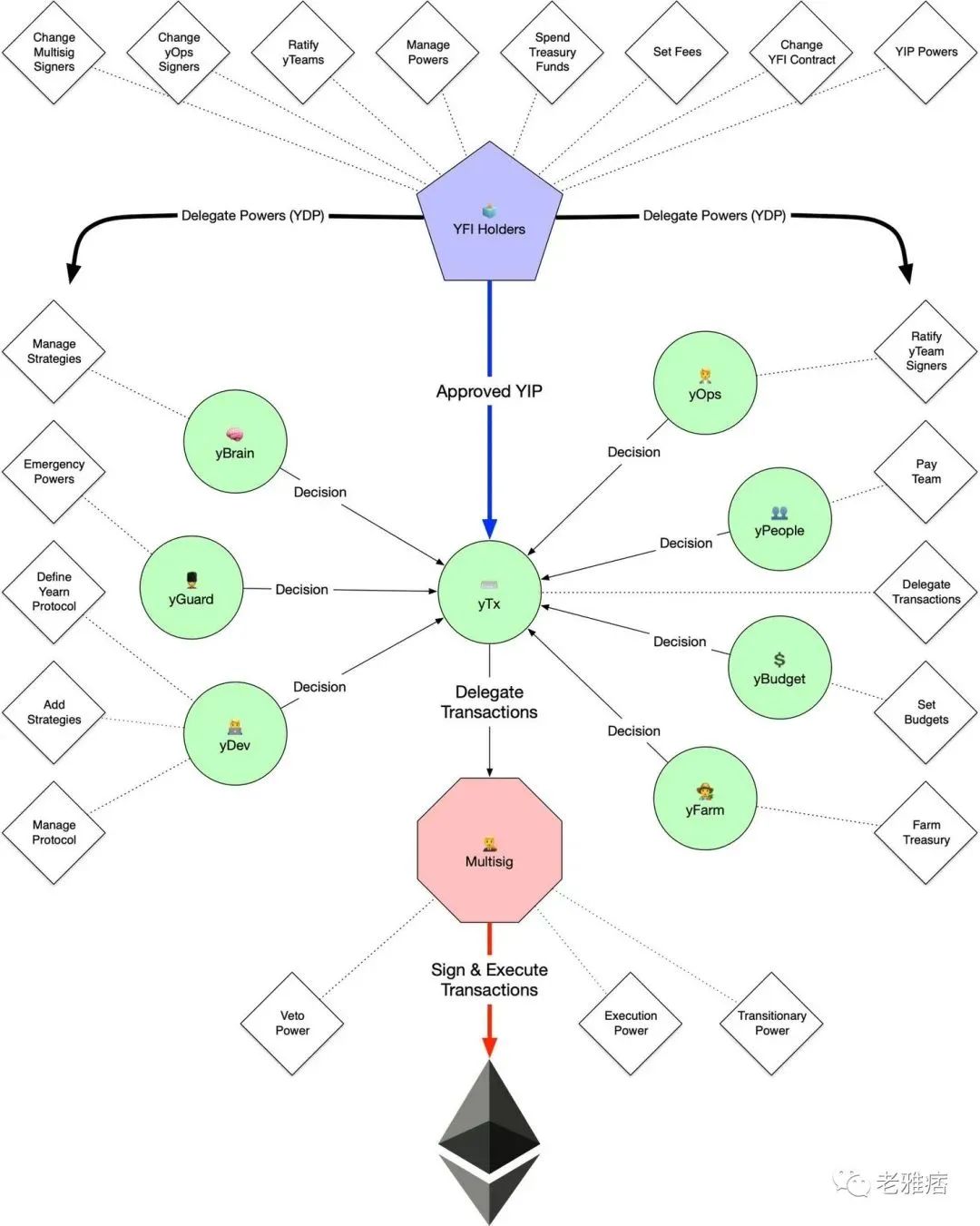

A positive example is Yearn's organizational structure.

Leaving aside the voting power of YFI holders (which I generally don't see as a value-add), we see decisions being split into specific working groups (yDev, yFarm, etc.) and then explicitly fed back to a central multi-department. In addition, each working group has clearly demarcated, non-overlapping responsibilities. As far as I know, this structure works very well for Yearn.

A typical DAO has a team, but in line with"decentralization"In spirit, the actual decision-making steps are often vague:

Who has the final say on each team?

How do decisions escalate from one level to another?

How much power do executive team members really have?

In the absence of such clarity, decision-making can degenerate into an anarchic process. Without a specific person accountable for the outcome of the team or subteam's decisions, there is often no proper incentive to follow through and enforce them.

first level title

Values of Web3

did i betray"Web3 values"– Inclusion, community engagement, open minds and diversity of thought?

I do not think so. Simply put, if a DAO's team is effective and capable, they will accept high-quality community feedback and suggestions. Open-mindedness, tolerance, kindness, etc. are not functions of organizational structures, token voting rights, etc., but functions of people. No structure can fix a bad team. However, there are structures that make good teams operate more effectively - and this may include being responsive to the urgent needs of their communities! This is called structure.

first level title

What should be on-chain?

A natural question I want to try to answer is: if we move away from on-chain token voting and collective governance, what exactly, if anything, should be on-chain? How should blockchains be incorporated into DAOs - or are they just better off as regular corporations?

I would guess that one of the main benefits of DAOs, maybe even the main benefit, is the ability to manage funds on-chain. Because fund management is fully transparent to the general public (and can be controlled via multi-signature mechanisms), this allows for greater confidence that funds raised will not be squandered on frivolous expenses. Of course, some level of corruption is always possible, and teams don’t need to publish detailed financial or spending reports, but can eventually check on-chain data and get a general idea of how funds are being spent.

As a direct result, I feel that DAOs enable international cooperation that would not otherwise be possible. Currently, launching a traditional multinational initiative has a very large barrier to entry, partly because you are completely dependent on the integrity and conduct of the executive team not to abscond with any funds (whether explicitly or through luxury purchases, etc.). The on-chain collection and management of DAO funds greatly solves this problem.

On-chain management of funds also allows for more trustless cross-DAO cooperation. Doing business with other businesses is often fraught with counterparty risk. The counterparty may not pay the funds owed on time or at all; they may waste the money you pay them; and generally, you have zero transparency into their activities. However, on-chain transparency helps mitigate these risks to some extent (e.g. counterparties cannot fraudulently claim a temporary lack of funds). Furthermore, depending on their specific nature, certain partnerships could be programmed as smart contracts, allowing DAOs to establish each other in a trustless and immutable manner, or to pay automatically when sufficient conditions are met.

At the risk of ending abruptly, I'd like to hear if you have specific ideas on how, in the context of a DAO or other collective entity, off-chain activity could be brought on-chain for clear value-add. At one point I thought DAO governance would be a major theme in 2022 (as some have suggested), but trying to understand which uniquely positive aspects of DAOs will survive the decades to come seems worthwhile.