Detailed Explanation of Dual Token Reputation System: How to Make Outstanding Contributors "Fame and Fortune"?

Original compilation: The SeeDAO

Original compilation: The SeeDAO

The reputation system provides an opportunity for the platform to recognize high-quality contributions made by participants and incentivize more high-quality contributions, including content creation, management, community building, and gameplay. This is critical to the growth and sustainability of any web3 project.

However, designing a reputation system requires comprehensive consideration around reputation supply, distribution methods, and credibility. So while many, from DAOs like FWB, to play-to-earn games like Axie Infinity, and new social platforms like BitClout are exploring this space, builders aren't quite sure about the best way to design reputation systems. Reach a consensus.

Using our knowledge in economic theory and game design, we design a dual-token reputation system to embody meaningful contributions.first level title

01

Evolution of the reputation system

The underlying premise behind reputation systems is not new. Since the dawn of civilization, we have stamped honor, such as awarding medals for merit or service. In the corporate world, employees are given titles or "ranks" to indicate their place in the hierarchy, and this "stamp" often determines a person's salary and other benefits.

integral"integral"Can be converted into in-game currency and used to buy new skins, weapons, characters, and more.

Often, reputation tokens in the crypto world take the form of social tokens.first level title

02

Paradox: Are Reputation Tokens Earned or Bought?

Reputation tokens for digital platforms typically serve two purposes:

As a form of signaling, identifying and rewarding users who contribute value to the platform can be leveraged by these users to increase public credibility.

Provides compensation that enables contributors to convert a portion of the value they create into a negotiable currency.

However, these two uses are in opposition to each other. To be liquid, a token needs to be exchangeable, but the more liquid a token is, the less effective it is as a pure reputation signal.

To illustrate this point, let us assume that reputation tokens are freely transferable. If tokens serve as a credible signal of reputational quality, their transaction value increases, which makes holders willing to trade them. However, once the tokens start trading, the ownership loses its signaling value, destroying the reputational capital the tokens nominally convey.

As an example, charities can mint NFTs to reward members who complete more than 500 hours of community service. However, if those people can sell the resulting NFT to anyone, then when you meet a holder, you will have questions:"Is this person an NFT earned by contributing? Or did you buy it outright?"Even if no one publicly trades their community service NFTs, the possible existence of private sale rounds will reduce signal value. And for this type of token, being in a fully circulated market means that the signal value completely disappears.

This reveals a paradox:If reputation tokens can be transferred at will, they can also be easily purchased by people who have no material contribution to the community, which will weaken their ability to serve as a reputation signal.

Buy"Buy"engagement metrics.

In addition, high prices will reduce the possibility of transfer. For example, the high price of CryptoPunks means that current holders are almost all early buyers. This would appear to remove the paradox and restore the token's reputational value, but the signal value may still be reduced as some people are willing to pay exorbitant prices for CryptoPunks to gain semblance of reputation. At present, there is a natural limit to the number of people who can enter the encryption field; but when more people accept cryptocurrency in the future, this issue will have to be considered on a larger scale.

Additionally, the decline in reputational capital associated with the token feeds back into the token’s market value. If a token loses its ability to serve as a reputation signal, people will be less interested in trading it. In fact, as people started buying Instagram followers in bulk, the follower count lost its signaling value, which in turn made influencers less interested in buying it. This opens up the market to buy other forms of reputation, including likes. An NFT whose value is not recognized by people, even if it is advertised"i am wealth", is not worth buying.

Making reputation tokens transferable reduces their ability to serve as both a reputation signal and value compensation.Therefore, building reputational capital requires that tokens be completely (or at least mostly) non-transferable.first level title

03

Social tokens are non-transferable ≠ sacrificing liquidity

A token has signaling value if it is awarded by a trusted source such as a brand, university or government. But in the world of encryption and blockchain, there is not necessarily a centralized third-party source for granting authority.

