How will Web3 change the future of human beings?

Original compilation: The SeeDAO

Original compilation: The SeeDAO

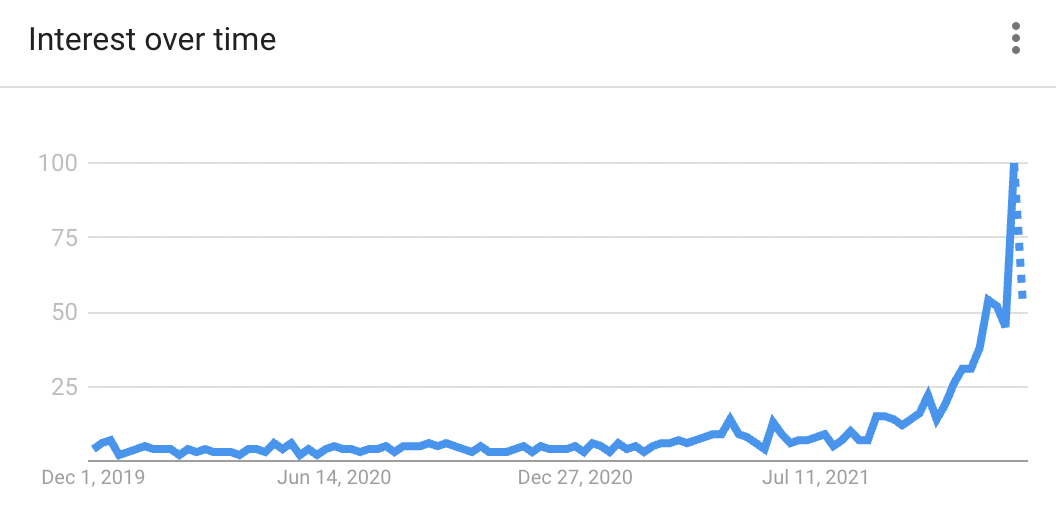

Web3 has been a very popular term this year, especially with frequent mentions by alternative finance cartoon characters and logically logical tweet strings from the tech world.

In 2021, if you want to raise your first capital and escape the critical thinking of investors, you can use two"cheat code",one is"Web3"Metaverse"Metaverse". If you picked up the buzzwords, congratulations, you now have $1 billion at your disposal and are off to a good start, good luck and have fun.

Although today's leaders publish a wealth of non-ideological articles, there is still no"What exactly is Web3"Reach a consensus."Web 3"if

if"What is Web3"first level title

What is the significance of Web3

Here I will not go into details about the uselessness of Web3. I will think about the possible definition of Web3 from the use of Web3. Do we need to give up on Web2? What problem does Web3 solve?

I think there are two important themes:

decentralization of power

There is growing distrust of centralized power. Be it governments, central banks, or global tech giants, they have all become more powerful than nations. Decentralization, behavioral empowerment, and censorship have fueled renewed interest in building trustless and censorship-resistant platforms that can empower ordinary people and fragment existing power structures.

value ownership

became"read"became"read and write"first level title

an open and fair network

I understand the excitement of supporters.

An idealized future network might be able to address these societal issues in a positive way, but also give founders powerful growth and retention tools to compete with incumbents.

We can build a network where users can share in the value they create and drive adoption. In such a network, it will not be up to the technical managers to decide what we talk about, or how many ads we have to see every day.

Perhaps Web3 can empower ordinary people who have spent thousands of hours as cogs in big corporations, only to have their energy reaped as profits for private shareholders.

first level title

Everything Can Be Ponziized

Perhaps more importantly, I understand the critics' fears.

A pessimistic idea: a future web that might be littered with tokenized microtransactions, rent-seeking on all user behavior, requiring users to own native tokens to properly operate their toasters.

It could be a network built on the sale of worthless ERC20 tokens to retail investors, and then the project fails. It extracts value in a more direct way than sales advertising, which took years to emerge.

It could also be a network where cybercrime becomes harder to prevent with insufficient means to deal with inappropriate content such as harassment or child abuse.

first level title

Which way should I go?

