In-depth analysis of the new paradigm of NFT mortgage lending: the capital pool model

Original author: Dyo Hu@Axia8 Ventures

Original source: Mirror

The value of this article

The value of this article

The current NFT market has reached tens of billions of dollars, but the valuation of NFT mortgage lending is mostly less than $100 million. The huge value gap implies huge opportunities.

This article will discuss why the current mainstream P2P model of NFT mortgage lending is not popular, and why I think the fund pool model will create a new paradigm, liberate 99% of the current idle NFT in the wallet, and open the track of NFT mortgage lending.

Contents of this article

NFT Mortgage Loan Track Scale

Why the current Peer-to-Peer model does not solve the problem well

Why I think the money pool model is better and how it works

track size

track size

track size

NFT mortgage lending means that NFT owners use their NFT as collateral to borrow money from fund providers.

In order for NFT to be used as a mortgage asset, it must meet the following requirements:

Sufficient value consensus: the market recognizes that the NFT series is valuable, has confidence in its price, and will not collapse due to short-term price fluctuations, and at the same time, fund providers are willing to obtain collateral

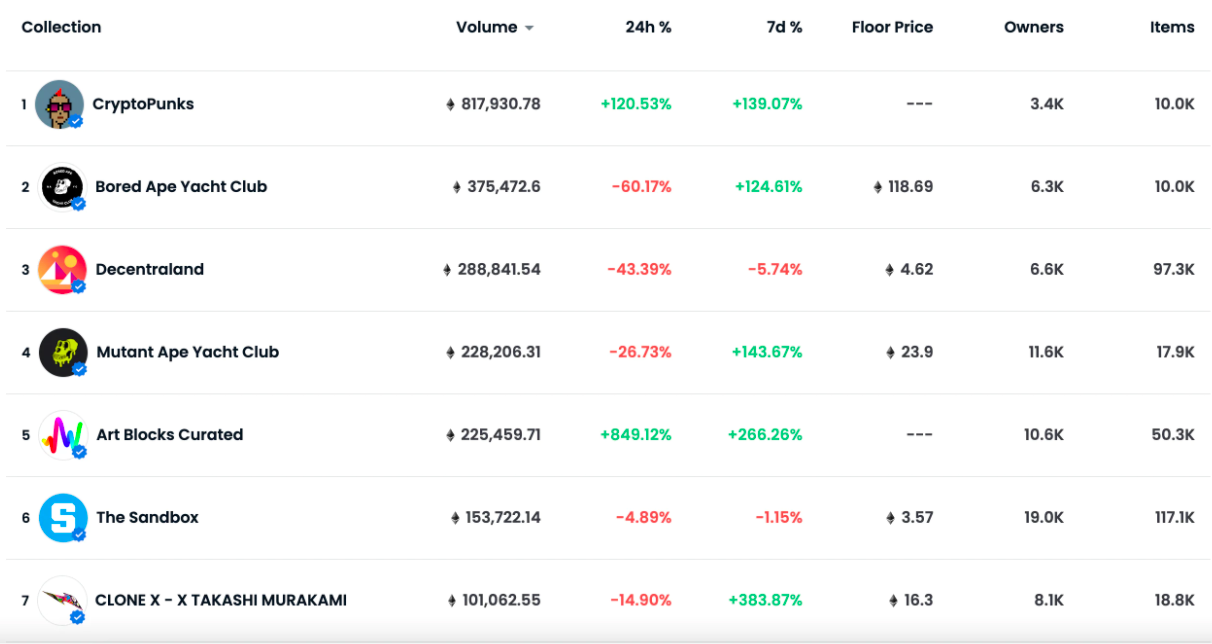

There are seven series with more than 100,000 ETH volume on Opeasea, CryptoPunks / BAYC / MAYC / Art Blocks / Clone X / Decentraland / SandBox. These seven series alone are already a $10 billion market, which is also the market size of NFT mortgage lending projects.

Opensea data - 2022/2/1

image descriptionSolv ProtocolThis Financial Voucher NFT with a clear price will also start to work. I think that in 2022, the top NFT projects can reach a market value of more than 20 billion US dollars, and NFT mortgage lending projects can also have projects with a market value of billions of dollars.

first level title

Introduction to peer-to-peer-mode

Peer-to-Peer Mode Introduction

The biggest problem with NFT as collateral is how to price it. Each NFT has a different rarity, resulting in different prices. Therefore, the current NFT mortgage lending is mostly a Peer-to-Peer model, allowing NFT owners and fund providers to communicate on an agreement on a price acceptable to both parties, and the project serves as a platform to facilitate transactions.

As an example, the use process is for the NFT owner to mortgage the NFT to the platform, and fill in the amount and period of the desired loan.

The fund provider can browse the expected loan amount of each NFT on the platform, and the fund provider submits the loan amount he is willing to provide and the required interest.