So another way to express value is to make it significantly easier for someone to acquire tokens if they have certain fundamental characteristics. In video games, for example, it's much easier to get a high score if you're really skilled or you've paid extra, so a high score marks a combination of great skill and a lot of hard work. The high traffic on platforms such as YouTube also reveals a similar logic.

The reason for the above-mentioned contradiction that the easier the token is to transfer, the worse the signaling ability is because once the reputation token can be freely transferred, the reputation token will be decoupled from the underlying institutions or the efforts to use it as a source of signal value.

So what if we separate the transferability from the token itself? This is why many games already separate scores or credits from coins; it's not hard to imagine allowing the use of"Fraction"Buying can really backfire.

integral"integral", used as a non-transferable reputation signal; another token called"gold", is a transferable asset that is distributed periodically to point holders.Points effectively generate bonus coins that can be used as a tradable currency. Additionally, since point holders accumulate coins over time, coins are also tied to eventual reputation.

At a high level, this design promotes positive feedback, where users earn points for making high-quality contributions on the platform (for example, contributing and curating content or winning games). Users can then use the points to earn gold coins that can be traded as currency. The demand for gold coins will incentivize users to earn points and thus incentivize users to make high-quality contributions.

first level title

04

Points are used to reward contributions

In order to maintain signal value and incentivize high-quality participation, points must be linked in some way to user contributions. In the context of a game, points may simply be awarded algorithmically as a function of performance. On a creator platform like YouTube or TikTok, points may be a direct function of people engaging with a creator's content. In other cases, such as a publishing platform like Mirror, there may be a group of users given the ability to award points, or there may be a governance/voting process that determines the distribution of points.

The key point is that points must reliably link their holders to the source (or driver) of the reputation. In addition, the function of contribution and point reward ratio needs to be easy to understand, so that users can get an overview of how much effort is required to achieve a certain point level. In other words, the participants need to understand the specific rules of the game before they start to act.

In most cases, points do not need to be scarce. For example, Discord has no cap on the number of badges that can be given to a moderator. However, scarcity can increase or strengthen reputational value within the system. For example in the Discord server"moderator"first level title

05

Key Issues: Dividends, Supply and Distribution

In order to create a liquid value attached to reputation, gold coins should be continuously distributed to point holders through a series of bonuses, and the gold coin rewards each point holder receives are based on the number of points they own.

secondary title

Dividend: How big should the dividend be?

The total size of each dividend, that is, the number of gold coins that need to be distributed each time a dividend is issued, depends on the macroeconomic goals of the system.

Unlike points, in order to give gold coins value as currency, it is especially important to guarantee that gold coins are relatively scarce. Many currencies (such as BTC) benefit from a long-term limit on the total supply, i.e. a fixed amount that can be minted. In this case, the average total dividend is bound to decrease over time unless there is some mechanism to absorb coins back into the system (e.g. via in-platform payments).

secondary title

Supply: How to determine the dividend frequency?

For platforms where participation functions like employment, such as gig or creator platforms, the best strategy is to distribute coins to holders on a regular basis, such as monthly or even daily. This means that users who make valuable contributions can keep their points at a certain level, thus earning a stable income.

secondary title

Distribution: the relationship between holding points and the amount of dividends