If you can imagine a happy future and a dystopian future, I wouldn't blame you for expecting the worst possible future to come true. It's clear that modern businesses often make the web more annoying: cookie permissions, data permission requests, banner ads, paywalls, loot boxes, and pay-to-play or cash games—these are all second-best or anti-user changes.

Looking at cryptocurrencies outside the box, we can’t blame outsiders for seeing something that closely resembles a scam. The wealth effect fuels the arrogance and arrogance of crypto market participants, while the self-ironic nature of crypto culture alienates outsiders.

I understand. Sometimes it was bad in the past and sometimes it is bad now, so you strongly reject the idea that you can find holes in the theory. You don’t have to think too hard to imagine ways that decentralized systems can be exploited; and you don’t have to look very far to find examples of token projects that exploit ordinary people for profit.

But at the same time, you don't have to look far to see the power of ownership and self-government in existing owner-operated systems.

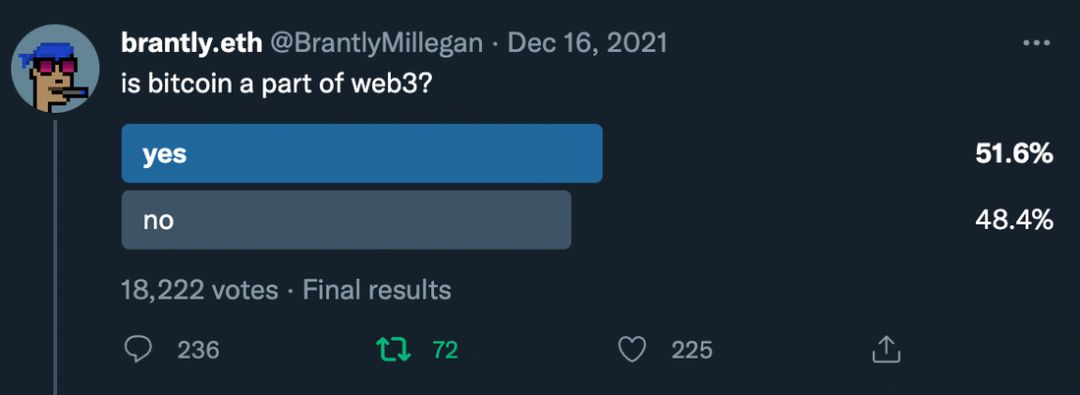

In a decade without the intervention of a central authority, Bitcoin went from"Dark web drug money"Become an institution-approved store-of-value asset.

Ethereum from"Techno Ponzi Scheme"Evolving into a massive owner-operated network with billions of transactions per day.

Businesses, users, and third parties contribute to creating incremental value for both networks, and they can share in the rewards. Anyone can participate and get value back, not just to founders or investors.

Even a purely fun social consensus project like ConstitutionDAO could be an example of shared user-generated value creation among all. Despite failing to photograph the constitution, the value of the DAO became higher, and this value was re-attached to the participants.

first level title

inequality

Inequalities are becoming more and more apparent. Asset prices have skyrocketed during the pandemic, and the rich have gotten richer. Meanwhile, small businesses struggled and the working class quickly ran through their stimulus cash. More than 50% of Americans have less than 3 months of emergency savings.

Wage growth has all but stagnated, yet housing costs have risen more than 400% over the past 40 years. People have begun to feel trapped in a system that is not conducive to their own development, and the future they want is quickly slipping away.

So the increase in the number of RobinHood retail options traders and Dogecoin buyers is also reasonable. Lottery investing has become a viable option for those who see no hope of achieving their financial goals through saving and investing.

Perhaps a more socialist model of equity or token ownership could be the answer to capitalism’s solution to universal basic income. Rather than having countries print a little cash for families, taxing future generations to pay for this generation, maybe people sharing the wealth that is produced can create a fairer world.

If users vote through their wallets, choosing companies for which they have already participated in value creation and are rewarded, these companies will find huge network effect tools to grow rapidly and displace incumbents. Those who actually participate can choose to own some of the value they co-create, rather than handing it all over to the founders and investors.

first level title

perfect idea

This was another concept that was immaculate when Bitcoin was created. Satoshi Nakamoto may be one of the most important creators in history when it comes to ensuring a fair place for all. No share of tokens was taken privately, nor was it given to any private investors. All users mine their own bitcoins on equal terms. Although they mined millions of bitcoins through their early participation, they didn't have much more to offer than that.

