Directly hit the Fed's interest rate meeting: Powell's hawkish speech is negative, and the capital market is "undecided"

Original Author: Wang Jiajian

The shoes finally landed.

At 3 a.m. Beijing time on the 27th, the Federal Reserve FOMC stated in a statement that it will keep the interest rate on excess reserves (IOER) unchanged at 0.15%. Asset purchases will end in early March. An appropriate increase in the federal funds rate will be forthcoming soon. Keep the discount rate unchanged at 0.25%. Will start shrinking its balance sheet after raising interest rates.

This means that it is in line with market expectations.

After the announcement of the Federal Reserve's interest rate decision, the three major US stock indexes rose in the short-term and expanded their gains. The Dow rose 1.2%, the Nasdaq rose 2.9%, and the S&P 500 rose 1.93%. Affected by this news, Bitcoin rose by 2% in a short period of time, breaking through $38,800. ETH rose 3%, breaking through $2,700.

However, when Federal Reserve Chairman Powell spoke, his obvious eagle remarks caused the trading sentiment in the US stock market and the encryption market to plummet, and asset prices also ushered in a wave of rapid correction.

first level title

What did the Fed and Powell talk about?

If you only look at the Fed FOMC statement, the result is in line with market expectations.

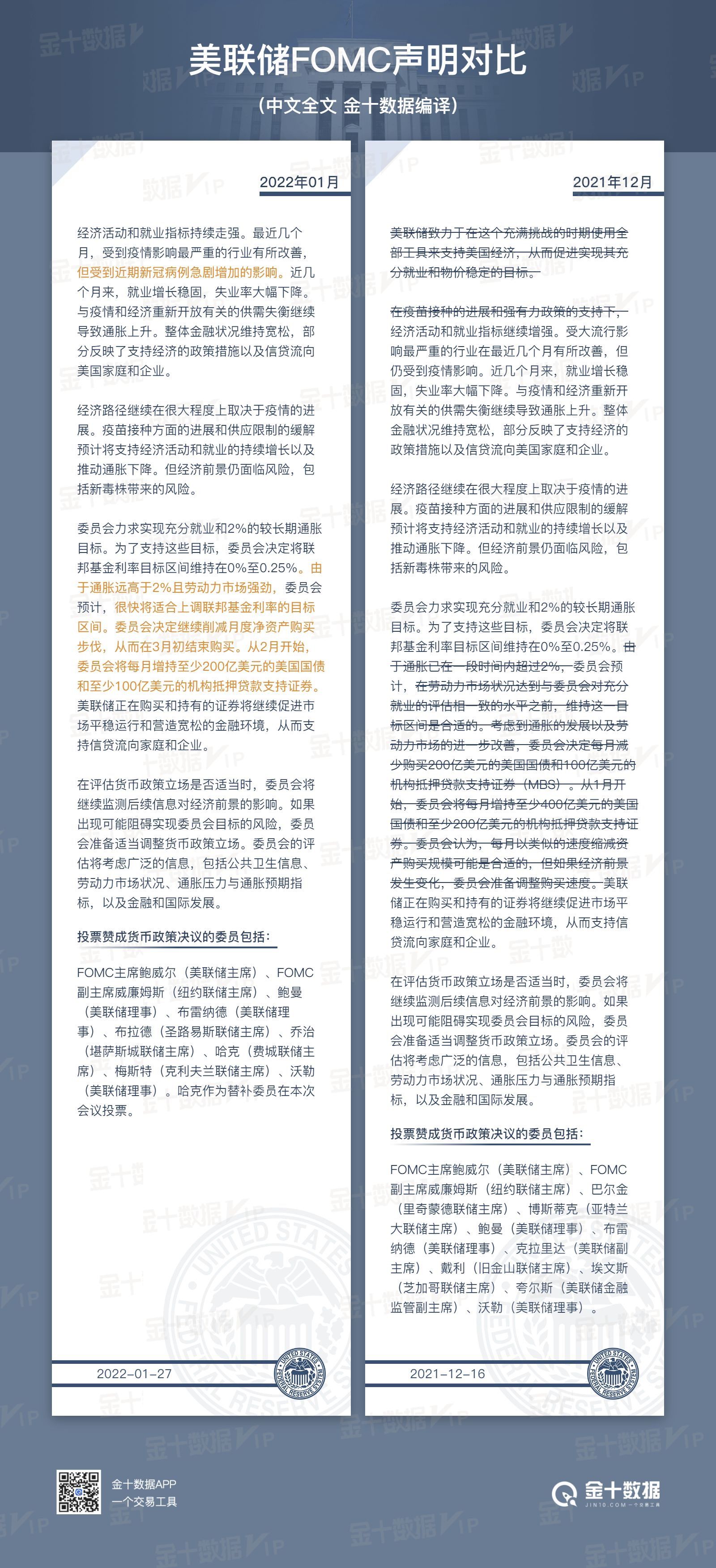

Let’s take a look at the Federal Reserve FOMC’s statement in January. Barabara said a lot of seemingly “useless” but obviously valuable words. Some important excerpts are as follows:

"The Committee decided to maintain the target range for the federal funds rate at 0% to 0.25%. With inflation well above 2% and a strong labor market, the Committee expects that an increase in the target range for the federal funds rate will soon be appropriate. The Committee decided to continue monthly asset reductions The pace of purchases will be increased to end purchases in early March. Beginning in February, the Committee will add at least $20 billion in U.S. Treasury securities and at least $10 billion in agency mortgage-backed securities per month."