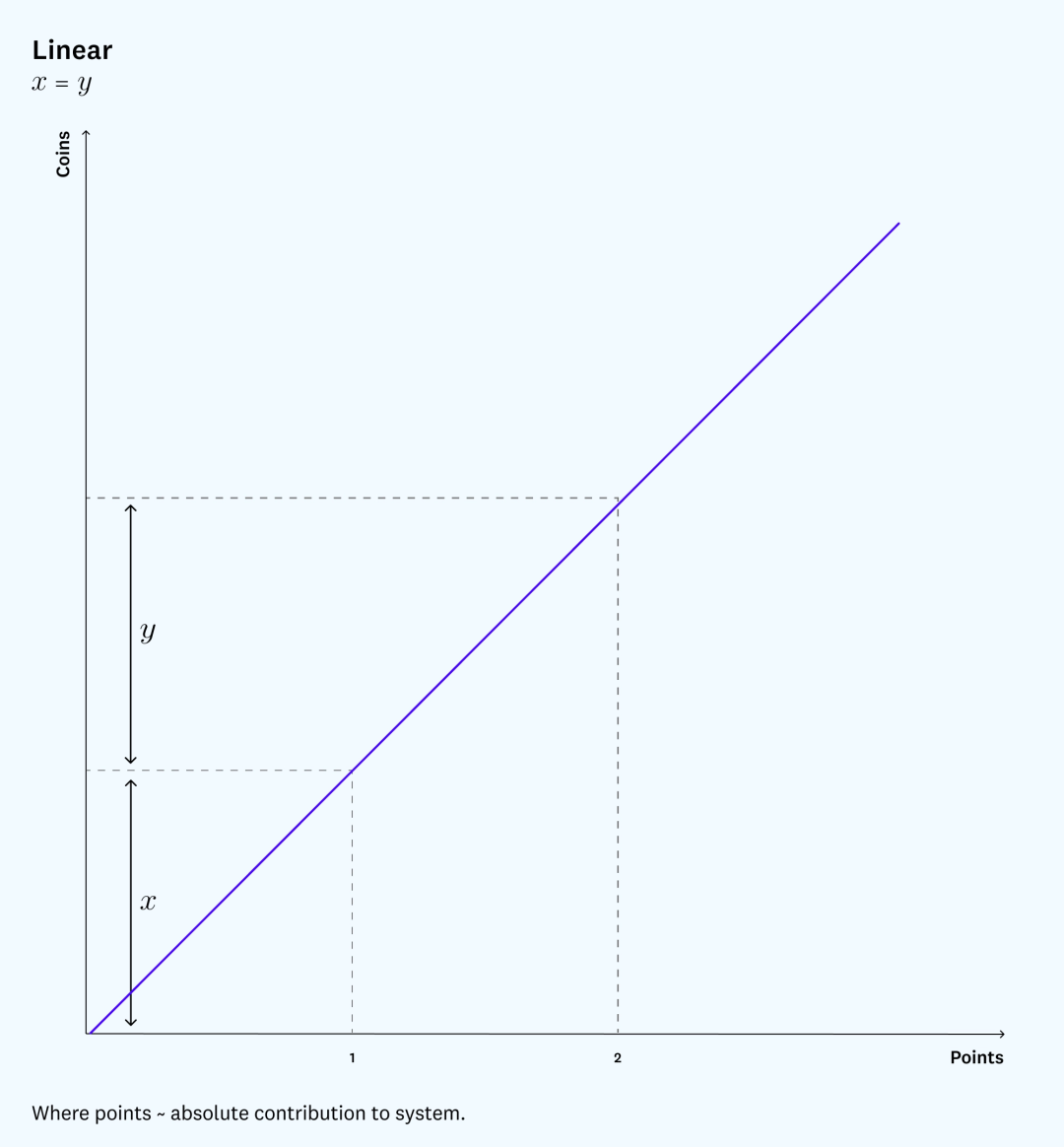

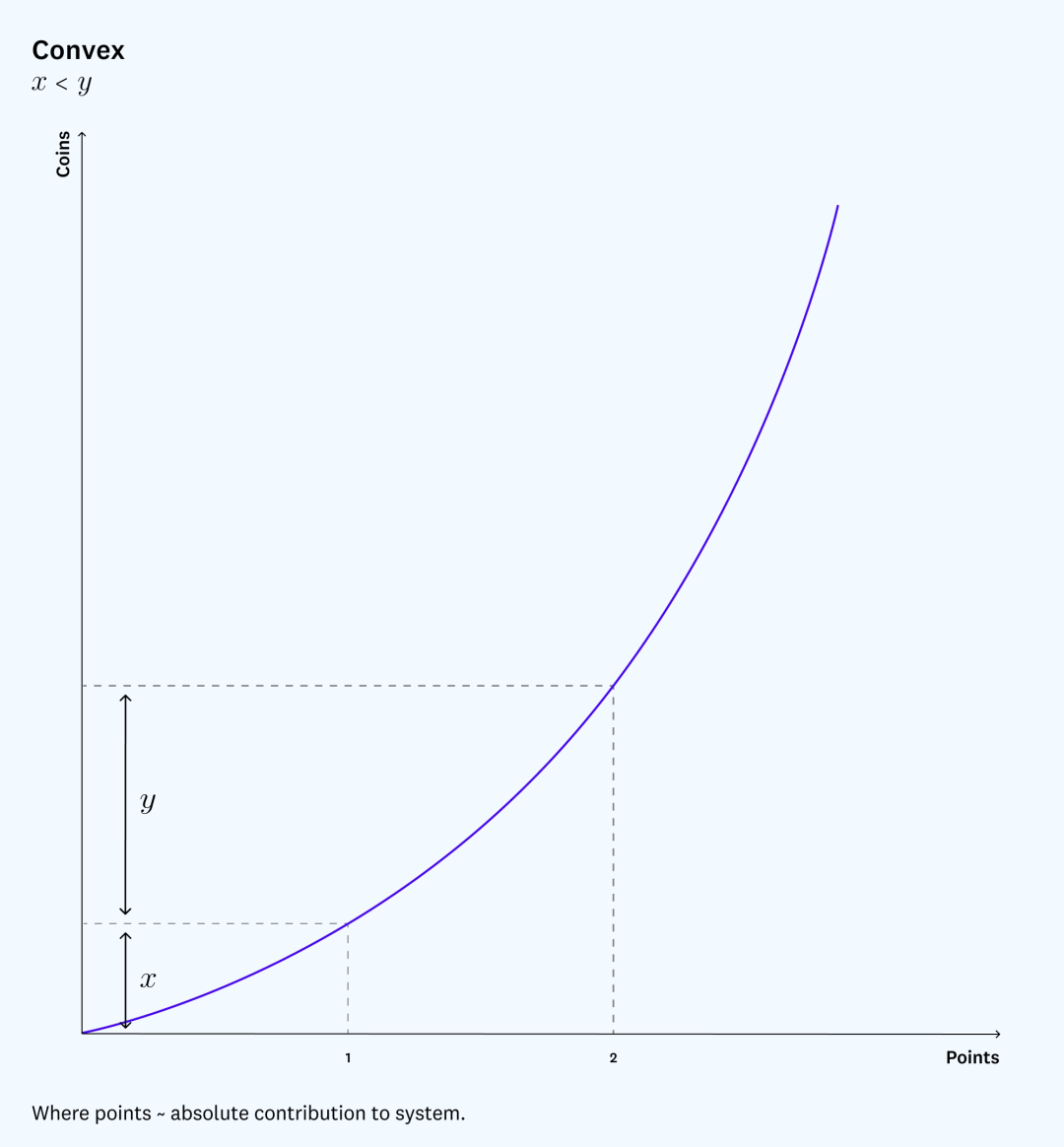

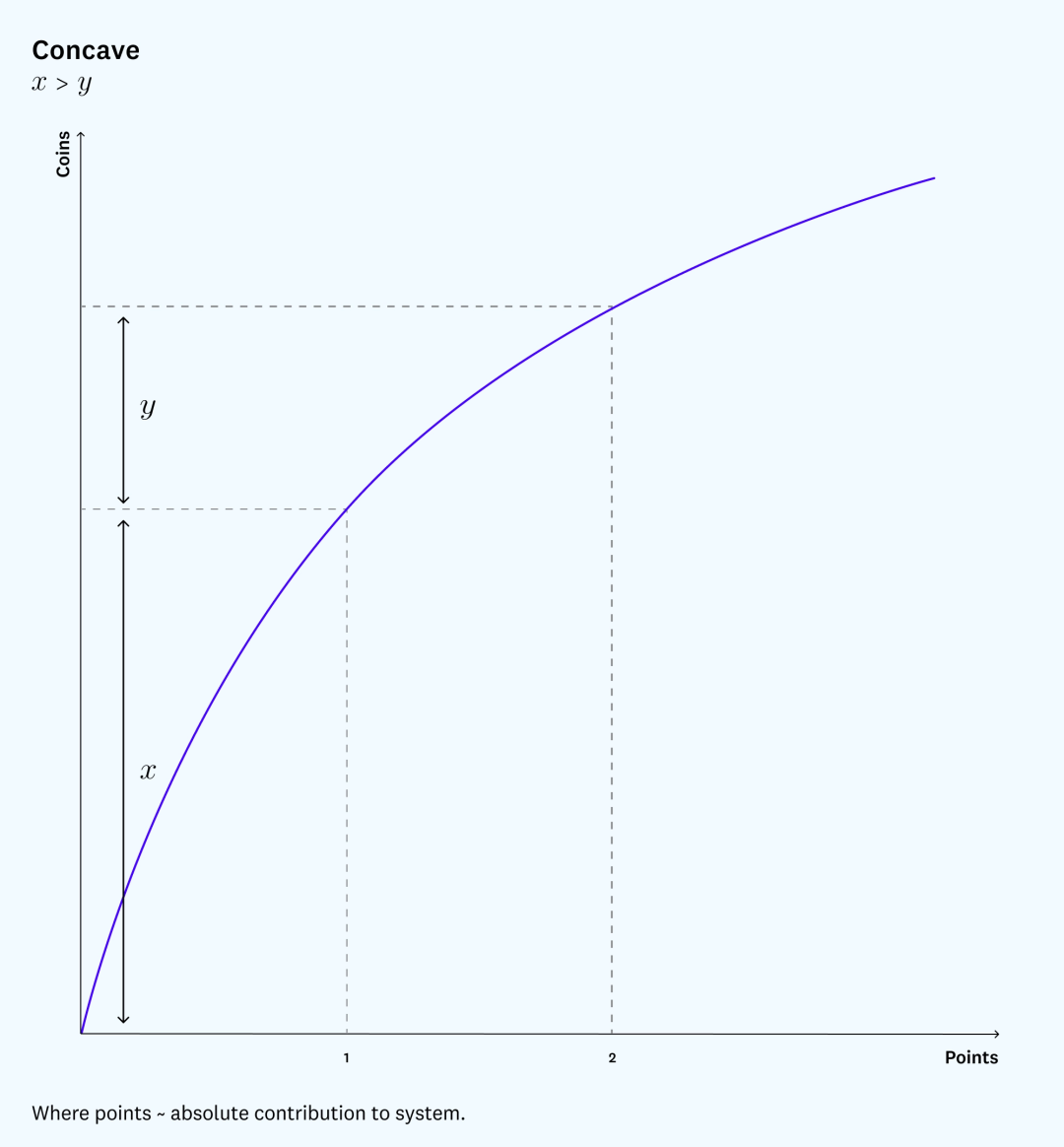

Perhaps the simplest distribution method is to have a linear relationship between gold coins and points, that is, users are entitled to an equal share of unit dividends based on unit points. But that's not the only option.

When the relationship between gold coins and points is a downward convex function, users with more points will have a larger share in each dividend. That is, the bonus increase from point 1 to point 2 is greater than the bonus increase from point 0 to point 1.This distribution method is beneficial to users who have participated in the system for a long time, and further motivates users to make continuous contributions.

It is the opposite when the relationship between gold coins and points is an upward convex function. In this case, the bonus increase from point 0 to point 1 is greater than the bonus increase from point 1 to point 2. This method is great for attracting new users because it rewards more for initial contributions than subsequent contributions, whether it's your second, third, or twenty-seventh contribution.first level title

06

Gold rewards should be aligned with contributions

The three main points of bonus design: dividend scale, supply and distribution determine the number of gold coins received by point holders in each time period. This relationship directly affects the incentive to earn points.

