Why are NFTs resilient?

This article comes fromthedefiant, original author: Pedro Herrera

Odaily Translator |

This article comes from

, original author: Pedro Herrera

Odaily Translator |

In recent weeks, a series of macroeconomic events have caused uproar in the crypto market, and are also reminding everyone of the potential risks and volatility that are ubiquitous in this nascent industry, such as:

1. Controversy surrounding Bitcoin mining in Kazakhstan has been aroused;

2. The outbreak of a new round of COVID-19;

3. Expectations of the Fed raising interest rates;

4. The unstable market situation in Ukraine.

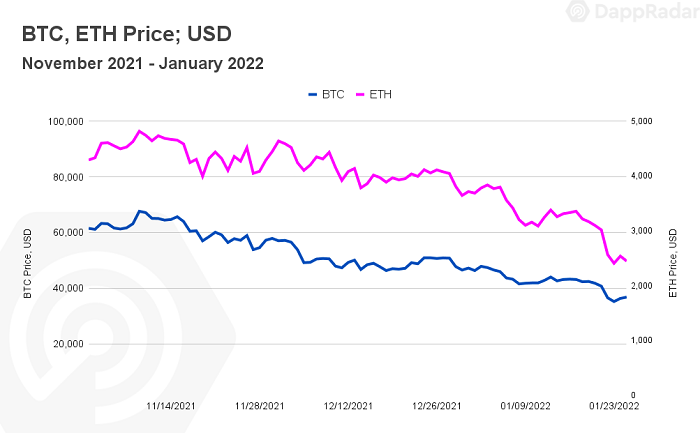

Due to the degree of correlation between cryptocurrencies and traditional markets, the impact is also being felt strongly in the blockchain space, with bitcoin and ethereum now down in price since reaching all-time highs in November 2021 Half, BNB, ADA, SOL, AVAX, SAND, MANA, GALA, and several other cryptocurrencies that have historically performed well were not spared either. During this period, the total market capitalization of cryptocurrencies has also shrunk from $2.9 trillion to $1.6 trillion.

Above image source: DappRadar

There is no doubt that the current crypto market sentiment is panic and challenges are everywhere. However, in the blockchain market, there is another scene in a special vertical industry, which is: NFT.

secondary title

Understanding NFT Macroeconomics

Although a series of events have hindered the progress of the encryption market, the following major factors have had a positive impact on the future development of NFT at the macroeconomic level.

At the same time, as the most popular social media platform for cryptocurrency and NFT enthusiasts, Twitter also enabled the first Web 3 function in order to expand its influence. Next, social media platforms Instagram and Facebook will follow suit with similar features. Meanwhile, even retail giant Walmart has jumped on the bandwagon, filing several trademarks for NFT use cases.

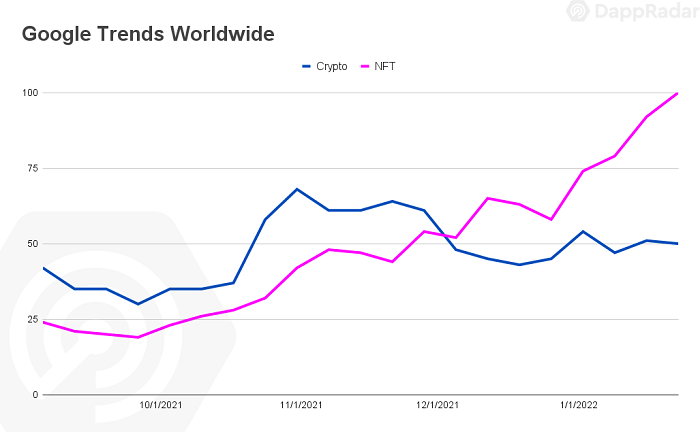

Above image source: DappRadar

At this stage, the popularity of NFT assets is definitely higher than ever. The numbers don’t lie: Google searches for the term “NFT” recently surpassed “crypto” for the first time, and a growing number of NFT enthusiasts from Asia are taking over a market once dominated by North American and European users.

secondary title

NFT On-Chain Metrics Tell a Bull Story

NFT was a dark horse in the blockchain industry last year and performed quite well. In 2021 alone, the NFT market will have a total transaction volume of $25 billion, which is 18,414% higher than the sum of transactions in the previous four years.