Advantages of p2p-

Advantages of P2P

Get the current market consensus price

Due to the uniqueness of NFT, the P2P mechanism can solve the price problem of any NFT, and the fund provider will appraise and quote, and the risk of income depends on the judgment ability of the fund provider. Especially for NFTs with high rarity, much higher than the floor price or NFTs with low transaction volume, the P2P model is needed to give the market an appropriate price at the moment.

Applicable to all kinds of NFT

Disadvantages of p2p

Disadvantages of P2P

long transaction process

NFT owners can only wait for others to quote after listing. They don’t know when someone will submit a quote, and they need to go back and check. Every NFT owner hopes to have multiple quotes to compare, and the transaction time is usually calculated on a daily basis.

In many cases, mortgage loans are urgently needed at the moment. In terms of transaction matching, the P2P model can only optimize the transaction time experience by increasing the number of fund providers and other means, but it still cannot accelerate the essence. For NFT owners who are in urgent need of money, this experience of uncertainty is less friendly and may be forced to accept offers with harsh conditions.

The number of NFT owners with professional appreciation is small, and the interest is high

The P2P model will dissuade most of the funding providers who are interested but lack professional appraisal capabilities. The fund provider of the P2P model must have professional appraisal capabilities, which requires high capabilities. If the wrong quotation is given, it will need to bear the risk of losing money after liquidation. There are only a handful of NFT owners who can understand the value range of each NFT in the entire series, so except for BAYC / CryptoPunks / ArtBlock, even MAYC / Axie / SandBox, basically no one quotes.

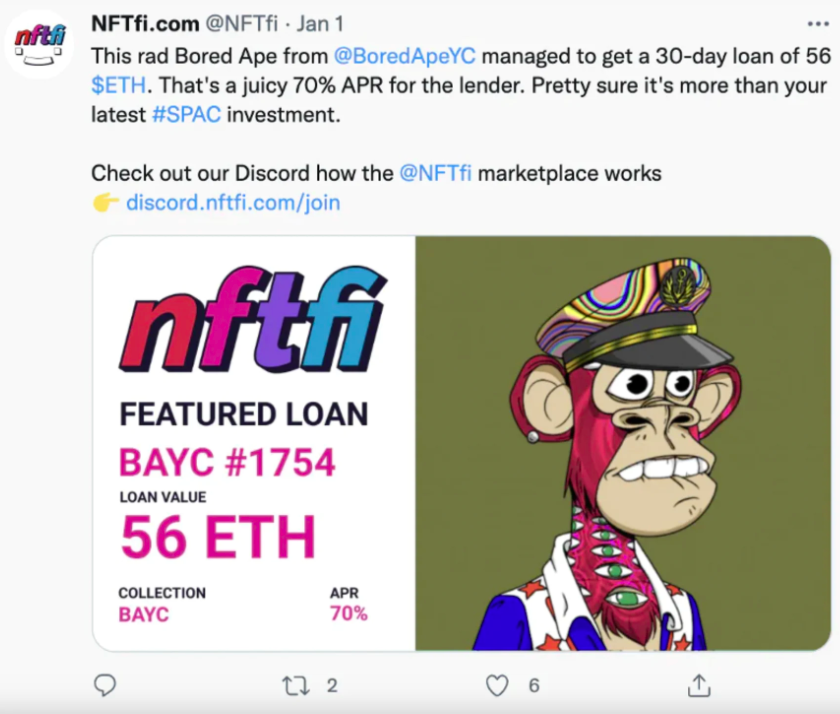

However, even BAYC/CryptoPunks only have single-digit quotes, and the interest required by fund providers is usually between 30-40%, and even 60%-100% can be seen. For borrowers, unless they can ensure that there is a way to bring higher returns during the period, there is a higher risk of loss, which greatly affects the willingness to supply.

The P2P platform advertises that the fund provider obtains a super high APY to attract more people to provide funds and reduce transaction time, but it means that the NFT provider needs to pay high interest, and the NFT provider who is the most critical to the entire model has a poor experience.

The transaction amount on the platform is small, and the loan funds cannot stay on the agreement

