In-depth Analysis of Yield Guild Games: GameFi Promoter

Originally Posted by Duy Nguyen, Analyst, Messari

Yield Guild Games: A Unique Business Model

As the intersection of blockchain games and DeFiGameFiWhen the market was in its infancy, YGG Y, as a decentralized autonomous organization (DAO), focused on in-game NFT and investment in decentralized games, aiming to accumulate assets in the emerging virtual world economy. YGG's core business can be described as a combination of (Buffett's) Berkshire Hathaway and Uber,YGG obtains various NFT assets from different P2E games, and rents these NFT assets to players who need initial funds (ie, in-game NFT assets) to make money.

For example, since players need some Axie (NFT digital pets) to play inAxie Infinitysecondary title

How to join the YGG guild?

To join YGG, participants need to mint their own YGGGuild Badge (guild badge, a kind of membership NFT), thus officially becoming a member of the guild and starting their game adventure. This badge will serve as their visa to enter the YGG website and participate in numerous activities including signing up for scholarships, unlocking exclusive features, and participating in esports events.

secondary title

NFT Balance Sheet as a Business Model

YGG rapidly expanded its revenue streams by investing assets in its coffers in a diversified portfolio of income assets. As of September 2021, YGG vaults hold approximately $850 million in assets, including in-game NFT assets, liquid tokens, and locked DeFi tokens.

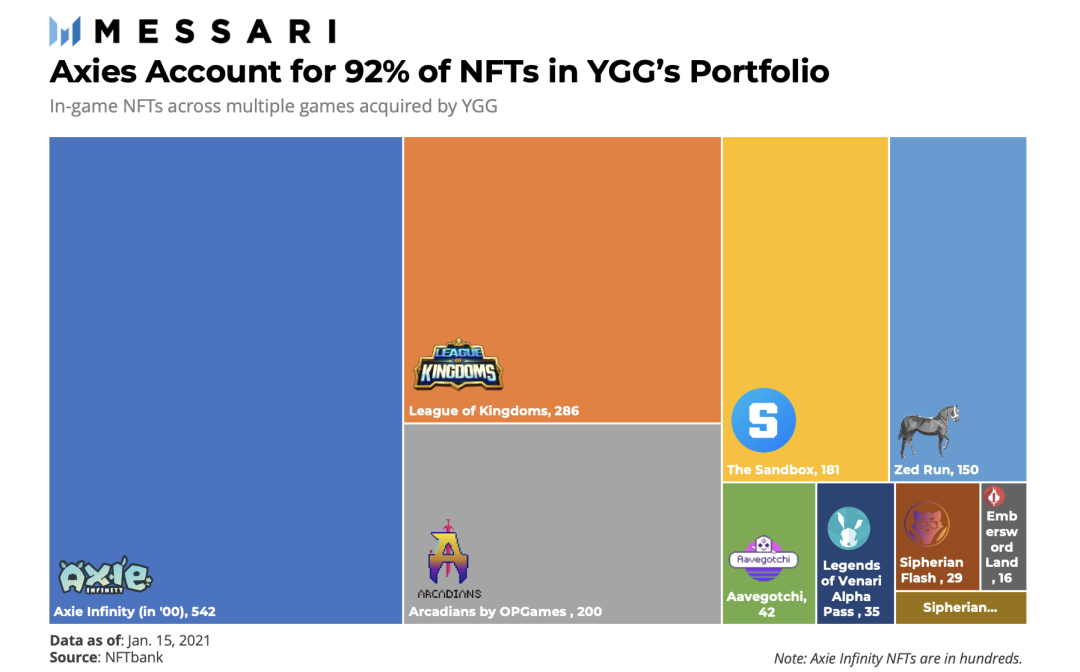

In order to bring the masses into the metaverse through GameFi, YGG has been actively forming partnerships with game developers and adding various NFT assets to their portfolios so that the community can explore different genres and ecosystems. Currently, YGG has nearly 63,000 community members and owns 38,000 NFTs worth about $18 million, including rare items in 12 games, and the number is still increasing. In addition to Axie Infinity, here are some games that show strong potential:

Aavegotchi:A pixelated NFT game based on Tamagotchi that allows players to farm tokens, lend land and participate in mini-games and governance.

Sandbox:A blockchain-based version of Minecraft and Roblox, but players can create their own items and trade them as NFTs. The project recently raised $93 million, led by SoftBank.

Star Atlas:A space-themed blockbuster game, I believe it will shock the global gaming community in the next few months.

secondary title

Create a guild

As a DAO, YGG owns its governance token, YGG, which can be used to vote on business-related decisions and stake rewards. The community receives a large portion of the token supply, with up to 45% of the token supply dedicated to community members. To further optimize the DAO and align it with the community, YGG introduced a subDAO dedicated to each game it owns. Each subDAO has its own wallet and governance token, allowing guild members to vote on development strategies, reward mechanisms, and even cultural customizations representing each region of the world (e.g. Vietnam and the US will have separate guilds and rules for Axie Infinity ).