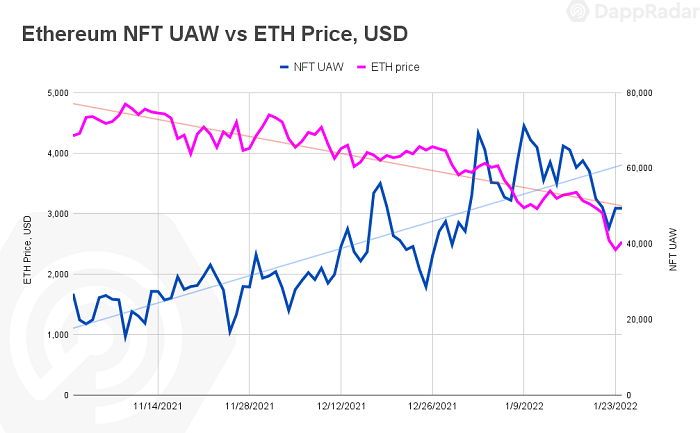

Although cryptocurrencies are in the heat of the water, NFT seems to be unaffected at all, but is thriving. Next, let’s narrow down the scope of analysis and focus on Ethereum. NFT on Ethereum also showed a very positive trend: its transaction volume accounted for 75% of the total transaction volume last year; NFT sales and the number of users on Ethereum continued to increase; the only active wallet (UAW) was Connected to collectibles decentralized marketplace NFT Dapps. According to statistics, since December 2021, an average of more than 53,300 unique active wallets are connected to Ethereum NFT Dapps every day, which is 43% higher than the third quarter of last year.

Above image source: DappRadar

Despite the underwhelming performance of cryptocurrencies, on-chain metrics are on the rise, driven by positive macroeconomic events and the central role NFTs play in the Play-to-Earn and metaverse realms. rising. Building a decentralized and interoperable metaverse is absolutely beneficial to the development of the NFT market.

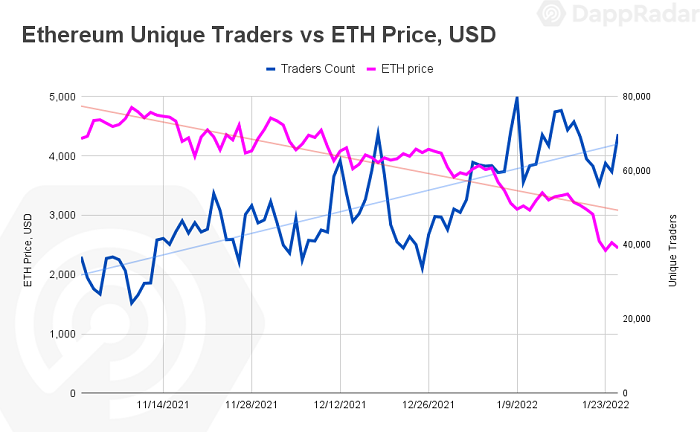

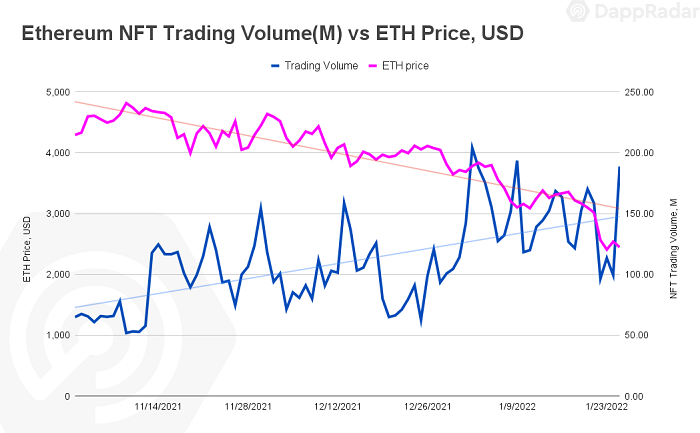

In addition, people may see now as a great opportunity to buy cryptocurrencies due to the decline in the value of cryptocurrencies, the underlying assets that support NFTs. Although 2022 is just getting started, there are more independent traders than ever before - reaching a record 1.6 million. Driven by these independent traders, Ethereum NFT has generated more than $3.7 billion in transaction volume, and this does not include the transaction volume on LooksRare. If this trend continues, it will hopefully break the August 2021 record of 4.5 billion USD transactions.