When Ethereum was created, they pre-mined some tokens and held a free-to-play public ICO. Anyone can participate, and a total of 60,000,000 ETH was sold at approximately $0.30 per ETH. The founders of Ethereum did set aside some tokens for themselves and the Ethereum Foundation, with founder Vitalik accounting for the most, but the proportion he received was less than 1% of the total supply of ETH. This ownership share is quite small compared to traditional stocks.

Although compared to Bitcoin, the establishment of Ethereum appears to be slightly less"fair", but it still has a relatively fair and open participation model. In 2017, the ICO model became popular, but it gradually faded as problems such as pre-sales and private sales to insiders emerged.

In 2018-2019, fair terms where participants compete freely are a thing of the past. The US Securities and Exchange Commission began to supervise ICO projects to protect the interests of retail investors. Due to regulatory pressure and lack of clarity, cryptocurrency builders can only raise money from venture capital firms rather than the general public. It is no longer possible for non-insiders to buy tokens on cheap terms early on, while VCs can.

You are pessimistic about the transition from a network with no founder rewards, free competition, and fair launch to a network with a lot of founder ownership, VC investment, and privatization benefits. It seems that the purity and beauty created by Satoshi Nakamoto has been corrupted by greed.

But the truth is, cryptocurrencies are very popular right now. When Bitcoin first emerged, the value of cryptocurrencies was not obvious to many people. Yet Bitcoin has proven it has value, and Ethereum has fueled that belief. Since the birth of Bitcoin 10 years ago, it has been showing an upward trend, which has attracted a large number of venture capital institutions.

When Satoshi Nakamoto launched Bitcoin, the difficulty of mining was very low, and a block reward of 50 BTC could be dug out with a computer. Undiscovered Bitcoin became a fair startup for amateurs, not a playground for hedge funds. If a project tried to launch in the same way today, the already wealthy would easily own all the hashes, accumulate all the tokens, and pay electricity bills for a share of the new project. In such an environment, founders might as well sell to them directly and still secure long-term funding.

first level title

Do you have to get rich while building your future?

No one would argue that Vitalik doesn't deserve to own 0.7% of ETH's supply because of his huge contribution to Ethereum. Likewise, no one would argue that Satoshi unfairly dug up 1 million bitcoins.

It cannot be ignored, however, that Web3's biggest proponents are already successful venture capitalists. Somewhat ironically, but not surprisingly, these entities are trying to become super-investors in this utopian, shared and community-governed economy by purchasing majority stakes at low prices in seed rounds.

It also cannot be ignored that founders and investors who only care about grabbing money take advantage of existing market dynamics and create behemoth-style bull projects to enrich their wallets.

Therefore, I think four things are true:

The consensus is that founders get rich when they create enormous value in the world, and it's both well deserved and expected.

There is a rough consensus that venture capital firms or angel investors are providing a service for their early funding and should be rewarded when the projects they fund create enormous value for the world.

Many believe that these funding opportunities should be open and fair, rejecting the existing rules for compliant investors as too paternalistic or counter-intuitive (yay, now we can take big bucks from VCs!).

Everyone hates founders or VCs getting rich without contributing anything of value.

Admittedly, that last point has now become commonplace in the crypto world. Many CEOs of underdeveloped products have become billionaires overnight simply by issuing tokens and promising NFT-powered video games, or building a single-digit active user startup."Web3"Summarize

Summarize

Web3 doesn't exist yet. There are a lot of Ponzi schemes in the bull market, and it may not be accurate to assess its value, but it is also not objective to ignore the dynamic changes in the market.

I think real-world and Web2 social problems exist and are worth solving, and there's a lot to look forward to in the Web3 vision.

I think it would be good for the world to replace central authorities with open, transparent and permissionless systems, rebalancing and decentralizing power.

I hope the financial boom in the crypto market will attract bright minds away from trying to sell people ads and instead build a more equitable and cooperative future.

first level title

Afterword

Original link