The Economist: Will Web3 Reshape Internet Commerce?

Original Author: Old Yuppie

This article is from the WeChat public account Laoyupi (ID: laoyapi), reprinted and published by Odaily with authorization.

Original Author: Old Yuppie

This article is from the WeChat public account Laoyupi (ID: laoyapi), reprinted and published by Odaily with authorization."web3 "In some respects, yes. But probably not like those being preached now.

Moxie-Marlinspike has created a non-forgeable token (NFT). These digital tokens use clever cryptography to prove that, without the need for a central authenticator, the buyer owns a unique piece of digital property. Like cryptocurrencies such as Bitcoin, NFTs are

The most obvious instance. Its advocates and their venture capital (VC) backers have hailed it as a better, more decentralized version of the internet, built on a distributed ledger known as a blockchain. Digital artists, celebrities, and even the occasional newspaper report that there are many collectors of NFTs, and NFTs are often expensive (the Economist's immaterial edition cover image sold for more than $400,000).

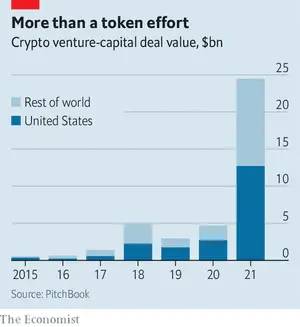

While it looks cryptographically like any other NFT, Mr. Marlinspike's token can change shape depending on who accesses it. If you buy it and watch it on your computer, it turns into a pooping emoji. A few days later, NFT was taken over by OpenSea, a digital art marketplace. This played into Mr. Marlinspike's hands. Because his purpose is not to raise cash, but to raise awareness. His tokens show that NFTs are not as indestructible as advertised. And OpenSea's response suggests that the so-called decentralized Web3 has new rules of its own."The Marlinspike incident is the latest twist in the biggest controversy that has erupted in the tech world in several years. On one side are technocrats, companies providing various web3 services and their venture capital backers. They claim that web3 is the next big thing in the Internet world, it is truly decentralized, and it has unlimited potential. Globally, the value of venture capital deals in the crypto space reached $25 billion last year, compared to less than $5 billion in 2020 (see chart). Last week, Andreessen Horowitz (a16z for short), one of Silicon Valley’s most prominent venture capital firms and largest web3 proponents, was reported to be raising a $4.5 billion web3-related fund, adding to three existing funds with a combined $3 billion . A senior partner left a16z this month to start his own firm focused on the web3 space."Opposed to them are people with a negative attitude. They include Mr. Marlin Spike, who is even well-respected among utopians in tech for creating the secure messaging app Signal, and Jack Dorsey, who founded the two platforms that web3 promises to replace (social The Twitter of media and the Square of payments). They believe that a truly decentralized internet is a fantasy,

You don't own 'web3'. VCs and their [limited partners] own web3,

Mr Dorsey warned last month. It's a dangerous question for uninformed investors: Cryptocurrency, worth about $10 trillion since November, is the most mature area of web3, and its heat may have died off.

This fight may seem far-fetched. But the stakes are high. It could change the trajectory of the internet, and the multimillion-dollar business models it has enabled."The history of modern computing is a continual struggle to decentralize and re-centralize. In the 1980s, the shift from mainframes to laptops gave more power to individual users. Then, Microsoft took back some power around its proprietary operating system. More recently, open-source software, which users can download for free and adapt to their needs, has replaced proprietary programs in some industries—but has been repurposed by giant technology companies to run their mobile operating systems (such as Google's Android) or Cloud computing data centers (including those operated by Amazon, Microsoft, and Google)."。

Combining the decentralization and community management spirit of web1 with the advanced and modern functions of web2"decentralized finance"That's thanks to the blockchain, which turns the centralized databases that big tech companies rely on into a public good that anyone can use without permission. A blockchain is a special kind of ledger that is maintained not centrally by a single entity (like a bank controls all of its customers' accounts), but collectively by its power users. Blockchain has outgrown its earliest application, cryptocurrencies, and proliferated into NFTs and other kinds of

decentralized finance"mixnet "(DeFi). Now, they are increasingly becoming the basis for non-financial services.

The thing is, it's a decentralized network that mixes messages in a way that means no one can actually know who's sending what to whom."smart contract"smart contract"Decentralized Autonomous Organization"managed

Decentralized Autonomous Organization"(DAO), these rules are encoded in software and embedded in the blockchain. And Sound.xyz allows musicians to mint NFTs to make money."。

What all these companies have in common, Mr. Dixon explained, is that they struggle to lock in customers. Unlike Google and Meta, they do not control user data. OpenSea (which a16z also has a stake in) and Alchemy are just pipelines to the blockchain. If their customers are unhappy, they can move on to a competing service. Alchemy boss Nikil Viswanathan said he couldn't stop them from leaving even if he wanted to."The idea is that this makes Network 3 companies work harder to satisfy customers, and to keep innovating. Whether they can do that while still making a lot of money is another matter. It's unclear how much demand there is for truly decentralized projects. This is the early web3 product (called"or"peer to peer"or"decentralized network"。

)The problem. Services like Diaspora and Mastodon, two social networks, never really took off. Their successors may face the same problem. Mr Marlinspike said a service like OpenSea would be faster, cheaper and easier to use,"because all the web3 parts are gone"or can it? A more fundamental problem is that even if web3 works as smoothly as its predecessors, it may become centralized. According to Mr Marlinspike, the lockdown came almost automatically. The history of the Internet shows that collectively developed technical protocols develop more slowly than those developed by a single company. He wrote:"If something is truly decentralized, it is hard to change and often stuck in time"

. This creates opportunity. He wrote:

A surefire recipe for success is to take a protocol from 1990, centralize it, and iterate quickly."Centralization and lock-in have been incredibly profitable. In fact, a16z has made billions from Meta, an early investor in the company; one of a16z's founders, Marc Andreessen, remains on Meta's board to this day. Web3's VC boosters may be counting on something like this to happen again. And to some extent, it's already happening. Despite being a relatively new phenomenon, Web3 is already showing signs of centralization. Due to the complexity of the technology, most people cannot directly interact with the blockchain, or find it too tedious. Instead, they rely on intermediaries such as OpenSea for consumers and Alchemy for developers."The Essentials of Recentralization"miner". One is that ownership of the computing power that keeps many blockchains up to date is often very centralized, making these

miner