Above image source: DappRadar

The series of on-chain indicators mentioned above reflect the market’s recognition of the new asset class and positive market sentiment. Not only that, but there is another indicator that can clearly reflect the market's pursuit of NFT assets-the floor price.

secondary title

Floor price analysis

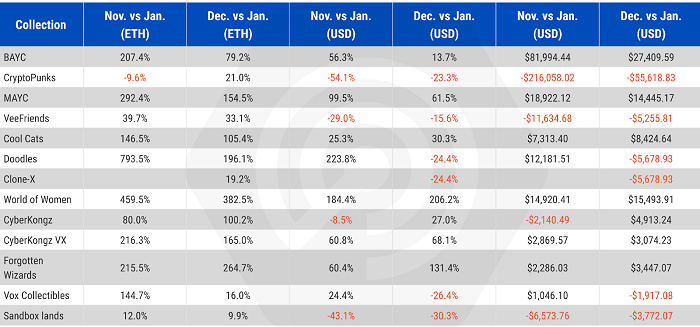

Floor Price is one of the most important indicators for evaluating NFT collectibles, especially from the perspective of investors. The floor price of an NFT collection is the lowest asking price of the collection, which represents the lowest barrier to entry.Our recent analysis of the floor prices of some important Ethereum collectibles shows that NFTs are more of a store of value asset and, importantly, assets in this category outperform cryptocurrencies and even Is better than gold and some traditional assets such as the S & P 500 index.

Above image source: DappRadar

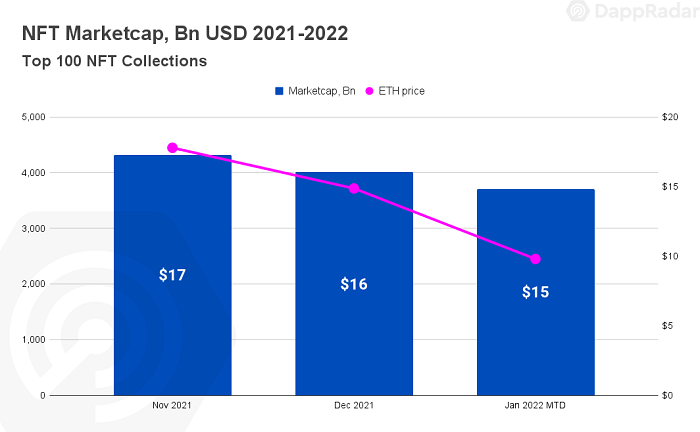

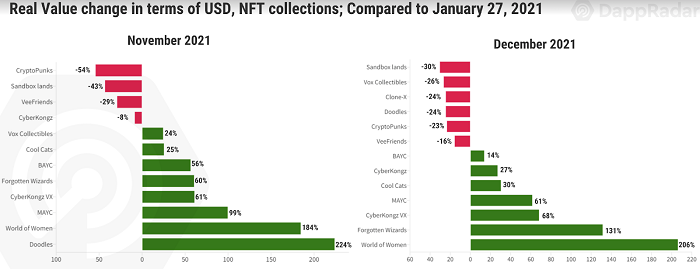

It is not difficult to see that the overall value of the NFT field is steadily increasing. By analyzing the floor price of the top 100 NFT collectibles, we found that the current value of NFT is about 14.8 billion US dollars, a decrease of 2.4 billion US dollars from November.

Although the price of ETH has been hit hard during this time, falling 50%, the price of the most traded NFT collectibles has not fallen by more than 15%, which also reflects the resilience of NFT assets.