Summarize

Summarize

Summarize

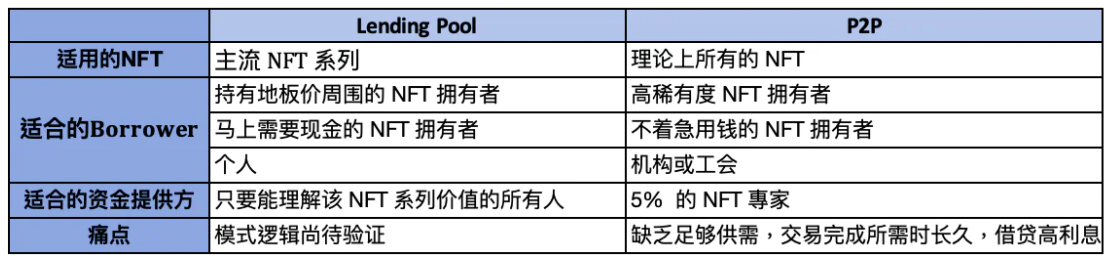

P2P logic does perfectly solve the problem of different NFT prices, but the low efficiency of capital use, long transaction time and high interest are obvious disadvantages.KyokoTherefore, I think the most suitable scenarios for P2P may be high-value NFT, long-tail NFT, etc. At the same time, NFT owners do not need money urgently and can wait for a few days. or like

Why I think the money pool model is better and how it works

Why I think the money pool model is better and how it works

The oracle problem

The oracle problem

The oracle problem

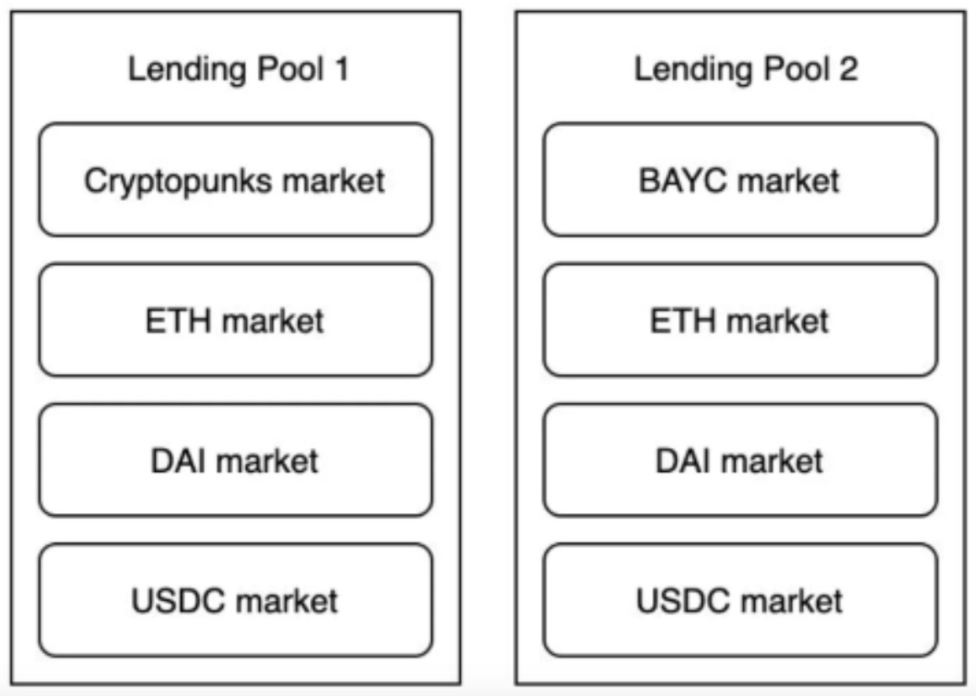

How does the capital pool model price NFT -

Advantages of the fund pool model

Advantages of the fund pool model

The transaction is completed quickly and the loan amount is clear

Most of Crypto's borrowing is used for currency speculation, and currency speculation values timing and knowing how much money can be invested. The fund pool model allows Punks and BYAC users to immediately obtain a clear amount of loans for investment as long as they have a loan demand, without waiting for price discovery.

Low and stable interest, funds can stay on the agreement

The capital pool can liberate a large amount of borrowing funds. There are many people who can understand the value of BAYC and CryptoPunks, but the people who can distinguish the value of each NFT may be less than 5%. The fund pool model allows everyone who has a consensus on the series to provide funds to the pool to earn interest. Compared with the P2P model, the amount of loan funds in the agreement can be significantly improved. I predict that this will also allow NFT owners to steadily reduce the interest rate of 30%-100% in the P2P model to 10%-20%.

Disadvantages and risks of the capital pool model

Disadvantages and risks of the capital pool model

The most obvious is that it is impossible to give a fairer loan amount to NFTs above the floor price, making NFTs farther away from the floor price less willing to use. This part cannot be solved at present. In the future, it may be opened separately for NFTs with specific rare parts. A pool is solved by floor price + X%, so I think that high rarity NFT is not the main service object of the fund pool now

Next, the biggest risk is price manipulation or sharp drop, which can be divided into several scenarios-

NFT prices are falling rapidly:

If the NFT series falls too fast, a large number of NFTs are liquidated and listed in the trading market, causing panic to continue to fall, and NFTs cannot be sold, resulting in losses for borrowers. This is why I think the fund pool model is currently more suitable for NFT series with strong consensus, ensuring that someone is waiting to be acquired when it is liquidated.