What exactly does this mean? We excerpted some analysts’ analysis from the traditional market, and a person named Dennis DeBusschere said: “The FOMC statement does not have any new bright spots, but this interest rate statement still provides some support for the market in the near future. , Of course, this kind of support is relative to raising interest rates by 50 basis points in March or ending QE in January.”

Reuters analysis: "The Fed hinted that it may raise interest rates in March, reiterated that it will end its bond purchases that month, and then begin to shrink its assets (balance sheet) sharply. Urgently combating the shift in inflation'."

Juan Perez, senior currency trader at Monex USA, said: "The Fed's decision sounds like they are not convinced that the time for a rate hike is necessarily in March, because they leave room for adjustments on demand to consider the policy rate. Keep the balance sheet before starting to raise rates. The same size of the table means that they really haven't fully removed all the easing measures. We think that is likely to happen, which is not a good signal for the dollar in the short term."

After the Fed announced its interest rate decision statement, Fed Chairman Jerome Powell held a monetary policy press conference. This press conference also had a huge impact on the market. At least judging from the performance of asset prices in the encryption market, they directly gave up their gains and fell all the way. What did Powell say?

He said: "Inflation remains well above our long-term target. Inflation is expected to decline over the course of the year. Taking inflation and employment into account, the economy no longer needs sustained high levels of support. The economic outlook remains highly uncertain and requires Remain humble. The federal funds rate is our primary policy instrument. Balance sheet reduction will occur after the start of rate hikes. Balance sheet reduction will occur in a predictable manner. No decision has been made on the timing and pace of balance sheet reduction. We will prepare to adjust all the details of the balance sheet reduction approach.”

Powell mentioned that the Fed's two major tasks are calling for it to abandon its highly accommodative policy. These very "hawkish" speeches surprised many people and caused the market to stumble.

In response to Powell's speech, some analysts commented that it sounds enthusiastic about the future, but the technical aspect of the wording is biased towards hawks.

Cardillo, chief market economist at Partan Capital Securities, said: "Powell created some uncertainty in the question-and-answer session of the press conference, and I think that's why the market reacted. Powell said that inflation may worsen, and supply bottlenecks may be worse. The rhetoric was supposed to be an attempt to prepare the market for a turnaround and try to balance some of the fear elements. But the rhetoric is creating an atmosphere of uncertainty, which is not good for the market.”

Mikko, a KOL in the encryption industry and the founder of Zhibao who has a better understanding of monetary policy, commented that his 13 years of experience in the continuous tracking of the Federal Reserve has hardly helped him. Because the path Powell is currently charting is beyond almost every possibility he has experienced.

Obviously, Powell surprised a lot of people.

Is the market really going to bear? What do crypto people think?

In response to the above content, we have seen that many analysts and KOLs in the encryption industry have expressed some opinions, which we excerpt as follows:

"Powell chose the hard way: He has a hawkish answer to every question. Last time that happened was late 2018." — @MacroAlf

"The Elders gather in a back room, and they've been doing it since 1913. If the chimney smokes black, it means no change. If it smokes white, it means they will add 0.25% to the price of the currency." - @LynAldenContact

"The Fed's decision is indeed positive, and Powell's speech turned into a negative, but according to analysts, the current interest rate hikes are all within expectations, and there may not be much change. It will have a great impact on the industry. When the good news was just announced, a large amount of funds were purchased. After the bad news appeared, it rushed up and fell back, consuming a lot of bull power. The current trend is not optimistic. ——@Phyrex_Ni

"Don't expect a reversal. Raising interest rates and shrinking balance sheets may only exceed expectations, and there will be no surprises below expectations. They will try to avoid black swans, and policy matters will try to make the market psychologically prepared. But the direction and purpose are clear. Execution is necessary." - Mining Little Penguin

In any case, the Fed meeting may be the most critical event in determining the future economy. The macro background of the global economy is placed here, and its influence will continue.

Remarks: This is the timetable for important Fed interest rate resolutions in the first half of 2022, Eastern time, please pay attention.

March 15-16. Fed rate decision, press conference, dot plot, economic forecast

May 3-4. Fed rate decision, press conference

June 14-15. Fed rate decision, press conference, dot plot, economic forecast