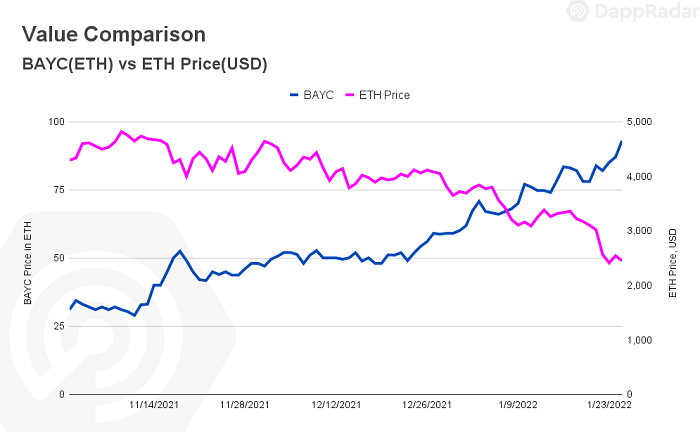

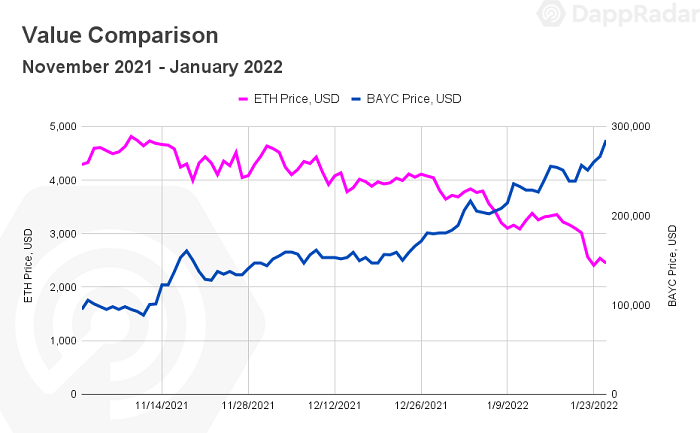

Here I have to mention one of the NFT collectibles that have a direct positive impact on NFT - BAYC. In early November, when Bitcoin and ETH reached historical highs, the floor price of BAYC was floating around 30 ETH. A week later, while the price of ETH fell by 15%, the floor price of BAYC rose by more than 60%, exceeding 50 ETH. By the end of 2021, the price of the cheapest BAYC has reached 60 ETH, and most of them have exceeded 90 ETH. This means that if calculated at the current ETH price, the cheapest BAYC must cost more than $225,000.

Above image source: DappRadar

Although the high-profile cryptocurrency has lost roughly half its market value over the past two months, BAYC has risen 207% (measured in ETH) since Nov. measured in dollars). In other words, if you held BAYC from November 10 to today, you would have made a 14% capital gain, while those who held any cryptocurrency would have netted a loss of 50%. Obviously, BAYC has become a store of value.

Above image source: DappRadar

However, BAYC is not the only avatar-like NFT that is on the rise. Another Ethereum avatar NFT, World of Women, is up 383% (measured in ETH) since Nov. 10, with an actual price increase of 185% over the same period. In addition, the floor prices of CyberKongz and its voxel (VX) version have actually increased by 27% and 68%, respectively, since December last year. The same goes for Doodles, whose floor price has risen 224% since November.

Above image source: DappRadar

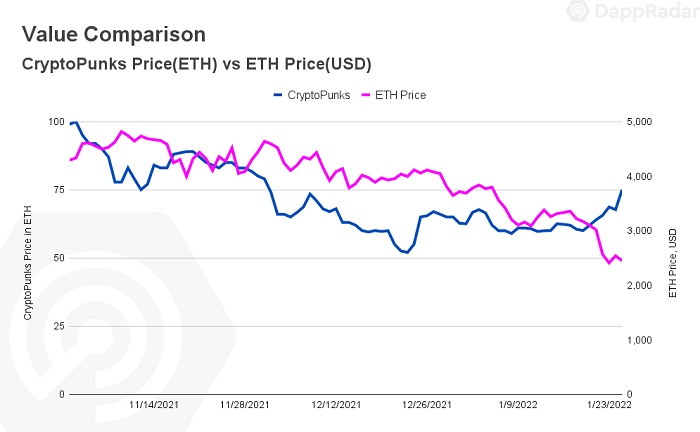

CryptoPunks, as the most "chronological" NFT collection, is tricky to analyze. Although the performance of this series of NFTs is not as good as the other series mentioned above, it has to be said that CryptoPunks still outperforms several other encrypted assets. The floor price of Cryptopunks hit 100 ETH on November 2, and then fell to 83 ETH a week later. On the same day, Bitcoin and ETH hit record highs. However, since that day, the floor price of CryptoPunks has dropped by 9.6% (measured in ETH), but the actual price has only shrunk from $254,000 to $229,000. It can be seen that CryptoPunks is also quite resilient.