Ideally, the coin distribution should be calibrated so that the marginal benefit of user-acquired points aligns with the marginal benefit of platform point-generating activities.How this marginal benefit is viewed depends on how contributions create platform value. In other words, you should earn points based on the value you create for the platform.

For example, on a platform such as YouTube, credits will reflect video views, and the platform can accurately estimate how much a given number of views contributes to platform engagement and the bottom line. The platform should then issue gold coins to each creator based on the marginal value of their visits. In this case, the convex dividend function may be more suitable, because"top"YouTuber can increase long-term user stickiness more than ordinary Youtuber. YouTube has gone through a few iterations of this: first tying compensation to views, then watch time, and most recently with a named"YouTube time", which takes into account more than just the amount of time content is watched on the platform.

also,

also,"marginal benefit = marginal benefit"first level title

07

Reputation incentives must be continuous

Linking points and coins provides a natural mechanism for rewarding users for quality contributions, but since points are non-transferable, there is a lagging factor:Users who accumulated points early could end up with a disproportionate share of the bonus, especially if the progressive gold supply is fixed.

In many crypto projects, the biggest holders end up being those who were the first to pay attention to the project, but those early participants are not necessarily the most valuable to the future of the project ecosystem. Therefore, maintaining an ongoing incentive to contribute and participate is critical. A natural way to achieve this in a dual-token framework is to have points degenerate or devalue over time. This can be achieved by reducing the bonus as a function of the user's credit age. An easier way to do this is to simply have the user's point total drop, either mechanically over time or as a function of the user's engagement relative to everyone else.

This is again similar to the situation in the game: using an absolute leaderboard makes accumulating points a zero-sum game, and if a player doesn't contribute consistently, they will eventually lose their current rank as other players surpass them.The same is often true on creator platforms, where competition to capture consumer attention incentivizes creators to keep working.

But even when the points pool itself is growing, rather than zero-sum, there may be value in having points decrease mechanically just to create an incentive to participate. It may also be valuable to explicitly specify the reason and rate of credit reduction, as this can help users optimize their own contribution levels.

The depreciation of points means that the gold coin dividend is like a stock dividend, which is automatically diluted over time, just like when a traditional listed company needs new investment to increase its market value, it dilutes its equity by issuing new shares at a certain ratio. In this sense, the depreciation of points reflects the need of users to continue to invest in the platform.

Of course, as with any monetary system, the actual value of a gold coin depends on the community consensus on its value. This means that the value of the points is largely determined by the accepted value of the gold coins. Therefore, the community consensus on the gold value needs to be at least high enough to support the total gold in the distribution.

This means that the platform may need to adopt monetary policies, such as adjusting the total currency supply through repurchase or restricting temporary transactions. For example, during the first few weeks after the launch, BitClout did not allow the exchange of BitClout into other currencies. The dual-token system we describe offers a simple alternative: adjusting the point accrual rate or bonus flow. For example, the game management committee can appropriately increase the difficulty of the game as a way to slow down the accumulation of points, or it can reduce the total size of the bonus as a way to reduce the long-term supply of gold coins.

But builders must be careful with these chains of incentives, because every change in the overall incentive structure for contributors affects contributor behavior.first level title

08

don't over financialize

We outline some core principles of social token design, but equally important are:Complement this design with product-market fit that inherently motivates users.For example, a company that focuses on making users profitable without putting"play"A good play-to-earn game that misses the point. As a game, the most important point should be to allow players to experience the fun of the game.

A product that starts around a reputation system but lacks real product-market fit can form a community full of speculators rather than actual users.

Once there is product-market fit, incentives come into play. If the platform does not properly reward users, it will be very difficult to scale the platform and adopt it at scale. For incentives to work, a reputation system should separate social capital from financial capital, and it is even more important if the former can be transformed into the latter in a clear way.

There's actually a lot more to consider, such as: the relationship between governance and reputation; making the reputation system responsive to the evolution of the contributor community; and making reputation building possible for all types of contributors.

Original link