Forbes: Where will DAO eventually go?

This article is from Laoyupi (WeChat public account ID: laoyapi), reproduced and published by Odaily with authorization.

Investors and fans, have you really thought about all the places where DAO scenarios can be applied?

In web3 and decentralized construction, there is a strange aspect, and that is the enthusiasm to reform the financial infrastructure, which is to reform what has failed in the past, and hope that"this time will be different". An interesting example from the world of sports, a business called WAGMI United is apparently planning to use cryptocurrency to buy a British football team. Backers of WAGMI United, including Philadelphia 76ers chairman Gary Vaynerchuk, Tiger Global, and Slow Ventures, are considering decentralized ownership, which could lead to a future decentralized autonomous organization known as the DAO. And this isn’t the only example in the sports world: there are other DAOs active in this space, such as the Links DAO planning to buy a golf course, and the Krause Hause DAO planning to buy a basketball team.

If you've been in the dark lately, I should remind you that a DAO is a blockchain-based organizational form, usually governed by a native cryptographic token. Owning these tokens means having the ability to vote on the policies of the DAO. DAO use"intelligent""contract"(i.e. applications that can and often do go wrong due to software) to manage the process and coordinate efforts and resources. I like the statement of Jonah Erlich (he is a member of ConstitutionDAO, which is trying to buy an original copy of the US Constitution at auction): he said that DAO is a"group chat with bank account"。

So what this means for sport is that clubs use ownership tokens for decision-making, which sounds appealing and a real engagement opportunity for fans.

Will the reform this time be different?

Maybe, but maybe it's time to learn from history now that we've tried a raw DAO football club in England. The club is called Ebbsfleet United and it has played an important role in the historical evolution of the football DAO, as it happened back in 2008 when it made headlines in the UK for being taken over by an online community news. The attempt was off to a good start, as the club won the FA Cup (a national knockout match for minor league teams) just months after taking over, finishing 1-1 in front of 40,000 people at Wembley's National Stadium. 0 beat Torquay United. They finished the middle of the league this season and then-manager Liam Dash was able to use investment to keep players that he couldn't have afforded without crowdfunding.

I think many social anthropologists would argue that fan crowdfunding evolved in a completely predictable way. After the investment, the fans vote on who should pick the team, themselves or the manager: they choose the manager every time. This is exactly what I want to do. If I had a vote on how City should line up for the weekend, I would inevitably give that vote to those who know what they're doing (in this case, one of the most successful managers in the history of the game , Guardiola). Why on earth would I let people like me decide things over which they have no apparent ability? (don't say anything to me"wisdom of crowds"crap like that, social media has made it irrelevant).

(Editor’s translation: This paragraph actually refers to the tyranny of democracy. Democracy does not mean advanced, but only the minority obeys the majority. The result of democracy may be chaotic and anti-intellectual.)

Will Brooks, who originally proposed the idea, later said,"One of my biggest lessons is that democracy is not necessarily an advanced way of making decisions". I think this is probably true for any other DAO as well. Even with the wisdom of the crowd to tap into, people have other things to do and other things to influence their decisions.

Such communities tend to quickly evolve into groups where the few coordinate their actions and the many happily delegate responsibility. You'll get to mentor organized cliques or councils in real life. Thus, there emerged what SEC Commissioner Hester Peirce called"shadow centralization"the trend of.

secondary title

Network 2.5

All of the above examples make me wonder what the DAO will eventually become, and whether people really want a DAO. Richard Brown, CTO of enterprise shared ledger firm R3, explores this issue from a very sensible perspective in an interesting article, noting that true decentralization would create a parallel financial system where anti-money laundering , KYC and CTF rules do not apply. A system in which investor protection rules do not apply. A system with no rules for accredited investors. Whether you think it's a good idea or not, Richard rightly points out that this isn't a new environment, it's an environment that we used to have, but no longer. In other words, if there is a Westworld, we're living in it.

Interestingly enough, The DAO is actually already exploring the real Wild West. In Wyoming, the DAO has been buying land, albeit as a"proof of concept"Come experiment with what it means to own real estate on a distributed ledger. One of the people behind the experiment, Max Gravitt (a member of the Kitchen Lands DAO), calls this form of ownership a"Highly mobile and global". It allows him to easily transfer tokenized shares of land, although it is still some distance away from the libertarian revolution, because the actual physical land owned by the DAO is still restricted by laws and licenses and so on. When asked where this is headed, one of the other DAO owners said:"No one really knows. Like, now there's just a lot of good looking stuff"。

(Maybe this commentator has never actually met someone in the real estate industry, and I don't want to be that guy, but I'm not sure that integrity is actually the bedrock on which this sector of the economy lives. Still, in honesty about parts of the profession in America Real estate brokers do score higher than congressmen and car salespeople on ratings based on social and ethical standards.)

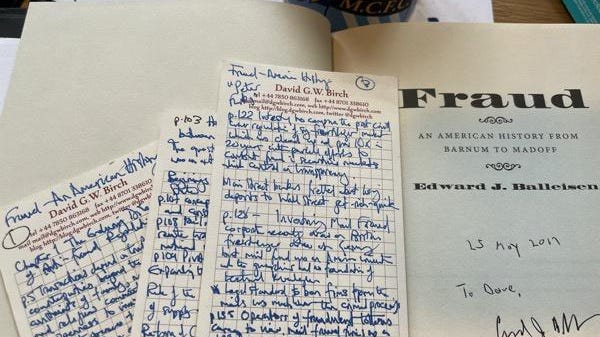

The call for the co-evolution of Westworld and the new technologies that created the economic world has given me an opportunity to mention one of my favorite books, Fraud—From Barnum to McGill by Professor Edward J. Doffer's American History.

(I discussed his book with Ed a few years ago, you can listen to it on Soundcloud).

This book describes the evolution of regulation and institutions that protect consumers and investors from the beginning of the Golden Age of Fantasy Stories. Reading this, I can't help but see that the world of web3 and the metaverse of the original ecology are similar to America in the era of railroad tycoons. All this concept of being your own bank and we don't need it all sounds fine until your grandma clicks on a scam link in an email and her house belongs to some anonymous wallet in Minsk within three nanoseconds of a split second.

The idea of a more efficient financial system based on trading tokens on a semi-transparent ledger is actually quite appealing because, as many have observed, the cost of financial intermediation is a tax on the economy, It directs resources away from the more productive uses we need to maintain living standards and economic growth. But that doesn’t mean there’s no regulation and institutions: truly decentralized systems just don’t survive, they mutate into centralized systems (i.e. representation and republics) or anonymous oligarchy. I don't know what to call the combination of defi technology and cefi governance, but now I call it web 2.5 to see if it can persist from concept to actual application field.