Above image source: DappRadar

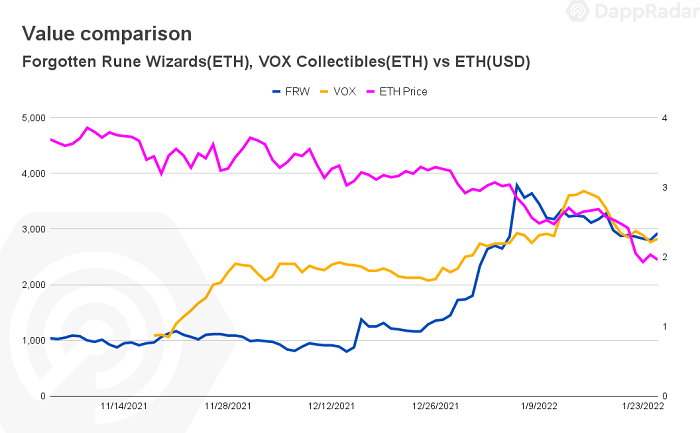

Just as the value of avatar-type NFTs has risen significantly, NFTs related to virtual worlds and games are no less. Forgotten Rune Wizards is a typical example, its floor price has increased by 210% (measured in ETH) since November 10th, and the actual price is 132% higher than in December. Similarly, the floor price of the Gala Games VOX NFT has also increased by 145% (measured in ETH) since November.

On the other hand, NFT, as the underlying architecture of the virtual world, has benefited a lot from the hype of the metaverse and has rapidly increased in value. For example, the floor value of virtual land in The Sandbox and Decentraland has remained high since Facebook announced the name change (although its real value in dollars has declined). Meanwhile, despite the downward trend in cryptocurrencies, floor prices for virtual apartments on the Worldwide Webb are up 242% since November (measured in ETH), while virtual plots on Cryptovoxels are 17% higher than in November. % (measured in ETH).

Above image source: DappRadar

We believe that analyzing the floor price of collectibles can understand the stability of the project from an investment perspective. Recent analysis has confirmed that while the overall market is showing a downward trend, some NFTs have gained a firm foothold. Why does this happen? Why are NFTs so resistant to falling cryptocurrency prices?

secondary title

Why are NFTs so resilient?

The answer to this question is not so simple. But what is certain is that under the influence of some specific factors, NFT has attracted many rational investors.

At the same time, NFTs such as BAYC and CryptoPunks have gradually become the mainstream of the market. On August 23, 2021, VISA announced the purchase of CryptoPunk #7610 for $150,000, further strengthening CryptoPunks' position as a store of value. In addition, 101 works in the BAYC NFT series were successfully auctioned at Sotheby's for $24 million.

Practicality

Although there are currently only a few collectibles that can be compared with the above two types of NFT, it is believed that in the near future, NFT will shine in the fields of music, ticketing, sports and fashion. All in all, people have great expectations for NFT, but only time will tell whether NFT will have a cultural impact that transcends generations.

secondary title

Practicality

One of the most important characteristics of a successful NFT project is rewarding its community members: holders can gain added value or utility by holding the NFT of these projects.

For example, CryptoPunks holders received free Meebit launched by the Larva Labs team in the later stage, which increased the actual capital return of the initial investment. The same goes for other projects such as: Cool Cats (the floor price measured in ETH has increased by 150% since November 10), The Meta Key (up 370%), Doodles, and BAYC.

BANANA Usability Framework, above Source: CyberKongz

In addition, NFT has also been integrated into other categories of projects such as DeFi and games. Among them, a typical example of the integration of DeFi and NFT is a platform like NFTfi, where users can use NFT as collateral. And in projects like Pixel Vault, NFTs in the MetaHero Universe (57%) can be staked or “mined” for tokens based on the proof-of-work (PoW) consensus mechanism.