YGG SEA is a great example of the first subDAO focusing on underserved markets in Southeast Asia such as Indonesia, Thailand, and Vietnam to help grow the gaming community. These segments will allow for greater flexibility and scalability as new games are launched and more members are added, providing more efficient management and a more localized sense of community on a wider scale.In short, YGG DAO is composed of many subDAOs that contribute to the collective hub in different ways.

To use an analogy, the subDAO is a ship, and the community manager will be the captain, driving the development of its sub-guilds through a series of strategies such as recruitment, education, and leadership. Through coaching sessions, subDAO enables gamers to improve their skills for more rewards. And, the better the guild members perform, the more YGG earns.

first level title

The next phase for gamers

Unlike traditional games where in-game items are only valuable in one specific game and are controlled by the game operator, items in blockchain games are 100% owned by players and can be converted to real money (stablecoins or fiat currencies) . The primitives of NFT and blockchain enable new games to decouple central markets and grant ownership of assets to gamers. Players can now decide how to spend their virtual assets on their own terms.

also,

also,The role of the YGG community manager is not only to train players to be the best they can be to achieve the expected income, but also to teach them one of the most critical skills of this decade, which is crypto literacy.By learning how to convert game tokens to cash through a DEX, players get their first exposure to the GameFi world and are ready to learn more complex concepts in the blockchain ecosystem, such as Staking (staking) and Farming (yield farming). in some meaning,YGG can serve as an entry mechanism for newbies to enter the crypto game and has the potential to attract more talents to join the guild.secondary title

guild risk

Currently, YGG relies heavily on Axie Infinity for its revenue, therefore, they need to rely on the continued success and growth of the Axie Infinity ecosystem to remain profitable. The DAO has been investing in numerous Web3 games to diversify its portfolio and reduce the risk of devaluation of individual holdings.

Another risk facing YGG is,Most P2E based games are characterized by making money which is not sustainable in the long run.first level title

Brief Game Industry Outlook

Games are the most approachable medium for educating newbies and introducing them to the world of blockchain and cryptocurrencies or emerging technologies in general, as people tend to acquire information faster through game-based learning. For example, people know and learn about AR/VR through PokemonGo and Web3 through Axie Infinity.