Protocol malicious attack:

Another common concern is that if some users continue to sell left-handed and right-handed far below the floor price, the floor price may be manipulated to drop rapidly, affecting the interests of protocol participants, even if it is not beneficial to hackers.

TWAP uses multiple time dimensions as data sampling sources, and removes extreme values at the same time to make a comprehensive floor price. At the same time, multiple transactions within the same NFT time can only be judged once to avoid being attacked.

Borrowing and deliberately liquidating after pumping up the price:

Large households used multiple NFTs to sell their right hands in a short period of time, which greatly increased the floor price, and then borrowed a large amount of money in the pool without repaying the money, allowing the agreement to liquidate NFTs that were not worth so much money. It is especially easy for long-tail NFT series. Therefore, the capital pool model is indeed riskier for non-mainstream NFTs. It is foreseeable that the interest of such project fund providers will be higher, and investors need to be more cautious.

As for mainstream projects such as BAYC and CryptoPunks, the pool mortgage rate is assumed to be 30%, and 15 ETH can be lent at a floor price of 50 ETH. If you want to make a profit by raising the floor price of borrowing, even if the big players collude, you still need to raise it to more than 150 ETH to make a profit. At the same time, it must be established on the premise that the intrinsic value of BAYC is that 50 ETH will not rise again. The cost is far greater than the benefit.

Smart contract risks:

Summary of Fund Pool and -p2p- Mode

Summary of Fund Pool and P2P Model

At present, most NFTs have no value as a mortgage loan, because no one wants them after liquidation, and most NFTs still have no turnover rate in 2022. In theory, P2P can serve all NFTs. However, there is currently a lack of sufficient capital providers and high-quality NFT supplies. Only BAYC / CryptoPunks and other series are quoted, and there are not enough professional appraisers for other series. Compared with the P2P model, the capital pool lowers the threshold for capital providers so that it can serve a wider range of mainstream NFT series.

Fund pool model

Fund pool model

Fund pool model

In February, the NFT mortgage loan fund pool was launched, and the BAYC / CryptoPunks pool was launched. The current fully diluted market value is about 30 million US dollars.

p2p mode project

P2P mode project

Most of them have not issued coins, and many projects have other businesses.

Pantera Capital investment, in beta.

other projects

other projects

other projects

Users can borrow money to buy NFT and pay fixed interest to the fund provider, with a market value of 5.8 million and an FDV of 162 million US dollars.

After mortgaging NFT, the PUSD provided by the agreement can be obtained from the pool, the mortgage rate is 32%, and no currency has been issued.

There is an NFT flashloan project for programmers that allows flashloan lending.

Updates will stop starting in October, not sure about the progress.

How to verify the success of the -nft-mortgage loan project

How to verify the success of the NFT mortgage loan project

The current judgment is subjective and static, but market changes are dynamic. Whether the judgment is correct, whether there are new influencing factors, and whether the project can be operated will take time to continue to verify.

Avatar NFT Mortgage loan is just needed

The current NFT mortgage market is all about head NFTs, but whether these avatars and land have sufficient liquidity and good pricing in the long run is actually a question mark. Is the P2P model tepid because of poor user experience or most top NFT buyers don’t have this demand, just like rich people don’t mortgage their famous paintings for loans.

Mainstream NFT supply quantity

The data that needs to be observed most is the supply of mainstream NFT. In the current market, only mainstream projects have mortgage loan value. Which protocol the mainstream project NFT mainly flows to will be the leading project on the track.

Mainstream NFT community discussion

Mainstream NFT projects are their own communities, and if the product hits the pain points of the community, there will be enough discussion volume.

Can serve more series

Finally, there is a bonus item, whether there is a real and sufficient supply and demand for NFT series other than BAYC / CryptoPunks.

future judgment

future judgment

The NFT mortgage lending track is more divided into entry angles and operational capabilities. The fund pool is currently the most suitable series for the mainstream. After the overall number of NFT buyers and sellers is sufficient, P2P is applicable to any series and scenario, and has stronger scalability.

Therefore, I think that the agreement of the P2P model in the future may increase the fund pool model, and the fund pool model may increase the P2P module, so that both borrowers and lenders with different needs can be satisfied in one agreement.

NFT mortgage lending can help NFT projects stabilize the floor price and increase its value. If a project is held, it can ensure that the loan agreement borrows money while receiving agreement token rewards, which will have more incentives for buyers to participate.

Therefore, if the mortgage lending agreement has a DAO and allows token holders to vote which NFT series to add, and to determine pool token rewards based on the number of votes, there is also an opportunity for various NFT project parties to compete for token voting rights like Curve.IQ ProtocolWhether avatars and land are the most suitable for mortgage loans also needs time to verify, at least land NFT I think it may be more suitable

Offered NFT leases instead of mortgage loans.Kyokorisk warning

risk warning

risk warning