Of course, NFT can also be better integrated into the game and become an essential game element. You’ll find that Mirandus NFTs and Aurory Villagers have all maintained their floor value despite significant price drops in ETH, SOL, GALA, and AURY. We've also previously looked at Forgotten Rune Wizards, another collection of NFTs that incorporate game utility mechanics, and its floor value has also been well developed. While maintaining the floor value of the myriad game alternatives is challenging, it's safe to say that demand for blockchain games is on the rise, adding value to essentially all of these types of NFTs.

secondary title

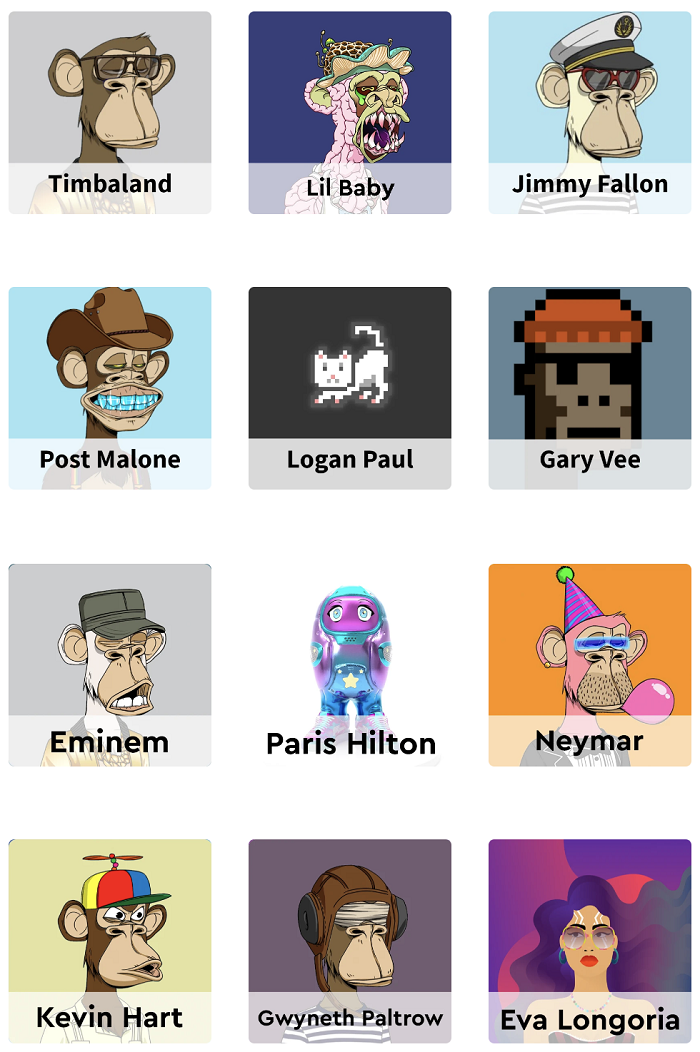

Celebrity star power and NFTs

The positive influence of celebrities is also reflected in another NFT project, it is: World of Women, the series rose 250% in the price of the floor in the hours after Eva Longoria announced the purchase, Doodles is another benefit from Pranksy, Loopify and Steve A project for famous NFT characters like Aoki.

Above: Celebrity NFT, Source: DappRadar

Similarly, the blessing of traditional big companies has brought considerable influence. For example, Adidas, Coca-Cola, Pepsi, Budweiser and several other brands have either launched their collections or cooperated with important NFT teams. The field occupies a place. The same goes for fashion giants Gucci, Dolce & Gabbana, Burberry and others exploring the metaverse.

secondary title

The teams behind NFT collectibles are highly responsible for the fate of their projects. Some teams have found that having talented artists and experienced developers grow with the NFT project is also a recipe for success. Once the team is successful, they can become a truly influential brand in the field.

Above image source: RTFKT

A prime example is RTFKT, the creative team behind Clone-X, which is responsible for developing unique NFT creations in collaboration with Jeff Staple and Fewocious. Ultimately, the digital design and fashion brand relied on this business model to deliver results and handle any challenges well. Today, RTFKT has become one of the most influential brands in the Web 3 field, and was acquired by Nike in December last year for an undisclosed amount.

secondary title

scarce asset

Finally, let's talk about the scarcity factor in the NFT field.

In fact, scarcity is very important because it is directly related to human psychology, the anxiety of missing something, also known as FOMO, this mentality is closely related to scarce assets and investment markets, and NFT combines the two.

Most collectibles come with a limited number of NFTs that are kept forever on the blockchain. Whether it's 10,000 NFTs or 20,000 NFTs, the limited supply of a particular edition will always remain the same. This is the charm of blockchain.

The result is that NFT has gradually become a "self-contained" asset class. While the relevance to cryptocurrencies remains due to the nature of the technology, NFTs are slowly creating an economy for themselves with macro events and market factors that positively or negatively impact the space.