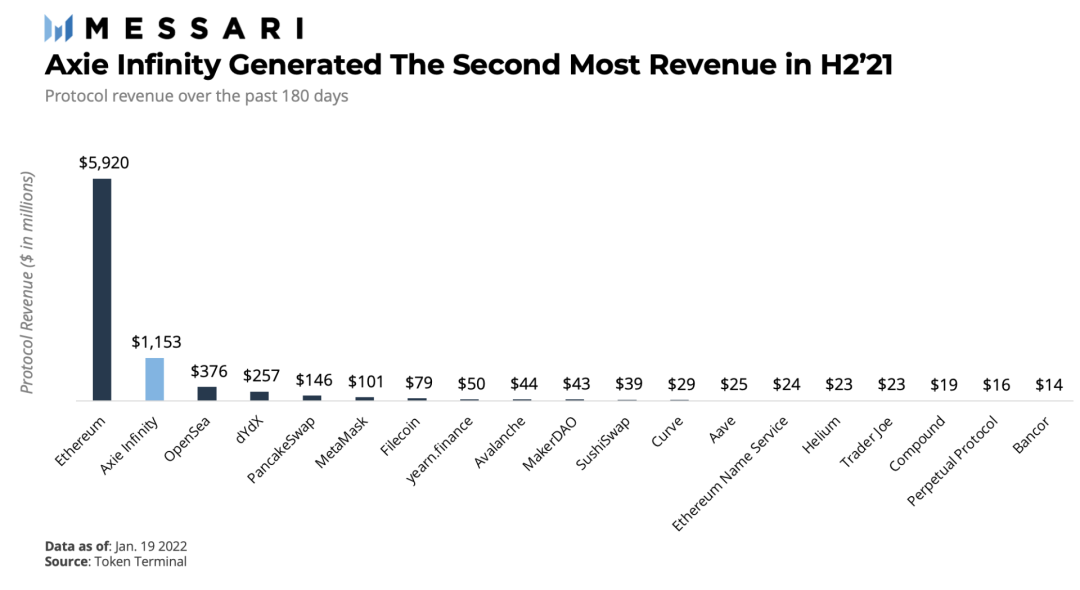

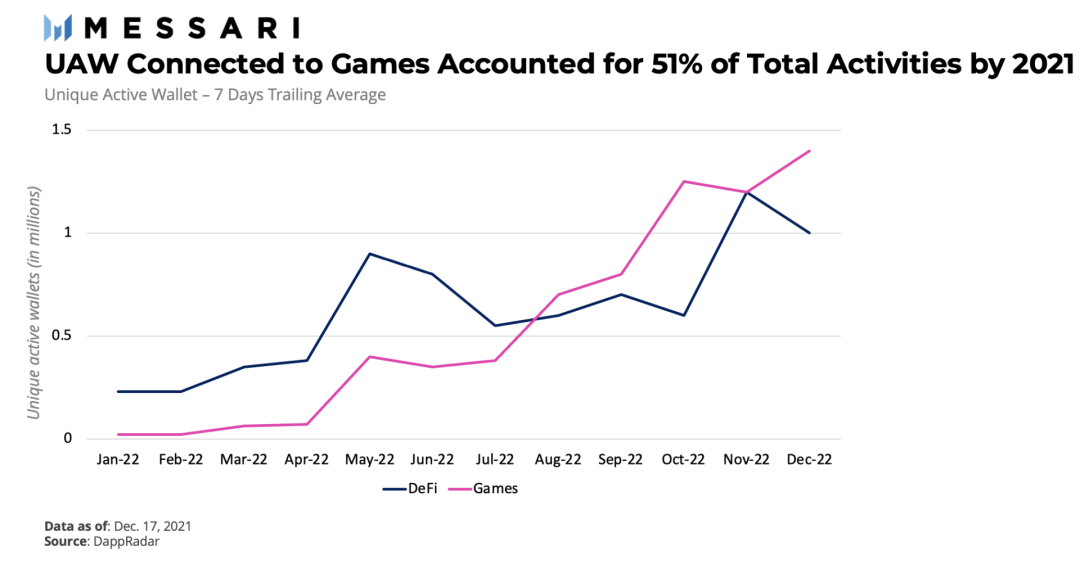

According to a DappRadar report, in the second half of 2021, more than 50% of the unique active wallets in the entire blockchain industry will be connected to GameFi, and the total number of users exceeding DeFi and NFT will reach 1.4 million. This means more people than ever are entering the blockchain world and interacting with the ecosystem.

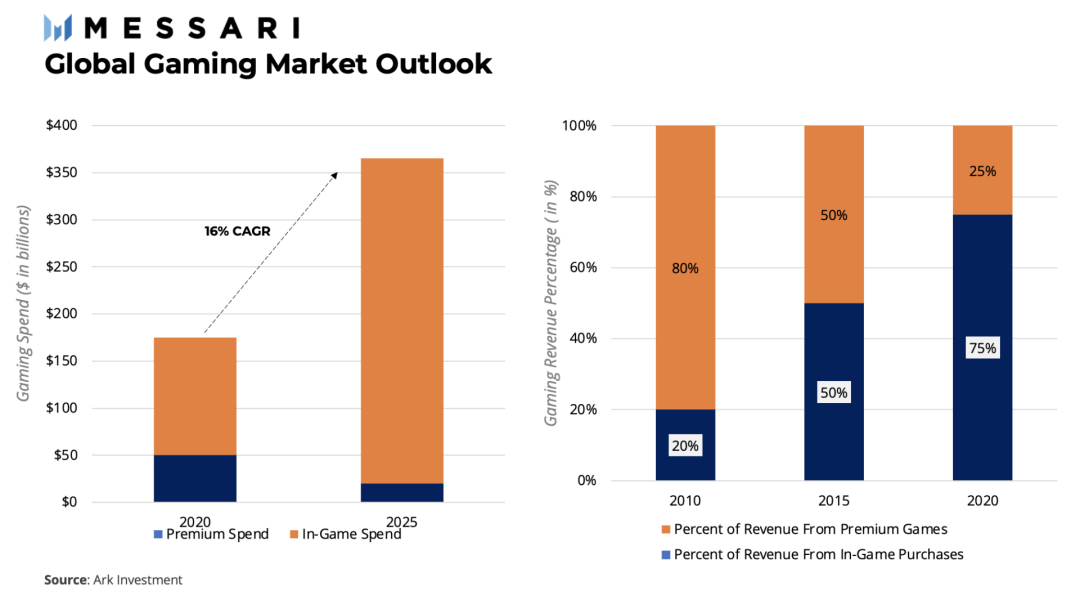

With active users growing, the global gaming market is expected to be worth approximately $365 billion by 2025, growing at a CAGR of 16%. At the same time, the proportion of revenue generated from virtual goods purchased in games has also been on the rise in the past decade, and may reach 95% of total game revenue in the next five years.

write at the end

write at the end

MetaverseMetaversepotential future. GameFi has the potential to be the trigger for blockchain explosion and wider adoption of Web3.

Tech giants such as Microsoft and Ubisoft have made huge investments in Crypto games, proving that the market has begun to respond to this phenomenon. As an early adopter, YGG has positioned itself at the forefront of the NFT gaming space by funding promising projects and building an army of players around the world. In view of this, the future of YGG is bright!